According to paragraph 3 of Art. 164 of the Tax Code of the Russian Federation, from January 1, 2021, VAT payers are required to apply a rate of 20%. This applies to all goods shipped since the beginning of the year. The increase in the VAT rate from January 1, 2021 does not depend on when and under what conditions the contracts were concluded. So, if you make a shipment in 2021, but received an advance payment in 2021 (and therefore calculated VAT at a rate of 18/118%), then the buyer must still present VAT at a rate of 20%. The advance date does not affect this.

You definitely need to prepare your cash register for the transition to 20% VAT. How to do this - read here. The online cash register receipt must indicate the new tax rate, as well as the name of the product. This means that you will need a cash register program that can do this. The Cashier MySklad application supports this and all other requirements of 54-FZ. Everything is already ready and tested: there is no need to configure anything specially. and try the application right now. It's free.

The most difficult issue in the situation of switching to a 20 percent VAT is transitional contracts, that is, transactions that were concluded in 2018, but will only be executed in 2021. Let’s look at how to take VAT into account in documents if payment and shipment occur in different years.

If the shipment was in 2021, and payment will be in 2021

This is a completely common situation that will not cause any difficulties. The tax base is determined in 2021. The seller pays the tax, and the buyer takes it as a deduction at a rate of 18 percent. After the transition to 20% VAT in 2021, there will be no problems under such supply contracts: at the time of payment, the tax base will not need to be recalculated, and the increase in the rate will not change the tax obligations of the seller and buyer.

Difficulty can only arise if in 2021 you do not ship all the goods under the contract. Then VAT will need to be charged separately for each shipment on the cost of the goods actually shipped. For those goods shipped after January 1, 2021, a VAT rate of 20 percent will apply.

It is more profitable for the seller to ship the goods before the new year. Whether the buyer pays this year or next, the seller will benefit from the lower tax rate.

Other legislative changes on VAT

Reducing the period of desk inspection

Now a desk audit of VAT returns lasts 2 months , not 3, as it was before. The Tax Service has long said that bona fide taxpayers are audited much faster than the three-month period. We are talking about those who are classified by the ASK VAT system into groups with minimal and low risk of tax violations. Now this is reflected in the Tax Code in the form of an official reduction in the audit period.

If there are grounds, the period may be increased to 3 months . The audit may be extended, for example, if breaks in the VAT chain are identified, if there is no correspondence between the information from the invoices of the buyer and seller, and other violations.

To extend the period of a desk audit, you need a decision from the head of the Federal Tax Service.

Confirmation of rate 0%

Certain transactions are subject to VAT at a rate of 0%. These are mainly export transactions. Changes have been adopted to simplify the procedure for confirming a preferential rate. They cover:

- Submission of supporting documents. Previously, the contract was submitted every time a bet was confirmed; now, for ongoing operations, there is no need to resubmit it. But it is necessary to send a notification to the Federal Tax Service with the details of the previously submitted contract.

- Submission of transport documents. By default, you no longer need to submit them, but the tax authority may request them. That is, it is still necessary to have such documents.

- Providing customs declarations. Previously, declarations were submitted with a mark from the customs office of departure. Now the rules are:

- if the declaration is carried out electronically, you can submit declarations without marks (print the electronic declaration);

- if declarations are submitted on paper, then marks from the customs office of the place of departure must be present (letter of the Federal Tax Service dated July 31, 2021 No. SD-4 -3 / [email protected] ).

The change in procedure is due to the fact that the Federal Customs Service and the Federal Tax Service interact with each other, so declarations are transferred from customs to the tax office without the participation of the taxpayer.

Data from the customs declaration or its copy submitted to the tax authority is compared with information from the Federal Customs Service. If any discrepancies are identified, the zero rate is not confirmed.

Simplification of the application procedure

As is known, under certain conditions, taxpayers can refund VAT on an application basis, that is, until the end of the audit. There have also been changes in this part:

- Previously, the preference applied to taxpayers who paid at least 7 billion rubles in taxes to the budget over the previous 3 years. Now this amount has been reduced to 2 billion rubles.

