The article touches on the topic of calculating and paying sick leave, except in the case of “pregnancy and childbirth”. The limitations and features of calculating sick leave in the case of caring for a sick child or other family member are recorded in 255-FZ (clause 5 of article 6 of 255-FZ, clause 3 of article 7 of 255-FZ).

In general, there were no fundamental changes in the calculation of sick leave in 2015.

| Insurance experience | Benefit amount |

| Less than 6 months | Based on the minimum wage |

| From 6 months to 5 years | 60% of average earnings |

| from 5 to 8 years | 80% of average earnings |

| 8 or more years | 100% of average earnings |

Introductory information

From July 1, 2021, organizations and individual entrepreneurs must pay employees at least 7,500 rubles (that is, no less than the new minimum wage). (See “What is the minimum wage today”) If the salary does not reach the specified amount, then it should be increased. In some cases, an increase in the minimum wage will also affect the calculation of sick leave, maternity and child benefits. Let's look at the amount of benefits from July 1, 2016 . However, we will immediately say that no indexation of benefits has occurred since July 1 . It’s just that due to the increase in the minimum wage, there have been changes in the calculation of benefits from July 1 . Also see “Directory of Minimum Wage Changes”.

Automatic accrual of sick leave using Kontur.Accounting

You can calculate sick leave in just a few steps using the online service Kontur.Accounting. Calculations comply with the law, all restrictions are taken into account. Also in the service you can calculate salaries, vacation and maternity pay, keep records of employees and dividends, submit reports to the Pension Fund of the Russian Federation, the Social Insurance Fund and the Federal Tax Service. The system is convenient because it saves the accountant’s time and prevents errors when preparing reports.

A special specialist will help you quickly calculate sick leave:

Calculate sick leave automatically and without errors

Find out more

New minimum wage

Sickness, maternity and child benefits, in general, should be calculated from the average earnings for the billing period, that is, for the two years preceding the onset of illness, maternity leave or vacation of the year (from January 1 to December 31). Accordingly, if an employee, say, fell ill in July 2021, then the billing period will be 2014 and 2015 (Part 1, Article 14 of Federal Law No. 255-FZ of December 29, 2006).

However, earnings for the billing period should not be less than a certain amount. The state guarantees the calculation of benefits based on the minimum allowable earnings. It is defined like this:

Accordingly, if an insured event (illness, maternity leave or parental leave) occurred after July 1, 2021, then the minimum earnings for the billing period will be 180,000 rubles. (RUB 7,500 × 24 months).

Before July 1, the “minimum wage” for the billing period was 148,896 rubles. (RUB 6,204 × 24 months)

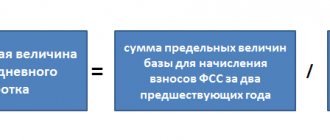

To find out the minimum average daily earnings for calculating benefits, the accountant needs to divide the resulting value by 730. The following formula is used:

Accordingly, from July 1, 2021, the minimum average daily earnings is 246.58 rubles per day (180,000 rubles / 730 days). From July 1, 2021, the average daily earnings for calculating benefits cannot be less than this value.

Before July 1, the average daily earnings were 203.97 rubles (6,204 rubles × 24 months / 730). That is, the average daily earnings increased by 42.61 rubles (246.58 rubles – 203.97 rubles).

Some non-standard cases for paying sick leave

For an employee working in one place, sick leave is calculated for that place, taking into account taxable payments for the previous two years for all places of work, but with the condition that the amount of accruals does not exceed the maximum amount of taxable amounts for each of the years taken into account in the calculation. What if an employee works in several places?

The employee works in several places and worked in the same place in the previous two calendar years.

How to pay: for all places of work.

The employee works for several policyholders, and in the two previous calendar years worked for other policyholders.

How to pay: according to Article 13, Clause 2.1 No. 255-FZ, all benefits are paid by the policyholder at one of the last places of work chosen by the insured person.

