Accounting policy of an enterprise: general requirements for registration

The accounting policy is drawn up in accordance with the rules established by the accounting law No. 402-FZ of December 6, 2011, as well as PBU 1/2008. In addition, each industry may have its own regulations that affect its content.

The accounting policy consists of two parts: accounting and tax. They can be drawn up as a single document consisting of two sections, or two separate provisions can be made.

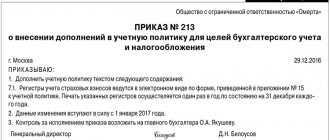

The organization's accounting policies are applied continuously from year to year, and reasonable changes to it can only be made from the beginning of the reporting year. The order on the accounting policy is approved by the manager no later than 90 days after registration of the company. For example, the accounting policy for 2021 had to be adopted before December 31, 2019, and the document approved in 2021 will come into force only from January 1, 2021.

An organization's accounting policies should reflect accounting methods only for actual assets, transactions, and liabilities. It is advisable to fix in the text of the document those accounting aspects for which there is a choice from several options, or the law does not contain an unambiguous interpretation on them. For example: what methods of depreciation are used, how reserves are created, etc. It makes no sense to rewrite unambiguous provisions of the PBU, or the Tax Code, that do not offer a choice.

Forms of primary accounting documents (PUD)

All primary accounting documents must be approved by the manager in the accounting policy:

- PUDs established by authorized bodies on the basis of other laws are mandatory for use. For example, cash documents.

- PUDs can be developed independently, including those approved from albums of unified “primary” forms.

- PUD may be recommended for use, for example, the “Universal Transfer Document” form by virtue of Letter of the Federal Tax Service dated October 21, 2013 No. ММВ-20-3/96.

Each form of the primary accounting document must contain 7 mandatory details by virtue of Part 2 of Article 9 No. 402-FZ. Additional details are not prohibited from being included in the form.

On the PROFBUKH8 website you can see our other free articles and materials on configurations: 1C: Accounting 1C: ZUP 1C: UT: Full list of our offers:

Give your rating to this article: (

1 ratings, average: 5.00 out of 5)

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

I am already registered

After registering, you will receive a link to the specified address to watch more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP 8 (free)

By submitting this form, you agree to the Privacy Policy and consent to the processing of personal data

Login to your account

Forgot your password?

“Accounting policies of the organization” PBU 1/2008: changes

From 08/06/2017, amendments to PBU 1/2008 “Accounting Policy of the Organization” came into force (Order of the Ministry of Finance of the Russian Federation dated 04/28/2017 No. 69n). Its provisions include, in particular, the following innovations:

- PBU “Accounting Policies” now applies to all legal entities, except credit and government organizations,

- a rule has been introduced on independent choice of the accounting method, regardless of the choice of other organizations, and subsidiaries choose from the standards approved by the main company (clause 5.1),

- the concept of rational accounting has been clarified - accounting information must be useful enough to justify the costs of its formation (clause 6),

- in cases where there is no specific method of accounting in federal standards, the organization develops it itself, based on paragraphs. 5 and 6 PBU 1/2008 and accounting recommendations, consistently referring to IFRS standards, federal (PBU) and industry accounting standards (clause 7.1), and to companies conducting simplified accounting (small enterprises, non-profit organizations, Skolkovo participants) , when forming an accounting policy, it is enough to be guided by the requirements of rationality (clause 7.2),

Contents of the accounting policy of the organization (LLC)

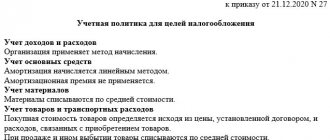

Accounting policies should reflect:

- list of regulations on the basis of which the company keeps records: Law on Accounting No. 402-FZ, PBU, Tax Code of the Russian Federation, etc.,

- working chart of accounts, prepared as an annex to the accounting policy,

- positions responsible for organizing and maintaining records in the company,

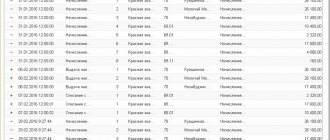

- forms of the “primary” used, accounting and tax registers - unified forms, or independently developed,

- depreciation issues – calculation methods, frequency (monthly, once a year, etc.),

- limits on the value of fixed assets, the procedure for their revaluation,

- accounting of materials, finished products, goods,

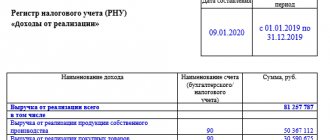

- accounting of income and expenses,

- the procedure for correcting significant errors and the criteria for classifying them,

- other provisions that the organization deems necessary to reflect.