- Similar changes have occurred for guarantors.

Services of foreign Internet companies

Until the end of 2021, Russian companies and entrepreneurs must pay VAT for their foreign counterparties from whom they purchase Internet services. This is, for example, hosting, consulting and other similar services that are provided directly via the Internet. Selling goods online does not apply here.

So, from the beginning of 2021, foreign organizations will pay Russian VAT on their own. To do this, they will use the electronic service “VAT office of an Internet company.” All interaction will be carried out through your personal account.

VAT office of Internet companies

Features of taxation for foreign Internet companies are as follows:

- They will pay VAT at a calculated rate of 16.67% (20/120).

- They are exempt from the obligation to issue invoices, maintain books of purchases and sales, and a journal of issued and received invoices.

In order for a Russian counterparty of such companies to receive a VAT deduction, you will need:

- An agreement with a foreign company for the purchase of services, in which the amount of tax is allocated, and the TIN and KPP of the seller are indicated.

- Document confirming payment of the cost of services, including VAT.

The deduction can only be obtained if the foreign company has registered as a Russian VAT payer with the Tax Service . This information can be viewed on the Federal Tax Service website. If the company does not have such registration, then the deduction will not be given. Accordingly, before concluding agreements with foreign counterparties for the purchase of IT services, it is worth discussing this point.

Unified agricultural tax payers will pay VAT

Law No. 335-FZ, from January 1, 2021, introduces the obligation to pay VAT for payers of the Unified Agricultural Tax. This will enable many companies that work with agricultural producers (for example, agricultural product processors) to benefit from VAT deductions.

The Unified Agricultural Tax is used by those entities whose activities are primarily related to agriculture, that is, they receive more than 70% of their revenue from it.

The nuances in connection with the payment of VAT on the Unified Agricultural Tax are as follows:

- When switching from OSNO, there is no need to restore previously deductible VAT.

- Input VAT on construction projects cannot be deducted, but it can be taken into account in the cost of goods classified as expenses (in activities subject to VAT). The following is implied here. An entity on the unified agricultural tax system invests in the construction of fixed assets and collects invoices issued to it by contractors. Having become a VAT payer in 2021, he will not be able to deduct input tax, but he will be able to write it off against the cost of goods.

- There are special conditions for exemption from VAT under Article 145 of the Tax Code of the Russian Federation. The exemption is given for a year, and during this year it cannot be waived. It is canceled only if the limits below are exceeded. This preference will be available to those payers of the Unified Agricultural Tax whose amount of income excluding VAT for the previous tax period did not exceed:

- 100 million for 2021;

- 90 million for 2021;

- 80 million for 2021;

- 70 million for 2021;

- 60 million for 2022 and subsequent years.

If the payment was in 2021, and the shipment will be in 2021

In the case of prepayment, the calculation of tax during the transition period for VAT from 18 to 20% depends on whether the price is indicated in the contract with or without tax.

If you entered into a contract in 2021 and indicated a price in it taking into account a rate of 18%, but the shipment will be in 2021, you will have to pay VAT at a rate of 20%.

If the price is given without VAT, add it on top additionally. This is more profitable for the seller, since the tax will be increased at the expense of the buyer.

What if the contract does not directly indicate that VAT is not included in the price? Check the terms of the contract and the circumstances of its conclusion, including related correspondence. If it does not follow from all this that VAT is not included in the price specified in the contract, this will mean the opposite: it is included in this price. In this case, you will have to calculate the tax using the estimated method. This is an unfavorable situation for the seller: if the rate increases, the cost of goods will decrease, and it turns out that VAT increases at the expense of the supplier.

How is VAT calculated?

VAT on the amount at a rate of 20% is calculated using the formula:

VAT = amount_without_VAT × 20 / 100

or using a simpler formula:

VAT = amount_without_VAT * 0.2

If you need to allocate VAT 20% from the amount that already contains VAT is determined using the expression:

VAT = amount_with_VAT / 1.20 × 0.20

What transactions are not subject to VAT?

