When is vacation pay paid?

The deadline for paying vacation pay is three calendar days before the start of the vacation.

The start date of the vacation is recorded in the vacation schedule or in the employee’s application. That is, for example, an employee who goes on vacation on Friday must be paid vacation pay on Tuesday. If the payment day falls on a weekend or holiday, issue vacation pay the day before (Letter of Rostrud dated July 30, 2014 No. 1693-6-1).

Vacation pay can be issued along with your salary. The main thing is not to miss the payment deadlines. For example, the salary payment deadline is October 5. An employee who goes on vacation on October 6 must be paid vacation pay on October 2 and can transfer his salary. An employee who goes on vacation on October 9 can be given both salary and vacation pay on October 5.

We issue an order for parental leave for up to 1.5 years

- statement written by the employee;

- the child’s birth certificate, a copy of the document should be made and attached to the application;

- certificate from the maternity hospital in the prescribed form;

- a certificate stating that the second parent has not taken leave and does not receive monthly child benefits.

If these documents are available, the personnel officer issues an order. The parent of the child receives the right to leave either from the date of birth of the child or from the day the maternity leave ends. As soon as the child turns 1.5 years old, parental leave for up to 3 years can be taken out, but payment for it is no longer provided.

Personal income tax on vacation pay in 2021: when to transfer

Personal income tax is withheld from the entire amount of vacation pay. In this case, the deadline for paying the tax into the budget is no later than the last day of the month in which vacation pay is paid, and if it is a day off, on the first working day of the next month. For example, an employee goes on vacation from January 25 to February 15, 2021. His vacation pay was paid on January 19. In this case, consider the income received on the date of issuance of vacation pay - January 19. Tax must be withheld from the payment on the same day. And personal income tax must be transferred to the budget no later than January 31, 2020 (clause 6 of Article 226 of the Tax Code of the Russian Federation).

Final payment upon dismissal of an employee

In the event that the manager does not make the final payment at the specified time, he will bear administrative responsibility. In this case, the citizen must receive not only compensatory payments, but also the salary itself during work. For each day of delay in payments, the manager pays a fine in the amount of 1/300 of the refinancing rate of the Central Bank of the Russian Federation. In addition, if the amount of the final settlement when paying severance pay is more than three times the employee’s earnings, then personal income tax in the amount of 13% will have to be paid on this monetary allowance. Tax is also withheld when paying vacation pay. Forgiveness of an interest-free loan: we charge personal income tax According to the rules in force from 01/01/2016, when issuing an interest-free loan to an employee, personal income tax must be calculated on a monthly basis from the individual’s benefit from saving on interest. The question arises: what to do with the already accrued tax amounts in the case when the lender forgives the borrower the entire amount of the loan issued.

- Severance pay in case of layoff: calculation example, formula, personal income tax

- Severance pay upon dismissal due to staff reduction

- Severance pay in case of layoff, its amount and payment period

- Severance pay in case of layoff: calculation and payment

- Payments upon dismissal due to staff reduction - procedure and terms of payments

Severance pay for layoffs: calculation example, formula, personal income tax Now 541.66 X 30 = 16,249.8 rubles, where 30 are calendar days. Quote: I got 11 days of compensation, right? I want to draw the moderator's attention to this message because: A notification is being sent... #2019 August 12, 2013, 10:14 pm Please help me calculate compensation. The employee worked from 02/04/13 to 08/15/13. I received compensation within 10 days. But how to do the calculation? (I’m not an accountant at all, but I need to do this work) salary (as I understand it, the amount that was given in person is taken into account, and not the salary?) As I understand it, for the calculation I do not take February and August (not fully worked months???)March - 1,302,430April - 1,389,600May - 1,296,600June - 1,371,000July - 1,371,0006,730,630/6/29.7*12= 453,241 Correct? And what taxes should I pay on this amount? ? Is it necessary to withhold 12% income tax from the employee and 1% to the Social Security Fund from this amount? I want to draw the moderator's attention to this message because: A notification is being sent...

