Accounting statements include a number of indicators by which the company's performance can be determined. There are connections between these meanings. They represent logical connections between indicators.

Question: How is the revaluation of fixed assets (fixed assets) reflected in accounting and annual financial statements? In January of the reporting year, the organization acquired real estate - a land plot for 10 million rubles. and a building for 80 million rubles. (without VAT). According to the accounting policy of the organization, these objects are annually revalued at current (replacement) cost. The revaluation carried out at the end of the reporting year showed that the market value of the land plot was 9.2 million rubles, and the market value of the building (including depreciation) was 83 million rubles. Depreciation accrued for the building in the reporting year is (conditionally) 2,000,000 rubles. View answer

INTRODUCTORY PART

Analysis of the balance sheet is of practical importance if its indicators are reliable.

Using balance sheet indicators, you can conduct a detailed analysis of the development of the enterprise and adequately assess its financial position in the reporting period in comparison with previous periods. This opportunity is provided by comparing the assets and liabilities of the balance sheet over time. Accidental or intentional distortions of balance sheet lines can be avoided if the internal control system is well established.

An economic entity is obliged to organize and carry out internal control of the facts of economic life. This obligation is established by Art. 19 of the Federal Law of December 6, 2011 No. 402-FZ (as amended on July 18, 2017) “On Accounting.”

Before you begin the analysis, you need to make sure that the financial statements comply with the following legal requirements:

- comparability of indicators for the reporting period and the previous two years (balance sheet indicators must be formed according to the same rules). Incomparability of indicators may arise if significant errors from previous years were identified in the reporting period and (or) the organization’s accounting policies changed;

- consistency of information reflected in the reporting;

- completeness of information on economic activities reflected in the report.

How to use interconnection in accounting

Reporting forms, both financial and accounting, in addition to the informational relationship, also have a logical relationship. This relationship is visible when one understands the balance sheet results, because for the most important total values, a detailed explanation can be seen in other forms. When deciphering the results in detail, the arithmetic side of filling out the reports is checked, and any changes are clearly visible.

Balance of indicators is the main principle of not only accounting, but also financial reporting.

For small companies and large holdings, accounting indicators are a stimulant for moving forward. It is possible to assess the state in which the company is currently located with the help of accounting records. At the same time, it should be understood that each form of reporting can characterize the situation “in its own way.” By applying relationships in practice, you can study accounting in more depth and draw the necessary conclusions.

The logical connection of the indicators is that they complement each other and also correspond in different reporting forms. Explanations of some balance sheet items can only be found in the accompanying forms. An example is the article “Intangible assets”, the explanation of which can be found in the appendix to the balance sheet.

COMPARABILITY OF BALANCE SHEET ITEMS

Checking the comparability of overlapping financial reporting line benchmarks helps ensure that all reports are prepared correctly.

An important point: the benchmark indicators in force in 2021 are publicly available to all taxpayers on the official website of the Federal Tax Service. The comparability of individual indicators is reflected in table. 1.

| Table 1. Comparability of the main indicators of financial statements | ||

| Balance sheet | Income statement | |

| I. Non-current assets | ||

| Line 1180 “Deferred tax assets” | The difference between the columns “As of December 31 of the previous year” and “At the end of the reporting period” | Line 2450 “Change in deferred tax assets” - value at the end of the reporting period |

| III. Capital and reserves | ||

| Line 1370 “Retained earnings (uncovered loss)” | The difference between the columns “As of December 31 of the previous year” and “At the end of the reporting period” | Line 2400 “Net profit (loss)” - value at the end of the reporting period |

| IV. long term duties | ||

| Line 1420 “Deferred tax liabilities” | The difference between the columns “As of December 31 of the previous year” and “At the end of the reporting period” | Line 2430 “Change in deferred tax liabilities” - value at the end of the reporting period |

| Balance sheet | Cash flow statement | |

| II. Current assets | ||

| Line 1250 “Cash and cash equivalents” - column “At the beginning of the reporting period” | String equality | Line 4450 “Balance of cash and cash equivalents at the beginning of the reporting period” |

| Line 1250 - column “At the end of the reporting period” | String equality | Line 4500 “Balance of cash and cash equivalents at the end of the reporting period” |

| Line 1250 - column “At the end of the reporting period” and column “At the end of the previous period” | Difference line 1250 at the end of the reporting period and at the end of the previous period | Line 4400 “Balance of cash flows for the reporting period” |

| Balance sheet | Statement of changes in equity | |

| III. Capital and reserves | ||

| Line 1300 “Total for Section III” - column “As of December 31 of the reporting year” | String equality | Line 3300 “Capital amount as of December 31 of the reporting year”, column “Total” |

Relationship with tax reporting

There are significant differences in the rules of accounting and tax accounting. This also entails differences in the rules for generating each type of reporting. Therefore, there is no direct correlation between accounting and tax reporting indicators.

Meanwhile, during audits, tax authorities can identify factual inconsistencies in these types of reporting.

EXAMPLE The cash flow statement shows the payment of dividends (line 4322), but there were no such payments on the income tax return.

ANALYSIS OF BALANCE SHEET ITEMS

Analysis of balance sheet items shows:

- volume of assets, their ratio, sources of financing;

- items that change at a rapid pace, and how this affects the structure of the balance sheet;

- share of inventories and receivables;

- the amount of equity, the degree of dependence of the company on borrowed resources;

- distribution of loans by repayment period (long-term and short-term);

- level of debt to the budget, banks and employees.

