In 2021, the rules for filling out payment orders have been updated. Some changes take effect immediately, while others take effect later.

At the beginning of the year there were a lot of questions about processing payments in 1C:

- Why is BIC 004525987 not in the bank classifier, but BIC 004525988 and BIC 024501901 are not in 1C?

- Does this change in payments to public sector contractors apply?

We will tell you in this article how changes in filling out payment orders to the budget are implemented in Accounting 8.3.

General approach

The payment order form that is relevant for filling out in 2021 is fixed by the regulation of the Central Bank of Russia dated June 19, 2012 No. 383-P. This form has the index 0401060. However, if you fill out a payment order online on the tax office website, you will not have to search and select the required form. The online payment order will be automatically generated by the tax system on the required form.

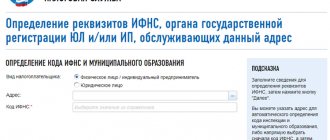

To issue a payment order to the Federal Tax Service online, you need to follow the following permanent link to the official website of the Russian Tax Service:

https://service.nalog.ru/payment/payment.html

This link is relevant for all regions of Russia. Using it, you can generate a payment order online with the Federal Tax Service using a special service designed to deduct mandatory payments to the treasury:

Also see “Electronic services for accountants on the Federal Tax Service website: use wisely.”

New in 2021

Before challenging charges, you should find out what changes in calculations have been adopted in 2021:

- the property fee is calculated from the cadastral value of the property;

- the list of vehicles to which the increasing factor is applied has been expanded;

- a law was passed on the deduction of six acres of land.

Rates and benefits vary depending on where the taxpayer lives, so it's also worth checking out changes in local government regulations.

Options

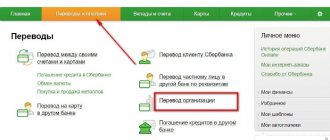

First of all, we note that only a company or entrepreneur can issue a payment order online to the Federal Tax Service. In addition, the latter can choose between an online payment order to the tax office and simply a payment document. And ordinary individuals through this service can generate only payment documents.

The payment document can be used:

- For cash payments when printing it and submitting it to the bank.

- For non-cash payments by electronic payment.

As for the payment order, it can only be used for non-cash payments when it is printed and submitted to a credit institution.

To create a payment order online to the tax office, you must first enter a number of initial data sequentially:

- Payment type.

- Details of its recipient.

- Details of the payment itself.

- Payer details.

Creating payment orders for taxes online is quite simple. If all the necessary data for generating the document is entered correctly, the service will generate a payment. Otherwise, it will display an error prompt and will not allow you to enter further data.

EXAMPLE

If you don’t know the required BCC, you can still generate a payment order online with the Federal Tax Service. To do this, first select the tax group and payment name, and, if necessary, specify its type.

Also see “Filling out a payment order in 2021: sample.”

The concept of “payments” and the grounds for payment

A payment order is understood as a documented order from the account owner to the bank that services him to transfer a certain amount of money to the recipient’s account.

The main provisions of this financial document are enshrined in Article 863 of the Civil Code of the Russian Federation. In addition, the Civil Code also specifies the time frame within which the bank is obliged to execute this client order:

- within two business days if the payment is made within the borders of one constituent entity of the Russian Federation;

- within five operating days throughout Russia.

Also, in column 106 of the said document, entitled “Bases of payment”, an entry is made about the voluntary repayment of the arrears arising for the payment of a tax or fee. Filling out such an order for other reasons is not allowed; other banking documents have been developed for payment for them. These are the ones you should use and not try to replace them with others, simply changing the payment amounts in them, as well as some other details.

