Employer reporting

Victoria Pechieva

Expert, chief accountant with 12 years of experience

Current as of December 26, 2018

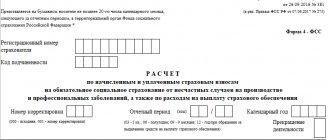

4-FSS for 2021 is submitted to the Social Insurance Fund within the deadlines established by law. Who submits the form and when should it be done? What are the consequences of late submission of a report? How to fill it out correctly? Let's look at the step-by-step filling out of the form, as well as answering important questions using an example.

Changes in reporting from the 1st quarter of 2021

The FSS of Russia has developed a draft order approving the new reporting form 4-FSS. The new document will come into force with reporting for the 1st quarter of 2021. The changes are related to the transition to direct payments to employees from the fund.

What will change in the calculation:

- The column “Subordination Code” will appear on the title page - the code of the FSS body where the policyholder is registered.

- Table 1 will change its name to “Calculation of premium amounts”; a new line “Calculated insurance premiums” has been added to it.

- Table 1.1 will be supplemented with a breakdown of information about the base and contributions for organizations with designated independent classification units (SCU). It is formed by type of activity: in the first line of the “Main Foreign Economic Activity” it is necessary to indicate data related to that part of production (activity) that is not allocated in the SKE.

- Table 2 is intended for policyholders who temporarily send their employees under an outsourcing agreement.

- Tables 2 and 3 will be removed from the current calculation form.

- Current tables 3, 4 and 5 will be renumbered.

Responsibility

An insured who fails to submit a calculation on time will be fined under paragraph 1 of Article 26.30 of Law No. 125-FZ of July 24, 1998. The fine is 5 percent of the amount of contributions due to the budget for the last three months of the reporting (settlement) period. This fine will have to be paid for each full or partial month of delay. The maximum fine is 30 percent of the amount of contributions according to the calculation, and the minimum is 1000 rubles.

In addition, an administrative fine of 300-500 rubles will be imposed on officials responsible for submitting the report.

Form for the 4-FSS report

The report form was approved by FSS order No. 381 dated September 26, 2016, and it has already been changed twice. The first time - from 01/01/2017 due to the transfer of administration rights for insurance coverage to the Federal Tax Service and the exclusion of calculations for temporary disability and maternity from reporting. And the second - from 06/07/2017 due to the new FSS order No. 275. No changes were approved in 2018–2020.

The report consists of a title page and five tables, as in the previous version of the document. You can use 4-FSS in the latest edition from the official website of the Social Insurance Fund. The title page and tables 1, 2 and 5 remain mandatory. Table parts 1.1, 3 and 4 are filled in only if the relevant information is available, otherwise dashes are added.

In 2021, officials added new fields to the form. The changes also affected the filling procedure. For example, the value of the field “Average number of employees” should now be calculated not for the previous reporting period, but from the beginning of the year. That is, to fill out the Social Insurance Fund form for the 4th quarter, we calculate the average payroll for employees for the past year (12 months).

General requirements

The procedure for filling out 4-FSS established by the supervisory authority determines a number of mandatory requirements for the document. Those who fill out information about the organization on paper should carefully read them.

In the case of working with an electronic document format, a special program will indicate that the fields are filled in incorrectly and will even check the compliance of the indicators in order to ensure that they are correct.

When submitting a calculation on paper, you can fill it out first on a computer or manually, but in this case you need to remember the following rules:

- You can only use a fountain pen or ballpoint pen;

- The ink color must be blue or black (the use of other colors is not allowed);

- Information must be entered strictly in block letters.

In the lines and columns, space is reserved for only 1 indicator; it is strictly prohibited to enter several in them. If some information is missing, then you cannot leave the column empty - you need to put a dash in it.

Error correction

Knowing the general rules for entering information, some policyholders do not remember how to fill out 4-FSS in case of errors. In such cases, it is strictly prohibited to use concealer or other similar products. If you find an error/clip, proceed as follows:

- the erroneous meaning must be crossed out;

- indicate the correct parameter next to it;

- near the adjusted value, the employer himself, acting as the policyholder, or his representative/authorized person puts his signature (in the same ink that the document itself is filled out);

- The date of amendments to the document is indicated, and not the date of submission of the report.

If an individual entrepreneur or organization has a seal, then she also needs to endorse the corrections.

Filling sequence

If the policyholder has recently opened an enterprise and is submitting reports for the first time, he may have a completely natural question about how to fill out form 4-FSS. You need to follow the established rules. It is better to enter information in this order:

- transfer all information about the organization to the title page;

- from the title page to the remaining pages, transfer the values for the fields “policyholder registration number” and “subordination code” (they will be the same for the organization) - in electronic format they are usually placed on other sheets automatically;

- fill out all mandatory tables and additional ones if data is available;

- check the received parameters;

- after entering all the information and carefully checking, make continuous numbering of all pages (1, 2, and so on), entering the appropriate values in the “page” field;

- indicate on all pages the date of preparation of the document, as well as the signature of the employer or his authorized/responsible person.

Please note : there is no “page” field on the title page, but this particular sheet will be the first, and for subsequent ones 2, 3, and so on are entered.

This algorithm will help you avoid getting confused and do everything correctly. But before entering information, you also need to familiarize yourself with the rules for filling out all components of the report.

Who rents

The obligation to provide a report to Social Insurance is enshrined in Law No. 125-FZ. According to legislative norms, all legal entities, individual entrepreneurs and private owners who employ the hired labor of insured citizens are required to report. That is, all employers who pay social insurance contributions to Social Security for their subordinates are required to submit the unified Form 4-FSS in 2021. Insured persons in accordance with clause 1 of Article 5 of Law No. 125-FZ are recognized as:

- Working citizens with whom an employment contract, agreement or contract has been concluded.

