The amount of tax withheld in 6-NDFL is line 070. It reflects the amounts calculated and withheld from an individual in the reporting period. Let's figure out which indicators the field should contain and which are unnecessary.

All employers and other tax agents report on income paid to individuals and taxes withheld from them. Providing incorrect indicators entails sanctions, so every entrepreneur needs to know how to fill out line 70 in 6-NDFL so that the tax authorities do not have any complaints.

Key points when filling out line 070

It is mandatory to fill out line 070 in 6-NDFL for all tax agents. It is located in Section 1 of the document, which provides generalized values for all indicators of interest to regulatory authorities. Numerical values must be entered without the minus sign; the correctness of the form is checked using control ratios. Page 070 in 6-NDFL is intended to reflect the amount of tax accumulated during the reporting period that was withheld.

For each period within one calendar year, the amount of personal income tax and other indicators in the Calculation must be shown as an accrual total from January 1 of the tax year. Tax in the reporting form appears in two forms:

- calculated amounts;

- retention.

The methodological material states that line 070 of form 6-NDFL indicates only deductions actually made. This category includes taxes that have been calculated and are due for payment. The period of actual transfer and withholding must coincide with the date of payment of taxable income to an individual (confirmation - Article 226, paragraph 4 of the Tax Code of the Russian Federation). Page 070 of form 6-NDFL cannot reflect amounts for which there is no reason to recognize income as paid.

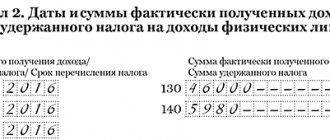

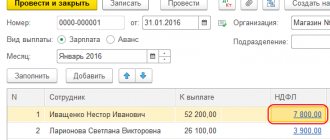

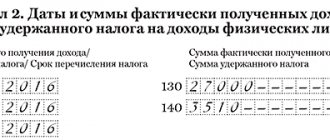

An unreasonable action would be to include in the column with withheld tax the amounts of personal income tax calculated when issuing a salary advance. Income in this situation will be recognized as paid at the end of the current or beginning of the next month, along with the entire amount of earnings (clause 2 of Article 223 of the Tax Code of the Russian Federation). Only after this the calculated personal income tax is transferred to the withheld tax group. How to fill out line 070 in 6-NDFL - you need to take into account only those amounts that were actually withheld from the income paid.

Results

Line 070 in the 6-NDFL report is located in section 1 and is used to reflect the total amount of personal income tax withheld for the reporting period. This amount is calculated by summing the values that fell into line 140 of Section 2 for the entire reporting period, adjusting it for situations that arise at the border of periods (when payment of income and tax withholding fall into one period, and the deadline for paying personal income tax falls into another). If during the year it was not possible to withhold personal income tax from the income paid to an individual, then the amount of tax related to such income will go to line 080 instead of line 070.

Sources:

- Order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/ [email protected]

- Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Equality of accrued and withheld tax

When preparing a personal income tax calculation for any period, the accountant pays attention to the ratio in the column of the accrued tax liability and the line of the actual tax withheld - lines 040 and 070 in 6-NDFL. Equality between them is an exceptional case. This is possible provided that the accrual of income and its distribution to individuals is always carried out within one month.

The discrepancies found between the indicators for accruals and deductions are a variant of the norm. The reason is that the salary is considered accrued (and along with it the tax) as of the last day of the month. Line 070 in 6-NDFL for the half-year and any other interval will not reflect these last accrued values.

The exception is situations when wages are paid by the employer on the last working day of each current month (the actual payment occurs in the period for which income is due). In this case, in 6-NDFL, line 070 is equal to line 040.

The amounts of calculated (line 040) and withheld (line 070) personal income tax may not match. There will be inequality if any income has already been recognized, the tax on it has been calculated, but the actual payment has not yet been made. For example, the date of actual receipt of salary is considered to be the last day of the month. On this day, the amount of income is known and the amount of tax that must be withheld from this income (calculated personal income tax) is determined. However, it is impossible to withhold this amount until the actual payment of income. Therefore, the indicator for filling out line 070 will appear only after the salary is issued. A possible discrepancy between the indicators of lines 040 and 070 of form 6-NDFL is provided for by control ratios. This is confirmed by the letter of the Federal Tax Service dated March 15, 2016 No. BS-4-11/4222.

EXAMPLE: Personal income tax on the December 2021 salary, paid in January 2021, amounted to 156,219 rubles, and personal income tax on the June salary, paid in July 2021, amounted to 118,206 rubles. If the total amount of calculated tax for the half-year of 2021 was 1,410,309 rubles, then on line 040 of Calculation 6-NDFL for the half-year of 2021 the amount of 1,410,309 rubles will be reflected, and on line 070 - an amount of 1,448,322 rubles (1,410 309 + 156 219 – 118 206).