There are several analysis methods:

- horizontal;

- vertical;

- trendy;

- factorial;

- financial ratios.

Horizontal analysis

Horizontal (time or dynamic) analysis reflects changes in indicators compared to the previous period. In horizontal analysis, the following is determined:

- absolute changes in indicators;

- relative deviations.

Absolute indicators

Absolute indicators characterize the number, volume (size) of the process being studied. They have a value (monetary) value on the balance sheet.

The calculated absolute indicator is the absolute deviation - the difference between two absolute indicators of the same name.

EXAMPLE 1

The amount of cash on line 1250 of the balance sheet in 2017 amounted to 2800 thousand rubles, in 2021 - 2400 thousand rubles. Let us find the absolute deviation of the amount of funds. 2021 will be the reporting year, 2021 will be the base year.

In the reporting period, compared to the base period, the amount of cash in absolute terms increased by 400 thousand rubles. (2800 thousand rubles – 2400 thousand rubles).

Relative indicators

Relative indicators represent the ratio of absolute or other relative indicators, that is, the number of units of one indicator per unit of another indicator. Their comparison allows us to identify relative deviations. An important detail: you can compare indicators of the same name that relate to different periods, objects, and territories.

The result of such a comparison in horizontal analysis is expressed as a percentage and shows how many times or how many percentages the compared indicator is more (less) than the base one.

EXAMPLE 2

The amount of cash on line 1250 of the balance sheet in 2017 amounted to 2800 thousand rubles, in 2021 - 2400 thousand rubles. Let's calculate the relative deviations.

The cash flow indicator increased by 116.67% (RUB 2,800 thousand / RUR 2,400 thousand × 100%) compared to 2021. That is, in 2021, cash accounted for 116.67% of 2021 cash. , their growth rate is 16.67% (116.67% - 100%).

Vertical analysis

The financial statements display the structure of the enterprise's property and sources of its financing. Vertical (structural) analysis shows the share of individual balance sheet items, for example, the share of non-current assets or inventories in the total balance sheet, where the value of the total balance sheet is taken as 100%. This way you can see the share of each balance sheet item in its overall total.

Suppose you need to calculate the share of cash in the overall balance sheet structure. To do this, the indicator is divided by the balance sheet currency, and the result of the division is multiplied by 100%. The resulting value is the desired number.

EXAMPLE 3

In 2021, the balance sheet on line 1210 “Inventories” reflects 2,550 thousand rubles. The total balance sheet for the year is 4650 thousand rubles. The reserves include:

- materials - 550 thousand rubles;

- finished products - 1500 thousand rubles;

- work in progress - 500 thousand rubles.

Let's determine the share of inventories in the balance sheet currency.

The enterprise's reserves account for 54% of the balance sheet currency (2550 thousand rubles / 4650 thousand rubles × 100%).

Trend analysis

Trend (forecast) analysis is performed by comparing each line of the balance sheet of the current period with past periods. The essence of such an analysis is to determine the dynamics of the line so that its further development can be predicted.

Important detail: it is recommended to take five periods for analysis.

Thanks to trend analysis, you can form an opinion about the main changes in certain indicators. Based on the analysis data, the average annual growth rate of indicators is determined and its forecast value is calculated.

Factor analysis

Factor analysis is understood as a technique for a comprehensive and systematic study and measurement of the impact of factors on the value of performance indicators. Factor analysis is mainly used in analyzing the financial performance of a company according to the income statement.

Financial ratios

Financial ratios are used to analyze the financial condition of an enterprise. They are relative indicators determined from the balance sheet and income statement.

The criteria for assessing the financial condition of an enterprise using financial ratios are divided into the following groups:

- solvency;

- profitability (or profitability);

- efficiency of asset use;

- financial (market) stability;

- business activity.

Analysis of the balance sheet can begin by calculating changes in absolute indicators compared to the previous period by conducting horizontal (time) analysis.

To form a forecast plan, trend comparisons of financial reporting indicators with several previous periods are carried out. Next, the proportions of reporting items in the final indicator are calculated by conducting a vertical analysis. The share of significant balance sheet items is determined. The dynamics of increase or decrease of these shares in the total balance are analyzed.

In horizontal analysis, the emphasis is on abrupt changes, and in vertical analysis, elements with a large specific weight are highlighted. Then financial ratios are calculated, which show the relationship between individual balance sheet items. The reasons for their changes are reflected by factor analysis.

What you need to know

Organizations that are legal entities must provide financial statements. It is formed on the basis of analytical and synthetic accounting information.

Reporting includes the results of operations at the enterprise. Accounting statements consist of the following components:

- balance;

- data on profits and expenses;

- a statement reflecting changes in capital;

- data on financial flows;

- appendices to financial statements;

- explanatory note;

- audit summary.

Accounting statements must be prepared in such a way as to fully characterize the activities of the organization.

The reporting that is compiled on the basis of regulations is considered correct and complete. Reporting forms are characterized by a logical and informational connection.

They consist of adding sections or individual articles. The reporting (in each part of it) must indicate:

- name of the part and date of the report (or reporting period);

- an indication of the organizational and legal form of the organization and its name;

- in what format are reporting indicators presented?

The report consists of 10 sections:

- intangible assets;

- capital assets;

- deposits based on income;

- expenses for scientific and experimental work;

- costs of studying natural resources;

- financial contributions;

- debit and credit debt;

- expenses for the usual types of company activities;

- provision;

- help from the state.

