In order to implement the Moscow Law of November 5, 2003 dated November 5, 2003 No. 64 “On the property tax of organizations” (hereinafter referred to as the Law) and in accordance with paragraph 7 of Article 378.2 of the Tax Code of the Russian Federation (hereinafter referred to as the Code) by the Moscow Government by Resolution dated November 29 .2016 No. 789-PP amendments were made to the resolution dated November 28, 2014 No. 700-PP “On determining the list of real estate objects in respect of which the tax base is determined as their cadastral value.”

According to the Decree of the Moscow Government dated November 29, 2016 No. 789-PP, a list of real estate objects is determined for which the tax base is determined as the cadastral value for 2021 (hereinafter referred to as the List).

In accordance with paragraph 2 of Article 378.2 of the Code and Articles 1.1 of the Moscow Law, the tax base as the cadastral value of real estate is determined in relation to:

1) administrative and business centers and shopping centers (complexes) and premises in them (except for premises under the operational management of government bodies, autonomous, budgetary and government institutions), if the corresponding buildings (structures, structures), with the exception of apartment buildings, located on land plots, one of the types of permitted use of which involves the placement of office buildings for business, administrative (except for buildings (structures, structures) located on land plots, the type of permitted use of which involves the placement of industrial or production facilities) and commercial purposes, retail facilities, public catering and (or) consumer services facilities ;

2) detached non-residential buildings (structures) with a total area of over 1000 square meters. meters and premises in them , actually used for business, administrative or commercial purposes, as well as for the purpose of locating retail facilities, public catering facilities and (or) consumer services facilities;

2.1) non-residential premises located in multi-apartment buildings, owned by one or more owners, actually used to accommodate offices, retail facilities, public catering facilities and (or) consumer services, if the total area of non-residential premises in an apartment building exceeds 3000 square meters. meters;

3) objects of real estate of foreign organizations that do not operate in the Russian Federation through permanent missions, as well as objects of real estate of foreign organizations not related to the activities of these organizations in the Russian Federation through permanent missions;

4) residential buildings and residential premises that are not taken into account on the balance sheet as fixed assets in the manner established for accounting, after two years from the date of acceptance of these objects for accounting;

5) detached non-residential buildings (structures, structures) and premises in them included in the list approved by the Moscow Government in accordance with Part 3 of Article 2 of this Law, if these buildings (structures, structures) are intended for use in accordance with cadastral passports or documents of technical accounting (inventory) of such real estate and (or) are actually used for business, administrative or commercial purposes, as well as for the purpose of locating retail facilities, public catering facilities and (or) consumer services facilities;

6) non-residential premises located in buildings (structures) included in the list approved by the Moscow Government in accordance with Part 3 of Article 2 of this Law, if the purpose of such premises is in accordance with cadastral passports of real estate objects or technical registration (inventory) documents of objects real estate provides for the placement of offices, retail facilities, public catering facilities and (or) consumer services, or which are actually used for the placement of offices, retail facilities, public catering facilities and (or) consumer services.

Property tax benefits are set by regions

Federal Law No. 401-FZ of November 30, 2021 clarified that the right to establish property tax benefits is given to the regions (clause 25 of Article 381, new Article 381.1 of the Tax Code of the Russian Federation).

If a region in 2021 does not issue a law on tax exemption for movable property registered as fixed assets on January 1, 2013, then starting from January 1, 2018, this benefit will not apply on its territory.

The same approach is applied to some “exempt persons” from corporate property tax – in relation to property located in the Russian part (Russian sector) of the bottom of the Caspian Sea. This benefit also applies if the corresponding law of a constituent entity of the Russian Federation is adopted.

And finally, a benefit that gives the right to use the lowest cadastral value as the tax base for “trade” real estate.

Let us remind you that in general, it is possible to apply the lowest cadastral value of real estate received from January 1, 2014 or from January 1 of the year in which the cadastral value first became effective for tax purposes, if on January 1, 2014 the cadastral value was absent or not applied. January 1, 2021 to January 1, 2021 (Article 19 of the Federal Law of July 3, 2021 No. 360-FZ).