Point 1: tax rounding for entry in line 070

Line 070 is filled in in full rubles and does not contain cells for recording the kopecks received when calculating the tax (as is provided for lines 020, 025, 030, 130). This circumstance is explained by the requirements of paragraph 6 of Art. 52 of the Tax Code of the Russian Federation, which prescribes rounding personal income tax when calculating to full rubles in compliance with the rule: you can discard kopecks only in 1 case: if their value is less than 50.

Based on this rule, the amount of tax withheld when paying income is calculated, falling into line 140 of section 2. That is, there it will already be shown in full rubles. Accordingly, when summing up such figures, the result will also be in full rubles.

Read more about the procedure for calculating personal income tax in the articles:

- “Calculation of personal income tax (personal income tax): procedure and formula”;

- “Personal income tax accrued (accounting entry)”.

Transactions on non-cash income

Individuals can receive material rewards:

- in monetary measures;

- in kind.

Income tax on the value of issued non-monetary resources must be assessed. It is impossible to transfer funds to the budget at the time of delivery of the reward in kind.

The operation of repaying the tax liability is postponed to the nearest date of payment of cash income. When filling out 6-NDFL for the six months, line 070 includes income tax from non-monetary sources of income of individuals on the date of actual deduction from other resources to be issued to this person. For deductions from earnings, there is a limit of 50% of the accrued amount in cash equivalent.

Personal income tax on the December 2021 salary, paid in January 2019, amounted to 156,219 rubles, and personal income tax on the June salary, paid in July 2021, amounted to 118,206 rubles. If the total amount of calculated tax for the half-year of 2021 was 1,410,309 rubles, then on line 040 of Calculation 6-NDFL for the half-year of 2021 the amount of 1,410,309 rubles will be reflected, and on line 070 - an amount of 1,448,322 rubles (1,410 309 + 156 219 – 118 206).

Read also

12.09.2016

What to include in the field

Like the other columns in section 1, line 070 6-NDFL for the 3rd quarter of 2021 is filled in with a cumulative total from the beginning of the year. Let's say you need to prepare a calculation for January-September (due no later than November 2, Monday). To do this, in the field, write down the amount of funds withheld by the employer (tax agent) during the entire reporting period - 9 months. If you are reporting for the entire year, indicate the total amount of income tax withheld from an individual in the reporting year.

As an example, what is included in line 070 of 6-NDFL with an accrual total for the 3rd quarter of 2021. The sample is also relevant for annual reporting.

Please note: the total amount of tax withheld in line 070 of 6-NDFL for the 3rd quarter of 2021 does not include data on fixed advance payments. They (if any) are reflected separately - in column 050.

Error due to technical problems

In some cases, due to technical problems, the tax agent submits an adjustment to previously submitted calculations. In this case, prosecution depends on how much the mistake made affected the tax base and the tax itself (amount of tax and payment deadlines, personal data, etc.). But timely, independent identification of errors and submission of adjustments to 6-NDFL to the Federal Tax Service before the Federal Tax Service discovers false data in the submitted documents can serve as a basis for exemption from liability.

When lines 70 and 140 are equal

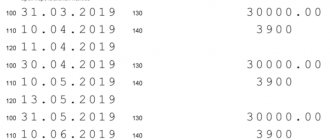

Since the first section reflects data in an increasing order, and the second section only for the last quarter, the values in lines 70 and 140 will exactly match in the report for the first quarter.

Subscribe to our newsletter

Yandex.Zen VKontakte Telegram

In reporting for half a year, 9 months or a whole year, lines 70 and 140 are more likely to not coincide. This is due to the fact that, for example, in a report for 9 months, line 70 will sum up the values of withheld personal income tax for the first, second and third quarters. At the same time, line 140 will display the amount of tax withheld only in the third quarter.

It is very likely that if you take quarterly reports according to f. 6-NDFL within the tax period and add up line 140 from each data, then this value can be equal to line 70 from the last report.

For example, the standard case is when wages for March are paid at the beginning of April. Typically, calculations are made based on the results of the period worked by the employee in the first days of the month following it. It turns out that in this case the principle of forming lines 70 and 140 will be the same, since the date of tax withholding and the period of its transfer to the budget will coincide.

Tax officials no longer require lines 70 and 140 to be equal, but that's not the only benchmark ratio they check. A ready-made solution from ConsultantPlus will help you check Form 6-NDFL yourself and avoid unnecessary questions from the Federal Tax Service. Check your report using the Federal Tax Service method using a free trial access to K+.

