Rosstat, by order of June 9, 2015 No. 263, approved a new form of statistical observation for individual entrepreneurs No. 1-entrepreneur “Information on the activities of an individual entrepreneur for 2015.” All entrepreneurs must fill out this form. Moreover, the information provided must not only be based on the data submitted to the inspectorate, but also be based on real facts of business activity. The deadline for submitting the form is April 1, 2021. Let’s get acquainted with the next innovation that you need to take into account in your activities.

Rosstat, by order of June 9, 2015 No. 263, approved a new form of statistical observation for individual entrepreneurs No. 1-entrepreneur “Information on the activities of an individual entrepreneur for 2015.” Let's talk about which of the merchants should submit this type of reporting, what information it should contain and in what time frame it should be submitted.

Page 001 - reasons for applying

Sheet 001 must be filled out by all individual entrepreneurs who, for specific reasons, submit form P24001 to the Federal Tax Service.

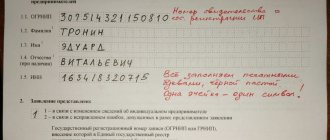

On the first page indicate the last name, first name and patronymic of the entrepreneur, INN and OGRNIP. When submitting an application due to a change of name, on the first page you must indicate the previous data that is registered in the Unified State Register of Entrepreneurs extract.

After your personal data, you need to select the reason for filing by indicating the number 1 or 2 in the empty cell, where:

- 1—change of information about the entrepreneur.

- 2 - correction of an error in the information provided earlier.

If the second reason is indicated, that is, code 2 is set, you must additionally enter the USRIP-OGRNIP entry number.

Sample of filling out 1 page

Form No. P24001

Page 001 - reasons for filing an application (filling example)

Sheet A, Page 002 - change of full name

Sheet A is filled out by individual entrepreneurs without citizenship, as well as foreigners who have changed their full name or made a mistake in their full name. You need to fill out the page in Russian in Latin alphabet.

When changing your full name, the entrepreneur must receive a new identity card, as well as a new document on temporary stay in the Russian Federation or a new residence permit.

If you receive documents, you will need to fill out sheets D and D, where you need to register their data.

Sample filling 2 pages, sheet A

Form No. P24001

Sheet A, Page 002 - change of full name (filling example)

Sheet B, page 002 - change of citizenship

Sheet B is also filled out by stateless entrepreneurs and foreigners, but this time they have changed, lost or acquired citizenship. Including Russian citizenship.

Civil status is indicated as a digital code, where:

- 1 is a citizen of Russia.

- 2 - foreign citizen.

- 3 – stateless person.

After the status, you need to write down the numeric code of the state in which you received your new citizenship. The numeric code can be found in the All-Russian Classifier of Countries of the World.

Sample of filling 2 pages, sheet B

Form No. P24001

Sheet B, page 002 - change of citizenship (filling example)

Why do you need form 1-IP?

Form No. 1-IP is an annual reporting form to Rosstat, designed to collect information about individual entrepreneurs and study the revenue they receive and labor resources.

Instructions for filling out form 1-IP can be obtained on the Rosstat website or from employees of the statistical office of your city

Who collects information

According to the law of November 29, 2007 No. 282-FZ, in our country, federal authorities monitor the economy, ecology, demography and other social processes, including the activities of individual entrepreneurs. This is done by the Federal State Statistics Service (Rosstat), subordinate to the Ministry of Economic Development. The information contained in form No. 1-IP is intended specifically for it.

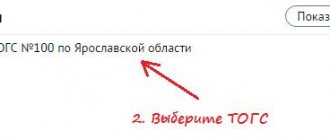

Based on the data from this form, information about individual entrepreneurs is collected and conclusions are drawn about their activities. Information is provided through the divisions of territorial bodies of Rosstat.

Rosstat analyzes the activities of individual entrepreneurs in order to give the Ministry of Finance of the Russian Federation recommendations on improving the business climate in the country

Table: contents of the form in 2021

| Information for the filler | Recipient Information |

|

|

Sheet B, page 002 - change of place of residence in the Russian Federation

Sheet B should also be filled out by foreign citizens and stateless persons, but in the event of a change in the Russian residence address. Information is entered based on the registration document at the new residential address. If the registration document has not been issued, there is no need to fill it out, as a mistake may be made and form P24001 will have to be resubmitted.

