How is the concept deciphered?

KRSB stands for budget settlement card and is a clearly grouped information resource that reflects information on accrued and paid tax payments.

A taxpayer card is formed from tax reports submitted by a person to the Federal Tax Service. In controversial situations possible between the parties, this document allows you to identify discrepancies and control the payment of taxes. In accordance with uniform requirements, budget settlement cards are maintained for each taxpayer and for each individual type of tax.

Each type of payment has its own code (KBK), and the code of the municipality where the tax revenues are received (OKTMO) is also taken into account. Different cards are provided for the taxpayer and the tax agent, so if the same person performs two tax functions at once, then two KRSB are issued for him, respectively.

Example of a statement of insurance premiums for employees

https://www.youtube.com/watch{q}v=en-lO0J3ZCY

This is a statement of insurance premiums for employees for compulsory pension insurance. At the beginning of the year, the entrepreneur had an overpayment of 3,497.14 rubles. These are the contributions he paid in 2021 from his October and November salaries. The amount is in both 11 and 13 columns. After:

- On January 9, he pays 1,697.15 rubles from his December salary, the overpayment increases to 5,194.29 rubles (3,497.14 1,697.15). We see this figure in column 13.

- On January 10, he submits a calculation for insurance premiums (DAM) and charges appear in the statement that reduce the overpayment to zero: 5,194.29 - 1,800 - 1,697.14 - 1,697.15 = 0. In the 13th column you will also see zero .

- The entrepreneur paid for the 4th quarter of 2021 exactly as much as he reflected in the declaration. As of January 15, he has no debts or overpayments. Ideally, this is how it should be.

Why do you need a budget card?

Quite often, companies and entrepreneurs find themselves in a situation where there is a discrepancy in information when checking the status of tax payments. In this case, the source of the necessary information is the database reflected in the card or the taxpayer’s personal account. Tax authorities use this tool to record tax payments, since tax legislation obliges them to reconcile paid taxes (penalties, fines), as well as generate statements and certificates about the status of the personal account of companies and individual entrepreneurs. Previously, the tax authority, when conducting desk audits, referred to the settlement card. However, since 2010, the document has been declared invalid and is for reference only. That is, for organizations and individual entrepreneurs, the card is an additional tool that allows them to monitor the state of their personal account.

What is a budget card?

Important! The budget settlement card (CRSB) is a concept that is directly related to the payment of taxes. The card is a kind of database for an individual or legal entity registered with the tax authority.

KRSB is an information resource that contains information on accrued and paid taxes. Its formation occurs on the basis of tax reporting submitted to the tax authority by the taxpayer. If disputes arise between a taxpayer or a tax authority, this document can help in identifying discrepancies, as well as in monitoring the payment of taxes.

Based on the requirements, the KRSB is maintained for each taxpayer and for each type of tax. Each tax payment has its own KBK code, as well as a municipal code (OKTMO).

It should be remembered that separate cards are maintained for taxpayers and tax agents. That is, if one person is both a tax agent and a taxpayer, then two cards will be created for him

Who maintains the document

The CRSB database is maintained directly by the Federal Tax Service on the basis of information submitted by the taxpayer. To do this, tax returns are submitted to the tax office in forms 2-NDFL (at the end of the reporting year) and 6-NDFL (quarterly). The use of RSB cards is a procedure within the jurisdiction of the tax authorities, carried out both at the initiative of the taxpayer and the Federal Tax Service.

Closing the card is also carried out through the Federal Tax Service, in particular for registering the taxpayer in a new place. Then the person is deregistered with one tax authority and transferred to another territorial department of the Federal Tax Service in the prescribed manner. As for fines for late tax payments and administrative offenses, the KRSB with these data is not transferred to a new place of registration, but is opened at the location of the authorities that made the decision on sanctions against the taxpayer. That is, information that does not reflect the activities of the organization/individual entrepreneur cannot be transferred to another Federal Tax Service.

How a register is opened, maintained and closed

The Federal Tax Service Inspectorate opens the card after the taxpayer registers. This occurs after the payment of the fiscal payment or when it is necessary to pay the contribution.

If a company has separate divisions that were registered with different Federal Tax Service Inspectors, then cards for one tax will be opened in all inspectorates at the place of registration. Responsible inspectorate employees are required to enter data into the KRSB when transferring payments or other transactions.

