The Social Insurance Fund is a government organization created in 1991. It pays benefits and provides disabled people with rehabilitation means. Information about the activities of the fund is collected on its official website. Insured persons can use the FSS personal account. There are 2 types of accounts - for individuals and legal entities.

On the Social Security Fund website you can view the approximate amount that should be paid for disability. A virtual calculator has been created to facilitate calculations. Users view information about benefits and other payments. All documents can be saved to a computer or printed on a printer.

Registration of the FSS personal account

Registering in your FSS personal account is very simple. Before starting work, it is recommended to study the capabilities and functionality of the system.

To register and log into your personal account, you need to open the official FSS website and choose one of three options:

- Office for the insured employee.

- Office for the policyholder.

- Office for ITU.

After opening the “Registration” section, you must enter the personal data of the individual: full name, phone number and email address. You can add registration after preliminary registration of the policyholder on the State Services website. After checking the data, the service will assign an individual access code. You can receive it by registered mail or at an identified center. You can choose the option that is convenient for you.

Using your password, you will log into your personal account. In your FSS personal account, you can add an organization this way:

- To add an organization and start working, a legal entity needs to open a personal account and fill out the organization’s data in Form 4.

- After you click next, the account activation section will open. You need to come up with a complex password to protect your personal account from hacking.

- The activation link will be provided after checking the data within 24 hours. After clicking on the link, an electronic portal opens where you can log in to your FSS personal account. To log in you need to enter your username and password.

- In the “Profile” tab, you need to open the “Organization” section, and then “Add”.

- An active certificate will be loaded, which allows you to submit a policyholder report through your FSS personal account. Each user has an individual certificate. If it is replaced, you need to enter new data.

- You can fill in the data in the “Profile” section: TIN, KPP, OGRN, name and address of the organization. In addition, you need to select the Social Insurance Fund with which you will work. Then click the "Save" button.

- In the personal account menu, you need to select “Application” and print the form. To complete the activation, you need to contact the fund with this application. Within up to 5 working days, you will be provided with all the features of your personal account, and in the “Profile” tab there will be about.

The main advantages of receiving government services electronically

The number of citizens receiving state and municipal services electronically has recently been growing rapidly. There are many explanations for this:

- saving personal time. Many services can be obtained electronically. If you need to make a personal visit to a government employee, you can make an appointment through your personal account;

- development of mobile applications that provide round-the-clock access to websites and personal accounts;

- the ability to obtain an up-to-date list of required documents in advance, this increases the time for their collection and preliminary verification;

- absence of queues and corruption;

- the ability to contact technical support;

- unified EPGU credentials for working in personal accounts of most government agencies.

The FSS help center number is 8-495-668-03-33. You can find out the hotline numbers of regional funds on the official website of the FSS.

How to log into your FSS personal account

To enter your personal account on the FSS website, you must enter your login and password. If you have an ESIA password, you can immediately log in to your personal account.

Through State Services

If you have previously registered in your personal State Services account, then you will not have any difficulties logging in. You need to open the official website of the FSS and go to the “Personal Account” section, then select “Insured Person’s Account” and click “Login to the FSS Personal Account”. A window will open for you to enter your username and password.

You can log in to the FSS in several ways:

- By mobile phone number;

- By SNILS number;

- By email address;

- Using an electronic signature key.

If you have already registered on the State Services portal, then you can choose any of the first 3 options. For example, a SNILS number, email address or phone number as a login, and the password will be the one you use when logging into the State Services website. Additionally, you do not need to register on the FSS website.

An electronic signature is a cipher that can replace a paper signature. In addition, you get the opportunity to use various electronic services and sign digital documents. You can create an electronic signature on the State Services website. After entering all the data, you need to click “Login” and your FSS personal account page will open.

Identity confirmation at State Services

To obtain a confirmed account in the Unified Identification and Information System of State Services, you must go through the following procedures:

- Obtaining a simplified account. To do this, you need to log in and provide your personal information. By entering the code received in the SMS message, the user enters the system and receives a simplified account.

- Receiving a standard record. To do this, the profile data should be supplemented with information about your passport and SNILS details. After verification, which lasts several days, the account will receive the “Standard” status.

