The procedure for applying VAT on the sale of non-commodity goods - any movable and immovable property, vehicles, all types of energy - to the countries of the Eurasian Economic Union (Kazakhstan, the Republic of Belarus, Armenia, the Kyrgyz Republic) has its own characteristics. 1C experts tell you how to reflect in the 1C: Accounting 8 version 3.0 program the purchase and sale of non-commodity goods for export to the EAEU countries and confirm the zero VAT rate within 180 days after shipment.

Features of using a zero rate in export operations

The application of this tax rate in export operations to Kazakhstan is possible only if a complete package of documents is provided, the composition of which is given in paragraph 4 of the Protocol on the collection of indirect taxes.

If supporting documents are not provided, the standard rate of 10 or 18% is applied instead of the zero rate.

The zero rate for export operations from Russian territory also applies to the export of goods not subject to VAT.

The exporter prepares an invoice, in which he enters the rate of 0% in column 7, after which he transfers one copy to the buyer from Kazakhstan, keeps the second one for himself and enters its data in the Sales Book. The invoice is issued within 5 days from the shipping day, and the details are entered into the Sales Book in the quarter when all the documents required to justify the right to this rate are completed, executed and collected.

The 0% rate also applies to the removal of valuables for storage in warehouses in Kazakhstan with their subsequent sale by Russian sellers.

Purchase and shipment of non-commodity goods in “1C: Accounting 8” when exporting to the EAEU

Let's consider the procedure for reflecting in the 1C: Accounting 8 program, edition 3.0, transactions of acquisition and shipment of non-commodity goods for export to the EAEU countries.

Example 1

The organization Trading House LLC, which applies the general taxation system, purchased on July 20, 2018 from Sofa Factory LLC (supplier):

According to the concluded contract with the foreign partner Astana LLP (Kazakhstan), the organization Trading House LLC:

The sequence of operations is given in Table 1. Table 1 No.

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Setting up accounting policies and accounting parameters

In accordance with paragraph 3 of the Protocol on the procedure for collecting indirect taxes and the mechanism for monitoring their payment when exporting and importing goods, performing work, providing services (Appendix No. 18 to the Treaty on the Eurasian Economic Union) when exporting goods from the territory of one EAEU member state to territory of another EAEU member state:

- a zero VAT rate is applied when submitting to the tax authority the documents provided for in paragraph 4 of the Protocol;

- the right to tax deductions is exercised in a manner similar to that provided for by the legislation of the EAEU member state in relation to goods exported outside the EAEU.

If non-commodity goods are shipped for export to EAEU member states:

- the deduction of the presented amount of VAT is carried out in the generally established manner, i.e., similar to the deduction for goods (work, services), property rights acquired for the implementation of transactions subject to VAT at rates of 18% and 10% (clause 3 of Article 172 of the Tax Code of the Russian Federation) ;

- The taxpayer does not have the obligation to determine the amount of VAT relating to goods (work, services), property rights acquired for the production and (or) sale of goods using a 0% rate, i.e. there is no obligation to maintain separate accounting (paragraph 2 p. 10, Article 165 of the Tax Code of the Russian Federation).

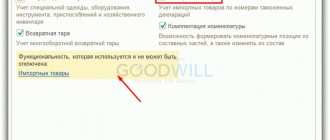

Consequently, if the taxpayer sells only non-commodity goods for export to the EAEU and there are no other grounds for maintaining separate accounting (carrying out transactions that are exempt from taxation under Article 149 of the Tax Code of the Russian Federation, and (or) the place of sale of which is not recognized as the territory of the Russian Federation according to Articles 147 and 148 of the Tax Code of the Russian Federation, and (or) which are not recognized as an object of taxation under paragraph 2 of Article 146 of the Tax Code of the Russian Federation), then on the VAT tab of the Accounting Policy form (section Main - subsection Settings - hyperlink Taxes and reports) you need to check the absence of a flag for the values Separate accounting of incoming VAT and separate accounting of VAT by accounting methods are maintained.

According to paragraph 3 of Article 172 of the Tax Code of the Russian Federation, the procedure for deducting input VAT when purchasing goods (work, services), property rights for operations for the sale of goods for export using a tax rate of 0% depends on whether or not the exported goods are raw materials (clause 10 of Art. 165 of the Tax Code of the Russian Federation).

Codes of types of goods related to raw materials were approved by Decree of the Government of the Russian Federation dated April 18, 2018 No. 466 in accordance with the unified Commodity Nomenclature for Foreign Economic Activity of the Eurasian Economic Union, approved. By decision of the Council of the Eurasian Economic Commission dated July 16, 2012 No. 54 (as amended on April 24, 2018).

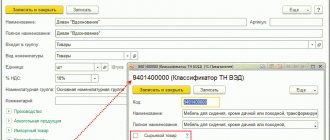

In accordance with the approved codes, it is necessary to indicate whether or not the goods sold for export belong to the group of raw materials by placing the appropriate flag for each specific HS code.

By default, the Commodity flag is cleared, i.e. all goods sold are classified as non-commodity products.

According to subparagraph 15 of paragraph 5 of Article 169 of the Tax Code of the Russian Federation and subparagraph “a.1” of paragraph 2 of the Rules for filling out an invoice, approved. By Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137, invoices issued for goods exported outside the territory of the Russian Federation to the territory of the EAEU member states must indicate the code of the type of goods in accordance with the Commodity Nomenclature of Foreign Economic Activity.

The corresponding HS code is automatically displayed in column 1a of the invoice when goods are exported to the territory of the EAEU member states if the following conditions are met:

- sales of goods are carried out using a tax rate of 0%;

- the HS code is indicated for the corresponding product item in the Nomenclature directory;

- the counterparty is a taxpayer of a member state of the EAEU (section Directories - subsection Purchases and sales).

Purchasing goods

The receipt of goods into the organization (operations: 2.1 “Receipt of goods”; 2.2 “Accounting for input VAT”) is registered in the program using the document Receipt (act, invoice) with the transaction type Goods (invoice) (section Purchases - subsection Purchases - hyperlink Receipts (acts , invoices)) (Fig. 1).

Rice. 1. Purchase of goods

Please note that if the taxpayer maintains separate accounting for VAT, i.e., on the VAT tab of the Accounting Policy form (Section Main - subsection Settings - hyperlink Taxes and reports) the flag Separate accounting for incoming VAT and Separate accounting for VAT by accounting methods is checked, then in the column The VAT accounting method for non-commodity goods purchased for export should be set to Accepted for deduction.

After posting the document Receipt (act, invoice), accounting entries will be generated:

Debit 41.01 Credit 60.01 - for the cost of purchased goods excluding VAT; Debit 19.03 Credit 60.01 - for the amount of VAT presented by the supplier on purchased goods.

For the purposes of tax accounting for corporate income tax, the corresponding amounts are also recorded in the NU resources: Amount Dt and Amount Kt for accounts with the NU attribute.

An entry with the type of movement Receipt and the event Submitted by VAT by the Supplier is entered into the VAT presented register.

To register the received invoice for purchased goods in the program (operation 2.3 “Registration of supplier invoice”), you must enter the number and date in the fields Invoice No. and from the document Receipt (act, invoice) (see Fig. 1) incoming invoice and click the Register button. In this case, the document Invoice received will be automatically created, and a hyperlink to the created invoice will appear in the form of the basis document (Fig. 2).