The employee works for several policyholders, but in the two preceding calendar years he worked for both these and other policyholders.

How to pay: according to Article 12, Clause 2.2 of 255-FZ, sick leave can be paid in two ways - 1) at one place of work, based on the average earnings for all policyholders; 2) for all current policyholders, based on the average earnings at the current place.

Earning less than minimum

The accountant of an organization or individual entrepreneur should ensure that employee benefits are calculated correctly. This will allow you to easily reimburse benefits from the Social Insurance Fund even after July 1, 2016 . Let us explain what to pay attention to.

So, let’s assume that the insured event (illness, maternity leave or the start of parental leave) occurred in July 2021. The calculation period will be 2014-2015. To calculate the benefit, the accountant needs to determine the average daily earnings using the following formula:

When calculating temporary disability benefits, the number of days should be substituted into this formula - 730. If you are calculating maternity or child care benefits, then the number of days may be less, since days of illness, maternity leave, child leave and release from work are excluded from the calculation period with preservation of earnings (clauses 3 and 3.1 of Article 14 of the Federal Law of December 29, 2006 No. 255-FZ).

Based on the results of this calculation, the average daily earnings cannot be less than the amount calculated from the minimum wage. That is, from July 1, 2016, the average daily earnings cannot be less than 246.58 rubles per day.

Keep in mind that when determining the minimum average daily earnings, you must take into account the minimum wage on the date of the insured event. Accordingly, if an employee gets sick or if an employee goes on maternity leave before July 1, 2021, then use the minimum wage in the amount of 6,204 rubles in the calculation. In this case, the minimum amount of daily earnings will be 203.97 rubles. (6204 × 24 months / 730 days). If the insured event occurred on July 1 or later, then focus on the “minimum” of 246.58 rubles. (RUB 7,500 × 24 months / 730 days).

For clarity, the amount of benefits from July 1, 2016 using the example of payment for a period of incapacity for work. Also see “How sick leave is paid in 2021.”

An example of calculating sickness benefits from the minimum wage. I.A. Feoktistova was ill from July 19 to July 27, 2021 (9 calendar days). Her insurance experience is 2 years and 3 months. The amount of payments in her favor for the billing period (2014 and 2015) amounted to 158,650 rubles. Under such conditions, the actual average daily earnings of I.A. Feoktistova is equal to 217.33 rubles. (RUB 158,650/730). However, the average daily earnings, calculated from the minimum wage, is 246.58 rubles. (RUB 7,500 × 24 months / 730). This amount is higher than I.A.’s actual earnings. Feoktistova: 246.58 rub. > 217.33 rub. Therefore, to calculate sickness benefits, the accountant should take the value calculated based on the minimum wage. Since the experience of I.A. Feoktistova is less than 5 years old, the amount of her benefit will be 60% of average earnings (clause 3, part 1, article 7 of the Federal Law of December 29, 2006 No. 255-FZ). As a result, the amount of sickness benefit will be 1331.53 rubles. (RUB 246.58 × 60% × 9 days).

So, using an example, you can trace the increase in benefits from July 1, 2021 . After all, if the minimum wage had not been increased, then the accountant would have to use the average daily earnings of 203.97 rubles as the average daily earnings.

Please note: if a regional coefficient applies in your area, multiply the minimum benefit calculated from the minimum wage by it. That is, if in the area where I.A. Feoktistov’s coefficient was set at, say, 1.7, then the amount of benefits due to her would be 2263.60 rubles. (RUB 246.58 × 60% × 9 days × 1.7).

There is no earnings in the billing period

If the employee has no earnings at all during the billing period, then to calculate the benefit, instead of zero, one should also take the earnings calculated by the minimum wage, which was established at the time of the insured event. This situation can occur if the employee did not work at all during the pay period and does not have the right to replace the years of the pay period. Let us give examples of such calculations.