An example of filling out 6-NDFL when paying salaries for June before the end of June

Salaries are paid on the 16th of the current month and the 1st of the month following the current one. So, the salary for June was paid the day before - 06/30/2021 (for example, the payment date falls on a weekend). The salary amount is 100,000 rubles, the personal income tax amount is 13,000 rubles. No deductions are provided.

When calculating 6-NDFL, fill in:

| for half a year | 020 | 100000 |

| 040 | 13000 | |

| In 9 months | 020 | 100000 |

| 040 | 13000 | |

| 070 | 13000 |

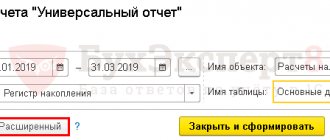

How to check if a field is filled in correctly

Tax authorities use special formulas to check reporting. The following control ratios are applied in line 070 6-NDFL: income contribution to the budget = 070 - 090. Cell 090 reflects the amount returned by the tax agent. If the difference is less than the actual budget transfers, this means that the tax agent underpaid the contribution.

Order No. ММВ-7-11/ [email protected] indicates whether line 070 in 6-NDFL can be changed retroactively - yes, if the agent provides the Federal Tax Service with an adjustment for this cell. If an error is made in the report and clarification is not provided, the taxpayer will face a fine under Art. 126.1 of the Tax Code of the Russian Federation - 500 rubles for each erroneous document.

How to correctly fill out form 6-NDFL

The amounts reflected in lines 040 and 070 are the main ones in form 6-NDFL, since tax inspectors will first pay close attention to them. The purpose of the audit is simple: to ensure that all tax due is transferred to the budget.

To correctly fill out lines 040 and 070 of form 6-NDFL, you need to study the letters of the Ministry of Finance of the Russian Federation

The tax inspectorate introduced the new form 6-NDFL in accordance with the law “On Amendments to Parts One and Two of the Tax Code of the Russian Federation” in order to increase the responsibility of tax agents for failure to comply with the requirements of the legislation on taxes and fees.

Federal Law No. 113-FZ of 05/02/2015

And although enterprises and organizations have been reporting on Form 6-NDFL for two years now (for 2021, the second annual report will be submitted on Form 6-NDFL), entrepreneurs and accountants are still experiencing difficulties in preparing it. Therefore, at the end of 2021, tax authorities published Letter No. GD-4–11/ [email protected] , which addresses common errors.

Important to remember:

- that in form 6-NDFL it is necessary to show the total amounts of accrued income, the calculation and withholding of taxes from them for the enterprise (organization) as a whole, and in form 2-NDFL data is provided for each employee. It is important to compare the totals of both reports;

- if the tax agent withholds tax at several rates, then section 1 is filled out for each of them, and the results for lines 060–090 are shown separately for each tax rate;

- To fill out the form, you must take into account that income may be received in one period, and deductions from it will have to be shown in the next report.

To submit correct reports without fines and sanctions, use the provisions of the Tax Code of the Russian Federation along with the explanations of the Federal Tax Service.

For clarification of controversial aspects of filling out form 6-NDFL, you can contact your tax inspector

Checking line indicator 070

You can check the correctness of filling out the calculation using the control ratios recommended by the Federal Tax Service. For example, on line 070, the withheld and paid personal income tax is compared and the following must be performed:

Paid tax > Line 070 – Line 090

Failure to comply with this condition indicates that the withheld tax was not transferred to the budget in full.

It is also important to note that the value of line 070 (section 1) should not equal the sum of lines 140 (section 2), which depends on the carryover payments.

Important! If the organization has not made payments to employees, then there is no need to submit a zero calculation, but if the calculation is submitted, then the Federal Tax Service is obliged to accept it.

6-NDFL and budget settlement card (CRSB)

KRSB is a special register maintained by tax authorities to record taxes, insurance contributions and other payments for each taxpayer. Taxpayers do not have direct access to it; its data is classified and is a tax secret. The tax office also checks that it is filled out correctly.

- The difference between the line art. 070 and Art. 090 cannot be more than personal income tax paid since the beginning of the tax period. If the difference is higher, then the tax amount may not have been transferred to the budget;

- Date in Art. 120 must correspond to the actual date of tax transfer.

Error in calculation submission

The organization does not operate (there is 1 director on staff, he is not paid a salary) and has not submitted 6-NDFL.

The Federal Tax Service does not have the right to hold such an organization accountable and suspend operations on the account. But, due to the fact that the Federal Tax Service does not have information about the suspension of activities, you can submit a zero calculation or an information letter about the suspension of activities and lack of payments, otherwise a violation report is drawn up and a decision is made to suspend transactions on bank accounts and electronic transfers and in this case, within 1 month, you must submit to the Federal Tax Service objections to the act in writing, explaining the reasons for not submitting 6-NDFL.

