Details

The authorized capital of a legal entity is the initial provision of the organization’s activities by contributing funds (property, securities) by owners or shareholders.

Note from the author! The size of the authorized capital undergoes the procedure of official state registration and is displayed in the constituent documentation of the company; the data in the financial statements and documents must be identical.

Depending on the organizational and legal form of legal entities, a certain procedure for the formation of the initial property of the organization is established:

- JSC: authorized capital - the nominal value of shares purchased by shareholders.

The minimum amount for a PJSC is 100 thousand rubles, a non-public company is 10 thousand rubles. - LLC: authorized capital - the initial amount of funds contributed by the founders.

Minimum amount: 10 thousand rubles, funds must be deposited within 4 months from the date of state registration of the company.Note from the author! The initial deposit can be formed not only in cash, but also in tangible assets (fixed assets, goods, etc.), securities. When making a contribution with property, its value must be assessed by an independent appraiser.

- State and municipal unitary enterprises: the formed fund is the minimum amount of initial property that ensures the interests of potential creditors of the organization.

The minimum amount of the fund for a government institution: not less than 5,000 minimum wages established by the government on the date of registration.The minimum amount of the fund for municipal enterprises: not less than 1000 minimum wages established by the government on the date of registration.

Note from the author! From January 1, 2021, the Federal Law established the minimum wage at 9,489 rubles. Regions have the right to apply federal laws to determine the minimum wage for employees. From May 1, 2021, the minimum wage will be 11,163 rubles.

Line 1310 of the balance sheet of the financial statements belongs to the Capital and liability reserves section of the balance sheet: information on the state of the authorized capital of the organization as of December 31 of the current year, the previous year and the previous one is displayed here. The data must completely match the registered constituent documentation.

Note! In the financial statements, the amount of the authorized capital is reflected in full, regardless of whether it has been paid at the moment.

Making a Balance Sheet: A Cheat Sheet for Nonprofit Organizations

Specialists from the Russian Ministry of Finance have issued clarifications that will be useful to accountants of non-profit organizations when preparing financial statements for 2011 (information letter No. PZ-1/2011). Four years ago, financiers issued similar recommendations. But during this time, accounting legislation has undergone changes, which led to the emergence of new explanations.

What we take into account

Financiers reminded non-profit organizations what documents should be used as a guide when preparing financial statements. First of all, this is the Federal Law of November 21, 1996 No. 129-FZ “On Accounting” (hereinafter referred to as the Accounting Law).

You should also be guided by:

— Regulations on accounting and financial reporting in the Russian Federation, approved by Order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n (hereinafter referred to as Regulation No. 34n);

— PBU 4/99 “Accounting statements of organizations”, approved by order of the Ministry of Finance of Russia dated 07/06/99 No. 43n;

— Chart of accounts for accounting of financial and economic activities of organizations, approved by order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n.

Please note that changes have been made to these documents that must be taken into account when preparing reports for 2011 (orders of the Ministry of Finance of Russia dated November 8, 2010 No. 142n, dated October 25, 2010 No. 132n and dated December 24, 2010 No. 186n).

In the previous explanations given by financiers to non-profit organizations in the information letter No. PZ-1/2007 dated January 1, 2007 (hereinafter referred to as Recommendations No. PZ-1/2007), specialists from the Russian Ministry of Finance also recommended using the above-mentioned documents (with the exception of the order of the Russian Ministry of Finance dated July 29. 98 No. 34n, which at that time contained many outdated provisions).

In addition, you need to remember that starting from the reporting for 2011, the forms of financial statements have been changed. Now they have been approved by Order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n “On Forms of Accounting Reports of Organizations” (hereinafter referred to as Order No. 66n).

Composition of reporting

Non-profit organizations are given the right not to disclose certain indicators in their financial statements.

Thus, they are not required to disclose information about the presence and changes in the authorized capital, reserve capital and other components of the organization’s capital. Also, non-profit organizations are allowed not to submit a cash flow statement (clause 85 of Regulation No. 34n). If the company decides to generate such a report, it must follow the norms of the new PBU 23/2011 “Cash Flow Report”, approved by Order of the Ministry of Finance of Russia dated 02.02.2011 No. 11n.

As for the form of the report on the intended use of the funds received, it must be used only by public organizations (associations) and their structural divisions that do not carry out entrepreneurial activities and, apart from disposed property, do not have turnover in the sale of goods (works, services). But what about other non-profit organizations?

The answer to this question is contained in clause 4 of order No. 66n. This norm states that for other non-profit organizations this form is recommended and is used when creating the appropriate explanations for the balance sheet. But, in our opinion, it is still better to prepare this report for all non-profit organizations, thereby meeting the requirements for the reliability of financial statements. Let us note that in previous Recommendations No. PZ-1/2007, specialists from the Russian Ministry of Finance adhered to precisely this point of view.

With regard to public organizations (associations) and their structural divisions that do not carry out entrepreneurial activities and, apart from disposed property, do not have turnover in the sale of goods (works, services), it should be noted that they submit financial statements only once a year and it includes:

- balance;

- Profits and Losses Report;

— report on the intended use of property (clause 4 of article 15 of the Accounting Law).

