Options for errors requiring a refund and their consequences

In relations between counterparties, errors in the transfer of funds are possible, associated with:

- with the wrong choice of counterparty when generating a payment order;

- indicating an incorrect payment amount;

- reflection in the purpose of payment of the details of a document that does not exist in the relationship.

Such errors can be identified by any of the parties, but will require a mandatory written expression of the initiative of the payer of funds to take actions carried out in connection with their correction.

In a number of situations, the error can be corrected by adjusting the purpose of the payment if, for example, there is a supplier-buyer relationship between the counterparties, against which an erroneously transferred amount (or a payment with an incorrectly specified purpose) may be taken into account. Correction via payment adjustment cannot be applied if there are no current engagement agreements with the payee.

Regardless of the reason for which the payment was considered to have been made without reason, it is recorded by both the payer and the recipient using the same algorithms, taking into account the fact that for these two parties the transactions when returning the erroneously transferred funds will be mirror images.

Since erroneous transfers subject to refund have no connection with the calculations performed between suppliers and buyers, VAT on them is not allocated either for payment or as deductions. However, if calculations are carried out in foreign currency, then exchange differences attributable to income/expenses may arise. The recipient of the funds, when returning them, in the purpose of payment in the payment document should reflect information that this payment is used to return the funds erroneously transferred to him, and provide a link to the details of the document in which the payer expressed a request to return the money to him.

If the error is corrected by taking into account the transferred amount as payment under another supply agreement, then it will be taken into account in the usual manner for the supplier-buyer relationship with the implementation of the necessary VAT transactions.

Answer

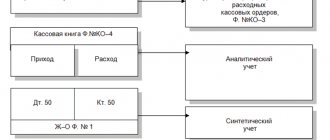

In accounting, funds erroneously received to the organization's current account should be reflected by posting Debit 51 Credit 76-2, returned Debit 76-2 Credit 51. When calculating the single tax, erroneously received amounts are not taken into account (clause 1 of Article 346.15 of the Tax Code of the Russian Federation).

What to do if funds were mistakenly credited to your current account

In accounting, the receipt of erroneously transferred funds, which the organization is obliged to return, should be reflected in the debit of account 51 “Current accounts in correspondence with account 76-2 “Calculations for claims (Instructions for the chart of accounts).

If funds are incorrectly credited to the organization's current account in accounting, make a posting*:

Debit 51 Credit 76-2

– funds mistakenly credited to the organization’s current account are taken into account.

Incorrectly received funds in accounting do not belong to the income of the organization. This is due to the fact that in accounting income is recognized as an increase in the economic benefits of the organization (clause 2 of PBU 9/99). However, when erroneously transferred money arrives in the current account, its purpose is not determined. They do not relate to income from ordinary activities or other income (clause 4 of PBU 9/99). The organization is obliged to return them, therefore such amounts cannot be recognized as income in accounting. In addition, in relation to these funds, the conditions for recognizing income given in section IV of PBU 9/99 are not met. An exception to this rule is funds received, which the organization has the right not to return. Reflect them in accounting depending on the purpose of the funds received (advance payment, accounts receivable with an expired statute of limitations, etc.).

When returning erroneously credited amounts, there is also no need to reflect them as expenses. This is due to the fact that in relation to such funds the conditions for recognizing expenses given in paragraph 16 of PBU 10/99 are not met.

In accounting, reflect the return (write-off) of funds previously credited to the current account by mistake by posting*:

Debit 76-2 Credit 51

– funds previously mistakenly credited to the organization’s current account are written off.

This is stated in the Instructions for the chart of accounts (76, 51).

Erroneously received amounts do not form the organization’s taxable income (clause 1 of Article 346.15 of the Tax Code of the Russian Federation)*. They do not relate to either sales income or non-sales income (Articles 249, 250 of the Tax Code of the Russian Federation). These amounts are not recognized as the economic benefit of the organization (Article 41 of the Tax Code of the Russian Federation). In the ledger for accounting income and expenses, approved by order of the Ministry of Finance of Russia dated October 22, 2012 No. 135n, erroneously received amounts do not need to be reflected. A similar point of view is contained in letters from the Ministry of Finance of Russia dated November 7, 2006 No. 03-11-04/2/231 and the Federal Tax Service of Russia for Moscow dated December 16, 2004 No. 21-09/81715.

