The minimum wage in Moscow is 20,589 rubles. This indicator is set by the metropolitan government.

According to Article 133.1 of the Labor Code of the Russian Federation, constituent entities of the Russian Federation have the right to establish their own minimum wage, which applies to all organizations except those financed from the federal budget. But there is one nuance: if a region approves its own indicator, for example, the minimum salary in Moscow from January 1, 2021, it must be no lower than the federal value. This year it is 12,792 rubles.

Moscow minimum wage 2021

The minimum wage is the minimum wage that an organization or individual entrepreneur (employer) must accrue to employees for the month they have fully worked (Article 133 of the Labor Code of the Russian Federation).

An increase in the cost of living in the capital is followed by an increase in the minimum wage. The new minimum wage comes into force on the 1st day of the month following the month in which the next minimum wage resolution comes into force.

The minimum wage in Moscow from January 1, 2021 will be 20,195 rubles (Resolution No. 1177-PP dated September 10, 2019). This value is already in effect. Thus, the minimum wage in Moscow from January 1, 2021 is significantly higher than the federal level (20,195 rubles versus 12,130 rubles).

It is important to note that if the cost of living for the 3rd quarter of 2019 is lower than the current minimum wage, then this value (RUB 20,195) will continue to apply from January 1, 2021. Accordingly, the minimum wage in Moscow will remain 20,195 rubles. After all, a reduction in the minimum wage due to a decrease in the cost of living is not allowed (clause 3.1.1 of the agreement dated December 15, 2015).

Minimum wage size in 2021

A project to change the methodology for calculating the minimum wage has been submitted to the State Duma.

The current version provides that from January 1 of the corresponding year the minimum wage is set no lower than the subsistence level of the working population in the country as a whole for the second quarter of the previous year. This system has existed for the last two years - since January 1, 2021. Based on this calculation logic, then for 2021 the minimum wage should be 12,392 rubles . And this is confirmed by Order of the Ministry of Labor dated August 28, 2020 No. 542n.

However, the draft law, which is currently being considered in the first reading, proposes a higher minimum wage in 2021 - 12,792 rubles. Apparently, the initiative is related to the consequences of the prolonged pandemic.

New methodology for calculating the minimum wage

The proposal is that the minimum wage should now depend on the median salary for the previous year.

The bill clarifies that starting from 2021, the ratio of the minimum wage to the median salary will be set at 42%. This ratio will be reviewed at least once every 5 years, taking into account socio-economic circumstances.

At the same time, the minimum wage cannot be lower than the subsistence level of the working population as a whole for the next year.

What is median per capita income

By this concept we should mean the amount of money income, relative to which half of the population has an average per capita income below this value, the other half - above this value.

The median per capita income is calculated taking into account the collected statistical information.

What employers in Moscow need to know

The minimum salary in Moscow from January 1, 2021 cannot be lower than 20,195 rubles. Therefore, companies located in the MSC cannot pay employees less than this amount.

Note that the Moscow minimum wage, applied from January 1, 2021, already includes the tariff rate (salary) or wages under a non-tariff system, as well as additional payments, allowances, bonuses and other payments, with the exception of payments:

- for working in harmful and dangerous conditions;

- combining professions (positions), expanding service areas, increasing the volume of work;

- night and overtime work, work on weekends and holidays.

In other words, for overtime work, you need to pay above the Moscow minimum wage. This procedure follows from clause 3.1.3 of the Tripartite Agreement. Compare the total payment amount for the month with the minimum wage before you withhold personal income tax. That is, a person can receive less than the minimum wage.

Include in the minimum wage all bonuses and rewards included in the remuneration system. The exception is regional coefficients and bonuses; they are calculated above the minimum wage.

