An application for offset of overpaid tax is a document with which the taxpayer applies to the Federal Tax Service with a request to offset the tax overpayment. The form was approved by order of the Federal Tax Service dated February 14, 2017 No. ММВ-7-8/ [email protected]

In 2021, the documents that legal entities and individuals must use to offset and refund overpayments on taxes have changed. Let's look at what the application form for offset of overpaid tax now looks like and how to fill out this document correctly.

What are the reasons for overpayments?

The circumstances in which organizations pay tax in excess of the required amount may vary. They can be caused by banal technical errors by specialists in the accounting department, overpayments on advance payments, incorrectly calculated tax base, etc. In such cases, enterprises have two options: either request a refund or write a statement about their offset.

An overpayment can be detected both by the taxpayer himself and by tax inspectors.

Offsetting is the most preferred option to resolve the problem of excessive tax transfers.

Taxes that can be offset

Not all types of tax payments can be adjusted in case of overpayment, and vice versa, not all types of payments can be redirected to this overpayment. The table shows the types of overpayments allowed for adjustment with the corresponding options for channeling funds.

| № | Type of tax overpayment | Where is it allowed to redirect money? |

| 1 | Federal taxation (overpayment of VAT, UTII, income tax, etc.) | To account for future payment of any federal tax, penalty or interest on such tax. |

| 2 | Regional taxation (transport tax, corporate property tax, etc.) | On account of future payment of the same tax or other regional fee, penalty, fine or arrears on regional taxes |

| 3 | Local taxes (land). | On account of the same tax or penalty. |

As you can see, re-offset of funds can only occur between taxes of the same level.

The nuance of redirecting for personal income tax

Income tax is calculated by the tax agent. Various rates apply to it, it is a direct payment, so there are certain subtleties regarding the return or credit for its overpayment. It cannot be carried out by the owner of these funds - the employee, but only by his employer as a tax agent, but by expressing the will of the employee - in a written statement. If an overpayment is revealed in relation to an already dismissed employee, this does not relieve the obligation to return it if the former employee so desires.

If the personal income tax return was submitted to the INFS by the taxpayer himself, for example, an individual entrepreneur, a re-offset or refund for the identified overpayment will be made by the inspectorate. In this case, the deadlines are calculated not from the submission of the application, but from the time the declaration is verified.

Overpayment control

The taxpayer is primarily interested in the correct payment of taxes and the absence of overpayments. Therefore, it is advisable to monitor the amount of funds paid to the budget and take action if an overpayment is detected.

If the fact of an overpayment is established not by the payer himself, but by the tax authorities during the audit, they must notify him of this within 10 days (working days, not calendar days).

IMPORTANT! If the payer has an arrears of a tax of the same level as the overpaid one, or a penalty or fine for a tax of the corresponding level, a refund of the overpayment is not possible, only a re-offset is carried out.

Results

If the taxpayer made an error in the KBK or other fields of the payment order and the payment was received in the budget system of the Russian Federation, then the payment is considered executed. In this case, you should send an application to the Federal Tax Service to clarify the payment.

If critical errors were made: in the recipient's account number or the name of the recipient bank, the payment does not go to the budget. In this case, you need to re-transfer the tax amount to the correct details, pay penalties and write an application for a refund of the incorrectly paid tax to your current account.

Sources

- https://assistentus.ru/forma/zayavlenie-o-zachete-naloga-s-odnogo-kbk-na-drugoj/

- https://glavbuhx.ru/nalogi/kbk/pismo-v-ifns-o-perenose-oplaty-s-odnogo-kbk-na-drugoj-obrazets.html

- https://nalog-nalog.ru/uplata_nalogov/rekvizity_dlya_uplaty_nalogov_vznosov/obrazec_zayavleniya_ob_utochnenii_nalogovogo_platezha_oshibka_v_kbk/

- https://ppt.ru/forms/nalogi/utochnenie-plateja

- https://assistentus.ru/forma/zayavlenie-ob-utochnenii-platezha-v-nalogovuyu/

- https://buhguru.com/effektivniy-buhgalter/utochnyaem-platezh-v-nalogovuyu-pri-nevernom-kbk.html

- https://buhguru.com/spravka-info/zayavlenie-ob-utochnenii-platezha-po-nalogu-v-2019-godu-tekst-i-obrazets.html

- https://www.Assessor.ru/notebook/zajavlenie/zayavlenie_ob_utochnenii_platezha_v_nalogovuyu_blank/

The essence of the statement

The application is essentially an official application by an organization or individual entrepreneur to the state tax service for the right to realize the legitimate interests of the taxpayer. Tax authorities are obliged to consider this appeal and make the right decision on it.

It should be noted that if this statement is not made, tax officials have every right to independently distribute the overpaid amount of tax.

As a rule, the money is used to pay off various types of fines and penalties. That is why taxpayers are not recommended to delay filing an application, so that later they do not have to spend a long and painful time figuring out where the money went and whether it can be redirected or returned.

The period in which the money will be credited

Within ten days after receiving the application, tax specialists make a decision, which is drawn up in writing and brought to the attention of the taxpayer.

If it is positive, then within the time period established by law (usually no more than one month, but if we are talking about an updated declaration, then at least three) the money will be credited. They will go either to pay off penalties, arrears and fines, or to pay off some other mandatory payments - at the choice of the taxpayer.

