The Federal Tax Service does not advise companies to cooperate with partners who have a mark of false information in the Unified State Register of Legal Entities. This mark warns that working with a counterparty is risky (information on the Federal Tax Service website dated 09/01/17).

Tax officials recommend checking partners every quarter. But it is not enough to break through the counterparty only on the nalog.ru website. There are many more official resources that need to be studied: registers of unscrupulous suppliers, the Prosecutor General’s Office, bailiff services, etc. Although you can do it easier - use the “Checking counterparties” service on rnk.1cont.ru. It combines all known legal sources about counterparties.

Find out about the counterparty

To obtain a dossier on a counterparty, enter the TIN, OGRN or the name of the company you want to check in the search bar. Click on the "Check" button. The service will find the company - click on it. On the screen you will see information about the company and recommendations from the service.

When a potential partner is reliable, the service will inform you that you can work with him. This means that the company has a good business reputation, there are no financial risks or protracted litigation, and it is not in the process of liquidation. But before concluding an agreement, check whether the organization has enough resources to fulfill the agreement.

When a potential partner has problems, the service will warn with the message “We do not recommend working.” The reason is indicated next to it. For example, there are unreliable entries in the Unified State Register of Legal Entities or a company at the stage of bankruptcy. You will see the reason why the service decided to give a negative review nearby.

The service may advise you to additionally check your partner. For example, if a company has recently opened and does not yet have enough experience, a partner is suing or there is a tax arrears.

Section Financial analysis

The Financial Analysis section provides an analysis of the enterprise according to four criteria:

- Bankruptcy risk assessment.

- Creditworthiness.

- Return on assets.

- Sales profitability.

Click the Show calculation to get a detailed calculation of the indicator.

Bankruptcy risk assessment

The degree of risk of bankruptcy of the counterparty is assessed using the Altman formulas . Depending on the range of values in which the calculated Altman index Z , the program assesses the probability of the risk of bankruptcy of the counterparty:

- If the Altman index is less than or equal to 1.1, then the probability of bankruptcy is high.

- If the Altman index is less than 2.6 but more than 1.1, then the likelihood of bankruptcy cannot be ruled out.

- If the Altman index is not less than 2.6, then the probability of bankruptcy is low.

Creditworthiness

To assess the creditworthiness of the counterparty, an analysis of reporting is used according to the methodology approved by the Sberbank of Russia Committee for Providing Loans and Investments dated June 30, 2006 N 285-5-r.

Based on the reporting data, financial ratios and profitability are determined, and the Credit Score is calculated using a special formula. Depending on the range of values in which the calculated indicator S falls, the program evaluates the creditworthiness of the counterparty:

- If the Credit Index is less than or equal to 1.25, then the organization is creditworthy.

- If the Credit Index is less than or equal to 2.35, but more than 1.25, then lending to an organization requires a balanced approach.

- If the Creditworthiness Index is greater than 2.35, then lending is associated with risk.

Return on assets

Return on assets is an indicator of an organization's ability to effectively generate profits.

Return on assets is calculated using the formula:

The calculated indicator is compared with the industry average. Industry data for comparison is determined from the OKVED .

Return on sales

One of the most important indicators is Return on Sales , which reflects the net sales income of the organization. Return on sales is calculated using the formula:

The calculated indicator is compared with the industry average. Industry data for comparison is determined from the OKVED .

Profitability below 90% of the industry average profitability is one of the criteria for assigning an on-site tax audit!

Get complete information about your partner

The service determines the level of reliability of a company based on a number of criteria. The service evaluates the characteristics of a shell company, solvency and availability of resources, risks of non-fulfillment of obligations, business reputation and experience. If you click on “View details”, you can find out more about them.

But you will see more complete information in the report on the counterparty (tab “Download report” → “By counterparty”). In it we included summary information from accounting and the Unified State Register of Legal Entities, data on the partner’s arbitration cases and enforcement proceedings. From the report you will find out which departments checked the counterparty and whether they found violations, etc.

Print the report and save it as a file on your partner. He will confirm to the inspectors that you did your due diligence before entering into the transaction (see sample).

Sample. Counterparty report (fragment)

For each item of the report, you can get more detailed information: download an extract from the Unified State Register of Legal Entities, get a balance sheet, or find out the details of the arbitration case, inspections carried out and violations identified.

Section Program Data

Program Data section is filled out only for contractors included in the database.

Program Data section displays information about this counterparty entered into the program:

- Name,

- TIN, KPP, OGRN,

- Legal address,

- Actual address,

- Mailing address,

- Contact faces,

- Bank accounts,

- Agreements,

- Telephone,

- email,

- Group of counterparties,

- A comment.

Track changes across all regular partners

There are two tabs on the main page of the service: “Tracking” and “Recently Watched”. They will help save time. This way you can quickly find companies you've recently checked out and see up-to-date information.

Inspectors recommend auditing companies every quarter before reporting and before major transactions and payments. But the service allows you not to waste a lot of time on this.

Once you have checked the organization, click on the “Track changes” button. You will see all the important changes that have occurred with your partner on the main page of the service in the “Tracking” tab.

But only regular users of the service can use the tracking function.

Reporting analysis section

The Reporting Analysis section displays summary indicators from the counterparty’s financial statements:

- Sales.

- Profit.

- Money.

- Materials, goods, semi-finished products (stocks).

- Buildings, equipment, vehicles, land (OS).

- Advances issued, debts of counterparties.

- Advances received, debts to suppliers.

- Received credits and loans.

- Net assets.

This information is very clear and understandable even to those users who are not accounting specialists.