Personal income tax payment from vacation pay

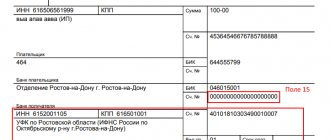

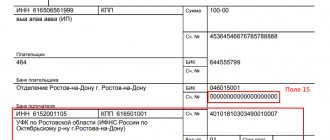

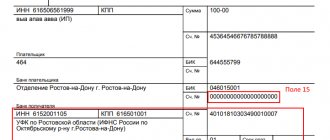

How to correctly fill out a payment order for personal income tax in 2021 is stated in the order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n and the Regulation of the Bank of Russia dated June 19, 2012 No. 383-P. The payment order must be filled out on a unified form. This is form 0401060.

Personal income tax on vacation pay must be transferred by the end of the month in which the money was issued (paragraph 2, clause 6, article 226 of the Tax Code of the Russian Federation). Field 107 indicates the month in which employees received vacation pay. For example, if the company issued vacation pay in November 2021, then MS.11.2020 is indicated. If in December, then MS.12.2020. A sample of filling out a personal income tax payment slip in 2021 is presented below.

In 2021, transfer personal income tax from vacation pay to KBK 182 1 01 02010 01 1000 110. Also see “KBK Handbook for 2021”. This code is used by LLCs and individual entrepreneurs that have employees. The procedure for filling out payment slips for personal income tax on vacation pay does not differ for them.

What it is

Based on the Regulations of the Bank of Russia dated June 22, 2012, the purpose of payment refers to the details specified for the transfer of funds. The payment order can be drawn up both electronically and in paper form. But in all cases, the necessary details, including the payer, recipient, sender's bank and payment destination, must be filled in.

Transfer of non-cash payments

All payment orders can be divided into three types:

- transfers to private individuals;

- transferring money to your own accounts;

- payment for goods or receipt of services by individual entrepreneurs or legal entities.

Important! If, when completing a payment order, the necessary details are not specified correctly, the bank may reject the transaction until the inaccuracies are corrected.

Payment order for payment of personal income tax on vacation pay: sample for 2018

Wages From clause 2 of Article 223 of the Tax Code of the Russian Federation it follows that wages become income on the last day of the month for which it is accrued (clause 2 of Article 223 of the Tax Code of the Russian Federation). Therefore, enter in field 107 the number of the month for which the salary was accrued. Let’s assume that the accountant is preparing a personal income tax payment from the salary for August. Then in field 107 he will indicate “MS.08.2016”. Even though the payment is drawn up in September. Online magazine for accountants For salary tax in field 107, enter “MS.07.2016”, and for bonus tax “MS.08.2016”. There is no need to combine bonuses and salaries into one payment slip. Moreover, bonuses and salaries are also divided in the calculation of 6-personal income tax (See.

Order on payment of compensation for unused vacation

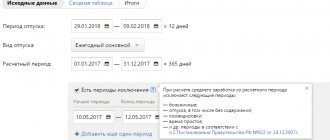

However, if some days were missed due to illness (and there are sick leaves), then a clarifying formula is used that takes this parameter into account. For example, instead of 12 months, the employee actually worked 10 and 3 days. Then instead of 12 you should substitute 10+3.

The order can be issued either on a standard A4 sheet or on a special form of the organization. The essence of the latter is that at the top of it are the details of the company whose head is signing the document.

Deadlines for filing income taxes

Vacation pay is always subject to income tax. The employee receives the amount minus personal income tax. Tax withholding is made on the day of issuance of vacation pay, and its transfer is due no later than the last day of the current month.

This rule also applies to rolling vacation pay, when the start of the vacation falls on one month and the end on another.

Thanks to such payment deadlines, the accountant can transfer income tax at the end of the month for several employees who went on vacation. To pay, it is enough to fill out one payment order form.

The employee took leave from February 20 to March 12, 2021. They accrued his vacation pay on February 16 and withheld income tax on the same day. Personal income tax must be transferred by February 28 of this year.

The letter from the Federal Tax Service dated July 12, 2016 states that it is necessary to fill out separate payment orders if income tax is transferred on vacation pay this month and personal income tax on wages for last month.

How is it filled out?

When filling out a payment order, it is important to remember that all amounts are written in full rubles. Pennies are rounded according to arithmetic rules.

