General provisions

A leasing agreement is a form of a rental agreement, and therefore paragraph 1 of Chapter 34 of the Civil Code of the Russian Federation will apply to the agreement. Article 624 of the Civil Code of the Russian Federation states that leased objects can be purchased by the lessee. The purchase is made at the full purchase price. The lease agreement may contain provisions regarding mutual settlements and the amount of the redemption price. If such clauses exist, the purchase is made on their basis, that is, at the cost specified in the contract. If there is no information in the agreement, an additional transaction is drawn up. An agreement is concluded which stipulates these points:

- Formation date.

- Details of both parties.

- Characteristics of the leased object.

- The volume of residual value (redemption value minus payments already made).

- Rights and obligations of participants.

- Payment method.

The agreement must contain the signatures of both parties. It is important to write down all points in detail. This will avoid possible disputes.

IMPORTANT! The leased object can be purchased both after the completion of the leasing agreement and during its validity.

Expiration

It is important to note that after the period of the agreement regarding the provision of certain property for leasing expires, the cost of these property complexes may be paid in full or in part. If the price, for example, of a car or apartment is partially paid, then the property is redeemed in accordance with the residual value of the apartment or vehicle. You need to know that in the event of full repayment of the original cost of a home or car (their place may be taken by other leased items), the redemption of the property is carried out in accordance with the redemption value of the apartment or vehicle, which is established through a purchase and sale agreement.

The procedure for purchasing the leased asset

To purchase an object, the following procedure is relevant:

- Sending a notification to the lessor about the desire to purchase the property.

- The lessor provides written consent to the purchase.

- Conclusion of an additional agreement establishing the payment procedure.

- Conclusion of the purchase and sale document necessary for the official transfer of ownership.

- Issuing an invoice to the buyer.

- Drawing up a transfer and acceptance certificate.

- Transfer of accompanying documents to the lessee.

The procedure under consideration is advantageous in that it prevents the emergence of disputes between participants.

Example

It would be advisable to consider the mechanism for calculating the redemption value of leased property using a specific example. Let’s say the cost of a leasing vehicle is five hundred thousand rubles, provided that the conclusion of the contract is valid for a period of twelve months. In addition, lease payments must be repaid monthly. At the same time, the amount of compensation payments to the leasing structure for renting a car is twelve percent of the total cost on an annual basis. It is important to note that the payment in question includes payment of the initial cost of transport in the amount of twenty thousand rubles.

Thus, in accordance with the conditions defined above, the amount of compensation will be sixty thousand rubles (five hundred thousand divided by one hundred and multiplied by twelve). Accordingly, the monthly rent will be five thousand rubles (sixty thousand divided by twelve). So, the redemption value of the property will be two hundred and sixty thousand rubles (subtract two hundred and forty thousand from five hundred thousand).

Features of graduation cost education

The graduation price can be formed in different ways. It all depends on the wishes of the parties to the contract. Let's consider the formation methods:

- Including cost in the leasing payment structure. The cost of the object in this case is initially included in the amount of leasing payments. Costs are evenly distributed over the entire period of lease payments. Therefore, the more payments have been made, the lower the redemption price.

- Separate payment. In this case, the redemption price is not included in regular payments. The lessee will have to purchase the property at the full cost specified in the contract.

Calculation of the redemption value is carried out on the basis of an agreement between the parties.

Inclusion of the redemption value in leasing payments

The cost of the acquired property may initially be included in the amount of lease payments transferred to the lessor and distributed evenly between them. According to paragraph 1 of Art. 28 Federal Law No. 164, the leasing payments transferred by the lessor to the lessee include:

- remuneration paid to the lessor;

- costs of acquisition, delivery, installation, maintenance of the purchased leased asset, as well as other additional expenses.

Obviously, the fewer payments the lessee has to make before the lease agreement expires, the lower the redemption price becomes. If he fully repays his existing debt, the redemption value will be reduced to zero. If an additional agreement is concluded before the debt is paid, it must indicate the cost of the leased item, which has already been paid by the lessee by making advance payments throughout the entire term of the agreement, as well as the remaining amount to be paid.