How to show vacation pay in 6-NDFL - practical examples

For many years now, filling out form 6-NDFL has been raising questions from the accountant, one more intricate than the other. Situations with vacation pay also did not escape this fate. And the main problem is that they have their own rules for withholding personal income tax, which differ from wages and other payments. In addition to the vacation pay itself, many questions arise about compensation for unused vacation upon dismissal.

Colleagues, I would like to reassure you right away! In the situation with vacation pay, and even with compensation, when filling out 6-NDFL, everything is quite logical and obeys simple rules. In this article we will look at this with practical examples. What are we going to talk about?

The content of the article:

1. Where do the difficulties with 6-NDFL come from?

2. Date of receipt of vacation pay in 6-NDFL

3. Date of deduction of personal income tax from vacation pay in 6-NDFL

4. Deadline for transferring personal income tax from vacation pay to 6-NDFL

5. Vacation pay in section 1 of the 6-NDFL report

6. How to show vacation pay in 6-NDFL

7. An example of reflecting vacation pay in 6-NDFL

8. Vacation pay in January in December in 6-NDFL

9. We reflect vacation pay along with salary in 6-NDFL

10. Unused vacation upon dismissal in 6-NDFL

11. Recalculation of vacation pay in 6-NDFL

So, let's go in order.

Where do the difficulties with 6-NDFL come from?

Before you figure out how to show vacation pay in 6-NDFL, you should understand that the solution to any situation that arises follows from the logic of constructing the reporting form itself. The report on Form 6-NDFL is submitted quarterly and completed on the reporting date - March 31, June 30, September 30, December 31. It includes two sections, the principles of including income and tax in which are not the same:

Section 1 is filled in with a cumulative total throughout the year, i.e. income and tax are reflected in it in total. It includes income that is considered received by the employee.

Section 2 includes only those transactions that were performed over the last 3 months. Moreover, the main criterion for inclusion in this section is that the personal income tax payment deadline falls within this reporting period (not the actual deadline, but the deadline according to the law).

The main difficulties in filling out are related to the fact that the dates of receipt of income, its deduction and transfer of personal income tax differ and may fall in different reporting periods. This is also true for vacation pay. Therefore, first of all, let’s look at how the date of receipt of income for vacation pay is determined, the date of tax withholding, and what are the deadlines for transferring personal income tax for this type of income. By the way, if your organization pays dividends, then in this article you can also look at examples of filling out 6-NDFL for this type of payment.

Date of receipt of vacation pay in 6-NDFL

Holiday pay, as defined by the Supreme Court, is part of wages. However, the date of actual receipt of income in the form of vacation pay is determined not by wages, but by paragraph 1 of clause 1 of Article 223 of the Tax Code of the Russian Federation (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated 02/07/2012 No. 11709/11, letter of the Ministry of Finance dated 01/26/2015 No. 03-04-06/2187, etc.).

Those. for the purposes of calculating personal income tax, the date of receipt of vacation pay in 6-NDFL is the day of payment to the employee - transfer to a bank account, withdrawal from the cash register (letter of the Federal Tax Service dated July 21, 2017 No. BS-4-11 / [email protected] ).

According to Article 136 of the Labor Code, the employer is obliged to pay vacation pay no later than 3 calendar days before the start of the vacation (there is also a letter from Rostrud dated July 30, 2014 No. 1693-6-1 on this topic).

The start date of the vacation does not matter, even if it falls on the next calendar month. It doesn’t matter if the vacation is transferable and affects different months, quarters, calendar years (letter of the Federal Tax Service of Russia dated May 24, 2016 No. BS-4-11/9248). To determine the date of receipt of income, only the date of payment of vacation pay is important. For this date, line 100 of form 6-NDFL is filled out.

The date of payment of vacation pay determines whether the amount of vacation pay and personal income tax on it falls into section 1.

Date of deduction of personal income tax from vacation pay in 6-NDFL

The next important step to show vacation pay in 6-personal income tax is to determine the tax withholding date, which is reflected in line 110. Everything is very simple here: personal income tax is withheld at the time of payment of income (clause 4 of article 226 of the Tax Code). Therefore, for vacation pay, the date of receipt of income and the date of withholding personal income tax from vacation pay in 6-NDFL will coincide, i.e. this is one day.

Deadline for transferring personal income tax from vacation pay to 6-NDFL

In general, for most types of income, the deadline for transferring personal income tax to the budget is no later than the first working day following the day the income is paid. But the picture is different for vacation pay! Because the deadline for transferring personal income tax from vacation pay is regulated by a separate norm - clause 6 of Article 226 of the Tax Code. The tax must be transferred no later than the last day of the month in which the payment took place .

