SZV-STAGE for a part-time worker in 2021

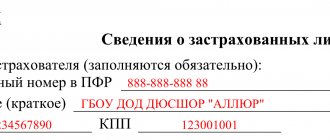

The form for submission to the Pension Fund includes information about all insured persons who are in an employment relationship with the organization.

Employees working part-time must be shown in SZV-STAZH. SZV-STAZH must be taken for both internal and external part-time workers (clause 1.5 of the Procedure, approved by Resolution of the Board of the Pension Fund of the Russian Federation dated December 6, 2018 No. 507p).

Data on part-time workers in the SZV-STAZH form is reflected as for regular employees. The period of work under normal conditions is reflected in section 3 of SZV-STAZH in the general manner, in one line.

Section 4. Data on the policyholder

The section is completed if EDV-1 is submitted simultaneously with the SZV-ISH forms or with the SZV-KORR form with the “Special”

.

The following indicators are indicated in the corresponding columns:

- debt at the beginning and end of the reporting period;

- the amount of accrued and paid insurance premiums.

Attention! These data are reflected separately in relation to insurance premiums for insurance and funded pensions, as well as according to the tariff. A separate table provides a breakdown of the insurance premiums paid by the periods for which the premiums were paid.

SZV-STAZH upon dismissal of an employee

The procedure for passing SZV-STAZH upon dismissal of an employee depends on the reason for dismissal.

If an employee resigns due to retirement, the SZV-STAGE for it must be submitted to the Pension Fund within three calendar days from the date the employee submits the application. In column 7 SZV-STAGE for such an employee his last working day is indicated. (Clause 2.3.4 of the Procedure, approved by Resolution of the Pension Fund Board of December 6, 2018 No. 507p).

If an employee leaves in the middle of the year, the period of his work is indicated only in columns 6 and 7. From column 7 it will be clear that this employee no longer works for the company. For all working employees, column 7 will be December 31, the last day of the reporting year.

An example of a completed SZV-STAZH form in 2021

Form SZV-STAZH in 2021

The only founder in SZV-STAZH in 2021

The sole founder - director - is included in SZV-STAZH, even if an employment contract is not concluded with him and he does not receive a salary.

Moreover, reporting must be submitted even to those companies that do not have any employees, there is only a director and he is also the only founder.

According to the procedure for filling out SZV-STAZH, approved. By resolution of the Board of the Pension Fund of the Russian Federation dated December 6, 2018 No. 507p, organizations submit this form to insured persons working under an employment contract, including the sole founder or participant.

The founding director is an insured person for the purposes of compulsory pension insurance. He is in an employment relationship with the organization, regardless of whether an employment contract is concluded with him or not, whether he receives a salary or not.

The SZV-STAZH form must be submitted to the director - the sole founder or participant. This is confirmed by paragraph 1 of Article 7 of the Law dated December 15, 2001 No. 167-FZ, Article 11 of the Law dated April 1, 1996 No. 27-FZ, paragraph 1.5 of the Procedure approved by the resolution of the Pension Fund Board of December 6, 2018 No. 507p, letter of the Ministry of Labor of the Russian Federation dated March 16, 2018 No. 17-4/10/B-1846.

Moreover, for the sole founder you need to pass not only SZV-STAZH, but also SZV-M.

If the director does not receive a salary, SZV-STAZH is filled out for him with the code “NEOPL”. For directors working in the Far North and equivalent territories, fill out columns 8–10 in section 3.

An example of a completed SZV-STAZH form in 2021

Form SZV-STAZH in 2021

SZV-STAZH upon liquidation of a company

The SZV-STAZH form is submitted to the pension fund at the end of the year. So, for 2019 you need to report before March 1, 2021 inclusive, for 2020 - before March 1, 2021 inclusive. But, if the organization is liquidated, SZV-STAZH must be submitted without waiting for the end of the year.

Companies that have decided to liquidate submit SZV-STAZH within one month after they approve the interim liquidation balance sheet, and no later than the day when documents are submitted to the Federal Tax Service to register the termination of activities

Example: On February 9, 2021, the founders of Dynamics LLC at a general meeting decided to liquidate the Company. On April 11, 2021, the accounting department of Dynamics LLC formed an interim liquidation balance sheet. Dynamics LLC must submit the SZV-STAZH to the Pension Fund on May 10, 2021.

How to fill out SZV-STAZH when liquidating an LLC in 2021

SZV-STAZH includes all employees who worked under an employment or civil contract, not forgetting those employees who were fired during the year.

