Often, when conducting on-site or desk audits, the Federal Tax Service Inspectorate requests from companies many copies of documents, i.e. copies, the information in which completely coincides with the original. Do I need to certify copies of documents for the tax office?

Yes need. Documents should be submitted to the Federal Tax Service Inspectorate in the form of certified paper copies (Clause 2 of Article 93 of the Tax Code of the Russian Federation). Certification of information in copies is a mandatory action to ensure their legal significance. They should be submitted in full as requested by the Federal Tax Service, in accordance with the criteria existing today. We will learn how to properly certify copies for the tax authorities and what to follow when doing so.

Why do you need to certify copies?

GOST R 7.0.8-2013 “System of standards for information, library and publishing.

Record keeping and archiving. Terms and definitions" (approved by order of Rosstandart dated October 17, 2013 No. 1185-st) divides all copies taken from documents into regular and certified. In this case, a copy is recognized as a copy of a document that completely reproduces the information of the original. And a certified copy is a copy that contains details that ensure its legal significance. Receive requests from the Federal Tax Service for free and send the requested documents via the Internet

As you can see, certification of a copy is necessary to give it legal significance. In other words, only such copies are used in official document circulation, including for submission to state and municipal authorities or for transfer to other organizations, individual entrepreneurs and individuals.

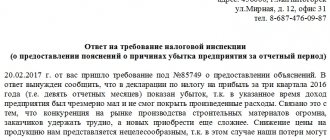

In particular, it is certified copies of documents that can confirm expenses for tax purposes (letter of the Ministry of Finance dated October 25, 2019 No. 03-03-06/1/82236). You will also have to certify copies of paper documents submitted to the tax office in response to the corresponding requirement (Clause 2 of Article of the Tax Code of the Russian Federation).

Please note: you can simplify and speed up the process of sending documents to the inspection using special services, for example, the “Connector Kontur.Extern” web service. It makes it possible to prepare and send tens of thousands of electronic documents to tax authorities at a time, while approximately 9 thousand documents are processed per hour. Through the “Connector” you can transfer to the Federal Tax Service any electronic documents created in approved formats (for example, invoices, TORG-12 invoices, etc.), as well as scanned images of any documents created on paper: acts, contracts, payments and etc.

Connect to Kontur.Extern for free with your electronic signature

Responsibility

Desk and on-site inspections

If the company does not submit documents within the prescribed period, it will be fined 200 rubles. for each document not submitted (clause 1 of article 126, clause 4 of article 93, clause 6 of article 93.1 of the Tax Code of the Russian Federation). Moreover, the fine increases to 400 rubles. for each document, if within a year the organization commits a similar repeated violation (clauses 2 and 3 of Article 112, clause 4 of Article 114 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of Russia dated July 24, 2012 N 03-02-08/64) .

Let us note that a taxpayer cannot be held accountable if the number of documents he has not submitted is not reliably determined. Establishing the amount of the fine based on the presumed availability of at least one of the requested types of documents is unacceptable (Letter of the Ministry of Finance of Russia dated October 17, 2013 N 03-02-08/43377).

Arbitrage practice. If the requirement to submit documents necessary for a desk tax audit is not fulfilled by the taxpayer due to the request for documents that are not related to the subject of the audit, or due to the uncertainty of the documents requested, then there are grounds for applying the liability provided for in paragraph 1 of Art. 126 of the Tax Code of the Russian Federation, not available (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated 04/08/2008 N 15333/07).

In addition, for failure to submit documents to the inspection within the prescribed period, an administrative fine is imposed on officials - from 300 to 500 rubles. (Part 1 of Article 15.6 of the Code of Administrative Offenses of the Russian Federation).

Guidelines for certification

Certification of copies of documents is regulated by another state standard, namely: GOST R 7.0.97-2016 “System of standards for information, library and publishing. Organizational and administrative documentation. Requirements for the preparation of documents" (approved by order of Rosstandart dated December 8, 2016 No. 2004-st; hereinafter referred to as GOST).

Also, recommendations for preparing copies of documents are given in Appendix No. 18 to the order of the Federal Tax Service dated November 7, 2018 No. ММВ-7-2/ [email protected] , in letters of the Ministry of Finance dated August 7, 2014 No. 03-02-RZ/39142 and dated October 29, 2015 No. 03-02-RZ/62336.