Other non-profit organizations submit reports in the generally established manner: quarterly - within 30 days after the end of the quarter, annual - within 90 days after the end of the year.

When preparing reports, it is necessary to remember that non-profit organizations independently determine the details of the balance sheet and profit and loss statements, as well as the content of the explanations (clauses 3 and 4 of Order No. 66n).

As before, when forming financial reporting indicators, a non-profit organization must proceed from the requirements of materiality. In this case, the criteria for the materiality of a particular indicator, taking into account its assessment, nature, and specific circumstances of the organization’s emergence, are determined independently.

Recommendations of the Ministry of Finance

In information letter No. PZ-1/2011, specialists from the Russian Ministry of Finance examined the features of the formation by non-profit organizations of balance sheet indicators, profit and loss statements, as well as a report on the intended use of funds received, taking into account the requirements of current legislation.

For convenience, we have summarized all recommendations for drawing up a balance sheet in a table in a comparative analysis with previous explanations of the Russian Ministry of Finance.

| Indicator name | Features of the formation of indicators | |

| Recommendations No. PZ-1/2007 | Recommendations No. PZ-1/2011 | |

| Group of articles “Fixed assets” | The initial cost of fixed assets is reflected: — assigned to the right of operational management or transferred to a non-profit organization for economic management; — acquired using funds allocated by the founders; — received as voluntary property contributions (share contributions) and donations; — acquired through targeted contributions for the acquisition (creation) of fixed assets (including public use). In this case, fixed assets must be intended to support the statutory (including entrepreneurial) activities of the non-profit organization. Analytical accounting of fixed assets should provide data on the availability and movement of objects. Information about the depreciation of fixed assets accrued in a straight-line manner is disclosed in the Certificate of the availability of assets recorded in off-balance sheet accounts. The disposal of fixed assets due to impossibility of use is reflected as a decrease in the groups of articles “Fixed assets” and “Additional capital” (under a separate article called, for example, “Fund of real estate and especially valuable movable property”). At the same time, the corresponding indicator of depreciation amounts for fixed assets is reduced in the Certificate of availability of valuables recorded in off-balance sheet accounts. Information about property acquired by a consumer cooperative of citizens for the purpose of providing ownership and use to members of the cooperative, and not for use in its activities and at its own discretion, is disclosed in the Certificate of the availability of valuables recorded in off-balance sheet accounts, in an assessment determined based on the amount of obligations members of the cooperative on the specified property | It is clarified that information about the depreciation of fixed assets, accrued in a straight-line manner and taken into account on the balance sheet, is disclosed in the table of explanations “Availability and movement of fixed assets”, respectively, in the columns “Accumulated depreciation” and “Accrued depreciation”. And information about the property acquired by a consumer cooperative of citizens and accounted for on the balance sheet is disclosed in the table of explanations “Other use of fixed assets.” Disposal of fixed assets due to impossibility of use is reflected as a decrease in the groups of articles “Fixed assets” and “Fund of real estate and especially valuable movable property” |

| Group of articles “Inventories” | Remains of material and production assets intended to ensure the statutory activities of a non-profit organization and belonging to it by right of ownership or other property right are reflected. A non-profit organization may not include the article “Raw materials, materials and other similar values” in the specified group if there are no significant balances and there is an effective system of operational control over the expenditure of such values. In this case, material assets used for management needs are recognized as an expense, respectively, in the groups of articles “Costs for maintaining the management apparatus” and “Costs for targeted activities” directly in the Report on the targeted use of funds received | The order remains the same |

| The article “Costs of construction in progress” in the group of articles “Inventories” | To be completed if there are expenses for unfinished work and unfinished provision of services in accordance with the subject and goals of the activity. These expenses are reflected in the expense accounts for ordinary activities provided for in the Chart of Accounts | It is clarified that the indicator is filled in if there are significant costs for unfinished work and unfinished provision of services. In addition, these costs are reflected in the accounts of Section III “Production Costs” of the Chart of Accounts |

| Group of articles “Accounts receivable” | Consumer cooperatives reflect the debt of members of the cooperative who have the right to share savings when transferring property intended for the ownership and use of its members to members of the cooperative. The occurrence of such debt is due to the obligations of a member of the cooperative to pay the share contribution, or to return the property given to him for possession and use in the event of non-payment of the share contribution, or on other grounds provided for by the charter of the cooperative | It has been added that, based on Regulation No. 34n, reserves for doubtful debts are created for receivables of legal entities and individuals at the time they are recognized as doubtful, taking into account the requirement for timely reflection of facts of economic activity in accounting in accordance with PBU 1/2008 |

| The group of articles “Financial investments” in section I “Non-current assets” and the group of articles “Financial investments (except for cash equivalents)” in section II “Current assets” | A credit consumer cooperative of citizens reflects the amount of loans provided to its members at the expense of the mutual financial assistance fund formed in the prescribed manner by a credit consumer cooperative of citizens. When filling out these items, you must be guided by PBU 19/02 “Accounting for financial investments” | The grouping of articles has been changed. Previously, a group of articles “Long-term financial investments” and a group of articles “Short-term financial investments” were provided. The procedure for filling out the indicator remains the same |

