Salary

Natalya Vasilyeva

Certified Tax Advisor

Current as of December 18, 2019

An employer can reward an employee both for production successes and on the occasion of a holiday or a specific event. The bonus, like any other employee income, must pay insurance premiums and taxes. Let's figure out whether bonuses are always subject to personal income tax and contributions.

Are bonuses taxable?

It is easier to answer the question if you understand the very concept of the award and its essence from the very beginning.

The name of the bonus was given to a payment to an employee of a stimulating, incentive nature. It is assigned to those who most successfully cope with their responsibilities. Often the rules require the payment of bonuses for certain events.

The inclusion of bonuses in salary is not a mandatory requirement. But Articles 191 and 121 of the Labor Code of the Russian Federation give this right to employers. Therefore, in practice, such solutions occur quite often.

Thanks to this approach, two problems are solved at once:

- It influences the interest of employees in doing better work.

- Due to the bonus part, the amount of labor costs is regulated by the costs that are taken into account in accounting documents.

The bonuses themselves can have two sources for payment:

- Costs - if bonuses are awarded due to labor achievements.

- Net profit - when payments are related to certain events, and not to the results of work.

Attention! The source does not affect whether bonuses can be included in wages. Company management always has this right.

But it is still classified as the employee’s income, even if one of the following conditions is met:

- Payment from profits.

- One-time character.

- Inclusion in the incentive part of remuneration.

Based on this statement, the application of the taxation system is determined.

Insurance premiums are calculated on the same day when the premium is transferred according to accounting. The moment of direct payment to employees does not matter. The issuance of an award order is also not taken into account.

What insurance premiums are charged on the premium and is personal income tax paid on it?

So, what is the taxation of bonuses to employees in 2020-2021, is income tax levied on the bonus?

Since the incentive payment is part of the salary, there is no need to wonder whether bonuses are subject to income tax and insurance premiums. Of course they are taxable! A bonus is part of an employee’s income, and on it, as well as on other components of remuneration, it is necessary to accrue all insurance contributions for compulsory pension, social and medical insurance and withhold personal income tax.

Taxation of bonuses to employees with income tax is carried out taking into account the norms of Chapter. 23 Tax Code of the Russian Federation.

NOTE! Prizes for achievements in the field of education, literature and art, science and technology, and the media according to the list of awards approved by the Government of the Russian Federation (clause 7 of Article 217 of the Tax Code of the Russian Federation) are not subject to personal income tax.

Taxation of 2020-2021 premiums by insurance premiums is subject to the provisions of Sec. 34 of the Tax Code of the Russian Federation and the law “On compulsory social insurance against accidents...” dated July 24, 1998 No. 125-FZ.

According to what rules are bonuses paid to an employee after dismissal taxed, ConsultantPlus experts told:

Get free access to K+ and learn all the nuances.

What payments do not need to be deducted from?

Such payments exist, usually in the following situations:

- If there is a connection with holidays. For example, for a holiday, all staff are given the same amounts. Then it is believed that the results of labor will not be taken into account. The taxation application will depend on the name of the remuneration. For example, if we are talking about gifts, then you do not need to pay taxes. But here they rely on the conditions of Article 574 of the Code of Civil Procedure. This helps to properly document payments.

- Financial assistance at any time, as long as it does not exceed 4,000 rubles per year for each individual employee.

Reference! Such schemes are considered legal and do not violate current legislation. But there is no need to get carried away with transferring money only in the form of gifts. In any case, this will raise additional questions for regulatory authorities.

Is it possible to reduce the amount of personal income tax and premium contributions in 2020-2021?

The Tax Code does not contain provisions allowing employee bonuses and contributions to be tax-free. But if a company employee is awarded a bonus for a significant event or holiday, such as the New Year, then you can arrange it as a gift from the employer. According to paragraph 28 of Art. 217 of the Tax Code of the Russian Federation, gifts totaling 4,000 rubles. per year, are not subject to personal income tax.

