The next financial year is nearing its end, which means that reporting for the 4th quarter and 2021 for legal entities is just around the corner. This period is the most crucial for the company’s accountant, since reporting for the 4th quarter of 2021, due to the peculiarities of accounting for many reports, is formed incrementally from the beginning of the year and automatically becomes annual financial reporting, the indicators of which play a very significant role for many users. In addition to the reliability of the data in the generated reporting of the enterprise, it is important to remember the timing of its submission to the regulatory authorities. Our publication will remind you of them.

BASIC

As before, the most labor-intensive reporting can be considered reporting under the general taxation system. An accountant who services companies on OSNO will have to submit more than a dozen different reports in 2021, including:

1. Tax returns for:

- VAT;

- arrived;

- property;

- transport;

- earth.

2. Reporting to extra-budgetary funds:

- 4-FSS;

- confirmation of the main type of activity;

- SZV-M;

- SZV-experience.

3. Other reporting to the Federal Tax Service:

- calculation of insurance premiums;

- information on the average number of employees;

- 2-NDFL;

- 3-NDFL;

- 6-NDFL;

- financial statements (balance sheet and appendices thereto).

Results of the 4th quarter: new forms, reporting deadlines and payments

The year ends with the fourth quarter.

Therefore, at the end of the 4th quarter of 2021, we have to submit both quarterly and annual reports. Among them there are new ones, including those that have changed significantly. That's why we suggest you create a plan for your reporting campaign and get acquainted with the innovations now. Read more about taxes with quarterly reporting here.

And in this article we told you everything about when taxes for the 4th quarter need to be paid.

You can find out who calculates advance payments in the 4th quarter and how here.

And then we will tell you where to find comments from our experts on types of reporting:

- for general regime residents;

- for special regime workers;

- on personnel;

- on property and other taxes.

VAT declaration

Persons on OSNO submit VAT once a quarter (Article 174 of the Tax Code of the Russian Federation). In this case, the tax payment can be divided into three parts and paid once a month (Clause 1, Article 174 of the Tax Code of the Russian Federation). We recommend that you fill out the declaration thoughtfully, reflecting only reliable documents. To avoid problems, we advise you to check incoming and outgoing invoices with counterparties before submitting the declaration. If your supplier does not reflect VAT, and you accept it for offset, the Federal Tax Service will send a demand.

In 2021, law-abiding taxpayers must submit a VAT return in accordance with the norms of the Tax Code of the Russian Federation within the following deadlines:

- until January 27 inclusive - for the 4th quarter of 2021;

- until April 27 inclusive - for the 1st quarter of 2021;

- until July 27 inclusive - for the 2nd quarter of 2021;

- until October 26 inclusive - for the 3rd quarter of 2021.

For the last quarter of 2021, the VAT return must be submitted no later than January 25, 2021.

The above dates take into account the transfer. For example, the deadline for submitting the declaration for the last quarter of 2021 falls on Saturday. Thanks to this, the accountant has a couple of extra days to prepare the report.

The majority of companies report VAT electronically. Certain categories of VAT payers have the right to submit a paper declaration (clause 5 of Article 174 of the Tax Code of the Russian Federation).

In addition to the declaration, the Tax Code provides for the submission of a log of received and issued invoices. But only a few categories of taxpayers hand over this magazine. Check the need to submit the invoice journal in clause 5.2 of Art. 174 Tax Code of the Russian Federation. If the law requires you to submit a Federal Tax Service journal, this must be done before the 20th day of the month following the expired tax period. The journal has only one form of submission – electronic.

What reports do special regime officers submit and what do they pay?

Our special modes include:

- UTII;

- simplified tax system;

- Unified Agricultural Sciences;

- PSN.

Declaration on UTII for the 4th quarter of 2020

The UTII declaration must be submitted according to the form from the order of the Federal Tax Service dated June 26, 2018 No. ММВ-7-3/ [email protected]

The form can be downloaded here.

The deadline for submitting the report is January 20, 2021. The payment deadline for the declaration is 01/25/2021.