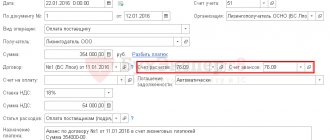

Accounting

If the object is on the buyer’s balance sheet, the following accounting nuances need to be taken into account:

- Receipt of object. The cost of the received object must be recorded on account 08, subaccount “Purchase under a leasing agreement.” Correspondence – credit to account 76, subaccount “Rental Obligations”. Expenses for the purchase of an item must be written off from KT08 to DT01, subaccount “Rented objects”. The object must be accepted for balance sheet accounting in the structure of fixed assets. Associated expenses of the lessee (installation, transportation, etc.) are not included in the initial cost of the item.

- Leasing payments. Payments received to the lessor's account must be recorded in DT76, subaccount “Rental Obligations”. Correspondence – KT76, subaccount “Leasing debt”.

- Depreciation. Depreciation is calculated based on the cost of the asset. The accelerated depreciation method may be used. The coefficient should not exceed the value of 3. Depreciation charges should be recorded in the DT “Production costs” KT02, subaccount “Depreciation of the leasing object”.

- Redemption of a leased object. When the entire redemption amount has been paid, ownership has been transferred, data is entered into accounts 01 and 02 of accounting.

Each posting is confirmed by primary documentation.

Finding the object on the lessor's balance sheet

If the leasing object is on the balance sheet of the lessor, these transactions are used when purchasing the item:

- KT01. Write-off of an asset from off-balance sheet accounting.

- DT08 KT60. Capitalization of an asset (performed if the cost of the item exceeds 40 thousand rubles).

- DT19 KT60. VAT accounting.

- DT10 KT60. Capitalization of the leasing object.

In this case, the lessor keeps records.

Finding the item on the buyer's balance sheet

If the leased object is on the balance sheet of the lessee, you need to use these entries:

- DT08 KT76. Acceptance of the leasing object for accounting.

- DT19 KT76. Presentation of VAT by the person who provided the leasing.

- DT01 KT08. Acceptance of an item into the structure of fixed assets.

- DT76 KT51. Transfer of lease payments.

- DT76 KT76. Accounting for monthly lease payments.

- DT68 KT19. Acceptance of VAT deduction.

- DT20 KT02. Depreciation calculation.

- DT76 KT51. Transfer of redemption value.

- DT01 KT01. Transferring an item from rented to owned.

- DT02 KT02. Depreciation on an object that has become property.

Accounting is maintained, accordingly, by the person who acquired the leased property.

Features of accounting depending on the time of payment

If the redemption is made at the end of the lease agreement, accounting during the term of the agreement will be carried out in the standard manner. The postings will change at the end of the agreement. If the object was on the lessor's balance sheet, you need to write it off from off-balance sheet account 1. After this, the property goes on the balance sheet.

If the repurchase is carried out during the term of the agreement, lease payments must be recorded in accounting. In fact, they are an advance payment. In accounting, payments are reflected as advances issued.

IMPORTANT! To account for leasing payments, it is necessary to create subaccounts. They are used to reflect the purchase of an object and leasing payments.

The leasing agreement contains an indication of the completion of a separate transaction for the repurchase of the leased property

As a rule, the best option in such a situation is to change the terms of the leasing agreement.

In particular, it makes sense for the parties to enter into an additional agreement providing for the repurchase of the leased property on the basis of the leasing agreement itself, and not an “additional” purchase and sale agreement. In other words, it is necessary to exclude from the leasing agreement the indication of a separate purchase transaction. This will greatly simplify the procedure for acquiring property and relieve the lessee from the risks that arise when making an “additional” transaction. At the same time, a situation is possible when it makes no sense for the lessee to change the terms of the leasing agreement. Thus, an additional agreement may not be concluded if:

- the parties provided for the repurchase of the property at a symbolic price (i.e. at a much lower price than the market value of the property at the time of the repurchase transaction) and at the same time

- property is not subject to state registration.