The list of transactions not subject to value added tax includes:

- relations arising from real estate lease agreements with foreign citizens or non-resident companies officially operating on the territory of the Russian Federation;

- sale of prosthetic and orthopedic equipment, as well as raw materials and components for its production;

- sale of equipment and transport designed for the movement, rehabilitation and socialization of disabled people;

- production and sale of glasses, lenses for vision correction and related frames;

- provision of compulsory health insurance services;

- provision of paid medical care related to the detection and treatment of diseases, including services for collecting donor blood, caring for bedridden patients, pregnancy management, etc.;

- services of teachers and nannies of kindergartens, as well as teachers of clubs and sections of out-of-school education.

An exhaustive list of transactions exempt from value added tax is specified in Art. 149 of the Tax Code of the Russian Federation.

Important features of VAT calculation

When determining the amount of VAT to be paid, the entity must take into account some important points. In particular, if the object of taxation is goods imported from abroad and paid for in foreign currency, their value is recalculated into rubles at the rate of the Central Bank of the Russian Federation. Moreover, the exchange rate is taken into account at the time of filing the declaration.

When calculating VAT on other categories of goods and services, the prices indicated in the invoices are taken as calculation data. As for declarations for this tax, they are submitted electronically using specialized computer programs.

Read also: Compensation for delayed wages

VAT calculation methods

Tax legislation offers three methods for calculating VAT:

- addition - VAT is defined as the product of the tax rate, the salary of one employee, “net” income and interest on each category of goods. This method has a noticeable drawback, namely the impossibility of total control over the calculation and payment of tax. Because of this, addition is rarely used as a primary method;

- deduction - the amount of tax payable is calculated as the product of the rate by the difference between revenue and the cost of goods sold. This method is more often used in enterprises because it allows the use of counter-checks to control tax payment.

- invoice method – considered the main method of calculating VAT. When using it, VAT is reflected in the invoice as the product of the commodity value and the tax rate. The seller provides the invoice to the buyer, and keeps one copy of it. The VAT payable is determined as the difference in taxes indicated on the invoices of the seller and the buyer.

If the shipment was in 2021, and a return is made in 2021

If the buyer returns an item, it is the seller who issues the adjustment invoice for the return. The document must indicate the rate not 20%, but 18%. And in the adjustment lines, the seller indicates those goods that the buyer wants to return.

Example:

In December 2021, the company sold goods worth 120,000 rubles to the buyer, including 18,000 rubles of VAT. But in January 2019, the buyer decided to return part of the purchases in the amount of 60,000 rubles.

The selling company must issue an invoice for 60,000 rubles. The accountant must indicate the VAT rate of 18% there, because the goods were sold in 2021 at the old rate.

Who is included in the VAT payers?

At first glance it seems that the subject, i.e. The VAT payer is the party selling the product or service. From a legal point of view this is true, but in fact the buyer pays the tax. To understand why this happens, you should consider the algorithm for its formation in practice.

So, for example, a certain enterprise purchases raw materials from a counterparty for its own production. After settlement with the supplier, the company determines the cost of the future product, including VAT. However, at this stage it is not accrued, but is only included in the “tax credit” category.

After the product has been manufactured, its selling price is assigned, which includes production costs, excise taxes, a markup constituting “net” profit, as well as VAT. Thus, the tax is included in the sales price that the buyer ultimately pays.

After selling a batch of goods, the company determines the amount of “net” profit, *20% of which will be value added tax.

*20% — VAT

Thus, the category of VAT payers includes:

- legal entities and individual entrepreneurs engaged in the paid sale of goods, works or services;

- companies and individuals bringing goods to Russia by crossing the customs borders of the state.

Objects of taxation

Based on Article 146 of the Tax Code of the Russian Federation, the following items are subject to VAT:

- provision of services;

- manufacturing jobs;

- sale of goods;

- import of movable objects.

The main condition under which a business transaction is subject to VAT is its sale on the territory of the Russian Federation.