If the “accounting” part of the organization’s accounting policy is quite universal for everyone, then the tax part will be different for each taxation regime, but in any case should contain:

- information about the applicable tax system, and if there is a combination of tax regimes - the procedure for maintaining separate accounting,

- how taxes are paid in separate divisions, if any,

- whether the company has tax benefits, and under what conditions they apply.

Features of accounting for individual transactions

As already noted, in 2015, no changes were made to the accounting legislation, and new accounting standards were not adopted. The recommendations of the financial department on maintaining accounting records of individual business transactions were communicated to interested users, management of organizations and employees of accounting services through the publication of letters and information. At the same time, some clarifications are essential for the formation of accounting and reporting indicators and, in our opinion, can be taken into account when forming the accounting policy of an economic entity for 2021.

Such documents, in particular, include:

— Recommendations for audit organizations, individual auditors, and auditors on conducting an audit of the annual financial statements of organizations for 2014 (appendix to the letter of the Ministry of Finance of Russia dated 02/06/2015 No. 07-04-06/5027; hereinafter referred to as the 2015 Recommendations);

— Recommendations for audit organizations, individual auditors, auditors on conducting an audit of the annual financial statements of organizations for 2015 (appendix to the letter of the Ministry of Finance of Russia dated January 22, 2016 No. 07-04-09/2355; hereinafter referred to as Recommendations 2016).

In accordance with the recommendations mentioned above, the following elements of accounting policies (in terms of methodological aspects) may be subject to clarification.

Reflection in discount accounting

In conditions of a sharp drop in demand for goods, works and services caused by the financial and economic crisis, improving the financial performance of an organization can be achieved through marketing policy measures, which include the provision of various discounts.

The 2015 Recommendations clarify that if the contract provides for the provision of a discount to the buyer (customer) if he complies with the conditions specified in the contract, the seller recognizes revenue under such an agreement in the amount minus the discount provided for in the contract. On the other hand, the buyer (customer) recognizes the costs of such a contract in the amount minus the discount provided for in the contract (except for the case where the buyer (customer) is unable (or does not intend) to comply with the conditions for receiving the discount). In this case, all discounts are taken into account, regardless of the form of their provision (refund of funds to the buyer, free provision of goods, etc.).

Thus, it seems appropriate to reflect in the annex to the accounting policy the marketing strategy of an economic entity, including indicating the list and amount of discounts provided or possible to receive, the conditions under which discounts may not be taken into account when generating income or expenses, and also indicate that for For accounting purposes, the price of a product, work or service should be reflected minus any discounts provided.

Accounting for settlements on commercial loans

The 2015 Recommendations clarified that when an organization acquires an asset (including an investment one) on the terms of a commercial loan provided in the form of installment payment, the loan debt in accounting and reporting is reflected in an amount that does not include an increase in payment for the installment plan (deferment) payment. The specified increase in payment, being the economic content of interest due to the lender (creditor), is recognized in accounting evenly until the end of the installment period in the manner prescribed by PBU 15/2008 (including regarding the inclusion of relevant expenses in the cost of the investment asset).

Organizations that use (or intend to use in the new year) calculations on the terms of a commercial loan, it makes sense to indicate in the accounting policy for accounting purposes a list of expenses paid on the appropriate terms, as well as provide a scheme for the distribution of interest until the end of the installment period.

