When the RSV is considered untimely submitted

To calculate insurance premiums in clause 7 of Art.

431 of the Tax Code of the Russian Federation sets the deadline for reporting - the 30th day of the month following the billing or reporting period. If you submit a payment to the Federal Tax Service at least 1 day later than this deadline, it will be considered untimely submitted. From time to time, insurance premium payers have the legal opportunity to submit the DAM a day or two later than the deadline reporting date and not be fined. This opportunity is provided by clause 7 of Art. 6.1 of the Tax Code of the Russian Federation, the norms of which provide for the postponement of the reporting date to the next working day if it coincides with a weekend and (or) a non-working holiday.

In 2021, such an opportunity will present itself. But any delay in sending the calculation to the inspectorate is fraught with a fine. We'll talk about its size below.

In 2021, the deadlines for submitting the DAM will be postponed:

- for 2021 - on Monday, 02/01/2021, from Saturday, 01/30/2020;

- for 9 months of 2021 - on Monday, 11/01/2021, from Saturday, 10/30/2020.

The remaining calculations must be submitted on time:

- for the 1st quarter of 2021 - until 04/30/2021;

- for the first half of 2021 - until July 30, 2021.

Who reports

All insurers - legal entities and entrepreneurs with employees - are required to submit calculations for insurance premiums, SZV-M, SZV-STAZH and SZV-TD.

IMPORTANT!

Tax authorities often issue a fine for failure to submit RSV-1 in 2021 to the Federal Tax Service, even if the company did not conduct business during the reporting period and no payments were made to individuals. To avoid punishment, submit zero calculations.

Read more: How to correctly fill out a zero calculation for insurance premiums

Submit RSV in electronic or paper form. If the company has more than 10 employees, the form is sent electronically; if there are fewer than 10 employees, the report is allowed to be prepared and submitted on paper.

As for reports to the Pension Fund, they are prepared in electronic format if the employer has 25 or more employees.

Read more: SZV-M reporting: step-by-step instructions for filling out

Amount of fine for late reporting

The rules by which a fine is imposed for late submission of the DAM are prescribed in paragraph 1 of Art. 119 of the Tax Code of the Russian Federation. The amount of the fine is determined by calculation - 5% of the unpaid amount of insurance premiums payable on the basis of the submitted DAM, for each full or incomplete month.

The amount calculated in this way does not always represent the final amount of the fine to be transferred to the budget. The legislator has established limits beyond which the amount of the fine cannot go: no less than 1000 rubles. and no more than 30% of the specified amount of contributions.

The amount of the fine for late submission of the DAM in 2021 is calculated using the same algorithm.

A fine for failure to submit (late submission) of the DAM is not all that can await the contribution payer. Tax authorities have a legislatively enshrined opportunity to suspend transactions on bank accounts if they do not receive the DAM within 10 days after the deadline for its submission (clause 3.2 of Article 76 of the Tax Code of the Russian Federation).

In addition, the manager can also be fined 300–500 rubles. (Article 15.5 of the Code of Administrative Offenses of the Russian Federation). The size of this punishment may increase in the future: legislators plan to increase it by at least 5 times.

What does the Pension Fund fine for?

In connection with the payment of insurance contributions for each person subject to compulsory pension insurance, the employer is obliged to submit reports to the Pension Fund:

- SZV-M - information about insured persons;

- SZV-STAZH - information about the length of service.

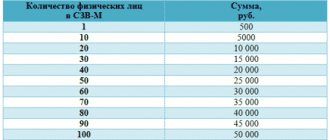

The Pension Fund's fine for late submission of a report is established by Article 17 of Law 27-FZ “On Personalized Accounting”. Penalties are provided in the amount of 500 rubles. for each person for whom information was not submitted or was submitted in error.

When can the fine be reduced?

If the payer of contributions has mitigating circumstances, the amount of the fine for the DAM can be reduced (clause 1 of Article 112 of the Tax Code of the Russian Federation). The presence of at least one such circumstance makes it possible to halve the fine amount (clause 3 of Article 114 of the Tax Code of the Russian Federation).

What mitigating circumstances help reduce the fine in court, see the figure:

If the payer of contributions violates the deadlines for submitting the DAM for the first time, this will be considered an aggravating circumstance and may lead to an increase in the amount of the fine.

Tax authorities or judges evaluate aggravating and mitigating circumstances when deciding on the amount of tax sanctions.

A ready-made solution from ConsultantPlus will help you draw up and submit a petition to the tax office to reduce the fine. Sign up for a free trial and you will learn about all the stages of this procedure.