On the one hand, this rule is designed to simplify accounting and reduce the number of payments, especially with a large number of employees. Because during the month the tax agent can “accumulate” the amount of tax on vacation pay, and at the end of the month transfer it in a single payment.

But for an accountant, due to his heavy workload, sometimes it is actually easier to transfer personal income tax as soon as the employee’s vacation pay is paid, so as not to forget about it in the future and not delay the transfer. The Tax Code does not prohibit this, so do what is most convenient for you.

The deadline for transferring personal income tax from vacation pay to 6-NDFL is reflected in line 120. An article about filling out the fields of a payment order will help you when paying tax.

Vacation pay in section 1 of the 6-NDFL report

So, we have sorted out the dates reflected in Section 2, a little later we will analyze problematic situations and look at an example of how vacation pay is reflected in 6-NDFL. In the meantime, just a few words about Section 1, everything is simple here.

This section includes income accrued to employees. For salaries, this is the last day of the month, and for vacation pay, as we have already found out, it is the payment day.

Those. if the payment of vacation pay took place in this period (or in previous ones, since the section is filled in with an accrual total), then their amount falls into Section 1. And personal income tax from vacation pay will fall into lines 040 and 070 of form 6-NDFL (calculated and withheld tax ).

How to show vacation pay in 6-NDFL

Let's look at a practical example. First, we will discuss the specific situation and all the dates for it, then we will see how it looks in the reporting form.

Employees of Bashmachok LLC are going on another vacation (dates taken for 2021):

- — warehouse manager Bosonozhkina B.B. from March 5 to 10 days, vacation pay in the amount of 9800 rubles, payment on February 28;

- - Secretary of Tufelkina T.T. from March 19 to 28 kd., vacation pay in the amount of 21,500 rubles, payment on March 15;

- — seller Sapozhkova S.S. from April 2 to the 14th day, vacation pay in the amount of 12,300 rubles, payment on March 29.

Personal income tax for each employee was transferred simultaneously with the payment of vacation pay, on the same day.

The dates for receiving vacation pay and the dates for withholding income will be as follows:

- — Bosonozhkina: February 28

- — Tufelkina: March 15

- — Sapozhkova: March 29.

These are the dates for vacation pay. According to these dates, we fill out Section 1 and lines 100 and 110 of Section 2.

The personal income tax transfer dates will be as follows (data for lines 120):

- — Bosonozhkina: February 28 (this is the last day of the payment month - February)

- — Tufelkina: April 2 (since the last day of the month – March 31 – falls on Saturday)

- — Sapozhkova: also on April 2 (for the same reason).

Each of these payments will be shown separately in Section 2, because There are no payments with a completely matching set of dates (terms 100, 110, 120) in the example. In reality, if you pay vacation pay to several employees on the same day, then they can be combined for Section 2. By the way, the date of actual transfer of personal income tax for them will not matter whether you transferred it on the same day or not.

An example of how vacation pay is reflected in 6-NDFL

Now let's see how the data in our example will look in 6-NDFL. For all female employees, vacation pay in Section 1 of the 6-NDFL report will be reflected in the 1st quarter. To simplify, let’s assume that there were no other payments in the organization.

With Section 2 the situation will be more complicated. In what period will the paid vacation pay be included in the report for the 1st quarter or for the half year? Let me remind you that this is determined by line 120 – the date of tax transfer (according to the Tax Code, not the actual one).

We have the following sets of dates:

| Bosonozhkina | Tufelkina | Sapozhkova | |

| line 100 | 28.02.2018 | 15.03.2018 | 29.03.2018 |

| line 110 | 28.02.2018 | 15.03.2018 | 29.03.2018 |

| line 120 | 28.02.2018 | 02.04.2018 | 02.04.2018 |

Thus, each payment will be entered into Section 2 as a separate block. And only Bosonozhkina’s vacation pay will be included in the 6-NDFL report for the 1st quarter.

Vacation pay for Tufelkina and Sapozhkova will be included in Section 2 only in the half-year report.

If March 31 was not a day off, then these vacation pay would also be included in the report for the 1st quarter.

Vacation pay in January in December in 6-NDFL

You can see that when it comes to vacation pay, everything turns out quite logically! The example already shows how “carrying over” vacation pay is included in the report, as well as payments for vacations that begin in the next reporting period.

However, many questions arise about how to show January vacation pay in December in 6-NDFL. The problem, in my opinion, is purely psychological – the long New Year holidays. Otherwise, there are no differences from other “transitional” situations between quarters. Therefore, we will also analyze a small example on the topic.