The rules on buyout leasing apply to leasing agreements that provide for the buyout of leased property on the basis of a separate purchase and sale agreement, but at a much lower price than the market value of the property at the time of buyout (paragraph 2, clause 1 of Resolution No. 17). Consequently, such relations between the parties are subject to the provision that ownership of the leased asset passes to the lessee from the moment of transfer of all payments stipulated by the leasing agreement, regardless of whether a separate purchase and sale agreement is concluded (paragraph 2, paragraph 2 of resolution No. 17). In other words, there is no need to complete a separate buyout transaction.

However, if the leased item requires registration, it is better to either change the terms of the agreement or conclude a separate purchase and sale agreement. This will reduce the risk that problems will arise during re-registration.

If the redemption price is not symbolic, but the parties still decide to leave the terms of the leasing agreement the same, the lessee will need to make another transaction with the leasing company - a purchase and sale agreement for the leased property.

Question: the leasing agreement contains an indication of the conclusion of a purchase and sale agreement for the leased property. The price under the purchase and sale agreement is not symbolic. Can the lessee purchase this property without concluding a purchase and sale agreement and without amending the terms of the leasing agreement?

Judicial practice shows that it can. However, it is better to conclude a purchase and sale agreement or change the terms of the leasing agreement, as this will reduce the risk of negative consequences.

There are situations when the lessee pays the lessor the entire amount of lease payments and the redemption price of the leased property, but the parties do not fulfill the condition for concluding a contract for the sale of property.

In such situations, courts often come to the conclusion that the lessee becomes the owner of the leased asset.

r />

Example from practice: despite the fact that the leasing agreement contained an indication of the conclusion of an agreement for the purchase and sale of leased property, the court considered that in order to transfer ownership of the property to the lessee, it is not necessary to conclude such an agreement. The lessee only needs to make the entire amount of lease payments and pay the redemption price

LLC "U." (lessor) entered into a contract with LLC “P.” (lessee) leasing agreement with a condition for the purchase of leased property (dump trucks) by the lessee. In particular, the parties provided that upon expiration of the contract or upon its early termination, ownership of the dump trucks passes to the lessee if three circumstances occur:

- the lessee has made all lease payments and other payments under the leasing agreement;

- the parties entered into a purchase and sale agreement for leased property and signed an acceptance certificate for fixed assets;

- the lessee transferred the purchase price.

LLC "P." transferred the leasing payments and the purchase price, but LLC "U." refused to enter into a purchase and sale agreement. According to the lessor, the grounds for completing the repurchase transaction did not arise, since the lessee did not pay the entire amount of the penalty accrued for violating the deadlines for making lease payments.

Considering the lessor's refusal to be unfounded, P. LLC. filed a lawsuit with the following demands:

- recognize ownership of the leased item;

- oblige the lessor to draw up documents confirming the transfer of ownership of the leased property (purchase agreement and transfer and acceptance certificate);

- oblige the lessor to hand over the original passports of the dump trucks.

The court considered that the agreement concluded by the parties is essentially a mixed agreement containing elements of a financial lease (leasing) agreement and a purchase and sale agreement. Moreover, LLC "P." not only made the total amount of lease payments, but also fulfilled the obligation to pay for the goods provided for in paragraph 1 of Article 454 of the Civil Code of the Russian Federation. Consequently, the lessee became the owner of the leased property.

The fact that the lessee did not transfer the amount of the penalty to the lessor, in the opinion of the court, does not prevent the transfer of ownership of the leased asset. The fact is that the basis for such a transition is the payment of the total amount of lease payments and payment of the redemption price (Article 624 of the Civil Code of the Russian Federation). The court considered that the term “other payments” contained in the leasing agreement does not mean the debt to pay the penalty, but the redemption price (Article 28 of the Leasing Law).