| Group of articles “Cash and cash equivalents” | The balances of funds are reflected in a separate bank account intended for making settlements related to the receipt of funds for the formation of endowment capital, the transfer of funds constituting the endowment capital into trust management of the management company, replenishment of the endowment capital already formed by a non-profit organization in accordance with the terms of the agreement donations or bequests, as well as with the use and distribution of income from endowment capital. Transactions related to the implementation of a property trust management agreement are reflected in the manner established by Order of the Ministry of Finance of Russia dated November 28, 2001 No. 97n. Personal savings of citizens transferred on the basis of an agreement for use to a credit consumer cooperative are taken into account and reflected in the balance sheet separately from other funds of the mutual financial assistance fund of the credit consumer cooperative | The procedure for filling out the indicator remains the same |

| Section III “Targeted Financing” | Instead of the groups of articles “Authorized capital”, “Reserve capital” and “Retained earnings (uncovered loss)”, a non-profit organization includes the articles “Unit fund”, “Target capital”, groups of articles “Target funds”, “Reserve and other target funds” ( depending on the type of non-profit organization) | “Additional capital” has been added to the list of replaced indicators. And the list of included indicators is “Fund of real estate and especially valuable movable property” |

| Article "Mutual fund" | Filled out by consumer cooperatives. This article reflects the following information: — on share contributions of shareholders of consumer cooperatives, members of credit consumer cooperatives of citizens, included in the article “Settlements with shareholders” of the group of articles “Receivables”; — on share contributions of members of a consumer cooperative of citizens entitled to share savings, received as sources of formation of property necessary to meet the property needs of members of the consumer cooperative. When a member of the cooperative pays the share contribution in full, the corresponding amount of the cooperative member’s obligations to return the property provided to him, reflected in the article “Settlements with Shareholders” of the group of articles “Receivables”, reduces the article “Share Fund”. The specified share contributions are reflected in the balance sheet separately from entrance fees and other sources of targeted financing of expenses for the maintenance of the management apparatus of the consumer cooperative of citizens, reflected under the item “Targeted funds” | The procedure for filling out the indicator remains the same |

| Article "Target capital" | Included in the balance sheet by a non-profit organization that forms endowment capital (endowment capital). It discloses information about the amount of the target capital of a non-profit organization formed as of the reporting date. From the date of transfer of funds into trust management of the management company, the target capital is considered formed and is reflected as an increase in the item “Target capital” and as a decrease in the item “Debt to donors” in the group of items “Accounts payable” | The procedure for filling out the indicator remains the same |

| Article “Targeted funds” | Here are reflected: - unused target funds as of the reporting date intended to provide the non-profit organization with the purposes for which it was created, and corresponding to these purposes, reflected in the report on the intended use of the funds received; — net profit/loss from the business activities of a non-profit organization, formed based on the results of its activities for the reporting year and intended for financial support of statutory activities in subsequent periods in accordance with the approved estimate. It is advisable to show these types of funds separately on the balance sheet. The group of articles “Target funds” is linked to individual articles reflected in section I “Non-current assets”, in section II “Current assets” for the groups of articles “Inventories”, “Cash”, “Short-term financial investments” for the amounts received by the non-profit organization funds and property contributions from founders (members), as well as other income. When a non-profit organization decides to disclose information about debt on membership fees or other expected revenues, the amount of accrued debt is reflected in the group of items “Accounts receivable”. The use of targeted financing received by a non-profit organization in the form of investment funds for the acquisition and (or) creation of fixed assets, including general use, is disclosed as a decrease in the group of items “Targeted funds” and, accordingly, as an increase in the item called “Fund for real estate and especially valuable movable property” property”, for the group of articles “Additional capital”. Information about the intended use of the funds received by a non-profit organization (in form, structure, composition of sources of income and areas of use) is disclosed in the report on the intended use of the funds received | The requirement that net profit must be intended for financial support of statutory activities in subsequent periods in accordance with the approved estimate has been eliminated. The phrase about the advisability of separately reflecting unused funds and net profit/loss has been excluded. The name of the articles with which the group of articles “Targeted Funds” is linked has been clarified. Instead of the article “Cash” there is the article “Cash and cash equivalents”, and instead of the article “Short-term financial investments” there is the article “Financial investments (except for cash equivalents)” |

| Group of articles “Fund of real estate and especially valuable movable property” | This group of articles reflects: — funds of targeted financing received by a non-profit organization in the form of an investment for the acquisition and (or) creation of fixed assets, including for general use, including those allocated to an indivisible fund; — funds from a mutual financial assistance fund created in accordance with the established procedure by a credit consumer cooperative of citizens. This information is disclosed separately, for example, under the articles referred to respectively as the “Real Estate and Highly Valuable Movable Property Fund” and the “Mutual Financial Assistance Fund” | The name of the group of articles has been changed. Previously it was called “Additional capital”. Therefore, the Russian Ministry of Finance recommended reflecting this information, for example, under the article “Mutual Financial Assistance Fund”. Otherwise, the procedure for generating the indicator remained the same |

| Group of articles “Reserve and other target funds” | Indicators are included that reveal the amount of reserve and other target and special funds provided for by the legislation of the Russian Federation and the charter of a non-profit organization | The procedure for filling out the indicator remains the same |

| Group of articles “Estimated liabilities” | There was no such group of items in the balance sheet | This includes indicators that take into account estimated liabilities reflected in account 96 “Reserves for future expenses.” When recognizing an estimated liability in accordance with PBU 8/2010 “Estimated liabilities, contingent liabilities and contingent assets”, depending on its nature, the amount of the estimated liability is included in expenses for ordinary activities or other expenses or is included in the value of the asset |

Now let’s see what recommendations the specialists of the Russian Ministry of Finance gave to non-profit organizations for generating a profit and loss statement.

