Taxes and fees

Natalya Vasilyeva

Certified Tax Advisor

Current as of March 9, 2020

Reporting on UTII is submitted by all impostors once a quarter. In 2021, the declaration form has not changed, but some sections no longer need to be filled out. Let's look at how to fill out a UTII declaration for the 1st quarter of 2021 and what needs to be taken into account when drawing it up.

UTII Declaration 2021: changes

[email protected] is still in effect.

Declaration form for UTII for the 1st quarter of 2021

Despite the fact that there were no amendments, when preparing reports it is necessary to take into account changes in the procedure for accounting for expenses for the purchase of cash registers: from 01/01/2020, tax collectors can no longer reduce the tax on expenses for the purchase of online cash registers.

Let us remind you that individual entrepreneurs who purchased and registered an online cash register before 07/01/2019 had the right to take into account expenses (no more than 18,000 rubles) when calculating the imputed tax. If the amount of expenses was not completely exhausted at one time, it could be transferred to other periods.

From 01/01/2020, the cash register deduction no longer applies. Accordingly, Section 4 no longer needs to be filled out, but it is still included in the reporting.

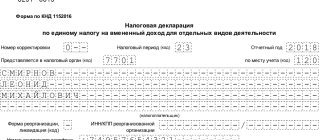

Declaration form

The form was approved by Order of the Federal Tax Service of the Russian Federation No. MMV-7-3 / [email protected] dated June 26, 2018. The same order approved the procedure for filling out the UTII declaration. Compared to the previous version, the report now contains a table for filling out data on the CCP used: based on this data, the individual entrepreneur has the right to reduce the amount of tax. Section 4 looks like this.

from ConsultantPlus

Amounts spent on the purchase of cash registers are included in section 3 - in a specially created field 040.

The document is generated in the form of PDF or TIF files; they are very convenient for filling out and further processing, as they are machine readable. How to submit UTII for the 4th quarter of 2021, if the number of employees exceeds 100 people, exclusively in electronic form via telecommunication channels.

When, where and how is the UTII declaration for the 1st quarter of 2021 submitted?

Reporting on UTII is quarterly. The deadline for submitting it to the Federal Tax Service is until the 20th day of the month following the previous quarter. If the due date falls on a holiday or weekend, it is postponed to the first working day (Clause 7, Article 6.1 of the Tax Code of the Russian Federation).

The UTII declaration for the 1st quarter of 2021 must be submitted to the Federal Tax Service by 04/20/2020.

Delivery methods:

- On paper (in person or through a representative).

If a representative submits the declaration, he must have a notarized power of attorney.

- By mail.

It is better to send reports by mail by registered mail with a list of attachments and acknowledgment of delivery.

- Via TCS through electronic document management operators.

When sending a declaration in this way, it must be signed with an enhanced qualified digital signature. You can learn about what this is from the article “Electronic signature tools - what are they?”

Reporting on UTII is submitted to the Federal Tax Service at the place of business, except for those types of activities that require a traveling nature of the work:

- delivery or distribution retail trade;

- placement of advertising objects on vehicles;

- provision of services for the transportation of passengers and cargo.

When carrying out these types of activities, a report on UTII must be submitted to the Federal Tax Service at the location of the imputed organization or place of residence of the individual entrepreneur.

When to pay tax

It is important for the taxpayer not only to submit reports on time, but also to transfer taxes to the budget on time. The deadline for paying the imputation is the same for all categories of payers - until the 25th day of the month following the expired quarter. If the date falls on Saturday or Sunday, then pay the tax on the first working Monday.

The deadline for tax payment for the 4th quarter of 2021 is 01/25/2021. UTII is no longer paid for 2021.

IMPORTANT!

Taxpayers from among SMEs, whose type of economic activity relates to industries affected by coronavirus, did not pay tax for the 2nd quarter of 2021 (172-FZ dated 06/08/2020). But the UTII declaration for the affected industries was submitted, but with a shift in deadlines. Payment of contributions and reporting for the 3rd and 4th quarters of 2021 are sent to SMEs within the deadlines established by the Tax Code of the Russian Federation.

