Since 2012, tax services have been checking compliance with cash discipline. As practice shows, the availability of the necessary documents and their correct execution is the key to successful inspections. Cash documents also include a cash receipt order. In addition to the fact that it records the issuance of funds from the cash register, RKO is additionally the connecting link of accounting entries. We will provide an example of how to correctly fill out a cash receipt order and tell you about the nuances of its use.

How to apply for RKO

Below are the basic rules and procedure for registering settlement settlements for individual entrepreneurs and organizations. A sample of this document is also attached.

- There is a special point where you need to indicate the structural divisions of your company. If they exist, then we indicate them. If they are not there, then put a dash.

- You must number such documents in the order of their appearance and enter them in a special journal, Form KO-3.

- Don’t forget to fill in the “OKPO Code” column.

- The document is drawn up exactly on the same day on which the funds were issued. It is important.

- We write rubles in numbers, we write kopecks after the decimal point (example - 100.40 rubles).

- There is also a column “Amount”. In it, rubles are written in capital letters, kopecks are indicated in numbers.

- We draw up the “Received” column according to the same principle.

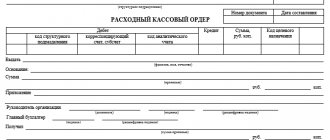

Sample of filling out the RKO form in 2021

RKO sample that can be used by both companies and entrepreneurs

What should a cash receipt order look like?

Sample

Sample cash receipt order for depositing cash to the bank

Cash settlement service for depositing cash at the bank

RKO for payment of wages according to the statement

RKO for payment of wages according to the statement

How to fill out RKO correctly in other cases

In the case of payment of money to provide financial assistance to an employee, a correct entry must be made in the “Base” field, for example, “Issue of financial assistance.” In addition, in the “Attachment” field you need to refer to the number and date of the corresponding application.

Who has the right to sign the document

Below is a list of officials who must sign the cash receipt order.

- Head, General Director of the company.

- Cashier or accountant performing his duties.

- Recipient of funds.

This document is not stamped.

How to fill out a cash receipt order. Preparation of cash documents: PKO, RKO, cash book

All organizations, including small enterprises, must prepare cash documents, but individual entrepreneurs may not draw up a cash book, draw up PKO and RKO. Correct and timely execution of cash documents is the responsibility of every organization.

Receipt cash order

When cash is received at the cash desk, it is drawn up according to form No. KO-1 in one copy. The PKO receipt is issued to the depositor of money to the cash desk.

When cash proceeds are received from citizens or organizations, a cash receipt receipt is issued, and a cash register receipt is drawn up for the entire amount of revenue for the day based on the control tape. The cashier must enter cash into the cash register before the end of the working day or the arrival of the collector.

The numbering of the PKO is arbitrary, usually in ascending order; you can use a letter code or a date.

Account cash warrant

When issuing money from the cash register, it is drawn up according to form No. KO-2 in one copy, and the recipient is given a RKO receipt.

When issuing salaries to full-time employees, a payroll sheet is drawn up in Form No. T-49 or a payroll sheet in Form No. T-53. A RKO is drawn up for the entire amount of the salary paid.

Corrections in PKO and RKO are not allowed; if an error is made, a new document must be drawn up.

Orders can be entered on paper by hand or in an automated manner.

Journal of registration of incoming and outgoing orders

Currently, the journal for registering receipts and expenditure orders in form No. KO-3 is not a mandatory document; it is not mentioned in the Procedure for Conducting Cash Transactions. Whether or not to keep a journal is a voluntary matter for the organization. There is no responsibility for its absence or non-filling.

The journal is intended for preliminary registration of PKO and RKO: the date, number, amount of the document and a note are indicated. After registration in the journal, monetary documents are transferred to the cashier's office.

The registration log is stored in the organization’s archives for 5 years.

Expense cash order is a document belonging to the primary category. Let's consider what criteria Russian organizations must follow when filling it out.

Page not found

If suddenly the form is damaged, then you just need to fill it out again.

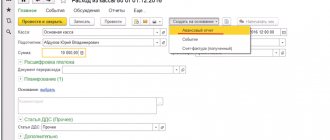

You can fill it out either by hand or using an accounting program on your computer. In addition, some sites allow you to create a cash receipt order online.

The main instructions for correctly filling out the PQS are prescribed in Bank of Russia Instructions No. 4416-U dated June 19, 2017.

Please note that the form is divided by a tear line into two parts, both of which must be filled out at the same time.

On the left is the receipt document itself; this part remains in the budget organization. It is signed by the chief accountant and cashier.

On the right is the receipt. It is signed and certified by the seal of the budget organization, and then given to the person who deposits the cash.

