The payment order form is familiar to every accountant, but its details and requirements for filling them out change regularly, presenting many surprises. In addition, payment cards are always the focus of judicial practice as the main evidence of any non-cash payment, and judges regularly voice new nuances of their design. In our material we will tell you where in the payment order there is a hidden signal for bankers to transfer funds exclusively to the Mir card, why the unique payment identifier is dangerous, what will be affected by specifying the transfer conditions code, as well as the shadow sides of well-known details.

Step-by-step instructions for filling out a payment order

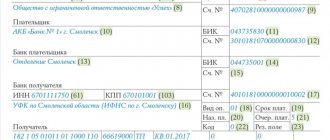

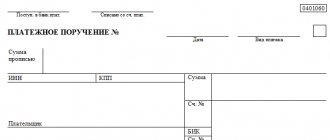

On the sample form, each cell is assigned a number to make it easier to explain its meaning and clarify exactly how it needs to be filled out.

Check whether you are using the current payment order form, updated in 2012. The new form is approved by Appendix 2 to the Regulation of the Bank of Russia dated June 19, 2912 No. 383-P.

Check the number listed at the top right. No matter who the money sent via payment order is intended for, the same numbers will be indicated - 0401060 . This is the form number of the unified form valid today.

We begin to fill out the fields of the document one by one. Field 3 – number. The payer indicates the payment number in accordance with its internal numbering order. The bank can provide the number to individuals. This field cannot contain more than 6 characters.

Field 4 – date. Date format: two digits day, two digits month, 4 digits year. In electronic form, the date is formatted automatically.

Field 5 – type of payment. You need to choose how the payment will be made: “urgent”, “telegraph”, “mail”. When sending a payment through a client bank, you must indicate the encoded value accepted by the bank.

Field 6 – amount in words. The number of rubles is written with a capital letter in words (this word is not abbreviated), kopecks are written in numbers (the word “kopek” is also without abbreviations). It is acceptable not to indicate kopecks if the amount is a whole amount.

Field 7 – amount. Transferred money in numbers. Rubles must be separated from kopecks with the sign – . If there are no kopecks, put = after the rubles. There should be no other characters in this field. The number must match the words in field 6, otherwise the payment will not be accepted.

Field 8 – payer. Legal entities must indicate the abbreviated name and address, individuals - full name and registration address, those engaged in private practice, in addition to this data, the type of activity, individual entrepreneur - full name, legal status and address must be noted in brackets. The name (title) is separated from the address by the // symbol.

Field 9 – account number. This refers to the payer's account number (20-digit combination).

Field 10 – payer bank. Full or abbreviated name of the bank and the city of its location.

Field 11 – BIC. Identification code belonging to the payer’s bank (according to the Directory of participants in settlements through the Central Bank of Russia).

Field 12 – correspondent account number. If the payer is served by the Bank of Russia or its division, this field is not filled in. In other cases, you need to indicate the subaccount number.

Field 13 – beneficiary bank. The name and city of the bank where the funds are sent.

Field 14 – BIC of the recipient's bank. Fill in the same way as clause 11.

Field 15 – recipient's subaccount number. If money is sent to a client of the Bank of Russia, there is no need to fill out the box.

Field 16 – recipient. A legal entity is designated by its full or abbreviated name (both can be done at once), an individual entrepreneur - by status and full name, privately practicing individual entrepreneurs must additionally indicate the type of activity, and it is enough to name an individual in full (without inclination). If funds are transferred to the bank, then the information from field 13 is duplicated.

Read more: Completing medical first aid kits in production

Field 17 – recipient's account number. 20-digit account number of the recipient of the funds.

Field 18 – type of operation. The code established by the Central Bank of the Russian Federation: for a payment order it will always be 01.

Field 19 – payment term. The field remains empty.

Field 20 – purpose of payment. See paragraph 19, until the Central Bank of the Russian Federation indicates otherwise.

Field 21 – payment queue. A number from 1 to 6 is indicated: queue in accordance with Article 855 of the Civil Code of the Russian Federation. The most commonly used numbers are 3 (taxes, contributions, salaries) and 6 (payment for purchases and supplies).

Field 22 – UIN code. A unique accrual identifier was introduced in 2014: 20 digits for a legal entity and 25 for an individual. If there is no UIN, 0 is entered.

Field 23 – reserve. Leave it blank.

Field 24 – purpose of payment. Write down what the funds are being transferred for: name of the product, type of service, number and date of the contract, etc. It is not necessary to indicate VAT, but it is better to be on the safe side.

Field 43 – payer’s stamp. Placed only on a paper version of the document.