Filling out the UTII declaration 2021: general requirements

The UTII declaration must be filled out in strict accordance with the requirements given in Appendix No. 3 to Order No. MMV-7-3 / [email protected] :

- Data is entered into the report from left to right from the first acquaintance. Numerical indicators are aligned to the right (when filled out using software).

- When filling out on a computer, you must use the Courier New 16-18 font.

- The data is recorded in printed capital letters, regardless of the method of filling out the declaration.

- If there are no indicators in any line or field, they need to be marked with dashes. This need not be done if the declaration is drawn up in a special program.

- When completing the report by hand, use black ink only.

- Changes cannot be made to the finished report either using special means (putty, proofreader) or by crossing out errors. This is due to the fact that the declaration is checked by a machine, not a person.

- Printing is only allowed on one side.

- You cannot fasten declaration sheets with a stapler or other methods that damage the barcode in the upper corner of the page. It is advisable not to even use paperclips as they can damage the barcode, causing the machine to be unable to “read” the report and causing it to be returned. It is better to submit the declaration to the inspector in a separate file.

- Write down the values of physical indicators in full rubles (discard anything less than 50 kopecks, and round up anything more to the nearest ruble).

Which form to use

The reporting form was changed in 2021. The adjustments are due to the fact that a special deduction was introduced for UTII taxpayers for the purchase of an online cash register. This information was entered into the report structure on a separate page. The form and procedure for filling out the UTII declaration were approved by order of the Federal Tax Service No. ММВ-7-3/ [email protected] dated 06.26.2018. Fill out reports by hand or using specialized programs.

Use the free instructions from ConsultantPlus to correctly fill out or check your UTII declaration.

to read.

Sample UTII declaration 2021 + instructions for filling out

Let's look at the procedure and features of reporting on UTII using an example. The order of filling out the sections is presented in the order in which it is used in practice: Title page, Section 2, Section 3 and Section 1.

Example

The example conditions are presented in the table:

| Taxpayer | LLC "Kadrovik" |

| Kind of activity | Providing repair, maintenance and washing services for motor vehicles |

| Place of business | Voskresensk, Moscow region |

| Data for tax calculation |

|

| Insurance premiums for employees | RUB 84,230 |

Features of paying UTII in 2021

In 2021, benefits were introduced for industries most affected by the spread of COVID-19. Payers of the single tax on imputed income included in the register of small and medium-sized enterprises and working in the most affected industries (the list is given in government decree No. 434 of 04/03/2020) were exempted from paying tax for the 2nd quarter of 2021. According to tax standards, the UTII declaration for the affected industries does not have any special features. It is filled out and submitted according to the usual rules for each quarter of 2021.

ConsultantPlus experts analyzed the deadlines for submitting reports on taxes and contributions in 2021

. Use these instructions for free.

Filling out the Title Page

The title page contains basic information about the imputator:

| TIN and checkpoint | We enter the TIN in accordance with the tax registration certificate. Organizations indicate a 10-digit TIN and KPP. IP - only TIN, consisting of 12 characters. In empty cells, the TIN (for organizations the TIN is 2 digits shorter) and the checkpoint (the individual checkpoint is not filled out) must be filled in with dashes |

| Correction number | |

| Reporting year | We indicate the year for which the declaration is being submitted - 2020 |

| Submitted to the tax authority | We enter the code of the Federal Tax Service to which the report is submitted. You can find it in the registration certificate or on the website of the Federal Tax Service of the Russian Federation |

| By place of registration (code) | We reflect the code of the place of reporting. You can find it in Appendix No. 3 to the Procedure[/cplink]. Organizations in relation to repair, maintenance and washing services for motor vehicles indicate code “214”. Individual entrepreneurs for this type of activity enter code “120”. The rest of the codes can be found here: |

| Taxpayer | Enter the full name of the organization or full name of the individual entrepreneur (line by line, without indicating the status of “Individual”) |

| Contact phone number | We indicate the current phone number in the format: country code - city code - phone number |

| On... application pages... | We enter the number of pages that make up the declaration (4) and the total number of sheets of documents attached to the report (for example, a power of attorney for a representative) |

| Reliability and completeness... | When submitting the declaration in person, enter code “1”; when submitting through a representative, enter code “2.” The lines “Full name” must only be filled in:

The lines “Name of the organization-representative of the taxpayer” are filled in only if the report is submitted for the imputed organization by the representative organization. Representatives enter information about the power of attorney (the word “power of attorney”, number and date of preparation) in the line “Name and details of the document...” |

| Signature and date | If the declaration is submitted by a representative, then his signature is affixed. When submitting the report in person, the imputation officer himself signs. The date of signing the document is also indicated |

How to calculate UTII

Before filling out the declaration, we will analyze the parameters that will be needed for this. Let the conditional individual entrepreneur Nikolaev N.N. from Tambov own a veterinary clinic in his city. It has 6 employees, the average salary is 30,000 rubles. For employees, individual entrepreneurs pay monthly insurance premiums in the amount of 30% of the wage fund. In addition, the entrepreneur transfers contributions for his own insurance - for the entire 2021 this is 40,874 rubles. For the first quarter, individual entrepreneur Nikolaev paid for himself a quarter of all contributions due for the year - 10,219 rubles.

UTII calculation calculator

This is all you need to know about an entrepreneur to calculate the “imputed” tax. The remaining parameters are contained in regulations. You will need the following data:

- a physical indicator (PI) depending on the type of business, for example, the area of a store / the number of car service employees / the number of vehicles carrying out transportation (Article 346.29 of the Tax Code of the Russian Federation). For veterinary activities, this is the number of employees taking into account the entrepreneur, that is, in our example 7.

- basic profitability (BR), that is, the amount of revenue that a unit of physical indicator brings in monthly (also stated in Article 346.29 of the Tax Code of the Russian Federation). For example, the yield of 1 sq. meter of store area, one vehicle. For our example, this is the profitability of one employee, namely 7,500 rubles per person, including the entrepreneur;

- deflator coefficient K1, which is set by the Ministry of Economic Development every year. It reflects the inflation rate. In accordance with order No. 793 dated December 10, 2019, in 2021 K1 is equal to 2.005;

- reduction factor K2. It is established by local authorities to support certain areas of activity. In the example, it is equal to 0.8 - as stated in the decision of the Tambov City Duma dated November 9, 2005 No. 75;

- UTII rate is 15%. It is applied by default. Municipal authorities have the right to reduce it to 7.5%, but this is a rare occurrence.

Based on these data, the tax base is calculated for each month of the quarter using the formula: FP x DB x K1 x K2. Then the calculation results for all 3 months are summed up. To calculate the tax, the resulting value must be multiplied by the rate.

The law allows entrepreneurs-employers to reduce UTII by the amount of insurance contributions for themselves and for employees, but by a maximum of 50%. Based on the conditions of the example, in the 1st quarter, individual entrepreneur Nikolaev paid:

- for employees: 30,000 x 6 x 30% x 3 = 162,000 rubles;

- for yourself 10,219 rubles.

The total amount of deductions is 172,219 rubles. It is deducted from the quarterly tax amount, but within 1/2 of it.

Free tax consultation

Filling out Section 2

This section contains information about the main indicators and types of imputed activities carried out.

If several types of activities are transferred to UTII, you will need to fill out as many Sections 2 as there are types of imputed activities you carry out.