You can complete the registration procedure in one of the following ways:

- Using online banks, if the person registering is a client of Sberbank, Post Bank and Tinkoff Bank;

- By visiting Russian Post offices to create an application to receive an identity confirmation code by letter;

- By visiting Service Centers in your locality, a list of which is on the website www.gosuslugi.ru.

You can check the status of your State Services account in the “Personal Data” section by opening the block with information about the account status.

After the registration on State Services is confirmed, the citizen can use all the capabilities of the portal, as well as go to the FSS personal account.

Login to the ITU office

Users of the ITU personal account are specialists of this institution. To use its functionality, you must have experience in the field of modern operating systems

Users of the LC are specialists from the ITU institution. To operate the personal computer, the user must have experience working in modern Windows operating systems and Internet browsers.

To start working, the user needs:

- Follow the link www.cabinets.fss.ru;

- Select the “ITU Account” tab on the main page and click “Login”;

- Enter your username/password pair and log in to the site.

If the authorization procedure is completed correctly, the browser work area will display the ENL of insured persons who are referred to a specific ITU institution, personal settings and a sick leave log.

LC functions

The electronic account of the FSS policyholder has various options:

- Tracking information about new certificates of incapacity for work.

- View and print sick leave certificates.

- Editing information by the policyholder in existing ELP .

- Completion of work with the ENL in the event of a discrepancy between the LN data and the printed form (in the case of registration of the ENL as an electronic copy of the certificate of incapacity for work).

- Export of electronic tax records to create registers stored in the Social Insurance Fund database.

- Monitoring benefits and sick leave accruals by entering the employee’s individual number or initials;

- Monitoring the log of records of interaction between a legal entity and the Social Insurance Fund.

- Search for employees who were injured at work.

- View and create a file with a list of errors in the FSS.

- Monitoring notifications from the Social Insurance Fund and settlements with policyholders .

- Make an appointment for a consultation at the FSS office.

You can also view your debt report on the FSS website.

Service specialists are constantly improving the level of security for policyholders registered in the system.

Why does the policyholder need a personal FSS account?

Almost all organizations have created personal accounts for the convenience of providing services. An insured citizen or policyholder can use the Social Insurance Fund online.

The FSS personal account makes life easier for an accountant and the head of a company. Previously, all actions had to be performed manually, filling out a lot of paperwork, and submitting documents to the Social Insurance Fund. Now you can do everything electronically and you don’t need to visit the FSS office to transfer documents. Of course, such a service is very convenient.

In your personal account you can store all the necessary information on a medium. Now you don't need to look for forms or worry about losing them. All documents that were sent to the FSS can be viewed at any time in your personal account. If necessary, you can find the policyholder's form using individual data or a unique number.

How to send a request

In your personal account there are two options to send a request:

- Click on your username in the top right corner and open “Foundation Requests.” In order to make a request, you need to click “New request”.

- Click the “Create” button and select a function from the list provided.

It is necessary to fill in all fields and indicate the subject of the request, and you also need to write the text of the appeal. In addition, if there are documents, they need to be uploaded. The answer will be sent to the “Response from the Foundation” section. But the answer may come by email.

The FSS personal account is a convenient service that completely replaces a visit to the Social Insurance Fund.

Registration of an individual entrepreneur with the Social Insurance Fund as an employer

Until 2021, all employers had to independently register with the Pension Fund and Social Insurance Fund. But now the situation is different - the Federal Tax Service is in charge of administering insurance premiums. Do I need to register an individual entrepreneur as an employer somewhere in 2021? Or does registration happen automatically?

Who should register

Registration of an individual entrepreneur with the Social Insurance Fund as an employer is mandatory in two cases:

- When concluding an employment contract;

- When concluding a civil law contract or an author's contract, if its terms provide for the payment by the customer of contributions to insure the performer against accidents.

What about individual entrepreneurs’ contributions for themselves? An individual entrepreneur is not required to pay insurance contributions for his social insurance, but can do so voluntarily. However, given that an individual does not have the right to conclude an employment contract with himself, registration of an individual entrepreneur with the Social Insurance Fund as an employer does not occur in this case.

In order for an entrepreneur to receive payments for temporary disability or in connection with maternity, he submits a special application for voluntary insurance of an individual to his FSS branch. Moreover, in order to receive benefits in the current year, contributions must begin to be paid in the previous year.