At the end of the tax period, a balance is created. A positive balance means the taxpayer has overpaid, and a negative balance means debt. If there is no basis for accounting for payments, then the document is closed. This may occur due to termination of the obligation to pay tax, transfer to another Federal Tax Service, or liquidation of the organization.

How does the RSB card start up?

According to the law, a card for a taxpayer must be created after he is registered in the appropriate status, as well as from the moment:

- the occurrence of his obligations to pay tax payments on the basis of documents submitted to the tax department;

- receiving fiscal postings from citizens with different statuses.

Important: the card must be opened separately for each tax payment with the obligatory designation KBK.

For example, if one subject has two statuses - taxpayer and tax agent, then two cards are created at once.

What kind of data does the card carry?

The payment card has a unified form and consists of 2 parts intended for specific purposes and has an appropriate structure:

- Featured part:

- INN and KPP of the taxpayer. How to restore the TIN if lost - read the publication at the link;

- type of payment and its BCC;

- OKTMO. OKATO and OKTMO are the same thing or not, you will find out here;

- activity code of the enterprise or entrepreneur;

- subject status.

In addition, this part may include information regarding:

- information about the person;

- budget commitment;

- necessary for the correct display of information.

- Balance of payments:

In this part there are 3 tables in each of which you need to enter the following data:

- date and due date of payment;

- the amount of funds received from the taxpayer;

- additional accrual or reduction of funds;

- balance paid by the taxpayer, what indicator it has - positive or negative;

- the amount of the penalty, if any;

- calculations of interest on account of penalties. Here you will find out what the fine is for failure to submit a declaration on time.

Important: these tables are the basis for further actions of the inspector, since from them you can see arrears in payments or their complete absence.

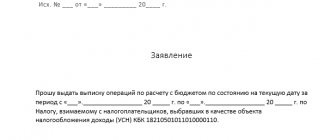

Extracting transactions for settlements with the budget.

Features of systematization of form data

The taxpayer's KRSB is a mandatory form that is drawn up at the time of registration of a company, individual entrepreneur or individual. The document is also filled out if a branch of the tax office has provided information about a change in the location of the organization or the place of residence of the entrepreneur.

The card is opened for a specific tax agent. Optimization of reports by Federal Tax Service employees is ensured by the systematic maintenance of separate forms intended for:

- taxes that are paid currently or for the quarter;

- KBK code of a specific enterprise;

- territorial code OKTMO;

- confirmation of taxpayer status. A separate form is intended for payers who are also tax agents.

Changes in tax laws in 2021 have resulted in some changes to the CLRS. According to the letter of the Federal Tax Service No. PA-4-1/25563, the administration of insurance premiums and payments is transferred to this service. Currently, payment cards for insurance transactions are opened by tax authorities.

Statement of reconciliation with the tax office - how to understand it

Hello Clerks! I climbed a bunch of sites, there were questions everywhere, but no concrete answers that were clear. I can’t reconcile the calculations with the tax office for personal income tax for 2021. If you get through (unlikely), they yell “order a reconciliation report and check” and hang up. I ordered both a statement of accounts and a reconciliation report... but I still can’t fully figure out who owes whom. It’s complete horror, my head is spinning (I can’t go to the Federal Tax Service, I’m in a different region). my example: In the statement in column 13 the amount is 20280 (without the minus), which means I think it’s an overpayment. And in the reconciliation report the same amount is Section 1. 1.1 total debt. including 1.1.1 negative balance. 12168 1.2. Positive balance. 12168

Section 2 1. Balance as of 01/01/19 clause 1.1 debt total 20280 clause 1.1.1 tax 20280 including: 1.1.1.1 negative balance 20280 2. For the reconciled period from 01/01/19 to 08/01/19 2.2 accrued 2.2.1 tax. 12168 2.4 Paid. 4056 2.4.1.1 tax. 4056 3. balance at the end of 08/01/19 3.1 Total debt. 3.2. Positive balance of everything. 12168 3.2.1 tax. 12168

I don’t understand what’s going on with them. My information is as follows: 20280 - we paid this from January to May (4056x5 months) Balance according to my turnover as of 01.01 4056 - personal income tax for December. The amount 12168 is the 6-personal income tax report for the 1st quarter. (31.12+31.01.+28.02) Their tax payment costs 4056=, and we paid monthly 4056= from January to July inclusive 28392(4056*7). How can I understand why they only charge 4056 for payment? And 20280 = in a negative balance, although in the statement in column 13 there is 20280 without a minus? Please help me figure it out. The tax office doesn’t even want to talk. Come, he says, and sort it out. Thank you very much in advance to whoever answers.