The fields of the Invoice document received will be filled in automatically based on information from the Receipt document (act, invoice).

Rice. 2. Invoice received for receipt

Besides:

- in the Received field the date of registration of the Receipt document (act, invoice) will be entered, which, if necessary, should be replaced with the date of actual receipt of the invoice. If an agreement has been concluded with the seller on the exchange of invoices in electronic form, then the date of sending the electronic invoice file by the EDF operator, indicated in its confirmation, will be entered in the field;

- in the line Base documents there will be a hyperlink to the corresponding receipt document;

- in the Operation type code field the value 01 will be reflected, which corresponds to the acquisition of goods (work, services), property rights in accordance with the Appendix to the order of the Federal Tax Service of Russia dated March 14, 2016 No. ММВ-7-3/ [email protected] ;

- The Receipt Method switch will be set to Hard copy if there is no valid agreement with the seller to exchange invoices electronically. If there is an agreement, the switch will be in the Electronic position.

Since the buyer does not maintain separate accounting, in the Invoice document received there is the possibility of a simplified application for deduction of input VAT, for which the flag for the value Reflect VAT deduction in the purchase book by the date of receipt is automatically set.

Please note that if the taxpayer maintains separate accounting for VAT, i.e., on the VAT tab of the Accounting Policy form (Section Main - subsection Settings - hyperlink Taxes and reports) the flag Separate accounting for incoming VAT and Separate accounting for VAT by accounting methods is selected, then in the document Invoice received is missing a line and a flag for the value Reflect VAT deduction in the purchase book by the date of receipt. In this case, the application for a tax deduction is always carried out using the regulatory document Formation of purchase ledger entries.

If it is necessary to change the specified data, for example, to clarify the date of receipt, the document should be repeated. To do this, click the Record and close button or execute the Run command from the list of available commands, opened by clicking the More button.

As a result of posting the Invoice document received, an entry will be made in the accounting register:

Debit 68.02 - for the amount of input VAT in the amount of RUB 162,000.00. Credit 19.03

An entry will also be made in the information register of the Invoice Journal. Register entries The Invoice Register are used to store the necessary information about the received invoice.

An entry with the type of movement Expense is made in the VAT accumulation register presented.

An entry with the event VAT Claimed for Deduction is made in the Purchase VAT accumulation register to register the invoice in the purchase book.

Based on the VAT Purchases register entry, the purchase book is filled out for the period of acceptance of purchased goods for accounting and receipt of a supplier invoice, i.e. for the third quarter of 2021 (section Reports - VAT subsection or Purchases section - VAT subsection) (see Fig. 3).

Rice. 3. Purchase book for the third quarter of 2021

The amount of input VAT on purchased goods will be reflected on line 120 of Section 3, as well as in Section 8 of the VAT tax return for the third quarter of 2021 (section Reports - subsection 1C-Reporting - hyperlink Regulated reporting).

Shipment of goods

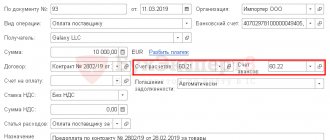

The shipment of goods for export to the buyer “Astana” LLP (operations: 3.1 “Shipment of goods for export”; 4.2 “Write-off of the cost of goods sold”) is registered in the program using the document Sales (act, invoice) with the transaction type Goods (invoice) (Fig. 4).

Rice. 4. Shipment of goods for export

After posting the document, the following accounting entries are entered into the accounting register:

Debit 90.02.1 Credit 41.01 - for the cost of written-off sofas; Debit 62.21 Credit 90.01.1 - for the sale price of sofas.

A record with the type of movement Receipt for the sales book is entered into the VAT register for sales of 0%, reflecting the accrual of VAT at a rate of 0%.

To create an invoice for goods shipped for export (operation 3.3 “Issuing an invoice for the shipment of goods”), you must click on the Write invoice button at the bottom of the Sales document (act, invoice) (see Fig. 4).

In this case, the document Invoice issued is automatically created in the information base, and a hyperlink to the created invoice appears in the form of the basis document.

In the new posted document Invoice issued, which can be opened via a hyperlink, all fields will be filled in automatically based on the data in the Sales document (act, invoice).

From 01/01/2015, taxpayers who are not intermediaries acting on their own behalf (forwarders, developers) do not keep a log of received and issued invoices, therefore, in the document Invoice issued in the Amount line: it is indicated that the amounts to be recorded in the journal accounting (“of which by commission:”) are equal to zero.

The Transaction Type Code field will reflect the value 01, which corresponds to the shipment of goods (work, services), property rights, including transactions taxed at a tax rate of 0% in accordance with the Appendix to the order of the Federal Tax Service of Russia dated March 14, 2016 No. ММВ-7-3/ [ email protected]

As a result of posting the issued Invoice document, an entry will be made in the information register of the Invoice Log. Register entries The Invoice Register are used to store the necessary information about the issued invoice.

Using the button Print the accounting system document Invoice issued, you can view the form of the invoice and then print it (see Fig. 5).

Rice. 5. Invoice for export goods

According to subparagraph 15 of paragraph 5 of Article 169 of the Tax Code of the Russian Federation and subparagraph “a.1” of paragraph 2 of the Rules for filling out an invoice, approved. Resolution No. 1137, in invoices issued for goods exported outside the territory of the Russian Federation to the territory of the member states of the Eurasian Economic Union, column 1a indicates the code of the type of goods in accordance with the Commodity Nomenclature of Foreign Economic Activity.

Operations of shipment of goods for export until the validity of the application of the zero VAT rate is confirmed in the VAT tax return will not be reflected.

Receipt of payment

Receipt of payment for goods sold (operation 4.1 “Receipt of payment from buyer”) in the 1C: Accounting 8 version 3.0 program is reflected using the document Receipt to current account with the transaction type Payment from buyer, which is generated in the following ways:

- based on the document Invoice for payment to the buyer (section Sales - subsection Sales - journal of documents Invoices to buyers);

- by adding a new document to the Bank statements list (section Bank and cash desk - subsection Bank - document journal Bank statements).

As a result of posting the document, the following accounting entry is entered into the accounting register:

Debit 51 Credit 62.01 - for the amount of payment received, which is 600,000.00 rubles.

The procedure for confirming the right to 0%

To apply a 0% rate to valuables exported from the Russian Federation, you need to collect a set of documentation, the list of which is strictly defined by the Protocol, and then send the prepared set to the tax office no later than the 180th day from the date of actual shipment of goods and materials. Days are taken as calendar days.

The list of documents itself is listed in clause 4 of the Protocol, and the procedure, timing and place of their transfer to the Federal Tax Service in clause 5 of the Protocol.

These statements are true for exports from Russian territory to Kazakhstan. These countries are members of the EAEU, between which an agreement has been concluded establishing special rules for interaction in trade matters. The above Protocol serves as an annex to the agreement concluded between the participants of the EAEU.