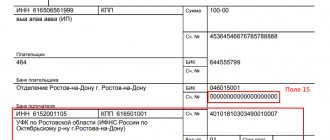

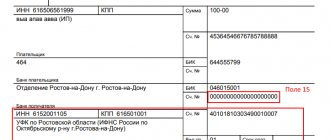

Example of an online payment order from Tax ru

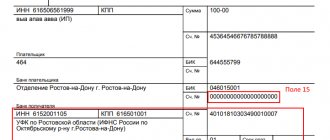

Let's assume that St. Petersburg needs to make an advance payment on transport tax for the second quarter of 2021. To fill out an online tax payment order, she sequentially indicates the following items:

| 1. TYPE OF TAXPAYER AND TYPE OF SETTLEMENT DOCUMENT | |

| Taxpayer: | Entity |

| Settlement document: | Payment order |

| 2. TYPE OF PAYMENT | |

| KBK: | 18210604011021000000 |

| Tax group: | Property taxes |

| Payment Description: | Transport tax for organizations |

| Payment type: | Amount of payment |

| 3. PAYMENT RECIPIENT DETAILS | |

| Taxable object address: | (empty) |

| IRS code: | 7835 – Interdistrict Inspectorate of the Federal Tax Service of Russia No. 4 for St. Petersburg |

| Municipality: | 40308000 – Vasilyevsky municipal district |

| 4. PAYMENT ORDER DETAILS | |

| Person status: | 01 – Legal entity |

| Basis of payment: | TP – Current year payments |

| Taxable period | KV.02.2017 |

| Date of signature of the declaration by the taxpayer: | 42752 |

| Payment order: | 5 |

| Amount of payment: | 2000 |

| 5. PAYER DETAILS | |

| Name: | LLC "Stroykomplekt" |

| Taxpayer Identification Number: | 7804300920 |

| Checkpoint: | 780401001 |

| Payer bank: | North-West Bank PJSC Sberbank |

| BIC of the payer's bank: | 44525225 |

| Account number: | 30301810000006000000 |

Below is shown how it turned out to create a payment order online on the tax office website with an advance payment for transport tax.

Also see "Transport Tax: Advance Payments in 2021."

Read also

16.05.2017

The payment can be generated through the electronic service of the Federal Tax Service

Individual entrepreneurs and legal entities pay taxes and fees exclusively in non-cash form. To do this, a certain amount of money equal to the amount of tax or fee will be deducted from their current account through a payment order in favor of the Federal Tax Service.

The obligation to accurately register it in this case is established by the Regulation of the Central Bank dated June 19, 2012 No. 383-P. The requirements for the formation of this financial document are recorded in Order of the Ministry of Finance of the Russian Federation dated November 12, 2013 No. 107n.

Alternative option

Debt verification is available on the government services portal. To do this, you need to log in and go to the “services” section, and then select “Tax debt”.

To obtain information, you need to provide payer information and TIN.

Data on accrued but not paid fees will be displayed on the screen. On the portal you can immediately transfer funds using a bank card. When the money is credited to the Federal Tax Service, the user will receive a notification in their personal account.

Online methods for generating payment documents for the payment of taxes and government duties - a convenient service. Using the Federal Tax Service website, you can easily pay any fees, without commission, which allows you to save money and time on visiting a bank or post office. If you are unable to receive notifications, you can fill them out yourself.

Taxpayer personal account – individual entrepreneur, modern entrepreneur

Connecting to the service does not require a personal visit to the inspectorate to obtain a password and login. To connect, you can use two methods: by analogy with legal entities, using a signature key certificate previously issued by a certification center and used to submit tax and accounting reports in electronic form, or using the login and password from the Taxpayer Personal Account service for individuals.

According to the head of the Federal Tax Service of Russia, Mikhail Mishustin, the new service was designed taking into account the needs of entrepreneurs and their level of financial and tax literacy. Based on a large-scale survey of representatives of small and medium-sized businesses, specialists from the Federal Tax Service of Russia created an intuitive interface that will help entrepreneurs independently, without the help of a professional accountant or lawyer, interact with the tax authority.