The offset date will be considered the date the tax authorities made this decision.

What if they didn’t re-enroll?

Tax authorities are required to respond to a received application for redirection of funds for overpaid taxes. This response must be received in writing within 5 days - refusal or consent. If the taxpayer does not agree with the reasons for the refusal, he will have to appeal to the arbitration court.

If the positive option is delayed for more than a month, the organization is entitled to interest as a “penalty”. Each day of delay in repayment is additionally paid at the Central Bank refinancing rate, which was relevant at the time of filing the application. The rate is not divided by the actual number of days in the billing year, but by the conventionally accepted number 360.

Taxpayers are required to pay interest for the entire period of delay, even if the overpayment funds were later legally offset or returned.

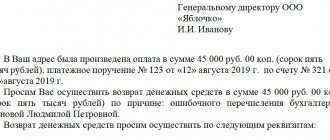

Composition of the letter form

Typically, this kind of paper is printed on the organization’s letterhead. On their upper part are the company details. If a business letter is printed on a regular A4 sheet without notes, then at the very top you must indicate the name and basic information of the organization that is sending the message.

The letter must contain:

- Information about the addressee. Full name of the head of the supplier’s organization, his position, the name of the company itself.

- Document Number. It is needed for subsequent accounting and recording of outgoing documentation.

- Date of signing.

- Title of the paper.

- The amount of overpayment. It must be clearly known to both parties.

- To which account the payment was made (link with document number and date).

- What to do with the overpayment: return it or offset it against payment for subsequent deliveries (or provision of services). If there is information about the number and date of the account to which the overpayment should be credited, then it is indicated.

- Please offset the overpayment against future payments if a specific account number is not available.

- If necessary, the amount of VAT.

- Signature, position of the head, seal of the organization.

Features of the application, general points

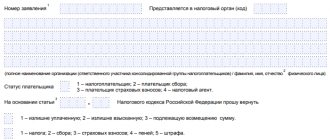

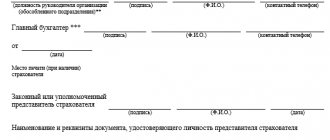

The application has a standard unified form that is mandatory for use. When filling it out, you must adhere to certain standards that are established for all such documents submitted to government agencies.

Let's start with the fact that information can be entered into the form both on the computer and by hand. In the second case, you need to ensure that there are no blots, errors or corrections. If you couldn’t do without them, it’s better not to correct the form, but to fill out a new one.

The application must be signed by the applicant or his legal representative. A document must be stamped only if the rule for using stamps to certify outgoing documentation is specified in the company’s accounting documents.

It is recommended to write the application in two copies , identical in text and equivalent in law, one of which should be handed over to a tax authority specialist, the second, after putting a mark on acceptance, should be kept. In the future, this approach will avoid possible disagreements with the tax service.

What's next

If there is an overpayment, then you need to decide what to do next with it within 3 years from the date of its occurrence (clause 3 of Article 78 of the Tax Code of the Russian Federation). If this deadline is missed, the overpayment can only be offset or returned through the court. And then only if the taxpayer proves that for a good reason he missed the deadline for offset/refund of the overpayment.

If there are no such reasons, or the court considers these reasons not valid, then you can forget about the overpayment.

To return funds to the organization, you must submit an application indicating the bank details for the return. A current account must be opened with any company, because... Not only settlements with counterparties, but also with government agencies pass through it. You can open a current account with free service at Ak Bars Bank. You can control payments and use additional features (for example, checking the risk of suspension of account transactions) through the Ak Bars Business Drive system on a computer or through a mobile application.

Sample application for crediting the amount of overpaid tax

At the beginning of the document it is stated:

- addressee, i.e. the name and number of the tax office to which it will be transferred;

- name and details of the applicant - TIN, OGRN, address, etc. intelligence.

Next, the main part includes:

- request for tax credit;

- the type of tax for which the overpayment occurred;

- the type of payment against which it is required to be transferred;

- amount (in numbers and words);

- budget classification code (KBK);

- OKTMO code.

Finally, the document is dated and the applicant puts his signature on it.

What to do if the inspection refused the test or carried it out late

You can appeal the refusal to offset to a higher tax authority, and then to the court (Article 137, clauses 1, 2 of Article 138 of the Tax Code of the Russian Federation).

As a general rule, the period for appeal is one year from the moment you learned or should have learned about a violation of your rights (Clause 2 of Article 139 of the Tax Code of the Russian Federation).

The period for going to court is three years from the day when you learned or should have learned about a violation of your right to offset (clause 79 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 30, 2013 N 57). If the inspection does not carry out the offset in a timely manner, then no interest is accrued on the offset amount. You can only appeal the inaction of the inspectorate in the manner indicated above.

How to submit an application

There are several ways to forward your application to the tax authorities:

- The simplest and most reliable is to go to the local tax office and give the application to the inspector in person, hand to hand.

- You can submit the application with a representative, for whom a duly certified power of attorney will be written.

- Send the application via Russian Post with a list of the contents by registered mail with acknowledgment of delivery.

- In recent years, due to the rapid development of electronic document management, sending documentation to government services via the Internet has become widespread. An application for offset of amounts of overpaid tax can also be sent in this way, but only on the condition that the company has an officially registered electronic digital signature.