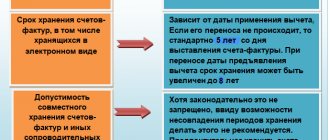

Numbering on invoices over several years leads to the fact that the numbers on the papers become larger and larger. This is not very convenient when keeping records, since you have to operate with large numbers. For this reason, some enterprises, usually large ones, start numbering from one every month, year or quarter. However, according to Letter of the Ministry of Finance of Russia dated October 16, 2012 N 03-07-11/427, the organization’s policy in this area has some nuances. The same document did not explain exactly how to carry out the numbering. For this reason, this operation still raises a lot of questions.

The legislative framework

Standard details of invoices for shipment, advances and adjustments are set out in paragraphs 5, 5.1 and 5.2 of the Tax Code of the Russian Federation. The serial number is also considered a property. However, there is no numbering order in the law. The features of this operation are spelled out in the Resolution of the Russian Federation dated December 26, 2011, number 1137. In particular, a reference to this normative act is contained in paragraph 8 of Article 169 of the Tax Code of the Russian Federation.

The numbering order has not been edited for many years. Some of the latest innovations were introduced in 2014: the resolution specified a separating symbol that is used when drawing up documentation. This law applies to the following structures:

- Separate divisions.

- Trust managers.

- Persons participating in the partnership.

In particular, you need to use the “/” sign for separation.

Common mistakes

Error:

The company's accountant used the dividing line “/” without any reason and without knowing how to number invoices. The company's management took disciplinary action against the accountant, believing that VAT could not be deducted due to the unreasonable use of a separator when numbering the invoice.

A comment:

According to the explanations of the financial department, the unreasonable use of the dividing line “/” (when we are not talking about separate divisions, partnership participants and trustees) is not a basis for refusing to accept VAT for deduction.

Error:

In an enterprise, invoices and adjustment invoices are numbered differently.

A comment:

The numbering system for regular invoices and adjustment invoices must be uniform - this is the requirement of the Government of the Russian Federation.

Numbering rules

The main rule of numbering is assigning numbers in chronological order: numbers are indicated as they are assigned. Renewal of numbering is permitted. This is inevitable if a company has been in business for a long time. It is imperative to reflect renewal periods in the company's accounting policies. The period may be as follows:

- Month.

- Quarter.

- Year.

However, a government decree limits the resumption of numbering: it cannot be started from the beginning every day. This will be considered a violation.

The frequency of updates depends on the document flow of a particular enterprise. The more papers are filled out, the more often the numbers are renewed.

Types of invoice numbers

The numbers can consist of both numbers and letters. Letter designations must be present when document flow is in the following structures:

- Separate units. After the number you need to indicate the index in numbers. Values are separated by slash (/). The index is determined by the company and prescribed under a specific contract.

- People in a partnership or trustee managers. The index separated by a slash must be specified in this case as well.

Compliance with rules is important not only for the implementation of regulations. Correct numbering ensures orderly document flow and prevents confusion.

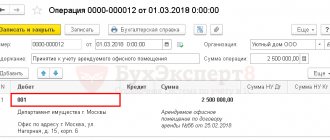

Option No. 1 - together with registration of documents for receipt of funds (advances)

Funds received to the current account are registered using the document Receipt to the current account. If the funds received are an advance, then based on the document Receipt to the current account, you can immediately issue an “advance” invoice.

This option is recommended to be used when the total number of issued invoices is small or when the generation of “advance” invoices is carried out by the employee responsible for maintaining the cash register and current account.

You can read about how to issue “advance” invoices based on the document Receipt to the current account in the article “Sale of finished products in bulk (prepayment - shipment)” on ITS https://its.1c.ru/db/hoosn #content:83:2 (see operation “2.2 Issuing an invoice for an advance payment”.

Features of putting down letter values

Some enterprises number advance and adjustment documents using different letters and numbers. For example, advance invoices are assigned the letter A, and adjustment invoices are assigned the letter B. This measure allows you to quickly find the necessary documents. However, it is not recommended to use the method in question, since there are no permissions for this in the law.