Sickness benefit: example of calculation after July 1 A.S. Ivanov was sick from July 4 to July 12, 2021 (that is, 9 calendar days). He had no earnings in the billing period (2014-2015). Experience – 5 years and 2 months. A.S. Ivanov works full time. In such a situation, the accountant should take the average daily earnings calculated from the minimum wage, namely 246.58 rubles. (RUB 7,500 × 24 months / 730) Experience A.S. Ivanov for more than 5 years. This means that he is entitled to 80 percent of average earnings (Clause 2, Part 1, Article 7 of Federal Law No. 255-FZ of December 29, 2006). Therefore, the daily allowance will be 197.26 rubles. (RUB 246.58 × 80%). A.S. Ivanov was sick for 9 days. During this period, the amount of benefits due to him will be 1775.38 (197.26 rubles × 9 days).

We will also give an example of calculating maternity benefits in a situation where there was no earnings in the billing period.

Maternity benefit: example of calculation after July 1 S.B. Nikolaeva wishes to go on maternity leave from July 28, 2021. The billing period is from January 1, 2014 to December 31, 2015. There was no earnings during the billing period. Insurance experience - 7 months. The regional coefficient does not apply. The minimum average daily earnings is 246.58 rubles. (RUB 7,500 × 24 months) / 730. Daily allowance - RUB 246.58. (RUB 246.58 × 100%). As a result, the amount of S.B.’s benefit Nikolaeva for 140 calendar days of maternity leave, calculated from the minimum wage, will be 34,521.2 rubles. (RUB 246.58 × 140 days).

Please note: an employee who is assigned sickness benefits, maternity benefits or child care benefits has the right to contact the accounting department and ask to replace one or both years of the pay period with other years. To do this, she will need to write a statement. In this case, the accountant will have to replace the years while simultaneously meeting 3 conditions:

- a woman wants to change the years in which she was on maternity leave or parental leave;

- the years selected for replacement precede the billing period (letter of the Ministry of Labor of Russia dated August 3, 2015 No. 17-1/OOG-1105);

- As a result of changing years, the benefit amount will become larger.

Thus, before calculating benefits from the minimum wage, it makes sense for an accountant to check whether the employee has the right to replace the years of the calculation period.

Basic Concepts

In situations where an employee recently (less than 6 months ago) got a job or if he has no work experience at all, sick leave pay is calculated based on the minimum wage (minimum wage). The minimum wage is the minimum that, according to the law, an employer is obliged to pay its employee for the performance of his work duties.

If the entrepreneur does not adhere to this rule of law, the insured person may go to court. The minimum wage indicator changes every year. So, for example, from July 2016. the minimum was 7500.00 rubles, and from July 2021 its value is 7800.00 rubles. per month.

Less than six months experience

Benefits for temporary disability and pregnancy and childbirth cannot exceed the minimum wage for a calendar month (taking into account regional coefficients), if the person’s length of service is no more than six months (Part 6, Article 7, Part 3, Article 11 of the Federal Law of December 29, 2006 No. 255-FZ). That is, with less than six months of experience, the benefit may be less, but not more than the minimum wage. To control this, you need to calculate the maximum daily allowance in each month (to understand what amount cannot be taken into account in the calculations). To do this, use the following formula (clause 20 of the Regulations on the calculation of benefits, approved by Decree of the Government of the Russian Federation of June 15, 2007 No. 375):

Accordingly, if we are talking, say, about illness in July, then the maximum daily benefit in this month will be 241.94 (7500 rubles / 31 days), since July 2021 has 31 calendar days.

Let's explain the calculations with an example.