Features of exports affecting its accounting

The implementation of export operations is reflected in accounting with a number of features due to the specifics of this type of activity:

1. Settlements under an export contract are most often carried out in foreign currency. This will require:

- opening a foreign currency account (or accounts if there are several currencies) and using account 52 in accounting for settlements with the buyer: Dt 52 Kt 62;

- mastering currency purchase and sale transactions and using account 57 or immediately account 91 for this purpose, depending on the adopted accounting policy: Dt 57 Kt 52;

- Dt 51 Kt 57;

- Dt 91 Kt 57 or Dt 57 Kt 91;

ConsultantPlus experts explained what wording in the contract affects the taxes and accounting of the supplier. Get free demo access to K+ and go to the Transaction Guide to learn all the nuances of accounting operations.

2. There is a need to organize separate accounting of information related to exports. This is due both to legal requirements and other goals:

- separating data on exports from information on activities subject to VAT at other rates or exempt from this tax (clause 4 of article 149 and clause 1 of article 153 of the Tax Code of the Russian Federation);

For information on what the organization of such accounting depends on, read the article “How is separate VAT accounting carried out (principles and methods)?”

- control over the completeness of receipt of payment from foreign counterparties (clause 1 of Article 19 of the Federal Law “On Currency Regulation...” dated December 10, 2003 No. 173-FZ);

- using the opportunity not to charge VAT on advances received from foreign buyers (clause 1 of Article 154 of the Tax Code of the Russian Federation);

- control over compliance with the deadlines allotted for confirming the right to apply the 0% rate (clause 9 of Article 165 of the Tax Code of the Russian Federation);

- tracking the moment of transfer of ownership, if, according to the international rules of interpretation of trade terms “Incoterms”, it does not coincide with the moment of shipment;

- correct correlation of shipment volumes used in VAT distribution calculations.

3. There is an obligation to record additional transactions related to exports:

- calculations for customs duties and fees using account 76 for this purpose: Dt 76 Kt 51 (52);

- Dt 44 Kt 76;

- Dt 45 Kt 41 (43);

List of documents to justify the 0% rate

If an export transaction is carried out between two parties to the agreement on the EAEU (in this case, between Russia and Kazakhstan), then when collecting the necessary documentation, the exporter should rely on the following list: (click to expand)

- A contractual agreement concluded between participants in a supply transaction;

- An application for the import of goods and payment of indirect taxes is prepared by the buyer from Kazakhstan, submits it to his tax office, where a mark is placed on the fulfillment of the obligation to pay additional tax (or exemption from it), and then passes it to the Russian seller;

- Documents evidencing the export of valuables from Russian territory (consignment note, goods and transport bill).

The list of item 4 also indicates a bank statement confirming receipt of proceeds from the export transaction, but it should be provided if required by the tax laws of the exporter’s state. In the Russian Federation, the list of documents for using the zero rate is specified in clause 1, article 165 of the Tax Code of the Russian Federation. The list of this item does not require the mandatory submission of an extract. Therefore, Russian exporters do not need to submit it to the tax authorities in connection with the export procedure to the EAEU countries.

To this list you need to add a VAT return to be completed for the quarter when the above documentation is prepared. To fill out, take a standard declaration form intended for submitting VAT information in a standard situation.

Since the indicated declaration is submitted before the 25th day of the month following the reporting quarter, the last day for filing documents will correspond to the 25th day of the month following the quarter of the end of the allotted 180-day period.

Confirmation of the VAT rate of 0% in 1C: Accounting 8 within 180 days

A 0% VAT rate can be applied by a taxpayer-exporter if, within 180 calendar days from the date of shipment (transfer) of goods, the validity of its application is confirmed by submitting a VAT return and a set of supporting documents to the Federal Tax Service (see above).

When selling goods provided for in paragraph 1 of Article 164 of the Tax Code of the Russian Federation, the moment for determining the tax base is the last day of the quarter in which the full package of supporting documents is collected (clause 9 of Article 167 of the Tax Code of the Russian Federation).

Let's consider the procedure for reflecting in the 1C: Accounting 8 program, edition 3.0, confirmation of the VAT rate of 0% within 180 calendar days from the date of shipment (transfer) of goods in the case of the sale of non-commodity goods for export to the EAEU countries.

Example 2

The organization Trading House LLC, which applies the general taxation system, purchased on July 20, 2018 from Sofa Factory LLC (supplier):

According to the concluded contract with the foreign partner Astana LLP (Kazakhstan), the organization Trading House LLC:

The organization Trading House LLC on 10/02/2018 collected a package of documents confirming the validity of applying the 0% VAT rate on goods shipped to Astana LLP (Kazakhstan). The sequence of operations is given in Table 2. table 2 No.

| |||||||||||||||||||||||||

where the sign “↓” means an incoming document, the sign “↑” - outgoing, the sign “→” - “create based on”, the sign “¦” - internal, the sign “+” (plus) in front of the register name means an increase according to the “VAT Register” ", the sign " - " (minus) is a decrease, the sign "~" is a record.

An example of determining the date for filing documents

The consignment note for export was generated on 05/04/2016.

Documents must be collected by October 31, 2016 inclusive.

The last date for submitting documents is 01/25/2017.

Method of submitting a set of documents:

- Paper (if the forms are in the form of copies, then they must be properly certified);

- Electronic via TKS (sent as scanned files).

It is better to check the available method of filing with the tax office where the documentation in question is submitted.

When are customs stamps needed?

An important condition for confirming zero VAT is the presence of stamps from the customs authority on the customs declaration. Tax legislation provides for two types of marks:

- “Release permitted” - about the placement of goods under the customs export procedure;

- “Goods exported” - about the export of goods from the territory of the Russian Federation.

The original marks are affixed in the form of a rectangular stamp with lilac-pink-blue mastic (the shade depends on the degree of wear of the stamp pad). In addition, the mark can be indicated in the form of information and be an analogue of the original stamp for electronic customs declaration.

Let's figure out in what cases the tax office needs one or another mark and in what form.

"Release permitted"

In a letter dated July 31, 2018 No. SD-4-3/ [email protected], the Federal Tax Service explained: if a company submits a customs declaration in electronic form - and there can be no other option, since 100% of customs declarations in the Russian Federation are submitted in electronic form - then It is enough to present it in the form of information about the release of goods. Such a mark will appear in the document automatically when the customs authority finishes checking the declaration and sends a corresponding message to the customs declaration service.

The Federal Tax Service also clarifies that in the future it is not necessary to affix the original “Release Permitted” stamp to printed copies of customs declarations.

It happens that the accounting department of an exporting company asks for a “Release Permitted” stamp to maintain internal records. Then the stamp can be obtained at the customs post where the goods declaration was submitted. In the case of remote declaration of goods, the stamp can be placed at the customs post indicated in column 30 of the customs declaration “Location of goods”.

The customs mark in the form of information about the release of goods in a copy of the electronic customs declaration looks like this:

What to do if documents are not collected on time

Violation of the established deadline of 180 days for submitting supporting documentation entails loss of the right to a preferential rate. If the tax office does not receive the necessary documents, then the exporter will have to add a tax to the shipping cost either at a rate of 10% for goods listed in clause 2 of Article 164 of the Tax Code of the Russian Federation, or 18% for other goods.

The calculated tax is payable for the tax period in which the shipping procedure for exported valuables to Kazakhstan was carried out.

