When terminating contracts of voluntary life insurance, non-state pension provision, voluntary pension insurance, or returning (paying) a monetary (redemption) amount to an individual, it becomes necessary to obtain a certificate in the form KND 1160077 (hereinafter referred to as the certificate). Let's take a closer look at how to obtain a social tax deduction certificate using the KND form 1160077 and in what cases it becomes necessary to obtain it.

In this case, there are exceptions: cases of termination of contracts for reasons that do not depend on the will of the parties, and when we are talking about a non-state pension agreement, when termination occurs due to the transfer of a monetary (redemption) amount to another NPF.

- When terminating which contracts do you need a KND certificate 1160077

- The procedure for obtaining a certificate in the form of KND 1160077

When returning (paying) the specified funds, the NPF or insurance organization must withhold personal income tax. For tax purposes, they reduce the payment you are entitled to by the amount of contributions you made under the specified agreements, unless you took advantage of the social tax deduction for these contributions. This point must be confirmed by a certificate issued by the tax authority at the place of residence.

It should be understood that based on this certificate you can pay personal income tax in a smaller amount. This is stated in paragraphs 2 and 4 of paragraph 1 of Art. 213, paragraph 2 of Art. 213.1, paragraphs. 4 paragraphs 1 art. 219 of the Tax Code of the Russian Federation.

The rules that we have outlined also apply when changing the validity period of a non-state pension agreement. Therefore, the points that we will talk about further apply to such cases (clause 2 of Article 213.1 of the Tax Code of the Russian Federation).

What is a certificate in the KND form 1160077

This is a document confirming the fact that the taxpayer did not receive a tax deduction. The full name of the certificate is in the sample below.

This form of certificate has been ratified by orders of the Federal Tax Service of the Russian Federation No. ММВ-7-11/ [email protected] dated 07/13/2016. You can read the order and download the form on the consultant’s website: https://www.consultant.ru/document/cons_doc_LAW_202843/9be78cf9c1b0221a71000deef128e58f1ad32778/

The abbreviation “KND”, according to the code compliance directory, means “tax documentation classifier”.

The document is prepared within 30 days.

Types of sample applications for personal income tax refunds

The main thing today is an application for a state refund of a tax deduction when purchasing real estate. The application includes two forms, one of which is issued to the employer, the second is addressed to the tax service.

When filling out the document, you must provide truthful information and also take into account the features of each form. For example, when issuing a form in the name of the employer, there is no need to indicate the bank account number.

It should also be noted that when an individual purchases a certain type of real estate and at the same time retires, the citizen will need to fill out a sample application, which will subsequently be reviewed by a tax inspector.

It is important to provide only truthful information in your application.

In what cases is it necessary

Changes have been made to the Tax Code of Russia regarding voluntary insurance. If a number of conditions are met, the taxpayer can return 13% of insurance premiums (social tax deduction for personal income tax).

In case of early termination of the contract, the insurer is obliged to withhold a tax deduction from the citizen. The certificate allows you to reduce the amount of the deduction.

The document will be required if the following contracts are terminated:

- voluntary pension insurance

- non-state provision of pensions

- voluntary life insurance

Concluded on yourself, your spouse, parents or children with disabilities (natural and adopted).

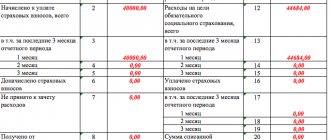

Example of deduction calculation

Petrov S.V.’s salary is 55,000 rubles. per month.

At the end of 2021, he entered into 2 agreements with a non-state pension fund (for himself and his wife) and submitted an application to the employer with instructions to withhold and transfer monthly contributions in the amount of 6,000 rubles from his salary, as well as provide a deduction for expenses incurred on non-state pension provision .

Every month throughout 2021, the accounting department paid personal income tax on the employee’s earnings, taking into account the following deduction:

(55,000 rub. – 6,000 rub.) * 13% = 6,370 rub.