However, the court did not satisfy the requirement that the lessor be obliged to conclude a sale and purchase agreement for dump trucks. According to the court, there is no need to complete a separate buyout transaction, since ownership of the property passed to the lessee from the moment he transferred the lease payments and the buyout price. In other words, LLC "P." became the owner of the leased asset immediately after full payment, and no additional agreements confirming the transfer of ownership are required (resolution of the Federal Antimonopoly Service of the North-Western District dated December 18, 2012 in case No. A56-5708/2012).

In other words, in the event of a dispute, the court may consider that the basis for the transfer of ownership of the property is not the fact of a transaction to buy the thing, but the fact that the lessee has paid the redemption price and all leasing payments (resolution of the Federal Antimonopoly Service of the Moscow District dated July 29, 2013 in the case No. A40-95474/12-114-903, FAS Volga District dated June 18, 2013 in case No. A57-22135/2012, dated May 8, 2013 in case No. A57-20961/2012). At the same time, it is possible that the court’s conclusion will be different.

The judicial acts listed above were issued before the clarifications of resolution No. 17 began to apply. In turn, this resolution provides that the rules on the transfer of ownership of leased property without concluding a separate purchase and sale agreement apply only in two situations (clause 1 of the resolution No. 17):

- the parties entered into a buyout lease agreement in its strictest sense;

- The parties to the leasing agreement stipulated that after the agreement expires, the lessee will have the right to purchase the property at a symbolic price.

Thus, the resolution does not directly indicate that ownership of the leased asset automatically passes to the lessee if two conditions are simultaneously met:

1) the leasing agreement provides that the purchase of property is carried out on the basis of a separate transaction and at a price that cannot be regarded as symbolic;

2) the parties did not complete a buyout transaction, but the lessee transferred to the lessor the entire amount of lease payments and the price that should have been indicated in the transaction.

Therefore, it is not a fact that in the future the courts will continue to consider the transfer of ownership of the leased asset to have taken place only on the basis that the two conditions indicated above are met.

If the parties have stipulated in the leasing agreement a condition for the repurchase of the property on the basis of a separate transaction, then it is better to complete such a transaction (or completely exclude from the leasing agreement the indication of a separate repurchase transaction). In this case, the lessor will have much less reason to doubt the transfer of ownership of the property than in a situation where the lessee transfers the redemption value to the counterparty without concluding a purchase and sale agreement. Consequently, the likelihood of disputes with the lessor will decrease.

In addition, if the leased item is subject to registration (for example, if a vehicle is leased), then if a separate purchase and sale agreement is concluded, the risk that the registering authority will refuse to register the leased property for the new owner (lessee) will be reduced. In particular, to register a car, it is necessary to submit documents certifying ownership of the vehicle (clause 15.5 of the Administrative Regulations of the Ministry of Internal Affairs of Russia for the provision of state services for the registration of motor vehicles and trailers for them, approved by Order of the Ministry of Internal Affairs of Russia dated August 7, 2013 No. 605) . If, instead of a purchase and sale agreement for a car, the lessee presents a leasing agreement providing for a separate purchase transaction, the registration department of the traffic police may refuse to re-register the vehicle, considering that the presented document does not indicate the transfer of ownership of the car to the lessee.

In order to correctly formalize the relationship between the buyer (lessee) and the seller (lessor), it is important to analyze the terms of the leasing agreement and establish:

- under what circumstances the lessee has the right to enter into a purchase and sale agreement for the leased asset;

- What terms and conditions should the purchase and sale agreement contain?

Grounds for concluding a purchase and sale agreement for leased property

As a rule, a purchase and sale agreement for a leased asset can be concluded if two circumstances occur simultaneously.

1. The lessee transferred the total amount of lease payments.

Typically, a leasing agreement directly states that the lessee has the right to purchase property only if he has made the full amount of lease payments. At the same time, in practice, sometimes there are agreements that allow the lessee to buy out the leased asset without making one or another part of the payments. However, with such a buyout, the buyout price usually exceeds the price that the lessee would have to pay after making the total amount of lease payments.

