The Federal State Statistics Service conducts a sample study of the activities of individual entrepreneurs who sell goods to the public and repair household products (as well as personal items).

Form 1-IP trade, which is used to conduct the study, was approved by Rosstat Order No. 185 dated May 12, 2010 (as amended on August 9, 2013). The report is submitted to the territorial Rosstat no later than October 17 of the current year by entrepreneurs included in the sample (the statistical agency sends a corresponding notification).

When filling out the form, you must answer either all questions, or only questions 3 and 4 for one retail facility at the location of the study, in accordance with the mark placed on the form.

New 1-IP form in 2021

Not only organizations, but also individual entrepreneurs must submit information about their activities to statistical authorities. Some statistical forms are developed specifically for individual entrepreneurs. Let's consider one of these - Form 1-IP for 2021. It was approved by Rosstat Order No. 419 dated July 22, 2019 in Appendix No. 11. You can download the new form 1-IP for 2021 not only in the specified Order, but also on our website by following the link:

You will find a sample form at the end of the article.

Title page

The title page of form 1-IP is standard for all business reports.

It is necessary to indicate the detailed address of the individual entrepreneur: subject of the Russian Federation, street, house, apartment and zip code. It happens that the actual and registration addresses differ, then you need to enter the details of the actual address.

Next, indicate the full name of the entrepreneur and sign.

A standard part with codes is also provided. It must indicate the TIN from the certificate and OKPO based on the notification of assignment of statistics codes.

The procedure for submitting 1-IP to statistical authorities. Who, when and where reports

Form 1-IP is called “Information on the activities of an individual entrepreneur. Obviously, this form is presented only to individual entrepreneurs. There are some exceptions from the list of respondents:

Please note that if an individual does not have the status of an individual entrepreneur and pays tax on professional income, then he does not have the obligation to submit 1-IP.

The report should be compiled and sent to the regulatory authorities only if the entrepreneur is on the list of respondents who must submit this form at the end of the tax period. You can find out your fate regarding being included in the list by receiving an information letter from the statistical authorities, or on the official website of the statistical service by entering your TIN.

Form 1-IP 2019 refers to annual reports, that is, it must be submitted only once a year, no later than March 2 of the year following the reporting year.

The place of reception is the territorial statistics office.

Penalties

Rosstat treats its reporting as strictly as tax reporting. For violation of the delivery procedure, late deadlines or provision of incorrect information, you will have to bear responsibility under the Code of Administrative Offenses of the Russian Federation.

Article 13.19 of the Code of Administrative Offenses provides for a fine for officials of 10-20 thousand rubles. If you commit a violation again, the fine will increase significantly and amount to 30-50 thousand rubles.

Law of the Russian Federation dated May 13, 1992 No. 2761-I provides that the violator is obliged to compensate the statistical authorities for the damage caused if he was late with the report or submitted incorrect data. In this case, Rosstat will have to make corrections to the final consolidated statements, and they will be required to compensate for this.

How to fill out the 1-IP form without errors

The form is very compact and fits into three sheets. The composition of form 1-IP is as follows:

- title page;

- the main part, consisting of five questions, the answers to which are the necessary data to fill out.

Title page

Entrepreneur registration details are entered here:

- Full name;

- postal address (please note that it is the postal address, and not the registration address, provided they do not match);

- OKPO;

- TIN.

Main section

After entering your data, the entrepreneur must answer five questions:

- The question is about the very fact of entrepreneurial activity. If business activity was carried out for at least one month out of the entire year, then you must answer “Yes”, go to question 3 and subsequently answer questions only regarding this activity without taking into account activities under employment contracts (if this also took place in the reporting year).

- Only those who answered “No” to the first question proceed to this question. And there are only two options here: “Yes” and “No”.

After answering question 2, you can complete the calculation. Sign, date and turn in.

- Those who answered “Yes” to question 1 go to question 3. Here it is necessary to indicate the volume of revenue with the following features:

- we take the proceeds including VAT and other similar taxes;

- We show revenue for all types of activities in total.

- In this paragraph we describe all types of activities that the individual entrepreneur carried out during the reporting period. Clause 4.1 – percentage share of each type of activity.

- The question is about the number of persons who participate or assist the individual entrepreneur in its activities. There are:

- partners - participate in the business on the terms of some kind of contribution and perform some work;

- helping family members - relatives who help individual entrepreneurs conduct business activities;

- hired workers - persons performing work for remuneration

At the end of the form, you traditionally need to sign, indicate the date, email and telephone number.

A completed sample form can be found at the following link:

Results

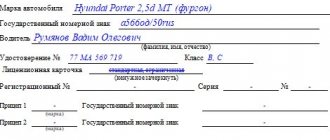

Small enterprises that regularly (or intermittently) provide services for the transportation of goods by road on a commercial basis must submit special reports. Form PM-1 auto cargo, depending on the activity of the company's auto cargo activity, is submitted to the territorial office of Rosstat quarterly or monthly (if the activity is carried out irregularly).