PKO can be compiled:

- for each operation of accepting cash at the cash desk;

- for the entire amount of money received at the cash desk of a budget organization per day. Such a PKO is drawn up on the basis of a control tape removed from cash register equipment, strict reporting forms equivalent to a cash register receipt, and other documents provided for by Law No. 54-FZ dated May 22, 2003.

The cash book is kept by the cashier (clause 4, clause 4.6, clause 4 of Directive N 3210-U). The Central Bank allows any employee to fill out the book. When the amendments come into force, the director will be able to fill out the book, for example (clause 4 of Directive No. 3210-U).

Is it necessary to issue a cash receipt order?

In accordance with information from the Ministry of Finance No. PZ-10/2012, Russian organizations have the right not to use forms of accounting documents contained in albums of unified forms of relevant sources. One of the albums of this type is included in the structure of Resolution No. 88, and it reflects the KO-2 form.

At the same time, in accordance with the same source, forms of documents that are approved by authorized structures on the basis of federal laws remain mandatory. Thus, in accordance with clause 4.1 of the Bank of Russia Directive No. 3210-U dated March 11, 2014, cash transactions must be formalized by business entities using cash outgoing orders corresponding to number 031002 according to the OKUD classifier, that is, exactly those provided for by Resolution No. 88.

In accordance with Art. 34 of the Law “On the Central Bank of the Russian Federation” dated July 10, 2002 No. 86, the Bank of Russia has the right to establish the procedure for conducting cash transactions for legal entities in general, as well as a simplified procedure for individual entrepreneurs and small businesses. Therefore, all taxpayers with the status of legal entities, entrepreneurs and small businesses are required to follow the provisions of Directive No. 3210-U. Thus, the legislation requires Russian organizations to use exactly the form of cash receipt order that is established by Resolution No. 88.

However, individual entrepreneurs who, in accordance with the legislation of the Russian Federation on taxes and fees, keep records of income or income and expenses or physical indicators characterizing a certain type of business activity, may not draw up cash documents and a cash book (clauses 4.1, 4.6 of Directive No. 3210-U) . Thus, if an entrepreneur takes into account the movement of business funds in the books of income (and expenses), then he may not formalize cash settlements.

Read more about cash discipline in 2017-2018.

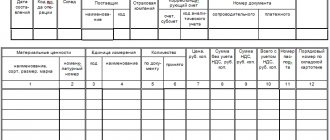

Stamp instead of receipt order m 4, sample

When receiving materials from the supplier, the purchasing company must issue a primary accounting document confirming not only the receipt and receipt of materials, but also their receipt. Such a document is usually a receipt order. The company has the right to develop the form of this document independently in compliance with the necessary requirements or use the unified M-4 form. This document is filled out upon receipt of materials in a single copy by the financially responsible person on the part of the purchasing company. For example, this could be a storekeeper or warehouse manager.

Which sources of law provide a sample of filling out an expense cash order?

Filling out an expense cash order is not regulated by federal law. Resolution No. 88 provides brief instructions regarding the application and completion of the RKO form:

- the contents of the operation must be recorded in the “Base” line of the order;

- the “Attachment” line should reflect the list of attached documents.

Instruction No. 3210-U contains the following information on filling out cash receipts:

- The cashier checks for the signature of the chief accountant or accountant, and if they are absent, for the presence of the manager’s signature. When registering a cash settlement on paper, the signatures must match the sample.

- The correspondence of the cash amounts entered in figures with the amounts entered in words is checked.

- The cashier checks the presence of supporting documents listed in the cash register.

- Cash issuance is carried out by the cashier directly to the recipient specified in the cash settlement or power of attorney. The recipient is identified by an identification document, usually a passport. The cashier checks the information about the recipient of the money in the cash register with the information on the identity document.

- The recipient of the funds must sign the cash settlement; if the order is drawn up in electronic form, then it can be signed with an electronic signature.

What day should I indicate in the “Date of compilation” field of RKO

This question arises if the salary is issued within several days. Instruction No. 3210-U directly states that RKO is drawn up for the amounts actually issued in paragraph. 4 clause 6.5 Instructions. Therefore, the date of compilation of the RKO

- this is

the closing date of the statement,

that is, the last day of payment of salaries. This rule is explained by the fact that it is not known in advance whether all employees will come to the cash desk for their salaries, therefore, it is impossible to predict what amount will be issued.