It is not always known in advance that a deposit into a bank account is erroneous. Therefore, a situation may arise when the amount received will nevertheless be included in taxable income (reflected in column 4 of Section I of the book of accounting for income and expenses). In this case, corrections must be made to the book of income and expenses (clause 1.6 of the Procedure approved by order of the Ministry of Finance of Russia dated October 22, 2012 No. 135n).

Incorrectly addressed money arrived in the current account: postings

For the recipient of funds to whose current account money was mistakenly received, a posting reflecting the receipt of unidentifiable funds will be made at the time the payment document is linked to the accounting accounts.

A similar amount is debited to account 76, and this is done by posting Dt 76 Kt 51 (52).

Accordingly, if the erroneous payment is returned to the counterparty's current account, the posting will be reversed: Dt 51 (52) Kt 76. The exchange rate difference when returning currency will be reflected by the posting Dt 91 Kt 76 or Dt 76 Kt 91.

If, in relation to a payment reflected as an error, a decision arises to take it into account as payment for a future or already completed sale of goods (performance of work, provision of services), then on the basis of written information received from the payer, an entry will be made Dt 62 Kt 76 with the ensuing hence the VAT implications.

Procedure on the part of the recipient of the money

What should a company do if it has received an erroneous payment? She needs to send a notification of the error to the bank within 10 days. The form of notification is not specified by law. It is established by internal acts. If the bank does not have a prescribed form, the notice is drawn up in free form.

Further actions on the part of the banking institution:

- If direct debit is possible, the funds are debited without additional instructions.

- If this option is not available, a debit order will be required from the recipient of the erroneous payment.

Partially, the procedure for returning funds depends on local instructions established for a particular bank.

Postings when returning an erroneously transferred payment from a counterparty

For the payer, the amount transferred to the wrong counterparty or transferred in a larger volume also goes to account 76: Dt 76 Kt 51 (52) or Dt 76 Kt 60 (if it is no longer possible to correct the posting made on the payment order).

The return of incorrectly transferred funds from the counterparty in the postings will be expressed as Dt 51 (52) Kt 76. For currency payments, here you will also need to take into account the exchange rate difference, the amount of which will be charged either to the debit or credit of account 91 (Dt 91 Kt 76 or Dt 76 Kt 91).

If, in relation to an erroneous payment, a decision is made to offset it against payment for a delivery within the framework of an existing relationship with the counterparty, then the payment recorded on account 60 will simply change the analytics due to internal posting. In this case, it will be possible to take into account VAT in deductions for both advance payment and delivery.

What is an assignment

Article 31 of Federal Law No. 395-1 of December 2, 1990 “On banks” states that credit institutions must carry out instructions for transferring money. In this case, the rules approved by the Central Bank must be observed. The form is established by Central Bank Rules No. 383-P dated June 19, 2012. The order must contain mandatory information. A list of them is in Appendix 1 to Central Bank Regulation No. 383-P dated June 19, 2012.

The correct indication of all details in the payment order is essential for the correct identification of the payment. Without the details, it is impossible to complete the order. Without them, it is simply not clear to whom to transfer money. If the document contains incorrect details, the funds will be transferred to the wrong place. What to do if such an error occurs? It is necessary to issue a refund for the payment.

Results

All actions with a payment transferred to a counterparty by mistake are carried out with a written indication of their nature on the part of the payer. In this case, the funds can be offset against settlements on existing relationships. In the accounting of both the recipient and the payer, the amount of the erroneous payment is reflected in account 76. In correspondence with this account, both parties will show the cash flow for the return: Dt 76 Kt 51 (52) - for the returning party, Dt 51 (52) Kt 76 - at the recipient of the refunded funds. Returning an erroneous payment has no tax consequences.

Accounting and tax accounting

Entries are entered into accounting that are completely opposite to those that were used when accepting money for accounting. In particular, these wirings are needed:

- DT51 KT62. Arrival of money.

- DT62 KT51. Refund.

- DT76 KT51. Write-off for refund of erroneous payment.

Let's consider tax accounting for refunds on payment orders:

- USN. The transfer of money is recorded in taxable income. The payment must be reflected on the date of receipt of money on the account. When funds are returned by payment, it is necessary to reverse the income, which is taxed. The reversal is issued on the date of refund.

- BASIC. The crediting and return of money transferred by mistake is an operation that is not recorded in the OSNO.

Important! When accounting and tax accounting, it is important to pay attention to the dates of return/crediting of money. Each operation must be confirmed by the appropriate document.