Registration procedure

So, if you have entered into your first employment or civil contract with an employee or contractor, then you need to submit an application to social insurance for registration as an employer. The deadline for submitting documents is no later than 30 calendar days from the date of conclusion of the contract.

In accordance with the Order of the Social Insurance Fund dated April 22, 2019 N 125, the mandatory list of documents for registration of an individual entrepreneur includes:

- Application in the prescribed form;

- A copy of the policyholder's identity document (passport of an individual entrepreneur);

- Copies of the employee’s work record book or concluded employment contract;

- Copies of a civil law agreement or an author's order agreement, if the conditions provide for the payment of insurance premiums for injuries.

Copies of documents are certified by an enhanced qualified electronic signature (when submitted via the Internet) or by FSS employees when verified with the originals. Depending on the type of contract concluded, an application for registration of the policyholder with the Social Insurance Fund is submitted using different forms.

For an employment contract:

- Application form (approved by Order of the Social Insurance Fund dated April 22, 2019 N 215).

For a civil contract:

- Application form (approved by Order of the Social Insurance Fund dated April 22, 2019 N 215).

Documents must be submitted to the social insurance department at the place of registration of the individual entrepreneur. If you have access to the State Services portal, you can register by submitting documents remotely.

Confirmation of registration

After receiving the documents, the Social Insurance Fund, within three working days, assigns the individual entrepreneur a registration number and subordination code, and also enters information about him in the register of policyholders.

All this data is indicated in the notice of registration of an individual entrepreneur as an insured, which is sent in the manner specified in the application (in person, by mail or electronically). In addition, another notification is issued - about the amount of accident insurance premiums, which depend on the professional risk class of the individual entrepreneur’s activities.

If documents for registration of the policyholder are not submitted within 30 days from the date of conclusion of the first contract, the entrepreneur will be fined under Art. 26.28 of Law No. 125-FZ of July 24, 1998.

The amount of the fine depends on the length of the delay:

- Up to 90 days inclusive - 5,000 rubles;

- More than 90 days - 10,000 rubles;

Registration in individual entrepreneur funds without employees

As you know, registration of insurance premium payers (including individual entrepreneurs) is carried out by two funds: the Pension Fund and the Social Insurance Fund.

The tax office independently transmits information about the new entrepreneur to its colleagues from the Pension Fund. They, in turn, are obliged to register the entrepreneur and assign him a registration number. Three days are allotted for this (paragraph 2, clause 1, article 11 of the Federal Law of December 15, 2001 No. 167-FZ “On Compulsory Pension Insurance in the Russian Federation”, hereinafter referred to as Law No. 167-FZ). As a result, representatives of the Pension Fund must send the entrepreneur a document confirming registration with the Pension Fund of the Russian Federation as an insurer (paragraph 6, paragraph 1, article 11 of Law No. 167-FZ).

As we can see, a registered individual entrepreneur without employees should not submit any documents to the Pension Fund. Registration is carried out without his participation (through the exchange of information between the Federal Tax Service and the Pension Fund of Russia).

While an individual entrepreneur does not have employees, he is not obliged to pay “for himself” insurance premiums for disability and maternity to the Federal Social Insurance Fund of the Russian Federation (Part 5, Article 14, Federal Law of July 24, 2009 No. 212-FZ “On Insurance Contributions”). Insurance premiums for insurance against industrial accidents and occupational diseases “for oneself” are also not paid.

Only those individual entrepreneurs who have entered into an employment contract with an employee are subject to registration with the Social Insurance Fund (clause 3, part 1, article 2.3 of the Federal Law of December 29, 2006 No. 255-FZ “On compulsory social insurance in case of temporary disability and in connection with motherhood”, hereinafter referred to as Law No. 255-FZ).

It turns out that an individual entrepreneur without employees is not required to visit the Social Insurance Fund and register. The only exception is the case when an individual entrepreneur wishes to receive benefits for temporary disability and maternity. In this case, he can voluntarily formalize relations with the fund. To do this, you need to submit a corresponding application and a copy of your identity document to the Social Insurance Fund at your place of residence (clause 12 of the Administrative Regulations, approved by order of the Ministry of Labor of Russia dated February 25, 2014 No. 108n). However, we repeat that this is his right, not his obligation.