Some organizations set the date of the 1st day of payment of wages (the 1st day of the period indicated in the statement), since they believe that the expense order formalizes the director’s order to issue wages in cash, and not transfer them to the accounts of employees. However, this is not true. Such an order is the payroll or payroll itself, signed by the director, and non-cash salaries are transferred on the basis of the payroll and Instructions for the use and completion of forms of primary accounting documentation for accounting for labor and its payment (Payroll), approved. Resolution of the State Statistics Committee dated January 5, 2004 No. 1. In addition, since June 1 last year, the signature of the director in the RKO is not required.

Basic rules for filling out a cash receipt order, examples

The sample filling out of the cash register must meet the following key criteria:

- if the enterprise does not have structural divisions, a dash should be placed in the corresponding paragraph of the form;

- the numbering of cash registers must correspond to the sequence established in the journal of registration of accounting documents (form KO-3, introduced by Decree No. 88);

- in the column “OKPO Code” information from state statistics is recorded;

- the date of drawing up the order must correspond to the date when the cash was issued from the cash desk;

- the amount is written in rubles using commas, for example 100.45 rubles;

- in the “Amount” column, the amount of money issued from the cash register is recorded in words, and the number of rubles should be indicated by a phrase starting with a capital letter, kopecks - by numbers;

- similarly to the rules formed for the “Amount” column, the “Received” column is filled in.

The listed points reflect problematic, controversial points common among Russian accountants who discuss certain examples of filling out cash receipts.

You can download the completed sample RKO-2 on our website.

How to properly report money

When issuing cash to report on a cash receipt order, the accountant must adhere to certain rules established by the procedure for conducting cash transactions (clause 6 of the instruction of the Central Bank of the Russian Federation dated March 11, 2014 No. 3210-U). Let's consider the main actions of an accountant:

- The employee is checked for debt on previous advances issued for reporting purposes. If there is one, then you cannot issue a new amount. You must first pay off your existing debt.

- If there is no debt on account 71, the employee’s application is accepted, which contains a request for the payment of a certain amount for a specified period, written in free form addressed to the manager. The manager's decision, signature and date are checked. Such a statement serves as the basis for issuing money for reporting.

- Next, a cash receipt order is issued in a single copy. Signed by an accountant or manager if both positions are occupied by the same person.

- The completed RKO, together with the application, is handed over to the cashier, who checks all items of the consumables for correct filling, and checks them with the document for the basis of issue.

- The cashier prepares the money, checks the identity of the accountant using the passport received from him, gives him the cash register for recording the amount, signing and date.

- After checking the records made by the employee, the cashier issues the money and puts his signature on the cash register.

- Then an entry is made in the cash book, and the tear-off part of its sheet is stitched with the cash receipt order.

IMPORTANT! Individual entrepreneurs, in accordance with the instructions of the Central Bank of the Russian Federation No. 3210-U, from 06/01/2014 may, at their discretion, not issue receipts and expenditure orders and not maintain a cash book.

When you can do without a statement, and when you can’t

If only one employee receives a salary at the cash desk or you have few employees in your organization, then when issuing salaries, you can do without a statement, that is, create a separate cash register for issuing money to each employee. This will not be a violation, because the issuance of wages according to RKO is provided for in Directive No. 3210-U along with the issuance according to the SP statement. 6 Directions.

But then the expense order must be drawn up according to the general rules - indicating f. And. O. and passport details of the employee and obtaining his signature. Also, such a cash settlement order will have to be signed by the director, because in this case the expense order also serves as a written order from the manager to issue wages from the cash register.

You can also make a statement for a single employee, if for some reason it is more convenient for you. Then the employee must sign only the statement, and he no longer puts his signature on the RKO compiled on its basis.

At the same time, there is a case when it is impossible to do without a statement - if the employee for some reason did not come to collect his salary on the days it was issued. A statement with the entry “Deposited” opposite the name of this employee serves:

- additional evidence that the failure to pay wages on time was not the fault of the employer. Let us remind you: for violation of the deadline for payment of wages, administrative fines are provided for. 1 tbsp. 5.27 of the Code of Administrative Offenses of the Russian Federation and payment of compensation to the employee for each day of delay. 236 Labor Code of the Russian Federation.

The Labor Code specifically stipulates that the said compensation is payable even if there is a delay by the employer

There is no salary payment, it’s his fault. 236 Labor Code of the Russian Federation. However, this rule does not work if the employee himself did not come to collect his salary, provided that at the beginning and end of the day of issue there was the required amount in the cash register and the money was prepared for issue according to a statement signed by the director. Indeed, in this case it is no longer possible to say that the employer delayed the salary;

- the basis for posting to the debit of account 70 and the credit of account 76, subaccount “Calculations for deposited amounts”;

- justification that personal income tax on wages was paid on time and not ahead of schedule.