ADVICE. Before certifying a document, it would be a good idea to familiarize yourself with the Methodological Recommendations for certifying the accuracy of copies of documents and extracts from them (approved by the decision of the FNP board of April 25, 2016, protocol No. 04/16). Although this document is designed for notaries, it contains a lot of useful information that will be useful when certifying copies yourself.

Stitching with threads

The importance of the stapling process is that it determines the correctness of the documents. The clerk must know all the processes that will occur with sewn paper. The specialist must take a course in the discipline “Documentation”. It will introduce you to important nuances and allow you to carry out paperwork procedures without fear.

Most entrepreneurs are faced with the peculiarities of document management for the first time. However, it is quite possible to figure it out and learn on your own.

Let's look at the procedure for stitching several sheets. You will need:

- needle;

- awl;

- stationery glue;

- twine, nylon thread;

- blank sheet of paper.

The most common is three-hole stitching. Technology is not new. Since ancient times, books and papers have been sewn together using thread and needle. Today the firmware has not changed.

Start by making three holes. To do this, use an awl or hole punch. The holes should be 2 cm away from the left edge. For stitching, take a large and thick needle - a “gypsy”. Regular needles will break quickly.

A 40 cm thread is threaded into the needle. If you follow the sequence, it will be enough for two stitches. This will prevent the threads from rubbing during long-term storage or frequent movements. The needle is inserted from the back.

- Sew from the bottom into the hole in the middle. Be sure to leave edges (more than 10 cm) for further binding after stitching.

- Bring the needle to the front side, threading it through the middle hole, and stick it into the top hole, bringing the thread to the back side.

- We pass the thread to the far hole on the back side of the document past the middle hole, stick the needle in, sticking the thread out onto the front side.

- Return the needle and thread to the middle hole from which you started stitching.

- Repeat all operations again.

- On the back side, tie the two ends of the thread with a double knot.

- They paste a small piece of paper onto the bundle and certify the document with signatures and seals.

The sticker and the ends of the threads are left so that the tied knot can be seen.

Who has the right to certify documents

Any authorized person has the right to certify the accuracy of the copy on behalf of an organization or individual entrepreneur.

Such authority may arise from the statutory documents (in particular, the head of the organization, the chairman or secretary of the general meeting, the head of the audit commission, etc. have the right to certify copies). Or it can be based on other documents - a power of attorney, an organization order, a job description, etc.

An entrepreneur has the right to independently certify a copy of a document or entrust it to another person (clause 5 of the Requirements given in Appendix No. 18 to the Federal Tax Service order dated November 7, 2018 No. MMV-7-2/ [email protected] ; hereinafter referred to as the Requirements). Please note that such a person can only be an individual entrepreneur. The position of this employee should be indicated on the certification mark affixed to the copy.

Check the counterparty for signs of a shell company and the presence of disqualified persons

Types of stitching

Documents can be stapled in various ways. The difference will be in the number of holes:

- 3-hole stitching is used for papers sent to the tax service and archives. The distance between the holes should be 3 cm. First, punch the middle hole, and then measure the distance from it and punch two more extreme ones. Turn the stack over and thread the thread through the middle hole, leaving the tip on the first page. The thread should go further in the following sequence: top hole - bottom - middle. Next, the ends are tied and sealed.

- 4-hole stitching is used for enterprise registration documents. The distance between the holes is 1.5 cm. After punching the holes, the paper is turned over with its back side. The thread should go the following way: bottom hole - bottommost hole - second bottom hole - second top - topmost - second top. Tie a knot and seal it with paper.

- 5-hole stitching for accounting documents with a shelf life of more than 10 years. The papers are stitched similarly to the previous method - with a snake.

When stitching, symmetry and verticality are strictly observed. The stitches must be even, and for this, all holes are marked exactly under the ruler. The final step is to tie the thread with one strong double knot. The free edges are sealed.

All visas and dates should be visible on the stitched sheets, and the inspector should be able to easily read all the text.

How to certify copies of statutory documents

The legislation does not contain any specifics regarding certification of copies of statutory documents. Therefore, the rules discussed above should be applied. Since we are talking about multi-page documents (charter, constituent agreement), it is also necessary to take into account the procedure for binding such papers for the purpose of their certification.