Acts of reconciliation with tax authorities are issued starting from 2021 according to the form approved. By Order of the Federal Tax Service dated December 16, 2016 No. ММВ-7-17/ [email protected] The article will discuss the purposes of changes to the previous form, the essence of the adjustments and the methods for obtaining such documents.

How to open, maintain and close a CRSB

In the process of tax registration with a certain Federal Tax Service, the tax payer (organization, as well as an individual) does not automatically have a KRSB.

The RSB card must be opened by the Federal Tax Service when the following circumstances occur:

- obligation to make a certain budget payment, insurance or other contribution or tax;

- obligation to make customs or fiscal payments.

Important! If an organization has branches or separate (separate) divisions that are registered with the Federal Tax Service inspection at different addresses, then different RSB cards are created that correspond to the checkpoint of the branch or separate divisions in the corresponding Federal Tax Service Inspectorate.

Inspectorate employees are required to enter information on payment of budget payments or fees, as well as other payments provided for by the legislation of the Russian Federation as soon as possible. At the end of the calendar year, a balance should be formed with the amounts recorded at the beginning and end of the tax period in the RSB card.

If the balance is negative, it is obvious that the taxpayer has arrears in payments to the state, but if the balance is positive, it means that an overpayment has been recorded. A legal entity or individual has the right to recover the overpayment by submitting an application to the relevant Federal Tax Service inspectorate in their personal account.

The RSB card is closed if the obligation to keep records of payments for insurance premiums, taxes and fees is terminated.

Such circumstances are:

- liquidation or termination of the activities of a legal entity;

- termination of an individual's employment, for example, in the event of job loss or retirement;

- change by an individual or organization of the Federal Tax Service, as a result of which a new KRSB is created in the new Federal Tax Service, which reflects the previous balance;

- termination of obligations to pay funds to the budget for a certain tax or fee, while there must be no debt on such payments. This situation arises, for example, if there is a change in the taxation regime, a transition from the basic to a simplified taxation system, or the dismissal of employees.

How is a card generated by the Federal Tax Service?

When registering an entrepreneur or organization with the tax authority, a budget settlement card is issued. This card is issued on a special form in which data on payments made by the taxpayer to the budget is entered . If previously the card indicated information only on tax payments, today the card also indicates information on the payment of insurance premiums.

Important! The KRSB is established not only for taxpayers, but also for tax agents who are obliged to withhold funds from taxpayers and pay them to the budget.

When organizations or entrepreneurs pay unified social tax and insurance contributions for pension insurance of individuals, the tax office opens an additional card for settlements with the budget with these values (

Why is the form now called an act of reconciliation of calculations of taxes and fees?

Each taxpayer has the right to realize his desire and check with the Federal Tax Service on payments made to the budget. Since 2021, the functions of the administrator of insurance premiums have been transferred to the Federal Tax Service. For this reason, the reconciliation report with the tax office was also changed.

The form has been supplemented to make it suitable for reconciliations and contributions. The document can now include information not only on tax payments and corresponding penalties and fines, but also similar information on contributions made to insurance funds.

A sample tax reconciliation report is available on our website.

And not so long ago, the reconciliation report and other documents for credit/refund of contributions were updated by the Social Insurance Fund.

Why do you need a budget card?

Quite often, entrepreneurs and organizations find themselves in a situation where there is a data discrepancy when checking the status of tax payments. In this case, the database reflected in the card or the taxpayer’s personal account can serve as a source of the necessary information. The tax authority uses this tool to record tax payments, since tax legislation obliges the Federal Tax Service to reconcile paid taxes, penalties, fines, as well as generate statements and certificates about the status of the taxpayer’s personal account. Previously, the tax office, when conducting desk audits, referred to the RSB card. But it should be remembered that since 2010 the document has been declared no longer in force and is for reference only. That is, for organizations and individual entrepreneurs, the card is an additional tool that allows them to monitor the status of their personal account.

Checking and sending

When all fields are filled in, you need to proceed to sending by clicking the button with the same name. The form will begin checking. Upon completion, the system will report the results. If errors are found, they must be corrected. To do this, you need to click on the link with a description of the error or click the “Edit report” button at the bottom of the results window. When the errors are corrected, you need to recheck the generated request.