In case of a change of address, sheet D is additionally filled out. On sheet D, the details of a new document permitting stay in Russia or the details of a new residence permit are indicated.

Sample of filling 2 pages, sheet B

Form No. P24001

Sheet B, page 002 - change of place of residence in the Russian Federation (filling example)

General information about the form

Form No. 1-entrepreneur was introduced for the purpose of continuous statistical monitoring of the activities of small and medium-sized businesses. The previous such survey was conducted in 20111 based on the results of 2010. Continuous statistical observations are carried out once every five years (clause 2 of article 5 of the Federal Law of July 24, 2007 No. 209-FZ “On the development of small and medium-sized businesses in the Russian Federation ").

Reliable statistics on the current state of small and medium-sized businesses are necessary to develop clear and realistic government policies.

Please note that the information provided is based not only on data submitted to tax reports, but is based on real business facts. Therefore, Rosstat guaranteed complete confidentiality of data, protection of information provided by participants in continuous observation, and the absence of a fiscal nature of observation - the transfer of information to tax and other authorities is excluded.

In the future, the information obtained will be used to generate official statistical information on the state of the small and medium-sized business sector in 2015. The results of continuous observation will be published and available on the official website of Rosst (www.gks.ru).

Form No. 1-entrepreneur consists of three sections and a title page. Let's look at how they should be designed.

Sheet G, page 002 - change of identity card

This is another sheet intended for foreigners. The sheet must be completed when changing your identity card. The entered data must correspond to those specified in the original document.

There is a column “department code” on the page, but it may not be in the original document. In this case, the column must be left empty.

Sample filling 2 pages, sheet D

Form No. P24001

Sheet G, page 002 - change of identity card

Examples of filling out form P21001

You can find a sample of filling out an application for state registration of an individual entrepreneur by following the links:

- Sample of filling out form P21001 (PDF)

Form P21001 example of filling. Page 1.

Form P21001 example of filling. Page 2

Form P21001 example of filling. Page 3

Form P21001 example of filling. Page 4

Form P21001 example of filling. Page 5

Sheet D, page 002 - changing documents on the right to temporary residence or residence permit

The sheet is intended to be filled out by foreigners and stateless persons in case of receiving new documents on a residence permit or temporary right of stay outside the territory of Russia. On the page you need to indicate the details of the new document.

Sample filling 2 pages, sheet D

Form No. P24001

Sheet D, page 002 - changing documents on the right to temporary residence or residence permit (filling example)

Sheet E, page 002 and 003 - change in activities

The sheet must be filled out by entrepreneurs who change their type of activity. The sheet includes two pages. On the first page the entrepreneur indicates new OKVED codes, and on the second page the OKVED codes that need to be deleted.

If the main activity is subject to change, both pages must be completed. In this case, on the first page in line 1.1 you must indicate the new type of activity, and on the second page in line 2.1 the old one.

If it is necessary to retain the old main activity as a secondary activity, it should be indicated on line 2.1 on the second page, as well as on line 1.2 on the first page.

If you only need to add an additional activity, indicate it on the first page. In this case, the second page can be left blank.

Sample filling 2 pages, sheet E

Form No. P24001

Sheet E, page 002 and 003 - change in types of activities (filling example)

Sample filling 3 pages, sheet E

Sample of filling 3 pages, sheet E

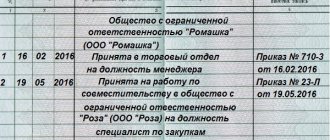

General information about the business

Here you should reflect general information about the business: the number of months of operation, location of activity, taxation system, number of employees.

Let us pay attention only to such an indicator as the number of employees, because In normal tax practice, this headcount calculation is not used. In this case we are talking about the following persons:

- employees (4.3) are persons who perform work for hire on the basis of a written contract or oral agreement;

- partners (4.4) are persons participating in a business on the basis of a property or other contribution and performing certain work in this business;

- Helping family members (4.5) are persons who work as helpers in a business owned by a household member or relative. If family members work for wages, they are considered employees.

The average number (clauses 4.3 - 4.5) is determined as follows: the number of people working in each calendar month, including those temporarily absent (sick, on vacation, etc.), should be added and divided by 12. The number of people is reflected with one decimal place.