VAT rates and calculation

Despite the fact that calculating this tax is quite difficult, subjects do it on their own. The calculation is made in the following order:

- the amount of mandatory collection is determined for all transactions carried out in the reporting period;

- the amount of deduction for each operation is determined;

- The amount to be paid to the budget is calculated.

Read also: Taxes of self-employed citizens in 2021

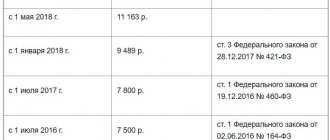

As for rates, today entities pay VAT in the amount of:

- 10%;

- 20% (18% until 2021);

- 0%.

A rate of 10% is applied when selling:

- agricultural products;

- fish and other marine products;

- some products for children;

- medicines, medical equipment and equipment;

- printing products.

The zero rate “works” in relation to:

- some types of transport operations, including international transport;

- works and services for organizing and holding sporting events;

- imported goods;

- forwarding activities;

- mining of precious and rare earth metals;

- work related to servicing the foreign diplomatic corps;

- export sales of fuels and lubricants.

In all other situations, the standard rate applies - 20% (18% until 2021).

How to take into account the increase in the VAT rate from 18 to 20% in the contract?

Obviously, you can prepare for such a situation during the remaining period of 2021, when you will enter into contracts whose obligations you intend to fulfill after January 1. A safe and profitable option that will protect you from losses is not to indicate the VAT rate. Since it is increasing on the basis of a law that will come into force only on January 1 next year, when concluding an agreement this year there is no formal reason to indicate a rate of 20%. You can specify in the contract the procedure for forming the final price, that is, the cost of goods excluding VAT + an indication that VAT will be charged additionally at the rate established by clause 3 of Art. 164 Tax Code of the Russian Federation. This will mean that until December 31 the VAT rate will be 18%, and from January 1 - 20%.

Is it possible to make changes to the contract for 2019, which has already been concluded, if the VAT rate increases? First of all, agree on the terms with your partner. Then draw up an additional agreement with changes to the VAT rate in 2021. The same principle applies here as with contracts. When concluding an additional agreement in 2021, it is better not to indicate a specific VAT rate, but simply refer to the one established by the Tax Code.

When drawing up an additional agreement to the agreement on changing VAT from 2021, you can include other conditions in it. This will help avoid losses. So, you can agree and indicate early delivery (without specifying a reason) - until the VAT rate changes in 2019. This will be beneficial for you because you will be able to apply the 18% rate. Also, to soften the transition to 20% VAT for your regular customer, you can offer him a discount on shipment.

Is it possible to save money?

In connection with the increase in rates, the issue of saving becomes relevant. Moreover, many suppliers find themselves in a situation where they lose 2% on already concluded contracts. Experts advise the following:

- Provide separate accounting. As a result, it will be clear which contracts require adjustment. It may be possible to negotiate with buyers on a change in price or reduce the volume of delivery.

- Structure your business. Probably, some areas of activity should be separated into a separate legal entity that applies a special tax regime. This will allow you to avoid paying VAT. But there is a pitfall here: you need to seriously consider the business purpose , otherwise the tax authority may suspect the fragmentation of the business. That is, different legal entities or structural divisions must have their own real activities, and not just formal document flow.

- Use incentives whenever possible. There is a list of goods that are subject to VAT at a reduced rate. It is possible to apply exemption from VAT under Article 145 of the Tax Code of the Russian Federation. There are activities subject to VAT at a zero rate.

- Refund VAT from the budget on time. As a general rule, tax can be deducted within 3 years. Since the summer of 2018, this period also applies to the refund of overpaid VAT from the budget. After 3 years, the right to a refund of overpaid amounts is lost. Therefore, you need to periodically check account 19 in order to promptly deduct or return the accumulated tax.

