In this article we consider the issues of filling out and submitting a zero UTII declaration for the 3rd quarter of 2021. Let us remind you that each obligatory payment provided for by the Tax Code has its own taxable base, which is reflected in the declaration. What if there is no base for a particular tax? Then you need to submit a “zero” declaration, or not submit it at all, if, in the absence of a base, the businessman (IP) is not a payer of this tax. But there is a third, special option. It is associated with reporting on the single tax on imputed income (UTII). Let's consider how and in what cases you should fill out a zero UTII declaration for 9 months of 2021 (or rather, for the 3rd quarter, because the tax period for UTII is quarterly).

Features of UTII and zero reporting

UTII is charged on the imputed amount, i.e. predetermined income, without taking into account actual revenue and generally regardless of the conduct of business. The main thing is that the taxpayer, in principle, has the opportunity to conduct business. What is necessary for this is determined by Art. 346.29 Tax Code of the Russian Federation. It lists the so-called “physical indicators” for different types of activities. This could be the number of staff, number of vehicles, retail space, etc.

If a businessman stops or suspends his activities, then, according to officials, he should be deregistered as a UTII payer. Article 346.28 of the Tax Code of the Russian Federation establishes a five-day period for this. If the taxpayer has not submitted such an application, then he must pay UTII based on the physical indicators reflected in the last submitted declaration. This opinion of the regulatory authorities is given in the letter of the Ministry of Finance dated October 24, 2014 No. N 03-11-09/53916.

However, there is a position of the Supreme Arbitration Court that differs from the approach of the Ministry of Finance (clause 9 of the Information Letter of the Supreme Arbitration Court of the Russian Federation No. 157 dated 03/05/2013). According to the judges of the Supreme Arbitration Court, there may be situations when a taxpayer, for objective reasons, is not able to use his assets to generate income:

- The vehicle has been leased to others or is being repaired after an accident.

- Part of the retail space is being renovated.

The letter from YOU refers to situations where an entrepreneur does not use only part of his assets, but continues to work. However, the same approach can be applied to a situation where a “force majeure” situation leads to a complete suspension of activities (for example, if the car involved in the accident was the only one).

The Federal Tax Service of the Russian Federation agreed with the position of the Supreme Arbitration Court in its information posted on the agency’s website on September 19, 2016.

However, the issue remains controversial. It is difficult to predict which explanation will be followed by local tax authorities in each specific case. In order to be guaranteed to avoid claims from tax authorities, in such a situation it is still better to temporarily deregister under UTII, and then (for example, after completion of repairs) re-apply for registration on it.

Next, we will consider how to fill out a zero declaration for those who nevertheless decided to use the explanations of the Supreme Arbitration Court and the Federal Tax Service of the Russian Federation.

Is it possible to submit a zero return?

As you know, many tax regimes require filing a zero return. If an individual entrepreneur using the simplified tax system or an organization using OSNO suffered losses at the end of the year or did not operate within the tax regime, then these business entities file a zero declaration and pay tax in the prescribed manner. In this regard, the question arises: can the “imputed” person file a zero declaration and under what conditions. The legislation gives a clear answer to this question: if you use UTII, then you cannot submit a zero declaration under any circumstances. This is due to the fact that the very concept of UTII assumes that the tax must be paid taking into account the basic (expected) profitability. In other words, when calculating the tax, the actual profit received and expenses incurred are not taken into account, and, therefore, these indicators do not affect the fact of payment/non-payment of tax and its amount.

What should an entrepreneur do in a situation where the activity was not actually carried out? How is reporting submitted and tax paid in this case? We will consider these and other difficult situations with the UTII declaration below.

Individual entrepreneur operates without income

Let’s say an individual entrepreneur or organization applies imputation and at the end of the year receives a loss. If an individual entrepreneur, for example, uses the simplified tax system according to the “income minus expenses” scheme, or the company works on OSNO, then the taxpayer submits a zero return. What should the “imputed” person do?

Since the UTII tax is calculated not on the profit received, but on the basis of the basic profitability, the loss received by the “imputed” entrepreneur does not affect the filing of the declaration and payment of the tax. The declaration is submitted quarterly in the prescribed manner, the amount of tax is indicated based on their estimated (rather than actual) income.

Example No. 1.

IP Skorokhodov K.N. operates in the retail trade of bakery products: in 2021, the entrepreneur opened the Krendel bakery in St. Petersburg and uses UTII. The bakery employs 12 people (10 workers, 1 entrepreneur, 1 accountant). At the end of 2021, the revenue of the Krendel bakery amounted to 1,241,660 rubles, expenses - 1,633,840 rubles, thus, Krendel received a loss of 392,180 rubles. (RUB 1,663,840 – RUB 1,241,660). We will calculate the tax amount and determine the procedure for filing the declaration.