Law No. 401-FZ clarifies that the decision to apply this rule must be made by the government body of the constituent entity of the Russian Federation no later than December 20, 2021. If this does not happen, then the lowest cadastral value in the region cannot be used.

Tax exemption

According to current legislation, some industries are completely exempt from taxes. Such a tax benefit can be permanent or temporary for a period of 3-10 years. Benefits can be imposed either on the organization in its entirety or on any of its property.

Exempt from taxes:

- religious organizations;

- federal bodies for the execution of criminal punishments;

- property of the association of disabled people, which is statutory;

- funds from pharmaceutical companies that are used to develop methods for treating and preventing epidemics among animals;

- companies engaged in innovative development and scientific research in Skolkovo;

- equipment of shipyards, which is used in the construction and repair of ships;

- oil and gas equipment used in marine geoexploration;

- property of enterprises located in special economic zones.

Tax exemption is regulated by Article 381 of the Tax Code of the Russian Federation.

If the object is not included in the list before January 1, we pay tax starting from the next year

The rules for paying property tax from the cadastral value have been changed if information about the property was not entered into the register before January 1 (subparagraph “e”, paragraph 57, article 2 of the Federal Law of November 30, 2016 No. 401-FZ).

For objects that are not included in the regional lists before January 1, you need to pay tax at the cadastral value only starting next year. But from January 1, 2021, only administrative and non-residential premises remain on this list. For residential premises, tax, based on the cadastral value, must be paid regardless of when they were included in the list.

Benefits for budgetary institutions

For budgetary organizations, restrictions on the maximum tax rate are established. This is prescribed by federal law, but is regulated at the level of regional authorities, since the budgetary sphere is quite extensive and can perform a variety of functions.

Maximum allowable rates for public sector employees:

- 2% according to the cadastre;

- 2.2% on residual value.

Some regions have suspended the issuance of property tax benefits for public sector employees. For example, in Moscow, preferences were abolished back in 2004. Budgetary organizations in the Pskov region, Sakhalin and Stavropol Territory have been deleted from the list of beneficiaries.

How to recalculate property tax after changing the cadastral value

Clause 15 of Article 378.2 of the Tax Code of the Russian Federation allows for a change in the cadastral value of an object if a technical error is detected in the tax period when this error was identified. From January 1, 2021, a change in the cadastral value is possible if not only a technical error is detected, but also any other error, as a result of which the cadastral value was determined incorrectly. And in this case, you can also change the cadastral value of an object for tax purposes in the tax period when the error was identified.

Article 401. Object of taxation

1. The following property located within a municipal formation (federal city of Moscow, St. Petersburg or Sevastopol) is recognized as the object of taxation:

- House;

- apartment, room;

- garage, parking place;

- single real estate complex;

- unfinished construction project;

- other building, structure, structure, premises.

2. For the purposes of this chapter, houses and residential buildings located on land plots provided for personal subsidiary plots, dacha farming, vegetable gardening, horticulture, and individual housing construction are classified as residential buildings.

3. Property included in the common property of an apartment building is not recognized as an object of taxation.

Bottom line

It should be noted that the new property tax in 2021 for individuals demonstrates a trend of increasing tax collections from ordinary citizens who are taxpayers. New articles of laws demonstrate a tendency to expand the tax base of the state to create conditions for stable revenues to the state budget from payments from private individuals, which should in the near future become the main source of state income, replacing the decreased revenues from oil and gas production.

Calculation of tax rates

A special formula has been introduced to calculate tax payments:

Tax = (Nk x Sk - Ni x Si) x K + Ni, in which:

- Nk and Ni - cadastre and inventory taxes;

- Sk and Si - tax rates for cadastre and inventory;

- K is a reduction factor depending on the type of property.

