Regulation of cash transactions

Cash flow is typical for almost all enterprises and individual entrepreneurs.

The specifics of conducting cash transactions are enshrined in the instruction of the Central Bank of the Russian Federation No. 3210-U dated March 11, 2014. The document regulates the registration and accounting of cash flows of economic entities. Since November 30, 2020, the document has been in effect in a new edition, which has introduced a significant number of changes. For example, cashiers are required to accept worn-out banknotes, but they can no longer be issued. They will have to be handed over to the bank. The description of such banknotes is given in the table:

ConsultantPlus experts told us what other innovations in the procedure for recording cash transactions came into effect on November 30, 2020. Get trial access to the K+ system and go to the review material for free.

Currently, there is still a need to independently determine the cash settlement limit each year. However, for small businesses and individual entrepreneurs the obligation to set a cash limit has been abolished. They no longer need to monitor their cash balance on a daily basis.

For more details, see the article “Cash discipline - cash balance limit for 2021 - 2021”.

Read about other nuances of working with cash:

- “Nuances of documenting cash transactions”;

- “What is the procedure for preparing cash documents?”;

- “What is the limit for cash payments between legal entities?”

Account 50. Cash desk: accounting entries upon receipt of funds and documents

| 50.01 To 62.01 | payment received from customers for shipped products |

| D 50.01 K 62.02 | received an advance on the account from buyers |

| D 50.01 K 90.01 | retail revenue for the day was capitalized |

| D 50.01 K 76.02 | the amount was deposited into the account of claims made under the business agreement |

| D 50.21 K 52 | cash withdrawn from a foreign currency bank account |

| D 51.01 K 51 | received at the cash desk from a current account, posting from a ruble account |

| D 50.01 K 55 | receipt of cash at the cash desk from a special account |

| D 50.01 K 75.1 | contribution to the authorized capital of the organization by the founder in cash |

| D 50.01 K 50.02 | money arrived from the operating cash desk to the organization's cash desk |

| D 50.01 K 79.2 | receipt of cash to the cash desk from a separate division |

| D 50.01 K 70 | return to the cash desk of overpaid wages by the employee |

| D 50.01 K 71 | unspent accountable funds were returned by the employee |

| D 50.01 K 73.1 | return by the employee of a previously received loan |

| D 50.01 K 73.2 | contribution by the employee to repay the material damage caused |

| D 50.03 K 60.01 | vouchers for employees, gasoline coupons received |

| D 50.01 K 50.01 | Received partial payment for the trip from an employee |

Cash documents

Two types of cash orders are recognized as cash documents: expenditure and receipt. The forms of these forms are unified and approved by law. The procedure for filling out cash orders does not allow corrections or blots to be made - with them the document becomes invalid.

Orders are registered in the cash order register.

And the main register for the cash register is the cash book.

Find out also:

- is it possible to make corrections to the cash book;

- how to make an extract from the cash book.

Check whether you are completing cash transactions correctly with the help of explanations from ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

Types of checks and their accounting

Check-writing organizations can use two types of checks - settlement and cash.

Cash checks are used for the purpose of withdrawing cash (for example, for issuing wages to employees, funds for reporting and other needs).

The operation of withdrawing cash by check is reflected in the accounting by posting Dt 50 Kt.

An organization can also use checks for settlements with counterparties (so-called settlement checks). Such payments are made in cashless form. When paying a supplier by check, the organization fills out an application for the issuance of checks, and then submits it to the bank. A payment order is attached to the application. Based on the documents provided, the bank reserves funds in a special account for subsequent transfer of non-cash payment.

To account for funds in settlement checkbooks, account 55/2 is used. The operation of depositing funds for settlements by checks is reflected by posting Dt 55/2 Kt, write-off by check - Dt 60 Kt 55/2.

Check forms refer to strict reporting forms, which is why it is necessary to record them on the off-balance sheet (Dt account 006). Used checks are written off according to Kt 006.

Responsibility for failure to comply with cash discipline

Business entities are responsible not only for the correct execution of cash documents, but also for the completeness of cash receipts. The statute of limitations for violations of cash transactions is short and is only 2 months. The tax office has the right to hold violators administratively liable if errors are discovered. According to paragraph 1 of Art. 15.1 of the Code of Administrative Offenses of the Russian Federation, the fine for organizations can reach 50,000 rubles. For individual entrepreneurs and managers under the same article, fine payments will amount to 4,000–5,000 rubles.

For more information about the level of responsibility, see the material “Are your cash discipline in order?”

ConsultantPlus warns: Violation of the rules for working with cash and the procedure for conducting cash transactions is a violation of cash discipline. What it is expressed in and what sanctions are provided for it, see K+. Trial access is available for free.

Individual entrepreneurs are exempt from full-fledged cash transactions with the establishment of a cash limit and the use of strict unified forms of documents. But if entrepreneurs still work in the course of their activities with cash settlement and payment services, then they must be filled out in accordance with all the rules.

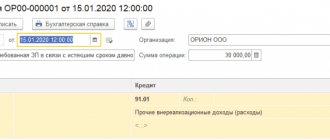

Which account accounts for cash flow?