Thus, over the year Petrov saved 9,360 rubles on personal income tax. (RUB 6,000 * 12 months * 13%).

Step-by-step instructions for registration

The procedure for issuing a certificate is clearly stated in the appendix to the letter of the Federal Tax Service No. ШС-6-3 / [email protected] dated 05/19/2008. The application consists of 5 sections, which describe:

- procedure for receiving and registering documents

- procedure for consideration of the issue by tax officials

- registration of results

Let's consider a step-by-step algorithm of actions.

Step 1

Collect documents. The required documentation is indicated in the letter (section 2):

- copy of the passport

- copy of the contract (insurance policy)

- payment receipts for payment of contributions under the agreement

If insurance was taken out for a relative, then additional documents (copies of passport or birth certificate) must be submitted. And also confirmation of relationship with him.

Step 2

To write an application. The following information is indicated (as stated there):

- contract details

- tax agent details (to whom the certificate will be provided)

- whether a tax deduction was provided or not

- list of attached documents

A sample application is provided below.

This application must be filled out independently or with the help of a tax authority employee.

Step 3

Submit documents to the tax authority. According to clause 2.2, section 2 of the Federal Tax Service letter, this can be done:

- visiting the tax office in person

- transfer a package of documents through an authorized representative

- send documentation by registered mail

The Federal Tax Service office must be located at your place of residence.

If all documents are presented personally by the citizen or through a representative, then the registration of the application is dated no later than the next day. In the case of mail, the date of receipt of the letter.

Step 4

Wait for the results. The review period is 1 month. If, in the process of studying the submitted documents, an employee identifies inaccuracies, the citizen will be informed in writing. Having received a refusal to issue the certificate itself. This is stated in section 4, clause 4.3 of the letter from the Federal Tax Service.

A positive outcome will be the taxpayer receiving a certificate by registered mail (clause 4.4, section 4).

The letter and all recommendations can be found on the consultant’s website: https://www.consultant.ru/document/cons_doc_LAW_77470/

When can I write a statement?

Before demanding payment of financial compensation from the state, a citizen needs to become familiar with the situations in which he can fill out applications. To do this, you should take into account a number of factors that may cause a refusal to consider the paper submitted by the applicant.

- The application was submitted before the deadline. If we talk about possible deadlines for filing an application, today there are certain rules related to this issue. For example, you cannot apply for a tax refund if a year has not yet passed from the date of purchase of the property.

- The citizen has already applied for a tax refund. In this case, he does not have the right to re-apply for compensation.

- The required package of documents was not attached with the application. Very often, individuals simply forget to put down the details on the application or attach documents required by the state.

In some cases, a tax deduction may be denied

Thus, in all the above cases, the application will not be accepted by the appropriate authority.

Possible difficulties

On social forums, Russians complain about some difficulties in obtaining and obtaining a certificate.

One of the difficulties is a personal visit to the Federal Tax Service and possible queues

All difficulties can be summarized into two large groups:

- filling out an application yourself. Since not all citizens can get an appointment with the tax authority

- turn to the Federal Tax Service specialist. Since it is not possible to make an appointment using the State Services portal

A solution to these difficulties would be to add to the services of the state reference website an additional option for obtaining KND certificate 1160077.

So, according to the letter of the Federal Tax Service No. ShS-6-3/ [email protected] , obtaining a certificate through State Services is not provided. This is only possible in person, by mail, or through a representative with a power of attorney.

Professional benefits

On this basis, personal income tax is reduced when performing work or providing services under a civil contract or receiving royalties for the creation of literary, musical, artistic, and other works, the invention of models and industrial designs. The amount is determined either in the amount of costs incurred or according to those established in clause 3 of Art. 221 Tax Code of the Russian Federation standards.

Read more about the professional basis for reducing personal income tax

If for some reason the employer calculated personal income tax on the full amount of income, then at the end of the year they submit a 3-personal income tax return to the Federal Tax Service and return the overpaid tax.