Question: the leasing agreement contains an indication of the completion of a separate transaction for the repurchase of the leased property, but does not provide that it can be completed only after making the total amount of lease payments. Can the lessee insist on selling the property until he has paid all lease payments?

Answer: no, it cannot.

The lessee must proceed from the fact that a necessary condition for the purchase of the property is the fact that the entire rent has been paid. Otherwise (i.e., if you offer the counterparty to sell the leased asset before making all lease payments), the interests of the lessor will be violated. In particular, the lessor will lose the income included in the payments, and will also lose the opportunity to fully reimburse its costs for the initial acquisition of the leased property (Clause 1, Article 28 of the Leasing Law). This may give rise to a dispute between the parties to the leasing agreement.

At the same time, the lessor, who has not received all payments, may independently offer the lessee to buy back the property at a higher price compared to the one that the parties provided in the leasing agreement as the redemption price. However, the lessee should not agree to such an offer. It is better to protect yourself from possible disputes related to payment under leasing and purchase and sale agreements, and transfer to the counterparty exactly the amounts of money that the parties initially provided for:

- total amount of leasing payments (rent under the leasing agreement);

- payment under the contract for the sale and purchase of leased property (purchase price).

2. The deadline for concluding a purchase and sale agreement has arrived.

The law allows the conclusion of such an agreement after the expiration of the leasing period (paragraph 4, paragraph 5, article 15 of the Leasing Law). However, in practice, leasing agreements often provide the lessee with the right to early repurchase. In this case, the lessee may, at his discretion, choose one of the following behavior options:

- wait until the end of the leasing period;

- conclude a purchase and sale agreement before the lease expires (subject to the total amount of lease payments).

If the lessee decides to exercise the right to early redemption, he needs to check whether the leasing agreement establishes any additional rules for such redemption. For example, the agreement may contain a condition on the lessee’s obligation to notify the lessor in advance of its intention to purchase the property ahead of schedule. In such a situation, the lessee will need to comply with the contractual requirements for the form and period of notification.

If the leasing agreement does not provide an opportunity to complete a transaction to buy out the leased property ahead of schedule, but the lessee intends to become the owner of the property as soon as possible, it makes sense for the lessee to propose to the lessor to change the terms of the agreement. In particular, you can try to insist on concluding an additional agreement that will provide the lessee with the opportunity to conclude a purchase and sale agreement ahead of schedule. However, the lessor may agree to sell the property without signing an additional agreement to the leasing agreement. However, it is still better to first conclude such an agreement, and only then purchase the leased item. This will reduce the risk of misunderstandings and disputes between the parties.

Terms of the leased property purchase and sale agreement

The purchase and sale agreement for the leased asset must be concluded on the terms and conditions provided for in the leasing agreement.

The conditions for the transfer of leased property into the ownership of the lessee are established by the parties in the leasing agreement (Clause 1, Article 19 of the Leasing Law). In this regard, a leasing agreement containing an indication of a separate transaction for the purchase of property is sometimes regarded as a preliminary purchase and sale agreement. This means that the parties must enter into a purchase and sale agreement precisely on the terms and conditions contained in the section of the leasing agreement devoted to the repurchase of the leased property.

In particular, when agreeing on the terms of the price, the parties to the purchase and sale agreement must be guided by the provisions of the leasing agreement that determine the redemption value of the leased property. For example, if a leasing agreement stipulates that the redemption price of the leased property is 10 thousand rubles, the following condition must be included in the purchase and sale agreement: “The price of the goods is 10,000 (Ten thousand) rubles.” The buyer has no right to insist on selling goods at a lower price.

Question: a leasing agreement, which provides for the conclusion of a purchase and sale agreement for leased property, does not specify the redemption price of the property. What wording of the price condition will meet the interests of the buyer (lessee)?

It depends on what type of property the leased asset is - movable or immovable.