How to prove good faith

From the criteria, in principle, it is clear what needs to be done in order not to come under scrutiny: more income and taxes, high salaries, say “no” to dubious transactions. In practice, the most common operation can turn into unsafe. In part, in previous articles we have already examined complex situations:

- Controlled transactions - practice under 115-FZ

- Explanations for low average wages – application of the minimum wage

I would like to note that careful selection of suppliers when working with VAT is relevant not only for large organizations, because a small company using the simplified tax system is sometimes required to pay tax (when importing).

As for other ways to ensure confirmation of your own integrity, you will need:

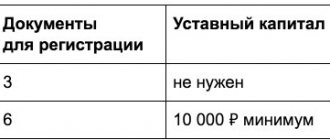

- When creating a company, check the participants and the manager for the presence of disqualification, unfinished court cases, large debts, in order to avoid refusal of registration and unnecessary attention at the initial stage.

- Somehow it is not customary (and the law does not require) when registering to be interested in the origin of the property contributed as a contribution to the authorized capital, but it should be. Spouses, for example, have joint property (including money); if the other spouse did not know about its use to create a company, he has the right to go to court, demand its return, and include it in the share, which, of course, will not benefit the organization. The easiest way is to obtain a notarized consent.

- Conduct the most open dialogue in transactions, guided, however, by the principle of reasonableness, while maintaining commercial secrets.

- Avoid too favorable terms in contracts, unless this is one of the customs of business or does not provide the company with additional benefits. For example, a long-term, unreasonable deferment of payment for a large contract for a new client will be suspicious from a tax point of view, but installment plans with monthly payments and interest are normal.

- Don’t leave accounts receivable to chance. This means: writing letters of claim if sanctions are provided (fines, penalties), calculating them and demanding payment, going to court, joining the ranks of creditors in bankruptcy.

- Pay attention to the execution of transactions and promptly (without delay!) resolve issues with errors, inaccuracies and incomplete completion in documents confirming expenses and invoices.

Note! In the provision on personal data, provide for cases of transfer of information to third parties. An example is passes to the closed territory of the supplier. Because they are manufactured by another party, it is necessary to obtain the consent of employees in advance. It is not necessary, but it is advisable to request written guarantees from the counterparty that the data will be used exclusively for the specified purposes.

Example: the supplier indicated the old legal address on the invoice, the manager immediately noticed the error, but did not send it for correction, the document was submitted for verification. The tax income will not be deducted for the supplier, the maximum that awaits him is a reprimand, but for the buyer, a refusal to deduct VAT is a real possibility.

The more careful you are in dealing with transaction security, the more reliably you are protected from tax claims. Now let’s look at what to demand from the counterparty and what signs should ring a bell.

Regions in which on-site inspection is available

The table shows the regions in which specialists of the Konur.Focus system will be able to carry out an on-site inspection to investigate the company of interest:

| Region number | Region/City | Old price | New price |

| 16 | Republic of Tatarstan | 7200 | 2000 |

| 16 | Kazan | 4300 | 2000 |

| 18 | Udmurt republic | 5800 | 2000 |

| 23 | Krasnodar region | 7200 | 2000 |

| 23 | Krasnodar | 4300 | 2000 |

| 24 | Krasnoyarsk | 5800 | 2000 |

| 25 | Primorsky Krai | 4300 | 2000 |

| 25 | Vladivostok | 2900 | 2000 |

| 31 | Belgorod region | 7200 | 2000 |

| 31 | Belgorod | 4300 | 2000 |

| 33 | Vladimir region | 7200 | 2000 |

| 36 | Voronezh region | 7200 | 2000 |

| 36 | Voronezh | 4300 | 2000 |

| 38 | Irkutsk region | 4300 | 2000 |

| 40 | Kaluga region | 7200 | 2000 |

| 41 | Petropavlovsk-Kamchatsky | 3600 | 2000 |

| 46 | Kursk region | 7200 | 2000 |

| 46 | Kursk | 4300 | 2000 |

| 47 | Leningrad region | 7200 | 2000 |

| 49 | Magadan | 3600 | 2000 |

| 78 | Saint Petersburg | 4300 | 2000 |

| 50 | Moscow region | 7200 | 2000 |

| 77 | Moscow | 4300 | 2000 |

| 52 | Nizhny Novgorod Region | 7200 | 2000 |

| 52 | Nizhny Novgorod | 4300 | 2000 |

| 53 | Novgorod region | 4300 | 2000 |

| 54 | Perm region | 2900 | 2000 |

| 54 | Permian | 2200 | 2000 |

| 55 | Omsk region | 7200 | 2000 |

| 55 | Omsk | 4300 | 2000 |

| 60 | Pskov region | 4300 | 2000 |

| 61 | Rostov region | 7200 | 2000 |

| 61 | Rostov-on-Don | 4300 | 2000 |

| 62 | Ryazan Oblast | 7200 | 2000 |

| 63 | Samara Region | 5800 | 2000 |

| 63 | Samara | 2900 | 2000 |

| 65 | Yuzhno-Sakhalinsk | 3600 | 2000 |

| 66 | Sverdlovsk region | 7200 | 2000 |

| 66 | Ekaterinburg | 4300 | 2000 |

| 69 | Tver region | 7200 | 2000 |

| 71 | Tula region | 7200 | 2000 |

| 72 | Tyumen region | 7200 | 2000 |

| 72 | Tyumen | 4300 | 2000 |

| 74 | Chelyabinsk region | 7200 | 2000 |

| 74 | Chelyabinsk | 4300 | 2000 |

| 76 | Yaroslavl region | 7200 | 2000 |

| 91 | Republic of Crimea | 7200 | 2000 |

| 91 | Simferopol | 4300 | 2000 |

| 92 | Sevastopol | 7200 | 2000 |

The report is generated by specialists of the Kontur.Focus system within 3 working days.

The on-site inspection report can be ordered using the “Advanced Information” , as well as within the “Premium +” tariff.