How to obtain a certificate (knd 1160077) of social tax deduction?

The need to obtain a certificate in the form of KND 1160077 (hereinafter referred to as the certificate) arises when terminating contracts of voluntary life insurance, voluntary pension insurance, non-state pension provision and the return (payment) of a monetary (redemption) amount to an individual. The exception is cases of termination of contracts for reasons beyond the will of the parties, as well as in relation to a non-state pension agreement - its termination due to the transfer of a monetary (redemption) amount to another NPF.

When returning (paying) the specified amount, the insurance organization or non-state pension fund must withhold personal income tax. At the same time, for the purpose of calculating tax, they will reduce the payment due to you by the amount of contributions you made under these agreements, if you did not take advantage of the social tax deduction for these contributions, which must be confirmed by a certificate issued by the tax authority at your place of residence. That is, on the basis of this certificate, it is possible to pay personal income tax in a smaller amount (clauses 2, 4 clause 1 of Article 213, clause 2 of Article 213.1, clause 4 of clause 1 of Article 219 of the Tax Code of the Russian Federation).

The stated rules also apply when changing the validity period of a non-state pension agreement. Therefore, what is said below also applies to such cases (clause 2 of article 213.1 of the Tax Code of the Russian Federation).

Categories of contracts, upon termination of which a certificate is required

Reducing the monetary (redemption) amount by the amount of contributions under contracts of voluntary life insurance, voluntary pension insurance, non-state pension provision on the basis of a certificate is possible subject to the following conditions (clauses 2, 4, clause 1 of Article 213, clause 2 of Article 213.1, paragraph 4, paragraph 1, article 219 of the Tax Code of the Russian Federation; paragraph “b”, paragraph 9, article 2, paragraph “a”, paragraph 12, article 2, part 1, article 4 of the Law of November 29, 2014 N 382- Federal Law; clause “a” clause 4, clause 5, clause “a” clause 10 article 1, part 1, 5 article 4 of the Law of July 24, 2007 N 216-FZ; Letter of the Ministry of Finance of Russia dated June 25 .2015 N 03-04-07/36707):

a) a voluntary life insurance contract must be concluded by an individual for a period of at least five years in his own favor and (or) in favor of his spouse, parents (adoptive parents), children (including adopted children under guardianship or trusteeship). In this case, insurance premiums paid under such contracts starting from 01/01/2015 are accepted for deduction;

b) a voluntary pension insurance agreement must be concluded by an individual in his own favor and (or) in favor of his spouse, parents (adoptive parents), disabled children (including adopted children or those under guardianship (trusteeship)). In this case, insurance premiums paid under such contracts starting from 01/01/2008 are accepted for deduction;

c) a non-state pension agreement must be concluded by an individual with a licensed Russian NPF in his own favor and (or) in favor of his spouse, parents (adoptive parents), children (including adopted children), grandparents, grandchildren, brothers and sisters, and also disabled children under guardianship (trusteeship). In this case, insurance premiums paid under such contracts starting from 01/01/2008 are accepted for deduction.

Procedure for obtaining a certificate

To get help, we recommend following the following algorithm.

Step 1. Prepare your application and required documents

To obtain a certificate, you need to prepare an application for its issuance. You will also need the following documents (clause 4, clause 1, article 219 of the Tax Code of the Russian Federation; clause 2.1 of the Recommendations to the Letter of the Federal Tax Service of Russia dated May 19, 2008 N ShS-6-3 / [email protected] ):

- a copy of the agreement (insurance policy) with an insurance organization or non-state pension fund;

- copies of payment documents confirming your payment of contributions under the relevant agreements (in particular, payment orders, receipts for cash receipts, bank statements);

- copies of documents confirming the degree of your relationship with the person for whom you made contributions (marriage certificates, birth certificates (adoption documents) of a child, etc.).