For information on how to fill out a waybill for a truck, read our article “Truck waybill in accounting (form).”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Procedure for filling out the PM-1 auto cargo report

In the address column of the form you should indicate the full name of the company, corresponding to that specified in the charter, and then a short name in brackets. The actual address of the company is indicated, even if it does not coincide with the official one.

The report, the form of which was approved by Rosstat order No. 527 dated August 19, 2014, must contain all the necessary indicators. If a value is not specified, a dash is placed in its place. The report contains data for the reporting month or reporting week.

The obligation to submit reports is also imposed on those businessmen who do not provide motor transport services on a regular basis. If during the reporting period there were no activities related to road transportation, then only the basic 1st section is filled out.

This section contains all the information about the freight transport available at the enterprise, including those rented or leased. The report does not include information about special vehicles, such as snowplows, auto repair shops, i.e., those that are engaged in the economic maintenance of territories and/or mechanisms.

Section 1 provides information about all trucks, even if at the time of filling out the report they are not in service (for example, they are under repair or leased). Line 101 of column 3 does not indicate information about those cars that are being repaired or awaiting early repair, as well as about those that will be written off from the balance sheet due to the impossibility of restoration to a working condition.

Section 2 contains data on the operation of vehicles transporting goods. Further, the report reflects in a structured manner information about the operation of the cars (whether they took part in the survey when they were released from the garage).

Section 3 contains information about the company’s cargo turnover for the reporting period. Only work on the transportation of goods done for payment is taken into account. In this case, in subsection 3.1 generalized information for the quarter is indicated, but then subsection 3.2 is not filled out. Conversely, when filling out subsection 3.2, information about each car trip for the reporting week is entered, but subsection 3.1 is not filled out.

If the company has a large fleet of trucks, then subsection 3.2 provides information about each trip for 2 days of the reporting week with the volumes of transportation inherent to this company.

Regulatory acts: Form PM-1 (vehicle cargo)

Order of Rosstat dated 06/01/2020 N 284 “On declaring appendix no. 8 to Rosstat order no. 385 dated August 3, 2021 invalid” to be declared invalid starting from the second quarter of 2020, appendix no. 8 “Form of federal statistical observation N PM- 1 (auto cargo) “Sample survey of the activities of small enterprises in the field of road transport,” approved by Rosstat order No. 385 dated August 3, 2021.

Order of Rosstat dated 03.08.2016 N 385 (as amended on 01.06.2020) “On approval of statistical tools for organizing federal statistical monitoring of activities in the field of transport” Lost force with the report for the second quarter of 2021. — Order of Rosstat dated June 1, 2020 N 284.

Reporting in January

- January 1 - January 9 Submission of form N P (services) for December 2021

- January 1 - January 15 Submission of form N P-4 > 15 people,

- January 1 - January 20 Submission of form N P-6 for the 4th quarter of 2021

- January 1 - January 9 Submission of form N PM-trading for December 2021

- January 1 - January 27 Submission of form N 4-OS for 2021

- January 1 - January 21 Submission of form N 1-T (working conditions) for 2021

- January 1 - January 30 Submission of form N P-5 (m) for the 4th quarter of 2021

- January 1 - January 9 Submission of form N P-4 (NZ) for the 4th quarter of 2021

- January 1 - January 27 Submission of form N 1-TR (motor transport) for 2021

- No data

- January 1 - January 20 Submission of form N 1-technology for 2021

- January 1 - January 9 Submission of form 4-inventory for December 2021.

- January 1 - January 30 Submission of form N 22-Housing and communal services (consolidated) for 2021

- January 1 - January 15 Submission of form P (services) for the 4th quarter of 2021.

- January 1 - January 9 Submission of form N P-1 for December 2021

- January 1 - January 29 Submission of form N PM for the 4th quarter of 2021

- January 1 - January 14 Submission of form N PM-prom for December 2021

- January 1 - January 28 Submission of form N P-3 for December, as of the end of 2021

- January 1 - January 27 Submission of form N 7-injury for 2021

- January 1 - January 10 Submission of form N Salary-education for the 4th quarter of 2021

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 1 2 3 Reporting via the Internet to all regulatory authorities

We recommend reading: Order to open a private enterprise

How to send the finished Form 200 to the tax office?

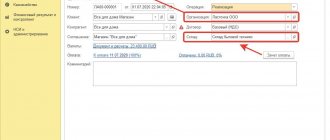

The finished form can be downloaded from the Mybuh.kz platform and sent to the tax office through the Taxpayer’s Account or uploaded directly to the server of the State Revenue Committee of the Ministry of Finance of the Republic of Kazakhstan.