Non-profit organizations reflect in the income statement the income due (received) by them from the provision for a fee for temporary possession and (or) use of real estate, income from the sale of assets, and other income related to entrepreneurial and other statutory activities.

If a non-profit organization forms endowment capital, then it discloses income from the use of property constituting endowment capital and placed by the non-profit organization independently and through trustees.

Depending on the significance, the above-mentioned income is reflected in the form of separate items in the income statement or included in the item “Other income”.

In the profit and loss statement, a non-profit organization must disclose the costs associated with the trust management of property constituting the endowment capital, and the remuneration of the management company, carried out from income from the endowment capital in accordance with the legislation of the Russian Federation. Just like income, these expenses, depending on their significance, are reflected in the form of separate items in the income statement or are included in the item “Other expenses”.

The amount of net profit of the reporting year is written off by the non-profit organization with the final turnover of December to the credit of account 86 “Targeted financing” in correspondence with account 99 “Profits and losses”. In the balance sheet, it is reflected in Section III “Targeted Financing” under the group of items “Targeted Funds”, and in the report on the intended use of funds received under the item “Profit from the business activities of the organization.”

The amount of net loss is reflected in a similar manner, with the only difference being that it is written off as a debit to account 86, and in the report on the intended use of funds received, this loss is shown as part of the funds used under the item “Other”, highlighting, if significant, a separate item “ Losses from the organization’s business activities.”

As for the report on the intended use of the funds received, the recommendations of the Russian Ministry of Finance for its formation practically remained the same. In the new clarifications, financiers clarified that the article “Expenses related to wages (including accruals)” includes changes during the reporting period in the amount of estimated liabilities:

- on paid vacations of the employee;

— for employee benefits in the form of incentive payments (end-of-year remuneration, bonuses, bonuses, etc.), in the form of severance pay and other payments upon termination of an employment contract;

— to ensure employee benefits after termination of the employment contract with the organization in the form of pensions, insurance and other payments, etc.

In addition, specialists from the Russian Ministry of Finance recommended recording a net loss as a separate item if its amount is significant. If it is not significant, the loss is reflected in the “Other” item.

And the last point that non-profit organizations should pay attention to when preparing financial statements. It applies to those companies that discovered significant errors in previous reporting periods and corrected them in 2011 or made changes to their accounting policies. Such information is disclosed in Table 2 “Adjustments due to changes in accounting policies and corrections of errors” in the statement of capital flows. Moreover, instead of the indicators “Capital” and “Retained earnings (uncovered loss)” of the specified table, the non-profit organization includes the indicators “Targeted financing” and “Targeted funds”, respectively.

Common entries for the formation and adjustment of authorized capital

- Formation of the authorized capital of a legal entity

- Increase the authorized capital

Dt84 Kt80 - at the expense of profit.Dt82, 83 Kt80 - using additional or reserve funds.

Dt50,51,52,55,01,41 Kt80 – contribution of funds and property as contributions to a simple partnership.

Note from the author! In LLCs and JSCs, contributions from founders and shareholders are reflected in accounting in correspondence with Kt account 75 (for example, Dt51 Kt75 - crediting the owner's contribution to the current account).

- Reducing the fund size

Dt75 Kt80 – reduction of the nominal value of shares, reduction of the founder’s share in the company.Dt80 Kt81 – cancellation of own shares purchased from shareholders.

Dt80 Kt84 – equalization of the company’s net assets with the amount of the authorized capital by writing off losses.

Dt80 Kt50,51,55,01,41 – return of property to partners operating under a simple partnership agreement.

>Questions and answers on the topic

No questions have been asked about the material yet, you have the opportunity to be the first to do so

Save the article to social networks:

Line 1350 “Additional capital (without revaluation)”

Line 1350 reflects the amount of additional capital of the organization, with the exception of the amounts of additional valuation of non-current assets:

(except for the amounts of additional valuation of fixed assets and intangible assets)

Additional capital can be formed through:

· share premium, which is the amount of the difference between the sale and par value of shares (shares), received in the process of forming the authorized capital of the organization (upon the establishment of the organization, with a subsequent increase in the authorized capital) through the sale of shares (shares) at a price exceeding the par value;

· exchange rate differences associated with settlements with founders on deposits, including contributions to the authorized (share) capital of an organization, expressed in foreign currency;

· the difference arising as a result of the recalculation of the value of the assets and liabilities of the organization, expressed in foreign currency, used to conduct activities outside the Russian Federation, into rubles;

· contributions to the property of a limited liability company;

· the amount of VAT recovered by the founder when transferring property as a contribution to the authorized capital and transferred to the established organization (if the specified amounts are not a contribution to the authorized capital of the established organization).