An example of calculating disability benefits for less than six months of work experience. M.V. Trugmanov was ill from July 11 to July 28, 2016 (18 calendar days). The employee's length of service is less than six months. In the billing period (2014-2015), there are no payments in favor of the employee (this is his first place of work). As we have already found out, the average daily earnings, based on the minimum wage, from July 1, 2021 is 246.58 rubles. (RUB 7,500 × 24 months / 730). Moreover, if the insurance period is up to five years, then when calculating sickness benefits, 60% of average earnings should be taken into account (clause 3, part 1, article 7 of the Federal Law of December 29, 2006 No. 255-FZ). Therefore, the amount of M.V.’s daily allowance Trugmanov will be 147.95 rubles. (RUB 246.58 × 60%). As a result, for 18 calendar days of illness, the benefit amount will be 2663.10 rubles. (147.95 × 18 days). Now let's check whether this amount is overestimated. To do this, let’s take the maximum amount of daily benefits in July, calculated from the minimum wage, that is, 241.94 (7,500 rubles / 31 days). If we take this amount, then for 18 days of illness the maximum benefit will be 4345.20 rubles. (RUB 241.94 × 18 days). We no longer take into account the employee's length of service. 4345.20 rubles more than 2663.10 rubles. This means that for July M.V. Trugmanov needs to pay a smaller amount - 2663.10 rubles. The maximum value is not exceeded.

We will also provide the calculation of maternity benefits for less than six months of service.

An example of calculating maternity benefits for less than 6 months of service. L.S. Sadovskaya will go on maternity leave from June 21, 2021. It will end on November 8, 2021. In the billing period from January 1, 2014 to December 31, 2015, she has no income. Insurance experience - 5 months and 1 day. The regional coefficient does not apply. Let's determine the average daily earnings from the minimum wage, which was applied at the beginning of maternity leave (that is, in June). The average daily earnings will be 203.97 rubles. (6204 rubles × 24 months / 730 days). Accordingly, the daily allowance will be 203.97 rubles. (RUB 203.97 × 100%). The maximum daily benefit depending on the number of calendar days is as follows:

- in June – 206.80 rubles. (6204 rubles / 30 calendar days);

- July, August and October – 241.94 rubles. (RUB 7,500 / 31 calendar days);

- September and November – 250 rub. (RUB 7,500 / 30 calendar days).

Now let’s compare the amount of the daily allowance from the minimum wage with the maximum daily allowance for each month of maternity leave. And it turns out that the daily allowance from the minimum wage does not exceed the maximum daily allowance in all months of maternity leave:

- RUR 203.97 < RUB 206.80;

- RUR 203.97 < RUB 241.94;

- RUR 203.97 < 250 rub.

Thus, the accountant has the right to calculate the allowance from the daily allowance calculated from the minimum wage - 203.97 rubles. As a result, the amount of benefit to L.S. Sadovskaya for 140 calendar days of maternity leave will be 28,555.8 rubles. (RUB 203.97 × 140 days), where 140 days is the duration of maternity leave.

Basic rules for filling out sick leave by an employer:

Place of work and name of organization

The name of the organization is included in the sick leave in accordance with the constituent documents in full or in abbreviated form. It is important that the recording does not go beyond 29 cells. If the name does not fit into this cell limit, it can be shortened. An individual entrepreneur in this column indicates his full name with spaces.

Form of work

It is necessary to check the box whether the employee’s place of work is his main one or part-time.

Registration number

The number that the organization received from the territorial body of the FSS of the Russian Federation upon registration is entered. If necessary, this data can also be viewed on any report of Form No. 4-FSS.

Enterprise subordination code

A five-digit code is indicated, implying the territorial body of the Social Insurance Fund to which the organization is attached.

Employee TIN

If the sick leave is for pregnancy and childbirth, it is not filled out by the employer.

SNILS

The number of the employee’s insurance certificate, which was issued to him by the Pension Fund, is indicated.

Insurance period and non-insurance periods

The number of full years and months of the employee’s work experience for which contributions were made to the Social Insurance Fund of the Russian Federation is entered. Non-insurance periods - the time of military or other service.

Benefit due for the period

The day, month and year when the employee fell ill and the day, month and year when he recovered are indicated.

Average earnings for calculating benefits and average daily earnings

The employer must attach to the sick leave a sheet calculating the amounts on the basis of which payments are based. If payments are calculated according to the minimum wage, the number of days in the month in which the employee went on sick leave should be taken into account.