The indicators will be comparable if during the activities of the organization no dividends were received and there were no contributions to reserve capital.

If reporting will be submitted to the tax office, then each coefficient must be assigned a code.

Necessary concepts

| Balance sheet | The main form of reporting characterizing the state of the organization’s activities in a certain period of time |

| Small business | A commercial organization, in the capital of which there is a share of constituent entities of the Russian Federation, religious associations and others |

| Financial statements | A system of indicators characterizing the activities of the organization - financial and property |

| Tax reporting | A set of coefficients that characterize the correctness of tax calculations |

| Comparison of indicators | Comparison of indicators after preparation of financial statements. Data can be compared within the same reporting and between its different forms |

| Explanatory note | Information attached to the report; supplements missing data contained in reporting forms |

| VAT | Indirect type tax; one that is withdrawn from the budget of a state for a share of the cost of goods or services |

| Cash method of expenses and income | Necessary to recognize income and expenses in tax reporting |

Why is this necessary?

The purpose of financial statements is to summarize information over a certain period of time. Tasks:

- selection of indicators necessary for performance results;

- data systematization;

- reporting is a source of information for analysis;

- main method of communication.

All reporting forms are interconnected. This makes it possible to simplify the maintenance of documentation in the organization. The essence of the connection is the mutual complementation of reporting forms.

Logical connections are supplemented by information ones, which makes it possible to present an overall picture of the organization’s activities, helps to understand the contents of the report, and check for errors and inaccuracies.

Legal basis

Regulations that should be followed:

- Federal Law No. 208 “On Financial Reporting”, adopted on July 27, 2010.

- Federal Law No. 129 “On Accounting” dated November 21, 1996.

- Tax Code, parts 1 and 2.

- Order of the Ministry of Finance No. 67n, issued on July 22, 2003.

Article 25 of the Tax Code states that profits and expenses can be verified using the accrual or cash method.

According to Article 273, paragraph 1 of the Tax Code, this method can be used to pay income tax and when applying a simplified tax regime.

If the revenue for the reporting period is more than the established limit, then the accrual method is used, if less, the cash method is used. This is stated in Articles 273 and 275 of the Tax Code.

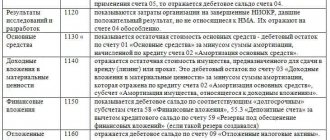

Characteristics of interconnection according to various indicators (table)

Let's consider an example of the mutual relationship between indicators (excerpt)

The relationship between the balance sheet and the income statement:

| Line 1370 (profit that was not distributed) – column 4 | Line 2400 “Net income” - column 4 |

| Line 1180 “Assets that are deferred” - the difference between the data in columns 4 and 5 | Line 2450 “Change in deferred assets” - column 4 |

Relationship between BB and statement of changes in equity:

| Line 1310 “Authorized capital” - column 6 | Line 3100 “Authorized capital” - column 3 |

| Line 1320 “Own shares that were purchased from shareholders” - column 6 | Line 3100 “Repurchased shares” – column 4 |

The connection between the BB and the financial flow report:

| Line 1250 “Cash and equivalents” - column 5 | Line 4450 “Cash balance” - column 3 |

| Line 4500 – column 3 | Line 1250 – column 4 |

The relationship between the balance sheet and its Explanations and the income statement:

| Line 1110 “Intangible assets” - column 5 | Line 5100, column 4 – 5100, column 5 |

| Line 1150 “Fixed assets” - column 5 | 5200, column 4 – 5200, column 5 |

Interrelation of indicators of financial statements of small enterprises

Small enterprises have the opportunity to prepare financial statements for the year not in full. The composition depends on whether the company conducts an audit.

If an enterprise must carry out auditing activities, then the reporting consists of a balance sheet and a statement of profits and expenses. If it is not subject to audit, an explanatory note is also attached.

The note reports the impossibility of applying reporting rules in situations where it is impossible to reliably reflect the state of property and the results of the organization’s activities.

For existing forms of primary accounting documents, see the article: primary accounting documents.

Order granting the right to sign primary documents.

Changes that will affect reporting next year are also indicated. The relationship is easy to detect in the balance sheet, which has 5 sections.

Reporting indicators are combined into certain forms, they are all important and related to each other. Interrelation of various forms:

| Net income | Highlighted in the balance sheet (section 3), statement of changes in capital (section 1), income and expense report. Form 2 contains the factors due to which a certain result was obtained |

| Debt indicators by debit | Indicated in the 2nd section, supplement them and provide an explanation in the 5th form |

| Loan debt | Indicated in the 5th section, decryption - in the 5th form |

| Capital and reserves | Reflected in the 3rd section, their periodic movement is in the 3rd form |

| Losses | Added to undistributed income or expenses of previous years |

With tax accounting data

The relationship between tax and accounting information is the presence of connections and mutual connections between individual components and reporting indicators.

The essence of comparability is that both reports contain information that is needed for the purpose of calculating the tax base.

Income tax

The accounting regulations make it possible to cope with the following tasks:

| Display in accounting the impact on the methods of calculating income taxes | Those factors that arise when applying methods of mapping transactions for tax purposes |

| Make contact | Between financial performance and tax base indicators |

| Find out how tax liability is affected | For financial results |

Accounting and tax reporting are generated on the basis of different registers. The income tax return is reconciled not only with statements relating to financial results, but also with the balance sheet.

This verification method will make it possible to timely determine discrepancies in individual tax and financial reporting indicators.