Let us remind you that this is the last reporting campaign for UTII. Starting from 2021, the special regime has been cancelled.

If you have not yet decided what to do after canceling UTII, study the opinion of ConsultantPlus experts on this issue. If you do not have access to the K+ system, get a trial online access for free.

See also: “The procedure and deadline for submitting the UTII declaration for the 4th quarter of 2021.”

You will find the procedure and example of filling out the declaration here.

Declaration under the simplified tax system for 2021

For the year, simplifiers report on a general basis. But the reporting deadlines differ: one deadline is set for organizations, and another for individual entrepreneurs.

For more details, see the article “What are the deadlines for submitting a declaration under the simplified tax system?”

You can view and fill out the “simplified” declaration in this article.

And we talked about the deadlines for paying taxes under the simplified tax system for the 4th quarter here.

See also articles:

- “Submission of reports under the simplified tax system for the year - what to submit?”;

- “Declaration under the simplified tax system for the year - how to fill out?”

Declaration on Unified Agricultural Tax for 2021

The next special tax regime is the unified agricultural tax. You will also need to report on it for the past year. When should the declaration be submitted? When should taxes be paid to the budget? Where can I find an example of calculating the Unified Agricultural Tax for the year.

Find answers to these and some other questions in this article.

PSN for the 4th quarter of 2020

does not provide for its own reporting on the special regime .

But it is not possible to do without reporting completely.

This article describes in detail what kind of reporting an individual entrepreneur has on PSN.

Income tax return

In fact, income tax is calculated and reported once a quarter. Since the profit tax is considered a cumulative total, the reporting will not be quarterly, but for the first quarter, half a year, 9 months and a year (Article 285 of the Tax Code of the Russian Federation). During reporting periods, advance payments are made, and at the end of the year, the taxpayer sends to the treasury a tax reduced by previously paid advances (Article 287 of the Tax Code of the Russian Federation). There is no need to pay tax at all if the organization operates at a loss.

In 2021, the same deadlines for sending the declaration have been retained (Article 289 of the Tax Code of the Russian Federation):

- until March 30 inclusive - for 2021;

- until April 28 inclusive - for the 1st quarter of 2021;

- until July 28 inclusive - for the 1st half of 2021;

- until October 28 inclusive - for 9 months of 2021.

But reporting for 2021 should be submitted no later than March 29, 2021 (provided that the legislator does not change the deadlines for annual reporting).

The frequency of advance payments directly depends on the company’s income. When the average income for the quarter exceeds 15 million rubles, you should report and pay advances every month (clause 3 of Article 286, Article 287 of the Tax Code of the Russian Federation).

The profit declaration must be submitted electronically if the company employs more than 100 people. In other cases, it is permissible to report on paper (clause 3 of Article 80 of the Tax Code of the Russian Federation).

Individual entrepreneurs do not submit income tax returns. Entrepreneurs are assigned a separate form - 3-NDFL. For 2021, these reports must be submitted by 04/30/2020.

Reporting to funds

Despite the reform in insurance coverage, the procedure for submitting reports to extra-budgetary funds has been partially preserved. You will have to submit information to the Social Insurance Fund about calculated contributions for injuries on employee salaries. Report to the Pension Fund about the length of service and the number of insured persons.

Calculation 4-FSS

The form is fixed by order of the Social Insurance Fund dated September 26, 2016 No. 381.

Please note that the deadline for submitting calculations to the Social Insurance Fund directly depends on the method of data submission.

Report electronically:

- I quarter 2021 - 04/27/2020;

- half year 2021 - 07/27/2020;

- 9 months 2021 - 10/26/2020;

- 2020 - 01/25/2021.

You submit 4-FSS on paper:

- I quarter 2021 - 04/20/2020;

- half year 2021 - 07/20/2020;

- 9 months 2021 - 10/20/2020;

- 2020 - 01/20/2021.

The method of provision is determined by the average number of employees:

- up to 25 people - allowed on paper or electronically;

- 25 or more employees - only in electronic format.

