Toll scheme of work. Documents for registration according to the tolling scheme.

ACCOUNTING SERVICES FOR YOUR COMPANY >>

Here you will find a set of documents that will allow you to correctly prepare documents both on behalf of the Provider (Customer) and on behalf of the Processor (Contractor) *). We highly recommend using them in your document flow to avoid sanctions from the tax authorities.

Contact us >> Cost of accounting services for your company >> Why do you need us to service your company >>

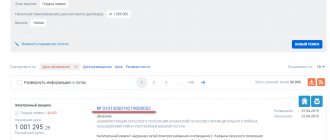

Invoice for the transfer of raw materials to the Processor (M-15) - with this accompanying document drawn up by Davalets, the material (raw materials) is transferred to the Processor for processing. The document is required to be drawn up.

Certificate of acceptance and transfer of materials to the Processor for processing.doc - this document, together with the M-15 form, must be transferred by the seller when transferring materials for processing. The document is required to be drawn up.

Receipt order for materials, goods, etc. (M-4) - this document formalizes the receipt of materials at the Processor's warehouse on the basis of the M-15 invoice received from the Provider and the materials acceptance and transfer certificate.

Invoice for the transfer of finished products to the warehouse (MX-18) - with this document, the Processor registers the receipt of finished products received from processing from HIS production at its warehouse.

Processor's report - this document is drawn up monthly when working under a tolling scheme. The document is required to be drawn up.

Act on excess consumption of materials and waste.doc - this document is drawn up if, during processing for the production of a certain amount of finished products, it was discovered that more materials were consumed than was established in the calculation (annex to the contract), which, among other things, indicates consumption standards for the production of a unit of product, as well as defect rates and the amount of acceptable waste. . The document is required to be drawn up if the specified standards are exceeded.

Certificate of acceptance and transfer of finished products to Davalts.doc - this act is drawn up each time the finished product is transferred from the Processor to Davalts.

Act of transfer of customer-supplied materials

The finished products are transferred to the Provider along with an invoice in form M-15, drawn up by the Processor (similar to how this is done when the Processor receives materials - the invoice has the same form, and the act has its own form for the transfer of finished products). The document is required to be drawn up.

*) The documents presented on our website are only samples and cannot be used without detailed study and adjustments taking into account the activities of each specific company. The owners of the site www.profitgroup.ru do not bear any responsibility for the use and consequences of the use of any files (documents) obtained from this site

The legislative framework

When concluding agreements regarding the transfer of customer-supplied raw materials (and the act of transfer of customer-supplied materials will be an appendix to such an agreement), one should be guided by the Rules for accounting for customer-supplied raw materials, which are clearly stated in Methodological Instructions No. 119n (clause 156), which were approved by a separate order of the Ministry of Finance dated December 28, 2001 . In particular, it describes the transfer mechanism, the conditions that counterparties must follow, and other fundamentally important points.

Don't have a dacha yet?

Construction of houses in Pereslavl-Zalessky.

- huge lake

- pine forests

- hunting and fishing

- 1.5 hours from Moscow

find out more

An invoice (standard form No. M-15) is drawn up in case of supply of goods and materials on the basis of an agreement and other documents to business entities of their organization located outside its location, as well as to other third-party organizations.

The invoice must be drawn up in two copies, one is given to the warehouse (which is the basis for the release of goods and materials), and the other is given to the recipient of the goods and materials.

Persons who can issue this form:

- The accounting employee who is responsible for this area,

- Responsible employee of the structural unit,

- A storekeeper who acts on the basis of a power of attorney or order.

Use of customer-supplied materials.

Every year, the numbering of invoices starts from one. When filling out the form (outsourcing of goods and materials), in the first table you must indicate:

- Date of registration,

- Sender. You must indicate the name of the structural unit and the type of its activity,

- Code of the type of operation performed (if the organization uses a code system),

- Recipient. You must indicate the name of the department, its type of activity,

- Responsible for the supply of goods and materials. Contractor code, unit name, type of activity.

After this, the document that serves as the basis for issuing the invoice is indicated. In the “To” line, write the name of the recipient of the goods and materials (the business entity of its organization or a third-party organization). In addition, write down the full name of the recipient and details of the power of attorney provided by him. Column 3. Write the name of the goods and materials, their characteristics: brand, size, grade. Column 4. Nomenclature number (if not available, then put a dash). Column 5. The code of units of measurement according to OKEI is recorded. Column 6. The name of the units of measurement is indicated. Column 7. Write the amount of material required for shipment. Column 8. Filled out by the storekeeper, indicating the actual quantity of materials released. Column 9. The price of one unit of goods and materials in rubles and kopecks without VAT. Column 10. Price of issued inventory items without VAT. Column 11. Total VAT amount. Column 12. Total cost of goods including VAT. (in total columns 10 and 11). Column 13. The inventory number is recorded. Column 14. The passport number of goods and materials (precious metals) is recorded. Column 15. Entry number in a special materials accounting card.