In addition to errors, the system may issue warnings. You can send a request using them, but it is still advisable to check them.

If there are no errors or warnings, you can send a request to the Federal Tax Service. To do this, there is a “Proceed to Send” button at the bottom of the screen:

In the same window the user is given the opportunity to print:

- generated request - the “Print on form” (you can also save the request in PDF format through this);

- a list of errors and warnings that the service issued after the test - the “Print test results” button.

After clicking the “Proceed to Send” button, the request submission window will open. In it you need to click “Sign and send” . The request has now been submitted to the Federal Tax Service.

Can I see my RSB card?

You need to know that according to the law of the Russian Federation, the information contained in the KRSB is not subject to disclosure, therefore the card itself is not issued at the request of the taxpayer. Typically, legal entities and individuals can find the necessary data on budget payments in their personal account registered on the Federal Tax Service website. Organizations can use the services of their providers that provide access to electronic reporting, for example, VLSI. You can request a reconciliation of your calculations with the budget for the required period of time.

If necessary, the data of interest from the card should be requested from the Federal Tax Service inspection. The Tax Service will provide basic information from the KRSB data, including:

- calculated amounts of taxes;

- calculated penalties and fines;

- balance recorded at the beginning and at the end of the requested period;

- payments made by the taxpayer during the requested time.

A request for an extract can be sent through your personal account or TKS telecommunication channels. The deadline for providing an extract is five working days.

It should be noted that sometimes the information in the KRSB is not updated. In this case, the taxpayer must submit an application for correction of information through the TKS or in the personal account of the Federal Tax Service.

Detailed information can be obtained by calling the toll-free hotline located on the Federal Tax Service website nalog.ru or at your Federal Tax Service Inspectorate.

How to send (ION) a request to the tax office?

The transmission (ION) of the request is carried out electronically via telecommunication channels (TCC), this requires a qualified electronic signature issued by the electronic document management operator (EDF). To send an ION request, we will consider the two most popular methods.

- Contour.Extern

- Nalog.ru

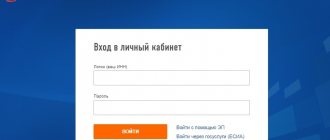

Step one:

- Log in to the Kontur Extern website.

If you do not have Kontur Extern, then use the free “Test Drive” version: 3 months.

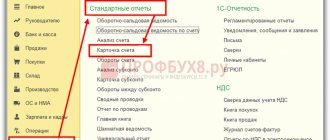

- On the main screen of Contour Extern, go to the “FTS” tab, then click on the “Request reconciliation” button.

Step Two:

- On the “Request Reconciliation” tab, select the required document.

Step Three:

- On the request screen for the provision of information services, fill in all the required fields: (Type of request by Federal Tax Service, Inspection Code, Date)

- In the “Response format” field, enter: “XML”.

- Next we move on to sending.

Step Four:

- Wait for the results of document processing by the tax authority (usually this operation takes a few minutes, but delays may occur.)

- Go to the “Documents”, “ION Requests” section and download the finished document.

How to decipher tax statements

To reconcile with the tax office, you will need two documents:

- A statement of the status of settlements shows only the debt or overpayment of taxes and contributions on a specific date. But to figure out where they came from, you will need another document - an extract of transactions for settlements with the budget.

- The statement of transactions for settlements with the budget shows the history of payments and accrued taxes and contributions for the selected period. Based on the statement, you will understand when the debt or overpayment arose and find out the reason for the discrepancies.

OPTION 2: Request KND certificate 1166107 on the tax website

Step one:

This method will require you to register in the personal account of a legal entity on the website of the Federal Tax Service.

- Log in to the website nalog.ru in your personal account of a legal entity.

Step Two:

- Select the “document request” tab in your personal account.

Step Three:

- Select “Statement of transactions for settlements with the budget” and set the desired response method.

Problems

If a taxpayer discovers a filing error, he can file a claim. It is necessary to attach documents that would confirm payment. If a refusal was received when sending the request, the payer will have to appear in person at the Federal Tax Service.

When transferring money, you may receive a notification about an error in the documents and the absence of an open KRSB, and the payment will be registered as unclear. Inspection details and current CSCs will be attached. In this case, it is necessary to write a statement for clarification - indicate the KBK and OKTMO.