Postings for the return of money and goods in the buyer’s accounting department

If significant deficiencies or defects are identified, the buyer may refuse to fulfill the terms of the contract in full and demand the supplier to return the money paid.

In such a situation, the buyer must send a written claim to the supplier to terminate the contractual relationship with a demand for a refund of the money paid.

The seller, in turn, has the right to return the goods refused by the buyer.

If the need to return the goods and money occurred after the buyer had posted material assets, then if the issue of returning the goods and money is resolved positively, entries will be made in the buyer’s accounting department to the appropriate sub-accounts, based on the claim to the seller and the invoice for the returned goods:

- D-t 62 invoices and K-t 90 invoices - for the amount of the returned goods,

- Invoice Dt 90 and Invoice Dt 68 - VAT is charged on the returned goods.

A refund from the supplier (seller) to the buyer’s bank account for a low-quality product (service) or a product of the wrong assortment will look like this:

- D-t 51 invoices and K-t 62 invoices - for the amount of the invoice issued by the buyer for the return of goods.

If the refund by the seller (supplier) was made directly at the buyer's (customer) cash desk, then the posting of the refund will look like a debit of 50 and a credit of 62 accounts.

Your right

Maybe after a year the consumption of 290 will be positive?

Justification How to take into account money to secure an application or execution of a contract for procurement under Law No. 44-FZ In the recommendation, we will tell you how to reflect the monetary security of an application or contract to an institution: - a procurement participant; - a customer.

The transfer of money as security for an application for participation in the procurement should be reflected in article KOSGU 610 “Disposal from budget accounts.” Such clarifications are given in the letter of the Ministry of Finance of Russia dated April 27, 2015 No. 02-07-07/24261. The application of this article is due to the fact that the money that the institution transfers to secure the application is not the institution’s expenses, but leads to a decrease in the balance on the personal account.

Make the following entries in accounting: Contents of the transaction - Money was transferred to the customer (ES operator) as security for the application Dt 0.210.05.560 Kt 0.201.11.610 Increase in off-balance sheet account 18 (according to KOSGU code 610) Return of collateral from the customer or ES operator (in established cases) reflect under article KOSGU 510 “Receipts to budget accounts” (letter of the Ministry of Finance of Russia dated April 27, 2015

No. 02-07-07/24261). Make the following entries in accounting: Contents of the transaction - Reflects the receipt of collateral returned by the customer (ES operator) Dt 0.201.11.510 Kt 0.210.05.660 Increase in off-balance sheet account 17 (according to KOSGU code 510)

Postings for the return of money and goods in the accounting department of the supplier (seller)

The receipt of returned goods in the supplier's accounting department is carried out on the basis of an invoice issued by the buyer for the return of materials (goods):

- D-t 60 invoices and K-t 10, 41 invoices - for the amount of the returned goods,

- Invoice Dt 19 and Invoice Dt 60 - VAT is reflected on the returned goods.

A refund to the buyer’s bank account for a low-quality product or product of the wrong range from the supplier will look like this:

- D-t 60 invoices and K-t 51 invoices - for the amount of the invoice issued by the buyer for the return of goods.

If the refund to the buyer was made directly at the seller’s cash desk, then the postings will look like debit 60 and credit 50 to the account.

We will set up any reports, even if they are not in 1C

We will make reports in the context of any data in 1C. We will correct errors in reports so that the data is displayed correctly. Let's set up automatic sending by email.

Examples of reports:

- According to the gross profit of the enterprise with other expenses;

- Balance sheet, DDS, statement of financial results (profits and losses);

- Sales report for retail and wholesale trade;

- Analysis of inventory efficiency;

- Sales plan implementation report;

- Checking of employees not included in the time sheet;

- Inventory inventory of intangible assets INV-1A;

- SALT for account 60, 62 with grouping by counterparty - Analysis of unclosed advances.

Order report customization

Refund of erroneously (excessively) paid funds

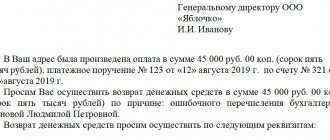

Refunds of funds transferred to the supplier by mistake are made on the basis of a letter from the customer, which indicates the payment document, its number, date and the amount paid by mistake.

The party that received the erroneous amount reconciles the calculations and deliveries. If excess money is discovered, the supplier returns it to the customer.

In the accounting department of the customer (buyer), the erroneously transferred money is reflected in account 76, the corresponding subaccount.

