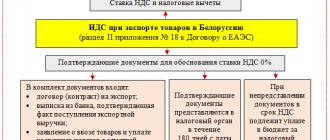

The need to confirm the zero VAT rate arises for the seller when goods are sold for export. In this case, no value added tax is paid (in accounting terms, “taxed at a rate of 0%”).

True, you need to collect a package of documents confirming the legality of this operation. Note that these documents are not registered in 1C; they are presented to the tax office along with the VAT return.

There is a certain period for preparing all necessary documentation - 180 days.

If the documents are not collected during this time, VAT will have to be paid.

Let's consider the sequence of actions in 1C Accounting 8.3 to confirm the zero VAT rate:

- Set up accounting policy

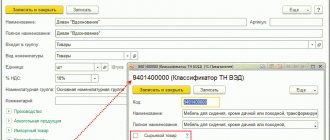

- Correctly register goods intended for export

- Correctly register the sale of goods for export

- Generate a document “Confirmation of zero VAT rate”

- Create a purchase book

Accrual and payment of VAT penalties to the budget

The organization independently establishes in its accounting policies the procedure for recording the amounts of accrued penalties. In our example, we will adhere to the position of the Ministry of Finance of the Russian Federation and attribute accrued penalties to other expenses by posting Dt 91.02 Kt 68.02 (Letter of the Ministry of Finance of the Russian Federation dated December 28, 2016 N 07-04-09/78875).

Penalties are calculated taking into account the period of delay:

Up to 30 days:

Starting from day 31:

The current refinancing rate can be viewed on the website of the Central Bank of the Russian Federation.

Learn more about the procedure for calculating penalties

The deadline for paying VAT is no later than the 25th day of each of the three months following the expired tax period (clause 1 of Article 174 of the Tax Code of the Russian Federation). Therefore, VAT penalties are calculated on every 25th day of the payment deadline. In our example, we must calculate penalties for the 1st quarter of 2021, tax payment deadlines are April 25, May 27, June 25.

The taxpayer independently decides from what day to accrue penalties for late payment of VAT on unconfirmed export sales. There are two positions - penalties are charged:

- from the 26th day of the month following the quarter in which there was an unconfirmed export sale - the position of the Federal Tax Service (Letter of the Ministry of Finance of the Russian Federation dated July 28, 2006 N 03-04-15/140);

- from 181 days from the date of implementation - judicial practice (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated May 16, 2006 N 15326/05, Resolution of the Federal Antimonopoly Service of the Volga-Vyatka District dated October 7, 2010 N A43-40137/2009).

Let's calculate penalties using our example:

If the export is confirmed later than 180 days, then the paid penalties are not refundable. Only the amount of VAT paid on unconfirmed exports can be returned or offset against future payments (paragraph 2, paragraph 9, article 165 of the Tax Code of the Russian Federation, paragraph 2, article 173 of the Tax Code of the Russian Federation).

The accrual of penalties is documented in the document Transaction entered manually, type of operation Transaction in the section Operations – Accounting – Transactions entered manually.

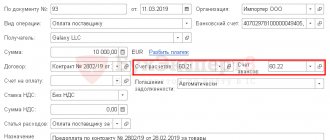

The payment of VAT penalties to the budget is reflected in the document Write-off from the current account transaction type Payment of tax in the Bank and cash desk section - Bank - Bank statements - Write-off button.

Let's look at the features of filling out the document Write-off from a current account using an example.

Learn more Calculation and payment of VAT penalties

Postings according to the document

The document generates the posting:

- Dt 68.02 Kt - payment of penalties to the budget for VAT.

Submission of the VAT return for the 3rd quarter. to the Federal Tax Service

Reporting

Confirmed export sales are reflected in the VAT return:

In Section 4 “Calculation of the tax amount...the validity of applying a tax rate of 0 percent for which is documented”: PDF

- page 010 – transaction code 1011410 “Sale of goods exported under the customs export procedure...”, specified earlier in the document Customs declaration (export) in the Transaction code ;

- line 020 – tax base for VAT.

In Section 9 “Information from the sales book”:

- registration of an invoice issued for export sales, transaction type code ““.

When converting revenue from foreign currency into rubles, to calculate the tax base for VAT, only the exchange rate of the Central Bank of the Russian Federation on the date of shipment of goods is used (clause 3 of Article 153 of the Tax Code of the Russian Federation).

The VAT declaration is submitted in the general form, i.e. according to the same one that is used for internal implementation (Appendix No. 1 to the Order of the Federal Tax Service of the Russian Federation dated October 29, 2014 N ММВ-7-3 / [email protected] in the current edition). There is no separate VAT declaration form for exporters:

- when confirming exports, a special Section 4 “Calculation of the amount of tax on operations for the sale of goods (works, services), the validity of applying a tax rate of 0 percent for which is documented” is filled out;

- the deduction of input VAT on the export of non-commodity goods that were purchased from 07/01/2016 is reflected in Section 3 of the VAT return for the period in which the taxpayer received the right to it. Input VAT is accepted for deduction regardless of whether the VAT rate of 0% is confirmed or not. In our example, the VAT deduction was applied in the 1st quarter.

The general deadline for submitting a VAT return for exporters is until the 25th day of the month following the reporting period in which the VAT rate of 0% was confirmed (Letter of the Ministry of Finance of the Russian Federation dated September 29, 2015 N 03-07-14/55546).

If the deadline for collecting documents has expired within the quarter and the package of documents was collected on time, then the VAT return is submitted according to the general deadlines, and not ahead of schedule at the moment when the package is collected and the deadline for collecting documents has expired. The moment of determining the tax base in this case is the last day of the quarter in which supporting documents are collected (clause 9 of Article 167 of the Tax Code of the Russian Federation).

What to do if in 1C the 0% rate is not confirmed

If there is no confirmation of a 0% VAT rate, the expenses incurred will have to be written off under the “Other expenses” category. In this case, the write-off process is carried out through the document “Confirmation of the zero rate”.

But at the same time, the system will make the appropriate entries and draw up an invoice, which will be reflected in the sales book on the “Additional Sheets” tab.

In this case, the system automatically calculates the VAT amount at a rate of 18%, which is considered standard. This amount can be reduced by the amount of VAT paid when purchasing the goods. In our case, it is 18 thousand rubles.

Payment of VAT debt to the budget

Additional payment of VAT to the budget is reflected in the document Write-off from the current account transaction type Tax payment in the Bank and cash desk section - Bank - Bank statements - Write-off button.

