Account 58 in accounting: features of use

Account 58 is used by enterprises to reflect and analyze the amounts of investments and deposits in bonds, shares, and securities (both other organizations and government ones). When making a deposit, its amount is recorded according to Debit 58, when it is written off - according to Credit 58. Analytical accounting for account 58 is organized in the context of the types of transactions reflected on it (shares, debt loans, deposits, coupon bonds, etc.).

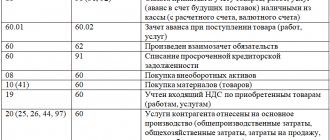

Let's look at typical wiring: (click to expand)

| Debit | Credit | Description | Document |

| 58.2 | 75.1 | Shares were received as the founder’s contribution to the authorized capital | Minutes of the board's decision |

| 58.1 | 98.2 | The cost of shares received free of charge is reflected in deferred income. | Transfer and Acceptance Certificate |

| 76.1 | 58.1 | Insured shares are written off due to compensation received from the insurer | Insurance contract |

| 90.2 | 58.1 | Reflected expenses from shares sold (cost) | Contract of sale |

Read more about the accounts used in the articles: account 76 and account 90 (sales).

Definition and classification of documents giving the right to a share in capital

By this category, experts mean monetary documents that confirm the right to own capital or indicate the nature of the relationship between the owner of the document and its issuer.

The functions of such monetary documents as an object of market relations are as follows:

- mobilization of savings of individuals and free resources of enterprises to cover expenses;

- regulation of money circulation;

- acting as a source of investment designed to create new companies or develop existing ones;

- fulfilling the role of a credit settlement instrument;

- redistribution of funds between industries and sectors of the economy;

- granting the right to capital;

- transfer of rights to manage the company;

- acting as a source of income.

In world practice, all existing financial instruments are divided into basic and derivative financial instruments or derivatives. In the first case, we are talking about documents based on the property right to a certain asset.

If we are talking about derivatives, then in this case we are talking about a non-documentary form of right to property that appears due to a change in the value of the financial instrument that underlies it.

If we take the form of issue as a basis, then we can distinguish issue-grade securities, for example, shares, and non-issue securities, for example, checks and bills.

If we classify documents according to the order of ownership, then we should distinguish between registered, warrant and bearer papers.

In practice, there are many other criteria by which designated monetary settlement documents can be classified.

Account 58: account transactions using examples

In order to clearly understand all aspects of accounting for account 58, we use examples.

Account 58. Operations involving the provision of loans

According to the agreement concluded on August 1, 2015, Spectr JSC provides Etude LLC with a loan on the following terms:

- loan amount – 1,415,300 rubles;

- Refund deadline – November 30, 2015;

- interest on borrowed funds is 28% per annum.

Based on the agreement, the accountant of Spektr JSC recorded the following transactions:

| Debit | Credit | Description | Sum | Document |

| 58.3 | 51 | Funds were transferred to Etude LLC as a loan provided | 1,415,300 rub. | Payment order |

| 76 | 91.1 | The amount of interest accrued on the loan amount to Etude LLC is reflected (RUB 1,415,300 * 28% / 365 days * 122 days) | RUR 132,457 | Loan agreement |

| 51 | 58.3 | Funds have been credited from Etude LLC to repay the debt on a previously provided loan | 1,415,300 rub. | Bank statement |

| 51 | 76 | Funds have been credited from Etude LLC to pay off interest debt | RUR 132,457 | Bank statement |

About account 51 (current account) is written in detail in the article: “Account 50, 51. Accounting for cash and non-cash funds at the enterprise. Postings."

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8000 books purchased |

Account 58. Accounting for bonds with coupon income

Hidden text

- nominal value - 1241 rubles;

- purchase price – 1315 rubles.

The issuer of the bond is Megapolis JSC.

For this bond you must receive two coupon payments, each of which is 15% of the bond's par value (1,240 rubles * 15% = 186 rubles).