For wages below the minimum wage, fines are imposed without proper justification. The company, if the violation is the first, faces a fine from 30,000 to 50,000 rubles. If the violation is repeated – from 50,000 to 70,000 rubles. For an official, the sanctions are accordingly: a fine from 1000 to 5000 rubles. and from 10,000 to 20,000 rubles. or disqualification from one to three years. The same rules apply to an entrepreneur as to an official, only disqualification cannot be applied to an individual entrepreneur (clauses 1 and 2 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation).

Minimum wage when setting wages for LLC branch employees

There are often situations when an LLC is registered in one subject of the Russian Federation, and its employees work in a branch of the LLC in another subject. In this case, what minimum wage should we be guided by when setting salaries for branch employees?

In this case, it is legal to set the salary taking into account the minimum wage established in the subject where the LLC branch is located.

Calculate your salary and benefits taking into account the increase in the minimum wage from 2021

As stated above, in the regions the minimum wage can be established by regional agreement. In accordance with Part 2 of Art. 133.1. The Labor Code of the Russian Federation, the minimum wage in a constituent entity of the Russian Federation can be established for employees operating in the territory of the corresponding constituent entity of the Russian Federation, with the exception of employees of organizations financed from the federal budget.

Some may apply the federal minimum wage rather than the Moscow one

Employers have the legal opportunity to refuse the Moscow minimum wage and adhere to the federal minimum wage in Moscow in 2021. Your refusal must be sent within 30 calendar days from the official publication of the Moscow government decree on the new living wage for the 3rd quarter of 2021. The refusal must be sent to the Moscow Tripartite Commission at the address: 121205, Moscow, st. Novy Arbat, 36.

Read also

06.01.2020

Minimum wage and sick leave

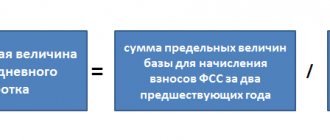

Another innovation for 2021, which came after the peak of the pandemic, is payment of sick leave not lower than the minimum wage. Based on Federal Law No. 478-FZ of December 29, 2020, temporary disability benefits are compared with the minimum wage in the country, increased by regional coefficients (if they are approved in the region). If the estimated amount is lower, sick leave will be recalculated based on the minimum wage (RUB 12,792).

Dynamics of the minimum wage

More details on how the numbers changed in Moscow are shown in the table.

| Period | Salary amount, rub. |

| 01.01.2015 — 31.03.2015 | 14 500 |

| 01.04.2015 — 31.05.2015 | 15 000 |

| 01.06.2015 — 31.10.2015 | 16 500 |

| 01.11.2015 — 31.12.2015 | 17 300 |

| 01.01.2016 — 30.09.2016 | 17 300 |

| 01.10.2016 — 30.06.2017 | 17 561 |

| 01.07.2017 — 30.09.2018 | 17 642 |

| 01.10.2018 — 30.06.2019 | 18 781 |

| 01.07.2019 — 30.09.2019 | 19 351 |

| From 01.10.2019 | 20 195 |

| From 01/01/2020 | 20 361 |

| From 01/01/2021 | 20 589 |

When the piecework quota is not met

Depending on the circumstances, a piecework worker may not fulfill the work norm prescribed to him. What to do in this case? Should his salary be equal to the minimum wage?

According to Art. 155-157 of the Labor Code of the Russian Federation, in case of failure to comply with labor standards, payment to employees is made based on the reasons that caused such failure.

Thus, in the amount of average earnings (in proportion to the actual time worked), failure to comply with labor standards due to the fault of the employer is paid. The employer must also pay for downtime caused by his fault - at least 2/3 of the employee’s average salary. If the employee is defective, but not through his own fault, such products are paid for as good.

When the employee himself is to blame for failure to fulfill the norm, he is paid only for the fulfilled part of the norm. Complete (i.e. irreparable) defects, as well as downtime caused by the fault of the employee, are not subject to payment. For partial (correctable) defects for which the employee is at fault, payment at reduced rates is applied.