Line 1360 “Reserve capital”

Line 1360 reflects the amount of the organization’s reserve capital, formed both in accordance with the constituent documents and in accordance with the law:

(except for special funds to finance current expenses)

Plus

(in terms of special funds (with the exception of special funds for financing current expenses))

Line 1370 “Retained earnings (uncovered loss)”

Line 1370 reflects the amount of retained earnings or uncovered loss of the organization:

Interim reporting:

Plus/minus

Minus

(in terms of interim dividends accrued in the reporting period)

Annual reporting:

The amount of retained profit (uncovered loss) of the reporting period is equal to the amount of net profit (net loss) of the reporting period, i.e. profit (loss) after tax. Therefore, if the organization does not have retained earnings (uncovered loss) from previous years and the distribution of interim dividends during the reporting period, then the value of line 1370 coincides with the value of line 2400 “Net profit (loss) of the reporting period” of Form No. 2.

Line 1300 “Total for Section III”

Line 1300 reflects the sum of indicators on lines with codes 1310 - 1370 and reflects the total amount of the organization’s capital:

Sum of lines: 1310 “Authorized capital (share capital, authorized capital, contributions of partners)” 1340 “Revaluation of non-current assets” 1350 “Additional capital (without revaluation)” 1360 “Reserve capital” Minus 1320 “Own shares purchased from shareholders” plus/ minus 1370 “Retained earnings (uncovered loss)”

Line 1410 “Borrowed funds”

Line 1410 reflects information on the status of long-term (for a period of more than 12 months) loans and borrowings received by the organization:

Line 1420 “Deferred tax liabilities”

Line 1420 reflects information about deferred tax liabilities:

When preparing financial statements, an organization is given the right to reflect in the balance sheet the balanced (collapsed) amount of a deferred tax asset and a deferred tax liability.

Reflection in the balance sheet of the balanced (collapsed) amount of a deferred tax asset and a deferred tax liability is possible if the following conditions are simultaneously met: the presence of deferred tax assets and deferred tax liabilities in the organization; deferred tax assets and deferred tax liabilities are taken into account when calculating income taxes.

Minus

(! if the result is positive!

More found about capital and reserves

- Analysis of the relationship between net profit and net cash flow Other assets 1290 as well as increases in liability items Reserve capital 2150 Retained earnings 21 60 Life insurance reserves 2210 Insurance reserves

- How to predict the bankruptcy of a debtor Liabilities page 1700 - Capital and reserves page 1300 - Deferred income page 1530 - Reserves for future expenses

- Formation of consolidated financial statements in IFRS format Minority interest includes two components of share capital authorized capital other sources of equity capital additional capital reserve capital retained earnings of a subsidiary corresponding to the participation of third-party founders of shareholders EXAMPLE

- Current issues and modern experience in analyzing the financial condition of organizations - part 8 Analysis of liabilities is carried out by groups of items on the debtor’s balance sheet and consists of an analysis of the capital of reserves of long-term and short-term liabilities 19. Based on the results of the analysis of capital and reserves in documents

- Methodology for economic analysis of the financial and economic activities of a construction organization in order to confirm the continuity of development Coefficient of total solvency Capital and reserves Balance sheet currency Characterizes the share of own funds in the total composition of total capital degree

- Forecasting the balance sheet of a commercial organization using the percentage of sales method III CAPITAL AND RESERVES Authorized capital 410 1500 1500 Own shares purchased from shareholders 411 —

- Rules for conducting financial analysis by an arbitration manager Analysis of liabilities is carried out by groups of items on the debtor’s balance sheet and consists of an analysis of the capital of reserves of long-term and short-term liabilities 19. Based on the results of the analysis of capital and reserves in the documents

- Analysis of the status and use of borrowed (raised) capital on the basis of accounting (financial) statements Next, when monitoring, it is necessary to compare the amount of liabilities as a whole with the amount of the enterprise’s own funds, the result of section 3 of the balance sheet Capital and reserves with the total of sections 4 Long-term liabilities and 5 Short-term liabilities At the same time

- Problems of determining the “cash” component of retained earnings Liability Capital and reserves including 68,501.50 73,132.50 Authorized additional capital 8.00 8.00

- Introduction of a program-targeted (normative) approach to the financial planning system at small enterprises Liability Capital and reserves 6,481 8,700 11,660 15,072 Including -

- Analysis of the capital structure and profitability of leading Russian oil and gas enterprises Own working capital Capital and reserves Deferred income Long-term liabilities - Non-current assets RUB 2,881,80

- Autonomy coefficient Ka Own capital and reserves Total assets Calculation formula for groups of assets and liabilities Ka P4 A1

- Equity concentration ratio Kksk Equity capital and reserves Total assets Calculation formula for groups of assets and liabilities Kksk P4 A1

- Financial independence coefficient Kfn Equity capital and reserves Total assets Calculation formula for groups of assets and liabilities Kfn P4 A1