Instructions for filling out: Sample of filling out form 4-FSS in 2020.

Fines: 5% of the amount of insurance coverage payable for each full or partial month of delay. No more than 30%, but not less than 1000 rubles. Officials - a fine under Art. 15.33 Code of Administrative Offenses of the Russian Federation - from 300 to 500 rubles.

SZV-M

The form of the monthly form is fixed by the resolution of the Pension Fund of Russia board dated 02/01/2016 No. 83p.

Report by the 15th day of the month following the reporting month:

- January 2021 - 02/17/2020;

- February 2021 - 03/16/2020;

- March 2021 - 04/15/2020;

- April 2021 - 05/15/2020;

- May 2021 - 06/15/2020;

- June 2021 - 07/15/2020;

- July 2021 - 08/17/2020;

- August 2021 - 09/15/2020;

- September 2021 - 10/15/2020;

- October 2021 - 11/16/2020;

- November 2021 - 12/15/2020;

- December 2021 - 01/15/2021.

It is allowed to submit reports earlier than the deadline, but only if verified information is available.

If the reporting form includes information about 25 employees or more, then report only electronically. Other policyholders have the right to report on paper.

Instructions for filling out: Reporting SZV-M: step-by-step instructions for filling out.

New SZV-TD

The report in the SZV-TD form is a new electronic book, the transition to which began in the summer. Not all policyholders report, but only those whose staff has undergone personnel changes. The grounds for filling out and submitting the SZV-TD include:

- conclusion of a new employment contract;

- termination of an employment contract or agreement with an employee;

- assignment of qualifications, transfer to another job, other personnel changes that require reflection in the work book;

- submission by an employee of an application to choose the method of maintaining a work record in 2021 and subsequent years.

Rules for drawing up a new pension report are in the article “How to fill out a new monthly SZV-TD report.” Submit reports to the Pension Fund on a monthly basis. The timing coincides with SZV-M. Submit information for generating electronic work books by the 15th day of the month following the reporting month.

SZV-STAZH

Enshrined in Resolution of the Board of the Pension Fund of January 11, 2017 No. 3p.

The report is submitted annually, before March 1 of the year following the reporting year:

- for 2021 - 03/02/2020;

- 2020 - 03/01/2021.

Instructions for filling out: Fill out and submit the SZV-STAZH form to the Pension Fund of Russia.

Responsibility for failure to submit SZV-M, SZV-TD and SZV-STAZH is 500 rubles for each employee. The fine for officials is similar - from 300 to 500 rubles (Article 15.33 of the Code of Administrative Offenses of the Russian Federation).

If the due date falls on a holiday or weekend, then reports are submitted on the first working day.

Form 4-FSS

The report is filled out by those firms and entrepreneurs who have employees.

Due dates:

- until January 20 inclusive (on paper) and until January 27 inclusive (electronically) - for 2021;

- until April 20 inclusive (on paper) and until April 27 inclusive (electronically) - for the first quarter of 2021;

- until July 20 inclusive (on paper) and until July 27 inclusive (electronically) - for the first half of 2021;

- until October 20 inclusive (on paper) and until October 26 inclusive (electronically) - for 9 months of 2021.

All dates are subject to postponement due to weekends.

How many months are there in a quarter?

This term should not be confused with another similar concept “season”. After all, it is also equal to the fourth part of the calendar year. There are as many months in a quarter as there are in a season. But, unlike a season, which denotes 3 months of one season (spring, summer, winter and autumn seasons), a quarter is three months in order, one after another, not taking into account the time of year.

The beginning of the quarter count is the new calendar year. So, for example, the first quarter of the year consists of January, February and March - two months of winter and one of spring. And the first season - winter, begins a month before the onset of the new calendar year - in December and consists of three winter months. It is worth noting that not a single quarter coincides with the season.

An interesting fact: in the old days, the Slavs counted the New Year from the first month of spring - March. If a similar time calculation were used today, the quarter of the year and the season of the year would chronologically coincide completely and, perhaps, one of these concepts would be abolished.