Step 2. Submit documents to the tax authority

You can submit an application and supporting documents to the tax authority at your place of residence (clause 2 of article 11.2 of the Tax Code of the Russian Federation; clause 2.2 of the Recommendations; clause 5 of the List to the Order of the Federal Tax Service of Russia dated March 17, 2017 N CA-7-6 / [email protected ] ):

- personally or through your representative directly to the inspectorate;

- by mail. It is advisable to send documents by registered mail with acknowledgment of receipt and an inventory of the contents in order to have confirmation of their receipt by the tax authority;

- in electronic form, in particular through your personal account on the website of the Federal Tax Service of Russia. In this case, scanned images of the required documents must be attached to the electronic application.

Step 3. Wait for the result of reviewing the application and documents

If, when considering your application and documents, the tax authority determines that you did not indicate the necessary information or did not submit the necessary documents, or you do not have the right to receive a social tax deduction, they will refuse to issue you a certificate and will notify you about this in writing (clause 4.3 recommendations).

If the review of your documents is positive, you will receive a certificate that should be presented to the insurance organization or non-state pension fund when contacting them in the event of termination of the relevant contracts.

Related situations

How to get a social deduction for personal income tax for voluntary life insurance? Find out →

How to take advantage of the social tax deduction for contributions to non-state pension provision and additional contributions to a funded pension? Find out →

Useful information on the issue

Official website of the Federal Tax Service - www.nalog.ru

A certificate in the form of KND 1160077 is a document confirming the fact that a citizen has received or not received a social tax deduction in the amount of paid pension (insurance) contributions under a non-state pension provision (voluntary pension insurance) agreement with a non-state pension fund (insurance organization).

You can obtain this certificate from the tax office after submitting an application and submitting the necessary documents.

You will find more information about obtaining a certificate in the KND form 1160077 in the article.

KND 1160080 or certificate of status of settlements with the budget

The certificate in KND form 1160080 contains information on mutual settlements between legal entities and individual entrepreneurs with tax authorities, including data on penalties, fines and interest. The document is issued within five days from the date of receipt of the request, which can be submitted in paper or electronic form. Read our article on how to obtain such a certificate.

In the ongoing activities of any business, it is often necessary to provide information that:

- Your company or individual entrepreneur has no problems with the tax office

- taxes are paid in good faith and on time.

It is also recommended to periodically conduct such reconciliations to ensure your own confidence that there are no problems with the regulatory authority.

Form KND 1160080 is precisely a document that presents data for a specific date in terms of taxes. The form indicates debts or overpayments on the main obligation, as well as penalties, fines and interest.

The form was approved by order of the Federal Tax Service of Russia dated December 28, 2016 No. ММВ-7-17/ [email protected] and is called “Certificate on the status of settlements for taxes, fees, insurance premiums, penalties, fines, interest of organizations and individual entrepreneurs.”

The procedure for sending a request for a certificate depends on the form in which you plan to receive it:

- if in paper form, then the request is drawn up and submitted on paper;

- if in electronic form, then the request is sent electronically via telecommunication channels or through the taxpayer’s personal account.

There is no form of written request strictly established by law to obtain the necessary certificate. You can make a request yourself or follow the recommendations of the Federal Tax Service of Russia (clause 125 of the Administrative Regulations of the Federal Tax Service in accordance with Order of the Ministry of Finance of Russia dated July 2, 2012 No. 99n (as amended on December 26, 2013)).

In any case, the document must contain:

- mandatory details of your company or individual entrepreneur (TIN, full name of the legal entity (full name of the entrepreneur), postal and email address, if possible, checkpoint);

- the date on which you need information about settlements with the budget (otherwise, the certificate is provided on the date of receipt of the request);

- information about the method of obtaining a certificate (by mail or in person);

- signature of the manager or authorized representative. In the second case, according to paragraph 3 of Art. 29 Tax Code of the Russian Federation, clause 4 art. 185.1 of the Civil Code of the Russian Federation, the original power of attorney or a certified copy is attached.