Since Skorokhodov uses “imputation”, the resulting loss is 392,180 rubles. does not affect tax calculation and does not allow filing a zero return. Skorokhodov will have to pay tax based on the following calculation:

4500 rub. * 12 people * 1,798 * 0.2 = 19,418 rubles.

Skorokhodov must submit a quarterly declaration to the Federal Tax Service and pay taxes in the prescribed manner. The data in the declaration must be updated in each reporting period. For example, if in the 3rd quarter of 2021 the number of employees decreased to 10, then such information must be reflected in the declaration, and the tax must be calculated taking into account the new data.

Old or new?

First of all, you need to decide on the form of the report. Today there is a new form of declaration, approved by order of the Federal Tax Service of the Russian Federation dated June 26, 2018 No. ММВ-7-3 / However, this document has not yet been registered with the Ministry of Justice.

Therefore, the tax authorities, in their letter No. SD-4-3/ dated July 25, 2018, reserve taxpayers the right to submit a UTII return for the 3rd quarter of 2021, both in the new form and “in the old way,” i.e. in accordance with the order of the Federal Tax Service of the Russian Federation dated July 4, 2014 No. MMV-7-3/

The essence of the changes to the form is to reflect the application of the new tax deduction. From the beginning of 2021, taxpayers - individual entrepreneurs have the right to reduce the amount of UTII payable on their expenses for the purchase of cash register equipment (clause 2.2 of Article 346.32 of the Tax Code of the Russian Federation).

It would seem that if the declaration is “zero”, then the “cash” deduction will still not be needed, and then what is the point of submitting it using the new form? However, we are talking about a situation where a businessman has temporarily suspended his activities, but intends to carry them on in the future. This means that he will be required to submit reports in the following periods. Therefore, it is advisable to immediately submit a new form, because in the future you will still have to use it.

Therefore, let’s look at the procedure for filling out a “zero” report using the new form as an example, noting its differences from the old one.

A sample of filling out a zero UTII declaration for the 3rd quarter of 2018 can be downloaded here .

Application for deregistration - solution to the problem

The most reliable way to avoid a conflict with regulatory authorities is to submit to the inspectorate, in the absence of activity, an application for deregistration as a UTII payer. Then no declarations will be required - neither zero, nor with accrued taxes.

You can read about how a taxpayer is deregistered in the article “What is the procedure for deregistering a UTII payer who has ceased activity?”

Many letters from officials and judicial acts were issued before 2013, when taxpayers were required to apply UTII if their activities met the criteria of this regime (Chapter 26.3 of the Tax Code of the Russian Federation). But it can be assumed that the conclusions made in these letters and decisions regarding the submission of a non-zero or zero UTII declaration in the absence of activity have not lost their relevance at the present time.

Title page

This section includes general information about the taxpayer and the return itself. Its format and filling procedure have not changed compared to the previous report.

- TIN and checkpoint codes are taken from the certificate issued by the Federal Tax Service. For an entrepreneur, the checkpoint is not completed.

- The adjustment number is indicated in the form “0 – -”, “1 – -” and shows whether changes were made to the report.

- The period for submitting the report is reflected in the fields “Reporting year” (2018) and “Tax period”. The tax period code is taken from Appendix No. 1 to the Procedure for filling out, attached to the letter dated July 25, 2018 No. SD-4-3/ (hereinafter referred to as the Procedure ). For the 3rd quarter, the code “23” is used.

- The Federal Tax Service code, like the Taxpayer Identification Number, is filled out on the basis of the certificate.

- The code for the place of delivery is taken from Appendix 3 to the Procedure. It shows on what basis the report is submitted to this Federal Tax Service (this may be place of residence, registration, business, etc.).

- The code of the reorganization form (from Appendix 2 to the Procedure) and the codes of the reorganized company are filled in only by the legal entity - the legal successor, submitting a report for the reorganized company.

- The contact phone number is indicated without spaces or other “additional” characters.

- The number of sheets of the report itself and supporting documents (if any).

- Confirmation of the accuracy of the report. This block includes the full name, signature of the responsible person and the date of completion. If the report is submitted by a representative, then information about him and the details of the power of attorney are indicated.

- Data on the acceptance of the report is filled out by the tax inspector. They include the filing form, number of sheets, registration number, date, full name and signature of the Federal Tax Service employee.

How and where to submit tax reports

In 2018, the recipient of individual entrepreneurs’ tax returns, including zero ones, remains the Federal Tax Service inspectorate at the entrepreneur’s place of residence.

The place of residence of an individual entrepreneur means the address where he is registered, or, as they say in the old fashioned way, registered. An entrepreneur can actually live and conduct business anywhere, but must send reports to the tax office at his place of registration, even if he has registration at his place of residence somewhere else.