In the conclusion, indicate the number of items of goods and materials issued, the total amount of the invoice and additionally VAT, which is included in the total amount.

The invoice form is signed by: the responsible employee who authorized the release of goods and materials, the employee who released the goods and materials, the chief accountant and the recipient of goods and materials.

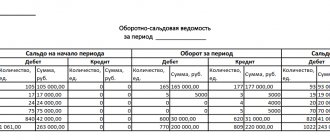

Postings for accounting of DS

The reflection in the accounting of transactions with DS at the customer will be as follows:

- Dt 10.7 Kt 10.1 (10.8) - transfer of DS to the contractor;

- Dt 10.1 Kt 10.7 - receipt of processed materials;

- Dt 10.1 Kt 60 - the cost of work on processing DS is added to the cost of materials;

- Dt 19 Kt 60 - VAT is taken into account on the cost of processing work;

- Dt 68 Kt 19 - VAT is accepted for deduction;

- Dt 60 Kt 51 - the contractor is paid for the work performed on processing the DS;

- Dt 20 Kt 10.1 - materials processed on the outside were sent to production;

- Dt 43 Kt 20 - finished products made from DS are registered.

In case of receipt of products from the contractor that are considered semi-finished products, the customer can make the following entries:

- Dt 21 (10.2) Kt 10.7 - write-off of DS for the production of semi-finished products;

- Dt 21 (10.2) Kt 60 - including the cost of processing services there;

- Dt 19 Kt 60 - VAT on processing is taken into account;

- Dt 20 Kt 21 (10.2) - the semi-finished product is released into production.

If you have access to K+, check the correctness of accounting and documentation of transactions at the customer using the Ready Solution. If you don't have access, get a free trial access and move on to the Ready Solution.

The contractor will use the following entries in accounting for transactions with DS:

- Dt 003 - DS accepted from the customer and sent for processing;

- Dt 20 Kt 02 (10, 23, 25, 26, 60, 69, 70) - the costs of processing DS are taken into account;

- Kt 003 - finished products from the DS have been shipped to the customer;

- Dt 62 Kt 90.1 - revenue from processing work is reflected;

- Dt 90.3 Kt 68 - VAT is charged on the cost of processing work;

- Dt 90.2 Kt 20 - the cost of processing is written off;

- Dt 51 Kt 62 - payment received from the customer.

Displaying information on account credit 10 from the contractor is possible only in relation to his own materials (for example, fuel and lubricants for the equipment on which the work is performed). The cost of DS is never included in the contractor’s cost price.

If you have access to K+, check the accuracy of the contractor's accounting and documentation of operations using the Ready Solution. If you don't have access, get a free trial access and move on to the Ready Solution.

Act No. of acceptance and transfer of customer-supplied raw materials

In the case of the supply of material assets to the farms of one’s organization located outside its territory, or to third-party organizations, on the basis of contracts and other documents, an invoice is issued for the supply of materials to the third party. More often the document is used in the first case.

The standard intersectoral form No. M-15 (approved by Decree of the State Statistics Committee of Russia dated October 30, 1997 No. 71a) is used as a document form.

The invoice is issued in two copies: the first is transferred to the warehouse (as the basis for the release of goods and materials); the second - to the recipient of the goods and materials.

The invoice can be issued in the accounting department - by the employee responsible for this accounting section, in the warehouse - by the storekeeper on the basis of a written order from the manager and a power of attorney presented by the recipient of the goods and materials, or in a structural unit - by the responsible employee.

Several people can take part in drawing up the invoice.

When describing the procedure for filling out columns of form No. M-15, we will be sure to indicate if any column must be filled out by a specific employee.

The numbering of invoices is continuous. Starting from the new year, the numbering starts from number 1.

The first table indicates:

- date of preparation of the invoice;

- transaction type code (filled in if the organization uses a coding system);

- sender: name of the structural unit and type of its activity;

- recipient: name of the structural unit and type of its activity;

- person responsible for delivery: name of the structural unit, type of activity and contractor code (filled in if the organization uses a coding system).

Next, indicate the document on the basis of which this invoice is issued.

In the “To” line indicate the name of the recipient of material assets: the farms of your organization or third-party organizations. In addition, enter the last name, first name, patronymic, as well as details of the power of attorney submitted by the recipient.