Accounting for funds in banks whose license has been revoked

Revocation of banking license in 2008–2015. has become widespread. Therefore, it seems advisable to provide in the organization’s accounting policies the features of accounting for funds in such a situation.

The 2015 Recommendations clarified the procedure for accounting for funds in current accounts opened in credit institutions whose license to carry out banking operations has been revoked - in this case, the amount of funds in the current account in a credit institution whose license to carry out banking operations has been revoked is disclosed in a separate article (for example, “Funds in accounts whose transactions have been discontinued”) in the “Current assets” section of the balance sheet. The need to separate such amounts in accounting determines the introduction of changes to the working chart of accounts - additional sub-accounts of a lower level should be included, opened to accounts 51, 55 and 76 (the Recommendations explain that from the moment the credit organization’s license is revoked until the organization submits an application for Closing a current account in such a credit institution and returning funds, these funds are reflected in accounting on account 55 “Special accounts in banks.” After submitting an application, these funds are reflected on account 76 “Settlements with various debtors and creditors.”

Accounting for transactions when determining revenue as they are ready

The right to recognize in accounting revenue from the performance of work, the provision of services, the sale of products with a long manufacturing cycle as the work, service, product is ready or upon completion of the work, the provision of a service, or the manufacture of products in general is granted to economic entities, clause 12 of PBU 9/99 . The choice of this method of revenue recognition should be enshrined in the accounting policy for accounting purposes. In this case, a mandatory condition, subject to which an organization can determine revenue as it is ready, is the ability to determine the readiness of a work, service, or product. Most often, this right is used by contract construction organizations.

The 2015 Recommendations clarify that in the case where stages of work are identified in a construction contract, revenue under such a contract is recognized both for completed stages and for stages not completed and not accepted by the customer at the reporting date. At the same time, attention is drawn to the fact that revenue under the contract and expenses under the contract should be determined based on the degree of completion of work under the contract confirmed by the organization as of the reporting date and are recognized in the income statement in the same reporting periods in which the relevant work was performed, regardless of whether , whether they should or should not be presented to the customer for payment before the complete completion of the work under the contract (the stage of work provided for by the contract).

This clarification must be taken into account when concluding construction contracts. In addition, changes and additions may be made to an already concluded agreement in terms of documentation and settlements. For example, an additional agreement may be concluded that the contractor has the right, during the execution of the contract, to issue interim invoices to the customer for payment for work performed. In this case, accrued revenue for work presented for payment is written off to accounts receivable as interim invoices are issued to the customer. Consequently, it may be necessary to make changes to the organization’s working chart of accounts (in terms of the structure of subaccounts for accounting for revenue and receivables) and the methods of accounting.

The 2021 Recommendations indicate that when recognizing in accounting revenue from performing specific work, providing specific services, selling products as they are ready, it is advisable to develop a method for determining the degree of completion of work, services, products as of the reporting date based on PBU 2/2008 (in terms of method for determining the degree of completion of work under a construction contract). Since the documents of the accounting regulatory system do not establish methods for determining the degree of completion as of the reporting date of products, services, and work other than work under a construction contract, this element should be disclosed in as much detail as possible in the accounting policy of the organization.

Accounting for transactions with funds and reserves

The 2015 Recommendations clarified that expenses are recognized in the reporting period when they occurred, regardless of the time of actual payment of funds and other form of implementation. PBU 10/99 does not make the recognition of expenses dependent on the presence (absence) of a source of their financial support (production development funds, consumption funds and other similar funds) and the period (time) of their formation.

In practice, this clarification means that the corresponding expenses should be taken into account even after the reserves that were created to finance the expenses have been exhausted, that is, there is no need to replenish the reserves to the amount of expenses actually incurred. This circumstance should be taken into account when including in the accounting policy of the organization provisions governing the procedure for the creation and use of funds and reserves. At the same time, in our opinion, in the case when funds are created to provide financial support for capital expenditures, the accounting policy or other internal regulatory act should specify the procedure for making a decision on the implementation of expenses in amounts exceeding those originally planned (size of funds).

