A VAT return is a report submitted by payers of the general taxation system. In addition, those who work under special tax regimes, but have issued an invoice with a dedicated value added tax, must report.

Who must submit a VAT return in 2018

The VAT return in 2021 must be prepared by organizations and individual entrepreneurs, including intermediaries, which (clause 5 of Article 174 and subclause 1 of clause 5 of Article 173 of the Tax Code of the Russian Federation):

- are recognized as VAT payers;

- are tax agents for VAT.

At the same time, the following may not submit a VAT return in 2021:

- organizations and individual entrepreneurs using the simplified tax system, unified agricultural tax, UTII or patent taxation system;

- organizations exempt from VAT (whose revenue excluding VAT over the last 3 months did not exceed 2 million rubles);

- taxpayers submitting a simplified tax return (who have no VAT transactions or no movements in current accounts).

Individual entrepreneur with VAT: pros and cons 2021

Sometimes buyers of individual entrepreneurs refuse to cooperate after learning that they are not VAT payers. Let's consider what the pros and cons are in the OSN, which provides, among other things, for the payment of value added payments.

Pros:

- can be applied regardless of the type of activity, number of personnel, amount of income (there are significant restrictions on the use of any special regime);

- you can recognize more expenses than under the simplified tax system (with the tax base “Income minus expenses”);

- You can issue invoices to customers with a dedicated value added tax, which they can take as a deduction.

Minuses:

- you need to pay a lot of tax payments: personal income tax, VAT, property taxes, transport, land;

- it is necessary to organize tax accounting of all business transactions in a special register;

- you need not only to issue invoices, but also to maintain registers: a sales book and a purchase book;

- quarterly reporting is provided for VAT (in the manner described above), property tax, as well as annual reporting for personal income tax and other property taxes.

After analyzing the advantages and disadvantages of the regular tax system, the individual entrepreneur must decide whether it makes sense to switch to it.

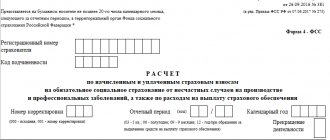

VAT return form in 2018

In 2021, prepare a declaration in the form approved by order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558.

As part of the declaration, each organization that pays VAT must submit to the tax office:

- title page;

- Section 1 “The amount of tax subject to payment to the budget (reimbursement from the budget), according to the taxpayer.”

Include the remaining sections in the declaration only if the organization performed transactions that should be reflected in these sections. For example, sections 4–6 must be completed and submitted if during the tax period the organization carried out transactions subject to VAT at a rate of 0 percent. And section 7 - if there were transactions that were exempt from VAT.

One of three

Let's start with the fact that there are three valid VAT declarations today.

- Declaration of indirect taxes - KND 1151088 (order of the Federal Tax Service of the Russian Federation dated September 27, 2017 No. SA-7-3/765). This form is used by importers of goods from the countries of the Eurasian Economic Union.

- VAT declaration for the provision of services by foreign organizations in electronic form - KND 1151115 (Order of the Federal Tax Service of the Russian Federation dated November 30, 2016 No. ММВ-7-3/646). Who is required to submit this report is clear from its name.

- VAT return – KND 1150001 (Order of the Federal Tax Service of the Russian Federation dated October 29, 2014 No. ММВ-7-3/558). This form is submitted by most VAT payers, and we will consider it in detail.

Deadlines for submitting the declaration in 2021: table

In 2021, the VAT return must be submitted no later than the 25th day of the month following the expired quarter (Articles 163, 174 of the Tax Code of the Russian Federation). The deadline is the same for submitting a declaration on paper and in electronic form. The reporting months in 2021 are January, April, July, October.

In 2021, VAT payers can submit a VAT report via the Internet. And only tax agents can submit a declaration “on paper”. The exception is an agent who does not pay VAT. That is, a person applies a special regime or is exempt from paying tax under Article 145 of the Tax Code of the Russian Federation. Then it is allowed to submit the declaration “on paper” or electronically.