Several Sections 2 will need to be completed if there is only one type of imputed activity, but there are several places where it is carried out. For example, several stores with different addresses within one OKTMO.

| Page 010 | We enter the code of the type of activity transferred to UTII. You can find it out in Appendix No. 5 to the Procedure: |

| Page 020 | We indicate the address at which the imputed activity is carried out. The subject code is selected from Appendix No. 6 to the Procedure. The Moscow region corresponds to the code “50”, Moscow - “77”, St. Petersburg - “78” |

| Page 030 | Enter the OKTMO code at the address from page 020 |

| Page 040 | We reflect the amount of basic profitability by type of imputed activity. You can find it out in paragraph 3 of Art. 346.29 Tax Code of the Russian Federation. To provide services for repair, maintenance and washing of motor vehicles, the base income is 12,000 |

| Page 050 | Enter the deflator coefficient K1. It is established once a year and applies to all types of activities. In 2021, K1 is 2.005 (approved by Order of the Ministry of Economic Development of Russia dated December 10, 2019 No. 793) |

| Page 060 | We indicate the size of the correction factor K2. You can find it out from the legal act of the local government authority. It is established separately for each type of activity, depending on the place of its implementation and other features. You can find out which legal act approves the value of K2 on the Federal Tax Service website. To do this, in the upper left corner, select the region in which the imputed activity is carried out. Then we go to the very bottom of the page “Features of regional legislation” and select the municipality in which the activity is carried out (if there are several of them): |

| Page 070-090 | In column 2 we enter the size of the physical indicator monthly. You can find it out in paragraph 3 of Art. 346.29 Tax Code of the Russian Federation. This value is individual for each type of activity and depends on the number of employees, premises area, number of vehicles, etc. When providing services for repair, maintenance and washing of motor vehicles, the physical indicator is the number of employees, including individual entrepreneurs. We enter information in column 3 only if the imputed activity began (ended) in the middle of the quarter (reporting period). When switching to UTII, enter the number of days from the date of transition to the end of the month. When deregistering, we indicate the number of days from the beginning of the month to the day specified in the UTII-3 or UTII-4 notification. In column 4 we indicate the size of the tax base, calculated using the formula: page 040 x page 050 x page 060 x 070 (080 or 090) |

| Page 100 | We indicate the total amount of the tax base for all 3 months. To do this, add up the values of lines 070, 080 and 090 from column 4 |

| Page 105. | Enter the rate for UTII. If the municipality does not apply a reduced rate, indicate the value “15.0” |

| Page 110. | We determine the amount of imputed tax using the formula: line 100 x line 105: 100 |

Zero reporting on UTII

Sometimes it happens that the imputator temporarily ceases activities. Is he obliged to submit zero reports in this case? The opinions of regulatory authorities on this issue differ.

If a company has ceased operations, but still has physical indicators for calculating tax (retail space, vehicles, etc.), the regulatory authorities are categorical: the taxpayer, despite the lack of real income, is not exempt from paying tax.

If both activity and physical indicators are absent, then there is nothing to calculate the tax from. But the Federal Tax Service sometimes makes claims in this case too.

To avoid disputes with the Federal Tax Service upon termination or suspension of work at the “imputation”, submit an application for deregistration.

Filling out Section 3

Section 3 contains information on the amounts of insurance premiums paid for employees and individual entrepreneurs for themselves.

| Page 005 | If there are hired workers, enter code “1”; if they are absent, enter code “2”. Organizations always put the code “1” in this line, even if it employs only one person - the general director. Code “2” can only be set by individual entrepreneurs who do not have employees |

| Page 010 | We reflect the total amount of calculated imputed tax for all types of activities. To do this, we sum up lines 110 of all sections 2 (if there are several of them) |

| Page 020 | We indicate the amount of insurance premiums paid for employees (no more than 50% of the tax calculated for payment). We pay insurance premiums paid for employees, subject to a limit of 50% of the tax amount. In our case, the amount of contributions paid for employees was 84,230 rubles, but we can only take into account 10,827 rubles when calculating the tax. (21,654 x 50%). This procedure is enshrined in clause 2.1 of Art. 346.32 Tax Code of the Russian Federation. When combining several tax regimes, line 020 needs to reflect only those contributions paid for employees engaged in imputed activities |

| Page 030 | This line is filled in only by individual entrepreneurs who have paid fixed insurance premiums in the amounts established by clause 1 of Art. 430 Tax Code of the Russian Federation |

| Page 040 | From 01/01/2020 this line is not filled in. Previously, it included the amount of expenses for the purchase of an online cash register by an entrepreneur who purchased and registered it before 07/01/2019 |

| Page 050 | We indicate the final amount of imputed tax to be paid, taking into account insurance premiums. It is calculated according to the formula:

page 010 - (page 020 + page 030) Please note that the resulting result cannot be less than page 010 : 50%.