Benefit amount

The amounts paid by the company for the first 3 days of sick leave and by the Social Insurance Fund of the Russian Federation for all other days are indicated separately.

Total accrued

The total amount of payments that the employee will receive in hand is indicated.

Seal

Placed in a specially designated place “Employer’s Seal”. The print may extend beyond the boundaries, but must not appear on the recording.

Violation of hospital regulations

The employer has the right to limit the amount of sick pay for a full calendar month to the minimum wage if the employee, without good reason (Part 1, Article 8 of Federal Law No. 255-FZ of December 29, 2006):

- violated the hospital regime - from the day the violation was committed;

- did not show up for an appointment with a doctor or for a medical and social examination - from the day of failure to appear;

- fell ill or was injured due to alcohol, drug, or toxic intoxication - for the entire period of incapacity.

Let us explain how you can limit the amount of benefits using the minimum wage.

An example of limiting sickness benefits in case of violation of the regime. A.G. Petrov brought a certificate of incapacity for work to the accounting department for the period of illness from July 11 to July 28, 2021. However, the sick leave note contains a note about violation of the regime on July 18 (the employee did not show up for an appointment with the doctor for an unexcused reason). In such a situation, sick leave benefits until July 18 must be calculated according to general rules, based on their average earnings. And from July 18 to July 28 (that is, 10 days from the date of violation), benefits can be paid based on the minimum wage. In the region where A.G. works Petrov, the regional coefficient has not been established. His insurance experience is eight years. This means that he is entitled to a benefit in the amount of 100 percent of his earnings (Part 1 of Article 7 of Federal Law No. 255-FZ of December 29, 2006). The maximum average daily earnings for July, calculated from the minimum wage, will be 241.94 rubles. (7500 rubles/31 days) The amount of benefit for July 18–28 (that is, for the period of violation of the regime) will be: 2419.40 rubles. (RUB 241.94 × 10 days). Before the date of violation, benefits can be calculated according to general rules (not from the minimum wage).

Calculator for calculating sick leave

To calculate sick leave, you can use the free calculator from the Kontur.Accounting service. It complies with current legislation and allows you to calculate sick leave in 3 steps.

- Enter the information from the sick leave certificate.

- Enter your earnings for the previous two years to see your average daily earnings.

- Get the final table for calculating the amount of sick leave. The amount of payment at the expense of the organization and at the expense of the Social Insurance Fund will be calculated automatically

New minimum amount of child care benefit

Now let's talk about the increase in child benefits from July 1, 2016 . So, let us recall that the employer must pay child care benefits to the employee monthly in an amount equal to 40% of average earnings, but not less than the minimum amount (Clause 1, Article 11.2 of the Federal Law of December 29, 2006 No. 255-FZ). From February 1, 2021, the minimum child care benefits are as follows:

- 2908.62 rubles – for the first child;

- 5817.24 rubles – for the second and subsequent children (Resolution of the Government of the Russian Federation of January 28, 2016 No. 42).

However, due to the increase in the minimum wage, the minimum amount of child benefit from July 1, 2021 , established on February 1, is not applied from July 1, 2021 (for the first child). The fact is that until July 1, the minimum wage had no effect on the minimum child benefit. When the minimum wage was 6,204 rubles, it was pointless to calculate benefits based on this amount - it turned out to be less than 2,908.62 rubles. (6204 × 40% = 2481.60). However, as of July 1, 2021, the situation has changed. The minimum amount of benefit for caring for the first child from July 1, 2021 is 3,000 rubles. (RUB 7,500 × 40%). However, the new value can only be used if the holiday began on or after 1 July 2021. At the same time, the “minimum wage” for caring for the second and subsequent children has not changed. It remains 5817.24 rubles even after July 1.

Payment of sick leave in 2015

If the employee himself falls ill, sick leave is paid as follows:

- the employer pays for the first three days of illness at his own expense (clause 1, clause 2, article 3 of Federal Law No. 255-FZ),

- From the fourth day of temporary incapacity for work, sick leave is paid from the Social Insurance Fund.