The formula will remain in effect until 2021 to gradually increase residential property taxes. To do this, each year the decreasing coefficient will increase by 20%. By 2021, its size will have to be 100% in relation to the then current market value of taxable objects.

Table for calculating cadastral rates when calculating tax on private real estate

| Cost of the property | Tax rate as a percentage |

| Up to 10 million rubles. | 0,1 % |

| From 10 to 20 million rubles. | 0,15 % |

| From 20 to 50 million rubles. | 0,2 % |

| From 50 to 300 million rubles. | 0,3 % |

| Over 300 million rubles. | 2 % |

| Garages and parking spaces | 0,1 % |

| Unfinished construction of a residential building | 0,3 % |

| Other objects | 0,5 % |

The tax rate always depends on the current price of the property, as well as on the purpose of the property itself. The new formula for calculating the interest rate is currently applied only if the cadastral value of taxable real estate is higher than the inventory value.

Important! To prevent a sharp increase in tax payments for individuals, the state has introduced a transition period that will last from 2021 to 2021.

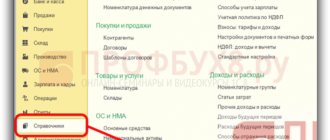

How to fill out the calculation

We will show you how to fill out a new form for calculating an advance payment of corporate property tax using a numerical example.

In it we will fill out the calculation for the advance payment for the six months (Q2). EXAMPLE 1. CALCULATION OF ADVANCE PAYMENT ON ORGANIZATIONAL PROPERTY TAX FOR A HALF-YEAR

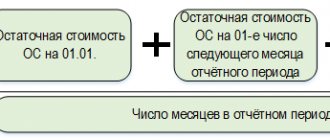

Example 1. Calculation of an advance payment on corporate property tax for a half-year Vector LLC is located in the city of Arkhangelsk, OKTMO code – 11,701,000. The organization’s balance sheet includes movable assets and real estate - fixed assets recognized as objects of taxation, the residual value of which is: as of 01/01/2017 - 1,200,000 rubles; — as of 02/01/2017 – RUB 2,300,000; — as of 03/01/2017 – RUB 2,200,000; — as of 04/01/2017 – RUB 2,800,000; — as of May 1, 2017 – RUB 2,700,000; — as of 06/01/2017 – RUB 2,600,000; - as of 07/01/2017 - 2,500,000 rubles. Vector's accountant reflected this data on lines 020 - 080 in column 3 of section 2 of the calculation. The organization does not have benefits, so the accountant does not fill out column 4 of section 2 of the calculation. Average cost of property for the reporting period period (line 120) is: (RUB 1,200,000 + RUB 2,300,000 + RUB 2,200,000 + RUB 2,800,000 + RUB 2,700,000 + RUB 2,600,000 + RUB 2,500,000) : 7 = 2,328,571 rubles. The organization does not enjoy property tax benefits. Therefore, in all the lines where data on benefits are reflected, the accountant added dashes. The tax rate in force in Arkhangelsk is 2.2%. Her accountant entered it in line 170 of section 2 of the calculation. The amount of the advance payment for the six months (line 180) is equal to: RUB 2,328,571. (line 120) × 2.2 (line 170) : 100 : 4 = 12,807 rubles. The residual value of fixed assets related to movable property as of 01.07.2017 is 1,200,000 rubles. The residual value of immovable fixed assets of the organization as of 01.07 .2017 amounted to 1,300,000 rubles (2,500,000 rubles – 1,200,000 rubles). This amount is reflected in line 050 of section 2.1 of the calculation. The organization owns an office building in Arkhangelsk, OKTMO code - 11,701,000. The building is included in the list of real estate objects for which the tax base is determined as their cadastral value. Its conditional cadastral number is 22:00:0000000:10011. The cadastral value of the building is 45,000,000 rubles. The organization also does not have benefits established by regional legislation. The corporate property tax rate for an office building in 2021 is 2.2%. The amount of the advance payment for the six months is 247,500 rubles. (45,000,000 rubles × 2.2%: 4). The company reflected this data in section 3 of the calculation. The total amount of the advance payment for corporate property tax for the six months, reflected in section 1 of the calculation on line 030, is equal to 260,307 rubles. (12,807 + 247,500).