In order not to calculate insurance premiums on gifts, they need to be formalized in the form of civil law relations. According to paragraph 4 of Article 420 of the Tax Code, income received by the insured person under a GPC agreement, the subject of which is the transfer of ownership of property, is not subject to insurance premiums. To do this, you must conclude a written donation agreement with the employee in accordance with the provisions of Art. 574 Civil Code of the Russian Federation.

Calculation rules using an example

For example, the second quarter has ended. Management decided to reward employees for their success in trading. 120,000 rubles – the total amount of transfers related to this area.

Contributions are calculated as follows:

- Social payments: the amount is multiplied by 2.9%. Result – 3480 rubles.

- Pension payments require multiplication with 22%. The result is 26,400.

- Medical payments at a rate of 5.1%. They pay 6120.

- Injuries with a coefficient of 0.2% of the amount. It turns out 240 rubles.

Typical entries with postings will look like this:

- After settlements with staff for bonus payments - D 70 K 50 (51).

- D 20 (44, 26, 91, 25) K 69 – confirmation that contributions have been transferred.

- D 70 K 68 - this is necessary to record the fact that income tax has been withheld from wages.

- D 20 (44, 26, 91, 25) L 70 – so that the report makes it clear that the bonus has been awarded.

Results

Is the salary bonus taxable in 2020-21? Yes, it is taxable! And as part of the remuneration, it is subject not only to personal income tax, but also to all insurance contributions. The source from which the premium is calculated does not matter in this case. If the bonus is unearned, payment of contributions can be avoided.

Sources:

- Tax Code of the Russian Federation

- Labor Code of the Russian Federation

- Civil Code of the Russian Federation

- Federal Law of July 24, 1998 No. 125-FZ “On compulsory social insurance against industrial accidents and occupational diseases”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Important nuances in accounting

There are only some situations where premium contributions are considered legal and justified. For example, employees are paid a one-time remuneration due to the fact that 50 years have passed since the founding of the enterprise. The organization did not pay insurance premiums for the costs incurred. The tax office assessed additional contributions because it considered such a decision to be unfounded. The management did not agree and filed a lawsuit.

After studying the case materials, the following circumstances were established:

- Payments applied only to current employees. She was not associated with former subordinates and those who were on maternity leave.

- In the order, the directors determined the size of the bonus separately. The determining factors for the result were the quality and quantity of work performed, and the qualifications of the subordinate.

- The anniversary bonus was not mentioned in the collective agreements that were formalized earlier.

Therefore, the court came to the conclusion that the insurance premiums were legal, because the payments were directly related to the results of work. One of the Resolutions directly states that the nature of the premium paid must be taken into account when the court makes an appropriate decision.

It is necessary to look at whether the awards fall within the scope of the following articles of the Labor Code of the Russian Federation:

- 15;

- 16;

- 56;

- 57;

- 129;

- 135;

- 191.

Such amounts are taken into account in expenses when taxing profits, the same applies to calculations with average earnings - for example, when determining vacation payments.

For contributors, risks can be reduced if the following conditions are met:

- Holiday bonuses apply to all employees, not just a specific group.

- The length of service, position, and salary of subordinates do not affect the final figures.

- Employment contracts do not include provisions for bonuses that are not employment benefits.

Important! The amount of gifts is determined on an accrual basis from the beginning of the year; this rule is applied for each employee. Sometimes in a household, gifts become part of the salary. Then, refusing to apply insurance premiums can be a risky decision. You need to carefully look at who and for what reason gifts are given, especially if it concerns valuable things.

Are there any specifics to taxes on bonuses that are paid from net profit?

Is a 2020–2021 bonus paid to an employee out of net profit, for example, on a holiday, taxable or not?

As income received by the employee, any bonuses are subject to personal income tax, and this tax must be withheld from the employee’s bonus. The source of the premium payment in this case does not matter.

Are premiums subject to insurance premiums when paid out of net profit?