Once again we repeat the important points on which we rely:

- Vacation pay in Section 1 and lines 100-110 are reflected by the date of their payment.

- The deadline for transferring personal income tax is the last day of the month. If this day falls on a weekend or holiday, then the transfer date for line 120 will be the next business day.

- Line 120 determines the reporting period for which vacation pay and the tax on it in Section 2 will be included.

That's all the “tricks”!

At LLC “Bashmachok” the director is Kozhemyakin K.K. goes on vacation from January 8, 2021. On December 28, 2021, he was paid vacation pay, and personal income tax was transferred on the same day.

- The date of receipt of income and withholding of personal income tax is December 28.

- The personal income tax transfer date is January 9, because December 31st falls on a day off, and the first working day after the New Year holidays is January 9th.

Thus, Kozhemyakin’s vacation pay will fall into Section 1 of the report for 2017:

and in Section 2 of the report for the 1st quarter of 2021.

We reflect vacation pay along with salary in 6-NDFL

All situations regarding the payment of vacation pay come down to two cases:

- Vacation pay is paid regardless of salary, as it accrues . In this case, wages and vacation pay are reflected in Section 2 in separate blocks for the following reasons:

- the date of receipt of income will most likely differ (exception is if vacation pay is paid on the last day of the month);

- special procedure for the deadline for transferring personal income tax from vacation pay (the last day of the month of payment).

- Vacation pay is paid along with salary. This may simply be a coincidence of dates, or, for example, an employee takes a vacation and is subsequently fired.

Let’s say vacation pay and wages were paid on the last calendar day of the month and the date of receipt of income in the form of vacation pay and wages, the tax withholding date coincided. But the date of transfer of personal income tax on wages is the next working day, and for vacation pay it is still the same last calendar day of the month. This is the example with Bosonozhkina, discussed above.

Thus, in 6-NDFL, vacation pay along with wages will be reflected in Section 2 in separate blocks.

Let's look at a small example of filling out 6-NDFL in case of vacation followed by dismissal. Let's assume that Tufelkin's secretary T.T. from our example with Bashmachok LLC, goes on vacation for 28 days from March 19 with subsequent dismissal.

Let the settlements with the employee be made on March 16 (Friday, this is her last day of work), she was paid vacation pay in the amount of 21,500 rubles. and wages for March in the amount of 10,400 rubles. Personal income tax from the current account is transferred on the same day.

Despite the fact that the employer transferred to the employee all payments due to her in one amount on one day, we are talking about two independent payments - wages for working days in March and vacation pay.

In the event of termination of the employment relationship before the end of the calendar month, the date of actual receipt of income in the form of wages is considered to be the last day of work for which the income was accrued (clause 2 of Article 223 of the Tax Code). In the example, this is March 16 (since March 17 and 18 are days off for which salaries were not accrued). The deadline for transferring personal income tax is March 19, the next working day.

Vacation pay must be shown in 6-NDFL on the date of receipt of income on March 16, and the deadline for transferring personal income tax is April 2. There will be no differences here from regular vacation pay.

Section 2 of the 6-NDFL calculation for nine months is filled out as follows.

Unused vacation upon dismissal in 6-NDFL

Vacation followed by dismissal is a rare case. Much more often, an employee quits and receives compensation for unused vacation. But the rules here will be the same:

- If an employee resigns, then the date of receipt of income in the form of wages is considered to be the last day of work (Clause 2 of Article 223 of the Tax Code of the Russian Federation).

- The date of receipt of income in the form of vacation compensation is the day of its payment.

Article 140 of the Labor Code of the Russian Federation establishes that upon termination of an employment contract, payment of all amounts due to the employee from the employer is made on the day of the employee’s dismissal. In other words, in case of dismissal, compensation for unused vacation and wages for the last month worked are paid on one day, which is the last day of work.

Let's take the same example with the secretary of Bashmachok LLC T.T. Tufelkina, assuming that she quits on March 16, receives a salary for March of 10,400 rubles. and compensation for unused vacation 21,500 rubles.

The date of receipt of income and the date of withholding personal income tax for both payments is the same - this is March 16. The deadline for transferring personal income tax from wages is also clear - March 19. But what is the personal income tax transfer date for compensation?

The provisions of Chapter 23 of the Tax Code of the Russian Federation do not contain explanations of what income is classified as income in the form of vacation pay.

From Art. 236 of the Labor Code of the Russian Federation it follows that “vacation payment” and “severance payments” (which also includes compensation for unused vacation) are different in their legal nature. Compensation for unused vacation cannot be considered as part of vacation pay. Therefore, compensation will not have a “special” deadline for transferring personal income tax, as in the case of vacation pay. The general rule applies - we transfer no later than the next business day .