The 2021 Recommendations clarify that if an object of financial investment is a receivable for a loan provided, then the form of provision for impairment of financial investments in relation to such an asset is the reserve for doubtful debts.

This clarification must be taken into account if, in accordance with the accounting policy of the organization, a reserve for doubtful debts is created - it is advisable to supplement the list of reserved losses from asset impairment with receivables for loans granted, and also indicate the procedure for calculating the amounts included in the reserve on this basis.

In accordance with the explanations given in the 2016 Recommendations, estimated liabilities may also reflect the upcoming costs of paying bonuses to employees of the organization based on the results of work for the year - in the case where the organization has established a bonus system for employees, providing for the payment of bonuses in subsequent reporting periods upon achievement relevant indicators (conditions) in the reporting year. Thus, it is possible to include in the accounting policy a provision regulating the creation of a reserve for the payment of these premiums in the year following the reporting year. At the same time, in our opinion, criteria should be established for assessing the likelihood of achieving the indicators at which the bonus is paid and, therefore, provide for the possibility of adjusting the reserve if, at the end of the reporting year, there is a likelihood that the established indicators will not be achieved or will not be achieved in full. When recognizing such an estimated liability, you should also clarify the organization’s working chart of accounts - in terms of the list of sub-accounts opened for account 96.

By creating reserves, financial risks can also be hedged. The accounting procedures for such transactions are not regulated by the documents of the accounting regulatory system. The 2021 Recommendations clarify that in such situations, an organization’s accounting policies may include methods of accounting for instruments for hedging financial risks and the facts of economic life associated with such instruments, developed on the basis of IFRS 9 “Financial Instruments” or IAS 39 “ Financial instruments: recognition and evaluation”, put into effect for use on the territory of the Russian Federation by orders of the Ministry of Finance of Russia, respectively dated 08.26.2015 No. 133n and dated November 25, 2011 No. 160n.

Also, as part of estimated liabilities, economic entities can take into account issued guarantees (civil legislation allows the issuance of independent guarantees not only by credit institutions, but also by other economic entities). To recognize issued guarantees as part of estimated liabilities, it is necessary to comply with the conditions established by clause 5 of PBU 8/2010. Since the conditions are formulated in the most general form, in our opinion, it is advisable for organizations that provide for the issuance of independent guarantees to specify individual elements (the list of circumstances assessed when analyzing the likelihood of the occurrence of a corresponding economic event, the procedure for assessing the amount of the estimated liability and the likely decrease in economic benefits). Of course, if necessary, the working chart of accounts must be adjusted.

In addition, it should be borne in mind that if at least one of the conditions established by PBU 8/2010 is not met, the guarantor discloses a contingent liability in the financial statements, that is, such a liability is not reflected in system accounting. Consequently, it is appropriate in the accounting policy to determine the procedure for analytical accounting of contingent liabilities.

Accounting for settlements with accountable persons

Recommendations 2015 draw attention to the fact that since 2015, the procedure for documenting travel expenses has been changed. In general, the actual length of stay of an employee on a business trip is determined by travel documents.

At the same time, organizations are actually granted the right to use other documents for these purposes. Thus, it seems appropriate to include in the Regulations on Business Travel (an appendix to the accounting policy for accounting purposes) a list of documents that a posted employee can submit to confirm the expenses incurred and the actual duration of the business trip.

Accounting for certain types of inventories

Recommendations 2021 clarify that if waste is generated during the production of products, performance of work or provision of services, then their cost should be reflected in subaccount 10-6 “Other materials” of account 10 “Materials”. In this case, the cost of waste is determined by the organization based on the prevailing prices for scrap, waste, rags, etc. (that is, at the price of possible use or sale). The cost of recorded waste is included in the reduction of the cost of materials released into production.

Please note that we mean only the so-called returnable waste - waste, the formation of which is determined by technological schemes. When forming the cost of products, work or services, the cost of such waste is reflected with a minus sign, which involves opening a separate sub-account to account 20 (or another account for recording production costs).