The completed request can be sent by mail with a description of the attachment. If you are filing directly with the tax office, bring two copies of the document with you. One of them will be returned to you with the date of acceptance. It is also required when receiving a certificate.

Such a request is submitted via telecommunication channels (TCC) or through the taxpayer’s personal account (lkul.nalog.ru).

Please note that if you are the largest taxpayer, then the request for a TKS certificate is sent to the tax authority that works with the largest legal entities. For others, the recipient of the request is the Federal Tax Service at the place of registration.

Typically, the form of this document is implemented in the reporting program. The electronic request contains the same information as the paper request (settlement date, details, method of receipt). In this case, the information is shown with the mandatory addition of an inspection code, checkpoint and electronic signature (clause 150 of Order No. 99n of the Ministry of Finance of Russia dated July 2, 2012 (as amended on December 26, 2013)).

Please note that if your organization has separate divisions registered with the same tax office, you can receive a certificate for all calculations. To do this, simply do not indicate the checkpoint when submitting your request.

If you and your separate divisions are registered with several Federal Tax Service Inspectors, then it will be enough to indicate zeros (0000) in the request instead of the Federal Tax Service Code and also not indicate the checkpoint (clause 3 of the order of the Federal Tax Service of Russia dated December 28, 2016 No. ММВ-7-17/ [email protected] ).

When a request is sent through the taxpayer’s personal account, only a “certificate on the status of settlements” is selected from the list of possible documents. No additional forms are required.

The tax office issues a certificate within five working days from the date of receipt of the request (subparagraph 10, paragraph 1, article 32 of the Tax Code of the Russian Federation, paragraphs 127, 146 of the order of the Ministry of Finance of Russia dated July 2, 2012 No. 99n (as amended on December 26, 2013)).

The date from which the date is counted depends on the method of submitting the request for the issuance of the document.

| Request to the tax office | Date the request was received |

| At the Federal Tax Service in person | Indicated by the Federal Tax Service employee on the second copy of the request, which remains with you |

| By mail with a valuable letter with a list of attachments | Equal to the date of receipt of the tax document. You can find it on the Russian Post website - pochta.ru/tracking |

| Electronically | Indicated in the receipt of the request, which is sent to you no later than the next day after receipt of the document |

If your data does not correspond with the tax data, it is necessary to reconcile the calculations.

According to the order of the Federal Tax Service of Russia dated November 22, 2018 No. ММВ-7-21 / [email protected], the departments of the Federal Tax Service for the constituent entities of the Russian Federation must be informed by higher government agencies about the establishment, change and termination of any types of regional and local taxes.

From 01/01/2019, this process is carried out using the form according to KND 1190803, approved by the above-mentioned order.

These actions are aimed at clearly tracking any changes in taxation and, among other things, contribute to the correctness of reconciliation of calculations. Based on these changes, the structure of the data presented in Form 1160080 also changes if the taxpayer has a taxable base for certain obligations based on changes in regional and local taxes.

Save 5,000 rubles when you subscribe to Simplified. Pay your bill with a 30% discount. Or pay by card on our website

Download invoice

Source: https://www.26-2.ru/art/354967-knd-1160080-ili-spravka-o-sostoyanii-raschetov-s-byudjetom

What is KND certificate 1160077 and why is it needed?

The full name of the mentioned certificate is: “Certificate confirming that the taxpayer has not received a social tax deduction or confirming that the taxpayer has received the amount of the provided social tax deduction provided for by subparagraph 4 of paragraph 1 of Article 219 of the Tax Code of the Russian Federation for ____ year.”

The abbreviation KND stands for “classifier of tax documentation.”

The need to obtain a certificate in the KND form 1160077 may arise when terminating certain types of certain contracts and returning a sum of money to the citizen. Such agreements include the following agreements:

- voluntary life insurance;

- voluntary pension insurance;

- non-state pension provision.

However, in cases of termination of these contracts for reasons beyond the control of the parties, no refund is made.

A citizen can conclude such agreements both in his own favor and in favor of his spouse (widow, widower), parents (adoptive parents) and disabled children (including adopted children and wards).