System requirements

To interact with LC , a legal entity will definitely need a unique qualified electronic signature. A computer to interact with the system when using such a signature of a legal entity must have a special means of protecting and encrypting the available data. This ensures the security of the system, verifies and identifies the owner of the electronic signature.

The virtual service is not demanding both in terms of the power of the user’s equipment and software. For its stable operation, an operating system based on Windows 7, 8, 10 and more advanced models from Microsoft is suitable.

Uninterrupted operation of the system is guaranteed in the following browsers:

- Internet Explorer 9 (and higher).

- Mozilla Firefox 13 (and higher).

- Google Chrome 19 (and higher).

The domestic Yandex browser has also proven itself well.

Having good equipment is the key to comfortable and convenient work without unpleasant failures and malfunctions.

Registration of Limited Liability Companies in the Social Insurance Fund

Before applying for registration with the Social Insurance Fund, an organization must register with the main regulatory government body - the Federal Tax Service. After the registration process at the local branch of the Federal Tax Service, which takes no more than five working days and receipt of all title documents, the founder of the LLC must be registered with the Federal Tax Service.

Important! Unlike an individual entrepreneur, an LLC is required to register with the Social Insurance Fund, regardless of the number of employees. Quite often this is exactly what happens – the role of the employee is the founder and director rolled into one.

Application deadline

In order to register with the Social Insurance Fund, an LLC is given a rather limited period - only ten days. In case of delay, the organization may be fined in the amount of 10,000 rubles. In addition to the organization itself, an official, in particular the director of an LLC, may also be subject to monetary punishment.

Package of documents

- Writing an application in accordance with the template established by law.

- A passport, if the director submits documents in person, or a notarized power of attorney, if an authorized person submits the application for the director. Most often, this is the chief accountant.

- Certificate of registration of the LLC with the tax service (TIN and KPP).

- Certificate of state registration of LLC.

- Statistics codes from Rosstat.

- An extract of information from the Unified State Register of Legal Entities, which must be issued no earlier than 1 month.

- Copies of passports of hired personnel (page with personal data and page with registration address) and copies of employment contracts or copies of work books (first and last sheet).

Before submitting documents, it is advisable to clarify the list at the territorial office of the FSS. According to the law, the registration procedure with the Social Insurance Fund should last no more than five days.

Reasons for filing an application

Both entrepreneurs acting as employers and ordinary citizens can apply to the Social Insurance Fund with an official application. There are many reasons why people turn to employees of an organization.

Entrepreneurs usually make appeals on the following issues:

- the occurrence of an accident during the production process;

- questions regarding the submission of official reports;

- receiving material compensation;

- sending a letter of clarification.

Citizens turn to FSS employees for the following reasons:

- receiving disability benefits;

- registration of a birth certificate;

- submitting an application for a voucher for sanatorium treatment;

- insurance or recourse payments;

- filing a complaint against an employer;

- registration of a sick leave certificate if, for various reasons, a citizen cannot contact the employer with this question.

It is even possible to draw up an official appeal regarding the inaction of the head of the company, who does not want to independently arrange benefits for the employee.

FSS confirmation of type of activity 2020

The Social Insurance Fund approves your contribution rate “for injuries”, based on data about your main type of activity. The main type of economic activity is considered to be the one that, based on the results of the previous year, has the largest share in the total volume of products produced and services provided (clause 9 of the Rules, approved by Government Resolution No. 713 of December 1, 2005).

To confirm the main type of activity, the following set of documents is submitted to the territorial body of the Social Insurance Fund where the policyholder is registered, on paper or electronically (clause 3 of the Procedure, approved by Order of the Ministry of Health and Social Development dated January 31, 2006 No. 55):

- Application for confirmation of the main type of economic activity;

- Certificate confirming the main type of economic activity;

- A copy of the explanatory note to the balance sheet for the previous year (except for insurers - small businesses).

To confirm the type of activity in the Social Insurance Fund in 2021, the application form is the same as in 2021.

Confirmation deadlines

To confirm the main type of activity for 2021, documents must be submitted to the Social Insurance Fund no later than April 15, 2020 (clause 3 of the Procedure, approved by Order of the Ministry of Health and Social Development dated January 31, 2006 No. 55).

What happens if the type of activity is not confirmed?