The subject of leasing is movable property (car, equipment, etc.)

In this case, the price can be determined according to the rules of paragraph 3 of Article 424 of the Civil Code of the Russian Federation. In other words, the buyer (lessee) can purchase the property at the price that, under comparable circumstances, would normally be charged for similar goods.

This conclusion is contained in resolution No. 1729/10. At the same time, the resolution refers to a leasing agreement, which provides for a condition for the purchase of property, but does not contain instructions for a separate purchase transaction. However, it seems that the conclusion about the size of the redemption price is also applicable to cases where the parties to the leasing agreement formalize the transfer of ownership of the property in the form of a purchase and sale agreement.

Moreover, when agreeing on the terms of the price, the buyer should adhere to the general rules for determining the amount of the redemption price. Otherwise, there is a risk of purchasing goods at an inflated price, which will not meet the interests of the buyer.

The subject of leasing is real estate (non-residential premises, garage, etc.)

In such a situation, there is a risk that in the event of a dispute, the court will recognize the purchase and sale agreement as not concluded.

In one of its resolutions, the Presidium of the Supreme Arbitration Court of the Russian Federation indicated that if a real estate lease agreement does not provide for the redemption price of the property, then it is considered not concluded in terms of the redemption of the property (Resolution No. 12102/04). The Presidium of the Supreme Arbitration Court of the Russian Federation argued that such an agreement is considered a mixed agreement with elements of a lease agreement and a purchase and sale agreement. In turn, without agreeing on the conditions on the price of real estate, the contract for its sale is considered not concluded (clause 1 of Article 555 of the Civil Code of the Russian Federation).

There is a risk that the court will come to a similar conclusion when considering a dispute between the buyer (lessee) and the seller (lessor). After all, general rules on leasing apply to relations under a leasing agreement if they do not contradict special rules (Article 625 of the Civil Code of the Russian Federation).

If the court decides that the leasing agreement concluded between the parties is a mixed agreement containing elements of a leasing agreement and a purchase and sale agreement, it may refer to Resolution No. 12102/04 and recognize the agreement as not concluded in terms of the redemption of property. In this case, the court may consider that the purchase and sale agreement is also not concluded, since it does not represent an independent transaction for the sale of real estate, but only formalizes the repurchase relationship provided for in the leasing agreement and recognized as inconsistent.

To eliminate this risk, you need to take two steps in sequence:

- conclude an additional agreement to the leasing agreement, stipulating the amount of the purchase price of the property;

- conclude a real estate purchase and sale agreement, indicating the price stipulated in the leasing agreement.

Question: the lessor avoids concluding a contract for the sale and purchase of leased property, despite the fact that the grounds for redemption have arisen. How can a lessee become the owner of this property?

The lessee may, at his discretion, choose one of the following behavior options:

- make a demand to the lessor for the obligation to conclude a purchase and sale agreement for the leased property (in such a situation, the lessee does not risk his money);

- list the redemption price (in addition to the entire amount of lease payments) and refer to the fact that ownership of the leased property has transferred to the lessee (in this case, the lessee risks the amount of money that constitutes the redemption price).

If the lessee decides to insist on a separate purchase transaction, he will need to refer to the fact that the leasing agreement is a preliminary purchase and sale agreement. The lessor can be forced to enter into a purchase and sale agreement on the basis of paragraph 5 of Article 429, paragraph 4 of Article 445 of the Civil Code of the Russian Federation (Resolution of the Federal Antimonopoly Service of the Moscow District dated May 4, 2011 No. KG-A40/3314-11 in case No. A40-97394/10 -82-848). The demand for such compulsion must be submitted within six months from the moment when the grounds for repurchase of the leased property arose.