Posting a refund of funds erroneously transferred to the seller to the customer’s bank account will look like:

- D-t 51 accounts and K-t 76 accounts - in the amount of excessively (erroneously) transferred funds.

The return of money through the customer's cash desk is recorded as turnover on the debit of account 50 and the credit of account 76.

Consultation on accounting entries for financial returns can be obtained from organizations specializing in consulting accountants or tax authorities. Qualified employees of these organizations will answer any questions you may have regarding accounting for the company’s funds.

How are payments made using a corporate card?

For this purpose, it is possible to approve a local act regulating the payment scheme for the card and the frequency of drawing up reports on money spent. The internal regulations for using a corporate card perform a number of tasks:

- approves a list of situations in which the employer has the right to file claims against the responsible employee for misappropriation of money, identified shortages or abuses;

- minimizes the risks of disputes with tax authorities in matters of withdrawing cash from cards;

- makes the process of withholding card shortages from guilty parties as transparent and understandable as possible.

In the rules for the use of corporate cards approved by the enterprise, it is necessary to fix limits on various types of spending actions, approve the list of employees allowed to access money on plastic cards, and establish a time frame for such access.

Topic: Posting a refund of an erroneously transferred amount

Quick transition Accounting and Taxation Up

- Navigation

- Cabinet

- Private messages

- Subscriptions

- Who's on the site

- Search the forum

- Forum home page

- Forum

- Accounting

- General Accounting Accounting and Taxation

- Payroll and personnel records

- Documentation and reporting

- Accounting for securities and foreign exchange transactions

- Foreign economic activity

- Foreign economic activity. Customs Union

- Alcohol: licensing and declaration

- Online cash register, BSO, acquiring and cash transactions

- Industries and special regimes

- Individual entrepreneurs. Special modes (UTII, simplified tax system, PSN, unified agricultural tax)

- Accounting in non-profit organizations and housing sector

- Accounting in construction

- Accounting in tourism

- Budgetary, autonomous and government institutions

- Budget accounting

- Programs for budget accounting

- Banks

- IFRS, GAAP, management accounting

- Legal department

- Legal assistance

- Registration

- Inspection experience

- Enterprise management

- Administration and management at the enterprise

- Outsourcing

- Enterprise automation

- Programs for accounting and tax accounting Info-Accountant

- Other programs

- 1C

- Electronic document management and electronic reporting

- Other tools for automating the work of accountants

- Clerks Guild

- Relationships at work

- Accounting business

- Education

- Labor exchange Looking for a job

- I offer a job

- Club Clerk.Ru

- Friday

- Private investment

- Policy

- Sport. Tourism

- Meetings and congratulations

- Author forums Interviews

- Simple as a moo

- Author's forum Goblin_Gaga Accountant can...

- Gaga's opusnik

- Internet conferences

- To whom do I owe - goodbye to everyone: all about bankruptcy of individuals

- Archive of Internet conferences Internet conferences Exchange of electronic documents and surprises from the Federal Tax Service

- Violation of citizens' rights during employment and dismissal

- New procedure for submitting VAT reports in electronic format

- Preparation of annual financial/accounting statements for 2014

- Everything you wanted to ask the electronic document exchange operator

- How to turn a financial crisis into a window of opportunity?

- VAT: changes in regulatory regulation and their implementation in the 1C: Accounting 8 program

- Ensuring the reliability of the results of inventory activities

- Protection of personal information. Application of ZPK "1C:Enterprise 8.2z"

- Formation of a company's accounting policy: opportunities for convergence with IFRS

- Electronic document management in the service of an accountant

- Time tracking for various remuneration systems in the program “1C: Salary and Personnel Management 8”

- Semi-annual income tax report: we will reveal all the secrets

- Interpersonal relationships in the workplace

- Cloud accounting 1C. Is it worth going to the cloud?

- Bank deposits: how not to lose and win

- Sick leave and other benefits at the expense of the Social Insurance Fund. Procedure for calculation and accrual

- Clerk.Ru: ask any question to the site management

- Rules for calculating VAT when carrying out export-import transactions

- How to submit reports to the Pension Fund for the 3rd quarter of 2012

- Reporting to the Social Insurance Fund for 9 months of 2012

- Preparation of reports to the Pension Fund for the 2nd quarter. Difficult questions

- Launch of electronic invoices in Russia

- How to reduce costs for IT equipment, software and IT personnel using cloud power

- Reporting to the Pension Fund for the 1st quarter of 2012. Main changes

- Income tax: nuances of filling out the declaration for 2011

- Annual reporting to the Pension Fund. Current issues

- New in financial statements for 2011

- Reporting to the Social Insurance Fund in questions and answers

- Semi-annual reporting to the Pension Fund in questions and answers

- Calculation of temporary disability benefits in 2011

- Electronic invoices and electronic primary documents

- Preparation of financial statements for 2010

- Calculation of sick leave in 2011. Maternity and transition benefits

- New in the legislation on taxes and insurance premiums in 2011

- Changes in financial statements in 2011

- DDoS attacks in Russia as a method of unfair competition.

