In addition, the barcode has been changed, OKVED has disappeared from the title page, there are small clarifications in section 1 due to a change in line numbering.

View the archive of changes for 2021 Starting with reporting for the 1st quarter of 2021, the UTII declaration must be submitted in the form with changes made by Order of the Federal Tax Service of Russia dated October 19, 2016 N ММВ-7-3/ [email protected] (previous changes - dated 12/22/2015 N ММВ-7-3/ [email protected] ). In 2021, the changes were minor, the sections, the principle of filling - everything was preserved, if historical details are needed - look in the Order itself, there is no particular point in dwelling on them. And changes from the 1st quarter of 2021 affected the bar code and section 3: the wording on insurance premiums and the calculation of deductions for individual entrepreneurs with employees. It looks like this: Let us remind you that now individual entrepreneurs include in the deduction not only contributions for employees, but also “personal” contributions.

Delivery conditions

The tax return for UTII is submitted to the Federal Tax Service at the place of business of the entrepreneur or at his location (if it is impossible to accurately determine the specific place of activity - for example, for taxi services).

Since 2013, UTII, like the simplified tax system, has been a voluntary taxation system.

The tax declaration of individual entrepreneurs and organizations is completed based on the results of each quarter - no later than the 20th day of the month following the reporting quarter (clause 3 of Article 346.32 of the Tax Code of the Russian Federation).

There cannot be a zero declaration for UTII. Even if the taxpayer temporarily does not conduct business, he must pay tax based on physical indicators (area, number, etc.).

Contents of the form according to KND 1152016

The type and content of KND 1152016 is regulated by Letter of the Federal Tax Service of Russia No. SD-4-3/14369 dated July 25, 2018. The form consists of the following sections:

- A title card in which a businessman writes information about himself and the tax authorities.

- Section 1 - the total amount of duty under the current taxation scheme.

- Section 2 ㅡ calculation of information from paragraph 1 on various areas of employment accrued for payment to the tax budget.

- Section 3 - counting information from paragraph 1 for the reporting period.

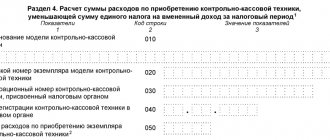

- Section 4 ㅡ calculation of losses on cash registers, which reduce the amount of duty accrued for payment of UTII.

The paragraphs contain comments that help a businessman calculate this or that indicator. Hints are displayed in the form of simple formulas. For example, page 020 = page 050 3 sec. * (sum of lines 110 section 2 according to the corresponding code OKTMO / page 010 section 3).

In 2021, the legislation of the Russian Federation has simplified many declaration forms to make it easier for entrepreneurs to fill them out.

What kind of reporting do individual entrepreneurs and legal entities submit? faces on UTII?

In addition to the declaration, the following reports are submitted:

- 4-FSS (for a quarter, half a year, 9 months and a year);

- Calculation of insurance premiums;

- 2-NDFL;

- 6-NDFL;

- Information on the average number of employees (once a year);

- Confirmation of the main type of activity in the Social Insurance Fund;

- Annual financial statements to the Federal Tax Service (organizations on UTII are required; individual entrepreneurs on UTII are not required to keep accounting records and generate appropriate reporting).

Individual entrepreneurs without employees submit only a UTII declaration.

If an organization or individual entrepreneur is engaged in several types of activities, some of which do not fall under UTII, then they need to submit reports under two tax regimes at once and keep separate records for the correct payment of taxes.

Where to submit the declaration

They submit the declaration either at the place of registration or at the place of business activity. The requirement that the UTII tax return for certain types of activities be submitted to the Federal Tax Service at the location (or registration for individual entrepreneurs) is presented only if the organization or individual entrepreneur is engaged in:

- delivery and distribution trade;

- passenger and freight transportation;

- placement of advertising.

If there are separate divisions that fall under the jurisdiction of one tax office, they submit only one UTII declaration.

Many controversial issues arise when opening separate units in different areas of the city or outside it. In this case, where should I submit reports and should I re-register with each tax authority in whose jurisdiction the activity is conducted?

According to the explanations given in the letter of the Federal Tax Service No. GD-4-3/1895 dated 02/05/2014, the organization is required to register with each tax authority in whose department the territory in which the business activity of a separate division is conducted is located. It is necessary to submit reports to these Federal Tax Service quarterly. For example, in the resolution of the Seventeenth Arbitration Court No. 17AP-10551/2014 dated 09.09.2014, the judges refer to Art. 83 of the Tax Code of the Russian Federation, which states that it is necessary to register separate divisions at the place of their activities. Organizations using UTII in this case are required to submit a declaration to each tax office at the place of registration. You can fill out the UTII declaration online for free in the taxpayer’s personal account on the website of the Federal Tax Service of Russia.

If organizations are registered in different municipal districts, but are served by one Tax Inspectorate, they create a single declaration and submit it to this branch of the Federal Tax Service.

Use the free instructions from ConsultantPlus to correctly fill out or check your UTII declaration.

The procedure for filling out the UTII declaration

The rules for document execution are specified in the Order of the Federal Tax Service of Russia dated June 26, 2018 No. ММВ-7-3/ [email protected] Filling out a tax return for UTII occurs after calculating the tax, which is made according to the following formula:

UTII = (Tax base * Tax rate) - Insurance premiums.

Let us recall that

Tax base = Imputed income = Basic profitability * Physical indicator

The basic yield is adjusted (multiplied) by coefficients K1 and K2.