- Citizens forced to work by court decision as part of the execution of a sentence.

- Individuals working under civil contracts, copyright contracts, construction contracts and others, the terms of which provide for social insurance (payment by the employer of contributions for injuries).

If the organization employs not only full-time employees, but also contract workers, be sure to study the contract that was signed with such a specialist. Pay special attention to the terms of accrual and payment of insurance coverage. If, in addition to mandatory contributions (compulsory health insurance and compulsory medical insurance), contributions for injuries are also indicated, then the amount of remuneration for the work of contract workers will have to be included in the reporting.

Deadlines for submitting 4-FSS in 2021

The deadline for submitting a report to Social Insurance in Form 4-FSS for the 4th quarter of 2021 depends on the method of submission. For policyholders who generate reports on paper, the report is submitted no later than 01/20/2021. There is a deadline of January 25 for injury contribution payers reporting electronically.

A single memo to the accountant, the deadline for submitting the new Form 4-FSS for 2020 in one table:

| Electronic | On paper |

|

|

IMPORTANT!

There are special rules for choosing the type of submission of 4-FSS reports: for policyholders with an average number of up to 25 people, they are provided on paper, for payers with 25 or more employees - exclusively in electronic form.

The policyholder independently determines how to submit 4-FSS electronically: use the free state FSS portal or purchase a license to send electronic reports through an electronic document management operator.

How to send a report to the fund

You can submit reports to the fund by sending a document by mail or telecommunication channels (VLSI, Kontur-Extern, AstralReport) or by going to the FSS yourself and handing over the completed report to the insurance inspector assigned to your organization. Of course, the best option is to submit the report yourself, since by being present in person, you will be able to explain and comment on the controversial situation. After the inspector accepts the documents, you will have one copy of the report with the seal of the insurance authority, confirming the transfer of the report.

How to fill out if activity is suspended

Companies suspend operations infrequently. In most cases, this situation occurs in non-profit organizations; public sector employees are “frozen” much less often.

If the activity of the entity is suspended, there are no taxable charges in favor of employees, it is necessary to submit a zero 4-FSS. Even if there were no accruals in favor of full-time employees in the billing period, for example, if a non-profit organization did not make payments throughout 2021, then still submit the report on time.

Officials did not provide any exceptions; a zero 4-FSS report is required to be submitted to inspectors. A fine will be issued for failure to pass zero marks. To prevent the application of sanctions, you will have to fill out the title page of the 4-FSS form and tables numbered 1, 2 and 5.

This is what 4-FSS zero reporting looks like for 2021:

Features of filling out 4-FSS

Representatives of the Social Insurance Fund require that basic rules be followed when drawing up a reporting form for injuries. Key rules on how to fill out form 4-FSS without errors:

- It is acceptable to fill out the 4-FSS form by hand. Use only black or blue ink for notes.

- All pages of the paper report are signed by the head of the organization indicating the date of signing. Don't forget to put the page number in the special field at the top.

- Corrections are not allowed. If you made a mistake on one of the pages, you will have to rewrite it.

- The electronic version of 4-FSS must be certified with a qualified signature of an authorized person of the institution. The electronic form must be checked in specialized verification programs before sending.

It is not necessary to print out 4-FSS pages that lack information and submit them to Social Security.

Other calculation sheets

The remaining sections are filled out optionally, subject to the conditions specified in the instructions. For example, part 3 is addressed to employers who, in the reporting quarter:

- preventive measures were carried out;

- benefits were paid to employees who were injured at work.

For more information, see “Table 3 of Form 4-FSS: filling out.”

In turn, the 4th table is intended for companies that have had accidents at work.

For more information about this, see “Filling out Table 4 of Form 4-FSS.”

Compliance with the current procedure for filling out 4-FSS for 2021, set out in the regulations of the Social Insurance Fund, will protect the employer from unnecessary problems and clarifications, and the imposition of penalties.

Also see “4-FSS: fines in 2021.”

Read also

05.04.2018

The procedure for drawing up a 4-FSS report by a budget organization

Let's look at a clear example of filling out form 4-FSS: GBOU DOD SDUSSHOR "ALLUR" receives funding from the regional budget. OKVED 93.1 corresponds to group 1 - tariff 0.2%. The average number of employees for the reporting period was 28 people. Employment contracts have been concluded with all employees.

Total accruals for the four quarters of 2021 are 9,000,000 rubles, including in the 4th quarter of 2021:

- October - 1,000,000 rubles;

- November - 1,000,000 rubles;

- December - 1,000,000 rubles.

| Name of section of form 4-FSS | How to fill out |

| Title page | We enter information about the organization in the following order:

|

| Table 1 | In the tabular section we indicate information about accruals made to employees, amounts not included in the calculation of insurance premiums, and the taxable base. We indicate the information by month, and the total amount - on an accrual basis. We obtain information for filling out the reporting form by generating a turnover sheet for account 302.10 “Calculations for wages and accruals for wage payments.” We determine the contribution rate in accordance with the professional risk class. |

| table 2 | We fill in information about accrued insurance premiums for injuries and information about the transfer of payments to the budget. We obtain the data for the table by generating a turnover sheet for account 303.06 “Calculations for insurance contributions for compulsory social insurance against industrial accidents and occupational diseases.” |

| Table 3 | To be completed if available:

|

| Table 4 | Information about employees injured on the territory of a budgetary institution or while performing their official duties. If there are none, put dashes. |

| Table 5 | Information about the special assessment of working conditions. If a special assessment was not carried out, put dashes in the cells. |