How to properly keep a journal of business transactions? Reliable and up-to-date information on business transactions is needed both in order to effectively manage the company and for tax accounting purposes. The business journal is one of the basic accounting documents. On its basis, statements, certificates, and summaries are compiled that are necessary for the work of any financier or accountant.

Journal-order form of accounting

The form of accounting in which all data on business transactions is taken into account and systematized in journals for recording business transactions is called journal-order.

The basic principles are:

- Entries are made exclusively on credit accounts, indicating correspondence on debit.

- Synthetic and analytical accounting records are combined in a single accounting system.

- Data is reflected in accounting documents in the context of indicators necessary for control and reporting.

- You can apply combined journals to related accounts.

- You can create them monthly.

It is not necessary to use this form of accounting. An organization can keep records using a memorial order form, which is based on drawing up memorial orders for each business transaction. This type has a number of disadvantages: a significant lag between analytical accounting and synthetic accounting, as well as increased labor intensity: you have to duplicate records several times.

main book

The total data of the journal orders at the end of the month is transferred to the general ledger, on the basis of which the balance sheet is compiled.

The general ledger (form approved by Order of the Ministry of Finance of the Russian Federation dated March 30, 2015 No. 52n) is the main accounting summary document, in which, as a rule, one account is assigned to each account. The loan turnover of each synthetic account is reflected in one entry. Debit turnover is reflected in the amount for each corresponding journal-order as a whole, regardless of the correspondence of accounts. If the amounts of debit and credit turnovers, as well as debit and credit balances are equal, it means that all transactions in accounting are reflected correctly and you can begin to generate financial statements.

Magazine templates

№ 2

№ 6

№ 7

№ 8

№ 10

№ 11

№ 13

Magazine forms

For public sector employees, the Ministry of Finance developed and recommended unified forms (Orders No. 123n dated September 23, 2005 and No. 25N dated February 10, 2006). But it is not necessary to use them (No. 402-FZ dated December 6, 2011). The organization has the right to independently develop and approve forms for accounting journals. But for this they should be approved by a separate order of the manager or in the form of an appendix to the accounting policy.

Balance program. Reports. Balance.

Form No. 1 or “Balance Sheet” should be generated after all manual entries for tax accrual have been entered, entries for financial results have been indicated (accounts 20, 26, 90, 91 are closed). This version of the program generates a shipment balance. Form No. 2 for shipment is also generated, although you can set up formulas for generation for payment. Entries for balance sheet reformation must be made in the previous period, but the formulas for filling out form No. 1 are configured so that this entry will not be taken into account. For example, when changing the accounting year, the transition will be made from 2002 to 2003. The entry should be reported in the 4th quarter of 2002.

List of current journals

State employees use these types.

| Magazine number | Type of operations |

| №1 | Cash desk and cash flow |

| №2 | Bank current accounts |

| №3 | Calculations with accountable persons |

| №4 | Settlements with suppliers and contractors |

| №5 | settlements with debtors on income |

| №6 | Calculations for wages, scholarships, allowances |

| №7 | Disposal and transfer of non-financial assets |

| №8 | Settlements for other transactions |

| №9 | Validation |

Non-profit organizations use others.

| Name of journal-order | Contents of operations |

| JO No. 1 | Cash flow at the institution's cash desk |

| JO No. 2 | Current accounts |

| JO No. 3 | Special bank accounts |

| JO No. 4 | Payments for loans and borrowings (short-term and long-term) |

| JO No. 6 | Settlements with suppliers and contractors |

| JO No. 7 | Calculations with accountable persons |

| JO No. 8 | Calculations for taxes and fees, intra-business transactions, calculations for advances |

| JO No. 10 | Primary production |

| ZhO No. 11 | Accounting for finished products (goods, works or services) |

| JO No. 12 | Accounting for target financing |

| ZhO No. 13 | Fixed assets and depreciation |

| JO No. 15 | Retained earnings (uncovered loss) |

| JO No. 16 | Investment in non-current assets |

Balance program. Reports. Tax calculation.