Procedure for filling out the RSV

Title page

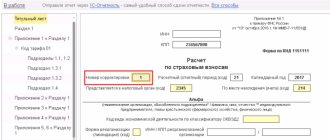

First of all, on the title page, fill in the name and TIN/KPP of the organization or individual entrepreneur. If you are filling out the RSV on behalf of a separate division that independently pays salaries to its staff, then indicate the checkpoint of the specific division.

Please indicate the correction number. These are three digits in the format 001, 002, etc. For the initial calculation, enter 000.

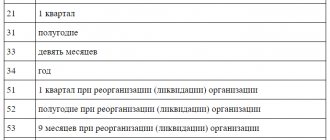

To indicate the period for which the DAM is submitted, in the line “Reporting period code”. For example, code 33 means that the period is 9 months.

Submit the RSV to the Federal Tax Service where you are registered. In the “Federal Tax Code” line, indicate the number of your inspection.

In the line “At location”, enter the three-digit code corresponding to the place where the calculation is submitted to the Federal Tax Service. You can view the codes in Appendix No. 4 of the Order of the Federal Tax Service of Russia dated September 18, 2019 No. ММВ-7-11/ [email protected]

If an organization submits an updated payment for a closed enterprise or one deprived of the authority to accrue payments, then in the “Form of reorganization (liquidation) (code)/Deprivation of authority (closing) of a separate division (code)” field, enter code “9”, and in the “TIN/ KPP of a reorganized organization / TIN/KPP of a deprived of authority (closed) separate division”, indicate the TIN/KPP of this unit.

Enter the OKVED code, full name of the signatory and the date of signing the calculation. Leave the column “To be completed by a tax authority employee” empty.

Section 1

In the first section, indicate “Payer Type”:

“1” - if in the last three months of the billing (reporting) period payments and other remuneration were actually made in favor of individuals;

“2” - if in the last three months of the billing (reporting) period no payments and other remunerations were actually made in favor of individuals (in relation to all employees);

write down the code OKTMO and KBK. Fill in all other lines with data from appendices 1 and 2. Therefore, start filling out section 1 from appendix 1.

Appendix 1. In it, reflect information about contributions to compulsory health insurance and compulsory medical insurance. The application itself consists of three subsections. Let's look at how to fill out the mandatory subsections 1.1 and 1.2.

Subsection 1.1. To be completed in relation to contributions to compulsory pension insurance.

In line 001, indicate the code of the applicable tariff in accordance with Appendix 5 to the filling procedure. If more than one tariff is applied in the reporting period, then you must fill out Appendix 1 for each tariff.

In line 010 the number of insured persons is entered, in line 020 - the number of employees with insurance contributions.

If you have employees whose income exceeds the maximum base, then enter their number in line 021.

In line 030, enter the amount of staff income. And enter non-taxable income (for example, sick leave) in line 040. In line 045 you can indicate the amount of actually incurred and documented expenses associated with the extraction of income received under an author's order agreement, an agreement on the alienation of the exclusive right to the results of intellectual activity. Line 050 is the difference between lines 030, 040 and 045.

If you exceed the maximum base for calculating insurance premiums, write down the excess amount on line 051.

Line 060 for each column is equal to the amount of contributions accrued at the corresponding rate for all employees.

Lines 061 and 062 are intended to break down the calculated contributions from income without exceeding the base and from income exceeding it.

Lines 030 to 062 are filled in in the following sections:

- total since the beginning of the billing period;

- for each of the three months.

Subsection 1.2. It will reflect information on compulsory medical insurance contributions. Contains the same lines as subsection 1.1. Fill in the same way. Only line 060 is equal to line 050 multiplied by the compulsory medical insurance contribution rate. Remember, the compulsory medical insurance subsection is required to be filled out, even if you apply a compulsory medical insurance rate of 0%.

Appendix 2. It describes the calculation of social insurance contributions. On this sheet there is line 001 “Payer tariff code”, where you must indicate the code of the applied tariff in the same way as filling out Appendix 1. Fill out as many pages with lines 001 - 060 as the number of tariffs applied in the reporting period. In line 002 “Payment characteristic”, indicate the characteristic. If Social Insurance directly pays benefits to your employees, enter 1. If you make these payments yourself and then offset them, then enter 2.

In line 010 the number of insured persons is entered, in line 015 - the number of employees with insurance contributions.

In line 020, indicate the amounts of payments, in line 030 - amounts that are not subject to contributions, and in line 040 - amounts exceeding the maximum base for calculating contributions.

Line 050 = page 020 - page 030 - page 040.