Learn more Payment of VAT (general procedure)

Postings according to the document

The document generates the posting:

- Dt 68.02 Kt - payment of VAT debt.

Generating VAT purchase book entries at zero VAT rate

It is by register movements that the program analyzes the state of VAT accounting. If you now create a purchase book, the required entry will automatically appear in it (Fig. 11).

Fig.11

The transactions generated in 1C by the document “Creating purchase book entries (0%)” show that the VAT we paid when purchasing goods intended for export was successfully deducted.

Fig.12

Export not confirmed for three years

If after the expiration of 180 days the organization submits to the tax office a package of documents justifying the application of the zero rate, then the amounts of VAT paid at a rate of 10 or 18 percent can be deducted (clause 10 of article 171, paragraph 2 of clause 3 of article 172 of the Tax Code of the Russian Federation). The right to deduction is retained by the organization for three years from the end of the corresponding tax period (clause 2 of Article 173 of the Tax Code of the Russian Federation).

Debit 68 subaccount “Calculations for VAT” Credit 19 subaccount “VAT on unconfirmed export supplies” – VAT accrued at a rate of 10 or 18 percent on unconfirmed export supplies is accepted for deduction.

This follows from paragraph 10 of Article 171 of the Tax Code of the Russian Federation.

An example of reflecting in accounting transactions related to the calculation of VAT and penalties for an unconfirmed export transaction. Payment for goods is made after shipment. The organization has collected the necessary package of documents before the expiration of three years after customs clearance of goods

On April 25, Alfa JSC entered into a contract for the supply of wood for export to Finland. The price of the export contract is USD 22,000. In the same month, Alpha purchased a shipment of wood for 590,000 rubles. (including VAT - 90,000 rubles) and paid for the purchased goods.

The wood was released abroad under the customs export regime on April 30. Payment from the Finnish company was received on May 5. Selling expenses amounted to 3,000 rubles.

- April 30 – 29.60 RUB/USD;

- May 5 – 29.70 rubles/USD.

Debit 19 subaccount “VAT on unconfirmed export supplies” Credit 68 subaccount “VAT settlements” – 117,216 rubles. (USD 22,000 × RUB 29.60/USD × 18%) – VAT is charged on unconfirmed exports.

Having completed the calculations, the Alpha accountant submitted an updated VAT return for the second quarter to the tax office. In the declaration, in addition to the initial data, he reflected the amount of accrued VAT on unconfirmed exports and the amount of tax deduction on goods sold.

The amount of additional payment according to the declaration will be: 117,216 rubles. – 90,000 rub. = 27,216 rub.

Debit 68 subaccount “Calculations for VAT” Credit 51–27,216 rub. – transferred to the VAT budget on unconfirmed exports.

According to the updated declaration, this amount is payable to the budget:

- no later than July 21 - in the amount of 9072 rubles;

- no later than August 20 - in the amount of 9072 rubles;

- no later than September 22 - in the amount of 9072 rubles.

The duration of the delay is:

- from July 21 to October 27 – 99 days;

- from August 20 to October 27 – 69 days;

- from September 22 to October 27 – 36 days.

The refinancing rate in force during the period of delay was 8.25 percent.

9072 rub. × 1/300 × 8.25% × 204 days. = 508 rub.

Debit 99 Credit 68 subaccount “Calculations for penalties and VAT fines” – 508 rubles. – penalties accrued;

https://www.youtube.com/watch?v=ytadvertiseru

Debit 68 subaccount “Calculations for penalties and VAT fines” Credit 51–508 rub. – the amount of penalties is transferred to the budget.

Debit 68 subaccount “Calculations for VAT” Credit 19 subaccount “VAT on unconfirmed export supplies” – 117,216 rubles. – VAT previously accrued on an unconfirmed export supply has been accepted for deduction.

In the fourth quarter, Alpha did not charge VAT at rates other than 0 percent. Therefore, based on the results of the fourth quarter, the amount of tax deduction exceeds the amount of VAT on sales (the VAT refundable is reflected in the declaration). After a desk audit, the tax inspectorate decided to reimburse the organization for the input VAT paid to the supplier of the exported goods.

Debit 51 Credit 68 subaccount “VAT calculations” – 117,216 rubles. – the amount of refunded tax has been credited to the current account.

The amount of penalties paid to the budget by the organization is not returned.

Situation: from what point does the three-year period for VAT refund on unconfirmed exports begin? After the expiration of the period allotted for confirming the right to apply the zero rate, the organization did not collect documents

Count three years from the end of the quarter in which the goods were shipped.

If, within the time limits established by paragraph 9 of Article 165 of the Tax Code of the Russian Federation, the exporter has not confirmed the right to apply a 0 percent VAT rate, the right to a tax deduction is retained by him for three years after the end of the corresponding tax period. This follows from the provisions of paragraph 2 of Article 173 of the Tax Code of the Russian Federation.

The procedure for determining a three-year period in relation to unconfirmed export transactions is not regulated by law. In such conditions, organizations should be guided by the position of the Presidium of the Supreme Arbitration Court of the Russian Federation, which is reflected in Resolution No. 17473/08 dated May 19, 2009. It follows from this document that the three-year period during which an organization can refund VAT on unconfirmed exports must be counted from the end of the tax period in which the goods were shipped. To substantiate its position, the Presidium of the Supreme Arbitration Court of the Russian Federation cited the following arguments.

VAT is accrued at the end of each tax period for transactions for which the tax base is determined during this tax period (Clause 4, Article 166 of the Tax Code of the Russian Federation). When shipping goods for export, the moment for determining the tax base is the last day of the quarter in which the full package of documents provided for in Article 165 of the Tax Code of the Russian Federation is collected.

If these documents are not collected within 180 calendar days from the date of customs clearance, the moment of determining the tax base is the day of shipment of goods (subclause 1, clause 1, clause 9, article 167 of the Tax Code of the Russian Federation). Thus, if the organization was unable to confirm export within the established time frame, the three-year period allotted to it for VAT reimbursement in the future is counted from the end of the quarter in which the goods were shipped for export (clause 2 of Article 173 of the Tax Code of the Russian Federation).

For example, if VAT in connection with unconfirmed exports was accrued in the first quarter of 2013, then you can claim it for deduction (if you have all the necessary documents) in a tax return submitted no later than March 31, 2021.