When returning the contract amount to a citizen, the insurance organization or non-state pension fund must withhold personal income tax. At the same time, for the purpose of calculating income tax, these organizations reduce the amount of the agreement due to the citizen by the amount of contributions made by him under these agreements, but only on the condition that the citizen has not previously taken advantage of a social tax deduction in relation to these contributions. But the fact that a citizen took advantage (or did not take advantage) of a tax deduction must be confirmed by a certificate issued by the tax office at the citizen’s place of residence. This certificate is a certificate in the form of KND 1160077.

Based on this certificate, a citizen will be able to pay income tax in a smaller amount.

Let us consider in more detail the conditions under which it is possible to reduce the amounts paid as personal income tax for various types of contracts.

The reduction in tax payment is a consequence of a reduction in the monetary (redemption) amount by the amount of contributions under the agreements listed below, based on KND certificate 1160077, subject to the following conditions:

- for a voluntary life insurance contract: this contract must be concluded by a citizen for a period of at least five years in his own favor and (or) in favor of his spouse, parents, children (including adopted children, those under guardianship or trusteeship). In this case, insurance premiums paid starting from January 1, 2015 are accepted for deduction to reduce personal income tax;

- for a voluntary pension insurance agreement: this agreement must be concluded by a citizen in his own favor and (or) in favor of his spouse, parents, disabled children (including adopted children or those under guardianship or trusteeship). Please note that insurance premiums paid under such contracts starting from January 1, 2008 are accepted for deduction;

- for a non-state pension agreement: such an agreement must be concluded by a citizen with a licensed Russian non-state pension fund (NPF) in his own favor and (or) in favor of his spouse, parents, children (including adopted children), grandparents, grandchildren, brothers and sisters, as well as disabled children under guardianship (trusteeship). Under such an agreement, insurance premiums paid starting from January 1, 2008 can be deducted.

The stated rules also apply when changing the validity period of a non-state pension agreement.

Conditions for obtaining START

You can take advantage of the deduction if certain conditions are met:

1. A citizen must have official income subject to personal income tax at a rate of 13% in the year in which he paid contributions to the NPF.

It should be understood that a deduction is a refund (not a withholding) of tax that has already been paid (to be paid in the near future) to the state on the income of an individual. If a citizen does not have such income, then he is not entitled to a deduction.

Please note: deductions do not apply to income in the form of dividends, as well as winnings received by participants in gambling and lotteries.

2. A non-state pension fund must have a valid license to carry out activities in pension insurance and provision (information about non-state pension funds must be entered in the Register of non-state pension funds - participants in the system of guaranteeing the rights of insured persons).

3. A pension agreement concluded between a citizen and a non-state pension fund must contain the mandatory information listed in paragraph 1 of Art. 12 of the law of 05/07/1998 No. 75-FZ as amended. from 08/03/2018, including:

- provisions on the procedure and conditions for making contributions;

- type of pension scheme;

- contract time;

- provisions on the conditions for termination of the contract.

How to get a certificate, procedure for receiving it

To obtain a certificate, you must prepare and submit the following documents to the tax office:

- application for the issuance of a certificate form KND 1160077;

- a copy of the agreement (insurance policy) with an insurance organization or non-state pension fund;

- copies of payment documents confirming the payment of contributions under the relevant agreements (in particular, payment orders, receipts for cash receipt orders, bank statements);

- copies of documents confirming the degree of relationship of the citizen with the person for whom he made contributions (marriage certificates, birth certificates of a child, etc.).

Next, the specified documents must be submitted to the tax office at the place of residence in any of the following ways:

- personally to the tax office (or through a representative);

- by registered mail with acknowledgment of delivery and a list of the contents;

- in electronic form, in particular through your personal account on the website of the Federal Tax Service of Russia. In this case, the application and necessary documents (scanned) are sent electronically.