The accountant of Stolitsa JSC carried out the following accounting operations:

| Debit | Credit | Description | Sum | Document |

| 58.2 | 51 | Funds were transferred as payment for the purchased bond. The receipt of the purchased bond is taken into account | RUR 1,315 | Payment order, agreement |

| 76 | 58.2 | The write-off of part of the bond value upon receipt of coupon income is reflected ((RUB 1,315 – RUB 1,241) / 2) | 37 rub. | Agreement |

| 76 | 91.1 | The amount of the difference between the coupon income (accrued) and the cost of the bond (written off) is taken into account (186 rubles - 37 rubles) | 149 rub. | Agreement, accounting certificate-calculation |

| 51 | 76 | Funds are credited as coupon income received | 186 rub. | Bank statement |

| 76 | 91.1 | The amount of debt of Megapolis JSC for the redeemed bond is taken into account | RUB 1,241 | Agreement |

| 91.2 | 58.2 | The face value of the bond is written off as expenses | RUB 1,241 | Agreement |

| 51 | 76 | Funds were credited from JSC Megapolis to pay off the debt | RUB 1,241 | Bank statement |

If the agreement provided for the purchase of a bond at a price of 1063 rubles, then the entries in the accounting of JSC Stolitsa would be as follows:

| Debit | Credit | Description | Sum | Document |

| 58.2 | 51 | Funds were transferred as payment for the purchased bond. The receipt of the purchased bond is taken into account | RUB 1,063 | Payment order, agreement |

| 58.2 | 76 | Reflects additional accrual of part of the bond value upon receipt of coupon income ((RUB 1,241 – RUB 1,063) / 2) | 89 rub. | Agreement |

| 76 | 91.1 | The amount of income on the bond is taken into account - coupon income (accrued) and the cost of the bond (additionally accrued) (186 rubles + 89 rubles) | 275 rub. | Agreement, accounting certificate-calculation |

| 51 | 76 | Funds are credited as coupon income received | 186 rub. | Bank statement |

| 76 | 91.1 | The amount of debt of Megapolis JSC for the redeemed bond is taken into account | RUB 1,241 | Agreement |

| 91.2 | 58.2 | The face value of the bond is written off as expenses | RUB 1,241 | Agreement |

| 51 | 76 | Funds were credited from JSC Megapolis to pay off the debt | RUB 1,241 | Bank statement |

Account 58. Placing a foreign currency deposit

On September 12, 2015, an agreement was concluded between Kvartal JSC and Stolichny Bank for the placement of a deposit:

- deposit amount – USD 54,300;

- placement period – 2 months;

- interest rate – 9.5% per annum.

The conventional US dollar exchange rate was:

- as of September 12, 2015 – 61.47 rubles/dollar. USA;

- as of September 30, 2015 – 61.72 rubles/dollar. USA;

- as of 10/31/2015 – 61.66 rubles/dollar. USA;

- as of November 12, 2015 – 61.22 rubles/dollar. USA.

The accountant of Kvartal JSC recorded the following entries in the accounting:

| Debit | Credit | Description | Sum | Document |

| 58 | 52 | Funds were credited to replenish the deposit in foreign currency (USD 54,300 * 61.47) | RUR 3,337,821 | Bank statement |

| 58 | 91.1 | The exchange rate difference (positive) resulting from the revaluation of the deposit as of September 30, 2015 was taken into account ((USD 54,300 * (61.72 – 61.47) | 13.575 rub. | Accounting statement, bank agreement |

| 76 | 91.1 | Income reflected - interest accrued for 09/2015 ($54,300 * 9.5% / 365 days * 19 days * 61.72) | RUR 16,574 | Banking agreement |

| 91.2 | 58 | The exchange rate difference (negative) resulting from the revaluation of the deposit as of 10/31/2015 was taken into account ((USD 54,300 * (61.72 – 61.66) | RUR 3,258 | Accounting statement, bank agreement |

| 91.2 | 76 | The exchange rate difference (negative) resulting from the revaluation of interest for 09/2015 was taken into account ((USD 54,300 * 9.5% / 365 days * 19 days * (61.72 – 61.66) | 16 rub. | Accounting statement, bank agreement |

| 76 | 91.1 | Income reflected - interest accrued for 10/2015 ($54,300 * 9.5% / 365 days * 31 days * 61.66) | RUR 27,014 | Banking agreement |

| 91.2 | 58 | The exchange rate difference (negative) resulting from the revaluation of the deposit as of November 12, 2015 was taken into account ((USD 54,300 * (61.66 – 61.22) | RUR 23,892 | Accounting statement, bank agreement |