However, practice shows that the lessee is not always able to conclude a purchase and sale agreement (resolution of the Federal Antimonopoly Service of the Volga-Vyatka District dated December 8, 2011 in case No. A43-3201/2011, determination of the Supreme Arbitration Court of the Russian Federation dated March 29, 2012 No. VAS- 3138/12 refused to transfer the case to the Presidium of the Supreme Arbitration Court of the Russian Federation for review in the manner of supervision).

r />

Example from practice: despite the fact that the leasing agreement provided for a condition on concluding an agreement for the purchase and sale of leased property, the court did not satisfy the claim to force the lessor to enter into this agreement

JSC "E." (lessor) and LLC "M." (lessee) entered into a leasing agreement with the condition of purchasing the leased property (vehicle). In particular, the parties established that ownership of the vehicle passes to the lessee on the basis of a purchase and sale agreement. Such an agreement must be concluded:

- or upon expiration of the leasing term;

- or before the expiration of this period, provided that the lessee has made the entire amount of lease payments and six months have passed since the transfer of the property for leasing.

The lessee transferred the total amount of lease payments and the redemption price of the vehicle, but the lessor refused to enter into a purchase and sale agreement. For this reason, LLC "M." filed a lawsuit to compel the conclusion of the contract.

The courts of the first, appellate, and cassation instances did not satisfy the claim, citing the fact that before the transfer of leasing payments, the leasing agreement was terminated at the initiative of the lessor. At the same time, the courts ordered LLC "M." return the vehicle to the lessor.

The Presidium of the Supreme Arbitration Court of the Russian Federation did not agree with the conclusions of the lower courts that JSC “E.” lawfully terminated the leasing agreement. As a result, the Presidium of the Supreme Arbitration Court of the Russian Federation recognized the agreement as valid and sent the case for a new trial to the court of first instance (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated July 25, 2011 No. 3318/11).

However, the court again refused to satisfy the lessee's claim. This time he argued his decision by saying that the lessor sold the vehicle to a third party. Therefore, JSC "E." cannot act as a seller, since he is not the owner of the leased property and does not have the right to dispose of it (Article 209, paragraph 2 of Article 455 of the Civil Code of the Russian Federation). At the same time, the court did not consider the question of whether ownership of the vehicle was transferred to the lessee after he transferred the total amount of lease payments and the redemption price. In other words, the court considered that only a separate purchase and sale agreement could serve as the basis for the transfer of ownership of the leased asset. Since it is impossible to force the lessor to enter into this agreement, the lessee cannot exercise its right to repurchase (decision of the Moscow Arbitration Court dated December 9, 2011 in case No. A40-111672/09-113-880).

If the lessee decides to transfer the redemption price without concluding a purchase and sale agreement, but the lessor returns it, the lessee will be left with only one option - to force the counterparty to conclude a purchase and sale agreement.

If the lessor accepts the payment amount, the lessee will need to notify the counterparty that, from the moment of transfer of the redemption price, ownership of the leased property has transferred. In this case, it would not be superfluous to give the following arguments:

- the concluded leasing agreement is considered a mixed agreement containing elements of a leasing agreement and a purchase and sale agreement (Resolutions No. 1729/10, No. 17389/10);

- despite the fact that the parties indicated the completion of a separate transaction for the redemption of the leased property, the transfer of ownership of the property to the lessee is considered to have taken place from the moment the entire amount of lease payments is made and the redemption price is paid (resolution of the Federal Antimonopoly Service of the Moscow District dated July 29, 2013 in case No. A40 -95474/12-114-903, FAS North-Western District dated December 18, 2012 in case No. A56-5708/2012, FAS Volga District dated June 18, 2013 in case No. A57-22135/2012, dated May 8 2013 in case No. A57-20961/2012).

If the lessor does not agree with the above reasoning, it would be advisable for the lessee to go to court with a demand for recognition of ownership of the leased asset.

Tax accounting

Let's consider the features of tax accounting of leasing objects:

- Receipt of leased item. If the leased object is on the buyer’s balance sheet, the lessee needs to include it in a suitable depreciation group (based on paragraph 10 of Article 258 of the Tax Code of the Russian Federation). The initial cost of an object is the total of the lessor’s expenses for the purchase of the item, delivery, installation, etc. The price does not include taxes that are subject to deduction (based on paragraph 3 of paragraph 1 of Article 257 of the Tax Code of the Russian Federation).