- Banking products for individuals: lending, deposits, special offers

- A document in electronic form is an effective solution to current problems

- How to find a job using Clerk.Ru

- Providing information per person. accounting for the first half of 2010

- Tax liability: who is responsible for what?

- Inspections, collection, refund/offset of taxes and other issues of Part 1 of the Tax Code of the Russian Federation

- Calculation of sick sheets and insurance premiums in the light of quarterly reporting

- Replacement of unified social tax with insurance premiums and other innovations of 2010

- Liquidation of commercial and non-profit organizations

- Accounting and tax accounting of inventory items

- Mandatory re-registration of companies in accordance with Law No. 312-FZ

- PR and marketing in the field of professional services in-house

- Clerk.Ru: design change

- Building a personal financial plan: dreams and reality

- Preparation of accounting reporting. Changes in Russia accounting standards in 2009

- Kickbacks in sales: pros and cons

- Losing a job during a crisis. What to do?

- Everything you wanted to know about Clerk.Ru, but were embarrassed to ask

- Credit in a crisis: conditions and opportunities

- Preserving capital during a crisis: strategies for private investors

- VAT: deductions on advances. Questions with and without answers

- Press conference of Santa Claus

- Changes to the Tax Code coming into force in 2009

- Income tax taking into account the latest changes and clarifications from the Ministry of Finance

- Russian crisis: threats and opportunities

- Network business: quality goods or a scam?

- CASCO: insurance without secrets

- Payments to individuals

- Raiding. How to protect your own business?

- Current issues of VAT calculation and reimbursement

- Special modes: UTII and simplified tax system. Features and difficult questions

- Income tax. Calculation, features of calculus, controversial issues

- Accounting policies for accounting purposes

- Tax audits. Practice of application of new rules

- VAT: calculation procedure

- Outsourcing Q&A

- How can an accountant comply with the requirements of the Law “On Personal Data”

- The ideal archive of accounting documents

- Service forums

- Archive FAQ (Frequently Asked Questions) FAQ: Frequently Asked Questions on Accounting and Taxes

- Games and trainings

- Self-confidence training

- Foreign trade activities in harsh reality

- Book of complaints and suggestions

- Diaries

Who is required to use CCP

All legal entities and individual entrepreneurs are required to use cash register equipment when making payments, including non-cash payments.

The cash register, included in the register of cash register equipment, is used on the territory of the Russian Federation without fail by all organizations and individual entrepreneurs when making payments.

The definition of the term “settlements” is given in Article 1.1 of the Federal Law of May 22, 2003 No. 54-FZ “On the use of cash register equipment when making payments in the Russian Federation” (hereinafter referred to as Law No. 54-FZ). In particular, settlements mean the acceptance (receipt) and payment of funds in cash and (or) by bank transfer for goods, work, and services.

CCT is not used for non-cash payments between organizations and individual entrepreneurs, with the exception of settlements using an electronic means of payment (for example, a bank card) with its presentation.

The receipt of erroneously transferred funds from an individual to the organization's current account without the sale of goods (work, services) to him is not a settlement within the meaning of Law No. 54-FZ. Therefore, in this case there is no need to run a cash register check.

The supplier came for cash: we issue money correctly

- to confirm that you paid for the purchased goods, works, services to the proper person - in case the supplier claims that he did not receive payment from you. After all, if you have not exercised your right to demand evidence that you are giving money to the proper person, then all the risks associated with the fact that the supplier will not receive payment are borne by you, Art. 312 Civil Code of the Russian Federation;

- to confirm payment of expenses for the simplified tax system and the cash method of calculating income tax. Without a power of attorney, tax authorities may consider payment for goods, work, or services unconfirmed and will remove expenses for them from the calculation of the tax base. After all, cash settlement confirms only the issuance of money from the cash register, and a power of attorney confirms that the money was issued to a specific supplier in payment for specific goods, work, and services.