How to request a tax reconciliation report

As before, a reconciliation report with the tax office is provided upon request sent to the Federal Tax Service. Despite the fact that the document can be drawn up in any form, when compiling it you should adhere to certain rules of format and sequence of presentation.

In order for taxpayers to be able to navigate the rules for its preparation, a sample for a written application for a tax reconciliation report is presented on our website.

request for written request

Answers to common questions

Question: The tax authority identified discrepancies between the 6-NDFL calculation submitted by the company and the card calculations with the budget. At the same time, a fine was immediately imposed on the company, without asking for clarification on 6-NDFL. Are the tax authorities’ actions legal?

Answer: If in the submitted 6-NDFL calculation the indicated amount is greater than the amount reflected in the budget settlement card, then the tax office has the right not to request explanations for the calculation and to fine the company. Explanations are requested only if errors and contradictions were found in the calculation during verification. Otherwise, the tax office is not obliged to demand an explanation, but immediately has the right to impose a fine. That is, the tax authorities’ actions are truly legal.

The process of sending a request and receiving a response

Interaction through Kontur.Extern includes the following stages:

- Formation and sending of a request. It is signed electronically by the taxpayer or his representative. In the latter case, you must attach a message about the representation.

- Receive confirmation from the operator.

- Receiving a “Notice of Receipt” or “Error Message” from the tax authority. The notice is signed with a digital signature from the tax office.

- Receiving from the Federal Tax Service one of two documents: “Acceptance Receipt”. This means that tax officials are working on the request and preparing a response.

- "Notice of Refusal." The request is not processed, you need to submit it again.

What information is reflected on the card?

The KRSB reflects information on the following types of data:

- on accrued taxes, as well as fines and penalties on them;

- on taxes paid, as well as fines and penalties on them;

- according to the balance between the accrued and paid amounts of tax (in this case, if a negative value is formed, then this indicates the taxpayer’s debt, and if it is positive, then it indicates an overpayment).

This information is entered into the card on the basis of declarations submitted by taxpayers and tax agents, decisions on desk audits, decisions of judicial authorities, as well as other documents.

Thus, the KRSB reflects information on tax payments to the budget received from various economic entities.

Important! Sometimes, the information contained in the KRSB is not true. Among other things, the card reflects bad debts that are not possible to collect. In some cases, they are reflected in the card for several years, which significantly distorts the final balance of the CRSB.

View answer

To see the documents received from the Tax Service, on the main page of the service you need to go to the “Federal Tax Service” tab and then select the desired section. For example, if a request has been submitted, you need to click on the block “All reconciliations” :

A list of documents will open, among which you need to find the one you are interested in:

In this list you can see the responses of the tax authority indicating the Federal Tax Service number and date. When the response is received, the document flow with the tax authority is completed.

How long should I expect a response? It depends on the type of request. If this is a request regarding the organization as a whole or about the fulfillment of the obligation to pay tax, the response will be received within 6 business days. Responses to other requests will be received within 3 business days . The period is counted from the moment the request is sent.

Contents of the KRSB

The conditions for opening a card are the deadline for paying fees or taxes, submitting a declaration or other reporting, obtaining a license or registration document. The form is also created in case of unclear payments discovered during the audit. A payment card is not a basis for the reliability of personal income tax information, since it relates to internal forms of control by the tax service.

What is CRSB in tax practice will help clarify its content. The document includes:

- data on the amounts of duties, fines and penalties. This information is entered by Federal Tax Service employees based on the declarations provided by the legal entity or individual entrepreneur, as well as on the basis of an audit or a court decision;

- information about the fact of transfer of tax, penalty or fine;

- balance – the difference between accruals and transfers. A negative value reflects the debt of the tax agent, and a positive value indicates the presence of an overpayment.

A prerequisite for a payment card is that the amounts entered into it correspond to the current budget of the enterprise or individual.

Saving and Printing

Any document that is involved in the document flow with the inspection can be viewed and printed. To do this, in the “Federal Tax Service” section, select “All reconciliations” and go to the desired request by clicking on its name. In the next window, the user will have the opportunity to select the actions that need to be performed with the document. You can save it by clicking the link highlighted in the following image:

In addition, the document can be printed:

The type of document sent for printing will depend on its format. In the same window, in addition to printing, it can be saved .