If you do not send documents to the Social Insurance Fund within the established time frame, the tariff will still be set for you. It will correspond to one of the types of activities that you entered into the Unified State Register of Legal Entities and have the highest professional risk class. The actual conduct of such activities will no longer matter (clause 13 of Government Decree No. 713 of December 1, 2005).

With this option of tariff approval, a notification from the Social Insurance Fund will be sent to you before 05/01/2020 (clause 5 of the Procedure, approved by Order of the Ministry of Health and Social Development dated 01/31/2006 No. 55).

There is no responsibility for failure to confirm the main type of activity in the Social Insurance Fund. Therefore, an organization that has the highest professional risk class of all types of activities listed in the Unified State Register of Legal Entities, does not exceed the class for the main type of activity, may not issue documents for the Social Insurance Fund. After all, regardless of whether such an organization submits documents to confirm the tariff to the Social Insurance Fund or not, the tariff will be set to it the same.

Also read:

- Additional tariffs for insurance premiums 2020;

- Calculation of insurance premiums: codes;

- Calculation of insurance premiums: form;

- Fixed contributions for individual entrepreneurs - 2020;

- Limit base for contributions in 2021;

- Insurance premium rates for 2021;

How to prepare a 4-FSS report in electronic form

You can generate an electronic 4-FSS report in the Kontur.Extern system: select the “FSS” menu > “Create report”.

After that, select the type of report, reporting period and organization for which you want to submit the report and click on the “Create report” button. If you started filling out the report earlier, then by clicking the “Show report in the list” button you can open it for editing and sending.

To download a ready-made calculation from your accounting program, select the “FSS” menu > “Load from file”. The downloaded report can be viewed and, if necessary, edited by clicking on the “Download for editing” button.

After filling out the report, it will appear in the “FSS” > “All reports” section. Hover your cursor over the line with the desired report and select the required action.

After proceeding to send the report, select the certificate to sign and click on the “Check Report” button. If errors are found when checking the report, click on the “Open Editor” button, correct the errors and proceed to submit the report again.

If there are no errors, click on the “Proceed to Send” button.

After this, just click “Sign and Send”, and the system will upload the report to the FSS portal.

Next, you can track the status of the report - the control protocol and receipts for receiving reports will be sent directly to Extern.

When the status changes to “Receipt Received”, this means that the report has been submitted. The receipt can be opened and viewed, and saved if necessary. If the calculation status is “Submission Error,” it means that the calculation was not sent and you need to try again.

If the status is designated as “Decryption error,” the FSS was unable to decrypt the calculation or verify the electronic signature. Make sure you select the correct certificate to sign the payment and submit again.

The status “Format control error” indicates that the calculation has not been submitted. You need to correct the errors and resubmit the report. If the status is indicated as “Logical control error”, then a receipt with errors was received. The need to correct them must be reported to the FSS.

Submit electronic reports via the Internet. The Kontur.Extern service gives you 3 months free of charge!

Try it

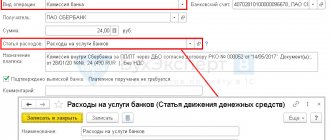

How to reimburse expenses to the Social Insurance Fund

Regarding social expenses, the employer is the insurer. Organizations transfer benefits for temporary disability and maternity, after which the Social Insurance Fund compensates for these expenses.

The compensation process itself is structured like this: the company acts as an intermediary between social insurance authorities and its employees, paying for insured events. At the end of the month, the policyholder calculates insurance premiums and transfers them to the Federal Tax Service.

If during the reporting period (the same month) expenses were incurred for temporary disability and maternity benefits, the organization reduces the monthly payment by the amount of these expenses (Part 2 of Article 431 of the Tax Code of the Russian Federation). At the end of the quarter/half-year/year, a reconciliation is carried out to identify debts and overpayments. Overspending is subject to reimbursement.

What is overspending in this case? This is the excess of actual employee benefit costs incurred over the final accruals. This amount requires compensation, which is carried out either in the format of offsetting the overpayment against future periods, or in the form of returning real money to the policyholder (Article 4.6 255-FZ of December 29, 2006).

What is the main difficulty? By way of refund. Previously, all operations were carried out through the Social Insurance Fund - payment of contributions, reimbursement of expenses, and reporting. Since 2021, payments and reports go through the Federal Tax Service, and compensation continues to be controlled by social insurance. At the same time, direct refund of money is also carried out by the Federal Tax Service.