Similar clarifications are contained in letters of the Ministry of Finance of Russia dated February 3, 2015 No. 03-07-08/4181 and the Federal Tax Service of Russia dated July 9, 2014 No. GD-4-3/13341.

Debit 91-2 Credit 19 subaccount “VAT on unconfirmed export supplies” – VAT paid to the budget on unconfirmed export supplies is written off.

An example of reflecting in accounting transactions related to the calculation of VAT and penalties for an unconfirmed export transaction. Payment for goods is made after shipment. The organization did not collect the required package of documents within three years after customs clearance of goods

9072 rub. × 1/300 × 8.25% × 204 days. = 509 rub.

Debit 99 Credit 68 subaccount “Calculations for penalties and VAT fines” – 509 rubles. – penalties accrued;

Debit 68 subaccount “Calculations for penalties and VAT fines” Credit 51–509 rub. – the amount of penalties is transferred to the budget.

Debit 91-2 Credit 19 subaccount “VAT on unconfirmed export supplies” – 117,216 rubles. – taken into account as part of other expenses VAT paid to the budget on an unconfirmed export supply.

Situation: is it possible to take into account the amount of VAT paid by an organization on an unconfirmed export transaction when calculating income tax?

Answer: no, you can't.

When calculating income tax, VAT amounts paid by an organization on an unconfirmed export transaction are not taken into account. Such expenses are economically unjustified, that is, they do not meet the criteria of Article 252 of the Tax Code of the Russian Federation. This is stated in letters of the Ministry of Finance of Russia dated November 29, 2007 No. 03-03-05/258, dated July 17, 2007.

Advice: there are factors that allow you to include VAT amounts accrued on unconfirmed export supplies as expenses that reduce taxable profit. They are as follows.

When calculating income tax, expenses include the amounts of taxes accrued in accordance with current legislation (subclause 1, clause 1, article 264 of the Tax Code of the Russian Federation). The exception is the taxes listed in Article 270 of the Tax Code of the Russian Federation. Namely, income tax and VAT charged to buyers (clause 4, 19, article 270 of the Tax Code of the Russian Federation).

https://www.youtube.com/watch?v=ytpolicyandsafetyru

For unconfirmed export supplies, organizations pay VAT at their own expense: these amounts are not presented to buyers. Consequently, the provisions of paragraph 19 of Article 270 of the Tax Code of the Russian Federation do not apply to them. VAT is accrued for payment to the budget in accordance with the law (clause 9 of article 165 of the Tax Code of the Russian Federation).

Therefore, when calculating income tax, an organization has the right to take into account the amounts of VAT accrued for payment to the budget (minus input VAT accepted for deduction), on the basis of subparagraph 1 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation. VAT must be included in expenses in the period in which the obligation to pay it arises. That is, based on the results of the quarter in which the 180-day period established for collecting documents confirming the fact of export expired.

| 90.3 | 68.02 | VAT is charged on sales at a rate of 18% | 130 085 | Bill of lading, invoice, customs declaration, waybill |

| 99.01.1 | 68.02 | Penalties charged for late payment of VAT | 2 435 , 97 | Accounting information |

Registration of customs declarations for export transactions

To use the 0% VAT rate, you must justify it by submitting a certain package of documents to the Federal Tax Service.

If the 0% VAT rate is not confirmed within 180 days, then the sale will be subject to VAT at the usual rates of 18% (10%).

For non-commodity goods purchased and sold after July 1, 2016, the right to deduct input VAT does not depend on whether export is confirmed or not. Documentary confirmation of the 0% VAT rate is necessary precisely in order to have the right to register for export sales at such a “reduced” rate.

To confirm the 0% VAT rate on exports, a package of documents is provided to the Federal Tax Service (Article 165 of the Tax Code of the Russian Federation). Documents can be submitted entirely on paper or in a more convenient form - on paper and electronically using a special register:

Option No. 1. Package of documents on paper:

- contract (copy) with a foreign buyer;

- customs declaration with marks from the customs authority;

- copies of transport, shipping and (or) other documents with marks from the customs authorities of the places of departure, confirming the export of goods from the Russian Federation.

Option No. 2. Package of documents on paper and in electronic form:

- contract (copy) with a foreign buyer;

- registers of customs declarations (full customs declarations) of transport, shipping and (or) other documents in electronic form (clause 15 of Article 165 of the Tax Code of the Russian Federation, Appendix No. 5 to the Order of the Federal Tax Service of September 30, 2015 No. ММВ-7-15/427, Letter Federal Tax Service of the Russian Federation dated 02/04/2016 N ED-4-15/1636).

The register of customs declarations is provided to the Federal Tax Service in electronic form and replaces all documents except the contract.

Supporting documents, incl. registers are submitted to the Federal Tax Service simultaneously with the VAT declaration (clause 10 of article 165 of the Tax Code of the Russian Federation).

To automatically fill out VAT Register: Appendix 05, you must first enter the Customs Declaration (Export) in the Sales – Sales – Customs Declarations (Export) section. This document can be created based on the Sales document (act, invoice) by clicking the Create based on and selecting Customs Declaration (export) .

the Customs Declaration (export) document using an example.

The goods were exported from the Russian Federation by road and transport document CMR No. 0530634 dated March 15, 2018 was issued.

Document header

- Number – registration number of the customs declaration (3 blocks of TD number); PDF

- from — date of registration of the TD data. from field reflects the date the document was generated in 1C when confirming the VAT rate of 0%.

If you plan to confirm exports, then the Customs Declaration immediately during the export shipment period. In this case, the date of the goods declaration will be indicated in the from .

- Operation code – 1011410 “Sale of goods exported under the customs export procedure...” (Appendix No. 1 to the Procedure for filling out a tax return for value added tax, approved by Order of the Federal Tax Service of the Russian Federation dated October 29, 2014 N MMV-7-3 / [email protected] );

- Grounds – the basis document Sales (act, invoice) at a VAT rate of 0%, for which a customs declaration has been issued.

Tabular part of the document

- Type of transport – 30 “Road transport (except for vehicles indicated under codes 31, 32)”, i.e. code of the type of transport by which goods were exported from the Russian Federation. The props are selected from the drop-down list;

- Accompanying document – 01 “CMR”, i.e. code of the transport (shipping) document that confirms the export of goods from the Russian Federation. The props are selected from the drop-down list;

- Number – CMR number; the number of the accompanying document is indicated. If the document does not have a No., then it is allowed to enter the value w/n in the field, i.e. "without a number";

- Date – CMR date; the date of the accompanying document is indicated;

- Note - you can specify other documents for export sales, which are provided along with the VAT return. For example, contract details. In our case, Contract No. 1201/18 dated January 12, 2018. Information from this field also falls into the VAT Register document: Appendix 05 .