Let's calculate how many people, on average, worked for individual entrepreneur O.A. Petrov in 2015, provided that:

- hired workers (monthly): January – 10, February – 11, March – 9, April – 10, May – 15, June – 17, July – 17, August – 15, September – 12, October – 10, November – 10, December – 7;

- partners – 1 (all year);

- Helping family members – 2 (all year: wife, son).

The average number of employees is 11.9:

((10 + 11 + 9 + 10 + 15 + 17 + 17 + 15 + 12 + 10 + 10 + 7 ) : 12)

If the business operated for less than a full year, then when calculating the average number, the number of people working for an individual entrepreneur (pages 4.3–4.5) is also divided by 12.

Let's calculate how many people, on average, worked for individual entrepreneur O.A. Petrov in 2015, provided that:

- The activities of the individual entrepreneur began in June 2015;

- hired workers (monthly): June – 2, July – 5, August – 7, September – 7, October – 5, November – 7, December – 5;

- Helping family members (from the beginning of activity) – 3 (wife, sons).

The average number of employees is 3.2: ((2 + 5 + 7 + 7 + 5 + 7 + 5) : 12)

Helping family members - 1.8: (3 × 7: 12)

Sheet J, page 003 - signature and certification of data

The form must be completed by all entrepreneurs who submit an application. You must provide your full name and personal signature.

An individual entrepreneur can indicate his full name and sign only in the presence of a notary, an employee of the MFC or the tax office.

If the application is submitted through a representative or sent by mail, the signature must be notarized. If the application is submitted by a representative, he must have a notarized power of attorney.

Sample filling 3 pages, sheet G

Form No. Р24001

Sheet Ж, page 003 - signature and certification of data (filling example)

How can I apply to change the information of an individual entrepreneur?

Documents are allowed to be submitted in four ways:

- In person at the MFC or the Federal Tax Service. To submit, you need a passport and a package of documents.

- Through a representative. In addition to the package of documents, the representative must provide a notarized power of attorney. A power of attorney can be issued for the delivery and receipt of documents.

- By mail. To send, you will need to have the application notarized and also attach a copy of your passport. The documents should be placed in an envelope, an inventory of the contents should be made and sent in the form of a letter with a declared value.

- Send electronically through the Postal Agent program.

Requirements for the design and completion of form P21001

Among all the innovations introduced into the P21001 form in 2021, the following should be noted:

1. The new form P21001 is focused on machine readability, therefore:

- all letters and numbers are written in special cells;

- all letters must be capitalized;

- the size, type and color of the font for filling out the P21001 form are strictly regulated;

- all elements of the individual entrepreneur’s address must correspond to the spelling of the State Address Register (FIAS);

- rules for abbreviations are specified for documents, regions, location names, countries, etc.;

- Re-filling of previously entered data is minimized;

- barcodes changed;

- The rules for filling in gaps, hyphens, and lines are strictly defined;

- rules for aligning letters and numbers for all fields are defined;

2. OKVED codes are entered into the new form, starting with 4-digit ones;

3. The TIN of individuals, if available, must be indicated;

4. A field has been added to the new form for receiving individual entrepreneur registration documents on paper (if you do not check this box, the documents will only be received in electronic form).

When will the changes be registered in the Unified State Register of Individual Entrepreneurs?

The Tax Service undertakes to provide the applicant with the Unified State Register of Individual Entrepreneurs with the changes made within 5 working days or send a reasoned refusal to make changes to the existing data. If you must receive a response from the Federal Tax Service by mail, the period for receiving documents may increase in accordance with the delivery conditions.

If the applicant does not come on the appointed day to pick up the documents, the Federal Tax Service sends them by mail. The tax service does the same if the application does not indicate the method of obtaining documents. If you submit documents through the MFC, the response will also be sent there.

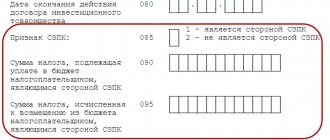

Key business performance indicators

This section reflects the main indicators of the individual entrepreneur’s business (whether services are provided, revenue by type of activity, information about fixed assets).

Services

In paragraph 5, you must answer whether you provided services to the public:

- page 5.1 – if they provided services to the population;

- page 5.2 - if you were an intermediary for services (you did not provide paid services, but only received payment from consumers for the service provided to them by another person). For example: intermediary services for organizing transportation, sales of express payment cards for communication services by the agent, etc.;

- p. 5.3 – did not provide services.