Thus, the firmware must be done for 4 punctures, although for documents of small volume 3 punctures are acceptable (clause 4.21 of the Rules for organizing the storage, acquisition, recording and use of documents, approved by order of the Ministry of Culture dated March 31, 2015 No. 526). At the same time, it must be possible to freely read the text of the document, all its details, dates, visas, resolutions, other inscriptions, seals, stamps and marks. Also, the firmware must be done in such a way that each individual page can be copied using a copy machine. But at the same time, the firmware should not “fall apart” into separate sheets (clause 3 of the Requirements).

The stitching must be done with a strong thread or tape, its ends should be brought to the back of the last sheet and tied. After this, the ends of the thread (tape) are sealed with a paper sticker, on which the certification inscription is affixed in the manner indicated above - that is, part of it is on the sticker, and part of it is on the sheet itself.

Determine the likelihood of an on-site tax audit and receive recommendations on the tax burden

Registration in the archive

Before stitching documents, prepare a general inventory, which will contain:

- Title of the document;

- date of compilation of the inventory;

- a short summary;

- inventory in the form of a table with serial numbers, names, dates and notes;

- number of sheets in words and numbers;

- Clerk's signature.

The document will be drawn up step by step:

- Preparation. All sheets are folded in a certain order in an even stack. Create a cover and number all sheets.

- Stitching. Select a stitching method and stitch the sheets twice. The threads are tied in a strong knot.

- Assurance. After creating a single document, it is certified by the signature of the manager and the clerk.

Page numbering does not allow for corrections. When skipping pages, you can use numbering from numbers and letters with the permission of the organization receiving the documents.

How to properly certify documents using the “Copy is True” stamp

GOST does not provide for the affixing of the “Copy is correct” stamp. At the same time, you can use a combination of two stamps - “Copy” and “Correct”. The first of them will mean that the corresponding document reproduces the original, but is not itself such. The second stamp is needed to mark the certification of the copy.

ADVICE. We do not recommend using the “True Copy” stamp to certify documents. Especially if copies will be used outside the organization.

In conclusion, we note that certification of a copy of a document is a simple procedure that any taxpayer can perform independently. But at the same time, you must adhere to the rules, violation of which may lead to the fact that the copy will not be considered certified. This, in turn, will entail additional costs of time and money. And in some cases it can lead to a fine for violating the deadlines for submitting documents to the Federal Tax Service.

Features of stitching for tax authorities

The tax service is a serious body that requires regular reports. She has the right to independently check all provided documentation for correctness and originality. The tax inspector will only require certified documents. All copies must be exact duplicates of the original and contain legally valid certification details. Copies are stitched similarly to the originals.

Any service will refuse to accept incorrectly bound documents.

The number of pages in one bound document should not exceed 150 sheets. Numbering starts from the first sheet and continues continuously throughout the document. Stitched in 2 or 4 layers. The knitted threads are attached with a sheet to the back of the document, which covers the knot and the place of stitching. The sticker must be small - up to 5x5 cm. It must include a certification signature, the length of the pages, the name of the manager and the seal of the organization.

Along with the embroidered papers, a covering letter is submitted to the tax authorities with a detailed indication of the contents and number of papers.

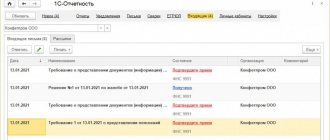

How not to miss a requirement (notification) under TKS

Requests or notifications from the tax office must be responded to in a timely manner. Otherwise, inspectors will block the organization’s current account.

How long does it take to respond to a request? Look at the date on the request. Within six business days after this date, you must send a receipt to the tax office indicating receipt of this request. Or refuse to receive it within the same period if the request was sent to the wrong address.

Let's say you received a request on June 25. This means that you need to respond to it no later than July 3. If the receipt is not sent within the prescribed period, the inspection has the right to block the organization’s account.

Important! The inspector has the right to send a request for a desk audit only within three months from the day you submitted the declaration. If the request was sent later, you do not have to respond to it. There is an exception to this rule: the inspector may send a request within the framework of additional tax control measures outside the three-month period.