Reporting indicators are checked by tax authorities. The main reasons for discrepancies in indicators:

| The organization accepted the founder's goods for free | This profit is not included in tax income, but there is no exception for this in the accounting part of the report. |

| The company received dividends | In tax accounting, profits appear at the moment they are credited to the account, and in accounting - during the period when the decision is made to credit them. |

| The organization revalued the property | There is no need to display this in tax accounting |

| When performing construction work | Their start date and end date fall in different reporting quarters |

With a declaration to the simplified tax system

Organizations that apply the simplified tax system, in addition to the declaration, also submit a report from the accounting department.

Inspectors who compare accounting and tax reporting data are interested in certain indicators - the amounts of income must match.

They check 2 reports, and if discrepancies are found, tax officials have questions.

The difference between accounting profit and the one used under the simplified tax system can be explained by the fact that in the second case, income is recognized on the day they are credited.

In financial statements - according to the accrual method. When generating a report under the simplified mode, the same codes are used, but there are nuances.

When a report is compiled according to the simplified tax system, more than one coefficient is allowed to be entered in one line. Such a report does not have sections “cost of sales” or “selling expenses”.

The indicators of these lines are summed up. With a simplified system, tax officials check the following:

| Income and revenue in the declaration | Highlighted in line 210, in the financial report - 2110. they must match |

| In the report the costs are 2120, in the declaration for the simplified tax system - 220 | If they do not match (especially if they are larger during simplification), problems may arise |

| Tax amount in the declaration (260) and report (2410) | They should also be the same. In case of discrepancies, an opinion may arise that the tax base is understated |

The interrelation of simplified financial statements indicators must be present in all sections of the report and declaration.

Examples

The interrelation of indicators in the accounting reporting forms is checked by the tax service. Tax returns and accounting reports are subject to audit.

An authorized person from the tax office checks the consistency of the following indicators:

- whether the data is calculated correctly;

- Are the coefficients of both tax and accounting returns interrelated?

- is there a logical connection between individual data;

- are the deductions justified?

- whether tax benefits are applied correctly;

- whether the data in the report corresponds to the results of the business type transaction.

During a desk audit, coefficients are checked for mutual relationships both within the account and between reporting forms.

At the end, a comparison is made with the results of previous periods. You can check the invoice both while filling it out and after the reporting is generated.

Consider the following examples:

| Results of the balance sheet audit (form 1) | Indicators of different forms should be the same. That is, cash at the beginning of the reporting period should be equal to the balance of finances as of January 1 of the reporting year (Form 4). If this happens, the reporting is formed correctly, the data is consistent |

| VAT declaration | The amount of VAT required to deduct the previously received advance is greater than that which was charged on the sale. This result arose due to the impossibility of organizing separate accounting of the advance received for goods that are and are not subject to VAT |

What purposes does interconnection serve?

Relationships represent either equality of values or their correspondence to each other. Their presence can be determined both by the accountant himself and by tax representatives. They are needed for these purposes:

- Control over the reliability of information.

- Completeness of information present in the reporting.

- Detection of inconsistencies, errors and their elimination.

- In-depth understanding of accounting reporting.

- Establishing the correctness of filling out papers.

What is the procedure for publishing financial statements ?

If tax representatives do not find any links, this may lead to the organization of desk or on-site audits. They can slow down the firm's operations. That is, checking the statements is beneficial, first of all, to company representatives. This will prevent problems and conflicts with tax authorities in the future.

How to reflect accounts receivable in financial statements ?

If the accountant prepares reports in accordance with the rules, then there will be interconnections in them. Their main function is to establish the reliability of the information presented. The reporting should be such that its user can understand all the information presented and “read” the document.

IMPORTANT! Control over the correctness of registration is the final stage of reporting. It ensures not only the elimination of mistakes, but also obtaining additional information and advanced analysis.

basic information

There must be relationships between the indicators of these reporting forms:

- Balance.

- Application to it.

- Income and Expense Report.

- Statement of capital.

- Cash flow report.

- Explanatory notes.

Reporting documents are usually drawn up in certain forms. However, a company can use its own or modified forms. But even in this case, logical connections must be present.

Question: How to determine the level of materiality of an error in the financial statements? View answer

Emerging nuances

Since accounting documents must reflect a real picture of the enterprise’s activities, there must be a mutual connection between them. Plus, it's easy to follow.

The balance sheet and reporting of financial results should be the same. The graphs and columns of the balance sheet and financial statements must also be interconnected.

The main accounting reporting documents must contain the following information:

- profit that is not distributed (the same data must be present in the report regarding changes in capital);

- debit and credit debt at the beginning and end of the reporting year;

- capital and reserve data;

- investments of various types - cash, profitable;

- Reserve capital.

For small businesses

A small enterprise has the right to demand the use of the cash method of recognition of profits and expenses in accounting. In simple terms, expenses can be recognized at the time of payment of debts to suppliers.

Find out what a sample of filling out a document flow schedule for primary accounting documents looks like from the article: a sample of a document flow schedule for primary documents.

How to correctly draw up a primary accounting document.

Storage period for primary documents in accounting.

It can be used if during the last reporting year the revenue amounted to no more than 1 million rubles in one quarter.

For a budget institution

In budget-type organizations, accounting statements have the following features:

- the form and content are uniform, which makes it possible to group data;

- uniformity of coefficients;

- correctness of the data for the report;

- inclusion of all data in the results of the operation.