Here the emphasis should be placed not on the source of funding for the bonus, but on its connection with wages. If the bonus is a labor bonus, then there can be no questions: the contributions are paid. If not, there are two possible points of view.

Officials believe that contributions for such a bonus should also be calculated (clause 1 of Article 420 of the Tax Code of the Russian Federation and clause 1 of Article 20.1 of Law No. 125-FZ dated July 24, 1998, letter of the Ministry of Finance dated October 25, 2018 No. 03-15-06/ 76608). For income tax purposes, these contributions can be taken into account in full as expenses that reduce the profit base (subclause 49, clause 1, article 264 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated April 2, 2010 No. 03-03-06/1/220 ).

The courts are against contributions from bonuses that are not of a labor nature.

Read more about this here.

OSNO and UTII

Payers of UTII have the right to decide to allocate the funds remaining after paying the single tax to pay bonuses.

If an organization pays UTII, the accrual and payment of any bonuses will not affect the calculation of the single tax. This is due to the fact that UTII is calculated based on imputed income (clauses 1 and 2 of Article 346.29 of the Tax Code of the Russian Federation).

Let’s say a bonus is awarded to an employee who is simultaneously engaged in the activities of an organization on the general taxation system and in activities subject to UTII. The bonus itself will not affect your tax liability in any way. After all, when calculating income tax, this payment is not taken into account. Premiums paid also do not affect the amount of UTII.

At the same time, insurance premiums that are accrued from bonuses to employees engaged in the organization’s activities on the general taxation system and in activities subject to UTII must be distributed. This is due to the fact that organizations that combine the general tax regime and UTII must keep separate records of income and expenses (clause 9 of Article 274, clause 7 of Article 346.26 of the Tax Code of the Russian Federation).

Insurance premiums that are accrued for bonuses to employees engaged in only one type of activity do not need to be distributed.

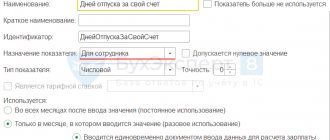

Terms and conditions of bonuses

The procedure for awarding bonuses to employees must be specified in the regulations on remuneration, regulations on bonuses or the collective agreement of the organization.

Read more: How to develop bonus regulations

The accrual itself is formalized by order of the management of the enterprise. The order contains the following data:

- basis of accrual;

- the period for which the payment is made;

- Full name of the employees receiving the bonus;

- accrued amounts.

Conditions for awarding bonuses

There are several official conditions for bonuses for employees:

- Federal Law No. 208. If one of the founders of the organization decides to award a bonus to employees, he makes this decision together with his colleagues.

- Article 129 of the Labor Code of the Russian Federation. The procedure for calculating monetary remuneration must be specified in the employment contract.

- Article 135 of the Labor Code of the Russian Federation. All issues of bonuses for employees must be agreed with the trade union, if there is one at the enterprise

Add bonuses for free and automatically calculate taxes through Kontur.AccountingTry for free

Decision on payment of bonuses

To pay bonuses from retained earnings, the consent of the owners of the organization (founders, shareholders) to such expenditure of profits is required.

This rule applies to both LLCs and joint stock companies (clause 2 of Article 67.1 of the Civil Code of the Russian Federation). The decision to spend retained earnings in an LLC is documented in the minutes of the general meeting of founders. There are no mandatory requirements for the minutes of the general meeting of an LLC in the legislation. But there are details that are better to indicate. This is the number and date of the minutes, place and date of the meeting, agenda items, signatures of the founders.

In a joint stock company, minutes of the general meeting of shareholders are drawn up. The minutes of a joint stock company differ from the minutes of an LLC in that they are drawn up in two copies and have mandatory details. They are listed in paragraph 2 of Article 63 of the Law of December 26, 1995 No. 208-FZ and paragraph 4.29 of the Regulations approved by order of the Federal Financial Markets Service of Russia dated February 2, 2012 No. 12-6/pz-n.