The tabular part of the VAT Register document: Appendix 05 is filled out according to the rules approved by Order of the Federal Tax Service dated September 30, 2015 N ММВ-7-15/427.

This document does not generate accounting and NU postings, only entries in the VAT registers.

Accounting entries. Example No. 1

For convenience of calculations, all examples are given in rubles.

On November 23, 2015, I purchased goods with a value of RUB 1,950,000. (including VAT RUB 297,457.63).12/14/2015 a contract was signed with an Italian company for the sale of inventory and materials in the amount of RUB 2,450,000 on December 21, 2015. the buyer paid an advance payment of 35% in the amount of RUB 857,500. 01/13/2016 delivered the goods and materials to the seaport. For its services, the company presented an invoice and a certificate of completion of work with a value of 380,000 rubles. (including VAT RUB 57,966.10) At the same time, the right to own the goods and materials passes to the buyer. On 02/08/2016, the Italian counterparty paid the balance of the debt in the amount of RUB 1,592,500.

By March 25, 2016 all delivery documents have been collected. 04/19/2016 The accountant submitted the declaration and the collected package of documents for a desk audit to the Federal Tax Service.

05/16/2016 The Federal Tax Service made a decision on the legality of export VAT.

The following entries must be made in accounting

| date | Debit | Credit | Amount, rub. | Content |

| 19.11.2015 | 60 | 51 | 1 950 000 | Payment for goods and materials transferred |

| 41 | 60 | 1 652 542,37 | The goods have been registered | |

| 19 | 60 | 297 457,63 | Input VAT taken into account | |

| 21.12.2015 | 52 | 62 | 857 500 | Advance payment received from buyer |

| 62 | 76 AB | 130 805,08 | Advance VAT payable has been allocated | |

| 76 AB | 51 | 130 805,08 | VAT paid on advance | |

| 31.12.2015 | 68 | 19 | 297 457,63 | Input VAT is claimed for deduction |

| 13.01.2016 | 76 | 51 | 380 000 | Paid for services |

| 44 | 76 | 322 033,9 | Delivery costs included | |

| 19 | 76 | 57 966,10 | Input VAT taken into account | |

| 62 | 90 | 2 450 000 | Inventory materials passed customs control | |

| 90 | 41 | 1 652 542,37 | The cost of inventory items is written off | |

| 08.02.2016 | 52 | 62 | 1 582 500 | The buyer paid the last tranche |

| 31.03.2016 | 19 | 68 | 297457,63 | VAT claimed for deduction has been restored |

| 16.05.2016 | 76 AB | 62 | 130 805,08 | VAT paid on the advance is claimed for reimbursement |

| 68 | 76 AB | 130 805,08 |

GLAVBUKH-INFO

| Page 3 |

| All pages |

To justify the application of a zero VAT rate, it is necessary to confirm the fact of real exports. To do this, the exporting organization must collect and submit a package of documents to the tax office (Article 165 of the Tax Code of the Russian Federation).

The deadline for submitting documents confirming the export of goods is limited to 180 calendar days. For goods, this period is counted from the day the goods are placed under the customs export procedure. In relation to works (services), the start date of this period will depend on the type of work (services). If, after this period, the organization does not submit a package of documents confirming export to the tax office, operations for the sale of goods are subject to taxation at a rate of 10 or 18 percent. This procedure follows from the provisions of paragraph 9 of Article 165 of the Tax Code of the Russian Federation.

The tax base

The tax base for VAT for unconfirmed exports is determined in rubles at the exchange rate on the date of shipment of goods. This procedure is established by paragraph 3 of Article 153, subparagraph 1 of paragraph 1, paragraph 9 of Article 167 of the Tax Code of the Russian Federation.

Calculate the amount of tax that needs to be paid to the budget as follows:

– if goods sold are subject to VAT at a rate of 18 percent:

| VAT accrued for payment to the budget | = | Cost of goods (works, services) under an export contract | × | 18% |

– if goods sold are subject to VAT at a rate of 10 percent:

| VAT accrued for payment to the budget | = | Cost of goods (works, services) under an export contract | × | 10% |

The moment of determining the tax base is the day of shipment (transfer) of goods (paragraph 2, clause 9, subparagraph 1, clause 1, article 167 of the Tax Code of the Russian Federation). Therefore, you will have to submit updated VAT returns to the tax office for the tax period in which the goods were actually shipped. For more information, see How to prepare and submit a VAT return to exporters.

Calculate the amount of the tax base in rubles at the exchange rate on the date of shipment of goods (clause 3 of Article 153 of the Tax Code of the Russian Federation). This procedure applies even if a 100% advance payment is received from the buyer for the supply of goods for export. Such clarifications are contained in the letter of the Ministry of Finance of Russia dated September 12, 2012 No. 03-07-15/123 (brought to the attention of the tax inspectorates by letter of the Federal Tax Service of Russia dated October 3, 2012 No. ED-4-3/16657). Do not charge VAT on advances received for upcoming export deliveries (paragraph 4, clause 1, article 154 of the Tax Code of the Russian Federation). If payment in foreign currency is received after the date of shipment, then do not take into account exchange rate differences when determining the tax base - it will remain unchanged.

Situation: how to issue invoices when calculating VAT at a rate of 18 (10) percent, if within 180 days the exporting organization has not confirmed the right to apply a zero tax rate

Prepare invoices in a general manner.

The Tax Code of the Russian Federation does not provide for special rules for the preparation and registration of invoices for export transactions. Therefore, when selling goods for export, an organization must draw up an invoice and register it on a general basis. On the date of drawing up the invoice, it must indicate the cost of goods without VAT and a zero tax rate. This follows from the provisions of paragraph 1 of Article 164 of the Tax Code of the Russian Federation.

If a complete package of documents confirming the right to apply the zero VAT rate is not collected within the established period, the moment of determining the tax base for the export supply is considered to be the date of shipment of the goods. Based on this, the invoice must be registered in the sales book in the quarter in which the goods were shipped for export. This procedure follows from the provisions of paragraph 2 of paragraph 9 and subparagraph 1 of paragraph 1 of Article 167 of the Tax Code of the Russian Federation.