If a company is liquidated, SZV-STAZH must also include employees of the liquidation commission, regardless of the form of the agreement concluded with them.

The report is compiled for the period from January 1 of the year to the day of liquidation of the company. The day of liquidation of an organization is considered to be the day on which an entry about liquidation was made in the Unified State Register of Legal Entities (clause 9 of Article 63 of the Civil Code of the Russian Federation).

Let us recall that the SZV-STAZH form was approved in Resolution of the Board of the Pension Fund of the Russian Federation dated December 6, 2018 No. 507p.

In section 2, enter the calendar year for which you are submitting reports. In a separate block “Type of information”. put o. When liquidating, you need to select the original one.

In section 3, enter the details of employees and the period of their work.

If employees performed work under a civil contract and received remuneration for this, enter “AGREEMENT” in column 11. This is exactly how you need to enter information about the services of a liquidator. If the company has not yet paid for his work, indicate “NEOPLDOG” or “NEOPLAUT” in the column.

Sections 4 and 5 of the form should be left blank; these sections are for reporting on retired employees.

An example of a completed SZV-STAZH form in 2021

Form SZV-STAZH in 2021

Section 2. Reporting period (code)

This section automatically indicates the code of the reporting period for which the information is provided.

A separate field indicates the type of form being presented.

Type "Original"

filled out to accompany a package of documents with personalized accounting forms.

Attention! The package may include documents of only one name and one type of information, and for a package of SZV-ISH forms - one name, one type of information and for one reporting period.

How to fill out SZV-STAZH when working part-time

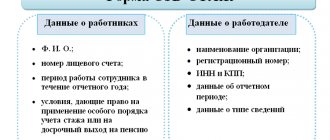

Employees who work part-time under normal conditions at SZV-STAZH do not need to be allocated in any special way. It is enough to indicate in SZV-Experience: full name, SNILS and validity periods of employment contracts.

In the SZV-STAZH form, part-time work is reflected if the enterprise operates under special conditions and employees have the right to early retirement.

Where the SZV-STAZH form reflects data on part-time work

In section 3 of the SZV-STAZH report, you need to reflect the scope of work or the share of the rate in accordance with clause 2.3.6 of the Filling Out Procedure.

Information about part-time work reflects:

- or in column 8 “Territorial conditions (code)”. In this column, enter the code of territorial conditions and the share of the rate;

- or in column 9 “Special working conditions (code)”. In this column the special conditions code and the rate share are entered.

To indicate territory codes with special working conditions, you need to use the Classifier of parameters used when filling out information for maintaining individual (personalized) records. This Classifier is approved in the annex to the Procedure for filling out the SZV-STAZH.

Problem: Warning is issued

When specifying the code “DLOTPUSK”, the PFR verification program may issue a warning with code 20. However, the warning is not a basis for refusal to accept reports and in this case is caused by technical problems. That is, even if the program warns you about the inadmissibility of specifying the “DLOTPUSK” code, just don’t pay attention. The report for 2021 will be accepted without problems. There cannot be any fines for this, since the accountant is guided by the official procedure for filling out the SZV-STAZH. Let's assume that a person was on annual paid leave from June 5 to June 25, 2021. Then show the DLOTPUSK code in SZV-STAZH as follows:

For more information, see “SZV-STAZH for 2021: sample filling.”

If you find an error, please select a piece of text and press Ctrl+Enter.

DLOTPUSK in the form SZV-STAZH

Paragraph 2.3.13 of Resolution No. 507p states that the code “DLOTPUSK” is indicated only for periods of work of the insured person under special working conditions, for which there is no data on the calculation of insurance premiums at an additional rate.

The “DLOTPUSK” code can be indicated in SZV-STAZH only in combination with codes for special working conditions.

In the SZV-STAZH form, section 3 reflects data on employees and periods of their work. This section should include employees with whom an employment or civil law contract was in force during the year.

Separately for each employee, you need to indicate the periods when he worked, did not work, was on vacation, was on sick leave, etc. In fact, the SZV-Experience form reflects the entire schedule of the employee’s professional life.

In columns 6 and 7 of the SZV-STAZH form, indicate the start date and end date of each vacation.

In column 11 “Additional information” of section 3 “Information on periods of work of insured persons” of the SZV-STAZH form, you must indicate the codes of each period. One of these codes is “DLOTPUSK”. The code “DLOTPUT” must be entered in column 11.

The “DLOTPUSK” code must be filled out only for periods when the employee works under special conditions and is entitled to early old-age pension. This refers to those periods for which insurance premiums were not calculated at the additional rate. The “DLOTPUSK” code is indicated only in combination with codes of territories with special working conditions.

