What is account 19 used for in accounting?

In accordance with the Tax Code of the Russian Federation, business entities in the general regime must include VAT in the cost of products produced, services provided and work performed. It is called output tax.

On the other hand, a business entity is a consumer of products, works and services, in the cost of which their suppliers also included these amounts of mandatory collection. This tax is called input VAT.

Input VAT is subject to exclusion from the cost of purchased material assets, works and services. An organization or individual entrepreneur has the right, when paying its outgoing VAT to the budget, to offset the incoming VAT on received goods, works, and services.

Therefore, incoming VAT is subject to separate reflection in accordance with the Chart of Accounts on account 19. The information collected on this account is of great importance in determining the VAT payable, therefore the indicators reflected on the account are under close attention when carrying out tax audits.

The amounts reflected in account 19 must be included in the tax register, which is called the purchase book. Information is entered into it based on invoices received from suppliers.

This account is also used by entities under the simplified tax system. This is due to the fact that they can also purchase goods, works, and services, the price of which includes input VAT. Since these entities cannot offset the output VAT due to its absence, the accumulated amounts are written off as a separate item in the company’s expenses.

Attention! Business entities in special regimes have the right not to use account 19. However, it must be remembered that there is a possibility for them of violating the conditions for using the special regime and losing the right to use it.

After such an event, it is necessary to recalculate all taxes, including VAT. Failure to use account 19 in such a situation will lead to the re-posting of all received documents with the allocation of tax.

When determining what is reflected in the debit and credit of this account, you need to remember that VAT may be reflected here on advance amounts listed to suppliers.

If an organization or individual entrepreneur simultaneously applies several taxation systems, for example OSNO and UTII, then it must organize separate accounting of VAT amounts on purchased goods, works and services that belong to different regimes on account 19.

Attention! Thus, activities that fall under VAT and without VAT can be carried out at the same time. Tax on non-taxable transactions cannot be claimed as a deduction, but must be included in the cost of the acquired assets.

Results

Thus, posting Dt 19 Kt 60 is applied in all cases when VAT is present in the supplier’s documents as a component of the price of the goods. The use of operation Dt 19 Kt 60 has its own nuances, since shipment does not always take place without violations on the part of the seller: the actual quality may differ from what is provided for in the documents.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Account characteristics

To answer the question which account 19 is active or passive, you need to know where it is reflected in the balance sheet.

You might be interested in:

Write-off of receivables in an organization with an expired statute of limitations: procedure

Since the account reflects the amount of VAT paid upon acquisition, it is reflected in the balance sheet as part of inventories and costs, which are reflected in the active part of the above report. Therefore, according to the Chart of Accounts, account 19 is active, which has a balance reflected in the debit of the account.

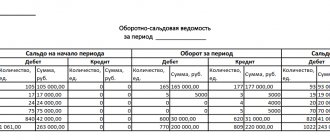

Let's take a closer look at what is accounted for in this account. The debit of the account reflects the amount of VAT paid on purchased goods, works, and services. For the credit of account 19, it is necessary to take into account the write-off of previously recorded VAT either on account of the output tax, or in special modes its inclusion in expenses.

The balance at the end of the month is determined based on the following rule. The turnover on the debit of the account should be added to the initial balance and the amount of VAT passed on the credit of account 19 should be subtracted.

Attention! As a rule, account 19 is closed at the time of writing off material assets in production, transferring them into operation, etc.

The account balance at the end of the year is to be reflected in the balance sheet. For this, line 1220 is used. If the requirements of tax legislation are met, this amount can be included in the VAT deduction in the next period.

Decor

When selling work, goods, or services, in addition to their actual cost, the buyer must pay VAT to the seller at the established rate. The latter must issue an invoice to the purchaser for its amount within five days. The calculation of the period begins from the date of shipment of products or provision of services/performance of work. In the settlement documentation and invoices of the supplier, VAT must be highlighted as a separate line. If transactions involving the sale of any services, products, or works are not subject to taxation or the seller is exempt from the obligation to pay tax, paperwork is completed without allocating it.

In this case, the payment documents must contain a corresponding entry “excluding VAT”. In the process of selling work, products or services to the public for cash, the requirements for drawing up documents and issuing invoices will be considered fulfilled if the seller has handed over a cash receipt to the buyer. He may submit other supporting paper in the prescribed form.

What subaccounts are used?

The chart of accounts recommends opening the following subaccounts for account 19:

- 19 subaccount 1 - VAT on acquired fixed assets;

- 19 subaccount 2 – VAT on acquired intangible assets;

- 19 subaccount 3 – VAT on purchased inventories.

By analogy, if necessary, an accountant can also open additional sub-accounts:

- 19 subaccount 4 – VAT on services received;

- 19 subaccount 5 - VAT transferred when importing goods into the territory of the Russian Federation from abroad;

- 19 subaccount 6 – VAT on goods at a rate of 0%;

- 19 subaccount 7 – VAT on the construction of non-current assets;

- 19 subaccount 8 - VAT on a decrease in sales value;

- 19 subaccount 9 – VAT on imports of goods from the countries of the Customs Union

- and many others.

Attention! All additional sub-accounts used by the organization must be assigned to the working Chart of Accounts.