If the exporter still wishes to later exercise the right to a preferential zero rate, then he must collect the required set of documents and send them to the tax office as soon as possible. In this case, the previously paid added export tax will be offset - sent to deduction.

From 07/01/16, the procedure for deducting the added tax is carried out on the day of the subsequent calculation of VAT at a zero rate, subject to the presence on this date of the necessary supporting documents confirming the possibility of using 0%.

VAT is sent for deduction in the amount determined by the exporter's tax form, which served as the basis for the transfer of the tax amount, calculated as a result of multiplying the cost by a rate of 10 (18%). This s/f was included in the Sales Book at the time of compilation. After collecting the necessary documentation, at the time of accepting for deduction the previously paid additional tax on exports, the same tax is entered into the Purchase Book, thereby carrying out the procedure for offsetting the transferred VAT.

Results

Exports of goods from Russia to Belarusian buyers are taxed at a rate of 0% if the supplier submits a set of supporting documents to the tax authorities along with the VAT return. If the documents cannot be collected on time, the supplier must submit an updated VAT return for the period in which the export shipment occurred.

Sources:

- Tax Code of the Russian Federation

- Treaty on the Eurasian Economic Union (signed on May 29, 2014)

- Decree of the Government of the Russian Federation dated April 18, 2018 No. 466

- Order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Accounting for input VAT on exports to Kazakhstan

The tax declared by suppliers of goods that are later exported to Kazakhstan is credited as a deduction, reducing the final VAT payable.

This operation is possible if the supplier has transferred a tax in which the amount of added tax appears as a separate column. For goods purchased after 07/01/16, this amount is accepted for deduction after they are accepted for accounting.

Input tax on so-called raw materials, specified in paragraph 3, paragraph 10, Article 165 of the Tax Code of the Russian Federation, is accepted for deduction on the day of calculating the base for calculating the added tax, defined in Article 167. In relation to the transactions under consideration, this moment will correspond to the last day of the quarter, when a package of documents confirming the possibility of using the zero rate has been prepared. If the documents are not collected, then the day the base is calculated will correspond to the shipment date.

The above rules prescribed for raw materials are also valid for valuables, services, works purchased and accepted for accounting before 07/01/16.

The moment of acceptance of input VAT for deduction on goods, services, works intended for export:

| Until 07/01/16 | From 01.07.16 | |

| Goods | At the time of calculating the base for the added tax:

| In the quarter of acceptance for accounting. A prerequisite is the presence of an invoice. |

| Services, works | ||

| Commodities | At the time of determining the tax base:

| |

In the quarter in which the exporter exercised the right to deduction, he has an excess of the tax added amount to be reimbursed over the amount to be paid. That is, in this situation, the tax office must reimburse the tax; the amount to be reimbursed is written down in the VAT return in section 1, field 050.

The refund procedure is standard. The tax can be offset against other federal taxes, against fines, penalties, and arrears on added tax. In this case, you can submit an application indicating how the offset should be made. If such an application is not submitted, the tax authorities will independently carry out the offset.

It is also possible to offset the refundable amount against future VAT payments.

If there is a need to receive this amount in cash, then an application must be submitted to the tax office with a corresponding request so that the tax authorities do not offset the amount of the refunded amount on their own.

VAT

According to paragraph 1 of Art. 2 of the Customs Code of the Customs Union, the single customs territory of the customs union consists of the territories of the Republic of Belarus, the Republic of Kazakhstan and the Russian Federation.

The main documents regulating the procedure for collecting VAT when exporting goods from the territory of the Russian Federation to Kazakhstan are:

- Agreement between the Government of the Russian Federation, the Government of the Republic of Belarus and the Government of the Republic of Kazakhstan dated January 25, 2008 “On the principles of levying indirect taxes on the export and import of goods, performance of work, provision of services in the Customs Union” (hereinafter referred to as the Agreement);

- Protocol of December 11, 2009 “On the procedure for collecting indirect taxes and the mechanism for monitoring their payment when exporting and importing goods in the Customs Union” (hereinafter referred to as the Protocol);

- Tax Code of the Russian Federation (in particular, Chapter 21 of the Tax Code of the Russian Federation).

In this case, the norms of the Agreement and the Protocol (Article 7 of the Tax Code of the Russian Federation) have priority.

In accordance with Art. 1 of the Agreement, the export of goods is the export of goods sold by taxpayers (payers) from the territory of one state - a member of the customs union to the territory of another state - a member of the customs union.

When exporting goods, a zero VAT rate is applied, subject to documentary confirmation of the fact of export (Article 2 of the Agreement).

By virtue of paragraph 1 of Art. 1 of the Protocol, when exporting goods from the territory of the Russian Federation to the territory of Kazakhstan, a zero VAT rate is applied, provided that the documents provided for in paragraph 2 of Art. 1 of the Protocol.

Based on clause 2 of Art. 1 of the Protocol to confirm the zero VAT rate, the exporting organization submits to the tax authority simultaneously with the tax return the following documents (copies):

- agreement (contract), taking into account amendments, additions and annexes to it, on the basis of which the export of goods is carried out;

- application for the import of goods and payment of indirect taxes, drawn up in the form of Appendix 1 to the Protocol on the exchange of information in electronic form between the tax authorities of the member states of the Customs Union on the paid amounts of indirect taxes, with a mark from the tax authority of the member state of the Customs Union into whose territory the goods were imported goods, on the payment of indirect taxes (exemption or other procedure, fulfillment of tax obligations) (in the original or in a copy at the discretion of the tax authorities of the member states of the customs union);

- transport (shipping) documents confirming the movement of goods from the territory of the Russian Federation to the territory of Kazakhstan. The specified documents are not submitted if for certain types of movement of goods the registration of such documents is not provided for by the legislation of the Russian Federation (note that, in the opinion of the regulatory authorities, transport and shipping documents submitted to the tax authorities do not provide any marks from the customs authority on the export goods (letter of the Federal Tax Service of the Russian Federation for Moscow dated August 17, 2010 N 16-15/086789));

- other documents confirming the validity of the application of the zero VAT rate, provided for by the legislation of the Russian Federation (let us clarify that other documents should be understood, for example, commission agreements (agency agreements, commission agreements), if goods from the territory of the Russian Federation to member states of the Customs Union are supplied through intermediaries) .

Let us note that at present, when exporting goods to the Republic of Belarus and the Republic of Kazakhstan, a bank statement is not required to be submitted to the tax authority (clause 2, clause 2, article 1 of the Protocol, clause 1, article 165 of the Tax Code of the Russian Federation).

The above documents are submitted to the tax authority within 180 calendar days from the date of shipment (transfer) of goods, which is recognized as the date of the first drawing up of the primary accounting document issued to the buyer of the goods (first carrier) (clause 3 of article 1 of the Protocol ).

If the full package of documents is not collected within 180 calendar days, then the zero VAT rate is not applied, and transactions for the sale of goods are subject to VAT at rates of 10% or 18% (see, for example, letter of the Ministry of Finance of Russia dated January 17, 2011 N 03-07-13/1-02). The tax base in this case is determined on the day of shipment (transfer) of goods (clause 3, article 1 of the Protocol, clause 9, article 165 of the Tax Code of the Russian Federation).