Confirmation of main activity

Different companies conduct different types of activities: some sell equipment, others rent out space, and others engage in cargo transportation. Each type of activity has its own risk class. The rate of insurance premiums against accidents depends on this class. Once a year, companies must submit a certificate indicating the predominant type of activity (Order of the Ministry of Health and Social Development of the Russian Federation dated January 31, 2006 No. 55).

Information should be sent to the Social Insurance Fund before April 15, 2020 inclusive. The report is considered submitted if the policyholder sends an application, a certificate confirming the main type of economic activity (indicating the necessary parameters), and a copy of the explanatory note to the balance sheet for 2021. Individual entrepreneurs do not report on this form, and small businesses submit an application and certificate without an explanatory note.

Declaration on property tax of organizations

If an organization owns property (real estate) as an owner, it is obliged to submit a corresponding declaration and pay tax.

The main innovation regarding property tax is that from 2020, tax calculations for advance payments have been cancelled. Now organizations submit only declarations. The declaration form has changed.

The property declaration for 2021 must be submitted by March 30, 2020 (Article 386 of the Tax Code of the Russian Federation).

An electronic declaration is sent to the Federal Tax Service of companies with more than 100 employees (clause 3 of Article 80 of the Tax Code of the Russian Federation).

Individual entrepreneurs pay property tax as an individual; they do not submit reports.

When to submit a balance sheet if the reporting period is shortened or extended

Typically the reporting period is one year. During this time, you need to draw up a balance sheet and submit it to all authorities within the established time frame.

But you can register and start working from any date within the calendar year, and then the reporting period will be shorter than traditional. At the same time, the deadline for preparing the balance sheet is usual: within 3 months after the end of the reporting period.

Another case is the liquidation of a company. For such a company, the reporting period ends with the date of entry into the Unified State Register of Legal Entities on liquidation (Article 17 of Law No. 402-FZ), and the same 3-month period applies for the preparation and submission of reports.

For more information about where the liquidation balance sheet is submitted, read the material . ”

An extended reporting period occurs when the decision to start a business is made at the end of the year and registration occurs after September 30 (for example, in October 2021). Then, according to paragraph 3 of Art. 15 of Law No. 402-FZ, the reporting period increases and lasts from October 1, 2021 to December 31, 2021. Such an increase does not affect the deadline established by law for submitting the balance sheet.

Transport tax declaration

For vehicles registered with the State Traffic Safety Inspectorate, a declaration must be submitted once a year (Article 357 of the Tax Code of the Russian Federation).

For 2021, you must report before 02/03/2020 inclusive (Article 363.1 of the Tax Code of the Russian Federation). The deadline is specified taking into account the transfer of the reporting date from a weekend to a working day.

Despite the fact that the declaration is submitted once a year, regions, by their decision, have the right to additionally introduce quarterly advance payments (Article 363 of the Tax Code of the Russian Federation).

Small companies of up to 100 people can take advantage of the legal right and submit a paper declaration; larger enterprises submit it only electronically (clause 3 of Article 80 of the Tax Code of the Russian Federation).

Individual entrepreneurs do not submit transport tax returns.

What it is?

The term “quarter” itself came from the Latin language through the mediation of German and is literally translated as “quarter”. Thus, from the very name of this period of time one can understand that a quarter is the fourth part of the year. That is, there are only four quarters in a year, which are designated by Latin numerals from one to four.

In English-speaking countries, the numbering of blocks is identical to Russian, but their graphic designation is different - using Arabic numerals, each of which is preceded by the Latin letter “Q”.

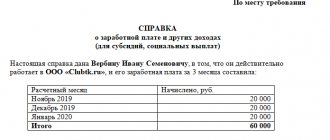

Reporting income of individuals

Once a quarter, form 6-NDFL is submitted to the Federal Tax Service (Clause 2 of Article 230 of the Tax Code of the Russian Federation):

- until March 2 inclusive - for 2021;

- until April 30 inclusive - for the 1st quarter of 2021;

- until July 31 inclusive - for the 1st half of 2021;

- until November 2 inclusive (the deadline is shifted due to weekends) - for 9 months of 2021.

