The purchase book is intended for registration and accounting of invoices received from suppliers and significantly facilitates the accounting of value added tax in terms of tax deductions from the budget. Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137 (hereinafter referred to as the resolution) regulates not only the forms and procedure for issuing invoices, but also the forms and procedure for accounting and registration of received and issued invoices. The book of purchases and sales in 1C is formed in full accordance with the requirements of this resolution.

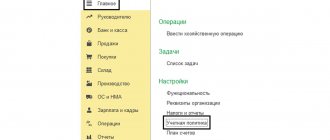

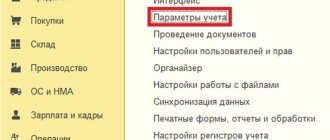

The functionality used to create a purchase book in 1C is implemented only for organizations operating on the general taxation system. In order for the user’s system to be able to fill out a purchase book, it is first necessary to select a general taxation system in the Main Menu - Accounting Policy - Setting up taxes and reports.

In order for the user’s system to be able to fill out a purchase book, it is necessary to make a number of settings. In order not to resort to consulting specialists on maintaining and finalizing the 1C 8.3 configuration, we suggest studying our article. First of all, you need to select the general taxation system in the Main Menu - Accounting Policy - Setting up taxes and reports.

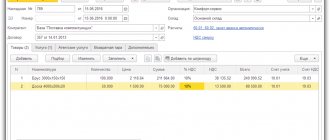

Fig.1 Formation of a purchase book

Next, go to the “Purchases” menu, then in the VAT section select the Purchase Book.

Fig.2 In the VAT section, select Purchase Book

The formation of purchase ledger entries is carried out through the registration of invoices received. Registration of invoices received is carried out in several ways: on the basis of documents reflecting the receipt of goods or provision of services (invoice, act), or in the journal of registration of invoices received.

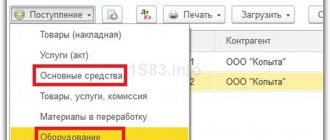

Receipt of goods

The receipt document is located:

Purchases -> Purchases -> Receipt (act, invoice)

To reflect the receipt of the product range, fill out the “Products” tabular section:

In addition to the product range, we also received delivery services. To reflect transportation costs, use the “Services” tab, and select our service from the “Nomenclature” directory:

Now the document needs to be processed, the result is:

Issuing an invoice

After posting the document, you need to register the invoice: assign it a number, date and click “Register”:

Let's open the created invoice:

By register

- VAT on purchases (an entry is created in the purchase book)

- VAT presented (the fact of receipt of the invoice forms the expense part)

The invoice generates the following entries:

The following entry is recorded in the invoice journal:

2) Reflection in the purchase book of such transactions as:

- VAT is accepted for deduction on fixed assets

- VAT is accepted for deduction upon adjustment of receipts

in the program is carried out using the document “Creating purchase ledger entries”.

For clarity, consider the following situations:

- The organization purchased fixed assets in the amount of RUB 52,000.00, including VAT - RUB 7,932.20.

- The supplier issued and submitted to our organization an adjustment invoice in the amount of RUB 33,967.95, including VAT - RUB 5,181.55 (according to which the cost of previously received goods increased)

Watch also our video on processing receipt and issuance of invoices:

The supplier has changed its name

It happens that the supplier changes its name, and even in the middle of the quarter. In the current period, the buyer has already received invoices from him, which are recorded in the purchase ledger. How to register the documents that he will exhibit after the name change?

In this situation, remember that in the purchase book, along with the name of the seller, his tax identification number and checkpoint are indicated.

If only the name of the company has changed, then the tax identification number and checkpoint remain the same. Therefore, in the purchase book you will have two different supplier names with the same TIN and KPP.

The inspection will identify the seller using the TIN and KPP. But to be on the safe side, ask the seller for certified copies of documents confirming the name change. Attach them to your shopping book.

But as for the declaration, where the data from the purchase book is transferred, there is no need to worry about this fee. Purchase data is transferred to section 8 without indicating the name of the seller. Only the TIN and KPP are reflected there.