Clause 1 of Art. 1 of the Protocol also determines that the taxpayer has the right to tax deductions in a manner similar to that provided for by the legislation of a member state of the customs union applied to goods exported from the territory of this state outside the customs union.

In other words, the exporting organization has the right to deduct the VAT charged to it upon the purchase of goods exported to the Republic of Kazakhstan in the manner established by Chapter 21 of the Tax Code of the Russian Federation.

Clause 3 of Art. 172 of the Tax Code of the Russian Federation establishes that deductions of tax amounts provided for in paragraphs. 1-8 tbsp. 171 of the Tax Code of the Russian Federation, in relation to operations for the sale of goods (works, services) specified in paragraph 1 of Art. 164 of the Tax Code of the Russian Federation (including goods exported under the customs export procedure) are carried out in the manner established by Art. 172 of the Tax Code of the Russian Federation, at the time of determining the tax base established by Art. 167 Tax Code of the Russian Federation.

In turn, clause 9 of Art. 167 of the Tax Code of the Russian Federation provides that when selling goods (work, services) provided for in paragraphs. 1, 2.1-2.8, 3, 3.1, 8, 9, 9.1 and 12 clause 1 art. 164 of the Tax Code of the Russian Federation, the moment of determining the tax base for the specified goods (works, services) is the last day of the quarter in which the full package of documents confirming the right to apply the zero VAT tax rate is collected. That is, deductions of VAT presented upon the purchase of goods sold for export to the Republic of Kazakhstan are made on the last day of the quarter in which the full package of documents confirming the 0% rate was collected.

At the same time, by virtue of paragraphs. 5 paragraph 3 art. 170 of the Tax Code of the Russian Federation, VAT amounts accepted for deduction on goods (work, services) are subject to restoration in the event of their further use for carrying out operations for the sale of goods (work, services) provided for in paragraph 1 of Art. 164 Tax Code of the Russian Federation.

Tax amounts are subject to restoration in the amount previously accepted for deduction.

Reinstatement of tax amounts is carried out in the tax period in which goods are shipped for export.

Recovered tax amounts are subject to deduction in the corresponding tax period, which coincides with the moment of determining the tax base for transactions involving the sale of goods (works, services) provided for in paragraph 1 of Art. 164 of the Tax Code of the Russian Federation, taking into account the features established by Art. 167 Tax Code of the Russian Federation.

This rule means that if the VAT presented by the supplier of the goods has already been accepted for deduction (for example, if the exporting organization planned to sell it in the Russian Federation), then the tax should be restored in the tax period in which the goods were shipped for export. Then VAT is re-deducted on the last day of the quarter in which the full package of documents confirming the 0 percent rate is collected.

If, when purchasing a product, the organization knew in advance that this product would be exported, then the VAT deduction should be applied in accordance with clause 3 of Art. 172 of the Tax Code of the Russian Federation, that is, as of the last day of the quarter in which a complete package of documents confirming the right to apply the zero VAT rate was collected. In this case, to apply the provisions of paragraphs. 5 paragraph 3 art. 170 of the Tax Code of the Russian Federation there are no grounds.

If the organization has not collected the required package of documents within 180 calendar days, it does not lose the right to deduct VAT. In this situation, VAT paid to the supplier of goods is accepted for deduction in the generally established manner.

In addition, the exporting organization is not deprived of the right to confirm the fact of export and deduct the paid VAT after the 180-day period for confirming the fact of export has expired (paragraph 6, paragraph 3, article 1 of the Protocol). To do this, the organization can use the norm of paragraph 10 of Art. 171 Tax Code of the Russian Federation.

So, paragraph 10 of Art. 171 of the Tax Code of the Russian Federation provides that tax amounts calculated by the taxpayer in the absence of documents provided for in Art. 165 of the Tax Code of the Russian Federation, for transactions of sale of goods (works, services) specified in paragraph 1 of Art. 164 Tax Code of the Russian Federation.

Deductions of tax amounts specified in clause 10 of Art. 171 of the Tax Code of the Russian Federation, are carried out on the date corresponding to the moment of subsequent calculation of tax at a tax rate of 0% in relation to transactions for the sale of goods (work, services) provided for in paragraph 1 of Art. 164 of the Tax Code of the Russian Federation, if at that moment there are documents confirming the right to apply the VAT tax rate of 0% (paragraph 2 of clause 3 of Article 172 of the Tax Code of the Russian Federation).

What does an exporter need to know when exporting to Kazakhstan?

The relationship between the Russian Federation and Kazakhstan in the export procedure is regulated by the Protocol attached to the agreement on the EAEU. This Protocol contains all the nuances of the relationship.

What the exporter needs to pay attention to: (click to expand)

- It is possible to adjust the tax base for added tax, the reasons for this are determined by the Protocol - an increase or decrease in the price of exported assets, a decrease in the quantity of goods, as well as others. In this case, adjustments due to an increase in the number of exported valuables are not allowed;

- Among the documents submitted to the Federal Tax Service to justify the right to a 0% tax rate is an application for the import of goods and payment of indirect taxes. They are provided by the buyer from Kazakhstan with his tax stamp. If there are several such applications, then you do not have to submit all of them to the Russian tax office, but provide a list of them, the format of which is standard and approved by Order No. ММВ-7-15 / [email protected] dated 04/06/15, prepared and approved by the tax office of the Russian Federation.

Documents for a supply contract from Russia to Kazakhstan, Belarus, Kyrgyzstan and Armenia

A contract for the supply of goods is an agreement between the supplier and the buyer on two main issues: the product and its transportation. Therefore, the execution of a supply contract is accompanied by the execution of two types of documents: 1) commodity, and 2) transport.

The preparation of documents for domestic Russian supplies of goods is regulated by the legislation of the Russian Federation. How to arrange the transportation of goods from Russia to Kazakhstan or another state party to the agreement “On the Eurasian Economic Union” signed on May 19, 2014. (hereinafter referred to as the “EAEU Treaty”)?

Transport documents for the transportation of goods from Russia to Kazakhstan and the EAEU countries

Waybill

Conditions:

Supply contract from Russia to Kazakhstan (or another state party to the EAEU treaty).

Transportation by road.

Start of transportation of goods (place of shipment): Russia.

Decor:

When transporting goods by road, the driver is required to have documents for the cargo (clause 2 of the Road Traffic Rules of the Russian Federation). The rules do not disclose what documents these are, but in essence they are documents confirming the legality of the driver’s possession of the cargo being transported.

Delivery of cargo under a supply agreement is possible by the supplier or buyer. In both cases, it is possible to use your own transport or hired carriers.

Situation 1: Under the supply agreement, delivery is included in the price of the goods and is organized by the supplier (Russian exporter) with the involvement of a carrier

The carriage of goods is formalized by a contract of carriage between the supplier and the carrier.

The existence of a contract of carriage is confirmed by the waybill (Article 785 of the Civil Code of the Russian Federation). Regardless of who, under the supply agreement, enters into a transportation agreement (supplier or buyer), draws up a waybill and transfers it to the carrier, the shipper (Articles 2 and 8 of the Charter of Road Transport, paragraph 6 of the Rules for the Transportation of Goods by Road).