In this case, VAT on sales must be charged at a rate of 18 (10) percent.

According to the Russian Ministry of Finance, in order to register an invoice for the past quarter, you need to draw up an additional sheet of the sales book with the note “the application of the 0 percent rate has not been confirmed” and indicating the amount of VAT accrued at the rate of 18 (10) percent.

If the right to apply the zero VAT rate is subsequently confirmed, the organization will be able to deduct the amount of tax accrued due to the lack of supporting documents. To do this, in the period in which the necessary documents will be collected, an invoice issued with a zero VAT rate must be registered:

- in the sales book - without additional notes;

- in the purchase book – with the note “deduction of previously calculated tax amounts” and an indication of the amount of VAT accrued due to the lack of supporting documents.

An example of issuing invoices when selling goods for export. Within the prescribed period, the exporting organization did not collect a complete package of documents confirming the right to apply the zero VAT rate

In April, Alfa CJSC entered into a contract for the supply of wood for export to Finland. The price of the export contract is USD 22,000. The wood was released abroad in accordance with the customs export procedure on April 19.

On April 20, Alpha's accountant compiled an invoice and recorded it in section 1 of the invoice journal. In this case, VAT is reflected in the invoice at a rate of 0 percent.

After 180 calendar days, Alpha has not collected a complete package of documents confirming the fact of real exports and the legality of applying the zero VAT rate. Therefore, on October 19, the organization’s accountant assessed VAT at a rate of 18 percent based on export revenue (USD 22,000 × 18%) and compiled an additional sheet to the sales book for the second quarter.

The tax base is determined at the dollar exchange rate on the date of shipment (clause 3 of Article 153 of the Tax Code of the Russian Federation). The conditional dollar exchange rate on April 19 is 30.00 rubles/USD. The amount of VAT accrued on an unconfirmed export transaction is equal to: USD 22,000 × RUB 30.00/USD × 18% = RUB 118,800.

Deduction of “input” VAT

The amount of “input” VAT (including recovered) on goods that are used to carry out an unconfirmed export operation can be deducted on the date of shipment of goods (clause 3 of Article 172 of the Tax Code of the Russian Federation). This operation must be reflected in accounting using the following entries:

Debit 19 subaccount “VAT on unconfirmed export supplies” Credit 68 subaccount “Calculations for VAT” – VAT on unconfirmed exports is accrued;

Debit 68 subaccount “Calculations for VAT” Credit 19 subaccount “VAT presented by suppliers” – accepted for deduction of “input” VAT on goods used in the production of goods, the export of which has not been confirmed;

Debit 68 subaccount “Calculations for VAT” Credit 51 – VAT is transferred to the budget on unconfirmed export supplies.

An example of reflecting in accounting transactions related to the calculation of VAT on an unconfirmed export transaction. Payment for goods is made after shipment.

On January 12, CJSC Alfa entered into a contract for the supply of wood for export to Finland. The price of the export contract is USD 22,000. In the same month, Alpha purchased a shipment of wood for 590,000 rubles. (including VAT - 90,000 rubles) and paid for the purchased goods.

The wood was released abroad under the customs export regime on January 19. Payment from the Finnish company was received on January 24. Selling expenses amounted to 3,000 rubles.

The notional exchange rate of the US dollar on the dates of transactions was:

- January 19 – 29.60 rubles/USD;

- January 24 – 29.70 rubles/USD.

Alpha's accountant made the following entries in the accounting records (the accrual of customs duties is not considered).

In January:

Debit 41 Credit 60 – 500,000 rub. (RUB 590,000 – RUB 90,000) – wood was posted to the warehouse;

Debit 19 Credit 60 – 90,000 rub. – “input” VAT on purchased wood is taken into account (based on the supplier’s invoice);

Debit 60 Credit 51 – 590,000 rub. – money is transferred to the supplier.

January 19:

Debit 62 Credit 90-1 – 651,200 rub. (USD 22,000 × RUB 29.60/USD) – revenue from the sale of goods for export is reflected;

Debit 90-2 Credit 41 – 500,000 rub. – the cost of goods sold is written off;

Debit 90-2 Credit 44 – 3000 rub. – sales expenses are written off.

January 24:

Debit 52 subaccount “Transit currency account” Credit 62 – 653,400 rub. (USD 22,000 × RUB 29.70/USD) – money received under an export contract;

Debit 62 Credit 91-1 – 2200 rub. (RUB 653,400 – RUB 651,200) – reflects a positive exchange rate difference.

After 180 calendar days, Alpha has not collected a complete package of documents confirming the fact of real exports and the legality of applying the zero VAT rate. Therefore, the organization’s accountant calculated VAT based on export proceeds converted into rubles on the date of shipment. The following entry was made in the accounting records on this day:

Debit 19 subaccount “VAT on unconfirmed export supplies” Credit 68 subaccount “VAT settlements” - 117,216 rubles. (RUB 651,200 × 18%) – VAT is charged on unconfirmed exports.

After the tax has been calculated, the amount of “input” VAT on goods sold is deducted:

Debit 68 subaccount “Calculations for VAT” Credit 19 subaccount “VAT presented by suppliers” – 90,000 rubles. – accepted for deduction of “input” VAT on goods sold.

Having completed the calculations, the Alpha accountant submitted to the tax office an updated VAT return for the first quarter of the current year. In the declaration, in addition to the initial data, he reflected the amount of accrued VAT on unconfirmed exports and the amount of tax deduction on goods sold.

An example of reflecting in accounting transactions related to the calculation of VAT on an unconfirmed export transaction. 100% advance payment has been received from the buyer.

On January 12, CJSC Alfa entered into a contract for the supply of wood for export to Finland. The price of the export contract is USD 22,000. In the same month, Alpha purchased a shipment of wood for 590,000 rubles. (including VAT - 90,000 rubles) and paid for the purchased goods.

The advance payment from the Finnish company was received on January 19. Selling expenses amounted to 3,000 rubles. The wood was released abroad under the customs export regime on January 24.

The notional exchange rate of the US dollar on the dates of transactions was:

- January 19 – 29.60 rubles/USD;

- January 24 – 29.70 rubles/USD.

Alpha's accountant made the following entries in the accounting records (the accrual of customs duties is not considered).

