Free legal consultation by phone:

8

This is a document that can confirm that a person does not have any debts to the state budget. When applying for a new job, or due to personal circumstances, a citizen must prove that he has no debts on taxes and fees. This means that a person does not have problems with the state budget.

In order to receive such a certificate of no debt, an individual must submit a request at the place of registration or registration. Such paper, a sample can be found in the article, may also be needed in cases where you simply need to get a loan from a bank or need to close a business. When receiving government subsidies, this confirmation is also required.

KND 1120101: what kind of certificate

In order to confirm the absence or presence of debt to the budget or to verify balances, there are several documents (Article 32 of the Tax Code of the Russian Federation):

- information on the status of settlements (KND 116080 and 116081);

- information on the fulfillment of the taxpayer’s obligation (form KND 1120101);

- reconciliation report on taxes and fees (KND 116070).

All these documents can currently be obtained in both paper and electronic forms.

Today we will dwell in more detail on what constitutes a certificate of tax arrears in the KND form 1120101. The document form was approved by Order of the Federal Tax Service dated January 20, 2017 No. ММВ-7-8/ [email protected]

KND 1120101 (form)

What is it about

When concluding a large contract, participating in a tender, or receiving a loan from a bank, an organization must confirm its solvency. One of the criteria is the absence of debt to the budget. For confirmation, KND form 1120101 is requested. The certificate confirms that the taxpayer is in good faith. He pays all taxes on time and has no debts on penalties and fines.

To understand what we are talking about, you need to refer to the order of the Federal Tax Service No. ММВ-7-8/ dated 01/20/2017. He approved the format for submission, the procedure for filling out and a sample certificate KND 1120101. This certificate, issued by the tax office, answers the question: does the company have debts to the budget. It does not contain a breakdown of specific taxes, fees, penalties and fines. It is impossible to find out the amount of debt from it. Having received a document with the entry “the organization has a debt,” you will have to additionally contact the Federal Tax Service to find out the amount of the debt and for what specific tax it should be transferred.

To obtain the document, you must contact the Federal Tax Service at the place of registration of the organization. The deadline for providing data by the inspectorate is ten working days after receiving the taxpayer’s request. You can submit a request either in person by visiting the Federal Tax Service, or by sending an application by mail, or by contacting electronic services: an electronic reporting operator or the taxpayer’s personal account.

The procedure for applying depends on the form in which you need a certificate confirming the presence or absence of tax debt:

- on paper: a paper application is drawn up or an appeal is sent through the taxpayer’s personal account;

- in electronic form: the application is sent by application in electronic form via TKS.

Certificate of presence (absence) of tax debt: where and how to get it

To obtain information about the fulfillment of taxpayer obligations, you must contact the Federal Tax Service. The document can be obtained from the tax office:

- in paper form with the seal and signature of the head of the Federal Tax Service;

- in electronic form with the digital signature of the head of the Federal Tax Service.

The form does not contain specific debt figures. If there is no debt, then a certificate of no debt will be received from the Federal Tax Service. If there is a debt, then a corresponding entry will be made in the form, and the Appendix will indicate the codes of the inspections with which the taxpayer has a debt.

If you receive information about the existence of a debt to the budget, you do not agree with this, you should check with the Federal Tax Service to detect and correct the error.

How to check tax deductions

How do you find out whether tax levies deducted from wages go to the tax and pension fund and how to see their value? In order to find out about tax deductions, the easiest way is to contact the accounting department at your place of work. There are not many reasons why taxes are not paid for an employee:

- Unofficial employment of a worker;

- The employer deliberately evades tax payments;

- Incompetence of accounting staff.

In addition, there are alternative ways to obtain this type of information:

- Branches of the Pension Fund of the Russian Federation. In order to receive an extract on tax deductions, you should contact the Pension Fund branch at the place of registration and fill out the appropriate application;

- Multifunctional government centers. Contacting the MFC occurs by analogy with Pension Fund branches;

- Banking organizations. To obtain a statement of tax deductions, you can contact one of the bank branches that deals with employee payroll.