You can read about the dangers of early transfer of personal income tax: 2014, No. 21, p.

4 Let us remind you: the tax agent must send personal income tax to the budget on the day he receives money from the bank for issuing salaries. 4, 6 tbsp. 226 Tax Code of the Russian Federation. But if one of the employees did not come for the money, then without a statement with the inscription “Deposited” there is no confirmation that the money withdrawn from the account was intended specifically for issuing a salary to this employee. Then, in the event of an audit, tax authorities may regard the personal income tax transferred to the budget as an erroneous payment by the employer in the budget. Letters of the Federal Tax Service dated September 29, 2014 No. BS-4-11/, dated July 25, 2014 No. BS-4-11/, since payment of the tax is from funds tax agent prohibited app. 9 tbsp. 226 Tax Code of the Russian Federation. And fine the organization under Art. 123 of the Tax Code for the fact that personal income tax was not paid when the late employee finally came to collect his salary.

What should you do if you issued wages to present employees using “personal” cash settlements without drawing up a statement, and after that it turned out that one employee did not come for the salary? Then the payroll will have to be prepared only for this one employee. This is unusual, but there is no violation in this.

And finally, there is also a situation when there is a salary slip, but the cash register is not needed for it - if the entire amount indicated in the payroll has been deposited. After all, the money was never released from the cash register.

Sample RKO for issuance for reporting: what does the document consist of?

Looking at the cash receipt order form, we can roughly divide it into three main parts:

- the first indicates the details of the document;

- in the second it is written for what purposes and to whom the money is given, with corresponding accounts and signatures of responsible persons;

- in the third, the procedure for issuing cash with the signatures of the performers is formalized.

Here you can issue a cash order in form No. KO-2, approved by Resolution of the State Statistics Committee of Russia dated August 18, 1998 No. 88.

Let's look at a sample of line-by-line filling of RKO for a sub-report - what information should be entered into it and how.

| Line name | |

| Organization | The name is written as indicated in the constituent documents |

| The code received upon registration in the statistics department is entered | |

| Structural subdivision | If there is such a unit, the line is filled in; if not, a dash is added. |

| Document Number | The next RKO number is indicated |

| Date of preparation | The date of issue of money is written in the report |

| Structural unit code | Enter the assigned code for the existing branch |

| Corresponding account | In case of issuance, a score of 71 is entered into the report. |

| Analytical accounting code | The assigned code for a specific accountant is written |

| The score is set to 50 | |

| Amount, rub., kopecks | The amount issued is indicated in numbers |

| Enter the full name of the accountable person | |

| Base | In the case of issuing a report, the following is written: “under report”, the purpose is indicated, for example, “for the purchase of goods” or “for travel expenses”, and the document is “employee application” |

| Rubles are written in capital letters, kopecks are written in numbers, an empty space on the line is crossed out | |

| Application | The document is indicated: the employee’s statement and the date of its preparation |

| Supervisor, Chief Accountant | Responsible persons sign with full name and full name. |

| The accountant indicates the amount in words with a capital letter and makes a dash in the empty space | |

| Enter the details of the identity document of the employee to whom the cash is issued | |

| Issued by the cashier | The employee who issued the money signs and makes a full transcript of his full name. |

Corrections when filling out RKO are not allowed. The document must be drawn up without errors or blots. In an organization, a manager can perform the functions of an accountant and cashier. In this case, it is recommended to reflect this fact in the accounting policy.

Filling out the approved RKO form

The form (form) of the accounting document under consideration was approved by the Committee of Statistics of the Russian Federation in the Resolution “On approval of unified forms for recording cash transactions...” No. 88, last edition dated May 3, 2000). The number of the approved RKO form, according to the resolution, is No. KO-2.

Sample of filling out cash register for individual entrepreneurs (example):

Let's take a closer look at the nuances of correctly filling out the form details:

- in the lines “Organization” and “Structural division” the full name is indicated; if there is no division, “——-” (a dash) is entered;

- “Document No.” and “Date” must be identical to the registration No. in the enterprise’s accounting journal;

- “Debit” cells (department code, correspondent/account number, analytical accounting code for correspondent account) are filled in when using individual entrepreneurs in accounting; if absent, put “———” (dash);

- line “Credit” - according to the chart of accounts, the account is indicated - 50 “Cash”;

- “Destination code” - must correspond to the purpose of issuance. A dash is added if the company does not use target codes in accounting;

- “Issue” - the recipient’s details are indicated, the full name is written down, abbreviations are not allowed;

- "Base". For example, you can indicate the following: advance payment for a business trip, issuance of financial assistance, issuance of scholarships, salaries, etc.;

- line “Amount” - filled in words. The empty space on the line is crossed out;

- cell “Amount” - fill in the digital value;

- “Appendix” - if there are additional documents, fill in the details of these documents, for example, a power of attorney.