If a general tariff is applied and income was paid to foreigners temporarily staying in the Russian Federation, then their payments should be indicated in line 055, in order to be separated from the general base and charged contributions at a rate of 1.8%. By multiplying the base (line 050 - line 055) by 2.9% and adding line 055 * 1.8% you will get the value for line 060.

If you put the number 2 in line 002, then fill out lines 070, 080 and 090 (to be filled in for the payer as a whole, i.e. one page for all applicable tariffs). In the first, indicate the amounts of benefits issued to you, and in line 080 - the amounts reimbursed to you by Social Insurance. In line 090, record the difference between the amount of Social Security contributions and the benefits paid. Line 090 cannot contain a value with a minus. To indicate a sign, use the codes:

- 1 - for positive values, that is, this is the amount that needs to be paid additionally to Social Security;

- 2 - for expenses exceeding the amount of contributions.

Procedure for paying a fine

The fine for failure to submit the DAM is paid according to special rules (letter of the Federal Tax Service dated 05/05/2017 No. PA-4-11/8641). Since there are 3 types of contributions in the calculation (pension, medical and social), the total amount of the fine must be divided proportionally to each contribution and transferred to three different CBCs.

Subscribe to our newsletter

Yandex.Zen VKontakte Telegram

To which KBK the fine should be transferred in 2021, see the figure:

Responsibility for failure to provide 4-FSS

Payment of contributions for injuries is regulated by Federal Law 125-FZ of July 24, 1998. This type of social contributions is completely left under the responsibility of the Social Insurance Fund. The Social Insurance Fund controls the accrual and transfer of mandatory payments and the financing of measures to reduce injuries at the enterprise.

Article 26.30 of the law establishes liability for failure to provide 4-FSS in the amount of 5% of the amount of payments accrued for transfer. Penalties cannot exceed 30% of the amount charged. The minimum sanction is the same amount as the fine for failure to submit a report to the Pension Fund - 1000 rubles.

How will they be punished if there are errors in the calculation or the method of presentation is not followed?

The Tax Code of the Russian Federation does not provide for a separate fine for errors in the DAM. However, the verification program does not pass reports with incorrect personal data, since these errors prevent the identification of insured individuals. Such a DAM is considered unrepresented (Clause 7, Article 431 of the Tax Code of the Russian Federation). Then the tax authorities notify the payer of the contributions about this, and he needs to correct the report.

If, during an inspection, inspectors reveal an understatement of the contribution base in the DAM, the contribution payer may be fined under clause 3 of Art. 120 of the Tax Code of the Russian Federation in the amount of up to 20% of unpaid contributions, but not less than 40,000 rubles. (letter of the Ministry of Finance dated May 26, 2017 No. 03-02-07/1/32430).

The K+ expert talks in more detail about liability for false information in the calculation of contributions. Get free online access to view the material.

Fine 200 rubles. company or individual entrepreneur controllers have the right if the DAM should be submitted electronically, but was received by the Federal Tax Service in paper form (Article 119.1 of the Tax Code of the Russian Federation).

Let us remind you that from 2021, insurers with an average number of employees for the previous billing/reporting period of more than 10 people are required to submit the DAM in electronic form. (clause 10 of article 431 of the Tax Code of the Russian Federation). This limit was established as of 01/01/2020. (Law “On Amendments...” dated September 29, 2019 No. 325-FZ). This rule applies to subsequent years until any additional changes are introduced.

Examples of calculating fines for insurance premiums in 2018

Example 1

sent the DAM for the 3rd quarter of 2021 to the Federal Tax Service not on time on October 30, but only on November 15. Since there was a delay in submitting the DAM, the tax authorities calculated the fine based on the amount of unpaid debt indicated in the calculation as of October 30. If all insurance premiums are paid by the company on time (before October 15), then the fine will be minimal - 1 thousand rubles.

If Perspektiva LLC has not paid insurance premiums (for example, 35 thousand rubles), then the fine for late provision of the DAM will be calculated as follows:

35,000 * 5% * 1 month. (incomplete) = 1,750 rub.

Let us note that the fine is calculated for each type of insurance separately, and if it is charged in a minimum amount of 1 thousand rubles, it is distributed according to the types of contributions. In our example, the distribution of the minimum fine would look like this:

- fine according to compulsory public insurance = 22% / 30% * 1,000 rubles. = 733.33 rub.;

- fine under compulsory medical insurance = 5.1% / 30% * 1,000 rubles. = 170.00 rub.;

- fine under OSS = 2.9% / 30% * 1,000 rubles. = 96.67 rub.

Attention! If insurance premiums are not paid, in addition to fines, the company will also have to pay late fees.