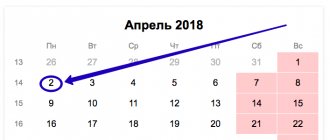

If the deadline for submitting the declaration falls on a weekend or holiday, you can, as a general rule, report on the next working day (Clause 7, Article 6.1 of the Tax Code of the Russian Federation). However, in 2021, none of the deadlines for submitting the declaration coincide with a weekend or holiday. Below is a table with the deadlines for submitting the VAT declaration in 2018.

| Reporting period | Deadline for submitting the VAT return |

| 4 sq. 2021 | January 25, 2021 |

| 1 sq. 2021 | April 25, 2021 |

| 2 sq. 2021 | July 25, 2021 |

| 3 sq. 2021 | October 25, 2021 |

| 4 sq. 2021 | January 25, 2021 |

We report VAT according to the new rules

On December 28, 2021, an order was issued on a new VAT return form.

Many people wonder why the tax authorities were not satisfied with the previous form and why it was necessary to develop a new one? It's simple: the VAT form no longer fully corresponded to its purpose and required urgent processing.

Now a new VAT return form must be completed starting from the 1st quarter of 2021. And it already takes into account all the latest innovations.

Who is affected by the amendments? What legislative adjustments are taken into account in the updated form? What lines appeared in the new form and how much has the technology for filling it out changed? Let's figure it out.

Who reports VAT?

VAT is a federal tax. The following are recognized as VAT payers:

- organizations (including non-profits);

- entrepreneurs.

At the same time, all VAT taxpayers can be divided into two groups:

- taxpayers of internal VAT. That is, VAT paid on the sale of goods (works, services) in the territory of the Russian Federation;

- taxpayers of import VAT, which is paid when importing goods into the territory of the Russian Federation.

How is value added tax calculated?

VAT is calculated from the difference between the sales price and the purchase price of the same product from another company. If you do not take into account simple resale, then VAT is included in the total cost of the goods produced and consists of purchased materials and components. VAT amounts are calculated at the appropriate tax rate, which is a percentage of the tax base.

If transactions are taxed at different rates, separate accounting is maintained, and the amount of VAT is determined by adding up the tax amounts calculated separately for each transaction. The taxpayer is also required to maintain separate accounting if part of the transactions he carries out are exempt from taxation.

The calculated VAT is reduced by the amount of the tax deduction. The amount of tax that the buyer paid when purchasing goods on the territory of the Russian Federation or when importing goods into the customs territory of the Russian Federation is accepted for deduction. If the taxpayer does not calculate the tax base for VAT, then he has no reason to deduct the amount of VAT paid in the cost of the purchased goods.

Please note that a taxpayer can deduct input VAT only if he has taken into account the goods, works, and services purchased by him. This must be confirmed by relevant source documents and invoices issued by the supplier.

A tax deduction cannot be applied if:

- the taxpayer's expenses are economically unjustified;

- business operations are unprofitable and unprofitable;

- invoices are not reflected in the accounting journal or are reflected untimely;

- there is no state registration of the acquired object, if it is mandatory;

- the counterparty was chosen without due diligence and caution, the counterparty from whom the taxpayer purchased the property did not comply with the requirements of tax legislation;

- the taxpayer’s actions are seen as a desire to extract unjustified tax benefits.

Tax calculation procedure

When an entrepreneur applies a single VAT rate to all of his transactions, the tax base must be determined in total in accordance with the requirements of Article 153 of the Tax Code of the Russian Federation.

Thus, if, based on the results of tax calculation in a certain tax period, the amount of the tax deduction is greater than the total amount of VAT calculated based on the results of all taxable transactions performed by the taxpayer, the resulting negative difference must be reimbursed to the taxpayer, the VAT payable to the budget in this case is assumed to be zero.

For example, in the case of foreign persons who are not registered with the tax authorities of the Russian Federation and are not Russian taxpayers. If such persons sell goods on the territory of the Russian Federation, then enterprises and individual entrepreneurs purchasing such goods are required to pay VAT.