Compliance with the above rules for filling out the form and the validity period of the order will help prevent gross errors and corrections when registering and using cash settlement services. A sample of the approved form can also be found on the website of the Russian Statistics Committee.

The cash receipt order is one of the main documents in cash discipline, so it is used in every organization. Cashiers and accountants should understand why the cash register is needed, how to fill it out correctly, and where the stamp is placed on this document. We will answer the most important questions and provide an example of how to fill out the RKO ideally.

RKO is a document that allows you to regulate the process of issuing cash in different situations.

An expense cash order may be required for the following operations:

- issuing salaries to employees;

- refunds to customers;

- issuance of funds against reporting to the employee for the needs of the organization (for example, travel expenses).

Basis in RKO when issuing for reporting

As we have already found out, only after the accountant’s application is signed and dated by the manager, the accountant can issue a cash settlement and pay the money to the accountant. The application can be written either by hand or submitted in printed form. It might look something like this:

To the Director of Rassvet LLC

M. M. Shipovalov

from employee Yu. V. Zvyagintsev

Statement

Please give me 1,000 rubles. 00 kop. (one thousand rubles) for a period of 10 calendar days for the purchase of fuel and lubricants for a company car.

Yu. V. Zvyagintsev 03/12/2016

I allow

Director ______________ M. M. Shipovalov 03/12/2016

When registering RKO, in the line to indicate the basis, write “under report” and indicate the document: “application”, with the date of its preparation. It is also recommended that the application form be approved by order on accounting policies as an annex to the regulations on settlements with accountable persons.

IMPORTANT! From 06/01/2014, on the basis that an employee of an organization is considered to be a person working under both an employment and a civil law contract, money on account can also be issued to persons who have entered into a civil law contract with the organization.

For novice accountants, as well as for those practicing accountants who want to check themselves on the correctness of filling out the cash register accountant for an accountable person, we offer filling out an expense order for reporting right here.

It must be remembered that before starting to fill out the cash register accountant, the accountant must receive from the employee his own handwritten application, endorsed by the manager. You need to draw up an expense cash order carefully; you must not make mistakes or make corrections. To do this, we advise you to download our sample and always have it at hand.

The main form drawn up when issuing cash from the company's cash desk is a cash expense order (RKO). It must be filled out every time money is spent in the course of business or other activities. The procedure for conducting cash transactions allows only entrepreneurs who keep records in a simplified version not to use cash settlement services.

The regulatory act that came into force in 2014 determines that you can use not only the standard KO-02 form, but also your own forms developed taking into account the needs and characteristics of the activity.

An expense order can be drawn up by an accountant, including a chief accountant, a cashier, the head of a company (if there is no accounting department at the enterprise) or a hired specialist hired under a contract. In this case, all necessary signatures are affixed by the director of the organization.

A form purchased from a printing house or filled out using specialized programs can be used. The consumable must not contain any corrections, otherwise it is considered invalid. If an error is made, the document must be reissued in the correct version.

The basis for spending money, with the exception of salary, is the employee’s statement, signed by the director of the company, indicating the direction of spending.

The issued form is presented to the cashier, who accepts it and checks that it is filled out correctly and that all required signatures are present. Then he records it in the log book.

Before issuing cash, the official must request an identification document from the recipient. After checking with him, the cashier enters the details of the passport or other document in the appropriate fields. Then the cash register employee transfers the funds to their recipient, who needs to count them and, if the amount is correct, sign for the consumables.

Important! If money is issued to an authorized person, then the power of attorney is checked along with the passport, after which it is attached to the cash register.

Employees can be paid according to payroll or payslips. In this case, when closing them, expense orders for the total amounts are also drawn up. The document is then handed over to the cashier, who stamps it “Paid.” Together with the cashier's report at the end of the day, the cash register is submitted to the accounting department.

Please pay attention! Employees who were given money for or for business expenses must report on the fact of their expenditure. Acceptance of money at the cash desk is carried out on the basis.

When to use

RKO is required to be filled out whenever cash is to be issued in person. These may be the following cases:

- during the delivery of proceeds, which are transferred to the bank account of a banking institution. In this case, in the “Base” section the following should be written: “Cash proceeds intended for transfer to the company’s account”;

- when issuance occurs to the accountable person. An example is the use of funds to conduct activities by an employee in the interests of the specified company. Cash is issued according to a written application from the accountable person. You can fill out the document in any form; it is necessary to display the amount issued and the duration during which you can dispose of it;

- when money is issued to an employee of an enterprise for independent use. These may include business trip expenses, financial assistance and other payments. Then you should enter the designation “For your own needs” in the destination line;

- when the company needs cash to carry out necessary work. A prerequisite is to display the specific intended purpose of the funds issued. The purpose of the payment may be worded: “Cash for the purchase of products” or “For settlements with suppliers.”

