The article discusses the procedure for registering invoices in “1C: Accounting 8” when advances are received from the buyer. 1C:ITS specialists provide options for issuing invoices for advance payments and, using a practical example, explain how to batch enter “advance” invoices for a specified period in the program using the “Registration of invoices for advance payments” processing. The setting up of the organization's accounting policy parameters regarding the procedure for registering advance invoices, as well as the numbering procedure for issued invoices, including those implemented in accordance with the explanations of the Ministry of Finance of Russia*, are discussed in detail. The information provided will help the user determine how to register advance invoices and number the invoices issued.

Note: * see letter of the Ministry of Finance of Russia dated August 10, 2012 No. 03-07-11/284. Read more here /news/uchet_nalogi/9477/.

When an advance is received from the buyer, an organization that is a VAT payer is obliged to issue an invoice for the advance and calculate VAT.

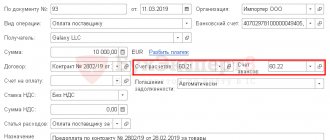

To issue invoices for advance payments in the 1C: Accounting 8 program, there are two options for creating a document Invoice issued with the type of invoice for advance payments: together with registration of documents for receipt of funds (advances) and automatically (list) using processing Registration of invoices for advance payments.

Actions after receiving ASF from the supplier

An invoice for an advance payment received by the buyer must be registered in the prescribed manner (read more about what an advance invoice is and why it is needed here, and from this article you will learn in what cases it is issued and what is the time frame for issuing this document ). To do this, you must register it in the purchase book, where you should note the appropriate information about the account.

If you work with documents in electronic form, you can register an account using the appropriate programs. This can be done either manually or automatically.

Then, at the end of the current period in which the document was drawn up, it must certainly be submitted to the local inspectorate for its registration and the possibility of exercising the rights to the necessary deductions. No other actions are required with issued advance invoices.

When a seller receives money from a client, he must do the following:

- Subtract VAT from the received amount and make an entry for accrual for payment (examples of entries below).

- Prepare an invoice in 5 days (you can find out how to fill out the ASF correctly and within what time period here, and we talked about how to use indexes and prefixes to number various types of invoices here).

- Record this account in the sales ledger in the quarter in which the money is received.

- On the day of actual shipment, issue the s/f again on account of the advance payment accepted earlier.

- Send the previously accrued VAT for the shipment for payment.

- And the VAT calculated upon receipt of the prepayment amount is sent for deduction.

- Record the advance invoice in the appropriate purchase ledger.

The buyer needs:

- accept for deduction the VAT noted in the advance invoice received from the supplier;

- allocate VAT on accepted goods and materials invoiced before the payment was made and send it for deduction;

- restore advance tax.

Issuing an invoice to the buyer

To perform operation 2 “Issuing invoices to the buyer” (see example table), you need to create the document Invoice for payment to the buyer. The document does not generate transactions.

Creating the document Invoice for payment to the buyer (Fig. 4):

1. Call from the menu: Sales - Account.

2. Add button.

Rice. 4

Filling out the header of the document Invoice for payment to the buyer (Fig. 5):

1. In the Warehouse field, select the warehouse from which you plan to ship goods.

2. In the Counterparty field, select the buyer from the Counterparties directory.

3. In the Contract field, select the contract with the buyer. Attention! In the contract selection window, only those contracts that have the type of contract With the buyer are displayed (Fig. 6).

4. In the Bank account , select the bank account for transferring funds from the buyer.

Rice. 5

Rice. 6

The Register advance invoices in an order consistent with accounting policy checkbox is cleared when, for a specific contract, it is necessary to establish an individual procedure for generating advance invoices that differs from the accounting policy settings (see Fig. 3).

In the field Generalized name of goods for an advance invoice, the name of the goods (work, services) (from the Nomenclature directory) is indicated, which will be inserted into the “advance” invoice issued to the buyer in the absence of an invoice for payment. When issuing an invoice, the item specified in the invoice is transferred to the Nomenclature (generalized name) field in the “advance” invoice.

Filling out the Goods tab of the Invoice document for payment to the buyer (Fig. 7):

1. Click the Add button.

2. In the Nomenclature field, select the products being sold (in the Nomenclature directory, the name of the product is usually located in the Products folder).