If the individual entrepreneur was both a manufacturer and an intermediary in the market of paid services to the population, then two marks should be put: on page 5.1 and on page 5.2.

Revenue

Next, you should indicate the revenue from the sale of goods (works, services) as a whole for all types of activities performed (p. 6.1), and with a division for each type of activity (p. 6.2, if there are not enough lines, then information on types of activities is filled out on a separate sheet).

Revenue is shown taking into account VAT, excise taxes and other similar mandatory payments. The revenue indicator depends on the applied taxation system:

- BASIC: income in accordance with the Procedure for accounting for income and expenses and business transactions for individual entrepreneurs;

- Simplified tax system: income from the Book of accounting of income and expenses of organizations and individual entrepreneurs applying the simplified taxation system3, page 113 of section 2.1 and page 213 of section 2.2 of the tax return under the simplified tax system;

- Unified Agricultural Tax: income from the Book of Income and Expenses of Individual Entrepreneurs applying the taxation system for agricultural producers (unified agricultural tax), page 010 “The amount of income for the tax period taken into account when determining the tax base for the Unified Agricultural Tax” of Section 2 of the tax return for the Unified Agricultural Tax;

- PSN: income from the Income Book of individual entrepreneurs applying the patent taxation system7;

- UTII: take into account the cost of products sold, goods, work and services provided in the reporting year on the basis of primary accounting documentation reflecting all business transactions.

Please note that when trading in stores, you must indicate the name of the goods being sold with the addition of the words “in the store (pavilion, department)” for each group of goods. For example: “retail sale of clothing in a store” (OKVED code – “52.42”), “retail sale of shoes and leather goods in a pavilion” (“52.43”), etc.

In the case of trade in a wide range of goods in a non-specialized store, “retail trade in non-specialized stores primarily of food products, including drinks, and tobacco products” (“52.11”) or “other retail trade in non-specialized stores” (“52.12”) is indicated.

If an individual entrepreneur sells goods of his own production to the public through his distribution network or leased retail facilities, then the proceeds from the sale of these goods relate to the type of activity as a result of which they were produced. For example: sausage production and sales through own stores/tents - “production of meat and poultry products” (“15.13”).

Intermediaries operating in wholesale trade under commission (assignment) or agency agreements show only the amount of remuneration received.

When carrying out travel agency activities, lines 6.1 and 6.2 reflect either the amount of commission (agency) remuneration or the difference between the sale and purchase price of the tourism product.

Let's fill out clause 6 of section 2 of form No. 1-entrepreneur for individual entrepreneur G.I. Astakhov, provided that:

- tax regime – simplified tax system;

- page 213 section 2.2 of the simplified taxation system declaration for 2015 – 5,251,107;

- revenue by type of activity:

- RUB 1,710,215 – retail trade in clothing (OKVED code – 52.42). Trade in a store;

- RUB 3,330,892 – wholesale trade in clothing, except underwear (OKVED code – 51.42.1);

- 210,000 rub. (agency remuneration) - the activities of agents in the wholesale trade of clothing, including leather clothing, clothing accessories and footwear (OKVED code - 51.16.2).

Fixed assets

This section reflects information about the availability of own fixed assets (p. 7.3 - value of assets, p. 7.4 - including the costs of creating new fixed assets in 2015).

Fixed assets are assets worth at least 40 thousand rubles that an individual entrepreneur uses in business for a long time (more than 12 months). Land plots and other environmental management facilities, young animals and fattening animals, poultry, rabbits, fur-bearing animals, and bee families are not considered fixed assets.

Moreover, we are talking here about all fixed assets used for business activities, owned both by the individual entrepreneur and his family members. In this case, leased objects are not taken into account.

The cost of fixed assets is shown at the cost of acquisition, taking into account its changes (as a result of revaluation, completion, expansion, modernization, additional equipment, reconstruction, partial liquidation, disposal) without deduction of depreciation at the end of 2015.

What to do if registration of changes is refused

The Federal Tax Service may refuse to make changes for the following reasons:

- The individual entrepreneur provided an incomplete package of documents;

- the application was submitted to the wrong registration authority;

- there is no notarization in cases where it is necessary to provide it;

- the application was signed by an unauthorized person;

- Before submitting the application to the Unified State Register of Individual Entrepreneurs or the Federal Tax Service, a bailiff's act was received prohibiting amendments.

The refusal is subject to appeal within three months from the date of receipt.