The analysis of indicators should be based on information on the movement of non-financial assets.

The final performance indicators of a budget-type organization must be compared with the coefficients of previous periods. Budget companies must prepare 2 balance sheets.

Therefore, ratios must be consistent across tax returns and financial statements.

At the slightest discrepancy, the tax inspectorate may have questions for the organization’s management. There is a logical and informational connection between the indicators.

The purpose of comparability analysis is the correct formation of enterprise reporting for submission to government audit authorities.

Previous article: Primary accounting documents Next article: Accounting calendar

The interrelation of financial reporting indicators (the table is located at the end of the article) is carried out in order to identify errors and inaccuracies in the balance sheet and other forms of financial accounting. Current forms are approved by Order No. 66n dated 07/02/10, and the company has the right to supplement lines, display detailed or, conversely, enlarged values to form a reliable picture of the state of affairs. At the same time, it is important to follow the basic rules for filling out documents and maintain the interrelation of accounting and tax reporting indicators. Let's take a closer look at how data relationships are checked.

Additional Information

Is it necessary to look for a logical connection between accounting and tax reporting? It is impossible to find a direct relationship between these documents. This is due to the fact that when drawing up different areas of reporting, different principles are applied. That is, different rules for generating documents are used. Therefore, there are no direct connections between the documents.

Who exactly should carry out the interconnection? Any legal entity, regardless of its size, should search for logical connections between reports. That is, interconnection is also sought by small business accountants. Moreover, for small companies the procedure will be simpler. This is due to the small number of documents and data. Searching for connections allows you not only to detect errors, but also to see the real financial results of the company’s activities.

Which specialist should look for logical connections? Essentially, this is the job of the chief accountant. However, it can be delegated to any representative of the financial or accounting department. If the company does not have competent employees, you can resort to the services of third-party specialists. Finding connections is a fairly simple job if you have the appropriate information.

However, if someone without proper financial knowledge undertakes this, inconsistencies may be missed.

Is it necessary to somehow record the implementation of interconnection? It is necessary, but the problem is that the law does not stipulate the appropriate forms of supporting documents. They need to be developed independently and reflected in the accounting policies. It is also advisable for the manager to establish the timing and procedure for carrying out the procedure.

Why is it necessary to interconnect indicators of annual financial reporting forms?

Checking the relationship is carried out in order to control the correctness and completeness of reports before they are submitted to government agencies. The testing procedure is established by each business entity independently. The main criteria can be found in Law No. 402-FZ, Regulation No. 4/99. At the same time, the interconnection of indicators of the forms of financial statements of a small enterprise, as a rule, is carried out in relation to the balance sheet in Form 1 and the report on financial results of Form 2. If the organization reports in full, it is necessary to compare the control ratios of the indicators of all mandatory forms of financial statements.

The legislation does not establish clear regulations for the procedure. The accountant of an enterprise, first of all, needs to compare data on tax and accounting, information on financial results in forms 1 and 2, information within and between individual types of reports. Tax employees perform similar actions and, if discrepancies are detected, they require the company to provide explanations (Article 88, paragraph 3 of the Tax Code) and submit clarifications if errors are identified. In some situations, discrepancies in reports cause the organization to be included in the plan for on-site or desk audits.

otchet_o_finrezultatah.jpg

The KS verification table shows that all relationships in the report are met:

| Graphs | Strings | ||

| Line 2400 | = | lines 2110 – 2120 – 2330 + 2340 – 2350 + 2410 | |

| 3 4 | 398 665 | = = | 5047 – 4997 + 636 – 260 +(– 28) 4466 – 4003 – 8 + 529 – 232 +(– 87) |

| 3, 4 | 0 | All values for lines 2110 and 2340 | |

| 3, 4 | 0 | All values for rows 2120, 2330 and 2350 | |

Checking the report on the intended use of funds

Control ratios to financial reporting indicators 2021

The benchmark indicators in force in 2021 are publicly available to all taxpayers on the official website of the Federal Tax Service. Using these values, it is checked under what conditions and with what the specified data must match. A table with individual indicators is posted below.

Interrelation of the main indicators of financial statements - table 2021:

| Form 1 “Balance Sheet” | Form 2 “Report on financial results” |

| Page 1180 OHA (calculation is done by subtracting the data in columns 4 and 5) | Page 2450 SHE in column 4 |

| Page 1180 OHA (calculation is done by subtracting the data in columns 5 and 6) | Page 2450 SHE in column 5 |

| Page 1370 “Retained earnings” in column 4 | Page 2400 in column 4 “Net profit” |

| Page 1370 “Retained earnings” in column 5 | Page 2400 in column 5 “Net profit” |

| Page 1420 IT (calculation is performed by subtracting data from columns 4 and 5) | Page 2430 “Changes to IT” in column 4 |

| Page 1420 IT (calculation is performed by subtracting data from columns 5 and 6) | Page 2430 “Changes to IT” in column 5 |

| Form 1 “Account balance” | Form 3 “Report on changes in capital” |

| Page 1310 in column 6 “Authorized capital” | Page 3100 in column 3 “Authorized capital” |

| Page 1310 in column 5 “Authorized capital” | Page 3210 in column 3 “Increase in total capital” |

| Page 1360 in column 6 “Reserve capital” | Page 3100 in column 6 “Reserve capital” |

| Page 1360 in column 5 “Reserve capital” | Page 3210 in column 6 “Increase in total capital” |