You can find out about the status of your pension contributions without leaving your home. To do this, just go to the State Services website, where you will need to go through the registration process, indicating the number of your passport, pension insurance certificate (SNILS), TIN, and so on.

Important! If the SNILS number is unknown to the employee, he can find it out using the TIN by filling out an online request on the official website of the Federal Tax Service!

Features of receiving in paper form

A certificate of taxes and fees on paper is issued upon written request. It is better to fill it out using the form recommended by the Federal Tax Service (you can download the application form at the end of the article).

The request can be submitted by visiting the inspection in person, or it can be sent by mail in a valuable letter with a list of the contents. If the company is registered in the taxpayer’s personal account, then the request can be sent through it. During a personal visit, the request must be submitted by the head of the company or an authorized person.

The form must indicate:

- name, TIN, address of the taxpayer;

- details of the inspection to which the request is submitted;

- the date for which the information needs to be generated;

- method of receiving the document (in person or by post);

- signature and full name manager or authorized person.

The document must be generated by the inspectorate and transferred to the taxpayer within 10 working days from the date of filing the application. If the application indicated that the certificate will be collected by the head or representative of the company, then after this period you must contact the operating room of the Federal Tax Service. The document will be issued against signature, and the fact of issue will be recorded in the appropriate log book.

Calculation of tax deductions

One of the most common questions from entrepreneurs is “How to calculate the salary of employees, taking into account all tax and insurance fees?” To avoid doing mathematical calculations yourself, you can use a special online calculator.

To carry out the calculation, you must enter the following data:

- The amount of monthly salary;

- The amount of wages from the beginning of the year in an accruing period;

- Indicate whether there are deductions (for children, disabled children).

The system will automatically take into account tax and insurance deductions (as a percentage), and then display the amount of wages after tax. In addition, the calculator has a mode that calculates the amount of tax deductions. To do this, you only need to indicate the employee’s salary before tax.

How to calculate social tax and social contributions

How to calculate wages, taking into account all tax calculations, including social ones? To carry out this operation, you just need to use an online calculator that allows you to calculate your “net” salary. To do this, you need to enter some data: worker status (retired, disabled, foreigner, etc.) and the employee’s salary to be calculated.

Features of receiving in electronic form

Increasingly, electronic document management is being used in practice and electronic forms of documents are being used. A certificate of tax arrears was no exception. Inspections are very actively introducing electronic document management via telecommunication channels through authorized operators.

To receive a document in electronic form, you must also send a request in electronic form via TKS. The Federal Tax Service has developed an appropriate form for this purpose. It was approved by Order of the Ministry of Finance dated July 2, 2012 No. 99n (see form at the end of the article).

In the application we fill in the following details:

- name, TIN, address of the taxpayer;

- details of the inspection to which the request is submitted;

- request code (in our case it is 2);

- the date for which the information needs to be generated.

In response, the Federal Tax Service will issue a form similar to a paper one, signed with an electronic digital signature.

The response time for TKS is also 10 days. But, as a rule, tax inspectorates generate a response much faster, and a response can be received within 2-3 days.

Taxes and deductions for individual entrepreneurs

Tax payments of an individual entrepreneur include not only tax fees, but also mandatory insurance contributions. And if the size of the former can be changed by choosing the optimal taxation system, then insurance premiums are a fixed amount.

Important! An individual entrepreneur is not required to pay taxes if his activities are suspended or not carried out at all. However, insurance premiums must be paid as long as the entrepreneur is listed in the Unified State Register of Entrepreneurs!

The amount of insurance payments does not depend on the chosen taxation system. For example, the amount of transfers for compulsory pension insurance is 26,545 rubles for 2021, and for compulsory health insurance - 5,840 rubles.

Important! If the income of an individual entrepreneur exceeds 300 thousand rubles per year, then the amount of pension insurance increases by 1% of the amount of the exceeded limit. However, there is a limitation - the maximum payment to the Pension Fund cannot be more than 212,360 rubles!

If an individual entrepreneur hires employees, then in addition to his own deductions, he also undertakes to pay insurance payments for employees:

- To the Pension Fund - 22%;

- To the Social Insurance Fund - 2.9%;

- To the Health Insurance Fund - 5.1%.