Example

A piecework worker must fulfill the production norm of 160 parts per month at a price of 75 rubles. for a part, but due to his own fault he only managed to produce 145 parts. In this case, payment will be made from the amount actually completed:

75 rub. x 145 pcs. = 10,875 rub.

Despite the fact that the accrued salary is less than the minimum wage (RUB 11,280), no additional payment will be made, because the employee did not fulfill the labor standard.

The competent authority will check whether it was possible to pay wages less than the minimum wage

Important! Prosecution is preceded by an inspection, which can be carried out following a complaint from an employee or a report in the media, or on a scheduled basis (Article 360 of the Labor Code of the Russian Federation). Inspections are usually carried out by a special supervisory body - a territorial body of the Federal Service for Labor and Employment (Rostrudinspektsiya) or the prosecutor's office, where employees often turn. However, if a violation is detected by the tax authority, it will be reported to the labor inspectorate under jurisdiction. So there are many options for detecting this fact.

State labor inspectors are empowered to freely enter the territory of any employer upon presentation of a certificate (Article 357 of the Labor Code of the Russian Federation). If violations are detected, an order to eliminate them may be issued. But most importantly, they can draw up a protocol on an administrative offense - such a power is enshrined in Art. 28.3 of the Code of Administrative Offenses of the Russian Federation (for more details about the procedure, see our article “Administrative liability of legal entities - concept”).

When conducting an inspection:

- There is no need to shy away from giving explanations. An employee who does not have sufficient information may refer to this when giving explanations, since the organization will have the opportunity to provide the necessary documents and explanations (objections) before considering the case.

- It happens that not all documents are available at the time of the audit (for example, they were transferred to the auditor). This also needs to be indicated in the explanations.

Piece wages

Unlike the time-based system, when workers are paid from a set salary (or tariff rate) depending on the time actually worked per month, the piece-rate form of payment takes into account the amount of work completed during the month (the number of units of products produced, the volume of services provided, etc.). P.).

“Piecework” is usually used where it is possible to calculate the specific result of an employee’s labor by establishing production standards, and not a salary is used, but piecework prices per unit of the result of his work. For example, if a piece rate of 150 rubles is set for the production of one part, then an employee who produces 200 such parts in a month will receive a salary in the amount of 30,000 rubles. (150 rub. x 200 pcs.).

Employees who have fulfilled the established production standard may additionally be paid bonuses (in a fixed amount, or as a percentage of earnings), for example, for absence of defects, for fulfilling/exceeding the plan established for the employee, etc. (piecework-bonus payment). Also, products produced in excess of the norm may be paid at increased prices (piece-progressive payment).

The use of a piece-rate payment system must be stated in the employment contract with the employee.

Details of the new bill

The introduction of MRES will take place on October 1, 2021; according to the new bill, payment will be 150 rubles per hour. According to the initiators of this bill, this figure is more fair to working citizens and better than the hourly rate, which was previously calculated on the basis of the minimum wage.

The government is also preparing other solutions for restoring the Russian economy, among which the following can be highlighted: Change the existing simplified system, cancel the simplified tax system declaration and create transitional regimes for citizens whose income exceeds the limits. Reduce insurance premiums for business entities, both small and medium-sized. Set 15% instead of 30% regarding an employee’s salary in case of exceeding the minimum wage.

If necessary, give SMEs a deferment on loan payments. In addition, there is a discussion about the advisability of suspending fulfillment of obligations on consumer loans. In this case, it is planned to provide “credit holidays” to individual entrepreneurs whose income has been seriously reduced.

What new minimum wage is in effect now?

Here I will show you a free tool with updated information on the minimum wage.

To easily use the tool you need to distinguish between 2 concepts:

- Minimum wage - minimum wage,

- MW – minimum wage.

What is the difference between them?

The minimum wage is set at the federal level.

It operates throughout the Russian Federation.

However, regional authorities can set their own minimum wage, which is valid on the territory of a constituent entity of the Russian Federation.