- Analysis of sources of capital formation It includes authorized capital, accumulated capital, reserve and additional capital, retained earnings and other income, targeted financing, charitable donations and

- What will help you look at your company through the eyes of the bank S Pr where KR is the total capital and reserves page 1300 of the balance sheet Options for assessing the ratio of equity and borrowed funds borrowed funds

- Explanation of the algorithm for calculating the free cash flow of a company and free cash flow to owners using the example of public financial statements TAL AND LIABILITIES Capital and reserves Authorized capital 197,239 Share premium 39,464 47,538 Own shares

- Analysis of financial and economic activities for administrations of constituent entities of the Russian Federation At the end of the analyzed period, the authorized capital of the enterprise is allocated as part of the enterprise's own capital, reserve capital, retained earnings. The authorized capital of the organization during the period under study increased by 1402 thousand

- Analysis of the arbitration manager At the end of the analyzed period, the authorized capital of the enterprise is allocated as reserve capital, retained earnings. The authorized capital of the organization during the period under study increased by 1402 thousand

- Distribution items of the balance sheet in the analysis of the liquidity indicators of the enterprise On the article Reserves for future expenses, such amounts are accrued amounts of expenses for the implementation of any work in the future, for example, an accrued reserve for major repairs, an accrued reserve for preparation for the launch of new production, and the like

Simplified balance sheet. The procedure for filling out the balance sheet and financial performance report

)

Deferred tax liability is a part of deferred income tax, which should lead to an increase in income tax payable to the budget in the next reporting period or in subsequent reporting periods.

Deferred tax asset is a part of deferred income tax, which should lead to a reduction in income tax payable to the budget in the next reporting period or in subsequent reporting periods.

A deferred tax liability is formed when taxable temporary differences arise (expenses in accounting are less than in tax accounting).

| Deferred tax liabilities | = | Taxable temporary differences | X | Income tax rate |

Line 1430 “Estimated liabilities”

Line 1430 reflects the amounts of estimated liabilities, the expected fulfillment period of which exceeds 12 months:

An estimated liability is recognized in accounting if the following conditions are simultaneously met:

· the organization has an obligation resulting from past events in its economic life, the fulfillment of which the organization cannot avoid. In the event that an organization has doubts about the existence of such an obligation, the organization recognizes a provision if, as a result of an analysis of all circumstances and conditions, including the opinions of experts, it is more likely than not that the obligation exists;

· a decrease in the economic benefits of the organization necessary to fulfill the estimated liability is likely;

· the amount of the estimated liability can be reasonably estimated.

Line 1450 “Other obligations”

Line 1450 reflects other liabilities of the organization whose repayment period exceeds 12 months:

Plus

Plus

Plus

Plus

Plus

Plus

In the balance sheet, assets and liabilities should be presented with a division depending on their maturity (maturity) into short-term and long-term. Assets and liabilities are presented as short-term if their maturity (maturity) period is no more than 12 months after the reporting date or the duration of the operating cycle, if it exceeds 12 months. All other assets and liabilities are presented as non-current.

Didn't find what you were looking for? Use Google search on the site:

Explanation of balance sheet lines for accounts

It can be carried out by increasing the value of the company’s property, through additional contributions from participants, or through contributions from third parties accepted into the company (if the latter is allowed by the Charter).

If at the end of the second and each subsequent financial year the value of the LLC’s net assets is less than its authorized capital, the company is obliged to register a decrease in its authorized capital to an amount not exceeding the value of its net assets. An LLC is subject to liquidation if the value of its net assets is less than the minimum amount of authorized capital established by the Federal Law “On Limited Liability Companies” as of the date of state registration of the company.

An increase in the authorized capital of a joint stock company (JSC) can be done by increasing the par value of shares or by placing additional shares. If at the end of the second and each subsequent financial year the value of the net assets of the JSC is less than the minimum authorized capital specified in the Federal Law “On Joint Stock Companies”, the JSC is subject to liquidation.

Rules for filling out Section III

You can list the key indicators used when filling out the section and the accounts for which they are used:

- Authorized capital – account 80. This category also includes the authorized capital or contributions of the participants of the partnership.

- Own shares that the company buys back from shareholders – account 81.

- Revaluation of non-current assets. The score used for this is 83.

- Additional capital – account 83.

- Reserve capital – account 82.

- Retained earnings and uncovered losses - accounts 84 and 99.

If participants contributed additional financial resources to increase the authorized capital, then before their registration in the Charter, such funds must be recorded in a separate line. Information about this is present in the special Letter of the Ministry of Finance No. 07-04-06/5027, published in 2015. It is also necessary to separately indicate interim dividends that were paid during the year.

In the third section of the balance sheet, it is necessary to indicate information indicating three dates. This is the reporting date, as well as the last day of the previous year and the last day of the earlier year. Thus, the report displays changes in information over the last three years, which makes it possible to judge changes in the enterprise’s own sources of financing.

useful links

►Economic literature◄ ►Methodology of financial analysis◄ ►Manual on financial statements◄ ►The largest joint stock companies in Russia◄

Line 1310 “Authorized capital (share capital, authorized capital, contributions of partners)”

Line 1310 reflects the amount of the authorized capital (share capital, authorized fund) of the organization:

This line reflects the amount of authorized (share) capital registered in the constituent documents as a set of contributions (shares, shares, shares) of the founders (participants) of the organization.