Account correspondence

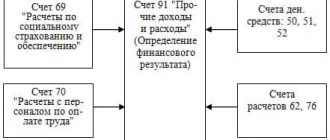

Account 19 can participate in transactions with the following accounts.

Based on the debit of account 19, entries can be made to the credit of accounts:

- Account 60 - when accepting incoming VAT from a supplier for accounting;

- Account 76 - when accepting input VAT on other transactions that are not reflected in account 60.

Using the credit of the account, he can generate transactions with the debit of the following accounts:

- Account 08 - when writing off the amount of VAT that is not reimbursed from the budget for the costs of preparing a non-current asset for operation;

- Account 20 - when writing off the amount of VAT that is not reimbursed from the budget for the costs of main production;

- Account 23 - when writing off the amount of VAT that is not reimbursed from the budget for the costs of auxiliary production;

- Account 25 - when writing off the amount of VAT that is not reimbursed from the budget, general production costs;

- Account 26 – when writing off the amount of VAT that is not reimbursed from the budget for administrative (general business) costs;

- Account 29 – when writing off the amount of VAT that is not reimbursed from the budget for the costs of service and subsidiary farms;

- Account 44 – when writing off the amount of VAT that is not reimbursed from the budget for the costs of preparing goods for sale;

- Account 68 - when carrying out an offset with the output VAT tax;

- Account 91 - when writing off the amount of VAT that is not reimbursed from the budget, other expenses of the organization;

- Account 94 - when writing off the amount of VAT related to inventories that were recognized as a shortage, damaged, etc.;

- Account 99 - when writing off the amount of VAT related to inventories that were lost due to emergency events.

You might be interested in:

Account 60 “Settlements with suppliers and contractors” in accounting: what it is intended for, characteristics, postings

Posting examples

Let's look at typical situations using count 19.

VAT deduction

| Debit | Credit | Description |

| 41 | 60 | Purchased goods for resale |

| 19 | 60 | Input VAT taken into account |

| 60 | 51 | Payment for goods has been made to the supplier |

| 68/VAT | 19 | The amount of input tax is presented as a deduction |

Write off VAT on the cost of goods

| Debit | Credit | Description |

| 10 | 60 | Materials for production were purchased |

| 19 | 60 | Input VAT taken into account |

| 10 | 19 | The amount of VAT is included in the cost of materials |

Write off VAT on expenses

| Debit | Credit | Description |

| 41 | 60 | Purchased goods from a supplier |

| 19 | 60 | Input VAT taken into account |

| 91 | 19 | The tax amount is written off as other expenses |

Reflection of VAT when adjusting an invoice

| Debit | Credit | Description |

| 41 | 62 | The buyer returned the goods |

| 19 | 62 | Input VAT on returned goods has been taken into account |

| 68/VAT | 19 | Tax amount accepted for deduction |

Learning to enter acquiring transactions (1C: Accounting 8.3, edition 3.0)

2017-06-13T22:31:11+00:00 Today we will learn how to make payments from customers through payment cards (Visa, MasterCard and others).

In another way, such operations are also called acquiring:

Attention! If you do not have the “Payment by payment cards” item, then you need to go to the “Main” section, “Functionality” item and check the “Payment cards” checkbox on the “Bank and cash desk” tab.

In the journal that opens, click the “Create” button:

Naturally, our type of operation is “Retail Revenue”:

Fill in the date and the warehouse field (with the type manual point of sale):

Create a new payment type:

- Payment type: Payment card

- Name: for example, Visa

- Counterparty: our acquiring bank VTB

- Agreement: Acquiring Agreement (you can also specify the number and date)

Don’t forget to also indicate the percentage of the bank’s commission for acquiring services (1%).

It will turn out like this:

We will indicate the payment amount and post the document:

Let's look at the wiring (DtKt button):

That's right:

62.R

(retail buyer)

90.01.1

(revenue) 100,000 (revenue reflected)

57.03

(transfers in transit)

62.Р

(retail buyer) 100,000 (revenue in transit, transfer from the acquiring bank to our current account is expected)

According to the statement dated January 2, the money (except for the commission) was transferred to our bank account.

To reflect the receipt of money, let’s go to the just created document “Payment by payment cards” and create on its basis “Receipt to the current account”:

Please note that the program automatically allocated the bank commission (in this case, 1,000 rubles):

And she attributed it to other expenses (account 91.02):

Let’s go through the document and look at the postings (DtKt button):

That's right:

51

(our current account)

57.03

(transfers in transit) 99,000 (payment less commission credited to our account)

91.02

(other expenses)

57.03

(transfers in transit) 1,000 (expenses for paying the acquiring commission)

By the way, if the revenue was not retail (62.R), but a regular payment from the buyer (a specific counterparty) - we simply should have selected “Payment from the buyer” as the type of transaction and then everywhere instead of 62.R 62.01 would appear indicating the selected by us the buyer (counterparty).

That's all

By the way, for new lessons...

Sincerely, Vladimir Milkin (teacher

Dt 19 Kt 60

- an operation used to reflect VAT allocated by the seller as part of the purchase amount. Proper VAT accounting is very important for an organization, since the Federal Tax Service annually carries out the largest number of audits for this tax and identifies violations.