Field 44 – signatures. On paper, the payer puts a signature that matches the sample on the card submitted when registering the account.

Field 45 – bank marks. On the paper form, the banks of the sender and recipient of the funds put stamps and signatures of authorized persons, and in the electronic version - the date of execution of the order. Field 60 – payer’s tax identification number. 12 characters for an individual, 10 for a legal entity. If there is no TIN (this is possible for individuals), write 0.

Field 61 – recipient’s TIN. Similar to paragraph 28.

Field 62 – date of receipt at the bank. Fills the bank itself.

Field 71 – write-off date. Issued by the bank.

IMPORTANT! Cells 101-110 must be filled out only if the payment is intended for tax or customs.

Field 101 – payer status. Code from 01 to 20, specifying the person or organization transferring the funds. If the code is in the range from 09 to 14, then field 22 or field 60 must be filled in without fail. Field 102 – payer checkpoint. Registration reason code (if available) – 9 digits.

Field 103 – recipient checkpoint. 9-digit code, if assigned. The first two digits cannot be zeros.

Field 104 – KBK. New for 2021. The budget classification code reflects the type of income of the Russian budget: duty, tax, insurance premium, trade fee, etc. 20 or 25 characters, all digits cannot be zeros.

Field 105 – OKTMO code. Indicated since 2014 instead of OKATO. According to the All-Russian Classifier of Municipal Territories, you need to write in this field 8 or 11 digits assigned to your locality.

Field 106 – basis of payment. The code consists of 2 letters and indicates various reasons for payment, for example, OT - repayment of deferred debt, DE - customs declaration. In 2016, several new letter codes were introduced for the basis of payment. If the list of codes does not indicate the payment that is made to the budget, 0 is entered in the cell.

Field 107 is an indicator of the tax period. It is noted how often the tax is paid: MS - monthly, CV - once a quarter, PL - every six months, GD - annually. The date is written after the letter designation. If the payment is not tax, but customs, the code of the relevant authority is written in this cell.

Field 108 – payment basis number. From March 28, 2016, in this field you need to write the number of the document on the basis of which the payment is made. The document is selected depending on the code specified in field 107. If cell 107 contains TP or ZD, then 0 must be entered in field 108.

Field 109 – date of the payment basis document. Depends on field 108. If there is 0 in field 108, 0 is also written in this cell.

Field 110 – payment type. The rules for filling out this field changed in 2015. This cell does not need to be filled out, since field 104 indicates the KBK (its 14-17 digits precisely reflect the subtypes of budget revenues).

Read more: Www customs u provision of statistical forms

Is it possible to restore a payment receipt at Sberbank?

| If the news was useful to you, then share the link with your friends. |

| Comment display order: Default Newest first Oldest first |

| 0Spam1 Oksana (24.10.2016 12:56) Good afternoon. The fact is that my husband made a payment at Sberbank on October 14, 2016 in the afternoon, and a week later they called him and informed him that the payment had not arrived. He lost the receipt. Is it possible to restore the payment receipt and find out where the money went? Answer: How was the payment made? |

| 0Spam2 Oksana (10/29/2016 10:02) Payment was made through the Sberbank cash desk Answer: Contact the Sberbank representative office. |

| 0Spam3 Pavel (02/19/2017 19:19) Is it possible to restore a payment receipt from 2000 to 2009 at Sberbank? Answer: No. |

| 0Spam4 Valery (08/16/2017 11:26) In the fall of 2015, I paid the transport tax at the Sberbank terminal, is it possible to restore the receipt? |

Additional nuances

Typically, the payment form must be drawn up in 4 copies:

- The 1st is used when writing off at the payer’s bank and ends up in bank daily documents;

- The 2nd is used to credit funds to the recipient’s account in his bank, stored in the documents of the day of the recipient’s bank;

- 3rd confirms the bank transaction, attached to the recipient's account statement (at his bank);

- The 4th with the bank’s stamp is returned to the payer as confirmation of acceptance of the payment for execution.

NOTE! The bank will accept the payment, even if there is not enough money on the payer’s account. But the order will be executed only if there are enough funds for this.

If the payer contacts the bank for information about how his payment order is being executed, he should receive an answer on the next business day.

The only details of the recipient that the bank is required to check is the account number

On December 13 and 14, 2021, the company sent payments to Sberbank addressed to two counterparties for a total amount of more than 7 million rubles, indicating erroneous account details of the recipients. The money went to a company with a completely different name. The chief accountant informed the bank about the discrepancy between the details, and on December 15 the company sent there a request for a refund, which remained unanswered. The company was unable to prove that the mistake was made by Sberbank and the recipient bank (Alfa-Bank), even in three courts.