page 010 - page 030. If the result is negative, indicate the value “0” |

Sample filling

In the updated declaration form, the barcodes on some pages have changed. The changes look like this:

- 0291 4015 on the title page is replaced by 0291 5012;

- 0291 4022 section 1 replaced by 0291 5029;

- 0291 4039 section 2 replaced by 0291 5036;

- 0291 4046 section 3 is replaced by 0291 5043.

Keep in mind when generating a report: it is possible to reduce the calculated quarterly tax by the amount of insurance premiums paid by an individual entrepreneur with employees. In this case, it is correct to show a single tax reduced by 50%.

Let's look at an example of filling out a UTII declaration with step-by-step instructions for generating a report.

Title page

All taxpayers must fill out the title page of the report. At the top of each sheet there are fields for the TIN and KPP of the legal entity. Entrepreneurs indicate only the TIN. The “Adjustment number” field is filled in. If the report is primary, it should be marked with “0—”. When submitting updated information, depending on its quantity, indicate “1—”, “2—” and so on.

The tax period in the declaration is provided separately for each quarter:

- 21 — report for the 1st quarter;

- 22 — report for the 2nd quarter;

- 23 — report for the 3rd quarter;

- 24 - report for the 4th quarter.

Thus, if we report for the 4th quarter, we set the code to 24.

Section 1

Section 1 reflects the amounts of tax payable calculated in sections 2 and 3. If the activity was carried out in territories whose jurisdiction is different tax inspectorates, then the tax amount is set for each OKTMO. To find this value in the total tax amount, the indicator in line 050 of section 3 is multiplied by the ratio of the tax amount for one OKTMO to the total UTII for the tax period.

Regarding the rules for filling out the report, consider the following:

- if the OKTMO code is less than 11 characters, then the procedure for filling out the UTII declaration requires filling out the cells from left to right, and in cells with empty familiar spaces, putting dashes (25003451– – –). The same applies to the TIN;

- When filling out a declaration on a computer and printing it out on a printer, it is allowed that there are no frames for familiar signs and dashes if they do not contain values.

IMPORTANT!

In connection with the coronavirus pandemic, taxes on the single tax on imputed income were forgiven for some entrepreneurs, and therefore certain rules were introduced for filing reports. But there are no concessions for entrepreneurs in the 4th quarter, and therefore the algorithm for filling out UTII declarations for affected industries remains the same for all payers.

Section 2

Fill out the second section for each type of business activity and for each OKTMO. According to clause 5.1 of the procedure for filling out the declaration, it is necessary to fill out the second section for each object so that the value of the physical indicator does not exceed the established limit.

Please note that all codes that are included in the report are contained in the appendices to the procedure for filling it out. They do not coincide with OKVED2 codes, for example:

- 01 - household services;

- 02 - veterinary services, etc.

Basic profitability indicators are established by Article 346.29 of the Tax Code of the Russian Federation. A physical indicator is the area according to documents, the number of employees, vehicles, seats or retail spaces. To calculate the tax, you will need coefficients K1 and K2. For 2020, K1 is 2.005. It has increased compared to the last two years. You can check K2 with your tax office, as it is established by local authorities.

Section 2 of the UTII declaration contains columns indicating the date of registration or deregistration. They are filled out by organizations that newly registered during the quarter or those who ceased activities permitted on UTII before the end of the year. In these cases, the tax base of the single tax is adjusted to the number of calendar days worked. To calculate the tax base for an incomplete month, its value is divided by the number of calendar days in the month and multiplied by the days actually worked.

The tax base for the month is calculated according to the well-known formula: the product of the basic profitability by the physical indicator and coefficients K1 and K2.

To find the amount for the quarter, add up the resulting figures for all three months, and then multiply this amount by the tax rate of 15%. The result is shown on line 110.