Where to pay UTII

Payment of UTII is made at the place of registration as a single tax payer (clause 1 of Article 346.32 of the Tax Code of the Russian Federation).

Example 1. Romashka LLC is located in Yaroslavl, but operates on a special basis in the city of Tutaev, where it is “imputed” registered with the Interdistrict Inspectorate of the Federal Tax Service No. 4 for the Yaroslavl Region. She transfers UTII to this Federal Tax Service.

It is worth noting that there is an exception to this rule. It concerns organizations and individual entrepreneurs that:

- transport goods and passengers by road;

- are engaged in distribution and distribution trade;

- place advertisements on vehicles.

Since such taxpayers in relation to the specified types of business activities are registered as “imputed” (paragraph 3, paragraph 2, article 346.28 of the Tax Code of the Russian Federation):

- by location (organization);

- at place of residence (individual entrepreneur),

then they must pay tax to the relevant Federal Tax Service. It does not matter in which municipalities and in which tax territories the activities subject to UTII are carried out.

This video is unavailable

From 2021, individual entrepreneurs and limited liability partnerships operating under a simplified taxation regime must pay taxes for employees monthly (pension, social contributions, income tax and compulsory medical insurance), as well as for the entrepreneur himself (pension and social contributions). Taxes for January must be paid by February 25, for February by March 25, etc.

Many entrepreneurs know that bank commissions are very high, and if you pay money monthly, you will spend even more on commissions! I would like to express my gratitude to KASPI Bank for allowing us to pay taxes without commissions - this is a great help to entrepreneurs!

Payment Identifier (UPI)

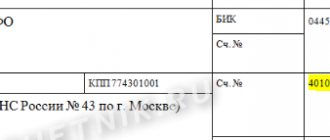

Also, special attention should be paid to field 22 - “Unique payment identifier” (UPI). This consists of 20 or 25 characters. As a general rule, the UIP should be reflected in the payment only if it is set by the recipient of the funds. In addition, the latter must communicate its value to the payer (clause 1.1 of the instruction of the Central Bank of the Russian Federation dated July 15, 2013 No. 3025-U).

When transferring amounts of current taxes, fees, and insurance premiums calculated by the payer independently, additional identification of such payments is not required. In this case, the identifiers are KBK, INN, KPP and other details of payment orders. In field 22 “Code” it is enough to indicate “0”. In this case, the bank:

- cannot refuse to execute such an order;

- does not have the right to require filling out the “Code” field if the payer’s TIN is indicated (letter of the Federal Tax Service dated 04/08/2016 No. ZN-4-1/6133).

At the same time, filling out a payment order at the request of the Federal Tax Service for 2021 obliges to transfer to the payment the UIP value, which must be indicated in the submitted request.

Otherwise, filling out the fields of a payment order at the request of the Federal Tax Service does not have any fundamental features.

Where can I get a new copy of the receipt for taxes paid long ago?

A situation is possible when a person paid tax to the budget on time, but after some time received a demand from the Federal Tax Service to pay it. When visiting a government agency, it turns out that the payment is not listed in the Federal Treasury system.

Typically, such situations are associated with payment using incorrect details or loss of payment in the document flow and the expiration of a large amount of time - several years.

How to find out the TIN for an individual via the Internet using a passport

You can only find a receipt from two or three years ago at a bank.

Methods:

- if a person paid charges with a bank card or through an open savings account, then you need to order an account statement for a certain period - it will reflect all monetary transactions, incl. for lost payment;

- if a citizen paid in cash, he will have to remember in which specific bank branch, on what date and in what amount he paid; If this information is available, the bank will accept an application to seek payment.

Paid receipts must be kept for 3 years.

Debt, taxpayer personal account, TIN, organization database

To receive the selected service in the Federal Tax Service hall, you must receive an electronic queue coupon before the appointed time. To do this, you must enter the 'PIN code' specified in the current coupon in the electronic queue terminal and receive a printed electronic queue coupon.