3. Fill in the remaining fields as shown in Figure 7.

4. To save the document, click the Save button.

5. To call the printed Invoice form, use the Invoice for payment button.

6. OK button.

Rice. 7

By analogy with this document, two more invoices are created for payment to the buyer:

— dated May 12, 2012 in the amount of RUB 1,500,000;

- dated June 12, 2012 in the amount of RUB 2,000,000.

In what reporting documents is it recorded?

After the prepayment for the transaction has been made and the ASFs have been created, they need to be registered.

For this purpose, as already mentioned, purchase/sales books held by the buyer and supplier are used.

Also, instead of using books, it is possible to register accounts using electronic programs (for example, 1C). How to reflect the receipt of these documents will be described below.

At the same time, regardless of the method used to prepare invoices, the period for their registration should not exceed five days from the date of receipt (in some cases determined by law - within a month).

Implementation of legal requirements in 1C products

When carrying out accounting using the 1C program, companies can be confident in the correctness and validity of issuing invoices, filling out all the necessary details and complying with the value added tax rates. Any changes in current legislation are promptly reflected in updated versions of the program. In addition, there is a system for notifying the accountant about introduced innovations; in automatic mode, the program will calculate the amount of advance tax payments, and will also remind you in advance about the deadlines for its payment, therefore the process of automating accounting based on 1C programs has long occurred in most enterprises of the Russian Federation.

Registration options

When registering an account in the 1C program, there are several ways to register it.

- Always register when receiving an advance . If you select this option, all advance invoices received will be recorded automatically for each accrued amount, with the exception of advances that were offset on the day of receipt.

- Do not register credits within 5 days . In this case, invoices will be created only for those amounts that were not credited within five days from the date of receipt. This method helps to implement the requirement in the Tax Code to register accounts within 5 days (Article 168).

- Amounts credited before the end of the month are not recorded.. This registration option is not suitable for all cases (otherwise you may receive a fine for late registration).

You need to choose it only in situations where the supply of goods or services occurs continuously in relation to the same person.It is suitable for advance payment for Internet access, communication, electricity services, as well as in other similar situations.

The fact that such a practice is not a violation was clarified in a letter from the Ministry of Finance dated March 6, 2009. In this case, invoices of this kind must be issued no later than the 5th day of the month following the month of transfer of the advance.

For example, the services of an Internet provider were paid in advance for July. In such a situation, the advance invoice will need to be issued no later than July 5 of the same year.

- Do not register accounts offset until the end of the tax period. The use of this clause is quite controversial and may cause disagreements with the tax authorities. It should be used only by those companies that are ready to defend their position.

The ability to choose this option is due to the following: there is an opinion that the name “advance payment” should not apply to payments accrued in the same period in which the shipment occurs, since then they do not correspond to the very concept of “advance payment”.And if so, then there is no need to prepare advance accounts for the current period. However, it should be said once again that if you choose this option, disputes with the tax service will be ensured.

- Do not register incoming payments as advance payments at all . It is suitable only for organizations designated in the Tax Code in Article 167. These include companies with a long production cycle of final products exceeding 6 months.

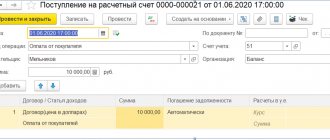

Receipt of advances from the buyer

To perform operation 3 “Receipt of advances from the buyer” (see example table), you need to create a document Receipt to the current account based on the document Invoice for payment to the buyer. As a result of posting the document Receipt to the current account, the corresponding transactions will be generated.

Creation of the document Receipt to the current account (Fig. 8):

1. Call from the menu: Sales - Account.

2. Select the base document (Invoice for payment to the buyer).

3. Click the Enter button based on .

4. Select Receipt to the current account with the transaction type of the document Payment from buyer . In this case, based on the document Invoice for payment to the buyer, a new document Receipt to the current account is created and automatically filled in. It is necessary to check the completion of its fields and edit them.

