Putting a fixed asset into operation is documented actions that confirm the readiness of the property for its intended use. This definition is given in GOST 25866-83, which was approved by Decree of the USSR State Standard of July 13, 1983 No. 3105.

This means that those objects that are in principle ready for use are put into operation, as follows from the documents. Even if you haven’t actually started using the property that is ready for this, it is already wearing out and becoming obsolete. This means that it can and should be depreciated. And only if the object is idle and mothballed, its properties do not deteriorate. But this can only be done after the facility has been put into operation.

Before starting to depreciate property, the very possibility of its use is assessed. In addition, the initial cost, depreciation group and useful life of the property are determined. And the commissioning itself is documented with the necessary documents.

Regulatory regulation of commissioning

Federal Law dated December 6, 2011 N 402-FZ defines accounting

Resolution of the State Statistics Committee of the Russian Federation dated January 21, 2003 N 7 establishes unified documents

Order of the Ministry of Finance of Russia dated July 29, 1998 N 34n approves the Regulations on accounting and reporting in the Russian Federation

Order of the Ministry of Finance of Russia dated March 30, 2001 N 26n PBU 6/01

Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 N 94n approved the chart of accounts

Order of the Ministry of Finance of the Russian Federation dated October 13, 2003 N 91n regulates accounting through methodological instructions

Decree of the Government of the Russian Federation dated January 1, 2002 N 1 provides the classification of fixed assets for the purpose of depreciation

The Tax Code of the Russian Federation, Part 2, determines the initial cost of more than 100,000 rubles for tax purposes

Write-off

Physical and moral wear and tear of objects is inevitable. If further operation of the property is impossible, and repairs and renovations are irrational, then the commission decides to write off the asset. For such a procedure, an act of write-off of a fixed asset item is drawn up. Moreover, an unusable asset does not necessarily need to be completely disposed of. The commission must analyze the possibility of using parts and structures of the facility as raw materials or inventories.

Develop document forms for write-offs yourself or use standardized forms approved by Goskomstat Resolution No. 7.

Basis for commissioning

According to clause 8 of PBU 6/01, the initial cost of fixed assets acquired for a fee is recognized as the amount of the organization's actual costs for their acquisition, construction and production, excluding VAT and other refundable taxes.

Expert of the Legal Consulting Service GARANT E. Lazukova

Commissioning must be documented with primary documents, which indicates readiness for its use. From January 1, 2013, it is not necessary to use forms of primary documents from albums of unified forms. Commissioning can be done using the following forms:

- OS-1 – for 1 object (except buildings)

- OS-1a – for buildings and structures

- OS-1b – for groups of objects (except buildings)

If the document is developed independently, then it is necessary to keep in mind that the form is approved by the accounting policy and contains mandatory details (Part 2 of Article 9 of Law 402-FZ):

- Name

- date of compilation

- name of the organization making the document

- reflects the fact of activity

- natural and monetary meter (indicating units of measurement)

- positions of persons responsible for registration

- signatures with transcript to identify responsible persons

Important! When purchasing, manufacturing or constructing a fixed asset in one month, and reflected in account 01 in another, it is necessary to draw up documents reflecting its unreadiness for use.

The readiness of the facility for operation can be determined by a special commission for the acceptance of acquired fixed assets, making a conclusion that is indicated in the commissioning act.

An inventory card or book must be prepared for the fixed asset (depending on the accounting used). In this case, you can use the following forms: No. OS-6, OS-6a, OS-6b.

How to draw up an act correctly

The act refers to primary documentation, therefore, since 2013, the requirement to draw it up according to a strict unified template has been abolished. Today, enterprises and organizations have every right to compose it in any form or according to a template developed and approved within the company.

Important condition : in its structure and content, the act must comply with certain standards of office work, business documentation and the rules of the Russian language.

The document must include some mandatory information:

- a link to the agreement, to which the act is an annex, as well as the number, date, place of its creation;

- enter information about the enterprises that form the act;

- indicate the name of the fixed asset, the address at which it is installed or put into operation;

- describe the tests and inspections to which the fixed asset was subjected, as well as their results;

- the conclusions should record the suitability of the fixed asset for further use and the date from which it can begin to be used in work.