Example 2

received a fine of 7 thousand rubles. for late delivery of the RSV. This fine must be distributed by type of insurance as follows:

- fine according to compulsory social insurance = 22% / 30% * 7,000 rubles. = RUB 5,133.33;

- fine under compulsory medical insurance = 5.1% / 30% * 7,000 rubles. = RUB 1,190.00;

- fine under OSS = 2.9% / 30% * 7,000 rub. = 676.67 rub.

Legislation on fines

From the moment control of accounting for insurance premiums is transferred to the tax department in 2021, and after appropriate changes are made to the legislation, the nature of disciplinary penalties and the extent of responsibility for submitting reporting documentation are established by the current Tax Code of the Russian Federation.

In some cases, punishments provided for within the framework of administrative liability may also be applied to violators, in accordance with the provisions of the Code of Administrative Offenses of the Russian Federation.

How to fill out the RSV correctly

Order No. ММВ-7-11/ [email protected] indicates which zero RSV sheets should be submitted to taxpayers:

- title page;

- section 1;

- subsections 1.1 and 1.2 of Appendix 1 to Section 1;

- appendix 2 to section 1;

- section 3.

The report must indicate the name, INN and KPP of the organization, the period for which the DAM is submitted, and the tax authority code. Enter zeros in all fields with amount indicators. Section 3 indicates the data of the organization’s employees (at least the general director). Due to the lack of accruals, subsection 3.2 does not need to be filled out.

Calculation of penalties for insurance premiums using an example

Let's give an example: Kompromiss LLC, according to the established deadlines, was supposed to transfer the total amount of 10,000 rubles to the Federal Tax Service for November 2021. until December 15, 2018. Let’s say their company paid on January 10, 2019. Let's calculate the total amount.

Let us take into account that before December 17, 2018, the refinancing rate was 7.5%, and after this date - 7.75%. Since the deadline for payment of contributions (December 15) and the payment day itself (January 10) are not taken into account, the total number of days of delay for Kompromiss LLC will be 32. Of these, 2 days fall in the period before the rate increase (from December 16 to 17) and are calculated at a rate of 7.5%, for the remaining ones - at a rate of 7.75%. In addition, please note that for the first 30 days you must count taking into account 1/300 of the rate, and from the 31st day - already 1/150 of the rate.

Let's calculate how much Kompromiss LLC owes:

(10,000 × 2 × 7.5% / 300) + (10,000 × 28 × 7.75% / 300) + (10,000 × 2 × 7.75% / 150) = 5 + 72.33+ 10, 33 = 87.66 rubles

The penalty calculator on our portal will help you do the calculation automatically.

Do entrepreneurs without employees rent out the DAM?

Not only organizations, but also individual entrepreneurs are recognized as payers of social contributions. An entrepreneur has the right to hire employees, but sometimes conducts business without hiring employees. You will not have to submit calculations for insurance premiums if the individual entrepreneur does not have employees. In this case, tax officials have the right to demand an explanation. Explain to them in writing that you are working without hiring employees.

If an individual entrepreneur has employees, but they are not working (on leave without pay, on maternity leave), then the entrepreneur submits a zero RSV.

How to fill out a report for organizations affected by COVID-19

For payers operating in the industries most affected by the spread of the new coronavirus infection, a zero rate of insurance premiums has been established for April - June 2021 (Article 3 of Federal Law No. 172-FZ of 06/08/2020).

Instructions on how to correctly fill out the calculation of insurance premiums for companies that are exempt from social contributions (letter of the Federal Tax Service No. BS-4-11/9528 dated 06/09/2020):

- Fill out the RSV title page as usual.

- In section 1, enter zeros in all totals.

- In lines 001 “Tariff code” of appendices 1 and 2 to section 1, enter “21”.

- When indicating the amount of payments, the tax base and the amount of accrued insurance premiums in Appendices 1 and 2, follow the rule: in the first column reflect the amounts of the first quarter, in the second, third and fourth columns enter zeros.

- When filling out line 130 of section 3 “Category code of the insured person”, indicate “KV”. In lines 140, 150, 160 and 170, enter zeros.

How to avoid a fine

If, based on the results of the audit, the tax inspector reveals violations, he is obliged to notify the payer about this, giving time to correct the provided calculation.

For untimely submission of reports or inaccuracies in the submitted calculation, a company, individual entrepreneur or individual who committed these violations may be subject to the following penalties:

- fines, within the framework established by the current Tax Code of the Russian Federation;

- administrative sanctions established by the Code of Administrative Offenses - applied to officials through whose fault the violation was committed.

If corrected versions of reports are submitted on time, punishment may not follow. But if the noted time restrictions are violated, when it is required to submit adjusted calculations, fines are imposed as provided for by current legislation for late submitted declarations.