In section 2, line 105 “Tax rate”, you must indicate the single tax rate, taking it from regional acts, or the 15% rate specified in the Tax Code, if the authorities of the constituent entity of the Russian Federation have not established special conditions in the region.

Section 3

In the third section, the taxpayer's characteristics are first indicated. This is done to reduce the tax on insurance premiums. Entrepreneurs who do not have employees have the right to reduce the tax by the full amount of insurance premiums actually transferred for themselves during the quarter. In line 005 of section 3 they put code 2.

For organizations and individual entrepreneurs with employees, the code is 1. Entrepreneurs with employees also have the right to include insurance premiums paid for themselves in the reduction amount, but, like organizations, they reduce the tax only to 50%.

In line 010, enter the sum of lines 110 of all completed second sections (for all OKTMO and types of activities). In lines 020 and 030, each category of payers reflects the insurance premiums transferred during the quarter. For payers making payments to employees, line 020, in addition to contributions to the Pension Fund and Social Insurance Fund, includes:

- temporary disability benefits paid at the expense of the employer (except for illness due to an industrial accident) for the first three days of illness;

- contributions for voluntary personal insurance of employees transferred during the quarter to licensed insurance organizations. These amounts reduce UTII only if the insurance payment is not more than the amount of benefits paid at the employer’s expense for the employee’s temporary disability for the first three days.

In line 040, indicate the costs of purchasing the cash register. These costs reduce the amount of UTII. This should include the sum of all values in lines 050 of section 4.

Line 050 reflects the amount of tax payable minus contributions and expenses for the purchase of cash registers (line 040).

Section 4

This is a section of the declaration where only individual entrepreneurs enter data (organizations do not need to fill it out, dashes are added).

The lines are filled in very simply:

- 010 — cash register model (make sure it is included in the cash register register);

- 020 — serial number of the cash register (look for it in the documentation);

- 030 — CCP registration number (assigned by the inspection);

- 040 — registration date;

- 050 - expenses for the purchase of cash registers (maximum 18,000 rubles).

Filling out Section 1

This section is filled out last, it indicates the amount of tax to be paid to the budget at the end of the reporting period for each OKTMO.

| Page 010 | We indicate OKTMO at the address from page 020. If there are several OKTMOs, then fill in as many lines 010 as there are OKTMO codes |

| Page 020 | We enter the amount of imputed tax payable for each OKTMO code. The value of this line is calculated using the formula: page 050 x (page 110 of all Sections 2 for this OKTMO: page 010 of Section 3) When carrying out only one type of activity (in one OKTMO), dashes must be placed in all other lines |

Features of filling out for individual entrepreneurs

The procedure for filling out reports for individual entrepreneurs is the same, with the exception of section 4. Section 4 of organizations is filled out by putting dashes - it was intended only for entrepreneurs, and in it they showed the cost of purchased cash register equipment from 02/01/2017 to 07/01/2019. Individual entrepreneurs had the opportunity to reduce the tax paid by the amount of expenses for the purchase of cash registers. As of today, the deadline for applying the deduction has been completed, and now individual entrepreneurs submit an empty section 4. It is necessary to put dashes in its lines.

Section 4

From 01/01/2020, this section of the declaration is no longer filled out, since individual entrepreneurs no longer have the right to take into account the costs of purchasing a cash register. Most likely, this section will be removed in the new declaration form, but until then it must be included in the reporting, even if only with dashes.

Sample UTII declaration for the 1st quarter of 2020

You can also see a sample of filling out the UTII declaration on the K+ website.

UTII declaration for SMEs from affected industries

Special rules for calculating tax for small businesses were in effect only in the 2nd quarter. The tax was written off, and the declaration was filled out taking into account the non-working period.

For “imputation”, it does not matter what revenue an individual entrepreneur or LLC has for the reporting period: the tax is calculated based on the basic indicator of imputed income. But the actual days of the special regime are taken into account when calculating the tax. Here is the calculation formula:

UTII = basic income × physical indicator: number of calendar days of the month × actual days during which the “imputation” was applied.