If there are any additional accompanying papers, they must be noted in the act as a separate item.

Documents required for commissioning of real estate

To commission constructed real estate, the developer must obtain a special permit issued by the institution that authorized the construction (according to paragraph 2 of Article 55 of the Town Planning Code of the Russian Federation). To obtain a permit, the following documents are required:

- documents granting the right to a plot

- urban plan

- permission

- object acceptance certificate

- conclusion of Gosstroynadzor

- technical plan

Commissioning and posting must coincide.

What hardware is included in the OS?

Commissioning is a documented confirmation of the readiness of the OS for its intended use.

According to the law, not every asset is classified as an operating system. The equipment must meet the following criteria:

- service period of at least 1 year

- the equipment was not purchased for the purpose of resale in the future

- the asset must be used for the personal needs of the enterprise or transferred to other persons on contractual terms for temporary use

- equipment purchased for the purpose of generating profit or income

Establishment of useful life (SPI)

The commission for accepting fixed assets for accounting establishes the SPI required for calculating depreciation from the month following registration. The period during which the original cost is written off is established based on the depreciation group, respectively, and the SPI, i.e. time of use for generating income, mode, number of shifts and operating conditions, repairs and other restrictions (for example, rental period). The SPI must be issued by order of the manager (in any form), and which can be revised as a result of reconstruction, retrofitting, etc. fixed asset.

Important! It is better to set the SPI for accounting and tax accounting purposes to be the same so as not to reflect temporary differences.

SPI is important for property taxation: the larger it is for accounting purposes, the longer the organization pays property tax. But this needs to be justified in the order.

Repair, reconstruction, retrofitting or modernization

During the period of use, an OS object eventually becomes unusable. For example, its technical characteristics do not meet modern standards. In this case, the company makes a decision: to update the asset or replace it with a new one. The decision is made by a special commission created in the company. It is necessary to take into account the rationality of financial investments in updating the OS. For example, it is more economical to buy a new computer monitor than to repair an old one. Or, conversely, it is cheaper to replace a broken or non-conforming machine part than to purchase a new set of equipment.

The corresponding stages of the life of the OS are documented with the following documents:

- act of acceptance and transfer of fixed assets for repair;

- act of acceptance and transfer of fixed assets for modernization;

- act of acceptance and transfer of fixed assets for reconstruction;

- act of acceptance and transfer of fixed assets for completion (retrofitting).

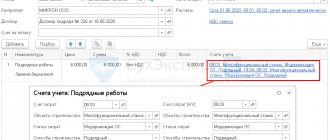

Commissioning accounting

In accounting, the initial cost of purchased fixed assets is the sum of all expenses of the organization, except for VAT and other refundable taxes.

The cost of these funds is reimbursed by calculating depreciation based on SPI, i.e. The more SPI, the slower its cost decreases.

In accounting (not in tax accounting) you can set any period and when determining it you can, but not necessarily, be guided by the Classification. But this period must be justified by the presented indicators, documentation, etc.

Accounting for the input of fixed assets

Accounting for the costs of commissioning a fixed asset must be carried out in the manner established by the organization.

| Operation | Debit | Credit |

| Receipt from the founders | ||

| Founders' debt | 75-1 | 80 |

| Receipt on account of contribution to the authorized capital | 08 | 75-1 |

| Construction by contract (third-party organization) | ||

| Formation of the cost of contract work | 08 | 60 |

| Construction in an economic way (by the organization itself) | ||

| Write-off of materials for construction | 08 | 10 |

| Payroll for employees (builders) | 08 | 70 |

| Purchase (without installation) | ||

| Accrual of payment amounts to the supplier | 08 | 60 |

| Delivery accounting | 08 | 76,60,23… |

| Purchase (with installation) | ||

| Accrual of payments to the supplier for equipment | 07 | 60 |

| Transfer of equipment for installation | 08 | 07 |

| Write-off of installation costs | 08 | 10,70,69… |

| Receive for free | ||

| Acceptance of fixed assets for accounting (account 91) | 01 | 91 |

| Putting the facility into operation | 01 | 08 |

At the same time, VAT is a refundable tax and is not taken into account in the initial cost.