The authorized (share) capital and the actual debt of the founders (participants) for contributions (contributions) to the authorized (share) capital are reflected in the balance sheet separately.

State and municipal unitary enterprises, instead of authorized (share) capital, take into account the authorized capital formed in the prescribed manner.

An increase in the authorized capital of a limited liability company is permitted only after its full payment.

An increase in the authorized capital of a limited liability company may be carried out at the expense of the company’s property, and (or) at the expense of additional contributions of the company’s participants, and (or), if this is not prohibited by the company’s charter, at the expense of contributions from third parties accepted into the company.

If at the end of the second and each subsequent financial year the value of the net assets of a limited liability company is less than its authorized capital, the company is obliged to announce a reduction in its authorized capital to an amount not exceeding the value of its net assets and register such a decrease in the prescribed manner.

If at the end of the second and each subsequent financial year the value of the company’s net assets is less than the minimum amount of authorized capital established by the Federal Law “On Limited Liability Companies” as of the date of state registration of the company, the company is subject to liquidation.

The authorized capital of a joint stock company can be increased by increasing the par value of shares or placing additional shares.

If at the end of the second and each subsequent financial year, in accordance with the annual balance sheet proposed for approval by the company’s shareholders, or the results of an audit, the value of the company’s net assets turns out to be less than the minimum authorized capital specified in the Federal Law “On Joint Stock Companies,” the company is obliged to accept decision on its liquidation.

| Item in the asset balance sheet of a simplified form | Balance of accounting accounts that are accounted for under this item | The corresponding asset item of the balance sheet in the generally accepted form | Line code |

| Tangible non-current assets | Account 08 (according to the corresponding subaccounts) + Account 01 + Account 03 – Account 02 | Fixed assets | |

| Unfinished capital investments | |||

| Profitable investments in material assets | |||

| Material prospecting assets | |||

| Intangible, financial and other non-current assets | Account 08 (according to the corresponding subaccounts) + Account 04 + Account 05 + Account 58 + Account 55 (deposit accounts) – Account 59 + Account 09, etc. | Intangible assets | |

| Research and development results | |||

| Intangible search assets | |||

| Financial investments | |||

| Deferred tax assets | |||

| Other noncurrent assets | |||

| Reserves | Account 10 + Account 11 + Account 15 +/- Account 16 + Account 20 + Account 21 + Account 23 + Account 28 + Account 29 + Account 41 + Account 42 + Account 43 – Account 14 + Account 44 + Account 45 + Account 97 | Reserves | |

| Cash and cash equivalents | Account 50 + Account 51 + Account 52 + Account 55 (except for time deposits) + Account 57 | Cash and cash equivalents | |

| Financial and other current assets | Account 58 + Account 55 (deposits) – Account 59 + Account 19 + Debit Account 60,62,68,69, 70,71,73,75,76 – Account 63 | Accounts receivable | |

| Financial investments (excluding cash equivalents) | |||

| Other current assets |

Now let’s take a closer look at the reflection of balances and turnover, which accounts are used to make up the Balance Sheet for small enterprises (Table 1.2).

Table 1.2

Formation of lines of a simplified balance sheet of a small enterprise

| Indicator name | Formation of meaning |

| Assets | |

| Line 1150 “Tangible non-current assets” | The line is calculated as the difference between the Balance at the end of the period for the Debit of account 01 and the Balance at the end of the period for the Credit of account 02. |

| Line 1190 “Intangible, financial and other non-current assets.” | The line is calculated as the difference between the Amount of balances at the end of the period for the Debit of accounts 03,04,09,58 and the Amount of balances at the end of the period for the Credit of accounts 05,59. |

| Line 1210 “Inventories”. | The line is calculated as the difference between the Amount of balances at the end of the period for Debit accounts 10,11,15,16.1,20,21,23,25,26,29,41,43,44,45,46,97 and the Amount of balances at the end of the period for Credit accounts 14, 16.1,16.2,42. |

| Line 1250 “Cash and cash equivalents.” | The line is calculated as the sum of the Balances at the end of the period for the Debit accounts 50,51,52,55,57. |

| Line 1260 “Financial and other current assets.” | Line 1260 is calculated as the Sum of balances at the end of the period for Debit accounts 19,60,62,66,67,68,69,70,71,73,75,76,79,86,94 minus Balance for Credit account 63. |

| Passive | |

| Line 1310 “Capital and reserves” | The line is calculated as the Sum of balances at the end of the period for Account Credit 80,82,83,84 minus Account Credit Balance 81. |

| Line 1410 “Long-term borrowed funds.” | The line is calculated as the Balance at the end of the period for Account Credit 67. |

| Line 1450 “Other long-term liabilities.” | The line is calculated as the sum of the balances at the end of the period for the Credit of accounts 75.77. |

Transfer of reserves to next year

The balance sheet of the enterprise displays as a separate line the balances of reserves that will be used next year. The issue of creating reserves and transferring them must be spelled out in the accounting policies of the enterprise. The amount of reserves fits into those balance sheet columns where future expenses of the organization are taken into account. The company has the right to reserve funds for the following upcoming expenses:

- Payment of vacation pay to staff.