If the review of the application and documents is positive, the tax office will issue a certificate KND 1160077, which the citizen submits to the insurance organization or non-state pension fund at the same time as contacting them upon termination of contracts concluded with them.

If the tax office refuses to issue a certificate, then it notifies the citizen in writing. The refusal may be due to the lack of necessary information, lack of documents, or the citizen’s lack of right to receive a social tax deduction.

How to return tax through the Federal Tax Service

Citizens have the opportunity to choose how to receive fiscal benefits; this is provided for in the Tax Code of the Russian Federation. Taxpayers have the right to write and send an application for a property tax deduction (and any other - standard, social, professional) directly to the territorial office of the Tax Service.

To qualify for a personal income tax refund through the inspection, you will have to collect a package of documents confirming your rights to benefits. Note that the registration of benefits through the Federal Tax Service begins only in the year following the year in which the grounds for applying the fiscal deduction arose. For example, if you became entitled to a benefit in 2020, then you will be able to contact the Federal Tax Service only in 2021.

In addition to the documents, you will need to prepare a 3-NDFL tax return. The fiscal report contains the personal details of the payer, information about income and the amount of personal income tax to be returned.

In addition to the declaration and copies of supporting documentation, you will have to fill out a special tax refund form. Such a written application for a tax refund for a property deduction or other benefit can be completed in any form, but the Federal Tax Service recommends using a unified form for such a document.

When terminating which contracts do you need a KND certificate 1160077

A reduction in the monetary (redemption) amount by the amount of contributions under contracts of voluntary pension insurance, voluntary life insurance, non-state pension provision on the basis of a certificate is allowed if certain conditions are met. They are enshrined at the legislative level in:

- Letter of the Ministry of Finance of Russia dated June 25, 2015 No. 03-04-07/36707;

- Part 1 art. 4 of the Law of November 29, 2014 No. 382-FZ;

- pp. “a” clause 4, clause 5, Clause. “a” clause 10 article 1, part 1.5 art. 4 of the Law of July 24, 2007 No. 216-FZ.

- pp. "b" clause 9 of Art. 2, pp. “a” clause 12 art. 2;

- clause 2.4 clause 1 art. 213, paragraph 2 of Art. 213.1, clause 4 clause 1 art. 219 of the Tax Code of the Russian Federation.

The conditions are as follows:

- A voluntary pension insurance agreement must be concluded by an individual in his own favor and (or) in favor of his parents (adoptive parents), spouse, disabled children (this also includes children who have been adopted or are under guardianship (trusteeship)). In this case, insurance premiums that were paid under these agreements, starting from January 1, 2008, are accepted for deduction.

- A voluntary life insurance contract must be concluded with an individual for a period of at least 5 years in their favor and (or) in favor of their parents (adoptive parents), spouse, disabled children (this also includes children who have been adopted or are under guardianship (trusteeship)). In this case, insurance premiums that were paid under these agreements, starting from January 1, 2015, are accepted for deduction.

- A non-state pension agreement must be concluded by an individual with a domestic non-state pension fund that has the appropriate license in its favor and (or) in favor of parents (adoptive parents), spouse, sisters, brothers, grandfathers, grandchildren, grandmothers, children with disabled status who are under guardianship (trusteeship). In this case, insurance premiums that were paid under these agreements, starting from January 1, 2008, are accepted for deduction.

Deduction amount

START is provided in the amount of actual expenses incurred, but not more than 120,000 rubles for one year.

Moreover, the above amount includes not only the costs of paying contributions to the NPF, but also other expenses of the citizen during the tax period, which, in accordance with Art. 219 of the Tax Code of the Russian Federation are included in social deductions (training, treatment, purchase of medications, voluntary life insurance, etc.).

If there are several types of expenses in one period that fall under the application of a deduction and in total exceed the established limit, the taxpayer must independently choose which specific types of expenses and in what amount to declare as part of the START.

Please note: the legislation does not provide for the transfer of the unused balance of the deduction to subsequent tax periods.