In situation 1, the shipper is a Russian supplier, and he is obliged to issue a waybill and hand it over to the carrier.

The consignment note not only confirms the fact of concluding a transportation contract, but also records the volume of transport services provided by the carrier and the price of these services. The consignment note is the basis for settlements between the transportation customer and the carrier for services rendered.

Do not confuse the waybill and the goods transport bill (TTN).

For domestic Russian transportation, a unified form TTN 1-T was developed and used until 2013 as the primary accounting document (for accounting and tax purposes) to account for services for the transportation of goods by road. The consignment note is given to the driver along with the accompanying documents for the cargo.

Russian exporters of goods to the countries participating in the EAEU Treaty (Kazakhstan, Belarus, Kyrgyzstan and Armenia) should take into account that the EAEU Treaty abolished customs clearance for the movement of goods between participating countries and simplified the transportation of goods, but the participating states remained sovereign .

Under these conditions, the transportation of goods from Russia to Kazakhstan, and similarly transportation between other states, is recognized as international transportation of goods , since it involves the movement of cargo from the territory of one state to the territory of another (Article 2 of the Law of the Russian Federation “On State Control of International Road Transport”).

The existence of a contract for the international carriage of goods is confirmed by an international consignment note and is drawn up in the CMR form (Convention on the Contract for the International Carriage of Goods by Road, Geneva, May 19, 1956) indicating the relevant details and attaching a set of documents.

According to the rules of international transportation of goods, the following is attached to the CMR consignment note:

- shipping specification,

- invoice - specification,

- quality certificate,

- quarantine and veterinary certificates or certificates

(clause 6 of the List of documents approved by the Ministry of Transport of Russia on October 27, 1998).

Conclusion:

Transportation of goods by road between the states parties to the Treaty on the EAEU is formalized by an international consignment note (CMR) indicating the relevant details and attaching a set of documents. When exporting from Russia, documents according to the List approved by the Ministry of Transport of Russia on October 27, 1998 are attached to the CMR. The documents are prepared and handed over to the carrier by the shipper (supplier).

We recommend: In the interests of the supplier, primarily in the event of tax disputes regarding VAT refunds as well as disputes with the buyer and the carrier, we recommend that after loading the driver enter the following entry in the CMR in his own hand: “The goods have been loaded. Pinned. There are no comments." When transporting by road, the cargo may shift, fastenings will break, body boards will break, etc.

In addition, in order to create an archive, which can also be used in the future in disputes, when shipping the goods, obtain a copy of the driver’s driver’s license and his passport, the accuracy of the copies of which must be certified by the corresponding records of the owner - the driver. “A copy of the driver’s license No. _____, issued by ______ is correct. I have certified the accuracy of the copy - last name, first name, patronymic, resident at the address: ______, date, signature.” Passport is the same.

Situation 2: Delivery is included in the price of the goods and is carried out by the supplier’s own transport

According to Russian legislation, in situation 2 there is no contract of carriage since the supplier transports the goods using its own transport. Therefore, there are no grounds for issuing a consignment note. Transportation is carried out by the supplier's employee in a car owned by the supplier (own transport). The driver confirms the accounting of delivery costs and the legality of ownership of the car with a waybill, and the legality of ownership of the goods - with a consignment note in the TORG-12 form.

Filling out waybills in Russia is carried out in accordance with Order of the Ministry of Transport of the Russian Federation dated September 18, 2008 N 152 “On approval of mandatory details and the procedure for filling out waybills”, according to which the waybill contains information about the validity period of the waybill; information about the owner (holder) of the vehicle; information about the vehicle; driver information.

The owner (owner) of the vehicle issues a waybill.

The invoice form TORG-12 has been developed and used in the Russian Federation as a primary accounting document for registering the sale (release) of commodity and material assets to a third party (Resolution of the State Statistics Committee of the Russian Federation dated December 25, 1998 N 132).

TORG-12 is drawn up in two copies. The first copy remains with the supplier of goods and materials, and is the basis for their write-off. The second copy is transferred to the buyer and is the basis for the recording of these valuables.

IMPORTANT: Buyers from Kazakhstan, Belarus and other EAEU countries must take into account:

Since 2013, Russian organizations have the right to use their own forms of primary accounting documents and not to use unified forms, including not to use invoices in the TORG-12 form.

Invoices issued by Russian suppliers may not comply with the requirements of the legislation of the state parties to the EAEU agreement.

In contracts for the supply of goods from Russia, it is advisable for buyers from the EAEU countries to agree with Russian suppliers-exporters on the forms of documents for goods and for the transportation of goods and the procedure for filling them out and transferring them.

Situation 3: Delivery of goods is carried out at the warehouse of a Russian supplier, delivery of goods is carried out by the buyer’s own transport.

The situation is similar to situation 2 described above: According to Russian legislation, there is no contract of carriage between the carrier and the supplier (Russian exporter), since under the terms of the supply contract, the transportation of goods is carried out by the buyer’s transport.

The buyer keeps track of his expenses for the delivery of goods using a waybill (fuel and lubricant costs, mileage, depreciation, wages, etc.). The goods are transferred by proxy to the buyer's representative by signing a copy of the TORG-12 consignment note issued by the Russian supplier.

At the same time, taking into account that the buyer is an economic entity in Kazakhstan or another state party to the EAEU treaty, it is important for him to correctly draw up transportation documents in accordance with the legislation of the relevant state. It is the buyer who bears the risk of document violations and the associated consequences. It is the buyer who has an interest in ensuring that shipping costs incurred are properly accounted for.

*When concluding a supply contract, it is recommended to draw the buyer’s attention to the specifics of drawing up transportation documents and agree on the relevant provisions in the contract.

For example, when making deliveries from Russia to Kazakhstan, in similar situations under 3 contract conditions, Kazakhstan tax authorities recommend that Russian suppliers issue and transfer a CMR invoice to Kazakhstan buyers.

Situation 4: Delivery of goods is carried out at the warehouse of a Russian supplier, delivery of goods is carried out by the buyer by an engaged carrier.

According to Russian rules (Charter of Motor Transport of the Russian Federation, Rules for the Transportation of Goods in the Russian Federation), a waybill is drawn up by the shipper to confirm the contract of carriage.

In the described situation of delivery of goods, the contract for the carriage of goods is drawn up by the buyer of the goods, since the obligation of transportation is assigned to the buyer by the delivery contract.

The buyer (registered not in Russia but in another state party to the agreement on the EAEU) before receiving the goods in Russia from the Russian supplier draws up an agreement for the international carriage of goods with the involved carrier.

Ownership of the goods passes to the buyer in Russia at the time of shipment at the warehouse of the Russian exporter. The shipper is the buyer. He also fills out the CMR invoice.

Please note: according to the rules of the Road Transport Charter of the Russian Federation, when executing a transportation contract, loading goods into vehicles is the responsibility of the shipper. Under the conditions of situation 4, delivery is carried out at the supplier’s warehouse in Russia. We recommend that the buyer agree in the supply contract on the supplier’s obligation to load the goods into the vehicle.

After loading the goods, the carrier puts a mark and stamp on the CMR consignment note. As part of the shipping documents, the supplier gives the buyer one copy of TORG-12 (or an invoice drawn up in another form agreed upon by the parties), on the second the carrier puts a mark (by proxy) on receipt of the goods.