- Payment of annual remuneration to employees of the enterprise based on work results.

- Annual payment to employees for long service.

- Warranty service and more. You can reserve funds for other purposes.

At the end of the year it is necessary to take inventory of the reserved amounts. If excess reserves appear, this amount may be reversed. Some types of reserve amounts are not reversed at the end of the year. For example, if an organization faces renovation costs, they may take several years. In this case, the excess amount should be reversed only after completion of the work.

If you find an error, please select a piece of text and press Ctrl+Enter.

Preparing financial statements of small businesses in a simplified version makes the work of an accountant easier, but requires the user to understand what information is contained in each line of the reporting forms. For example, capital and reserves in a simplified balance sheet are information about all types of equity capital of the company reduced to one figure. It is located in the third section of the balance sheet under code 1300. Let's figure out which accounts the accountant operates when filling out line 1300 of the simplified balance sheet, which accumulates all types of capital of the company.

Line 1310 “Authorized capital

Line 1510 “Short-term borrowed funds”. The line is equal to the Balance at the end of the period on the Credit of accounts 66. Line 1520 “Accounts payable”. The line is calculated as the sum of the balances at the end of the period on the Credit of accounts 60,62,68,69,70,71,73 ,75,76.Line 1550 “Other short-term liabilities.”The line is calculated as the sum of the balances at the end of the period under the Credit of accounts 96.98.The income statement shows the financial results of the organization for the reporting period.

In the simplified form of the financial results statement, there are no items of commercial and administrative expenses, gross profit, interim results of profit (loss) from sales, profit (loss) before tax, reference information about individual income and expenses, the total financial result of the period, etc.

Let's take a closer look at balances and turnover, for which accounts the Financial Results Report for small businesses is compiled (Table 1.3.).

Table 1.3

Formation of lines of a simplified report on the financial results of a small enterprise

| Indicator name | Formation of meaning |

| Line 2110 “Revenue, minus VAT, excise taxes.” | It is calculated as the difference between the turnover on the Credit account 90.1 and the sum of the turnover on the Debit account 90.3,90.4,90.5. |

| Line 2120 “Expenses for ordinary activities” | The line is calculated as the sum of turnover in the Debit of account 90.2, excluding commercial selling expenses and administrative expenses. |

| Line 2330 “Interest payable” | The line is calculated as turnover in the Debit of account 91 in terms of interest expenses. |

| Line 2340 “Other income” | The line is calculated based on the Turnover on Account Credit 91 |

| Line 2350 “Other expenses” | The line is calculated based on the Turnover in the Debit of account 91, all other expenses are indicated with the exception of Interest payable (they are reflected on line 2330) |

| Line 2410 “Income taxes, including current income tax.” | This line indicates the amount of income tax indicated in account 68. |

| Line 2400 Net profit | = Revenue – Expenses for ordinary activities + Interest payable + Other income – Other expenses + (-) Income tax. |

On January 1, 2013, the explanatory note and the auditor's report on the reliability of the accounting (financial) statements, confirming the reliability of the accounting (financial) statements, are not included in these statements.

If explanations are needed for the balance sheet and financial performance report, a small business entity draws up an appendix that provides the most important information, without knowledge of which it is impossible to assess the financial results of activities. In particular, the application can disclose the following information:

a) method of accounting for income and expenses;

b) significant errors of previous years identified and corrected in the reporting period;

c) accrual and payment of dividends to the founders;

d) changes in the authorized capital, etc.

Thus, having considered the main aspects of the formation of simplified financial statements of small enterprises, the following conclusions can be drawn.

The labor intensity of filling out accounting reporting forms for small businesses is much lower; there is no need to maintain a large accounting service at the enterprise. However, aggregation of balance sheet and income statement items into large subsections reduces their information content. It is difficult for analysts and investors to analyze the financial and economic activities of the enterprise of interest without additional transcripts to the statements.

Accounting statements of small enterprises

The simplified financial statements include two forms approved by Order of the Ministry of Finance of the Russian Federation No. 66n:

- balance;

- financial performance report (FPR).

By analogy with traditional financial statements, these forms are prepared at the end of the reporting year. Balance sheet form No. 0710001 includes the provision of final information for the reporting year, as well as for the previous and the year before. Despite the simplified version, the balance sheet provides all the necessary information about assets and their sources. The simplified balance sheet is structured like the regular form and contains the same indicators as the general one. The difference can only be considered a more enlarged reflection of information, i.e. each line has the greatest specific weight.

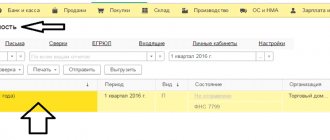

The balance sheet of a small enterprise with a breakdown of the lines, and the OFR (form No. 0710002) reflect data on the company’s income and expenses recognized in accounting also for the reporting and previous periods. The basis for filling out these forms is the turnover balance sheet, which contains all the data on account balances at the beginning of the period, account turnover and balance at the end of the period.