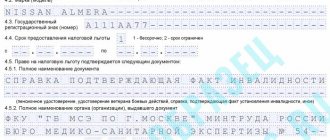

Is the received certificate filled out correctly?

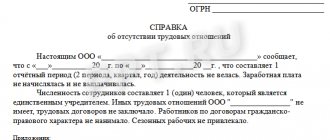

Let's look at an example of what a completed certificate KND 1120101 should look like: a sample is presented below.

1. A serial number must be assigned.

2. The name, INN and KPP, and address of the taxpayer are indicated. When generating information for a company that has separate divisions, the checkpoint may not be specified.

3. The date must correspond to the date specified in the request

4. The most important record is the record of the presence or absence of debt

5. The name of the inspection that issued the form must be given

6. At the bottom of the paper document there must be the signature and seal of the head of the Federal Tax Service, and on the electronic document - the digital signature details.

Below is a completed document, which is assigned a code according to KND 1120101: certificate (sample).

KND 1120101 (form)

Application (request form)

Tax payments to the federal budget

The state treasury is replenished from all budget levels: local, regional and federal. Tax deductions are distributed as follows:

- The local budget receives funds from land tax, personal income tax and the unified tax on temporary income;

- In the regional – enterprise property tax, transport tax, gambling tax and simplified tax system;

- In the federal - VAT, income tax, excise taxes, personal income tax, water tax, state duty, mineral extraction tax and the like.

Dates of issue and validity

After receiving the application, tax inspectors of the Federal Tax Service check the information in a unified federal database. Based on the data obtained from it about the presence or absence of debt, a document is drawn up according to the form. It takes 5-10 days. The method for obtaining the certificate is indicated when submitting the application. It arrives by mail, email, or is handed out to the Federal Tax Service.

In the latter case, the manager/representative comes to the operating room and takes the document for signature. A note about this fact is made in the accounting journal. It is advisable to take with you copies of checks and tax receipts, so that if unfair debts are discovered on paper, you can provide evidence to the Federal Tax Service employees.

In addition to issuing a certificate in its desired form, there are two more options for the development of events:

- Small debts or fines are discovered, then you need to pay them off and submit the application again (for more details, see Article 45 of the Tax Code of the Russian Federation);

- Instead of a certificate, you received a letter with an official refusal (possibly in case of large debts) - it also indicates the amount of tax or debt that must first be repaid.

- An individual or organization has arrears, penalties or unpaid interest; the document will contain a record of the debt. Along with it, an application is issued, which indicates the Federal Tax Service codes for which there are unpaid debts. If the data does not match, check the calculations with the Federal Tax Service to detect and correct the error.

It is recommended to obtain a document from the Federal Tax Service (certificate of absence of tax debt) immediately before it is applied, since its validity is limited to 10 days. The reason is simple - the debt of an individual or legal entity can form quite quickly, and after a month the document will not reflect the real state of affairs. Since its preparation period is only 5-10 days, you can afford to order it last when collecting documents, for example, for a loan or tender.

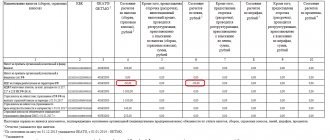

How to read a statement about the status of settlements

The main part of the certificate is a table of ten columns, which reflects:

- name of the tax (fee, insurance premium) for which there is a debt/overpayment (column 1);

- KBK payment, OKATO/OKTMO code (columns 2, 3);

- the status of settlements for taxes, fees, insurance premiums (column 4), penalties (column 6), fines (column

and interest (column 10);

and interest (column 10); - The columns also reflect the provision of a deferment, an investment loan, restructuring or suspension of collection of taxes, fees, contributions (column 5), penalties (column 7), fines (column 9).

It is not difficult to understand the contents of the certificate about the status of settlements. The main thing that a taxpayer needs to take into account is:

- The certificate does not include information on taxes, fees and insurance contributions, for which the tax authorities have a zero balance. That is, if the Federal Tax Service did not indicate any tax paid by the taxpayer in column 1 of the certificate of payment status, this means that the company or individual entrepreneur does not have any arrears or overpayments for it.