Filling out the document Receipt to the current account (Fig. 8):

1. In the from , indicate the date of payment in accordance with the bank statement.

2. In the In field. number enter the buyer's payment order number.

3. In the In field. Date Enter the date of the buyer's payment order.

4. In the Settlement account , check that account 62.01 “Settlements with buyers and customers” is indicated.

5. In the Advance Account , check that account 62.02 “Calculations for advances received” is indicated.

6. In the field Item movement money. funds, you must select the appropriate item.

7. Fill in the remaining fields as shown in Figure 8.

Rice. 8

To post a document, click the Post ; to view the postings, click the Result of document posting .

Figure 9 shows the result of posting the document Receipt to the current account.

Rice. 9

By analogy with this document, two more documents Receipt to current account are created:

— dated May 12, 2012 in the amount of RUB 1,500,000;

- dated June 12, 2012 in the amount of RUB 2,000,000.

As a result of these documents, transactions will also be generated reflecting the receipt of advances from the buyer:

1. Debit 51 “Current accounts” - Credit 62.02 “Calculations for advances received” - RUB 1,500,000.00.

2. Debit 51 “Current accounts” - Credit 62.02 “Calculations for advances received” - RUB 2,000,000.00.

Registration of invoices for advance payment by list

To perform operation 4 “Registration of advance invoices in a list” (see example table), you need to perform the Registration of advance invoices processing.

Processing is intended for the automatic generation of documents Invoices issued with the type For advance payment.

Start processing Registration of invoices for advance payments (Fig. 10):

Call from the menu: Sales - Maintaining a sales book - Registration of invoices for advance payments.

Rice. 10

Filling out the processing header Registration of invoices for advance payments (Fig. 11):

1. In the Period from... to... fields, select the period for which processing is performed.

2. Click on the hyperlink Register invoices whenever an advance is received. In this case, the Accounting Policies of Organizations window appears (see Fig. 3), in which the option of registering invoices for advances is indicated on the VAT tab.

3. Click on the hyperlink Uniform numbering of all issued invoices. In this case, the Setting up accounting parameters window appears (Fig. 12), in which on the VAT tab you can determine the numbering order of issued invoices:

- Uniform numbering of all issued invoices - all issued invoices will be numbered in chronological order sequentially, regardless of their type, in particular, “advance” invoices will not have the “A” prefix. The setting is installed by default and takes effect after updating the configuration to release 2.0.39.6. When switching to this numbering, previously issued invoices are not renumbered;

- Separate numbering of advance invoices with the prefix “A” - issued invoices will be numbered in chronological order sequentially, with the exception of “advance” invoices, which have a separate numbering with the addition of the prefix “A”. This mode was used before changes were made to the accounting settings (before release 2.0.39.6).

The possibility of a single numbering of all issued invoices was implemented in connection with the clarifications of the Ministry of Finance of Russia given in letter No. 03-07-11/284 dated August 10, 2012. In it, the financial department indicated that the serial numbers of the adjustment invoice and invoice are assigned in general chronological order (clause “a”, clause 1 of the Rules for filling out the adjustment invoice, approved by Decree of the Government of the Russian Federation of December 26, 2011 No. 1137) . At the same time, separate numbering of invoices for advances is not provided for by Decree of the Government of the Russian Federation of December 26, 2011 No. 1137. Please note that tax authorities allow the presence of additional information in invoices (letter of the Federal Tax Service of Russia dated March 12, 2012 No. ED-4-3/ [email protected] together with letter of the Ministry of Finance of Russia dated February 9, 2012 No. 03-07-15/ 17). In particular, the number assigned in chronological order may be supplemented by a letter designation, for example the letter “A” for advance invoices. Thus, if an organization assigned invoice numbers not in chronological order, then in accordance with the norms of the tax legislation of the Russian Federation, the taxpayer is not liable for this. At the same time, in accordance with paragraph 2 of Article 169 of the Tax Code of the Russian Federation, an organization can accept VAT as a deduction.