For those employees who work under normal conditions, the code “DLOTPUSK” is not entered in column 11 of section 3 of the SZV-STAGE form. There is no longer any need to separately highlight vacation periods in columns 6 and 7 of Section 3.

Please note: if at the beginning of the year, in January, an employee went on another vacation, received vacation pay in December, and quit on the last day of vacation, he will not have any contributions at all in the current calendar year. In all other cases, contributions will be accrued and the code “DLOTPUSK” does not need to be entered.

An example of a completed SZV-STAZH form in 2021

Form SZV-STAZH in 2021

Online magazine for accountants

Attention, by Resolution of the Board of the Pension Fund of the Russian Federation dated January 16, 2014 No. 2p), the policyholder, among other things, indicates information about the length of service of the insured person in subsection 6.8 “Period of work for the last three months of the reporting period.” If the employee honestly worked all these three months, then in this subsection it is enough to enter only the start and end dates of work, which will coincide with the start and end dates of the last expired quarter.

But if the employee was on leave without pay, parental leave, etc., then the corresponding period of time must be marked in the table with a certain code. For the purpose of reflecting periods of work in the RSV-1, many codes are used (for the correct calculation of length of service) - NEOPL, UCHOTUSK, DLDETI, etc.

Let's look at the NEOPL code in personalized accounting.

NEOPL code in the Pension Fund of Russia: decoding The NEOPL code in individual information means that for the specified period of time the employee did not receive money in wages. The reasons for this may be different, so the policyholder must enter the same NEOPL code in the RSV-1 in different situations.

Thus, the code NEOPL is used to designate (Table “Calculation of the insurance period: additional information” of Appendix No. 2 to the Procedure for filling out the RSV-1):

- leaves without pay (Article 128 of the Labor Code of the Russian Federation);

- period of downtime due to the fault of the employee (Article 157 of the Labor Code of the Russian Federation);

- unpaid period of suspension from work / non-admission to work (Article 76 of the Labor Code of the Russian Federation);

- unpaid leave provided to teaching staff (Article 335 of the Labor Code of the Russian Federation);

- additional day off per month without pay, provided to women working in rural areas (Art.

Info Labor Code of the Russian Federation);

- unpaid time for participating in a strike (Article 414 of the Labor Code of the Russian Federation);

- other unpaid periods, except for periods with codes DLDETI and Chernobyl NPP.

As we can see, in reporting submitted to the Pension Fund, NEOPL is a frequently encountered code. Which code to put: ADMINISTER or NEOPL in individual information Often on forums on the Internet, users ask the question: what code to enter - ADMINISTER or NEOPL? As of today, there is no ADMINISTR code as such.

Previously, with its help, policyholders noted such a non-working period for an employee as leave without pay. This code was canceled back in 2015 and, as you may have guessed, the code “NEOPL” was introduced instead.

SZV-STAZH when assigning a pension to an employee

When an employee is going to retire, he must write a statement in which, along with a request to be dismissed in connection with retirement, he asks to submit personalized accounting information to the Pension Fund of the Russian Federation. The SZV-STAZH form and the procedure for filling it out were approved by Resolution of the Board of the Pension Fund of the Russian Federation dated December 6, 2018 No. 507p.

For employees who are retiring, SZV-STAZH must be submitted to the Pension Fund within three calendar days from the date of submission of the application.

How to fill out SZV-STAZH when assigning a pension

When you submit SZV-STAZH for an employee retiring, in the upper right corner of the form, opposite the “Pension Assignment” field in the information type, you need to put o.

What to consider when preparing SZV-STAZH for a person retiring

Section 3

Section 3 of the SZV-STAGE reflects the employee’s periods of work, including periods of vacation, sick leave and other reasons for absence from work. Specific dates are indicated in columns 6 and 7.

SZV-STAGE is compiled for a calendar year. If an employee has been working in the company for a long time, the employment contract with him was concluded much earlier than the beginning of the year, the first date in column 6 will still be the first day of the reporting year “01/01/2019”. There is no need to indicate previous years in the report.

The last date in column 7 will be the day of retirement.

Please note: when submitting a retirement application, the employee must indicate the start date of the pension.

For employees who work in special conditions, in hazardous work part-time, the periods of work must be indicated in column 11. This applies to those who are eligible for early retirement.

Columns 8–10, 12 and 13 need to be completed only if the employee has the right to early retirement. In this case, it is necessary to indicate the codes of the relevant working conditions in column 12.

In column 10, write the code of the basis for calculating the insurance period of an employee who is entering early retirement.