Documents for goods when exported from Russia to Kazakhstan, Belarus, Kyrgyzstan or Armenia

Conditions:

Agreement for the supply of goods from Russia to Kazakhstan. Registration of transportation of goods from Russia to other states, with the exception of Armenia, is carried out in a similar way.

The transfer of goods between the supplier and the buyer, for the purpose of accounting for trade operations in the Russian Federation, is documented in primary accounting documents (RF Law “On Accounting”). Since 2013 in the Russian Federation, the use of unified forms of primary accounting documents is not mandatory. On the territory of Kazakhstan, goods received from Russia are accepted for accounting on the basis of the legislation of the Republic of Kazakhstan.

When concluding an export supply contract, it is advisable for economic entities in Russia and Kazakhstan to agree on and secure the types and forms of documents that will be drawn up during the execution of the contract. Including transport invoices, consignment notes, which will be used to formalize the transportation and transfer of goods. According to existing practice, operations for the transfer of goods by business entities from Russia to Kazakhstan are documented with a consignment note in the unified form TORG-12 (Approved by Resolution of the State Statistics Committee of Russia dated December 25, 1998 N 132).

The consignment note is drawn up in two copies. The first copy remains with the Russian supplier of the exporter, and is the basis for writing off the goods. The second copy is transferred to the buyer and is the basis for the receipt of goods.

Deadlines for collecting documents confirming the zero rate

The company can collect the above set of documents within 180 calendar days. In order to confirm the validity of applying the zero rate, when exporting products to Kazakhstan, the organization must perform the following actions:

- Within up to 5 calendar days from the date of shipment of the exported goods, it is necessary to issue an invoice with a 0% VAT rate. Don’t forget to enter the product type code in accordance with the unified Commodity Nomenclature for Foreign Economic Activity of the EAEU. True, at the moment there is no corresponding section in the invoice form, so put this code after the name of the product or below, under the signature of officials. Register the document in the sales book on the last day of the quarter in which the documents were issued. Do not forget that as of July 1, 2016, new codes for VAT were introduced, approved by order of the Federal Tax Service of Russia dated March 14, 2016 No. ММВ-7-3/136.

- If the proceeds are received in foreign currency, reflect the amount of delivery at the exchange rate on the date of shipment (clause 3 of Article 153 of the Tax Code of the Russian Federation).

- In the VAT return for the same quarter, fill out section 4. In field 020, indicate revenue. In field 030 the amount of deductions for input VAT attributable to goods sold is entered.

- From July 1, 2016, the procedure for deducting input VAT has changed; it can be declared on the date of acceptance of goods and services for accounting. In this regard, in field 030 now only the amount of deductions for goods purchased before 07/01/2016 is indicated. Read about this change in our next sections.

- If the goods were purchased earlier than 07/01/2016 and VAT on it has already been deducted, then the amount of incoming VAT must be restored and reflected in section 3 (column 5, line 100) of the VAT return drawn up for the shipment period.

- The declaration must be submitted to the fiscal authority at the location of the company no later than the 25th day of the month following the reporting period.

Section 4

In section 4, reflect export transactions for which the right to apply the zero rate has been confirmed. Indicate in it:

- on line 010 – transaction code;

- on line 020 – for each transaction code, the tax base for confirmed export transactions;

- on line 030 – for each transaction code, the amount of deductions of input VAT on goods (work, services) used to conduct confirmed export transactions;

- on line 040 - for each transaction code, the amount of VAT previously calculated for these transactions when the export had not yet been confirmed;

- on line 050 – for each transaction code, the recoverable amount of input VAT previously accepted for deduction when the export had not yet been confirmed.

Lines 040 and 050 of Section 4 must be completed if the organization was previously unable to confirm the export on time.

Fill in lines 070 and 080 when returning goods for which the right to apply a zero rate has not been confirmed. On line 070, reflect the amount of adjustment to the tax base, and on line 080, the amount of adjustment of tax deductions. These lines must be completed in the tax period in which the exporting organization recognized the return of goods (the parties agreed on the return).

If the price of exported goods for which a zero rate was confirmed has changed, indicate the adjustment amounts on lines 100 (if increasing) and 110 (if decreasing). Reflect the adjustment in the tax period in which the exporting organization recognized the price change.

On line 120, reflect the amount of tax to be reimbursed:

| Line 120 = (Lines 030 + Lines 040) – (Lines 050 + Lines 080) |

On line 130, reflect the amount of tax payable:

| Line 130 = (Lines 050 + Lines 080) – (Lines 030 + Lines 040) |

This is stated in section IX of the Procedure, approved by order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558.

Situation: how to reflect in section 4 of the VAT return the amount of VAT on the cost of services of a customs broker who carries out customs clearance for the export of goods? The broker works under a fee-based service agreement. Different VAT rates are established for exported goods

The amount of tax deduction for brokerage services must be distributed.

Customs brokerage services may be subject to VAT either at a zero rate or at a rate of 18 percent. The zero rate can only be applied if the broker provides services under a transport forwarding agreement when organizing international transportation. This was stated in the letter of the Ministry of Finance of Russia dated August 14, 2015 No. 03-07-08/46977. In the situation under consideration, there is no such agreement, so the tax rate of 18 percent applies. Since the input tax presented by the broker simultaneously applies to goods subject to VAT at different rates, when filling out section 4, its amount must be distributed.

The fact is that section 4 reflects:

- with code 1011410 – operations for the export of goods for which the VAT rate is set at 18 percent;

- with code 1011412 – operations for the export of goods for which the VAT rate is set at 10 percent.

Transaction codes are indicated on line 010 of section 4 of the VAT return. Line 020 of this section reflects the tax base for confirmed export operations, and line 030 - the amount of tax deductions for goods (work, services) used to carry out these operations.

Such instructions are contained in paragraphs 41.1–41.3 of the Procedure approved by Order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558.

Nothing is said about the reflection of tax deductions for goods (work, services) that simultaneously relate to transactions with codes 1011410 and 1011412 in the Procedure approved by Order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558. However, in order to correctly fill out the declaration, the amount of such tax deductions should be distributed proportionally to the tax bases for transactions with codes 1011410 and 1011412. To do this, use the following formulas:

| The amount of tax deduction for goods (work, services) used in the sale of goods for export, not specified in paragraph 2 of Article 164 of the Tax Code of the Russian Federation | = | The amount of tax deduction for goods (work, services) used in the sale of goods for export, specified and not specified in paragraph 2 of Article 164 of the Tax Code of the Russian Federation __________________________________________ | × | The cost of goods sold for export not specified in paragraph 2 of Article 164 of the Tax Code of the Russian Federation |

| The total cost of goods sold for export, specified and not specified in paragraph 2 of Article 164 of the Tax Code of the Russian Federation |

| The amount of tax deduction for goods (work, services) used in the sale of goods for export, specified in paragraph 2 of Article 164 of the Tax Code of the Russian Federation | = | The amount of tax deduction for goods (work, services) used in the sale of goods for export, specified and not specified in paragraph 2 of Article 164 of the Tax Code of the Russian Federation | – | The amount of tax deduction for goods (work, services) used in the sale of goods for export, not specified in paragraph 2 of Article 164 of the Tax Code of the Russian Federation |

The amounts of tax deductions received after distribution should be reflected on line 030 of section 4 of the VAT return according to the corresponding transaction code.