- If, according to the Federal Tax Service, the taxpayer has a debt or overpayment, such amounts will be reflected in columns 4, 6, 8 or 10, depending on what type of payment the amount relates to (tax, penalties, fines, etc.). The presence of amounts with a “-” sign means arrears, the absence of a minus sign next to the amount means an overpayment.

Certificate of settlement status – sample:

What role does it play?

In practice, one of the most common accounting statements for the court is about debt . Debtor and/or creditor. She simultaneously performs:

- supporting document (duplicates the necessary information from accounting and tax accounting);

- We prove to the court and the parties to the conflict the existence of specific facts.

Also see “Changes in state duty in 2021: how much you will have to pay.”

Not sure you don't have any debts?

If there is a suspicion that you have debts to the Federal Tax Service and the Tax Inspectorate, but there is no data on their size, it makes sense to first clarify the information with the Federal Tax Service (request data on debts), and then order a certificate. It’s better to go to the branch yourself (or hire a representative) to find out all the details on the spot.

What do we have to do:

- Request a sample application - often different departments in Moscow and the region have their own samples, they are used solely for the convenience of employees, since the application form is not regulated;

- Fill out the application, indicating the method of obtaining the result, hand it over to the inspector, provide your passport (and power of attorney, if necessary);

- After 5 days, receive documents from the tax authority, cover all debts and payments indicated therein, and directly apply for a certificate of no debt to the tax office.

Certificate of tax deductions

Where can I get a tax deduction certificate? According to labor law, the employer is obliged to provide a certificate of tax deductions upon request of the employee. If he refuses to extradite her, this will be a direct violation of the legislation of the Russian Federation. In order for an organization to provide a document on tax deductions, it is necessary to fill out a corresponding application.

However, there are cases when a certificate from a previous place of employment is required, but that employer cannot issue it (for example, the organization was liquidated). “So where can I get it?” - you ask. Under such circumstances, a document on tax deductions can be issued by the tax service at the place of registration of the liquidated organization.

Why and in what situations is a document needed?

For organizations and individual entrepreneurs, the document may be needed in the following cases:

- At the request of buyers or supplier. In financial business activities, especially when concluding a major transaction, or when participating in tenders and trades, such a certificate will be very necessary.

- Upon termination of the activities of an individual entrepreneur, or in the process of liquidation of an organization.

- Upon receipt of any government subsidies.

- Some banks, when applying for a loan to a legal entity or individual entrepreneur, ask for such information.

- When there is a change of director or chief accountant.

- When expanding an enterprise or when preparing a business plan.

- Counterparties may ask.

- When a taxpayer moves from one tax authority to another, when changing place of residence or registration with a tax authority.

The presence of a certificate of fulfillment of obligations to the budget from the tax authority by a company or individual serves as additional evidence of reliability and financial solvency.

For individuals, a certificate may be needed in several cases:

- Registration of an individual as an individual entrepreneur.

- Change of citizenship.

- When applying for a large loan (such as a mortgage), the lending institution may ask for a certificate.

- When applying for tax benefits. For example, on land.

- When making large transactions. For example, selling an apartment, car, land, etc.

When is the certificate provided?

The document, upon written application, is provided after 10 working days from the date of receipt of the application (the period is regulated by letter of the Federal Tax Service of Russia dated July 2, 2012 No. 99). Weekends and holidays are not included in this period.

Download: sample request to the tax office regarding the absence of debt

Tax deduction from pension contributions

And finally, it is worth adding that contributions to non-state pension funds, judging by the comments of Internet users, are increasingly gaining popularity among citizens who care about their life after retirement. When you transfer funds to a non-state pension fund, you have the opportunity to receive a tax deduction (tax refund). To do this, you must submit a corresponding application to the Federal Tax Service.

Who submits which tax forms? Who pays taxes and contributions monthly? You will find answers to these questions in the video:

and interest (column 10);

and interest (column 10);