In an LLC (consisting of one participant) and in a joint stock company (where all voting shares belong to one shareholder), the protocol is not drawn up (Article 39 of the Law of February 8, 1998 No. 14-FZ, paragraph 3 of Article 47 of the Law of December 26 1995 No. 208-FZ). In this case, the participant (shareholder) draws up a written decision to allocate net profit to pay bonuses.

Documenting

The basis for calculating a bonus is an order from the head of the organization to reward an employee (Form No. T-11) or a group of employees (Form No. T-11a). The employee (employees) must be familiarized with the order against signature (Section 1 of the instructions approved by Resolution of the State Statistics Committee of Russia dated January 5, 2004 No. 1).

Instead of standard forms of bonus orders, you can use independently developed forms of such documents (provided that they contain all the necessary details provided for in Part 2 of Article 9 of the Law of December 6, 2011 No. 402-FZ).

This procedure follows from Part 4 of Article 9 of the Law of December 6, 2011 No. 402-FZ and is confirmed by the letter of Rostrud of February 14, 2013 No. PG/1487-6-1.

Payment of bonuses from the cash register can be made:

- according to payroll or payroll (according to forms No. T‑49 or No. T‑53);

- according to an expense cash order (according to form No. KO-2).

This is stated in paragraph 6 of Bank of Russia Directive No. 3210-U dated March 11, 2014.

Tax rates

Russian tax legislation provides for various types of fees for both residents of the Russian Federation and non-residents. At the same time, the bet sizes also differ and depend on the type of income. The most common value used to calculate taxes for residents is 13% of the amount of income received from the sale of property or in the form of wages. The same rate is applied when withholding income tax on the amount of regular bonuses allocated from the cost part of the organization’s finances, as well as one-time payments from profits dedicated to an important date or special event.

Attention! The type of source of bonus funds does not matter; all cash incentives are subject to an income tax of 13%.

As a rule, personal income tax on income is 13%

For non-residents, 13% is calculated from the following income:

- profits received in the Russian Federation by citizens of other states;

- wages of foreign citizens working in the Russian Federation on the basis of patents;

- income of non-residents who move to the Russian Federation under a program promoting the voluntary resettlement of compatriots;

- income of stateless persons, as well as foreign citizens who have received asylum in the Russian Federation;

- salaries and remunerations of crew members of Russian ships who have citizenship of other states.

There are other rates that are deducted from different types of income. For example, 9% is charged on profits received from bonds, 15% on dividends transferred to individuals from organizations.

Attention! Non-residents must pay 30% of the amount received from the sale of securities to a Russian company.

Some income is subject to different tax percentages

Can an employer reward himself?

The awarding of bonuses to senior management is of a special nature. Rewarding top executives can only be done by business owners, since it is they who ultimately own the net profit. In all other situations, the manager does not have the right to sign an order on his own bonus. Otherwise, such an incident will become a reason for tax proceedings with the almost inevitable recognition of such a monetary transaction as an unjustified tax benefit.

Personal income tax: we determine the date of actual receipt of bonuses

Regarding personal income tax, the main problem is determining the date of actual receipt of income in the form of bonuses for production results. (Note that with non-production bonuses such a problem practically does not arise, since these incentives definitely do not relate to wages, which means that the provisions of paragraph 2 of Article 223 of the Tax Code of the Russian Federation are not applicable to them).

The date of actual receipt of income is important for several reasons. Thus, both personal income tax reporting forms are “tied” to it (calculation 6-NDFL and certificate 2-NDFL), incorrect completion of which threatens the tax agent with a fine of 500 rubles for each such document (clause 1 of Article 126.1 of the Tax Code of the Russian Federation).

Fill out and submit 6‑NDFL and 2‑NDFL for free via the Internet

In addition, the date of actual receipt of income is important when deciding on the provision of “children’s” deductions. If, as a result of an accountant’s mistake, an employee is accrued an excessive amount of deductions, then for the company this may result in a more significant fine in the amount of 20% of untimely withheld personal income tax amounts (Article 123 of the Tax Code of the Russian Federation).