To prepare and submit reports, including zero reports, businessmen often use the services of a specialized organization, which will have to be paid for. Online accounting services (for example, “Elba”, “My Business”, “Deal 24”, etc.) will help you generate declarations, or you can solve this problem entirely on your own.

How to submit zero reporting for individual entrepreneurs yourself

There are three options:

- personally take the documents to the tax office;

- send them there by mail;

- submit via the Internet.

It is necessary to take into account that starting from January 1, 2014, VAT payers (including those who are tax agents) can submit tax returns only electronically via telecommunication channels. The Federal Tax Service has not accepted paper payments for three years now.

When visiting the Federal Tax Service in person, you will need to have a second copy or photocopy of each document submitted. The inspectorate staff will mark them with acceptance.

Instead of an entrepreneur, his authorized representative can submit documents to the Federal Tax Service. To do this, you need to issue a notarized power of attorney for such a person, a copy of which is submitted to the tax office along with the declaration, and reflect the fact of submission of reports by the authorized person in the appropriate section of the title page.

By mail, documents are sent by registered mail with a description of the contents and notification of delivery.

To independently submit documents via the Internet, an entrepreneur will need an electronic digital signature (EDS), which is used to certify each of them, and an individual entrepreneur’s personal account on the government services portal or the website of the Federal Tax Service of Russia.

A “flash drive” with an electronic digital signature relieves entrepreneurs of many problems associated with submitting reports to the Federal Tax Service

Section 1: zero tax payable

This part of the form also “passed over” from the old declaration without changes. It includes information about the amounts of UTII payable to the budget. The section structure includes a number of blocks of lines 010 and 020.

Line 010 reflects the OKTMO code at the place of activity or place of registration.

Line 020 contains the amount of tax payable under this OKTMO code. In this case, it indicates zero.

The indicators of section 1 must be certified by the signature of the responsible person.

Declaration on UTII for the 3rd quarter of 2021: sample of filling out a new form

Valid form (approved)

In order to simply not waste time and effort proving your case in court, it would be more advisable to submit an application to the Federal Tax Service at the place of registration within five days to remove the payer from the imputed tax. When drawing up an application, you should indicate the date of actual termination of the UTII details. by order of the Federal Tax Service of Russia dated July 4, 2014 No. ММВ-7-3/)Title pageBarcode0291 40150291 6019Section 1 “UTI amount subject to payment to the budget”Barcode0291 40220291 6026Page. 010 Code according to OKTMOStr. 020 Amount of UTII payableSection 2 “Calculation of the amount of UTII for certain types of activities”Barcode0291 40390291 6033Page 010Code of type of business activityPage. 020Address of place of business activitiesPage. 030 Code according to OKTMOStr. 040Base profitability per unit of physical indicator per monthPage.

050 Correction coefficient K1Str.

060 Correction coefficient K2Str.

070Tax base in the 1st month of the quarterPage. 080Tax base in the 2nd month of the quarterPage. 090Tax base in the 3rd month of the quarterPage.

100Tax base in totalPage. 105Tax ratePage.

110Amount of calculated UTIISection 3 “Calculation of the amount of UTII for the tax periodBarcode0291 40460291 6040Page. 005Taxpayer signPage.

Section 2: tax and activities

It calculates the amount of tax for each OKTMO or type of activity. It also has not changed compared to the previous declaration form.

- Line 010 contains the activity code. It is selected from Appendix 5 to the Order. For example, for the provision of motor transport services for the transportation of goods, code 05 is indicated.

- Lines 020 and 030 include the address of the activity and the corresponding OKTMO code.

- Line 040 reflects the basic profitability by type of activity (Article 346.29 of the Tax Code of the Russian Federation). For road freight transportation this is 6,000 rubles. for 1 car per month.

- Lines 050 and 060 contain correction factors. Coefficient K1 is a deflator common to all “imputers”. For 2018, it was approved in the amount of 1,868 (Order of the Ministry of Economic Development dated October 30, 2017 No. 579). The K2 coefficient is determined at the local level and takes into account the peculiarities of conducting a specific type of activity in a given region.

- Lines 070 – 090 contain the calculation of the tax base by month, namely:

– Column 2 reflects the size of the physical indicator, i.e. in this case – zero;

– column 4 indicates the tax base, taking into account coefficients K1 and K2, i.e. similarly – zeros are filled in;

– column 3 is used if the businessman was deregistered or registered during the period; in this case, dashes are placed in it.

- Line 100 reflects the tax base for the quarter, i.e. the sum of lines 070-090 in column 4, respectively, also contains a zero indicator.

- Line 105 shows the tax rate in %.

- Line 110 contains the total amount of accrued tax for this OKTMO (type of activity), i.e. in this case - zero.

The procedure for terminating activities on UTII

From all of the above, it is clear that if an entrepreneur decides to cease operations, then this must be formalized. You can't just stop reporting. This will lead to penalties from inspection authorities.