It turns out that they act as tax agents (clause 3 of Article 166 of the Tax Code of the Russian Federation). In this case, accounting is carried out separately for each transaction related to the sale of goods by foreign taxpayers.

The amount of VAT that must be paid by the tax agent to the budget is determined on the basis of the invoice and is paid by him in full.

A controversial issue regarding the calculation of VAT and the application of tax deductions is the absence of taxable transactions for the taxpayer in the reporting period. However, the Ministry of Finance came to the conclusion that the taxpayer’s use of tax deductions in those tax periods in which he did not have a tax base is justified. The Federal Tax Service of Russia supports this position.

Tax payment deadlines in 2021

The procedure and deadlines for paying VAT are specified in paragraph 1 of Art. 174 Tax Code of the Russian Federation.

Tax payment should be made monthly by the 25th day of the quarter following the reporting period, dividing the amount of calculated tax in equal shares. If the payment deadline falls on a weekend, it is automatically postponed to the next working day.

VAT payment deadline in 2021:

| During the period | payment date |

| 4th quarter 2021 | 25.01.2019 |

| 25.02.2019 | |

| 25.03.2019 | |

| 1st quarter 2021 | 25.04.2019 |

| 27.05.2019 | |

| 25.06.2019 | |

| 2nd quarter 2021 | 25.07.2019 |

| 26.08.2019 | |

| 25.09.2019 | |

| 3rd quarter 2021 | 25.10.2019 |

| 25.11.2019 | |

| 25.12.2019 | |

| 4th quarter 2021 | 27.01.2020 |

| 25.02.2020 | |

| 25.03.2020 |

You can transfer the entire amount in one payment before the 25th of the first month, or pay 1/3 of the part by the 25th of the first month, and 2/3 by the 25th of the second month.

An exception to this procedure are tax agents.

That is, those who purchase goods and materials and services from foreign entities that are not registered with the Russian Federal Tax Service. In this case, the tax regime of the tax agent is not important. This also includes persons purchasing services (in the form of rent) from state authorities and local governments.

The declaration is submitted upon completion of the transaction no later than the 25th day of the month following the reporting quarter. The agent is obliged to pay VAT to the budget before payment for the purchase. Otherwise, the bank does not have the right to accept a payment for payment of goods and materials to the seller for whom the payer is a tax agent. The basis for calculating tax is determined for each transaction separately.

Thus, if one transaction was carried out during the year, then the declaration must be submitted once for the quarter in which it was carried out.

Conclusion: the deadline for paying VAT depends on who the person is: a regular VAT payer or a tax agent.

What happens if a company does not report VAT on time?

The Tax Code of the Russian Federation provides for taxpayer liability for late payment of tax. Punishment in the form of a penalty always occurs, but a fine is assessed only if the reason for late payment of VAT was an understatement of the tax base.

If the tax authority determines that the understatement was deliberate, the amount of the fine will double - from 20% to 40%. In this case, the fine can be reduced if the taxpayer has at least one mitigating circumstance.

What has changed in the declaration?

In 2021, the new VAT return takes into account the latest innovations, so some of its sections have changed.

With the advent of the new declaration form, the list of reporting entities has not generally changed. It was replenished by companies and individual entrepreneurs using the Unified Agricultural Tax.

The changes to the form affected sections 3 and 9, as well as some appendices.

This takes into account the emergence of a new rate of 20%, but the previous rates of 18% and 18/118 have not completely disappeared. They are present in sections 3 and 9 along with the new tax rate, as they are necessary for application during the transition period (for transactions that began before 01/01/2019 and ended later). At the same time, a significant part of the sections and annexes of the declaration remained unchanged. 1C users should take into account that if they have not updated the 1C program for VAT 20%, they will not be able to correctly download the declaration from the database.

Please note that the new instructions for filling out the report

approved together with a new VAT return form by the same order of the Federal Tax Service No. SA-7-3/853. However, it has changed slightly.