Please note that in Art. 230 of the Tax Code of the Russian Federation has been amended and the report for 2021 must be submitted a month earlier.

When preparing the 6-NDFL report, you should be guided by the norms of Chapter 23 of the Tax Code of the Russian Federation and correctly indicate the deadlines.

In addition, for 2021, do not forget to submit the 2-NDFL certificate before 03/02/2020 (Federal Law dated 09/29/2019 No. 325-FZ).

Both personal income tax reports can be submitted in paper form only if the number limit is observed - no more than 10 people. When there are more than 10 persons who received income, reporting is sent exclusively in electronic form (number criteria changed from 01/01/2020, previously the number limit was 25 people).

Financial statements

Companies disclose information about their financial condition, debt, reserves, and capital in their annual financial statements. A copy of such reporting must be submitted to the Federal Tax Service. Starting from 2020, there is no need to submit financial statements to Rosstat (Federal Law No. 444-FZ dated November 28, 2018).

As part of the reporting, you can find a balance sheet, a statement of financial results and separate appendices to them (clause 1 of article 14 of the Federal Law of December 6, 2011 No. 402-FZ). For small businesses, there are simplified reporting forms that allow you not to detail the presented indicators.

For 2021, reports must be submitted by March 31, 2020 (clause 5, clause 1, article 23 of the Tax Code of the Russian Federation, clause 2, article 18 of the Federal Law of December 6, 2011 No. 402-FZ).

simplified tax system

Experienced accountants know that working with the simplified tax system is much easier. And all because simplifiers do not pay the most difficult taxes to calculate: VAT, income tax and property tax. Only in exceptional cases can simplifiers become payers of these taxes (clause 2 of Article 346.11 of the Tax Code of the Russian Federation).

All workers and employees must submit data on insurance premiums. This means that they, just like companies on OSNO, will submit insurance premium payments to the Federal Tax Service in 2020.

Simplified workers also submit to the Federal Tax Service information on the average number of employees, accounting statements and income reports of employees and other individuals. persons according to forms 2-NDFL and 6-NDFL.

Land and transport taxes are paid by those companies that have these taxable objects.

The deadlines for mandatory reporting have already been given above for the general regime.

A specific report in this case is the annual declaration under the simplified tax system.

In order to meet the deadlines, companies must send taxes for 2021 to the inspectorate’s bank account and declare their activities by 03/31/2020 (Article 346.23 of the Tax Code of the Russian Federation), and individual entrepreneurs by 04/30/2020 inclusive.

Simplified tax advances are transferred to the account of the Federal Tax Service (Clause 7, Article 346.21 of the Tax Code of the Russian Federation):

- until April 27 inclusive - for the 1st quarter of 2021;

- until July 27 inclusive - for the 1st half of 2021;

- until October 26 inclusive - for 9 months of 2021.

UTII

It is easier for companies and individual entrepreneurs to maintain tax records in this special regime, because the legislation allows them not to pay a number of taxes: on profit, on property and VAT (clause 4 of Article 346.26 of the Tax Code of the Russian Federation). Other taxes are paid on a general basis.

In addition to standard reports (see the list in the example about OSNO), impostors fill out a UTII declaration and send it to the Federal Tax Service:

- until January 20 inclusive - for the 4th quarter of 2021;

- until April 20 inclusive - for the 1st quarter of 2021;

- until July 20 inclusive - for the 2nd quarter of 2021;

- until October 20 inclusive - for the 3rd quarter of 2021.

Advance payments are made quarterly by the 25th day of the month following the reporting period.

The company will lose the right to UTII if the number of employees exceeds 100 people (clause 1, clause 2.2, article 346.26 of the Tax Code of the Russian Federation).

Organizations and individual entrepreneurs who employ employees submit orders of magnitude more reports than companies without employees. To avoid getting confused about reporting deadlines, use this reporting calendar.