There is a risk that the buyer, upon discovering the letter designation, will require correction of the papers. A person’s motivation is to prevent problems from arising during a tax audit.

ATTENTION! There is a compromise method. You can assign both an official and an auxiliary number to an invoice. This measure will not be considered a violation. You can indicate the auxiliary number not only in the accounting program, but also in the document itself. However, the additional value does not need to be mentioned in the Number column. It is indicated after all the details in the “For reference” column. Permission to use additional numbers is given in letters from the Ministry of Finance.

What it is?

In this case, numbering is the invoice number, which allows you to distinguish a specific document from similar ones , even if issued in relation to the same counterparty for the same amount.

Numbering errors are not considered important. Even if the serial number was assigned with an error, the invoice may be accepted by the tax authorities if the information in other columns allows one to reliably identify the payment addressee, the payer and the basis on which the funds were paid.

Attention! An error in the number is not a basis for refusing to accept a VAT tax deduction.

Is it allowed to put separate numbers on different invoices?

Is it permissible to put numbers separately on advance or adjustment invoices? The need for a unified chronology is established by the Decree of the Russian Federation of December 26, 2011, number 1137. Until this year, such a norm did not exist, and therefore accountants often put different numbering on invoices for shipments and prepayments. This procedure was considered the simplest, but is now prohibited. Otherwise, violations may be revealed during verification.

Separate numbering is also clearly prohibited by Letter of the Ministry of Finance of Russia dated October 16, 2012 N 03-07-11/427. If you want to highlight advance invoices, you can use a letter value. The letters must correspond to a single chronology, for example, these could be the values “A”, “AB”.

There are also separate standards for filling out adjustment tax forms. They must be listed in chronological order.

Accurate document flow

The advance invoice must be drawn up in two copies: one copy for yourself, and the second for the buyer. Be sure to register your copy in the sales book (clause 3 of the Rules for maintaining the sales book), the buyer must do the same (clause 21 of the Rules for maintaining the purchase book).

It must be remembered that the supplier is obliged to transfer the VAT allocated in the advance invoice to the budget, and the buyer has the right to submit it for deduction (clause 9 of article 172 of the Tax Code of the Russian Federation). This means that if you are a buyer and you have doubts about the correctness of the document, and the supplier does not meet you halfway and refuses to redo the papers, then you have the right to protect yourself and not claim VAT on it for deduction.

At the time of shipment of goods (performance of work, provision of services, transfer of property rights), the parties to the transaction once again register an advance invoice. This time, the supplier makes an entry in the purchase ledger and the buyer makes an entry in the sales ledger. It is not allowed to make reversing entries in the books, since amounts with a minus are not provided for by the filling rules. The VAT allocated in the advance invoice can be deducted by the supplier (clause 6 of Article 172 of the Tax Code of the Russian Federation).

The buyer, in turn, is obliged to restore the previously accepted deduction (subclause 3, clause 3, article 170 of the Tax Code of the Russian Federation) and pay tax to the budget.

Penalty for incorrect numbering

Errors often occur when assigning invoice numbers. The most common ones are:

- Skipping numbers.

- Ignoring the need for chronology.

- Assigning the same number to the same document.

The last mistake is quite rare, since most accountants use special programs. The software prevents bifurcation.

Violation of the numbering order is the most difficult case. To correct the violation you will have to spend a lot of time and effort. An error in the chronology of one number leads to the fact that other numbers “creep”. It turns out that the invoices already sent to the buyer contain incorrect numbers.

Do the numbering need to be corrected? This measure makes sense if an error was made in the last number of the document, which has not yet been transferred to the buyer. If the error concerns a late number, it is not necessary to correct it. The seller does not bear any penalties for this violation.

ATTENTION! Article 120 of the Tax Code of the Russian Federation states that the absence of invoices for completed transactions entails a fine. These penalties do not apply to incorrect numbers. However, correct numbering is important in any case. This is taken into account during inspections.

How to number invoices - over what period should the numbering be done on a cumulative basis?

Having thought about the provisions of the Letters of the Ministry of Finance of the Russian Federation, you can think about the period during which the numbering of invoices should be formed on an accrual basis in order to please the financial department.