- Depreciation. The initial cost of items is included in expenses through deductions for depreciation on the basis of paragraph 2 of Article 253 of the Tax Code of the Russian Federation. For depreciation charges, you can use a coefficient not exceeding 3 (clause 2 of Article 259.3 of the Tax Code of the Russian Federation).

- Leasing payments. Monthly lease payments must be taken into account. Depreciation charges are deducted from them.

- Redemption of the leased object. When calculating the initial cost, VAT is not taken into account.

IMPORTANT! During the calculation of leasing payments, VAT can be deducted. The basis for the procedure is paragraph 2 of Article 171 and paragraph 1 of Article 172 of the Tax Code of the Russian Federation. You can also restore VAT, which was accepted for deduction from the prepayment.

About the redemption value in the form of a separate payment

The redemption value can be established in the form of an independent payment transferred by the lessee to the lessor after making all obligatory lease payments, in which it was not included.

When setting a symbolic redemption price in the contract (many lessors set it in an amount not exceeding several thousand rubles), it is worth remembering the position of the Presidium of the Supreme Arbitration Court of the Russian Federation, which in its resolution dated July 12, 2011 No. 17389/10 indicated that a low redemption price can be established only if the actual period during which the property is subject to operation coincides with the duration of the leasing agreement. Otherwise, in the opinion of YOU, the transfer of ownership of the property at a very low price (close to zero) is evidence that its real value was included in the monthly lease payments.

In the course of interaction between participants in a leasing transaction, such a situation may have negative consequences for both parties. Thus, the lessor runs the risk of receiving from the lessee a demand for the return of funds allegedly overpaid by him to pay for the redemption price in the event of early termination of the leasing agreement. Lessees will not be able to take into account the depreciation of leased property as expenses incurred, which will entail an increase in the income tax base and, as a consequence, an overall increase in the organization’s costs.

Third condition

Thirdly, this is a clearly established procedure for transferring rights to own, for example, a car. Since the payment for the redemption of property is directly related to the transfer of ownership, experts recommend that the contract reflect in what time frame and how exactly the lessor undertakes to re-register the leased asset to the lessee. Then, when the redemption value is not established through the terms of the contract, it is considered that it is established by the sum of absolutely all payments made. In other words, payment of the ransom payment is carried out on time and in the amount specified in the payment schedule.

Second condition

Secondly, these are payment terms, which represent an amount of money determined through a document, which, subject to inclusion in the leasing payment, is paid in accordance with the established schedule. It is important to note: if the payment for the redemption of the leased property is repaid separately, then the agreement may provide for two options: payment together with the final payment or payment until a certain day (date), usually set slightly later than the deadline for payment of the final lease payment.

Reflection in the contract

Having considered the redemption price and transactions with the lessee, it would be advisable to consider the formalization of the most significant factors of the agreement in the contract. Thus, at present, all the terms of the leasing agreement (including in terms of the redemption payment), which are determined by some importance, must one way or another be written down in the relevant agreement. The documentation should contain the three most important points, discussed in the following chapters.

Case Study

As it turned out, in order for the right to own the leased object (in our case, a car) to pass to the lessee, he needs to reimburse the remaining (outstanding) cost of the transport directly to the lessor, namely two hundred and sixty thousand rubles. It is important to note that the considered approach is usually used when executing a leasing transaction with structures that are just starting their own activities. Why? The fact is that it somehow allows newly opened companies to receive a deferment in terms of paying the full cost of rented real estate (buildings, structures, vehicles, and so on).

In accordance with the second situation, the initial cost of the leased property is paid directly by the lessee during the entire period of validity of the previously concluded agreement, subject to equal payments. In other words, the initial cost of a car or other property is divided into a certain number of payments, which are provided for by the generated schedule.