In January:

Debit 41 Credit 60 – 500,000 rub. (RUB 590,000 – RUB 90,000) – wood was posted to the warehouse;

Debit 19 Credit 60 – 90,000 rub. – “input” VAT on purchased wood is taken into account (based on the supplier’s invoice);

Debit 60 Credit 51 – 590,000 rub. – money is transferred to the supplier.

January 19:

Debit 52 subaccount “Transit currency account” Credit 62 – 651,200 rub. (USD 22,000 × RUB 29.60/USD) – money received under an export contract;

January 24:

Debit 62 Credit 90-1 – 651,200 rub. (USD 22,000 × RUB 29.60/USD) – revenue from the sale of goods for export is reflected;

Debit 90-2 Credit 41 – 500,000 rub. – the cost of goods sold is written off;

Debit 90-2 Credit 44 – 3000 rub. – sales expenses are written off.

After 180 calendar days, Alpha has not collected a complete package of documents confirming the fact of real exports and the legality of applying the zero VAT rate. Therefore, the organization’s accountant calculated VAT based on export proceeds converted into rubles on the date of shipment. The following entry was made in the accounting records on this day:

Debit 19 subaccount “VAT on unconfirmed export supplies” Credit 68 subaccount “VAT settlements” - 117,612 rubles. (RUB 653,400 × 18%) – VAT is charged on unconfirmed exports.

After the tax has been calculated, the amount of “input” VAT on goods sold is deducted:

Debit 68 subaccount “Calculations for VAT” Credit 19 subaccount “VAT presented by suppliers” – 90,000 rubles. – accepted for deduction of “input” VAT on goods sold.

Having completed the calculations, the Alpha accountant submitted to the tax office an updated VAT return for the first quarter of the current year. In the declaration, in addition to the initial data, he reflected the amount of accrued VAT on unconfirmed exports and the amount of tax deduction on goods sold.

Penalty

If the export could not be confirmed, then in addition to VAT, the organization will have to pay a penalty. Moreover, if the exporter later collects the necessary documents and returns the accrued VAT amount, the penalties will still remain in the budget. They cannot be returned (letter of the Ministry of Finance of Russia dated September 24, 2004 No. 03-04-08/73).

Situation: how penalties are calculated for late payment of VAT if the export could not be confirmed

Penalties are calculated in accordance with the general procedure.

If, within the prescribed period, the organization does not submit to the tax office a package of documents confirming the export, then in addition to VAT, it will have to pay a penalty for each calendar day of delay in paying the tax (Article 75 of the Tax Code of the Russian Federation).

Penalties are accrued from the 21st day of each of the three months following the quarter in which goods were shipped for export until the tax is paid (or until the date of filing a tax return with documents confirming the right to apply the zero VAT rate). It is explained like this.

If export is not confirmed, the goods are considered sold on the domestic market. In this case, the moment of determining the tax base for VAT is the day of shipment of goods for export (clause 9 of Article 165, clause 9 of Article 167 of the Tax Code of the Russian Federation). Therefore, VAT on an unconfirmed export transaction must be included in the calculation of the tax base for the period in which the goods were shipped. In this case, the tax amount must be transferred to the budget in the same manner as for goods sold in Russia.

Since the tax amount was not transferred to the budget in a timely manner (since the organization planned to confirm the right to apply the 0 percent rate), then from the day following each of the established tax payment deadlines, it will be charged penalties.

This conclusion follows from the provisions of paragraph 1 of Article 174, paragraph 3 of Article 75 of the Tax Code of the Russian Federation and is confirmed by letter of the Ministry of Finance of Russia dated July 28, 2006 No. 03-04-15/140 (brought to the attention of tax inspectorates by letter of the Federal Tax Service of Russia dated August 22, 2006 No. ШТ-6-03/840). These letters were issued when the VAT tax period was a month, and the entire tax amount for the month had to be transferred to the budget at a time. Despite this, the argumentation presented in them is still relevant today.

The chief accountant advises: there are arguments according to which the inspection has the right to charge penalties for late payment of VAT starting from the 181st day after customs clearance of goods for export. They are as follows.

Export confirmation after 180 days

If, after 180 days, the organization submits to the tax office a package of documents justifying the application of a zero tax rate, then the amount of VAT paid at a rate of 10 or 18 percent can be deducted (clause 10 of article 171, paragraph 2, clause 3 Article 172 of the Tax Code of the Russian Federation). The right to deduction is retained by the organization for three years from the end of the corresponding tax period (clause 2 of Article 173 of the Tax Code of the Russian Federation).

Situation: from what point does the three-year period begin, during which an organization can refund VAT on unconfirmed exports? After the expiration of the period allotted to confirm the right to apply the 0 percent tax rate, the organization did not collect the necessary documents

Count three years from the end of the quarter in which the goods were shipped.

If, within the time limits established by paragraph 9 of Article 165 of the Tax Code of the Russian Federation, the exporter has not confirmed the right to apply a 0 percent VAT rate, the right to a tax deduction is retained by him for three years after the end of the corresponding tax period. This follows from the provisions of paragraph 2 of Article 173 of the Tax Code of the Russian Federation.

The procedure for determining a three-year period in relation to unconfirmed export transactions is not regulated by law. There are no official explanations from regulatory agencies on this matter. In such conditions, organizations should be guided by the position of the Presidium of the Supreme Arbitration Court of the Russian Federation, which is reflected in Resolution No. 17473/08 dated May 19, 2009. It follows from this document that the three-year period during which an organization can refund VAT on unconfirmed exports must be counted from the end of the tax period in which the goods were shipped. To substantiate its position, the Presidium of the Supreme Arbitration Court of the Russian Federation cited the following arguments.

VAT is accrued at the end of each tax period for transactions for which the tax base is determined during this tax period (Clause 4, Article 166 of the Tax Code of the Russian Federation). When shipping goods for export, the moment for determining the tax base is the last day of the quarter in which the full package of documents provided for in Article 165 of the Tax Code of the Russian Federation is collected. If these documents are not collected within 180 calendar days from the date of customs clearance, the moment of determining the tax base is the day of shipment of goods (subclause 1, clause 1, clause 9, article 167 of the Tax Code of the Russian Federation). Thus, if the organization was unable to confirm export within the established time frame, the three-year period allotted to it for VAT reimbursement in the future is counted from the end of the quarter in which the goods were shipped for export (clause 2 of Article 173 of the Tax Code of the Russian Federation).