The general procedure for mutual settlements looks like this:

- The policyholder submits an application for reimbursement of expenses to the Social Insurance Fund.

- Social insurance examines the documents, simultaneously requesting from the Federal Tax Service information about the policyholder’s debts and overpayments.

- The insurance authority makes a decision on compensation and sends a notice to the policyholder.

- Social insurance informs the Federal Tax Service of the need to transfer compensation to the policyholder.

- The Federal Tax Service transfers the specified amount to the policyholder's current account.

It turns out that the decision to allocate funds is made by social insurance, and compensation is paid by the tax inspectorate. If the policyholder wants the regulatory authorities to make a positive decision and reimburse all expenses for benefits, he must provide only reliable information, correct calculations and complete justifications.

Rules for acceptance and deadlines for consideration of applications

FSS representatives take into account the following rules when processing applications:

- no response is given if the text does not contain the applicant’s full name, as well as his actual or email address;

- all requests are registered by FSS employees, for which information about each application is entered into a special automated accounting system;

- if a court decision is appealed with the help of such an application, then within 7 days the document is forwarded to the responsible structural department;

- if the text contains obscene or offensive words, and the person also threatens those in charge, then the application remains unanswered;

- if the text cannot be read or it needs to be sent to other government bodies, then the applicant is informed about this within 7 days after registration of the document;

- if the citizen has previously received answers to the questions posed, and there are no new circumstances or requests, then such a statement is considered unfounded, and therefore no answer is given;

- if in order to provide a service it is necessary to disclose secret information, the citizen is notified that it is impossible to receive an answer;

- The general period for consideration of applications is 30 days, but it can be extended if additional proceedings are necessary, but the person is notified about this in advance.

If a citizen sends several identical requests at the same time, then he is given only one answer.

Application “Social Navigator”

Recently, the FSS launched an application that allows you to use the functionality of your personal account from a mobile device. The service contains the following features:

- Calculator for calculating social benefits (disability, parental leave, etc.);

- Information on options for sending documents to the Fund to receive social payments;

- Tracking the stages of consideration of the submitted application;

- Information about nearby socially significant objects.

You can use the “Social Navigator” service by installing it on your cell phone or tablet. But work to improve it continues and updates and new features are added periodically.

Results

Electronic form 4-FSS can be submitted in several ways. The FSS portal also offers this opportunity. To submit reports, the policyholder needs to register on the portal and also have a qualified digital signature key for the person who will sign the 4-FSS. In addition, submitting 4-FSS via electronic communication channels will require the installation of additional software on the computer where the report will be signed and from which the report will be sent.

Sources: Order of the Federal Social Insurance Fund of the Russian Federation dated September 26, 2016 No. 381

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How to get an electronic sick leave certificate in your FSS personal account

An employee can independently choose in what form a sick leave certificate will be issued to him. It is recommended that you first ask your accountant if he can accept the document in electronic form. If an employee decides to use a new service, but his organization does not yet accept such documents, then he will have to issue a sick leave certificate in the usual form.

In this case, the clinic must cancel the submitted form and issue a paper document. If you find out in advance whether the accountant can accept the electronic format, then there will be no problems. The employer is not obliged to use the new FSS personal account system. Everyone makes their own decision.

When registering a sick leave, the patient must give written consent to the doctor for the processing of personal data and execution of the document online. The sheet does not need to be certified by the registry.

The sick leave certificate has a unique code by which you can find it in your FSS personal account. You can bring it to work or tell the accountant by phone.

Mobile application of the social insurance fund

The FSS has created an application for smartphones. You can find it in the Google Play store. Click the "Install" button. Wait for the new shortcut to appear.

Through the program, you can independently calculate the amount of payments, find out how to send documents, and find addresses of social facilities. The application also contains all the latest FSS news. Essentially, the application serves as a replacement for the official website. Users receive any information of interest related to the activities of the fund.

To get all the features of the application you need to log in. You must have an account on the government services portal. It must be confirmed, otherwise the functionality will remain limited. After logging in, you can track the progress of payments for insured citizens.

How to check your sick leave certificate

At any time, an employee can open his personal account and view the status of his sick leave. In order to receive information, you must register on the State Services portal. In the login field you need to enter your phone number and password. After logging into your FSS personal account, you can view all electronic sick notes and find out the following information:

- How much benefit is accrued?