| Page 1370 in column 5 “Retained earnings” | Page 3200 in column 7 “Increase in total capital” |

| Page 1370 in column 6 “Retained earnings” | Page 3100 in column 7 “Retained profit/loss” |

| Page 1350 in column 4 “Additional capital” excluding the amount of revaluation | Page 3300 in column 5 “Capital value as of 31.12” |

| Page 1370 in column 4 “Retained profit/loss” | Page 3300 in column 7 “Capital value as of 31.12” |

| Page 1300 in column 4 “Total amount of section III” | Page 3300 in column 8 “Capital value as of 31.12” |

| Form 1 “Account balance” | Form 4 “DDS Report” |

| Page 1250 in column 5 “Cash and, if available, equivalents” | Page 4450 in column 3 “Balance at the beginning of the amount of funds” |

| Page 1250 in column 4 “Cash, and, if available, equivalents” | Page 4500 in column 3 “Balance at the end of the amount of funds” |

| Page 1250 in column 6 “Cash, and, if available, equivalents” | Page 4450 in column 4 “Balance at the beginning of the amount of funds” |

The given examples of checking the relationship are carried out according to the 2016 rules. It is recommended to cross-check the data before each submission of reports. This will help you draw up the forms correctly and minimize possible claims from regulatory authorities.

report on practice Re-registration of an organization with government bodies

By clicking on the “Download archive” button, you will download the file you need completely free of charge. Before downloading this file, think about those good essays, tests, term papers, dissertations, articles and other documents that are lying unclaimed on your computer. This is your work, it should participate in the development of society and benefit people. Find these works and submit them to the knowledge base. We and all students, graduate students, young scientists who use the knowledge base in their studies and work will be very grateful to you. To download an archive with a document, enter a five-digit number in the field below and click the “Download archive” button

| Heading | Accounting and Auditing |

| View | practice report |

| Language | Russian |

| Date added | 17.02.2018 |

| file size | 50.0K |

Similar documents

- The procedure and features of closing some accounting accounts at the end of the reporting period. The concept of financial statements and the requirements for them. Types, forms of reporting and its composition. Characteristics of standard forms of annual financial statements. abstract, added 06/09/2010

- Review of international standards and requirements for financial reporting using the example of the organization TD-Yaroslavl LLC. The procedure for drawing up accounting reports, analysis of the contents of the balance sheet and the rules for evaluating its items. course work, added 09/16/2011

- General characteristics of the enterprise. Preparation of financial statements for the reporting period. Features of tax returns by type of tax. Analysis of the results of the financial and economic activities of the enterprise, its performance indicators. practice report, added 03/05/2011

- Features of the formation and disclosure of accounting policies at the enterprise. Drawing up accounting entries that correspond to the content of business transactions. Preparation of accounting registers containing information for filling out financial reporting forms. course work, added 06/21/2010

- Concept, meaning, types and composition of accounting (financial) statements. Documentation of business facts in accounting reports. Classification of accounting data and their reflection on accounting accounts - in accounting registers and the General Ledger. course work, added 01/22/2014

- The concept of financial statements as a system of tables and report indicators reflecting the financial and property position of an organization. Analysis of the main indicators of the financial and economic activities of the BMK organization, characteristics of methods for their assessment. course work, added 04/05/2016

- Analysis and types of activities of Vector LLC, stages of calculating the tax obligations of the enterprise. Characteristics of forms of annual financial statements. Features of the formation of balance sheet indicators and other forms of reporting, filling out registers. course work, added 09/22/2012

- Calculation of the main indicators of the financial and economic activities of the organization. Posting business transactions to accounting accounts. Filling out the turnover sheet for the reporting period, the “Profit and Loss Statement” and “Balance Sheet” forms. course work, added 02/13/2015

- Filling out the business transactions journal, order journals and general ledger. Registration of calculations in the form of accounting certificates. Interrelation of reporting indicators. Standards for accounting for assets and liabilities denominated in foreign currencies. course work, added 03/07/2013

- Familiarization with the procedure for preparing annual financial statements on the results of an enterprise’s economic activities: filling out the forms of the balance sheet and its attachments, profit and loss statements, changes in capital and cash flows. course work, added 08/24/2010

practice report on the topic “Re-registration of an organization with government bodies” - see text

- home

- headings

- alphabetically

- return to top of page

- return to similar works

Comparability of reporting data [p.22]

Accepted accounting methods in relation to the fund's property must be applied consistently from year to year. Changes in accounting policies may be made in cases of changes in the legislation of the Russian Federation or regulations of bodies regulating accounting, the application of new methods of accounting, or a significant change in business conditions. In order to ensure comparability of the fund's reporting data, changes in the accounting policies carried out in relation to the fund's property must be introduced from the beginning of the reporting year. [p.354]

The experimental-statistical method is used if the components of the consumption rate cannot be determined by calculation-analytical or experimental methods. At the same time, in the practice of standardization, a method is used to determine the average material costs based on actual expenses for previous years. A serious disadvantage of this method is the possibility of automatically transferring into the planning period all existing shortcomings in work, as well as waste and losses that occurred in the reporting period. Therefore, average statistical consumption rates as a measure of production consumption of material and energy resources can be adopted for the planning period only with mandatory adjustment based on a plan of organizational and technical measures aimed at eliminating or reducing the effects of factors that caused increased consumption of material resources in the past. At the same time, a prerequisite for applying the experimental statistical method of rationing resource consumption is the completeness of statistical data for reporting periods, preferably for 5 years or more, and the comparability of data for reporting years with the planned period. The use of the experimental-statistical method does not contribute to the introduction of new advanced equipment, technology and production organization. Therefore, it should be used when instructions for calculating rates based on the calculation and analytical method are not fully prepared, and the use of the experimental method requires significant time, which does not allow establishing the required consumption rates by the deadline. [p.8]