As a general rule, the reporting period is a year. The tax period for value added tax is a quarter. Maybe it's better to choose a month. But if you pay attention to the specialized programs used by accountants, in them the numbering of documents by default is carried out on an accrual basis during the calendar year.

It turns out that there are no obstacles to organizing daily numbering of invoices, and the opinion of the Russian Ministry of Finance is not justified.

How does incorrect numbering affect the buyer?

In most cases, incorrect numbering does not have any impact on the buyer. Errors don't bother you:

- identification of the parties to the contract;

- name of GWS, their cost;

- rate and total VAT.

That is, the buyer will not be denied a deduction, as stated in paragraph 2 of Article 169 of the Tax Code of the Russian Federation. If the controller makes his claims, they can be challenged, as evidenced by judicial practice. Based on court decisions, we can conclude that even the complete absence of numbering cannot be a basis for deducting VAT.

We prepare the invoice correctly

Carrying out business activities is complicated by the creation of an impressive number of documents. However, among them there are those that need to be drawn up both for recording business transactions and for preparing tax reporting - these are invoices. Every businessman must clearly understand for what purposes they are used, how to draw them up correctly and when not to do this.

Why do you need an invoice?

An invoice (IF) is considered an accounting document; experts say that for tax accounting it can be considered as a primary document, but for accounting it cannot, since it is compiled on the basis of other documents. An invoice is drawn up for each transaction, according to which the buyer receives the goods or services supplied by the seller. If an advance payment is received, an SF is issued for the amount of the advance payment.

But not only sellers and buyers use SF, it is also used by intermediaries, commission agents or agents. SFs are issued by forwarders and developers.

An invoice is not always necessary. Here are the cases when it is not used:

- The seller and buyer do not pay VAT (special tax regimes or Article 145 of the Tax Code of the Russian Federation).

- The seller supplies the goods to his employee free of charge.

- The buyer is an individual and purchases goods for subsequent sale.

- The transaction is not subject to VAT (Article 149 of the Tax Code of the Russian Federation).

Difference between invoice and delivery note

What is the difference between an invoice and a delivery note? The consignment note confirms the fact that the goods have been transferred by the seller to the buyer and is signed by both parties. And the invoice accumulates the amount of tax deductions, is signed by the seller and does not confirm the transfer of goods to the buyer.

Deadline for issuing the document

The seller should draw up and transfer the document to the buyer within 5 days from the date of fulfillment of the terms of the transaction (shipment of goods, provision of services, upon completion of work) or after receiving an advance payment.

Form and procedure for filling out an invoice

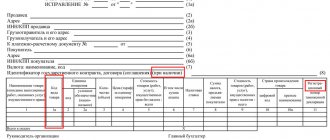

The document form can be downloaded here. The invoice consists of thirteen lines and eleven columns in the table. Let's consider the mandatory elements of the Federation Council.

Required document elements

An invoice consists of an information block about the parties to the transaction and a table with data about the subject of the transaction. The information block includes eight lines:

- Serial number and date of document preparation (line 1), the number is entered in accordance with the chronology of issuing invoices by the taxpayer.

- Number and date of changes, if changes were made (term 1a).

- Name of the seller (line 2), legal address for the seller - a legal entity or place of residence if the seller is an individual entrepreneur (in line 2a), individual taxpayer number in the tax office (line 2b).

- The shipper and his postal address (line 3).

- The consignee and his postal address (line 4).

- Buyer (line 6) and his legal address for a legal entity or place of residence (buyer individual entrepreneur) (line 6a), his tax number (line 6b).

- Number and date of the payment document for which the invoice was drawn up. If this invoice is drawn up for an advance received, then a dash is placed in line 5. If advance or other payments have been received for goods supplied in the future, then the document to which this invoice is attached is indicated.

- Currency (in line 7), the currency code must be the same for all goods listed in the document; you can find out the code for any type of currency here.

- Government contract identifier (string

is indicated if the delivery is made under a government contract.

is indicated if the delivery is made under a government contract.

is indicated if the delivery is made under a government contract.

is indicated if the delivery is made under a government contract.