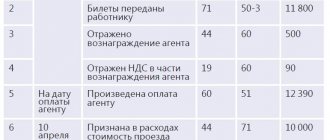

Entries in the purchase book upon receipt of OS

The procedure for creating documents upon receipt of a fixed asset:

- document “Receipt (act, invoice)”

- registration invoice received

- the document “Acceptance for accounting of fixed assets” is drawn up

- document “Creating purchase ledger entries”

OS and intangible assets -> Receipt of fixed assets -> Receipt of equipment

The document generates movement by registers:

After posting the receipt document, we register the invoice in the same way as the receipt discussed earlier:

An entry was made in the invoice journal:

We accept fixed assets for accounting (more details about accepting fixed assets for accounting can be found in a separate article):

An expense record is generated using the “VAT on purchased valuables” register:

The admission and registration procedure is discussed in more detail in our video:

Adjustment of goods receipt

Based on a previously created goods receipt, you can create an adjustment document. To do this, open the previously created document No. 789 dated June 15, 2016

Purchases -> Purchases -> Receipt (act, invoice)

and using the “Create based on” button

Let's create an adjustment document:

The nomenclature now has two lines:

- before change - price and quantity of the original document

- after a change, a new price or quantity is set

Also the supplier costs us 100 rubles. increased the cost of transport):

Register entries are created for the changed amount:

After posting the adjustment document, we will register the adjustment invoice:

See also our video on adjusting sales and issuing an adjustment sales invoice:

Registration of invoice (act)

Example

The organization purchased furniture for the director's office, as well as computer equipment for the accounting department. To reflect this operation in the “Purchases” menu, open the “Receipts (acts, invoices)” section.

Fig. 3 Receipts (acts, invoices)

In the “Receipt of goods: Invoice (creation)” window that opens, we sequentially fill in the document details, product range, quantity, price, total cost of goods, VAT amount.

Fig.4 Filling in details

By selecting the “VAT on top” or “VAT in total” mode, the system will automatically calculate the VAT amount based on the specified conditions.

Fig.5 Calculation of VAT amount

The total amount of VAT was 16,200.00 rubles.

In the lower left corner of the document, you need to pay attention to the invoice line: fill in the number and date and click on the “Register” button.

Then go to the “Purchases” menu, the “VAT” section and select the Purchase Book. This document contains the ability to generate a purchase ledger journal for a certain period. In addition, the settings allow you to generate additional sheets and display them in the context of the counterparty of interest, or display invoices for advances received.

Fig.6 Formation of a purchase ledger journal for a certain period

By clicking the “Generate” button, we display the purchase book for the 1st quarter of 2021.

Fig.7 Purchase book for the 1st quarter of 2021

Based on the invoice, you can generate the following documents.

Fig.8 Documents based on the invoice

The reflection of VAT for deduction is generated on the basis of the document “Receipt invoice” and is intended to reflect the deduction of VAT manually when there is no primary document - an invoice received, or it is necessary to adjust the incoming VAT. Please note that the date of the electronic document must coincide with the tax period in which the organization expects to deduct VAT on this acquisition (in our case, this is the first quarter of 2021). The document generates the corresponding transactions, and also reflects payment information and a list of purchased goods according to the invoice, automatically filled in from the primary document.

Fig.9 Receipt invoice

Please note that the date of the electronic document must coincide with the tax period in which the organization expects to deduct VAT on this acquisition (in our case, this is the first quarter of 2021). The document generates the corresponding transactions, and also reflects payment information and a list of purchased goods according to the invoice, automatically filled in from the primary document. If you still have questions about registering an invoice, you can ask them to the specialists of the 1C company consultation line.

Generating purchase ledger entries in 1C 8.3

Reflection of transactions

- VAT is accepted for deduction on fixed assets

- VAT is accepted for deduction upon adjustment of receipts

is made by a document. You can find the purchase book using the following path:

Operations -> Closing a period -> Regular VAT operations -> Create -> Generating purchase ledger entries

By clicking the “Fill” button, we see the records of the documents we created earlier in this section. After posting the document, we receive entries in the accumulation registers:

And in the “Purchase Book” report:

Printing a shopping book

You can find the purchase ledger report itself in the “Reports” section.

In the window that opens, we will indicate the period from January 1, 2021 to September 30, 2021 to create a sales book for the 3rd quarter.

The report reflected data on all three documents we entered. You can print this report or save it to an external file using the hotkey combination Ctrl+S.