If, in accordance with the document flow schedule established in the organization, the invoice is not issued in the accounting department, then columns 1 and 2 of the main table of the invoice will then be filled in by the accountant of the material desk:

- a synthetic accounting account and a subaccount with which the correspondence of the inventory account will be compiled based on this invoice;

- code for analytical accounting of written-off values. The following columns can be filled out by a non-accountant.

Column 3 indicates the name of the material assets that are issued according to the invoice, their brief description: grade, size, brand.

Column 4 indicates the nomenclature number assigned at the enterprise to this type of material assets in accordance with the developed nomenclature-price tag. If an enterprise has a small range of inventories, then it may not assign item numbers to them. In this case, a dash is placed in the column.

Column 5 indicates the code of the unit of measurement in accordance with OKEI.

Column 6 indicates the name of the unit of measurement adopted for this type of material (pieces, kilograms, meters, etc.).

Column 7 indicates the amount of material that should be issued according to the invoice.

Column 8 is filled in by the storekeeper when releasing goods and materials from the warehouse. It indicates the actual amount of material released.

If only quantitative accounting is maintained at the warehouse (or the responsible employee of the structural unit does not know the prices of materials), then columns 9 to 12 are filled in by an accountant.

Column 9 indicates the unit price of inventory items excluding VAT in rubles and kopecks.

Column 10 shows the cost of the entire quantity of inventory items excluding VAT in rubles and kopecks. It is calculated as the product of indicators from columns 8 and 9.

Column 11 indicates the amount of VAT on the entire quantity of goods. It is calculated by multiplying the indicator in column 10 by the corresponding VAT rate.

Column 12 indicates the total cost of the goods including VAT.

Rules for recording transactions with DS from the customer and contractor

The main feature of accounting for such operations is that these same raw materials/materials are not transferred into the ownership (on the balance sheet) of the contractor - therefore, they are taken into account by him in off-balance sheet account 003 (Article 156–157 of the order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n) . This means that the customer himself does not write off the DS from the balance sheet, but transfers it to a special subaccount 7 of analytical accounting, opened to account 10 (Order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n).

Accordingly, the ownership of the finished product produced by the contractor from the DS also remains with the processing customer (clause 1 of article 220 and clause 2 of article 703 of the Civil Code of the Russian Federation). This determines:

- The customer has the fact that the fact of transfer of DS for processing in tax accounting (under OSN and simplified taxation system) is not shown. The cost of processing services is subsequently included in material costs, and for the OSN - at the time the processor signs the report, and for the simplified tax system - after payment for the services of the contractor. The cost of the DS transferred for processing is written off by the customer in the amount indicated by the processor in its report on the consumption of raw materials (clause 1 of Article 713 of the Civil Code of the Russian Federation).

- The contractor has the fact that he accepts the DS into off-balance sheet account 003 at the cost specified in the processing agreement. If the contract does not indicate the price of the transferred materials/raw materials, then the processor can keep records in conventional units of cost.

The accounting features of the contractor are also determined by the fact that he:

- Opening an off-balance account is necessary for timely control of the availability and movement of financial assets.

- Finished products that were produced from the DS are also recorded in the off-balance sheet account. It is accepted for storage and accounted for at a conditional price. Accounting is carried out by quantity and amount. It is necessary to organize analytical accounting of DS by customer, by type of DS and by their location.

- The fact of receipt of DS from the customer is not reflected in tax accounting, and finished products manufactured for the supplier are also not taken into account.

- The cost of work performed is recognized as revenue from sales, and the date of reflection of this fact in accounting for taxpayers on the OSN is the date the customer signs the report, and on the simplified tax system - the date of receipt of payment from him.

You will learn about how accounting is carried out using off-balance sheet accounts in our article “Rules for maintaining accounting on off-balance sheet accounts” .

In the case of transfer to the customer of semi-finished products obtained as a result of processing of DS, which require further refinement at the customer’s place, they are accounted for by the customer on account 21 or on a separate sub-account to account 10 at the actual price, which is determined by calculating all costs incurred (clause 5 , 7 PBU 5/01, approved by order of the Ministry of Finance of Russia dated 06/09/2001 No. 44n).

PBU 5/01 has been canceled since 2021. Instead, you need to apply FSBU 5/2019 “Inventories”. The new accounting procedure differs significantly from the existing one. It can be applied earlier by recording changes in accounting policies.

ConsultantPlus experts spoke about the innovations. Get free demo access to the K+ legal reference system and go to Review Material to find out all the details of the changes.

Service Temporarily Unavailable

It is calculated as the sum of indicators from columns 10 and 11.