- Sick leave extended, opened or closed;

- On what dates are you considered disabled;

- Is the document drawn up correctly by the employer?

You can receive notifications about changes in sick leave status by email. In your FSS personal account, you can use the payment calculator function. You can independently calculate the approximate amount of sick pay. To do this, open the calculator in the upper right corner and fill in all the required fields.

The service will ask you about the reason and period of incapacity for work, as well as whether you were in a hospital and did not violate the regime. In addition, you will need to indicate the date when you started working at your last place of work, as well as the amount of wages you received over the last 2 years. It is worth noting that the result obtained depends on the regional coefficient.

After entering all the data, you should click on the “Calculate” button and the website will show the approximate cost that the accountant should charge you for the electronic sick leave.

Insured Account Settings

After authorization in the system, the services page of the personal account of the recipient of social insurance services opens. Its interface allows you to use almost the full functionality of the Internet portal.

Typically, work in the system begins with setting up an account for the insured person. It requires activating the “Personal Data” section of the additional menu, which allows you to open a page with personal information about the user. These include:

- basic information about the recipient of insurance services - full name, gender, year, day and month of birth, SNILS;

- details of identity documents;

- if available, information about disability;

- information on the insured person located in the Pension Fund databases;

- contact details – address, e-mail, phone number.

The source of information about the insured person is the Social Insurance Fund database. Therefore, to correct the above data, a personal application to the regional division of the fund is required.

Toll-free FSS hotline

The central office of the FSS is located in Moscow. Its opening hours are from 9.00 to 18.00, on Friday until 16.45. The reference telephone number that receives calls from Russia and abroad: +74956680333 operates in the operating mode of the FSS central office.

Please note that the number is not toll-free. Outgoing calls are charged according to the terms of the current tariff plan. In order to avoid unnecessary expenses and resolve the situation as quickly as possible, it is recommended that you contact local FSS offices with questions.

You can send a text message for free, attaching the necessary documents via fax. Fax number: +74956680234. During business hours, the fax will be received by an operator; the rest of the time the machine receives documents automatically. All received faxes are registered and sent for execution.

Hotline in Moscow

Phone number of the call center of the Moscow regional branch of the FSS: +74956501917. Fax: 4956502414. Email: [email protected]

Hotline in St. Petersburg

+78126778717 – reference number of the St. Petersburg regional branch of the FSS. Fax: 8123463583. Email: [email protected]

Hotline in the regions

The official website of the FSS - fss.ru - has complete information on hotlines in regional offices throughout the country, in:

- Republics;

- Autonomous okrugs;

- Cities;

- Edges and regions.

The service is created in such a way that when you hover your mouse over the location of a settlement on a map of the Russian Federation, the Hotline telephone number immediately appears.

FSS website

You can obtain current and reliable information about the activities of the Social Insurance Fund, the procedure for calculating benefits, and the amounts of payments for temporary disability on the official website of the Social Insurance Fund https://fss.ru.

The site is designed with high quality, and its interface is simple and understandable for users of any age category. The most popular sections are located in the header of the site.

On the website you can find the following information:

- With the main regulations governing the work of the Social Insurance Fund, the procedure for deductions, the fund’s budget, as well as the rights of the persons insured in it (the “Regulatory Documents” tab);

- With types of benefits, their size and calculation procedure, a list of documents that must be collected to receive them. The “Types of Benefits” tab contains answers to the most frequently asked questions from the fund’s clients, as well as consultations with leading experts.

- The header contains a “Benefit Calculator”, with which you can approximately calculate the amount of compensation for your insured event.

- The “Statistics” section contains digital material about the activities of the fund, its budget, amounts of income and expenses. All information is presented in dynamics over several years. This section is updated regularly.

- After activating the “Links” section, the user can visit the pages of various government agencies and services by clicking on the active link provided.

On the right side of the main page of the site there is information about the regional branches of the FSS. You can find the branch of your region, office address, name of the manager and authorized representatives, telephone numbers. The card of each regional branch contains an active link to go to its official website.

On the left side of the main page there is information about the FSS and its history. Here are links to go to the electronic reception, to download programs necessary for the policyholder to submit reports, information about open vacancies and new projects.

FSS pages are open on popular social networks: Odnoklassniki, Vkontakte, Telegram and Facebook.