An example of filling out an advance payment calculation

How to fill out a declaration

We will show you how to fill out a new tax return form for corporate property tax using a numerical example.

In it we will fill out a declaration based on the results of 2021.

All numerical indicators are conditional. EXAMPLE 2. REPORTING ON THE PROPERTY TAX OF ORGANIZATIONS

Let us continue the condition of example 1. Let’s assume that the residual value of fixed assets recognized as objects of taxation was: as of 08/01/2017 – 2,400,000 rubles; — as of September 1, 2017 – RUB 2,300,000; — as of 10/01/2017 – RUB 2,500,000; — as of November 1, 2017 – RUB 2,400,000; — as of December 1, 2017 – RUB 2,300,000; - as of 12/31/2017 - 2,200,000 rubles. Data on the residual value for the period from 01/01/2017 to 12/31/2017 was reflected by the Vector accountant on lines 020 - 140 in column 3 of section 2 of the declaration. The residual value of the organization's immovable fixed assets as of 12/31 .2017 amounted to RUB 1,560,000. This amount is reflected in line 141 of section 2 of the declaration. The organization does not have benefits, so the accountant did not fill out column 4 of line 141. The average annual cost of property (line 150) is: (1,200,000 rubles + 2,300,000 rubles + 2,200,000 rubles + 2,800,000 rubles + 2,700 RUB 000 + RUB 2,600,000 + RUB 2,500,000 + RUB 2,400,000 + RUB 2,300,000 + RUB 2,500,000 + RUB 2,400,000 + RUB 2,300,000 + RUB 2,200,000 .) : 13 = 2,338,462 rubles. The accountant calculated the tax base (line 190) as follows: 2,338,462 rubles. (line 150) – 0 rub. (line 170) = 2,338,462 rubles. The accountant entered the tax rate of 2.2% in line 210 of section 2 of the declaration. The tax amount for the tax period 2021 (line 220) is equal to: 2,338,462 rubles. (line 190) × 2.2 (line 210): 100 = 51,446 rubles. During 2017, advance tax payments were calculated: - for the first quarter of 2017 - 11,688 rubles; — for the first half of 2021 – 12,807 rubles; - for nine months of 2021 - 12,925 rubles. The amount of advance payments was: 11,688 + 12,807 + 12,925 = 37,420 rubles. The accountant reflected this amount on line 230 of section 2 of the declaration. The amount of tax on fixed assets to be paid additionally at the end of 2021 year – 14,026 rub. (51,446 – 37,420). The residual value of fixed assets related to movable property as of December 31, 2017 is RUB 1,050,000. For an office building, taxed at cadastral value, for 2017 the organization paid advance payments in the amount of RUB 742,500. (45,000,000 rubles × 2.2%: 4 × 3). The amount of tax calculated for the year is 990,000 rubles. (45,000,000 rubles × 2.2%). The amount of tax on an office building to be paid additionally at the end of 2021 is 247,500 rubles. (990,000 – 742,500). The organization reflected this data in section 3 of the declaration. The total amount of corporate property tax reflected in section 1 of the declaration is 261,526 rubles. (14,026 + 247,500).

Example of filling out a declaration

Article 409. Procedure and terms for payment of tax

1. The tax must be paid by taxpayers no later than December 1 of the year following the expired tax period.

2. The tax is paid at the location of the object of taxation on the basis of a tax notice sent to the taxpayer by the tax authority.

3. Sending a tax notice is allowed no more than three tax periods preceding the calendar year of its sending.

4. The taxpayer pays tax for no more than three tax periods preceding the calendar year of sending the tax notice.

5. Refund (credit) of the amount of overpaid (collected) tax in connection with the recalculation of the tax amount is carried out for the period of such recalculation in the manner established by Articles 78 and 79 of this Code.