Methodological recommendations for office work

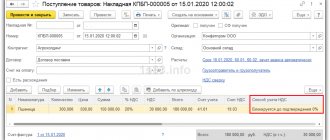

The certification, which is affixed to the copies requested by the Federal Tax Service, consists of:

- The phrases “the copy is correct”, “matches the original” or “true” (affixed to certify the validity of the paper provided).

- Signature of the person (official) who certified the copies.

- Explanation of the signature indicating the surname and initials of the person who signed the documents.

- Date of certification of copies of documents in the established format, example: 01/01/2018.

- Stamp of the seal of the enterprise (organization) or private entrepreneur.

As a rule, at large enterprises the inscription is affixed in the form of a stamp rather than written by hand

Important! If an individual entrepreneur does not have his own seal, submitting copies without affixing it is permitted and will not lead to the recognition of the certification as “inappropriate.”

When one document is submitted to the tax office, the entire certification is written directly on the copy itself. If the document is on several sheets, it is stitched. It is necessary to sew the package with a large needle, make holes with an awl or a hole punch, the holes should not touch the text, and after fastening there should be free access to completely turn the sheets and make copies from them; for this, two or three holes are made on the left side on a vertically located A4 sheet .

You need to make a rectangle measuring 6 by 4 centimeters from white paper and glue it to the stitched folder so that the knot of threads is in the center of the glued rectangle. The ends of the rope should be a little more than two centimeters.

The certification inscription is affixed directly to the glued rectangle, which also indicates the number of stitched and numbered sheets (as a rule, organizations have forms of such certification sheets).

Important! All documents in the bound folder are numbered. It is necessary to number sheets, not pages, since a double-sided copy is not allowed when presented to the tax office.

Improper certification of copies of documents submitted to the tax authorities may result in a fine.

If several documents are stitched, then an inventory is also included in the folder indicating the number of copies, names of documents and pages in the folder on which they are located.

The location of the indicated inscriptions on the certification sheet is also important. So, the seal should cover the signature, the transcript of the signature and part of the phrase about the authenticity of the copy.

There are no exact instructions on how to staple documents, but each institution has special standards. This helps to avoid losing important documents and quickly find the information you need among many papers.

Bound documents should be submitted to the following organizations:

- when reporting to tax authorities;

- when transferring cases to court;

- when submitting documents to the archive;

- when applying for participation in tenders;

- when transferring certified copies of papers to the bank.

For stitching you will need the following tools:

- stapler and staples;

- needle, awl and thread;

- special mechanical devices.

As you can see, there are several stitching options. However, some institutions require the use of thread only. This is a safety measure: it is impossible to replace stitched sheets secured with a seal.

Before stitching documents, prepare a general inventory, which will contain:

- Title of the document;

- date of compilation of the inventory;

- a short summary;

- inventory in the form of a table with serial numbers, names, dates and notes;

- number of sheets in words and numbers;

- Clerk's signature.

The document will be drawn up step by step:

- Preparation. All sheets are folded in a certain order in an even stack. Create a cover and number all sheets.

- Stitching. Select a stitching method and stitch the sheets twice. The threads are tied in a strong knot.

- Assurance. After creating a single document, it is certified by the signature of the manager and the clerk.

The importance of the stapling process is that it determines the correctness of the documents. The clerk must know all the processes that will occur with sewn paper. The specialist must take a course in the discipline “Documentation”.

Most entrepreneurs are faced with the peculiarities of document management for the first time. However, it is quite possible to figure it out and learn on your own.

Desk audit - what is it?

A desk audit is a type of tax audit carried out at the location of the tax inspectorate on the basis of tax returns (calculations) and documents submitted by the organization, as well as other documents about its activities available to the tax inspectorate (clause 1 of Article 88 of the Tax Code of the Russian Federation).

A desk tax audit begins after the organization submits a declaration (calculation) to the inspectorate. It is carried out by tax inspectors authorized to do so by their official duties. They do not require special permission from the head of the tax inspectorate to conduct a desk audit. This is stated in paragraph 2 of Article 88 of the Tax Code of the Russian Federation.

The Tax Inspectorate conducts a desk audit based on:

- tax returns (calculations) and additional documents submitted by the organization along with the reporting;

- other documents about the activities of the audited organization that are available to the tax inspectorate.