Waste generated during the dismantling or liquidation of non-current assets and inventories is also taken into account in subaccount 10-6, but in correspondence with the other income account - 91 (that is, they are not used to reduce costs, but directly to increase balance sheet profit).

Industry and geographical features of the activities of organizations in the sphere of material production may determine the need to create an insurance stock of assets (as a rule, inventories). The 2016 recommendations draw attention to the fact that regulatory legal acts on accounting do not establish special rules for reflecting in accounting the costs of acquiring (creating) and maintaining certain types of assets that form the corresponding safety stock of the organization. In such cases, it is recommended to form an insurance stock of certain types of assets (for example, equipment, components and spare parts, materials), the cost of such assets is determined by the organization by summing up the actual costs incurred for purchase, production in accordance with PBU 5/01, PBU 6/01, PBU 10/99.

In our opinion, in organizations that create safety stock, the procedure for its formation, use and evaluation should be included in a separate appendix to the accounting policy of the economic entity.

Accounting for transactions for accrual and payment of trade fees

A feature of the trade fee is that the amount of the fee paid (to be paid) by the organization reduces the amount of income tax (advance payment) calculated based on the results of the tax (reporting) period, and is included in accounting calculations with the budget for income tax.

Thus, there is a need to introduce a new subaccount to account 68 into the working chart of accounts. In addition, a separate scheme for offsetting collection amounts for settlements with the budget for corporate income tax can be prescribed.

Accounting policy of the simplified tax system

The nuances of tax accounting policy with “simplified” depend on the selected object: “income” (6%), or “income minus expenses” (15%).

When applying the simplified tax system “income”, tax policy should reflect:

- income accounting procedure,

- indicate how the paid insurance premiums reduce the tax base,

- in what order and at what rate are taxes and advance payments calculated,

- tax register - KUDIR.

With the object “income minus expenses”, special attention should be paid not only to income, but also to expenses, indicating:

- the procedure for accounting for fixed assets, the method of calculating depreciation,

- composition of material costs,

- procedure for accounting for sales costs (if any),

- recognition of past losses in the current period,

- procedure for calculating and paying the minimum tax,

Otherwise, the tax policy points will be similar to those indicated for the simplified tax system for “income”.

Accounting for inventory items

8. Material costs consist of the cost of purchasing materials, costs of bonuses issued to employees, customs duties, transportation costs, as well as losses incurred from the need to use computer and information services. VAT withheld on the purchase of inventories should be entered in a separate column when they are recognized as materials included in expenses.

9. Material costs are taken into account as payment is made and are subject to adjustment for the price of materials not yet applicable in commercial activities.

10. Expenses associated with fuel and lubricants are taken into account according to the norm in material costs.

11. Standards for recognizing costs for fuel and lubricants are distributed and indicated in the order of travel; the basis for drawing up documentation is waybills. The amounts entered into the book cannot exceed the established limits.

12. The price of products purchased for subsequent sale is indicated based on the purchase price in accordance with the concluded agreement.

13. The price of goods put up for resale is included in expenses as the products are sold; the chosen valuation method is the average cost.

14. VAT is also described as goods are sold.

15. Costs related to the purchase of products are recorded as expenses as the debt is actually repaid.

16. An entry in the accounting book is made based on a payment order or invoice for the release of products to the client.

OSNO accounting policies

One of the main points of tax policy under OSNO is accounting for income tax. The document should reflect:

- procedure for recognizing direct and indirect expenses of an enterprise (cash or accrual method),

- the procedure for accounting for fixed assets, whether increasing coefficients are used for depreciation, depreciation bonus, for which objects,

- methods for assessing materials, raw materials and goods,

- Are reserves formed to evenly distribute expenses throughout the year (vacations, bad debts, OS repairs, etc.),

- accounting for transactions with securities,

- in what order is income tax and advance payments on it calculated and paid,

- applicable tax registers, etc.

The specifics of VAT accounting when developing accounting policies should be pointed out to those who are exempt from tax or who carry out transactions taxed at a rate of 0% - this concerns the order of distribution of “input” VAT.