The State Statistics Committee of the Russian Federation concentrates the forms of accounting reports for large and medium-sized enterprises of all industries. The generalization of these data is disappointing; a large number of trading enterprises are unprofitable in retail trade - more than 40%, and in public catering - from 50 to 60%. In wholesale trade, despite the fact that there are no directly comparable data, things are still better. This is evidenced by the absolute amounts of profit received by profitable enterprises. Thus, in 1997, the profit of retail trade and public catering enterprises in the Federation as a whole amounted to 4827.1 billion rubles, which in relation to distribution costs amounted to 13.3%, and in wholesale [p.374]

The financial statements of an enterprise must contain comparable data with indicators for the corresponding period of the previous year based on changes in accounting policies, legislative and other regulatory documents. For comparability purposes, the nomenclature of the balance sheet items for the previous year should be brought into line with the nomenclature and grouping of sections and articles established for the balance sheet at the end of the year. The reporting is signed by the head and chief accountant of the organization, and in enterprises where accounting is carried out by a specialized organization on a contractual basis, it is signed by the head of this organization and the specialist conducting accounting. [p.114]

In order to achieve comparability, the structure of the reporting calculation, the content of its individual articles and the principle of distribution of actual costs in it must correspond to the same data from the planned calculation. [p.240]

If an organization decides to disclose data for each numerical indicator for more than two years (three or more) in the financial statements presented, then the organization must ensure comparability of data for all periods. [p.337]

IFRS 8 Net profit or loss for a period, fundamental errors and changes in accounting policies sets out the treatment of errors, changes in accounting policies and accounting estimates over different periods of time. When applying this IFRS, the principles of comparability and consistency should be followed, since in the event of a change in accounting policies, comparability of financial statements over different periods of time must be ensured. [p.82]

This chapter consists of five paragraphs. The first examines the social environmental factors that influence accounting standards and practices. The second paragraph is devoted to the issues of international classification of accounting systems. Features of accounting systems in France, Germany, Japan, China and Eastern European countries are presented in the third paragraph. The fourth deals with special accounting comparability issues, such as consolidated statements and foreign currency translation. Finally, the last paragraph is devoted to the problems of international accounting harmonization, where a brief overview of the experience in Australia and New Zealand is given. [p.543]

The explanatory note to the annual financial statements must contain essential information about the organization, its financial position, the comparability of data for the reporting and preceding years, valuation methods and significant items of the financial statements. The explanatory note must report facts of non-application of accounting rules in cases where they do not allow a reliable reflection of the property status and financial results of the organization, with appropriate justification. Otherwise, non-application of accounting rules is considered as evasion of their implementation and is recognized as a violation of the legislation of the Russian Federation on accounting. In the explanatory note to the financial statements, the organization announces changes in its accounting policies for the next reporting year. [p.378]

Productivity growth analysis. The essence of the analysis is that in addition to two income reports for the reporting and base years, an adjusted report is used, in which production volume is for the reporting year, and productivity is for the base year. Comparable data are presented in table. 4.23. [p.207]

The principle of profit comparability is based on the fact that the owner of an enterprise is primarily interested in making a profit. When analyzing the dynamics of production volume as one of the factors influencing the amount of profit, the general inflation index of the national currency should be used, since in this case the comparability of profits of the reporting and base periods is important. [p.187]

Comparability. The information contained in an entity's financial statements must be consistent over time and comparable with that of other entities in order to identify trends in its financial position and performance. Therefore, the measurement and reflection of all business transactions must be carried out consistently, in accordance with the chosen accounting policy. This principle does not mean uniformity. However, to ensure comparability of data, it is necessary to know the accounting policy, its changes and [p.27]

These include profit (loss) from sales, profit (loss) from financial and economic activities, profit (loss) of the reporting period, retained profit (loss) of the reporting period. The following indicators of financial results can also be calculated directly from the data in Form No. 2: profit (loss) from financial and other operations, profit remaining at the disposal of the organization after paying income tax and other mandatory payments (net profit), gross income from sales of goods, products, works, services. Form No. 2 also provides comparable data for the same period last year for all of the above indicators. [p.44]

The requirement for the materiality of accounting information and its significance is declared in clause 4 of Art. 13 Federal Law of the Russian Federation On Accounting An explanatory note to the annual financial statements must contain essential information about the organization, its financial position, comparability of data for the reporting and preceding years, valuation methods and significant items of the financial statements. Materiality in domestic accounting in the form of a relative indicator (at least 5 percent) in relation to the total of the relevant data, previously declared in the Instructions on the procedure for filling out annual accounting reporting forms (clause 4.31 of the order of the Ministry of Finance of the Russian Federation dated November 12, 1996 No. 97, as amended . subsequent amendments and additions), with the abolition of the latter did not lose their meaning. The materiality requirement is specified in PBU 4/99 Accounting statements of an organization. Its disclosure in the financial statements should be made separately in the form of indicating indicators about individual assets, liabilities, income, expenses and business transactions, provided that without knowledge of them by interested users it is impossible to correctly assess the financial position of the organization or the financial results of its activities. [p.23]