An example of reflecting in section 4 of a VAT return the amount of VAT on the cost of brokerage services related to the export of goods specified and not specified in paragraph 2 of Article 164 of the Tax Code of the Russian Federation

Alpha LLC entered into a contract for the supply to Finland of:

- children's clothing made of natural sheepskin and rabbit (the VAT rate is set at 10% (paragraph 3, subparagraph 2, paragraph 2 of Article 164 of the Tax Code of the Russian Federation));

- products made of genuine leather and natural fur (VAT rate is set at 18%).

The total cost of the export contract is 16,000,000 rubles. At the same time, the cost of children's clothing is 3,200,000 rubles, the cost of products made from genuine leather and natural fur is 12,800,000 rubles.

For customs clearance of goods, Alpha used the services of a customs broker. The cost of brokerage services amounted to 118,000 rubles, including VAT - 18,000 rubles.

Within the prescribed period, the organization collected all the necessary documents confirming the right to apply the zero tax rate. The amount of VAT on the cost of brokerage was distributed in proportion to the cost of children's clothing and products made from genuine leather and natural fur.

In section 4 of the VAT return, Alpha’s accountant indicated:

1) on the line with code 1011410 (sales of goods not specified in clause 2 of Article 164 of the Tax Code of the Russian Federation):

- on line 020 (tax base) – 12,800,000 rubles;

- on line 030 (tax deductions) – 14,400 rubles. (RUB 18,000: RUB 16,000,000 × RUB 12,800,000);

2) on the line with code 1011412 (sales of goods specified in clause 2 of Article 164 of the Tax Code of the Russian Federation):

- on line 020 (tax base) – RUB 3,200,000;

- on line 030 (tax deductions) – 3600 rubles. (RUB 18,000 – RUB 14,400).

VAT refund by tax authorities

After the taxpayer submits a VAT return with a package of documents confirming the right to apply the 0 percent rate, the tax authorities begin a desk audit of the validity of applying this rate (Article 88 of the Tax Code of the Russian Federation).

If the tax office makes a positive decision, the taxpayer reserves the right to apply a 0 percent rate. And in case of refusal, you will need to submit a “clarification” and pay an additional amount of unpaid VAT to the budget for this shipment, as well as penalties and fines for late payment of tax.

See also the material “How is VAT refunded: return (refund) scheme?”

What future awaits the export of goods to Kazakhstan?

Before talking about the export of goods to Kazakhstan from the Russian Federation, it is worth providing some statistical information. What volumes do exports of goods to Kazakhstan reach today? For the first two quarters of 2021, the amount is an impressive $4.55 billion. The leading positions among exporting countries today are occupied by the Netherlands (11%) and China (11%). Kazakhstan is in ninth place for the Russian Federation (3.3%), but it is second among the CIS countries, second only to Belarus (5.2%).

Export of goods to Kazakhstan is a fairly important item in the Russian economy. For comparison, European countries such as France or Poland have comparable positions. It is even more significant that Kazakhstan is already ahead of Spain, India, Finland, Belgium and the UK.

The export of goods from Russia is very significant for the economy of Kazakhstan itself, because our country is its main partner in the international arena, and only then – China and Germany.

The export of goods to Kazakhstan has been developing since the Customs Union was organized, because it was it that made it possible to bypass all political obstacles to trade between our states. Of course, everything is far from perfect regarding the export of goods to Kazakhstan from Russia. Today trade volumes are falling, but this is not caused by a deterioration in partnerships, but by the crisis.

The international economy significantly influences the situation with the export of goods to Kazakhstan, because it has long been established that international trade is conducted in dollars. It goes without saying that any financial problems also affect trade between our countries. The devaluation of national currencies has led to the fact that current statistical data give a very conditional picture of the objective situation. Currently the situation is as follows. Exports to Kazakhstan increased by 10.7%, imports from Kazakhstan decreased by 7.4%. It is important to pay attention to the fact that if you calculate in rubles, then the volume of trade between our states increased by 22.3%. This is a very impressive amount, because it amounts to 705.2 billion rubles. When converted to rubles, it becomes clear that the total share of mutual settlements between Russia, Belarus and Kazakhstan has reached 70%, which is much more than the 23.8% that is obtained when calculated in dollars.

Exports from Russia and exports from Kazakhstan are completely different goods. Russia supplies mainly products from the mechanical engineering sector, while Kazakhstan's exports are metals, ores and various minerals. Let's look at the statistics again. For example, in the second quarter of 2021, exports of goods to Kazakhstan had the following ratio:

- 22,6 %

- transport, machinery and other equipment (mainly nuclear reactors, mechanical devices, boilers, a little less - electrical equipment, and even less - cars);

- 16 %

– mineral products (fuels that Kazakhstan is not able to produce independently on the required scale);

- 15,9 %

metals and products made from them;

- 12 %

– food;

- 5,2 %

– wood, pulp and paper products, etc.;

- 2,6 %

– textiles, textile products, shoes.

Exporting goods to Kazakhstan is a natural process, because there are close, long-term relationships between our states. It could not be otherwise with such an extended common border. Over the years, trade routes, transport connections, etc. have been established. It is not surprising that most of the exports to Kazakhstan are transported from other countries through Russia - this is the most rational and economical route. Moreover, many of these goods (fuel, energy resources, etc.) are very important for Kazakhstan. The nuances of the relationship between the two states were established by the agreement of June 7, 2002.

An important issue in trade relations between Russia and Kazakhstan is the oil pipeline, because every year simply colossal volumes of oil are transported through it (15.5 million tons via the Atyrau-Samara oil pipeline and 5.5 million tons via the Makhachkala-Tikhoretsk-Novorossiysk oil pipeline).

It should be noted here that Kazakh oil is exported through the CPC (Caspian Pipeline Consortium) oil pipeline, which is jointly owned by the governments of Russia and Kazakhstan. In 2002, a joint venture between the Russian Gazprom and KazMunayGas (Kazakhstan) - KazRosGaz - was created. It supplies gas from the Karachaganak field to the Orenburg gas processing plant.

Another important point in the economic relations between Russia and Kazakhstan is the issue of uranium processing. The fact is that its reserves in Kazakhstan are so large that they are inferior in volume to only one country - Australia. However, Kazakhstan does not have its own nuclear power industry, so Russia and Kazakhstan organized a joint uranium mining project, which is being implemented by the Kazakh-Russian-Kyrgyz enterprise, Zarechnoye CJSC.

Of course, the export of goods to Kazakhstan, as well as other trade and economic interactions between the Russian Federation and Kazakhstan today, needs to be improved. Each country has impressive resources and economic potential, which have not yet been used to their full potential. But activities in this direction are underway. And it has great prospects. The bets are placed on import substitution programs in the Russian Federation and the industrialization of Kazakhstan, in particular on cross-border production chains in mechanical engineering and manufacturing. According to experts, this will have a positive impact on trade and economic relations between the countries, and therefore will increase the export of goods to Kazakhstan from the Russian Federation.

Read the article: Export risks: how to anticipate and reduce them