Therefore, personal income tax on compensation for unused vacation upon dismissal can be reflected in 6-personal income tax together with personal income tax on wages. In our example, this is March 19th.

Tufelkina’s salary and the compensation paid to her for unused vacation in lines 100-140 of form 6-NDFL will be reflected in the aggregate; there is no need to fill out these lines separately for income in the form of compensation for unused vacation.

Recalculation of vacation pay in 6-NDFL

Thus, we figured out how to show vacation pay in 6-NDFL. The only issue that was not touched upon was the situation with recalculation. The need for recalculation may be required not only in the case of arithmetic errors made by the accountant.

Often there is a need for early recall of an employee from vacation . And he will use the rest of his vacation separately in the future. Those. the employee initially received vacation pay for more days than he used.

Before we look at the recalculation of vacation pay in 6-NDFL using a practical example, remember the basic rules:

- The amount of income actually received in 6-NDFL is indicated already recalculated .

- The amount of tax withheld in 6-NDFL is indicated as actual, i.e. the one that was initially retained .

On May 14, the manager of Bashmachok LLC Shnurkov A.A. vacation pay was paid in the amount of 19,600 rubles for 28 days of vacation (from May 18 to June 15). On the same day, personal income tax in the amount of 2,548 rubles was transferred to the budget.

But on June 5, the employee was recalled from vacation. As a result of recalculation, vacation pay for 18 days (from May 18 to June 4) amounted to 12,600 rubles. (Personal income tax - 1638 rubles).

For June, the employee was entitled to a salary of 20,000 rubles. (Personal income tax - 2600 rubles).

On July 5, the employee received his salary for June, reduced by the amount of vacation pay for those days when he was recalled from vacation, that is, by 7,000 rubles. (for 10 calendar days from June 5 to June 15). As a result, the salary amounted to 13,000 rubles. And personal income tax must be paid in the amount of 2600 – (2548 – 1638) = 1690 rubles.

This is how the situation will be reflected in Section 2 of the 6-NDFL report.

Since the salary payment for June took place in July, the report for the half-year will include vacation pay, and the report for 9 months will include salary.

If you have questions about how to show vacation pay in 6-NDFL, ask them in the comments!

How to show vacation pay in 6-NDFL - practical examples

How do the values of pages 040 and 070 relate?

The numbers on pages 040 and 070 of 6-NDFL will almost never be equal.

This is due to the discrepancy between the date of accrual of income tax and the date of its withholding. So, the report for the half-year, or rather its first section, should include the June salary. The tax from this salary will be included in line 040, but it will not be withheld yet, since the moment of withholding corresponds to the date of payment of the salary, which usually falls in July. It seems that the value of line 040 should exceed the value of line 070 by the amount of tax on the June salary. BUT! Line 070 may include the tax that was withheld from the December salary if it was paid after the New Year holidays. This amount will not be reflected in line 040, since December is the last tax period. And if the December salary and tax amounts exceed the June values, then it is clear that the figure from line 070 will be greater than the figure from line 040. Don’t know your rights? Subscribe to the People's Adviser newsletter. Free, minute to read, once a week.

IMPORTANT! Letter of the Federal Tax Service of the Russian Federation dated March 10, 2016 No. BS-4-11/ [email protected] established the control ratios for 6-NDFL, which do not include such a ratio as “line 070 cannot exceed line 040.”

***

So, we have looked at what lines 040 and 070 are intended for. Taking into account all of the above, it can be argued that situations where the value of line 070 is greater than line 040 in 6-NDFL and vice versa are quite correct. The control ratios do not provide for a specific equality or inequality of these lines.

Recently, accountants have begun to receive strange demands from the Federal Tax Service regarding failure to comply with control ratios in form 6-NDFL.

We are talking about lines 040 and 070 of section 1 of the 6-NDFL calculation.

The Federal Tax Service reports that the control ratios have been violated:

“Amount of calculated tax” p.040 – “Amount of fixed advance payment” p.050 – “Amount of tax not withheld by the tax agent” p.080+ “Amount of tax returned by the tax agent” p.090) / “Amount of tax withheld” p.070 = acceptable range 0.99-1.10. Readers of our forum are perplexed. After all, line 040 of the half-year report reflects personal income tax calculated for January-June 2021, and line 070 reflects personal income tax withheld for this period. Even if the salary is paid on time (and this is not always the case), then the personal income tax from the salary for June, reflected in line 040, will not appear in line 070. In addition, the personal income tax withheld from the salary for 2021 may be reflected in line 070. which was paid in 2021. 050, 080,090 lines are empty for me, which means 040/070 I always get 1.2!