Let us remind you that the right to a “children’s” deduction is retained by the employee only until his income from the beginning of the year exceeds 350,000 rubles (subclause 4, clause 1, article 218 of the Tax Code of the Russian Federation). And according to paragraph 3 of Article 226 of the Tax Code of the Russian Federation, the calculation of personal income tax amounts is carried out by tax agents on the date of actual receipt of income, determined in accordance with Article 223 of the Tax Code of the Russian Federation. The inclusion of income in the tax base for the purposes of calculating the amount of personal income tax is also carried out taking into account the provisions of Article 223 of the Tax Code of the Russian Federation (clause 3 of Article 225 of the Tax Code of the Russian Federation). This means that the amount of income for the purposes of applying the provisions of subparagraph 4 of paragraph 1 of Article 218 of the Tax Code of the Russian Federation should also be determined on the basis of Article 223 of the Tax Code of the Russian Federation.

Calculate your salary and personal income tax with standard deductions for free in the web service

So, let's look at the rules for determining the date of actual receipt of bonus payments. Let us note that recently the regulatory authorities have apparently managed to come to some kind of consensus on this issue. The rules are as follows.

- Non-production bonuses for the purposes of calculating personal income tax are considered to be actually received on the day of payment (transfer) of funds. That is, these payments are subject to the rules of subparagraph 1 of paragraph 1 of Article 223 of the Tax Code of the Russian Federation.

- The same rule of subclause 1 of clause 1 of Article 223 of the Tax Code of the Russian Federation applies to production bonuses (both bonuses that are part of the salary and incentive bonuses), which are paid for production results determined over a period of time exceeding one month (i.e. for a quarter, half a year, year, etc.). In these cases, the date of actual receipt of income will be considered the day of payment (transfer) of the relevant funds. This conclusion is contained in letters from the Ministry of Finance of Russia dated October 23, 2017 No. 03-04-06/69115 and dated September 29, 2017 No. 03-04-07/63400 (see “The Ministry of Finance spoke on how to determine the date of receipt of income in the form of an annual bonus "). A similar approach is followed by the Federal Tax Service of Russia (letters dated October 6, 2017 No. GD-4-11/20217 and dated October 26, 2017 No. GD-4-11/217685, see “Annual bonus in 6-NDFL: tax authorities reminded how to determine date of actual receipt of income").

- As for monthly production bonuses (both bonuses that are part of the salary and incentive bonuses), a different principle applies to these payments: they, like salaries, are considered received on the last day of the corresponding month. Such clarifications are given in the letter of the Ministry of Finance of Russia dated 04.04.17 No. 03-04-07/19708 (see “The Ministry of Finance announced which day is recognized as the date of receipt of income in the form of a bonus for the purpose of paying personal income tax”) and the letter of the Federal Tax Service of Russia dated 14.09.17 No. BS-4-11/18391 (see “Explained how to fill out 6-NDFL if the bonus based on monthly performance is paid in the next reporting period”).

Based on these rules, it turns out that an accrued but unpaid monthly bonus increases the taxpayer’s income in the month based on the results of work in which the accrual occurred, and in the same month should be reflected in the 2-NDFL certificate and section 1 of the 6-NDFL calculation. This means that if, taking into account such a bonus, an employee’s income from the beginning of the year exceeds 350,000 rubles, then for the current month he is no longer entitled to a “children’s” deduction. Moreover, even if the bonus is actually paid later.

But all other bonuses (production bonuses based on work results for periods exceeding one month, as well as non-production bonuses) increase the employee’s income and are reflected in personal income tax reporting only in the month of actual payment of money. This means that, for example, an employee with a salary of 65,000 rubles, to whom an annual bonus in the amount of 250,000 rubles was accrued in February, but will actually be paid only in June, will be able to receive “children’s” deductions until May.