It should be noted that some arbitration courts adhered to this point of view earlier (see, for example, the decisions of the Federal Antimonopoly Service of the Moscow District dated March 4, 2009 No. KA-A40/903-09 (determined by the Supreme Arbitration Court of the Russian Federation dated July 2, 2009 No. VAS- 3716/09 refused to transfer the case to the Presidium of the Supreme Arbitration Court of the Russian Federation), dated February 13, 2009 No. KA-A40/7481-08, dated October 27, 2008 No. KA-A40/9863-08). At the same time, other decisions were made. It followed from them that the three-year period can be counted from the end of the period in which the deadline for submitting documents established by paragraph 9 of Article 165 of the Tax Code of the Russian Federation expired (see, for example, resolutions of the Federal Antimonopoly Service of the North-Western District dated October 13, 2008 No. A66 -8148/2007, dated February 21, 2008 No. A66-2192/2007, Moscow District dated September 12, 2007 No. KA-A40/9299-07). With the release of the Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated May 19, 2009 No. 17473/08, arbitration practice on the issue under consideration should become uniform.

In accounting, reflect the deduction of VAT previously accrued on unconfirmed export supplies by posting:

Debit 68 subaccount “Calculations for VAT” Credit 19 subaccount “VAT on unconfirmed export supplies” – VAT accrued at a rate of 10 or 18 percent on unconfirmed export supplies is accepted for deduction.

This follows from paragraph 10 of Article 171 of the Tax Code of the Russian Federation.

An example of reflecting in accounting transactions related to the calculation of VAT and penalties for an unconfirmed export transaction. Payment for goods is made after shipment. The organization has collected the necessary package of documents before the expiration of three years after customs clearance of goods

On January 12, 2012, Alfa CJSC entered into a contract for the supply of wood for export to Finland. The price of the export contract is USD 22,000. In the same month, Alpha purchased a shipment of wood for 590,000 rubles. (including VAT - 90,000 rubles) and paid for the purchased goods.

The wood was released abroad under the customs export regime on January 19, 2012. Payment from the Finnish company was received on January 24, 2012. Selling expenses amounted to 3,000 rubles.

The notional exchange rate of the US dollar on the dates of transactions was:

- January 19, 2012 – 29.60 rubles/USD;

- January 24, 2012 – 29.70 rubles/USD.

After 180 calendar days (July 17, 2012), Alpha did not collect a complete package of documents confirming the fact of real exports and the legality of applying the zero VAT rate. Therefore, the organization’s accountant calculated VAT based on export proceeds converted into rubles on the date of shipment. The following entry was made in the accounting:

Debit 19 subaccount “VAT on unconfirmed export supplies” Credit 68 subaccount “VAT settlements” - 117,216 rubles. (USD 22,000 × RUB 29.60/USD × 18%) – VAT is charged on unconfirmed exports.

After the tax has been calculated, the amount of “input” VAT on goods sold is deducted:

Debit 68 subaccount “Calculations for VAT” Credit 19 subaccount “VAT presented by suppliers” – 90,000 rubles. – accepted for deduction of “input” VAT on goods sold.

Having completed the calculations, the Alpha accountant submitted an updated VAT return for the first quarter of 2012 to the tax office. In the declaration, in addition to the initial data, he reflected the amount of accrued VAT on unconfirmed exports and the amount of tax deduction on goods sold.

The amount of additional payment according to the declaration will be: 117,216 rubles. – 90,000 rub. = 27,216 rub.

Alpha transferred this amount to the budget on July 20, 2012. The following entry was made in accounting:

Debit 68 subaccount “Calculations for VAT” Credit 51 – 27,216 rubles. – transferred to the VAT budget on unconfirmed exports.

According to the updated declaration, this amount is payable to the budget:

- no later than April 20, 2012 - in the amount of 9072 rubles;

- no later than May 21, 2012 - in the amount of 9072 rubles;

- no later than June 20, 2012 - in the amount of 9072 rubles.

The duration of the delay is:

- from April 21 to July 19, 2012 – 90 days;

- from May 22 to July 19, 2012 – 59 days;

- from June 21 to July 19, 2012 – 29 days.

The refinancing rate in force during the period of delay was 8 percent.

Alpha's accountant calculated the amount of penalties as follows:

9072 rub. × 1/300 × 8% × 178 days. = 431 rub.

In accounting, the accrual and payment of penalties are reflected by the following entries:

Debit 99 Credit 68 subaccount “Calculations for penalties and VAT fines” – 431 rubles. – penalties accrued;

Debit 68 subaccount “Calculations for penalties and VAT fines” Credit 51 – 431 rub. – the amount of penalties is transferred to the budget.

In the third quarter of 2012, Alpha collected a package of documents confirming the fact of real exports and the right to apply a zero VAT rate. After this, the accountant made an entry in accounting:

Debit 68 subaccount “Calculations for VAT” Credit 19 subaccount “VAT on unconfirmed export supplies” – 117,216 rubles. – VAT previously accrued on an unconfirmed export supply has been accepted for deduction.

In the third quarter of 2012, Alpha did not charge VAT at rates other than 0 percent. Therefore, based on the results of the third quarter, the amount of tax deduction exceeds the amount of VAT on sales (the VAT refundable is reflected in the declaration). After a desk audit, the tax inspectorate decided to reimburse the organization for the “input” VAT paid to the supplier of exported goods.

At the time of the decision to refund VAT, Alpha had no debt to the budget. Therefore, at the request of the organization, the tax amount was transferred to its current account. The following entry was made in Alpha's accounting records:

Debit 51 Credit 68 subaccount “VAT calculations” – 117,216 rubles. – the amount of refunded tax has been credited to the current account.

The amount of penalties paid to the budget by the organization is not returned.

Export not confirmed for three years

If within three years after the sale of goods it is not possible to collect the necessary documents, the amount of VAT on unconfirmed exports must be included in other expenses:

Debit 91-2 Credit 19 subaccount “VAT on unconfirmed export supplies” - VAT paid to the budget on unconfirmed export supplies is written off.

An example of reflecting in accounting transactions related to the calculation of VAT and penalties for an unconfirmed export transaction. Payment for goods is made after shipment. The organization did not collect the required package of documents within three years after customs clearance of goods

On January 12, 2012, Alfa CJSC entered into a contract for the supply of wood for export to Finland. The price of the export contract is USD 22,000. In the same month, Alpha purchased a shipment of wood for 590,000 rubles. (including VAT - 90,000 rubles) and paid for the purchased goods.