How to prepare cash registers for the application of the new VAT rate from January 1, 2019

The new VAT rate of 20 percent must be indicated on cash receipts starting January 1, 2021. The Federal Tax Service intends to treat violations strictly. Therefore, cash register equipment must be brought into compliance with this requirement as soon as possible. What you need to do - read our article >>

Sources:

- Letter of the Federal Tax Service of Russia dated October 23, 2018 No. SD-4-3/ [email protected]

- Letter of the Federal Tax Service of Russia dated September 10, 2018 No. SD-4-3/17537

- Letters of the Ministry of Finance of Russia dated 08/06/2018 N 03-07-05/55290, dated 08/28/2018 No. 24-03-07/61247, dated 09/18/2018 No. 03-07-11/66752, dated 04/07/2015 No. 03-07 -09/19392

- Art. 154, 164, 167, 168, 170, 171, 172 of the Tax Code of the Russian Federation

- Art. 452 of the Civil Code of the Russian Federation

- Federal Law of August 3, 2018 No. 303-FZ

- Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated May 30, 2014 No. 33 (clause 17)

What are the consequences of raising VAT to 20% for the seller?

Within the framework of state policy, such reform is objectively justified. In this way, the legislator stimulates the budget to be filled - more than half a million rubles will be additionally contributed annually through a two percent increase.

From the point of view of increasing the tax burden, the state provides for the containment of other fees. In particular, the fixed 10% limit is not subject to revision for local Russian air carriers. The tax will not be levied until 2025 for the Far East and Crimea; the Kaliningrad region will enjoy such a benefit on an indefinite basis.

The increase in the amount of contributions to social extra-budgetary funds has been canceled - the increase in the volume of deductions to 34% will not take place, the previous percentage will be maintained.

For the auto business, it remains possible to receive a deduction for targeted transactions - the added value can be returned when paying with budgetary funds.

A special issue for business owners is the problem of contract inventory. Due to a change in one of the essential conditions—price—there is a need to revise them. The problem is that contracts concluded in 2021 and earlier were agreed upon by the parties on financial obligations implying the old rate. The law, as well as the explanatory Letters from the Ministry of Finance, do not indicate whose responsibilities the additional payment is and which party will compensate for the added 2%. The same applies to prepayment, deferred payments, and long-term cooperation, which is automatically extended.

Subscribe to our channel in Yandex Zen - Online Cashier! Be the first to receive the hottest news and life hacks!

Rates for charging VAT by the seller during the transition phase

| Circumstances | Actions this year | Actions next year |

| The products were purchased this year and are planned to be sold next year. | Acceptance of input VAT for deduction at a rate of 18% | VAT accrual at the rate of 20% |

| The products were shipped this year, payment for them will be transferred next year | VAT accrual at the rate of 18% | No tax adjustment is needed. VAT is charged at a rate of 20% only on products, works and services that will be shipped and performed from 01/01/19. |

| Receiving 100% advance payment this year, shipment of products is planned next year | VAT accrual on advance payment at rate 18/118 | VAT is charged at the rate of 20% and tax is deducted from the advance at the rate of 18/118. Agreeing in the contract with the consumer the difference in price due to an increase in the tax rate |

| Receipt of part of the advance payment this year, shipment of products and receipt of the remaining amount from the consumer are planned next year | VAT calculation at the rate of 18/118 | VAT is charged at a rate of 20%, tax is deducted from part of the advance at a rate of 18/118. Agreeing in the contract with the consumer the difference in price due to an increase in the tax rate |

| Conclusion of a government contract by a company, receipt of an advance in the current year, execution of the contract by the company next year | VAT accrual on advance payment at rate 18/118 | Acceptance of tax deduction on advance payment at the rate of 18/118. Agreeing with the government customer on the difference in the contract price due to an increase in the tax rate. Unilateral changes in the contract value by the contractor due to legal adjustments are prohibited. The Ministry of Finance outlined the nuances of determining the cost taking into account the increase in the tax rate in letter dated August 28, 2021 No. 24-03-07/61237 |

Receiving payment this year, shipping goods next year

This year, the company received an advance payment for the delivery of products that will be shipped next year. In this situation, transfer the advance tax to the budget at a rate of 18/118%. Next year, after the products are shipped to the customer, the tax must be calculated at a rate of 20%. The tax previously transferred from the advance payment must be deducted in the previously accrued amount.

Based on the provisions of the agreement, VAT must be calculated differently when rates change. The various possible situations are described below.