Note! All actions with cash register services are confirmed by a cash register stamp.

Standard print type

Expense cash order sample filling

Let's look at a sample of filling out the RKO.

At the top of the document is written the name of the company and its code according to the OKPO directory. If the form relates to a specific department, then its name must be indicated below. Otherwise, “-“ is placed here.

To the right of the title of the document “Cash expenditure order” the serial number and the date of its execution are written down. The latter should look like DD.MM.YYYY.

The following table contains accounting data - corresponding debit and credit accounts, codes of structural divisions and analytical accounting - if they are used in the enterprise. Then the RKO amount is written down in numbers. The “Purpose Code” field should be filled in only if the company has developed and uses the necessary coding system.

In the “Issue” field, write your full name. the person to whom funds are released from the cash register. It is not allowed to enter the name of the company here.

In the “Basis” field, the reasons for which the money is issued are indicated. For example, “Salary”, “Change to the bank”, “Daily allowance”, etc.

In the “Amount” field, enter the amount of the document in words.

In the “Appendix” field the names of the documents on the basis of which this operation is carried out are indicated - the employee’s application, payroll, receipt, etc.

Then the document is signed by the head of the company and the chief accountant, who put their personal signature.

Important! Below, the recipient of the funds must manually write the amount received in words and without abbreviations, put the date of receipt and personal signature. Then indicate the full details of the identity document - passport, foreign passport, military ID, etc.

The cash order is signed by the cashier. Next, all expenditure and incoming cash transactions are entered into.

What mistakes in signing can be dangerous?

1. Fiscal officials always check whether the “signatory” could physically sign the cash order on the day on which the cash order was issued. They do this easily - using a time sheet. That is, if, according to the work time sheet, the chief accountant, for example, was on vacation, but he signed the PKO on that day, then the fiscal authorities will consider that the PKO could not have been issued on the date of receipt of the cash and, accordingly, will consider the cash to be untimely capitalized.

And this is immediately a 5-fold fine of the amount of unpaid cash.

Or if, for example, the chief accountant has an 8-hour working day (from 9:00 to 18:00), and according to the Z-report, cash could be physically capitalized only, for example, at 22:00, then the cash is also not recognized as capitalized on the day of its actual receipt, if the PKO was signed by the chief accountant (since the chief accountant could not physically sign the PKO at 22:00, since he works until 18:00).

The courts also agree with this. A striking example is the “fresh” decision of the Second Administrative Court of Appeal dated April 24, 2019 in case No. 520/11526/18

. The fiscal officials insisted that the PKOs submitted for inspection could not be signed with the dates on which they were issued, since the chief accountant was absent from the workplace, as evidenced by the time sheets.

Both the court of first instance and the court of appeal supported the fiscal authorities in the legality of applying penalties to the enterprise for late posting of cash.

Therefore, to avoid such situations, it is important to correctly formalize “delegation” of the right to sign cash documents in the event that the chief accountant/cashier/director is physically unable to sign them (more on such delegation below).

Moreover, as follows from the case materials, the enterprise kept additional time sheets, which recorded that the chief accountant worked on the days on which the PKOs were signed. However, the courts did not take these additional timesheets into account because there was no indication of this on the main timesheet. Apparently, the business entity was thus trying, and in case something happened, to immediately (1) fight off the claims of the fiscal authorities about the impossibility of the chief accountant signing the PKO and (2) not run into the claims of the “trudoviks” about non-compliance with the labor rights of workers. But this “trick” did not help.

2. The second mistake is when the signature in the cash order is placed by a person who, instead of the chief accountant/director/cashier, was delegated the right to sign, but at the same time there is the full name of the director/chief accountant/cashier. That is, the actual signatory and his full name indicated in the cash order do not match . Therefore, if you delegate the right to sign to other persons, and they are the ones who sign the cash document, do not forget to change the settings in the software.

Attention! There is no need to change the position of “director”, “chief accountant”, “cashier” in the cash order or add additionally the position of the person to whom the right to sign has been delegated.

Receipt cash order (form KO-1) in 2018

Line "Organization". The name of the organization is indicated (for example, LLC “Carrot”). If the PKO is filled out by an individual entrepreneur, then we indicate so (for example, individual entrepreneur Sergeev P.P.)