Which physical indicator to use depends on the type of activity and is determined by Art. 346.29 Tax Code of the Russian Federation.

Fines for late submission of UTII declarations

The standard fine for failure to submit a UTII return on time is 5 percent of the accrued tax. The fine cannot be more than 30 percent of the tax amount and cannot be less than 1,000 rubles (Article 119 of the Tax Code of the Russian Federation).

General filling rules

This information is for those who for some reason do not use specialized software.

If you fill out the form yourself on a computer, for example in Excel, there is nothing complicated, but spend some time filling it out “spell by word.” Need to remember:

- one sign (number/letter) is placed in each cell (familiar space);

- use printed capital letters, Courier New font, 16-18 points high;

- field values are right-aligned;

- all amounts are rounded to the nearest full ruble (according to the rounding rules: less than 50 kopecks are discarded, 50 kopecks or more - a ruble is added);

- format for numbering declaration sheets: 001, 002 ... 010, 011, etc.;

- It is better to put dashes in empty fields and cells.

see the features of filling out the declaration in writing, for example with a ballpoint pen.

If this is your difficult case and you need to fill out the declaration without a computer, in addition to the above rules:

- corrections using corrective means are not allowed;

- the pen can be blue, purple or black.

Once completed, the declaration sheets are numbered in order.

You cannot: stitch the sheets, fasten them with a stapler or in any other way that could lead to “damage to the sheets” - this is stated in the Rules for filling out the declaration.

In addition, the declaration form cannot be made double-sided; such savings may serve as a reason for refusing to accept the document.

Changes from 2021

From 01/01/2020, a new deflator coefficient K1 is applied. It is equal to 2.009.

The UTII will not be in effect for long; individual entrepreneurs and organizations will not be able to apply the imputation starting from 2021, and some will lose the special regime even earlier. The Ministry of Finance and the Government do not want to extend the regime because it is used for tax evasion.

Thus, companies and individual entrepreneurs that sell medicines and fur clothing that are subject to labeling will lose the right to work on UTII from the beginning of 2021. And from March 2021, it will be prohibited to use UTII when selling shoes. In Perm and the Perm municipal district, imputation will also not be valid in 2021 (resolution of the Perm City Duma dated September 24, 2019 No. 204, Zemsky Assembly of the Perm Municipal District dated August 29, 2019 No. 414).

Kontur.Extern will help you correctly draw up a UTII declaration that the regulatory authorities will accept the first time. All reporting forms for UTII and other relevant forms for organizations in special modes are available to system users.

Section 2 of the UTII report for the 3rd quarter of 2021

This section of the declaration contains the calculation of UTII for certain types of activities. For each type that falls under the “imputation”, you need to fill out a separate sheet. Activities of the same type in different territories are also taken into account separately (in accordance with the OKTMO code). Section 2 also “transitioned” without changes to the new declaration form.

- Line 010 indicates the code of the type of entrepreneurial activity from Appendix 5 to the Procedure.

- Line 020 contains the address of the activity.

- Line 030 indicates the OKTMO code for this address.

- Line 040 shows the basic profitability by type of activity.

- Line 050 indicates the deflator coefficient K1. Its value for 2021 is 1.868 (order of the Ministry of Economic Development dated October 30, 2017 No. 579).

- Line 060 contains the adjustment factor K2, which takes into account the specifics of conducting business. Its value is approved by local authorities.

- Lines 070-090 determine the tax base by month for July-September 2021.

– column 2 contains the value of the physical indicator for each month;

– in column 4, the monthly tax base is calculated as the product of the basic profitability and adjustment factors (lines 040, 050, 060) by the physical indicator of the month;

– if during any month of the tax period a businessman was registered or deregistered as a UTII payer, then column 3 indicates the actual number of days of business in that month; The UTII base in this case is recalculated based on the specified quantity.

- Line 100 reflects the total tax base for the 3rd quarter, i.e. sum of lines 070 – 090.

- Line 105 contains the tax rate as a percentage.

- Line 110 reflects the amount of UTII for this type of activity, which is determined as the product of the tax base and the rate.

Reporting Methods

The report can be submitted to the tax office in the following ways:

- On paper. In this case, you will need to issue 2 copies - one for the tax office, and the second for you. Tax authorities must stamp your copy with an acceptance stamp and the date the return was submitted. This will be proof of reporting.

- Send the reports by mail in a valuable letter with a list of attachments. In this case, the date of delivery will be considered the date indicated on the mail stamp, and in the inventory - what you provide.

- Electronic. This can be done using the tax service or through a special EDI operator. But for this you will need to enter into an agreement with the operator and receive an electronic digital signature.

Attention! If the report will be submitted to the tax office by a representative of the taxpayer, then a power of attorney will need to be issued. For this purpose, a simple written form is used - it is affixed with the company’s seal and the signature of the manager. The document is attached to the report.

Title page

On the title page, like on all the others, at the top you will see a place for entering the TIN for individuals, and the checkpoint for organizations. The correction number is indicated below. It indicates whether this is a primary report or a clarifying one. For primary, “0–” is indicated. If you have already submitted this report, but you need to clarify certain data, such a declaration is submitted again. However, the correction number “1–”, “2–” and so on is indicated.

Then the code corresponding to the tax period is written. Each reporting quarter has its own code. Also write down your full name here. In the appropriate fields, indicate the reporting year, activity code, and contact phone number.

At the bottom of the first page there are special fields intended for information about the head of the enterprise if the report is submitted on behalf of the organization. Below, in a specially designated place, you must enter the date the document was completed and your signature.