Rice. eleven

Rice. 12

Filling out the tabular part of the processing Registration of invoices for advance payments (Fig. 13):

1. Click the Fill button to automatically fill out the tabular part of the processing based on accounting data. When filling out the list, the balances of advances received from customers are analyzed for each date for the specified period. Amounts of advances for which the invoice registration period has not yet arrived or the invoice is not registered are not taken into account. If in an earlier period (not covered by running processing) there was an advance payment, on the basis of which an invoice was not issued, then the line with such an advance payment is also placed in the tabular part of processing and highlighted in red. The criteria for this analysis are the period selected by the user and the accounting policy settings (or the agreement with the buyer).

2. After filling out the list, you can change the field data, for example, adjust the advance amounts (Advance amount field), etc.

3. Click the Execute button to generate and post advance invoices.

4. Click the List of invoices (issued) button to view the list of created invoices for the specified period (Fig. 14). To view and edit, open each document Invoice issued (Fig. 15).

Rice. 13

Rice. 14

Editing the document invoice issued (Fig. 15):

1. In the Invoice issued , the document fields will be automatically filled in.

2. The Correction number checkbox is selected if a corrected invoice is registered. In our example, corrected invoices do not appear, so there is no need to select this checkbox.

3. The Invoice type field is filled in by default with the value For advance payment.

4. The Nomenclature (general name) field is filled in automatically with data from the invoice for payment (see Fig. 7) or (if there is no invoice) with data from the directory Contracts of counterparties (see Fig. 6).

5. The Date and Payment document number fields are filled in automatically with data from the Receipt to current account document.

6. The Operation type code field is filled in automatically and corresponds to the code of the operation being carried out, which is displayed in column 4 of the Journal of received and issued invoices.

7. Select the Checked box. Next, the field indicates the date of transfer of the invoice to the buyer and selects one of the issuing methods - On paper or Electronically.

8. Post the document by clicking the Post button.

9. To call the printed Invoice form, use the Invoice button.

10. OK button.

Rice. 15

To view the transactions generated when posting the document Invoice issued, click the Result of document posting . Figure 16 shows the result of the document.

Rice. 16

Invoices issued are recorded in the journal of received and issued invoices (Fig. 17) and the sales book (Fig. 18).

To call up a printed form of the journal, you can use the menu Sales - Maintaining a sales book - Journal of invoices according to Decree No. 1137, and this journal can also be called from the menu Purchase - Maintaining a book of purchases - Journal of invoices according to Decree No. 1137.

Rice. 17

Creating a printed form of the sales book (Figure 18):

1. Call from the menu: Sales - Maintaining a sales book - Sales book according to Resolution No. 1137.

2. In the Period from... to... fields, select the period for which the book is generated.

3. Using the Settings button, select JSC “TF-Mega” (Fig. 19).

4. Click the Generate .

Rice. 18

Rice. 19

In manual mode

There are two main ways to register ASF in the 1C program. The first one is the manual method. It is suitable when you have to register a small number of accounts. Instructions:

- In order to draw up a document in this way, you need to select the button in the documents for advance payment section: create based on. From the options that appear, select “invoice issued”.

- Once this item is selected, a separate account window will appear.

- After this, you only need to check that all the data is filled out correctly and click on the “conduct” icon, after which the document will be completed.

Issuing invoices for sales

An invoice is issued based on documents confirming the fact of sale. They are an invoice or a deed. In the main menu we find the item “Sales”, then “Sales (acts, invoices)”.

A journal of invoices appears on the screen, in which we select a counterparty.

Open the required invoice by double-clicking on it. At the top is the “Create from” window. There is a list available in it, from which we need the “Invoice issued” tab.

As a result, the program will generate a new form “Invoice - invoice issued for implementation (creation)”.

There is no need to change anything here. Confirm the action with the “Record” button. The invoice was generated automatically from the information specified in the invoice. Click “Print” and we see the finished document on the screen.

The user visually checks the form. If errors are detected, it can be edited. If some details were not filled in when entering information about the counterparty, the program will not display it on the invoice. You can manually make changes to the printed form. But in case of regular transactions with this buyer, you should correct the information in the “Counterparties” directory.

For example: the legal address was not specified. It was entered manually in the printed version of the document.

You can also issue an invoice from an open invoice by clicking the “Issue invoice” tab. It's in the lower left corner.

The program automatically creates a document. A serial number and date are assigned. In this case, the form is not displayed on the screen.