A description of the lines first entered into the form appears. There is an explanation for filling out the declaration by buyers of scrap metal, waste paper, raw hides, secondary aluminum and its alloys. In particular, those of them who do not pay VAT on themselves fill out Section 2 in the new declaration in the following order:

The Federal Tax Service has transferred the adjusted procedure to the instructions. If earlier controllers suggested that tax agents who do not pay VAT not fill out lines 010-030, now the instructions stipulate that they must include dashes in them.

Operation codes

The new declaration uses new and clarified transaction codes. The Federal Tax Service has summarized the information about transaction codes that it previously provided in separate letters. New codes have also appeared in this list:

Let's summarize:

The VAT return for the 1st quarter of 2021 is drawn up on a new form. New lines have been added to sections 3, 9 and individual appendices. Changes have also been made to the procedure for filling out the declaration: new transaction codes have appeared and previous transaction codes have been clarified, and the features of how individual transactions are reflected in the declaration are described. The deadlines and methods for submitting the report remain unchanged.

Draw your attention to!

When setting up data exchange within a distributed 1C information base, situations may occur that lead to errors. However, not all such situations are errors in their pure form: some of them can be attributed to normal situations corresponding to the data exchange protocol, some to the inability of the configuration to work within a distributed information base.

If you are configured to exchange data between 1C databases of several departments, we recommend checking the status of 1C exchanges, since with a distributed database they have several nodes.

If you need help in exchanging 1C databases, we will advise you, set up rules for exchanging 1C data, also with other IT solutions, and select the desired format for exchanging data with 1C. Call us, we will help you check the status of data exchange if you have distributed 1C databases.

Deadlines for submitting the journal of received and issued invoices in 2021

In 2021, intermediaries acting in the interests of third parties on their own behalf are required to submit logs of invoices received and issued. They are:

- commission agents;

- agents;

- forwarders (involving third parties without their own participation);

- developers (involving third parties without their own participation).

The deadline for submitting the log of received and issued invoices is no later than the 20th day of the month following the expired quarter. Below in the table we present the deadlines for submitting the journal of received and issued invoices in 2021.

| Reporting period | Deadline |

| 4 sq. 2021 | January 22, 2021 (postponed from January 20) |

| 1 sq. 2021 | April 20, 2021 |

| 2 sq. 2021 | July 20, 2021 |

| 3 sq. 2021 | October 22, 2021 (postponed from October 20) |

| 4 sq. 2021 | January 21, 2021 |

EXAMPLE OF COMPLETING A VAT FORM FOR Q4 2018

Let's give an example of filling out a document for, which performed the following operations in the fourth quarter of 2018:

- 09.2018 received an advance from the counterparty - 1,650,000 rubles. (including VAT 250,000 rubles), entered invoice No. 123 into the sales book.

- No goods were dispatched under this agreement during the reporting period.

- On 10.2018, goods were shipped in the amount of 1,060,000 rubles. (including VAT 160,000 rubles), as a result of which invoice No. 124 was issued and registered. No advance payment was received for this delivery.

- On 11.2018, goods were shipped in the amount of RUB 1,410,000. (including VAT 210,000 rubles), on the basis of which invoice No. 125 was issued. On the same date, an entry was made in the purchase book about invoice dated 09.21.2018 No. 90 for the previously received advance for the entire amount of delivery;

- On 11.2018, the company purchased and registered raw materials in the amount of RUB 1,290,000. (including VAT RUB 190,000). There was no advance payment for this transaction. The purchase book for the fourth quarter of 2021 contains invoice dated October 25, 2018 N 102;

- A residential building was sold for 15,000,000 rubles. (without VAT). This house was purchased for RUB 12,500,000. (without VAT).

- On 01.2019, Vostok LLC sent a VAT declaration to the Federal Tax Service for the fourth quarter of 2021. The declaration has a title page, section. 1, 3, 7, 8 and 9.

Title page

Paragraph 1

This should contain all the final information on the amount of VAT in monetary terms accrued for payment or reimbursement.