If you decide to no longer conduct activities that fall under the UTII taxation regime, then, according to Art. 346.28 of the Tax Code of the Russian Federation, you must submit an application to the Federal Tax Service. Do this within five days from the date of termination of business activities that fall under this tax regime. The application form was approved by Order of the Federal Tax Service dated December 11, 2012 No. ММВ-7-6/ [email protected]

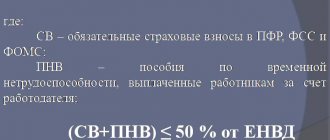

Section 3: Zero Tax Calculation

This part of the report calculates the total tax amount for all OKTMO and types of activities, taking into account deductions. In section 3, line 040 was added in the new form, reflecting the “cash” deduction.

- Line 005 indicates the taxpayer's characteristics. Attribute “1” is assigned if the “imputer” makes payments to individuals. If the taxpayer is an entrepreneur without employees, then characteristic “2” corresponds to him.

- Line 010 reflects the total amount of accrued UTII from all sections 2, i.e. in our case - zero.

- Lines 020 and 030 contain the amounts of insurance premiums and other payments paid for employees and for themselves (for individual entrepreneurs), which reduce the amount of UTII payable. If such payments were made during the period, then they can be indicated in these lines for reference.

- Line 040 reflects the amount of deduction for the purchase of cash registers. It is unlikely that a businessman who has suspended work will buy a new cash register, so in this case we indicate zero.

- Line 050 contains the amount of tax payable, taking into account deductions. Even if lines 020 – 040 contain non-zero indicators, line 050 still needs to be set to zero - the value in it cannot be negative (clause 6, clause 6.1 of the Procedure).

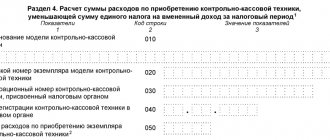

Section 4: deduction by cash register

This section is completely new and was introduced to “decipher” the deduction for cash registers. Each block of lines 010-050 contains information about one cash register:

- Name.

- Factory number.

- Registration number with the Federal Tax Service.

- Registration date.

- Purchase costs (within the established limit of 18,000 rubles per unit of cash register).

In our case, dashes are placed in all lines of the section.

Regulations for submitting reports and sanctions for violation

The procedure for submitting a declaration does not depend on whether it is “zero” or not. Clause 3 of Art. 346.32 of the Tax Code of the Russian Federation establishes that the UTII report must be submitted no later than the 20th day after the end of the tax period. Because 10/20/2018 is a Saturday, then taking into account the rules for postponing deadlines, the UTII declaration for the 3rd quarter of 2021 must be submitted no later than 10/22/2018.

But the fine for violating the deadlines for submitting a “zero” report is applied in a special manner. The point is that Art. 119 of the Tax Code of the Russian Federation connects the amount of the fine with the period of delay and the amount of tax payable specified in the declaration. Because in the “zero” report there is no amount to be paid “by definition”, then for any delay the same minimum fine is applied - 1000 rubles.

Also, additional sanctions may be applied for violating the deadlines for filing a declaration.

Firstly, this is an administrative fine in the amount of 300 to 500 rubles, imposed on responsible persons under Article 15.5 of the Code of Administrative Offenses

Also, the tax authority, if there is a delay of more than 10 days, has the right to block the taxpayer’s accounts (clause 3 of Article 76 of the Tax Code of the Russian Federation). And in this case, the fact that the report is “zero” does not matter.

General rules for filling out reports

Important! Please keep in mind that:

- Each case is unique and individual.

- A thorough study of the issue does not always guarantee a positive outcome. It depends on many factors.

To get the most detailed advice on your issue, you just need to choose any of the options offered:

- Use the online chat in the lower corner of the screen.

- Call: Federal number: +7 (800) 511-86-74

Reports submitted by taxpayers are scanned and automatically entered into a special program. To simplify the program’s recognition of data, tax authorities have made recommendations regarding filling out reporting forms. You need to familiarize yourself with them before filling out a zero declaration for an individual entrepreneur.

These rules are as follows:

- all words are written in capital block letters; if the report is prepared using computer technology, choose the Courier New font (16-18 height);

- amounts are indicated exclusively in full rubles;

- It is advisable to use black paste, but blue (purple) will also work;

- blots and corrections are unacceptable, corrector cannot be used;

- each letter is written in a separate box;

- put dashes in unfilled cells;

- if the amount is zero, then instead of “0” also put a dash “-”;

- The report cannot be flashed.

The zero declaration form for individual entrepreneurs 2021 can be downloaded on our website. Depending on the taxation system, entrepreneurs are provided with:

- declaration according to the simplified tax system;

- UTII declaration;

- OSNO declaration;

- VAT declaration.