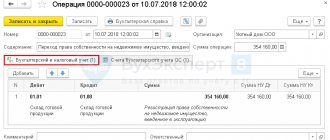

Example of transactions when purchasing fixed assets

Alpha and Omega LLC acquired a fixed asset for 236,000 rubles from Beta and Gamma LLC. (including VAT 36,000 rubles) for use in production activities. Both organizations are VAT payers. The transactions will be reflected in the accounting records as follows:

| Operation | Debit | Credit | Sum | Base |

| Fixed asset has arrived | 08 | 60 | 200000 | Acceptance certificate |

| VAT on fixed assets is reflected | 19 (VAT subaccount) | 60 | 36000 | Invoice |

| Payment for fixed assets (including VAT) | 60 | 51 | 236000 | Payment order |

| Submission of VAT for deduction | 68 | 19 (VAT subaccount) | 36000 | Book of purchases |

| Commissioning | 01 | 08 | 200000 | Act OS-1 |

Features of the functioning of the commission

The commission operates on a permanent basis. Its activities are regulated by the Regulations on the Commission. The commission must hold at least 1 meeting per month. The period for putting the OS into operation is determined by the complexity of the equipment. However, it is recommended to spend no more than 14 days on one object.

To make a decision on a particular object, voting is required. The decision is recognized as legal when 2/3 of the total number of commission participants was present at the meeting. If the chairman is absent, the meeting will not be held.

Tax accounting of introduced fixed assets

The procedure for calculating the initial cost of an introduced fixed asset does not depend on whether new fixed assets are being introduced or used ones and the entire amount of costs for the acquisition (manufacturing), delivery, repair (modernization) is taken into account, minus VAT and excise taxes, but when purchasing a fixed asset that has already been used by the seller, the reflection of the residual value according to the supplier’s documents and already accrued depreciation should not be taken into account.

When commissioning, it is necessary to establish a period of use as in accounting, determined independently on the date of commissioning, taking into account the classification. But for used fixed assets, the depreciation rate should take into account the SPI, when operated by previous owners based on their useful life:

- by classification (also applies to the acquisition of property from individuals - not individual entrepreneurs)

- established by classification and reduced by the period of use by the former owners in fact

- established by the previous owner and reduced by the period of use by the previous owners in fact

Who draws up the act

As a rule, the act is drawn up between two parties: the transferor of the fixed asset and the recipient of it, incl. putting into operation.

Representatives of the parties in most cases are directors of companies, their deputies or heads of structural divisions.

However, if necessary, a third party can be involved in the form of experts (this is especially true in cases of transfer of complex technical equipment, instruments, machinery, and various types of structures).

Answers to common questions

Question No. 1 : When purchasing from an individual, can it be accepted for accounting on the basis of a purchase and sale agreement and a transfer and acceptance certificate?

Answer : An individual seller does not have the obligation to provide forms OS-1 (OS-1a), therefore, to accept property for accounting, it is sufficient to accept transfer and acceptance certificates in any form, but with the obligatory indication of details, in accordance with 402-FZ for primary documentation.

Question No. 2 : Is it necessary to put into operation what is planned to be rented out (leasing)?

Answer : In order to start using it as a rental property (to generate income), it must be put into operation on account 03: D03 K08.

Registration of the results of the commission’s activities

The conclusions of the commission members are reflected in a special act. It is drawn up in free form. However, the act must necessarily contain the following information:

- OS inspection date.

- Place of examination.

- Data that will allow you to identify the object (for example, name, serial number).

- Specifications.

- Lifetime.

For example, a technical passport may serve as an annex to the act.

FOR YOUR INFORMATION! The act must bear the signatures of all commission members.