To submit the form through the Taxpayer's Account you must:

- open the form in the “Reports”, “Tax Forms” menu;

- click on the red button “Download TNF for manual import into the taxpayer’s account” in the upper left part of the screen (the form will be saved to your computer);

- log into the Taxpayer’s Account on the State Revenue Committee website, section “Tax Reporting Forms”, “Import of Forms”;

- load the form previously saved to your computer, click “Import”, “Send to OGD”;

- sign the shipment with the digital signature key.

You can also send the form to the KGD server directly. To do this, NCA Layer must be installed on your computer. If this software is not installed on your computer, you can download it:

- go to the “Reports”, “Tax Forms” menu;

- at the top of the screen above the form number, click on the question “What do you need to do?”

After downloading the NCA Layer software, you need to open the form (the “Reports” menu) and click on the “Send tax return” button in the upper left part of the screen.

Next, click “Submit” and sign the shipment with the digital signature key.

To find out the status of declaration processing on the tax service server, you must click on the “Request declaration status” button in the upper left part of the screen and also sign the request with an electronic digital signature key.

You can find out the status later. To do this, you need to go to the “Tax Forms”, “Tax Form Status” section; in the list of forms that opens, opposite the declaration, the current status of the report will be indicated.

You can see the procedure for filling out and submitting the form yourself more clearly in our video instructions:

- for individual entrepreneurs;

- for LLP.

This might also be useful:

- New form SZV-M “Information about insured persons”

- New form 6-NDFL 2021

- New RSV form 2021

- Payment of 1% on income over 300,000 rubles

- Property tax for organizations and individuals

- Form and rules for filling out form 4-FSS

Is the information useful? Tell your friends and colleagues

Dear readers! The materials on the TBis.ru website are devoted to typical ways to resolve tax and legal issues, but each case is unique.

If you want to find out how to solve your specific issue, please contact the online consultant form. It's fast and free!

forma_1-predprinimatel.jpg

After filling out the 1-entrepreneur form, you should make sure that the report is compiled correctly. In the considered example, IP Nefedov N.A. made no mistakes:

- in paragraph 1 he indicated that he carried out activities in 2021, and therefore filled out section 2;

- in paragraph 4, the average number of employees (6.6 people) is equal to the sum of employees in each group (1 individual entrepreneur + 2.8 employees + 2.8 family members);

- in clause 6, the total amount of revenue (RUB 1,103.6 thousand) is equal to the amount for each type of activity (652.3 + 263.4 + 187.9);

- in paragraph 7, the presence of fixed assets is noted and therefore data on their cost and fixed assets costs for 2021 are filled in.

Section 1

The amounts of Section 1 of form P-1 are indicated in thousands of rubles, excluding VAT, excise taxes and other similar payments. The data is filled in two columns - for the reporting month (column 1) and for the previous month (column 2).

Line 01 is intended to reflect shipped goods of own production. This line doesn't show:

- products of own production used for domestic consumption.

- targeted financing of the founder for the maintenance of the organization and the conduct of statutory activities - for NPOs;

Lines 11 and 12 are extracted from line 01:

- goods, works, services that can be classified as innovative (line 11);

- goods related to nanotechnology (line 12).

Products are considered shipped, the fact of sale of which is confirmed by documents - a bill of lading, a certificate (for services). That is, data is entered into the report according to the documents, and not the fact of receipt of money for the shipped goods.

We can say that the accrual method is used here.

Line 02 shows non-owned goods shipped. This may include not only goods purchased for resale, but also sold to inventory.

Fixed assets, intangible assets, securities and currency do not apply to shipped goods of non-own production for the purpose of filling out this line.

The rules for recognizing shipments are similar to the rules for line 01. Lines 03, 04 and 05 are filled out only in reports falling on the last month of the quarter. They show: These lines are filled out only in reports for March, June, September, December LINE NUMBER LINE NAME Line 03 of Section 1 Remains of finished industrial products of own production at the end of the month Line 04 of Section 1 Remains of finished agricultural products of own production at the end of the month Line 05 Section 1 Remains of goods for resale at the end of the month Lines 06 to 10 are intended to detail certain indicators: LINE NUMBER LINE NAME Line 06 of Section 1 Products credited to fixed assets in the reporting period Line 07 of Section 1 Construction and installation work performed on buildings and constructions by economic means in the reporting period Line 08 of Section 1 Agricultural products included in fixed assets in the reporting period Line 09 of Section 1 Own agricultural products transferred to their non-agricultural divisions Line 10 of Section 1 Processed customer-supplied raw materials Line 13 reflects the total volume of orders for the supply of products in future periods , including for export (line 14).

At the end of Section 1 of Form P-1, it is necessary to indicate for information whether there were exports and imports to the organization during the reporting period.