The wood was released abroad under the customs export regime on January 19, 2012. Payment from the Finnish company was received on January 24, 2012. Selling expenses amounted to 3,000 rubles.

The notional exchange rate of the US dollar on the dates of transactions was:

- January 19, 2012 – 29.60 rubles/USD;

- January 24, 2012 – 29.70 rubles/USD.

After 180 calendar days (July 17, 2012), Alpha did not collect a complete package of documents confirming the fact of real exports and the legality of applying the zero VAT rate. Therefore, the organization’s accountant calculated VAT based on export proceeds converted into rubles on the date of shipment. The following entry was made in the accounting:

Debit 19 subaccount “VAT on unconfirmed export supplies” Credit 68 subaccount “VAT settlements” - 117,216 rubles. (USD 22,000 × RUB 29.60/USD × 18%) – VAT is charged on unconfirmed exports.

After the tax has been calculated, the amount of “input” VAT on goods sold is deducted:

Debit 68 subaccount “Calculations for VAT” Credit 19 subaccount “VAT presented by suppliers” – 90,000 rubles. – accepted for deduction of “input” VAT on goods sold.

Having completed the calculations, the Alpha accountant submitted an updated VAT return for the first quarter of 2012 to the tax office. In the declaration, in addition to the initial data, he reflected the amount of accrued VAT on unconfirmed exports and the amount of tax deduction on goods sold.

The amount of additional payment according to the declaration will be: 117,216 rubles. – 90,000 rub. = 27,216 rub.

Alpha transferred this amount to the budget on July 20, 2012. The following entry was made in accounting:

Debit 68 subaccount “Calculations for VAT” Credit 51 – 27,216 rubles. – transferred to the VAT budget on unconfirmed exports.

According to the updated declaration, this amount is payable to the budget:

- no later than April 20, 2012 - in the amount of 9072 rubles;

- no later than May 21, 2012 - in the amount of 9072 rubles;

- no later than June 20, 2012 - in the amount of 9072 rubles.

The duration of the delay is:

- from April 21 to July 19, 2012 – 90 days;

- from May 22 to July 19, 2012 – 59 days;

- from June 21 to July 19, 2012 – 29 days.

The refinancing rate in force during the period of delay was 8 percent.

Alpha's accountant calculated the amount of penalties as follows:

9072 rub. × 1/300 × 8% × 178 days. = 431 rub.

In accounting, the accrual and payment of penalties are reflected by the following entries:

Debit 99 Credit 68 subaccount “Calculations for penalties and VAT fines” – 431 rubles. – penalties accrued;

Debit 68 subaccount “Calculations for penalties and VAT fines” Credit 51 – 431 rub. – the amount of penalties is transferred to the budget.

For three years, starting from April 1, 2012, Alpha never collected a package of documents confirming the fact of real exports and the organization’s right to apply a zero VAT rate. The amount of tax paid to the budget on an unconfirmed export delivery was written off by the Alpha accountant using the following entry:

Debit 91-2 Credit 19 subaccount “VAT on unconfirmed export supplies” – 117,216 rubles. – taken into account as part of other expenses VAT paid to the budget on an unconfirmed export supply.

Situation: is it possible to take into account the amount of VAT paid by an organization on an unconfirmed export transaction when calculating income tax?

No you can not.

When calculating income tax, VAT amounts paid by an organization on an unconfirmed export transaction are not taken into account. Such expenses are economically unjustified, that is, they do not meet the criteria of Article 252 of the Tax Code of the Russian Federation. This is stated in letters of the Ministry of Finance of Russia dated November 29, 2007 No. 03-03-05/258, dated July 17, 2007 No. 03-03-06/1/498, dated January 22, 2007 No. 03-03- 06/1/17. If in the future the organization can confirm the fact of export and the amount of tax paid will be reimbursed, it is also not necessary to include it in income (letter of the Ministry of Finance of Russia dated November 29, 2007 No. 03-03-05/258).

Arbitration practice on this issue is heterogeneous. Some courts share the position of the Ministry of Finance of Russia (see, for example, decisions of the Federal Antimonopoly Service of the Moscow District dated October 8, 2012 No. A40-136146/11-107-569 and the North Caucasus District dated October 4, 2010 No. A32-45113/2009) . However, there are examples of court decisions that recognize the legality of including VAT amounts on unconfirmed exports as expenses that reduce taxable profit (see, for example, resolutions of the Federal Antimonopoly Service of the West Siberian District dated January 23, 2006 No. F04-2578/2005(18865- A27-40), F04-2578/2005(18884-A27-40) and dated December 21, 2005 No. F04-9163/2005(18078-A45-35)).

Reporting

In the VAT return, indicate the amount of tax previously accrued on an unconfirmed export supply in column 4 of section 4. When calculating VAT payable to the budget (reimbursement from the budget), it reduces the amount of VAT accrued on transactions taxed at rates 18, 10, 18/118 or 10/110 percent. If the difference between the accrued VAT and the amount of tax deductions is positive, it must be transferred to the budget. If this difference is negative, the organization has the right to reimburse the tax from the budget. Moreover, if an organization is engaged only in export operations, then the “input” VAT accepted for deduction will be reimbursed from the budget in full. This follows from Articles 173 and 176 of the Tax Code of the Russian Federation and the Procedure for filling out a VAT return, approved by Order of the Ministry of Finance of Russia dated October 15, 2009 No. 104n.

For the refund of “input” VAT, see How to refund VAT if the amount of deductions exceeds the amount accrued

| < Previous | Next > |

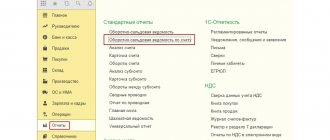

Confirmation of zero VAT rate in 1C 8.3

Now call the VAT accounting assistant (Fig. 7). Here we are interested in two sections - “Confirmation of the zero VAT rate” and “Creating a purchase book (0%)”.

Fig.7

First, we try to fill out the tabular part of the document “Confirmation of the zero rate...” (Fig. 8). If the sales documents at a 0% rate are filled out correctly, they will automatically be included in the document.

Fig.8

The user can only select the appropriate attribute (“confirmed”/“not confirmed”). We set the event “0% rate confirmed”, post the document and check the transactions.

Fig.9

In this case, there are no accounting entries, but there are movements in the VAT accounting registers. There is one entry in the “VAT on sales 0%” register (Fig. 9).

There are two entries in the “VAT presented” register (Fig. 10).

Fig.10