Here's how to fill out UTII for affected industries for the 2nd quarter of 2020:

- Indicate basic calculation information in sections 1 and 2.

- Calculate tax.

- Indicate zero accruals due to cancellation of payment of contributions for the 2nd quarter. If you paid part of the amount before cancellation, this money will be reflected in section 1, but the Federal Tax Service will take it into account as an overpayment. The taxpayer has the right to offset the money against future periods.

The UTII declaration for the 4th quarter of 2021 is filled out by SMEs according to the basic rules, without changes or exceptions.

Fine for late submission of UTII declaration

| Type of offense | Type of sanction |

| Late submission of UTII declaration | Fine (Article 119 of the Tax Code of the Russian Federation):

|

| A fine for officials of the organization in the amount of 300 to 500 rubles. (Article 15.5 of the Code of Administrative Offenses of the Russian Federation). | |

| Late submission of reports by more than 10 days | Blocking of current account (clause 2 of article 76 of the Tax Code of the Russian Federation) |

How to report to separate departments

If a company operates through structural divisions, take into account important reporting requirements:

| Situation | How to report |

| The company has separate divisions in one territorial entity | If all branches and structural divisions of the company are located in the territory under the jurisdiction of only one Federal Tax Service, then prepare one UTII declaration. Include information about all divisions, branches and head office in the report. |

| The company has OP in different territorial entities | If the structural divisions of the company and the head office are located in different territories and are subordinate to different departments of the Federal Tax Service, then reports will have to be submitted separately. Prepare a separate report for each territorial department of the inspection of the region in which the OP, branch or head office operates. |

An interesting situation: an organization opens a separate division in the same city as the head office, but in a different district, and the area of location is under the jurisdiction of a different Federal Tax Service. Is it required to register an OP with the inspectorate and what to do with the reporting? The organization is obliged to register a separate structural unit in the department of the Federal Tax Service in whose department the OP fell. Explanations are given in the letter of the Federal Tax Service No. GD-4-3/1895 dated 02/05/2014. Consequently, reports will have to be submitted separately: one declaration - at the location of the head office and a second - at the location of the separate division.

Latest news: extension of UTII until 2024

On 02/11/2020, deputies of the Jewish Autonomous Region submitted a bill to extend the validity of the UTII for another 3 years: until 01/01/2024. The deputies explain the need for an extension by the fact that the abolition of the imputation will entail the loss of a significant part of the income from the budgets of municipalities. As an example, officials cite the income of one of the municipalities, in which the share of UTII deductions is 96.77%.

Now this bill is going through the stage of preliminary consideration and it is impossible to say unequivocally whether it will be approved. We will monitor events and post information on the website as soon as something becomes clearer

Where is the declaration submitted?

Providing reporting for LLCs and individual entrepreneurs has certain features. They must be taken into account both when submitting reports and when paying taxes.

If the activity is carried out at the place of registration of an individual entrepreneur or the legal address of an LLC, then reporting is submitted to the tax office, where they are registered.

At the actual place of business, individual entrepreneurs and LLCs must submit reports if the following services are provided:

- In case of transportation of cargo and passengers by road.

- When placing advertising materials on vehicles.

- For peddling or delivery retail trade.

Since in these cases it is impossible to determine the area in which the activity is carried out, individual entrepreneurs provide reporting at the place of their registration, and organizations at their legal address.

The taxpayer carries out several types of activities under a single tax:

- If the activity is carried out at the place of registration of an individual entrepreneur or legal entity. the address of the company who fills out the appropriate number of sheets in Section 2 in the declaration. They must be filled out for each type of activity separately, and Section 1 indicates the total tax amount.

- If activities are carried out in different municipalities, then reports for each point are submitted separately to the tax office corresponding to the OKTMO code.

The taxpayer conducts one type of activity at several retail outlets:

- If the activity is carried out in one municipality, then the indicators are added up in section 2 of the UTII declaration, and one report is submitted.

- When conducting activities in different municipalities, separate reporting is provided to each of them.