To account for cash, account 50 “Cash” is used.

All transactions performed with cash in cash must be accompanied by a double entry in the accounting accounts.

Account 50 corresponds by debit and credit with other accounting accounts, depending on the purpose of incoming or outgoing cash.

The debit account 50 shows the amount of incoming cash, the credit shows the amount issued from the cash register.

Synthetic and analytical

For more convenient accounting at an enterprise, you can maintain synthetic and analytical accounting according to account 50.

Synthetic accounting reflects amounts in a generalized form. For convenience, it is possible to open sub-accounts on a synthetic account 50, in which cash will be grouped by type.

Analytics involves opening analytical accounts on account 50, where cash can be accounted for in more detail - distributed according to sources of receipt or disposal, as well as other parameters in accordance with the needs of the organization.

An enterprise has the right to develop a convenient system for analytical cash accounting. The chart of accounts does not provide any recommendations regarding the rules for conducting analytics for account 50.

As for synthetic accounting, the Plan recommends, if necessary, opening the following sub-accounts:

- 1 – “Organizational cash register” - for recording cash in the main cash register of the enterprise.

- 2 – “Operational cash desk” - for recording cash in separate ticket offices at stations, ports, piers, stopping points, and luggage compartments.

- 3 – “Cash documents” - intended for accounting for bills of exchange, air tickets, and state duty stamps.

Results

The cash register is an important area that is present in the accounting records of almost every business entity.

Therefore, every accountant should know the correspondence schemes for cash accounting accounts. Also, do not forget that cash register documentation is strictly unified and filled out in accordance with the normative procedure, and violations of cash discipline are fraught with fines. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Account 50. Accounting for funds, transactions for issuing money from the cash register

| 51 K 50.01 | cash deposit to current account |

| D 70 K 50.01 | wages paid to employees |

| D 71 K 50.01 | amount reported |

| D 71 K 50.21 | travel allowances issued in foreign currency |

| D 58-1 K 50.01 | payment in cash for shares purchased |

| D 58-3 K 50.01 | a cash loan was issued to a counterparty |

| D 60.01 K 50.01 | payment to the supplier in cash for the supply of goods, work, services |

| D 62.01 K 50.01 | refund to the buyer when returning the goods |

| D 66 K 50.01 | repayment of the loan (debt) and interest on it from the cash register |

| D 69-1 K 50.03 | workers were issued vouchers paid for from the Social Insurance Fund |

| D 73.03 K 50.03 | employees were given purchased vouchers and gasoline coupons |

| D 91.02 K 50.03 | part of the trip paid by the employer was written off |

What kind of wiring should I form?

The rules for determining revenue are determined by paragraph 6 of PBU 9/99. This paragraph states that revenue is received in an amount calculated in monetary terms equal to the amount of cash and other assets received.

The main account for accounting for the sale of goods is account 90 Sales. Revenue from the sale of goods, works or services is reflected in the credit of account 90.1 Revenue in correspondence with account 62.01. Revenue should be recognized when ownership passes from the seller to the buyer. As a rule, this happens at the time of shipment of goods (products) or transfer of a certificate of completion of work. Receipt of proceeds from cash sales is recorded by posting: Debit 50 Cash – Credit 90.1 Revenue.

We talked in detail about which accounting account revenue is shown in in this material.

Other publications by our experts may also be useful to you, after reading which you will learn:

- What is the difference between revenue and turnover, cost, income and profit?

- How can I find out the organization’s revenue using the Taxpayer Identification Number (TIN) and in what documents is such information displayed?

Renting a cash register in accounting

When renting a cash register, the costs include the cost of equipment and services provided for in the agreement with the lessor. In this case, the cash register must be accounted for in off-balance sheet account 001 “Leased fixed assets,” indicating the cost of expenses from the lease agreement. In accounting, costs must be reflected in expenses for ordinary activities (clause 5 of PBU 10/99).

It is important to take into account that the fiscal drive that must be installed in the cash register cannot be rented, since it does not belong to the renter, but to the owner of the cash register. OFD services are also paid separately, and additional equipment (for example, an EGAIS module or a barcode scanner) needs to be purchased.

In connection with amendments to Art. 21 and 30 of Law No. 402-FZ, as well as taking into account clause 7.1 of FSBU 1/2008, as of 01/01/2018 there is no Russian rental standard. Therefore, the provisions of IFRS must be applied, in particular IFRS 16, which came into force on 01/01/2019, or FAS 25/2018 “Accounting for Leases”, which contains a rule on its early application both from 2021 and 2021. Why do you need to know this? In this situation, additional grounds are proposed for simplified rental accounting in 2021. Thus, the international standard and FAS 25/2018 allow not to recognize the right to use an asset or an asset leased, as well as discounted lease obligations, if we are talking about the lease of low-value assets worth no more than 300 thousand rubles. When leasing a cash register, the lessee must evaluate its value, regardless of the age of the asset at the time it is leased.

In this case, if the rented cash desk has a low cost, the tenant’s accounting records the usual entries for recognizing the rental service fee as an expense.

In tax accounting, expenses for renting cash registers are recognized as usual.