Documentation

Those who submit the ERSV for the 3rd quarter of 2021 are submitted to the Federal Tax Service by all employers:

There are important notes The second half of January is the time when accountants throughout Russia

Personal income tax reporting Personal income tax reporting in the form of certificate 2-NDFL is submitted in the following order:

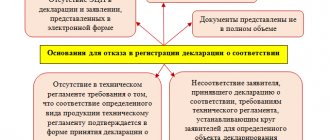

Others include costs for certification of products and services, as well as for declaration of conformity

Employer reporting Denis Pokshan Expert in taxes, accounting and personnel records Current on 24

Methods for submitting information to the Pension Fund To make it more comfortable for entrepreneurs, several options for submitting documents are offered:

2-NDFL for 2014 At the end of the year, the company must report on the withheld and paid

Women have the right to receive benefits for early pregnancy registration in

How the 4-FSS form has changed. The current 4-FSS calculation form has been approved by order of the FSS of the Russian Federation.

The Capital Amnesty Law (140-FZ) requires the declarant (the person wishing to use the law) to fill out a special