The developers of 1C 8.3 have provided a third option for issuing an invoice. The sales document (invoice) is also open. In the upper right corner we find the “More” button. When pressed, an additional menu is displayed. Select the item “Create based on”, then the “Invoice issued” tab.

The program allows you to create a document directly in the invoice journal. To use this method, you need to click on the “Sales” tab in the main menu. Next, find the option “Invoices issued”.

The next step is choosing a counterparty. Click the “Create” button. From the window that opens, select the “Invoice for sales” tab.

As a result, an electronic document is generated with the title “Invoice issued for implementation (creation).” It already contains information about the previously selected counterparty.

Then, in the “Base Document” line, click on “Select”. A new window “List of supporting documents” is displayed on the screen.

In the upper corner, on the left we find the “Add” tab. When you click it, you will be taken to the log of sales invoices issued for a specific buyer.

Select the desired operation and confirm the action with the “OK” button.

The selected implementation is highlighted in the “Base Document” line. Next, “Save and close” or “Save.”

The invoice will also have a serial number and date. You can print it out and make changes if necessary.

Automatically

In a situation where there are a lot of incoming invoices, registering them manually becomes inconvenient and time-consuming. In this case, it is better to set automatic registration. Instructions:

- To do this, you need to go to the “banks and cash desks” subsection, where you can find “advance accounts”. After selecting this item, a window will appear in which you should select the period for which documents will be generated.

- Then you need to click the “fill in” button and select all unregistered accounts. At the same time, the list can be easily adjusted and, if necessary, delete unnecessary ones or add new documents.

- When all the necessary advance invoices from the supplier have been selected, all that remains is to click on the “execute” button, after which they will be processed - this way all the rules for offsetting the ASF will be observed.

The list of all completed documents can be opened at any time by clicking on the link: “open list of accounts for advance payment”.

Verification of documents

To analyze and find documents for which there are no invoices, you can use a special processing in the program called “Express check”. It is located under the “Reports” menu.

The figure below shows an example of displaying errors for a problem of interest to us, as well as recommendations proposed by the program.

Which transactions correspond to the issued document?

When an advance payment is received, a transaction is generated that records the funds received in the account of the service provider (seller). Then, after the advance invoice is prepared by the seller and received by the buyer, the completed invoices are posted when they are registered.

This can be done either on an individual account basis or in a generally automated manner (as explained earlier).

The seller's wiring will be something like this:

- debit 51 Credit 62ав – advance money received from the buyer;

- debit 62av. Credit 68 – the accrual of added tax, which is allocated from the advance payment, is noted;

- debit 62 Credit 90.1 – income from the sale of inventory and materials is noted in the advance account;

- debit 90.3 Credit 68 – VAT is charged on the sales transaction;

- debit 68 Credit 62av. – advance VAT is accepted for deduction;

- debit 62av. Credit 62 rub. – prepaid money is counted.

And in accounting:

- Deb. 60 av. Credit. 51 – receiving an advance.

- Deb. 68 Cred. 60 Av – tax on prepayment is deductible.

- Deb. 19 Cred. 60 rubles – tax is allocated according to the goods and materials received.

- Deb. 68 Cred. 19 – income tax is accepted as a deduction.

- Deb. 60 av Cred. 68 – advance VAT restored.

- Deb. 60 RUR Credit. 60 Av – advance payment is counted.

As can be seen from the content of this article, the use of electronic programs for registering various accounts (including advance accounts) is preferable. It allows you to store all the necessary information in one place, and due to the interconnectedness of documents, the possibility of making errors in them is minimal.

In addition, mass automatic filling of documents allows you to significantly save working time.

Reflection of VAT in the declaration

When drawing up a VAT return, reflect the amount of input tax accepted for deduction from the advance payment transferred to the supplier (partial payment) on line 130 of section 3 of the declaration (clause 38.9 of section VI of the Procedure approved by order of the Federal Tax Service of Russia dated October 29, 2014 No. MMV-7 -3/558).

The amounts of VAT accepted for deduction and restored after the posting of goods (works, services, property rights) are reflected on line 090 of section 3 of the declaration (paragraph 2 of clause 38.5 of section VI of the Procedure approved by order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ -7-3/558).