Columns 13 to 15 are filled out by the storekeeper:

- Column 13 indicates the inventory number assigned to the material according to the warehouse card file;

- in column 14 - the passport number, which is usually available for material assets containing precious metals and stones. In other cases, a dash is placed in the column;

- Column 15 contains the entry number in the materials accounting card.

Based on the results of the invoice, the number of items of material assets issued, the total amount of goods and materials and VAT included in the total amount are indicated in words. Sign the invoice:

- the responsible person who authorized the release of material assets;

- the person who released the material assets;

- Chief Accountant;

- recipient of valuables.

Sample of filling out an invoice for issue of goods and materials on the side

Exhibitor's Guide to the Warehouse Exhibition. Transport. Logistics-2010"

1 2 3 4 5 6 7

| ^ Please submit 2 copies on the exhibiting company’s letterhead. Specify the paying company that has entered into an agreement with Expocentre |

| Expocentre Fairgrounds To the Exhibition Directorate "Stock. Transport. Logistics-2010" |

We ask for permission to import/export the following exhibition equipment and materials that will be presented and/or used at stand No.____________ in pavilion No. ______ during the exhibition “Warehouse. Transport.

Features of reflecting transactions with unused balances of DS

When performing certain types of work, for example, manufacturing structures from rolled metal, the contractor often has unused materials. Therefore, additional entries may arise to reflect transactions with these balances from the contractor and the customer-vendor.

Example

After processing the DS, materials remained on the contractor’s off-balance sheet account. Depending on the agreement between the counterparties, such situations are possible, shown in the following transactions.

Performer:

- Dt 10 Kt 91 - reflects returnable waste that was transferred free of charge to the contractor (in this and further cases - by agreement with the customer-vendor);

- Dt 10 Kt 60 (76) - the balance of the DS transferred from the vendor as payment for the work (for the amount of the cost of the transferred DS excluding VAT) is capitalized;

- Dt 19 Kt 60 (76) - for the amount of VAT on the transferred DS;

- Dt 60 (76) Kt (62) - offset of the cost of DS (with VAT) against payment for work performed for the supplier.

From the customer:

- Dt 10.1 Kt 10.7 - materials returned by the contractor that were not used by him or remained after processing were capitalized by the supplier;

- Dt 62 (76) Kt 90 - the remaining DS from the contractor was transferred to the contractor as payment for the work (including VAT);

- Dt 90 Kt 10.7 - for the amount of the cost of the transferred materials remaining after processing, excluding VAT;

- Dt 90 Kt 68 - VAT is charged on the transferred balances;

- Dt 60 Kt 62 (76) - offsetting the cost of DS with VAT to pay for processing services.

For information on drawing up an agreement on the offset of mutual claims, read the material “Agreement of offset between organizations - sample”.

Certificate of acceptance and transfer of building materials sample form

Logistics-2010"

| № p/p | Name | Quantity |

| 1 |

*Add lines if necessary. We guarantee removal of imported equipment, exhibits, containers, large packaging and construction materials for exhibition stands within the established time frame. Head of the organization _______________________/

(signature) (full name) M.P. ATTENTION!

If the cargo, in addition to exhibits, contains structural elements of the stand (wall panels, carpet, decorative structures and elements, etc.), it is necessary to undergo import approval at Expoconsta CJSC and PCH No. 160 of the Central Administrative District Directorate of the Ministry of Emergency Situations of Russia in Moscow.

powerful projection installations, sound reinforcement equipment and concert lighting equipment is carried out after agreement with the Telecommunications Department.

| Place of the stamp of JSC "Expokonsta" | Place of stamp IF No. 160 | Place of stamp of the Telecommunications Department |

D.04

employees of installation companies,

carrying out construction and installation work

exhibition stands and expositions

(provided in 1 copy)

on company/organization letterhead

To the Directorate of the exhibition “Warehouse. Transport. Logistics-2010"

We ask you to provide passes for entry to the Expocentre Fairgrounds for employees and workers of the installation organization ______________________, in the amount of _____ pieces, who are building the stand of our company _________________, taking part in the exhibition “Warehouse. Transport. Logistics-2010"

under Agreement No.________ dated “____” ____________ 20____ Pavilion No.________, hall_______, stand No.___________. The stand area is __________ sq. m.

List of employees (indicating passport details, place of residence; for non-residents it is necessary to provide a copy of registration of residence in Moscow):

| Item no. | Full name | Passport data (date and place of birth, places of permanent and temporary registration) | Instructions on safety precautions, fire safety and electrical work have been completed | |

| date | Signature | |||

| 1 | 2 | 3 | 4 | 5 |

1 2 3 4 5 6 7