There should also be no blank fields. The write-off amount and date should be written in words and numbers. The chronological order of payment invoice numbering should not be violated.

Each field on the payment form has its own number.

The payer status is indicated in 101 fields. According to the law, there are three types of status and corresponding codes:

- Tax agent, code - "02".

- Individual entrepreneur, code – “09”.

- Individual, code – “13”.

If the payment is filled out by a budget organization, then code “02” is filled in.

In field 16 entitled “Recipient” it is written – Federal Treasury Department for .... region. The name of the tax office is also written in brackets.

How the fields are filled in

Each type of translation has its own rules for filling out the column.

Payments for services

If an individual transfers money as payment for the provision of any service, then the following information must be indicated in the payment:

- full name of the service received, goods purchased or work performed;

- number of the agreement under which the legal relationship between the buyer and seller was established;

- period of provision of work or performance of services;

- payer's bank account;

- if the service was provided in relation to a certain type of property, it must be specified in the payment order. For example, an apartment, a house, a plot of land.

When repaying the payer's debt for the previous period, the month for which the transfers are made is indicated.

Purpose of payment when paying for services

Transfer of own funds

If physical a person transfers money between his personal accounts, then the purpose of the transfer is not required. This is necessary if a person sends money to his account, but in a different bank. In such a situation, you must write “transfer of own funds” in the field. The phrase may sound different, but its meaning should be that the money is not intended for third parties and is not used to pay for any service.

Purpose of payment for holiday pay 2021

After all, in accounting, the accrued tax will be recognized as an expense only in the month in which the employee’s vacation begins (clause 18 of PBU 10/99). A similar situation may arise for companies that pay corporate income tax quarterly, if the month of payment of vacation pay and the vacation itself fall on different reporting (tax) periods. You need to make the following entries to bring your accounting into line with tax accounting. In the month of payment of vacation pay and calculation of taxes and contributions: Debit 68, subaccount “Calculations for income tax”, Credit 77 - the deferred tax liability is reflected. In the month when the tax is recognized as an expense and an entry must be made in the accounting records: Debit 77 Credit 68, subaccount “Calculations for income tax” - the deferred tax liability is repaid. The same discrepancy between the two accounting systems can arise with pension contributions and contributions for insurance against accidents and occupational diseases. This situation is further complicated by the dispute about when to take into account these payments for compulsory insurance when calculating the corporate income tax (more about this in “NA”, No. 11, 2008, see also Letters of the Department of Tax Administration of Russia for Moscow dated June 30, 2004 N 26-12/43524, dated 01/27/2004 N 26-12/05495). Please note: in this article we are considering the option that is most often used in practice. That is, when pension contributions are taken into account in the period in which they are accrued. And contributions for “injuries” are paid as they are paid.

When is vacation pay paid?

The deadline for paying vacation pay is three calendar days before the start of the vacation.

The start date of the vacation is recorded in the vacation schedule or in the employee’s application. That is, for example, an employee who goes on vacation on Friday must be paid vacation pay on Tuesday. If the payment day falls on a weekend or holiday, issue vacation pay the day before (Letter of Rostrud dated July 30, 2014 No. 1693-6-1).

Vacation pay can be issued along with your salary. The main thing is not to miss the payment deadlines. For example, the salary payment deadline is October 5. An employee who goes on vacation on October 6 must be paid vacation pay on October 2 and can transfer his salary. An employee who goes on vacation on October 9 can be given both salary and vacation pay on October 5.

Sample application for payment of compensation for unused vacation

But, as a rule, compensation is issued precisely at the time of dismissal. Then the employee has the right to receive a full financial payment for all remaining unused rest days. At the same time, no employer can refuse him - failure to pay the full amount is a serious violation of labor legislation. The total amount of compensation depends on the employee’s daily wage rate multiplied by the number of unused vacation days.

Article 126 of the Labor Code of the Russian Federation allows us to replace with monetary compensation that part of the annual leave that exceeds 28 calendar days. If your employee has not used vacation for two or more years, then only that part of the annual leave that exceeds 28 days, or any number of days from this part, can be replaced with compensation.

This is interesting: How many births does a low-income family have at the moment?