The judges indicated that in relation to the transfer of non-cash funds, the rule enshrined in Part 7 of Art. 5 of Federal Law No. 161-FZ of June 27, 2011, according to which the irrevocability of the transfer begins from the moment the funds are written off from the payer’s bank account.

In addition, by virtue of paragraph 4.3 of Chapter. 4 of Regulation No. 383-P and clarifications of the Central Bank, when crediting funds, the bank must identify the recipient using two details, one of which is the account number of the recipient of the funds. At the same time, the legislation does not oblige the payer and recipient banks to conduct additional verification of the recipient’s details if the data specified in the payment orders is sufficient for the transfer and subsequent crediting of funds.

Also, according to the Determination of the Supreme Arbitration Court of the Russian Federation dated 04.03.2013 No. VAS-1709/13, the bank has the right, but is not obliged, to check the compliance of the digital and text details of the recipient of funds and can refuse to execute an order only if the distortion of the details does not allow it to be executed.

Themis established that Sberbank verified the authenticity of the EDS secret keys and the presence of all the necessary details in the disputed electronic documents. The Bank carried out transactions to transfer funds in accordance with the client’s instructions and is not responsible for the correctness and reliability of electronic documents transmitted through the remote service system.

Resolution of the Arbitration Court of the Moscow District dated June 25, 2018 No. F05-9255/2018

Source:

Magazine "Accountant's Time"

Heading:

Primary

payment order details of payment documents error in payment order

Sign up 7800

9750 ₽

–20%

Payment order to the bank

A bank payment order is an order to the bank to transfer funds to an individual or legal entity. As confirmation that the bank has processed the payment document, a mark is placed on it indicating that the order was executed or its execution was refused for one reason or another.

The mark on the payment card looks like a blue stamp. The original payment slip with this stamp can be obtained directly from the bank. The company can also print the executed document using the software installed on it to communicate with the bank.

Electronic payment method eliminates the need to certify the payment for the court

The organization applied to recover from its opponent in a legal dispute the costs of attorneys' fees. As confirmation of their payment under the contract, the institution submitted to the court a printout of the payment order. The first instance refused to recognize the document as appropriate evidence, pointing out that the blueprint of the payment order was not certified by the bank.

However, the appeal drew attention to the fact that the court did not have a copy at its disposal, but an electronic payment order printed for convenience of review by the court, executed in accordance with the rules on non-cash payments established by the Central Bank of the Russian Federation. The judges referred to Regulation No. 383-P and the position of senior colleagues from the cassation of the North-Western District, who explained that the requirement for a bank stamp and the signature of the responsible executor on the payment order applies only to the execution of a document on paper. When transferring funds electronically, the payment order must indicate: type of payment - “electronic”, date of debiting the funds, bank mark confirming the payment.

The arbitrators also noted that the Bank of Russia does not certify either copies or originals of payment orders used in settlements between non-governmental organizations. The cassation judges of the Moscow District confirmed the correctness of the position of their lower colleagues.

Resolution of the Arbitration Court of the Moscow District dated June 3, 2019 No. F05-7698/2019

Editor's note:

Regarding the “Bank Mark” details, please note that in accordance with clause 45 of Appendix No. 1 to Regulation No. 383-P, in the specified field of the payment order, the payment execution date must be indicated by the recipient’s bank. If there is an appropriate mark on the printout of the electronic payment order, the courts consider the fact of incurring expenses proven. Thus, the intellectual property rights court, in its Resolution No. S01-262/2019 dated April 8, 2019, did not accept the party’s arguments about the non-compliance of payment documents with regulatory requirements due to the lack of stamps on them. The judges noted that from the provisions of the current legislation it follows that the original payment document is drawn up in a single copy. In accordance with paragraph 1 of Art. 6 of the Federal Law of 04/06/2011 No. 63-FZ, information in electronic form signed with a qualified electronic signature is recognized as equivalent to a paper document signed with a handwritten signature. Consequently, the original of a payment order generated electronically in the Bank-Client system is an electronic document drawn up in the format established by the Central Bank of the Russian Federation and signed with a qualified electronic signature.

Copies of electronic payment bills presented to the court with marks from the recipient’s bank do not require seals and comply with Regulation No. 383-P.

Bank mark on the payment order

When making payments by payment orders, the bank puts marks on them about all the steps that the document goes through, and not just after it is completely processed. O means that the financial institution has received the document but has not yet executed it. If there is a “processing” stamp, this means that the bank is checking the received document and executing it.

These marks cannot serve as confirmation that the money has been transferred; they only inform about what stage of processing the payment is at.