The line below indicates the name and code of the structural unit in the organization. If there are no structural divisions, a dash is added.

Line “Code according to OKPO”. The OKPO code is indicated according to the data in the notification from Rosstat.

Field "Document number". The serial number of the PKO is indicated in accordance with the journal of registration of incoming and outgoing cash documents. According to the rules, cash documents are numbered in order from the beginning of each calendar year.

Field "Date of compilation". The PKO is drawn up on the day the money is received at the cash desk! And nothing else. The date is indicated in the format - DD.MM.YYYY. For example, 06/02/2017.

Column "Debit". Indicate the account number on the debit of which funds are received. Usually this is a count of 50 – “cash”. Individual entrepreneurs do not fill out this column.

TABLE BLOCK “CREDIT”. Individual entrepreneurs do not fill it out.

We write the code of the structural unit of the organization (if any) for which the PKO is being done.

Column “Corresponding account, sub-account”. The account number (subaccount) of the source of cash receipts is indicated according to the chart of accounts, for example:

• 51 – receipt of funds from the organization’s current accounts

• 62 – receipt of funds from buyers and customers

• 71 – return of money from accountable persons

• 75-1 – contribution by the founders of funds to the authorized capital

• 90-1 - revenue

Column “Analytical Accounting Code”. The corresponding code for the account specified in the previous column is reflected (provided that the organization provides for the presence of such codes).

Column "Amount". The amount of money received at the cash desk is recorded in numbers.

Column “Purpose code”. The code for the purpose of using the received funds is indicated (usually for targeted financing). This column is completed only if the organization uses the appropriate coding system.

The line "Accepted from". Indicated:

— Full name of an individual in the genitive case – if the money is accepted from an employee of the organization.

— “Name of organization” through “Full name” (see sample below) - if money is accepted from an employee of a third-party organization.

Line "Base". The basis for the receipt of funds (the content of the financial transaction) is specified. For example, “Payment under agreement No. 31 dated October 22, 2015”; “Return of the balance of accountable amounts.”

Line "Amount". We indicate the amount of money that goes to the cash register. In this case, rubles are indicated in words with a capital letter, and kopecks - in numbers. If there is a blank line left after writing the amount in rubles, a dash is placed in it.

The line "Including". The amount and rate of VAT are indicated. If the financial transaction does not provide for value added tax, then put a dash or make the entry “Without VAT”.

Line "Application". The attached primary and other documents (if any) are indicated.

Tear-off receipt. It duplicates data from the PKO.

How to put a stamp on a PKO?

Hello!

Quote (Galina1708): should the seal be in the middle (part on the PKO, and part on the receipt)? This requirement was made by the tax authorities a very long time ago. This is not relevant now. Tax officials demanded this locally. This was not established in the regulatory documents (I mean the procedure for putting a stamp on the PKO itself and the receipt). Here is the standard Resolution of the State Statistics Committee of the Russian Federation dated 08/18/1998 N 88 (as amended on 05/03/2000) “On approval of unified forms of primary accounting documentation for recording cash transactions, for recording inventory results” Cash receipt order (Form N KO-1) Used to process receipts cash to the organization's cash desk both in the conditions of manual data processing methods and when processing information using computer technology. The cash receipt order is issued in one copy by an accounting employee and signed by the chief accountant or a person authorized to do so. The receipt for the cash receipt order is signed by the chief accountant or a person authorized to do so, and the cashier, certified with the seal (stamp) of the cashier and registered in the register of receipts and expenditure cash documents (Form N KO-3) and handed over to the person who deposited the money, and the receipt the cash order remains in the cash register. In the cash receipt order and the receipt for it: in the line “Base” the content of the business transaction is indicated; in the line “Including” the amount of VAT is indicated, which is recorded in numbers, and if products, works, services are not taxed, the entry “excluding tax (VAT)” is made. In the cash receipt order, the line “Appendix” lists the attached primary and other documents, indicating their numbers and dates of preparation. In the column “Loan, structural unit code” the code of the structural unit to which the funds are allocated is indicated.” It follows from this that the stamp is affixed entirely on the receipt itself. There is no provision for affixing part of the seal imprint on the receipt order itself.

Seal of individual entrepreneur of the 2020 model with a list of requirements

Can an individual entrepreneur work without a seal? The general rule is that it can. More precisely, not a single regulatory legal act directly obliges the use of an individual entrepreneur’s seal, but in business there are many situations when stamps in documents are required.

When you can't do without printing

Here is a list of situations in which the law requires companies and individual entrepreneurs to affix stamps to documents.