The accounting policy developed and approved in accordance with the established procedure by the organization is applied consistently from year to year. This ensures comparability of accounting data obtained in different reporting periods. Consequently, in order to implement this requirement, the accounting policy must be put into effect on January 1 of the year following the year of approval of the relevant organizational and administrative document (order, instruction). [p.407]

The explanatory note to the annual financial statements must contain essential information about the organization, its financial position, comparability of data for the reporting and preceding years, valuation methods and significant items of the financial statements. [p.334]

For comparability of balance sheet data at the beginning and end of the year, the nomenclature of items in the approved balance sheet for the previous reporting year must be brought into compliance [p.22]

Comparability of reporting and planned indicators reflected in the reporting. To ensure comparability of data, changes in accounting policies must be introduced from the beginning of the financial year. If there is no comparability, data for the period preceding the reporting period are subject to adjustment. [p.193]

Information to ensure comparability of data for the reporting and preceding years (clause 8 of the Methodological Recommendations). [p.34]

The comparability of accounting data is necessary for users to analyze the economic activities of different organizations or the same organization for several reporting periods. Comparisons of reporting data are made [p.18]

The comparability of the data contained in the financial statements increases if the organization’s stable accounting policies are observed, which determines the accounting methodology, methods for assessing property and liabilities, systematizing transactions and facts, methods for their generalization and presentation in financial statements. Stable accounting policies imply that they will not be subject to any changes unless clearly necessary. Users of the financial statements will be made aware of the changes made and their reasons in order to allow adjustments to be made to the accounting information used. IFRS indicate that, for the sake of comparison, data for previous reporting periods must be presented in financial statements. [p.18]

Practice shows that incomparability, as a rule, is greater the longer the period covered by the analysis. Our scientists - accountants, statisticians and analysts - have developed a number of methods to take into account the influence of distorting factors. Thus, for the comparability of data in reporting, gross output is shown not only in current prices, but also in constant prices. Accounting for structural changes is especially difficult. Several methods of calculation have been accepted: enlarged, for individual products and the balance method, which has recently begun to be abandoned, since it does not guarantee against errors. [p.40]

Deep descriptive analysis goes beyond simply reporting metrics. In many cases, the analyst must make various adjustments to ensure comparability of data across different years and companies. This analysis is discussed in detail in part 2. [p.47]

Companies cannot be compared unless they both use fairly similar inventory valuation methods. If you have data, you can use the LIFO or FIFO method with equal success. Since most companies today use LIFO for at least some of their inventory, it may seem reasonable to adjust income and inventory figures for those companies that use the comparatively less common FIFO method. But this is only possible if these companies report the current value of inventories and products sold in accordance with Rule 33, or are willing to provide the necessary information to an analyst. This information is too often unavailable, and therefore the analyst has to do the opposite - adjust the reporting indicators of companies using the LIFO method. The SEC requires Form 10-K to include LIFO reserve and/or FIFO reserve amounts, and these same amounts can almost always be found in annual reports. Often data is even given per share. Thanks to this, there is almost always comparable data obtained using the FIFO method. [p.223]

Accounting methods and the provision of financial information currently do not fully reflect modern economic reality in essence, even when accounting and reporting according to international standards - most types of investments in intangible assets are considered under the pressure of tax systems as current costs. In addition, despite the regulation of various regulations designed to facilitate the comparability of these reports, when preparing financial statements within the framework of the accounting policies adopted by the enterprise, it is possible to use a variety of accounting methods, which can make accurate comparisons even between enterprises in the same industry difficult. [p.239]

Comparability requires that consistency be maintained in the accounting methods used by a given enterprise, thereby ensuring comparability of data on the enterprise's activities over several reporting periods. [p.28]

Depending on which value - base or reporting periods - is chosen as the basis for financial reporting, two directions for adjusting reporting indicators can be distinguished. Thus, in the case of using the actual cost of the reporting period to ensure comparability of reporting data, as provided for by IFRS No. 29, the reporting indicators of previous periods are recalculated. Such an adjustment can be called inflation, since its implementation requires superimposing inflationary growth on the reporting indicators of previous periods. [p.413]

Criticism of the postulates and principles of accounting began to take on other directions. Berkeley University professor William Vatter questioned the entire approach [33]. He argued that before you begin to solve any accounting problem, you need to understand why it is needed. Hence, goals, and not postulates, are the starting points in the construction of accounting theory. Principles represent the ways in which these goals can be achieved. They must follow certain conventions, such as the financial reporting convention, and theoretical principles, such as the desired consistency (comparability) of reporting data. In this case, the postulates only connect disparate fragments of the logical chain, and in a perfect theory there should be no postulates. [p.70]

For example, if there is a change in the inventory accounting methods (LIFO and FIFO) for financial reporting comparability, retained earnings should be adjusted to reflect the effect of the change. Changes in assessment [p.161]

Reporting period and submission deadlines. The reporting period for financial statements is the calendar year. The beginning of the reporting period can be determined from the 1st day of any month of the year. Intra-annual reporting by quarters or months, or any other time intervals, is considered interim and is presented to users by decision of the organization’s management or for other explicable reasons. The standard does not prohibit the establishment of a reporting period longer or shorter than a calendar year, for example, lasting 52 full weeks, or lasting six months, due to a change in the reporting date. The notes to the financial statements must indicate the reason for the change in the length of the reporting period and warn users that the comparative amounts of prior reporting periods are not comparable with the reporting data of the most recent period. [p.45]