Even if you take any salary!!! because Salaries for the last month of the quarter are always issued in the next quarter. During the first quarter, I wrote about this in an explanation to the tax office.

What can you say to make them fall behind???

— IrinaAccountant

Let's give a few examples. 1) Salary for December 2021 in the amount of 10,000 rubles. was paid in January 2021.

For January-May, a salary of 140,000 rubles was accrued. For June, a salary of 50,000 rubles was accrued, which was paid in July.

Thus, in the half-year report:

p.020 = 190000

p.040 = 24700

p.070 = 19500

The ratio line 040/line 070 = 24700/19500 = 1.27, which exceeds the permissible limit of 1.1 from the point of view of tax authorities.

2) Salary for October, November, December 2021 in the amount of 30,000 rubles. was paid in January 2021.

For January-May, a salary of 50,000 rubles was accrued. For June, a salary of 10,000 rubles was accrued, which was paid in July.

Thus, in the half-year report:

p.020 = 60000

p.040 = 7800

p.070 = 10400

The ratio line 040/line 070 = 7800/10400 = 0.75, which is below the acceptable limit, from the point of view of tax authorities, of 0.99.

3) In 2021 there were no salary payments for 2021. Moreover, in 2021, salaries were never paid at all. Moreover, it was accrued for May-June in the amount of 40,000 rubles.

Thus, in the half-year report:

p.020 = 40000

p.040 = 5200

p.070 = 0

Ratio p.040/p.070 = 5200/0 = “pattern break”, since you cannot divide by zero. Tax officials expect a range from 0.99 to 1.1 and when checking the ratio they are faced with division by zero.

Let us remind you that the control ratios are described in the letter of the Federal Tax Service dated March 10, 2016 No. BS-4-11 / [email protected] and such a ratio, which the tax authorities report in their requirements, is not contained there.

Have you received similar requests? A discussion on this topic takes place in our forum thread “6NDFL - requirement for non-compliance with control ratios.”

Tax audits are becoming tougher. Learn to protect yourself in the Clerk's online course - Tax Audits. Defense tactics."

Watch the story about the course from its author Ivan Kuznetsov, a tax expert who previously worked in the Department of Economic Crimes.

Come in, register and learn. Training is completely remote, we issue a certificate.

What does income tax withheld mean?

The name of line 070 of the 6-NDFL report is “Amount of tax withheld.”

Before considering how the information is formed in it, let us recall when personal income tax is considered withheld. When paying employees for wages, bonuses, vacation pay, some benefits, etc., the tax agent must reduce the payment by the calculated income tax and send it to the treasury, observing the time frame established for this.

Withheld personal income tax is the amount of tax withheld from an employee when paying him income.

How much time is allocated to fulfill the company’s obligations as a tax agent to its employees to pay tax depends on the type of income from which it was withheld:

- Taxes on sick leave and vacation pay must be sent by the end of the month they are paid.

- The deadline for transferring personal income tax on wages or other income will be the next day after their issuance.

The advance payment is not included in the list of payments from which personal income tax is withheld. An exception, when you still have to withhold income tax from the advance payment, will be its payment dated to the last day of the month (letter of the Ministry of Finance of the Russian Federation dated November 23, 2016 No. 03-04-06/69181). If the tax payment deadline falls on a weekend, it is moved to the next closest working day. Fulfillment of the obligation to transfer tax to the budget will transfer personal income tax to the status of transferred.

ConsultantPlus has collected all the information about the reporting of a tax agent for personal income tax in the Guide. If you don't have K+ yet, take advantage of the free trial so you don't miss anything in your work.

Nuance 3: relationship between lines 070 and 080 of the 6-NDFL report

If during the year the tax agent was unable to withhold accrued personal income tax from income paid to an individual, then for such tax, instead of line 070 in the 6-NDFL report, line 080 will be used, intended to reflect the personal income tax not withheld by the tax agent.

The inability of a tax agent to withhold personal income tax from the income of individuals may arise, for example, in the following cases:

- The employee received in-kind income from the company and then quit. At the same time, the dismissal amount was not enough to withhold personal income tax from the value of natural income.

- Former retired employees were given anniversary gifts (worth more than 4,000 rubles). At the same time, no other monetary income was paid.

- A company employee received an interest-free loan, but is on long-term leave without pay. At the same time, he receives monthly income from interest savings (material benefits), with which the employer is unable to withhold personal income tax due to the lack of income paid to the employee.

For explanations from tax officials on filling out lines 070 and 080, see the publications:

- “Annual 6-NDFL will not agree with 2-NDFL certificates regarding the amount of tax withheld”;

- “New explanations from the Federal Tax Service to line 080 of form 6-NDFL.”