Bank's note on execution of payment order

If the payment order is executed by the bank in full, then after the funds are debited from the organization’s account in favor of the required counterparty, a corresponding mark is placed on the payment order.

Typically, the mark includes:

- information that the funds have been successfully transferred (“Completed”, “Passed”, etc.);

- date of payment.

The mark also indicates the bank division that carried out the financial transaction, its BIC and the details of the bank employee who directly performed it.

Failure of the bank to execute a payment order

If the bank cannot execute the client’s order for any reason (insufficient funds in the account, errors in details, overdue payment, etc.), the corresponding “Rejected” mark is placed on the payment order.

In this case, the payer needs to clarify the reason and draw up a new document.

Punctuation marks in the “Amount in words” invalidate the payment document

The bank refused to execute the company's order to transfer funds due to the presence of dots in the fields of the documents "Amount in words". In its complaint, the company asked the judges to take into account that clause 6 of Appendix No. 1 to Regulation No. 383-P does not contain in its text any reference to the inadmissibility, restriction or prohibition of punctuation marks. The cassation arbitrators of the Moscow District indicated that the company had incorrectly interpreted this clause. From the description of the “Amount in words” detail of the regulations, it is clear that it does not allow the insertion of separators, spaces, punctuation marks and other symbols. The court qualified the inclusion of a dot in the “Amount in words” fields as a violation of the rules established by the Central Bank.

Resolution of the Arbitration Court of the Moscow District dated September 16, 2015 No. F05-12461/2015

Do I need to print bank statements and payments?

A printed payment order with the bank's execution mark may be required in various situations, for example, as confirmation of payment of a state duty or tax.

In accounting, payments are usually printed as an appendix to a bank statement. If an organization makes a large number of payments every day, this can be quite inconvenient.

The legislation does not precisely regulate whether it is mandatory to print electronic payment orders or whether a bank statement is sufficient. Primary documents signed with an enhanced digital signature can be accepted by the tax authorities as confirmation of expenses, and accordingly it is not necessary to print them out - the Ministry of Finance has repeatedly pointed this out in its clarifications (for example, letter of the Ministry of Finance of the Russian Federation dated January 13, 2016 No. 03-03-06/1/259 ). An exception is a request for a document on paper, a discrepancy between electronic formats, when an electronic document cannot be submitted to the Federal Tax Service, etc. situations.

Read more: How to close a legal entity step by step instructions

How to recover a lost receipt

You will need

- - Passport;

- — information about the payment;

- — application form;

- — information about the protocol (the person who compiled it, the essence of the offense, place, time of incident).

Instructions

As a rule, many motorists had to draw up a report for speeding and other administrative offenses. The consequence is the imposition of a fine, which is paid within a certain time frame. If you paid money and the receipt was lost or damaged, contact the bank where the payment was made.

Make a statement. In it, write down your request for the receipt to be restored. Enter your personal information. Indicate the exact date of payment, if known. If you don't remember the date, write down the approximate time period when you paid the fine.

Register the application with the bank. Be sure to duplicate the document in two copies, hand one of them to the bank employee, and keep the second statement with you so that in the future you can prove your rights if the matter comes to trial.

If you lose or damage your vehicle inspection payment receipt, contact the tax authority at your place of registration. Submit an application addressed to the head of the Federal Tax Service for the region where you live. Paid receipts are usually stored in a warehouse. The tax officer may look for the payment document himself or ask you to find a receipt.

Knowing the exact date will make it easier for you to find the receipt. You will be given a copy of the payment document from the tax office. It will be certified with a seal, the signature of an employee of the Federal Tax Service and the inscription “Copy is correct.”

If you lose an unpaid receipt, contact the traffic police. Tell the employee the date the protocol was drawn up, the personal information of the person who wrote the document, the place and time of the incident. Based on this information, you will be issued a new receipt, according to which you can pay the fine. Instead of a payment document, you have the right to submit a receipt if you made a payment through the terminal, or a notification if you paid the fine via online transfer.

- Unpaid fines: how to recover lost receipts in 2017

How to restore a payment receipt?

Every month we make at least one or two payments: for an apartment, for electricity, for major home repairs, for a telephone, for the Internet, kindergarten, school... And there are also receipts for payment of state fees, fines, loans, etc. Let's be honest: storing them in one place for 2-3 years, as the rules dictate, is absolutely unrealistic. But losing a payment receipt is as easy as shelling pears.

In some cases - if the payment was correctly processed and credited to the recipient's account - a receipt is not required. But in everyone’s life there have been unpleasant moments when money has been paid, but the receipt has been lost. So, how to restore a receipt for payment of services?