Postings for accrual of property tax and income tax are entered manually into the business transactions journal. Postings for VAT calculation are automatic in accordance with the knowledge base. The principle of generating transactions is based on the following: 1. Account balance (60.62, or 76) - shows how much a particular document has been paid. The algorithm is represented by different payment cases in the knowledge base. 2. After the current document is processed, the balance amount is reduced by the amount of the document. 3. Thus, the algorithm can cover three possible cases in nature: paid in full, partially paid and not paid. Programmer's note: Even a knowledge base customized for you is not a panacea for calculating VAT! The appearance of new transactions does not lead to the fact that their processing will automatically appear in the knowledge base. Remember this.

Features of the formation of accounting registers

Law No. 402-FZ establishes mandatory requirements for accounting documentation. Regardless of what type of form was chosen by the organization: unified or developed independently.

Mandatory register details:

- The name of the document and its form.

- Full name of the institution.

- Start date and end date of journal entries. The period for which it was formed.

- Type of grouping of accounting objects (chronological or systematic grouping).

- Indication of the unit of measurement of accounting objects, or the monetary value of the measurement.

- Indication of officials responsible for maintaining the register.

- Signatures of responsible persons.

Registration logs are compiled on paper or electronically. For the latter, you will need an electronic signature to certify the document. Without a signature (electronic or handwritten), the journal order is considered invalid.

Corrections are permitted. They can only be entered by the person responsible for maintaining the journal. Next to it, you should indicate the date and certify the correctional entry with a signature, with a description of the position and full name of the person responsible.

Directories and check routines

1.1. Chart of accounts - directory of accounting accounts. 1.2. Subkonto - directories of analytical accounting objects (directory of third-party organizations and individuals, directory of employees) 1.3. Packaging and reindexing are standard items in the main menu of any task. Packing reduces the number of records in database tables by physically removing records that are marked for deletion. Re-indexing is performed in case of computer or operating system failures. For this system, reindexing is not a prerequisite for operation. 1.4 Constants. Here you enter constant data for each enterprise (TIN, OGRN, series and numbers of certificates, codes, name of the tax office, and so on). 1.5 Programs for checking: the transaction log and the correctness of transactions. Successful verification of the transaction log is a necessary condition for the correctness of the calculations, so follow the recommendations issued by the verification program. Checking the correctness of transactions is one of the ways to find your erroneous transactions. Before checking, fill out the knowledge base in the “Settings” section. This function can also serve to control performers.

Filling rules

Each magazine has its own filling requirements. Let's take a closer look at the basic filling rules.

Journal of registration of incoming and outgoing cash orders (JO No. 1)

We make entries based on the cashier’s report, confirmed by the relevant documents (RKO and PKO) at the end of the working day. If movements at the cash register are insignificant, it is allowed to make entries in the register 3-5 days in advance, according to several reports at the same time. Then in the “Date” field we indicate the period for which we are making records. For example, 3-6 or 20-23.

Magazine order 2

Entries are made on the basis of bank statements and other supporting documents (checks, personal account statements). It is allowed to make one entry on several bank statements. In this case, in the “date” field, be sure to indicate the start and end date of the statements.

Magazine order 6

We fill out the register based on documents confirming settlements with suppliers and contractors. Merging records is not allowed. The final balances of the previous period are transferred to the next register, in the “Balance at the beginning of the month” field.

Magazine order 7

We register settlements with accountable persons. We make separate entries for each advance report. Concatenation or grouping of rows is not allowed.

Magazine order 8

We indicate data for each operation:

- advance payments and settlements with contractors and suppliers (issued and received);

- settlements with budgets for taxes and fees;

- settlements with various creditors and debtors;

- on-farm operations.