| 91.2 | 76 | The exchange rate difference (negative) resulting from the revaluation of interest for 10/2015 was taken into account ((USD 54,300 * 9.5% / 365 days * 31 days * (61.66 – 61.22) | 193 rub. | Accounting statement, bank agreement |

| 76 | 91.1 | Income reflected - interest accrued for 11/2015 ($54,300 * 9.5% / 365 days * 12 days * 61.22) | RUB 10,383 | Banking agreement |

| 52 | 58 | The deposit return amount is reflected - credited to the foreign currency account (USD 54,300 * 61.22) | RUR 3,332,246 | Bank statement |

| 52 | 76 | Funds were credited to the foreign currency account to pay off interest on the deposit (USD 54,300 * 9.5% / 365 days * 62 days * 61.22) | RUB 53,643 | Bank statement |

Account 58. Accounting for transactions with bills of exchange

As of November 1, 2015, the debt of Revansh JSC to the thermal energy supply company Teplovik amounted to 12,954 rubles, VAT 1,976 rubles. In November 2015, Revansh JSC acquired a bill of exchange from Teplovik at a price of RUB 9,340. (nominal value - 12,954 rubles). The promissory note was purchased to pay off the debt of Revansh JSC to the Teplovik company, which was done on November 30, 2015.

The accountant of Revansh JSC made the following entries in the accounting:

| Debit | Credit | Description | Sum | Document |

| 20 | 60 | The cost of thermal energy consumed by Revansh JSC as of 11/01/2015 is taken into account (RUB 12,954 – RUB 1,976) | RUR 10,978 | Acts, receipts |

| 19 | 60 | The amount of VAT is reflected on the cost of consumed thermal energy | RUR 1,976 | Invoice |

| 68 VAT | 19 | VAT is accepted for deduction | RUR 1,976 | Invoice |

| 58 | 51 | The transaction of purchasing a bill of exchange from the company “Teplovik” is reflected. | RUR 9,340 | Agreement |

| 76 | 91.1 | The bill “Teplovik” was presented for payment | RUB 12,954 | Bill of exchange |

| 91.2 | 58 | The accounting (book) value of the bill is written off as expenses | RUR 9,340 | Bill of exchange |

| 60 | 76 | The operation of debt offset between “Revenge” and “Teplovik” is reflected | RUB 12,954 | Bill of exchange |

| 91.9 | 99 | The amount of profit received at the end of November 2015 is taken into account (RUB 12,954 – RUB 9,340) | RUR 3,614 | Turnover balance sheet |

The legislative framework

The legality of all financial transactions carried out by a business entity is regulated by government regulations, orders, recommendations and guidelines on accounting. The balance sheet line “Financial investments” is legally provided for:

- Regulations on accounting audit PBU 19/02, in connection with Order of the Ministry of Finance of the Russian Federation No. 126 dated December 10, 2002 (amended in 2010).

- Federal project on accounting (402-FZ).

- Civil Code of the Russian Federation (both parts).

- Tax Code.

For accurate and legal financial investment, the organization must take into account all the necessary standards provided for in the bills. Regulatory regulation in this system consists of several levels.

The highest is the Decree of the President of the Russian Federation, and the lowest are the instructions and regulations of the enterprise itself in accordance with the industry focus and the amount of profit received.

Reflection methods

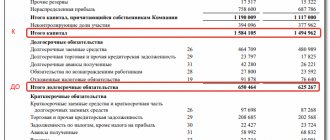

Based on PBU 19/02, financial investments in the balance sheet are reflected in long-term and short-term storage.

Information on the storage of loans is located in section 5. The report fully reflects the movement of the cash fund to receive interest and dividends from the investment procedure, as well as the allocation of cash to pay interest on purchased securities. Details of the accrual of dividends and interest are displayed in the income statement.

Methods for reflecting investments in accounting are determined by the assessment and analysis of cash investments upon disposal by type and method of analysis of economic activity.

Concept and types of securities

A security is a document that certifies the property rights of the holder. Such rights can be exercised and transferred only upon presentation of paper. The main types of securities include:

- stock;

- bills;

- bonds;

- checks;

- privatization papers:

- certificates of deposit.

A security is a document that, on the one hand, is used for financial investments, and on the other, to attract loans.