How to reflect the sale of a fixed asset in 1C: Accounting 8.3? This will be discussed in this article.

Why might organizations need to sell fixed assets, since they are purchased for a long period? Fixed assets as means of labor involved in the production process can quite often be updated at enterprises in connection with the development of new technologies, which means that it is most effective to sell unused fixed assets, and try to make a profit, or, in extreme cases, a zero financial result. Cases of a negative financial result cannot be excluded, but this is also a kind of income, because a retired fixed asset, albeit with a negative result, does not require costs for its further storage or disposal.

The transfer of fixed assets belongs to the section of operations for the disposal of objects, and documents for such operations are located in the corresponding configuration interface:

Fig. 1 Documents for disposal operations

Let's consider three options for transferring the OS:

- A fixed asset with zero residual value, i.e. depreciation on it has been accrued in full. The sale of such a fixed asset leads to the generation of income;

- An asset with a non-zero residual value and a sales price greater than its residual value. The sale of such a fixed asset leads to the emergence of both income and expense, as well as profit;

- An asset with a non-zero residual value and a selling price less than its residual value. The sale of such a fixed asset results in both income and expense, as well as loss.

It is important to understand that in all cases the procedure is the same - the document “Transfer of OS” is registered.

Differences will arise after the document has been processed. They consist in the principles of formation of accounting entries.

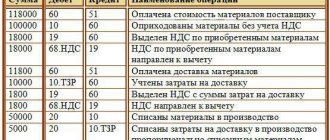

Receipt of Materials to the warehouse.

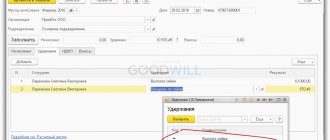

Go to the section Purchases - Receipts (acts, invoices) .

Select Receipt - Goods (invoice) . The document is generated in the same way as a regular receipt of goods, the main difference is that the receipt goes to other accounting accounts.

We fill out the document. And immediately notice that after you added our Material nomenclature, the accounting account was automatically selected as 10.1. Our timber can be taken into account on another account, for example at 10.8 if it is used as a building material. But we will use 10.1 because we plan to do production. This completes the formation of materials receipt.

Free use from the borrower

Borrower under a loan agreement for gratuitous use of property:

- BU

- does not receive income (clause 2 of PBU 9/99); - NU

- recognizes non-operating income (clause 8 of Article 250 of the Tax Code of the Russian Federation).

Expenses associated with the execution of a loan agreement, including the maintenance of the received property, can be recognized for income tax purposes, provided that the expenses (Article 252 of the Tax Code of the Russian Federation):

- economically justified;

- documented.

The borrowing organization determines the amount of income based on market prices for the rental of similar property. The income assessment must be confirmed by documents or an independent examination.

The income assessment should not be lower (clause 8 of Article 250 of the Tax Code of the Russian Federation):

- residual value – for depreciable property;

- costs of acquisition or production - for other property.

Free use for the lender

The transfer of the right to use property is subject to VAT (Decision of the Supreme Court dated August 23, 2019 N 303-ES19-13105).

The lending organization must calculate VAT on this service (clause 1, clause 1, article 146 of the Tax Code of the Russian Federation).

The amount on which VAT should be charged is determined based on market prices (excluding VAT) for the rental of similar property in comparable economic conditions (clause 2 of Article 154 of the Tax Code of the Russian Federation).

Maintenance costs, including depreciation charges, of property transferred for use free of charge cannot be recognized by the lender (Article 252 of the Tax Code of the Russian Federation, clause 2 of Article 322 of the Tax Code of the Russian Federation)

Depreciation in NU ceases to be accrued from the 1st day of the month following the month of transfer of property (clause 6 of Article 259.1 of the Tax Code of the Russian Federation).

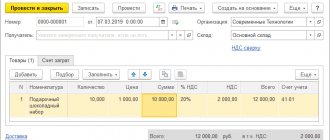

Write-off of materials into production with the creation of goods.

The next important operation with materials in 1C: Accounting 8.3 is operations for the production of finished products, semi-finished products and the provision of services. Go to the Production section - Production report for the shift .

We fill out all the points in the document and go to the Materials . We will produce a children's slide from timber, 2 pieces.

On the materials tab, select the full amount of materials for the production of a children's slide made of timber. And fill out cost items.

Let's see what transactions this document generated. As you can see, in addition to the write-off of materials, there is a posting of manufactured goods on 41.01. This is the difference between the document Request-invoice and the production report for the shift.

The work is qualified as repair of fixed assets

If installation work on assembling a sports surface on a sports ground is qualified as a repair, the cost of the fixed asset does not change.

However, the cost of the work should be reflected in the Inventory card for non-financial assets (f. 0504031).

| Excerpt from the document |

| “The result of work on the repair of a fixed asset object that does not change its value (including the replacement of elements in a complex fixed asset object (in a complex of structurally articulated objects that constitute a single whole) is subject to reflection in the accounting register - the Inventory card of the corresponding fixed asset object by making records of changes made, without being reflected in the accounting accounts.” |

| paragraph 27 of Instruction No. 157n |

To do this, you should use the document Overhaul, modernization of NFA with the operation Overhaul of fixed assets (Fig. 3).

Rice. 3

The document indicates the OS object that has been repaired and the cost of repair. When carrying out the document Overhaul, modernization of NFA, an entry is created in the Overhaul of OS register. This data will be reflected in the object's inventory card.

Accounting records should include entries on the acceptance of work (services) for installation of coatings, the accrual of non-operating income and the offset of mutual claims - see Table 1.

Table 1

| No. | Fact of economic life | Accounting records | BSU document | |

| Debit | Credit | |||

| 1. | Acceptance for accounting of works (services) for installation of coating | KRB 2 401 20 225 | KRB 2 302 25 730 | Services of third parties (with the operation “Purchase from supplier (ХХХ - 302.ХХ)”) |

| 2. | Accrual of non-operating income | KDB 2 205 80 560 | KDB 2 401 10 180 | Certificate of provision of services (with the operation Sales of services (205.ХХ - 401.10.1ХХ)) |

| 3. | Settlement of counterclaims of the same type | KRB 2 302 25 830 | KDB 2 205 80 660 | Operation (accounting) |

Considering that the procedure for reflecting gratuitously received work (services) in the accounting records of state (municipal) institutions is not defined by regulatory documents, the corresponding correspondence of the institution’s accounts must be determined in the Accounting Policy in agreement with the authorized body (the main manager of budget funds; the body exercising the functions and powers founder; financial body, treasury body to which the functions of external financial control are transferred).