- If you have employees. The current instructions for filling out work books (approved by Decree of the Ministry of Labor of Russia dated October 10, 2003 No. 69) obliges, when making personnel records, to certify them with the signature of the employer and stamps (of the organization or personnel service). That is, judging by this instruction, an individual entrepreneur’s seal is not required when hiring employees; this obligation is established only for legal entities. However, there is another resolution - the Government of the Russian Federation dated April 16, 2003 No. 225, and it no longer makes any distinction between an organization and an individual, but uses the concept of “employer”. Paragraph 35 of the Rules approved by the resolution requires that upon dismissal of an employee, all entries made in the work book during work must be certified by the signature of the employee, as well as the signature and seal of the employer. Thus, the obligation to certify entries in work books with stamps is established for all employers, and individuals are no exception.

- When preparing strict reporting forms. Until mid-2019, receipt of payment when providing services to the public can be confirmed not with a cash register check, but by issuing a BSO. The procedure for filling out forms (Resolution of the Government of the Russian Federation dated May 6, 2008 No. 359) requires the presence of a stamp of the executor; without a stamp, the primary document is considered invalid.

- When issuing a cash receipt order. PKO is a primary document that confirms the receipt of cash at the cash desk of an individual entrepreneur or enterprise. Unlike an expense cash order, a stamp on the PKO is required.

- When participating in government orders. The quotation application for the execution of a government order must be certified by a stamp; without this, the application will not be accepted.

Does an individual entrepreneur need a seal to open a current account? The instruction of the Central Bank of the Russian Federation dated May 30, 2014 No. 153-I states that a sample imprint is affixed only if it is available. If it is not there, then the bank does not have the right to refuse to open a current account only on this basis. But behind the scenes, bank tellers insist on this condition because the stamp helps identify the client.

What should the print look like?

There are no official 2021 printing requirements for individual entrepreneurs. They didn’t exist before, but that’s if we talk about laws at the federal level.

In Moscow, from 1998 to 2005, there was an official register at the Registration Chamber where stamps for individual entrepreneurs and legal entities were registered.

The Federal Tax Service has recognized the maintenance of the register as illegitimate, but manufacturers still take into account the requirements for the appearance of imprints and stamps, provided for by the order of the Mayor of Moscow No. 843-RM.

The rules established three main types of cliche shapes for printing:

- round – with a diameter from 38 to 42 mm;

- triangular - all sides are equal length from 38 to 42 mm;

- rectangular - the size of one side is from 35 to 50, the second - from 70 to 100 mm.

In addition, according to the rules, the individual entrepreneur’s seal had to contain the following mandatory information:

- full name of the individual registered as an individual entrepreneur;

- indication of the organizational and legal form “individual entrepreneur”;

- location, i.e. the locality indicated in the merchant’s registration;

- state registration number OGRNIP.

In 2021, these rules do not apply; rather, they must be taken into account as generally accepted business traditions.

To stand out from competitors or reflect the direction of activity, you can place a logo, your own trademark or service mark, photographs, drawings on the cliches.

The ban is established only for the placement of the Russian coat of arms, regional and municipal symbols, and foreign logos and signs on cliches.

A sample seal for individual entrepreneurs in 2021, familiar to business in the Russian Federation, looks like this.

Important: facsimile, i.e. a sample of a citizen’s personal signature is not an official symbol of the individual entrepreneur. Facsimiles can only be used with the consent of the parties when signing contracts and for internal circulation.

To make a seal for an individual entrepreneur, you need to contact a specialized organization. Unfortunately, in the absence of control over the production of stamp products, many performers work without a certificate confirming state registration of individual entrepreneurs. You can make stamps not only according to your own, but also other people’s details; for this, a sample of the imprint is enough.

To reduce the risk of counterfeiting, order cliches with protection that uses:

- guilloche mesh with a thickness of no more than 0.1 mm;

- special marks (control, chemical, UV);

- multicolor;

- engraving of drawings and photographs;

- special security elements used for coat of arms;

- two-dimensional barcode.

We do not discuss whether an individual entrepreneur needs a seal in the cases discussed above. In such a situation there is simply no reason to doubt. The answer to the question is, of course, it is necessary. But what if the entrepreneur does not find himself in situations where the IP seal is required? For example, he doesn’t have any employees, and he doesn’t issue strict reporting forms or receipts.

Can an individual entrepreneur operate without a seal if the legal act does not require it? Of course, it may be that many businessmen get along just fine without this attribute. And yet, this symbol, which identifies a businessman, inspires more confidence when drawing up business papers than a regular signature.

Source: https://www.regberry.ru/registraciya-ip/pechat-dlya-ip