Sick leave for caring for a sick family member, prosthetics or after-care in sanatorium-resort institutions of the Russian Federation is fully paid for by the Social Insurance Fund.

Sometimes it happens that sick leave is paid to employees who have already resigned: those who fell ill within 1 month after dismissal, and those who fell ill before dismissal and submitted sick leave for payment after termination of the employment contract with the employer. How to deal with payment in such cases?

An employee fell ill after being fired

According to Federal Law No. 255-FZ, if an illness or injury occurs within 30 calendar days after termination of an employment contract, sick leave after dismissal is paid in the amount of 60% of average earnings. At the same time, the basis for terminating the employment contract when paying sick leave in this case does not matter. Sick leave is not paid if the employee's family members become ill.

The employee fell ill before dismissal and presented sick leave for payment after dismissal

In this case, sick leave is paid according to the general rules.

Amounts of other benefits

The increase in the minimum wage will not affect the amount of unemployment benefits from July 1, 2021 . The fact is that the amount of this benefit is limited to the maximum (4,900 rubles) and minimum (850 rubles + regional coefficient, if established) amount. These amounts for 2021 are determined by Decree of the Government of the Russian Federation dated November 12, 2015 No. 1223 “On the amounts of the minimum and maximum amounts of unemployment benefits for 2021.” In this regard, despite the fact that from July 1 the minimum wage increased to 7,500 rubles, unemployment benefits still cannot be more than 4,900.

The amount of some other types of benefits will also not change in any way due to the increase in the minimum wage. So, for example, the lump sum benefit for the birth of a child will not change from July 1. Its size will remain at 15,512.65 rubles.

In the table below we have summarized the values associated with benefits. In the table, in particular, you can see changes in the calculation of child benefits from July 1 .

Sick leave: rules for filling out by the employer

When accepting a sick leave certificate, the employer must make sure that the doctor has filled it out without errors and in accordance with all the rules. Otherwise, there is a risk that the Social Insurance Fund will refuse to reimburse expenses for paying benefits.

You should pay attention to a number of points: in order for the sick leave sheet to be filled out in printed capital letters, without errors, with a gel, capillary or fountain pen of black color or on a computer (the use of a ballpoint pen is not allowed), the information is entered starting from the first cell, without going beyond the boundaries of the corresponding cells.

If an error is discovered on the sick leave certificate, the employee must be sent to the medical institution for a duplicate.

Table. Values associated with benefits from February 1 and July 1, 2021

| Benefit | From February 1, 2021 | From July 1, 2021 |

| Maximum monthly child care benefit | RUB 21,554.82 | RUB 21,554.82 |

| Minimum amount of maternity benefit | RUB 28,555.40 (for multiple pregnancy - 39,569.62 rubles, complicated childbirth - 31,818.87 rubles). | RUB 34,521.20 (for multiple pregnancy - 47,835.62 rubles, complicated childbirth - 38,465.75 rubles). |

| Maximum amount of maternity benefit | RUB 248,164 (for multiple pregnancy - 343,884.4 rubles, complicated childbirth - 276,525.6 rubles) | RUB 248,164 (for multiple pregnancy - 343,884.4 rubles, complicated childbirth - 276,525.6 rubles) |

| Maximum average daily earnings for calculating benefits | 1772.6 rub. | 1772.6 rub. |

| Calculation period for calculating disability benefits | 2014-2015 | 2014-2015 |

| One-time benefit for the birth of a child | RUB 15,512.65 (with indexation from February 1 7%) | RUB 15,512.65 |

| Benefit for registration in early pregnancy | RUB 581.73 (with indexation from February 1 7%) | RUB 581.73 |

| Minimum amount of benefit for child care up to one and a half years old | For the first child - 2908.62 rubles; Care for the second child RUB 5,817.24. (with indexation from February 1 7%) | For the first child - 3000 rubles; Care for the second child RUB 5,817.24. |