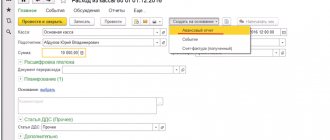

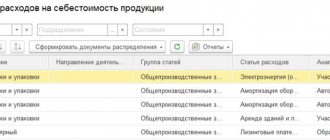

Magazine order 10

We make records of expenses for our own production, in the context of each business transaction (depreciation, wages of production personnel, materials, deferred expenses, etc.).

Journal warrant 11

We reflect data on accounting of finished products. It is allowed to enter generalized information. The form of the journal is developed by the organization independently, taking into account the specific features of the activity (production).

The fact of a business transaction

Limited Liability Company "Vesna" bought 3 cans of automotive paint for production needs for 1,200 rubles (400 rubles per piece) by bank transfer. In order for the accounting department to recognize the fact of this purchase, the authorized employee for this transaction must provide the accounting department for documentation:

- A purchase and sale agreement in writing indicating the cost of the goods, if the company from which the paint was purchased is engaged in wholesale supplies (Article 454 of the Civil Code of the Russian Federation). For retail purchases, no contract is required.

- A consignment note in the TORG-12 form, intended for documenting transactions for the sale of goods. The invoice form, together with instructions for filling it out, was approved by Resolution of the State Statistics Committee of Russia dated December 25, 1998 No. 132. The first copy of the TORG-12 form remains with the seller organization selling inventory items, and is also the basis for the accounting department to record the write-off of inventory items. The second copy is received by the purchasing organization, and it is on this basis that the accounting department can capitalize inventory items, in our example, paint.

- Invoice (if the organization that sells the paint is a VAT payer). An invoice is the most important and basic document on the basis of which Vesna LLC has the right to deduct VAT paid to the supplier company (clause 1 of Article 169 of the Tax Code of the Russian Federation). An invoice is a form of tax accounting and is used solely for the purposes of correct calculation and payment of VAT, but this type of accounting is also carried out by an accountant, and tax amounts are subject to posting on accounting accounts on an equal basis with other amounts.

- Payment order to pay the supplier organization 1200 rubles for the paint received. For non-cash payments, this document is used. If Vesna LLC bought paint for cash, then the payment documents would be a receipt for the cash receipt order and a cash register receipt (clause 1 of Article 252 of the Tax Code of the Russian Federation, Federal Law No. 54-FZ of May 22, 2003 “On the use of control cash registers when making cash payments and (or) payments using payment cards").

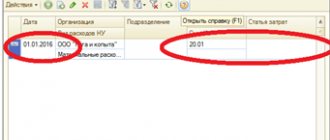

Balance program. Data. Sampling and calculation intervals.

Calculation interval.

This item allows you to set the billing period, for example: 1) from 01/01/2012 to 03/31/2012 - the billing period is set to the 1st quarter of 2012. 2) from 03/01/2013 to 03/31/2013 - the billing period is set to March 2013. The calculation interval specified here is used when generating output information: be it Analysis of an account in the transaction journal or generation of a balance sheet. Closed period - a date range that affects the possibility of changing data as in the household log. operations and in analytical accounting tasks. [X] — Highlight VAT. This is a logical attribute used for organizations whose work is subject to VAT. For private entrepreneurs and organizations exempt from VAT, it should look like [ ]. [X] - Accounting in construction. This feature is used when selecting from analytical accounting tasks. When issuing an invoice for services (work), it is possible to write off materials for these works in proportion to payment to account 20. Thus, when this attribute is set, the posting in the s/f document of type Dt 62 Kt 10.1 is automatically replaced by Dt 62 Kt 90.12, since these materials must be included in sales accounts as work. [X] - Restoration of unpaid documents. The attribute is used when calculating VAT as follows: in situations with the assignment of debt (not to be confused with offset, since the assignment of debt is not payment), it is necessary to restore the base of unpaid documents when returning for the sample to the previous reporting period. This may be necessary to prepare an updated calculation.