Point 3

Here you will find all the “key” data for your VAT return. All calculations of the amount of tax to be paid or refunded are made here.

Point 7

Clause 8

It contains a breakdown of tax deductions and transfers data from the purchase book.

Clause 9

This section of the declaration contains information about the accrued tax from the sales book.

If you miss the VAT reporting deadlines in 2021

The Federal Tax Service will be happy if in 2021 you submit your VAT return 5-10 days before the end of the deadline. However, if you submit your VAT return electronically, then there is nothing to fear. After all, the date for sending the declaration is fixed, and you will also have a corresponding protocol. If in 2021 you violate the deadlines for submitting a VAT return, then the liability in the form of a fine will be 5% of the unpaid amount of VAT payable on a late return for each full or partial month that has passed from the day set for submitting the return to day of delivery. However, the fine cannot be more than 30% of the amount of tax due and not paid on time and not less than 1000 rubles (clause 1 of Article 119 of the Tax Code of the Russian Federation).

Title page

This section of the return contains information about the taxpayer and the return itself.

- TIN and KPP codes assigned upon registration with the Federal Tax Service.

- The correction number has the format “0- -”, “1 – -”, etc. It shows the serial number of the “version” of the report.

- The tax period must be selected from Appendix 3 to the Procedure for filling out, approved by Order of the Federal Tax Service of the Russian Federation dated October 29, 2014 No. ММВ-7-3/558 (hereinafter referred to as the Procedure). The code for the 3rd quarter is “23”.

- Reporting year – 2021.

- Tax office code.

- The location (accounting) code is selected from Appendix 3 to the Procedure and shows why the declaration is submitted to this particular Federal Tax Service.

- Full name of the organization or full name of the entrepreneur.

- OKVED code.

- If the declaration is submitted by the legal successor, then he fills out special fields: “Reorganization / liquidation form code” (from Appendix 3 to the Procedure) and “TIN/KPP of the reorganized organization.”

- Contact number.

- Signature of the responsible person with a transcript, date of completion and stamp. If the report is submitted by proxy, then you need to indicate its details.

- Information about submitting the report is filled out by an employee of the Federal Tax Service.

When to submit a VAT return for imports in 2021

Organizations and individual entrepreneurs importing goods from EAEU countries must report to the Federal Tax Service by submitting a VAT declaration on imports no later than the 20th day of the month following the month of registration of imported goods/payment deadline under the contract (clause 20 of Appendix No. 18 to the Agreement on Eurasian Economic Union).

In 2021, importers are required to submit the relevant VAT return within the following deadlines:

| The period for which the VAT return for import is submitted | Due in 2021 |

| for December 2021 | 22.01.2018 |

| for January 2021 | 20.02.2018 |

| for February 2021 | 20.03.2018 |

| for March 2021 | 20.04.2018 |

| for April 2021 | 21.05.2018 |

| for May 2021 | 20.06.2018 |

| for June 2021 | 20.07.2018 |

| for July 2021 | 20.08.2018 |

| for August 2021 | 20.09.2018 |

| for September 2021 | 22.10.2018 |

| for October 2021 | 20.11.2018 |

| for November 2021 | 20.12.2018 |

The VAT declaration for imports for December 2021 must be submitted already in 2021 - no later than 01/21/2019.

Read also

27.12.2017

Section 9

This section of the declaration reflects information about accrued tax from the sales ledger.

- Line 001 indicates the relevance of the information, similar to section 8.

- Lines 005 – 090 are also filled in similarly to the corresponding lines of section 8. The exception is line 035. It is used during import and contains the details of the “incoming” customs declaration.

- Lines 100 and 110 contain the TIN and KPP of the buyer (intermediary).

- Lines 120 and 130 reflect the details of the document confirming payment.

- Line 140 contains the currency code.

- Lines 150 – 160 contain the total sales value of the invoice, including VAT.

- Lines 170 -190 show the amount of sales excluding VAT broken down by rates.

- Lines 200 -210 reflect the amount of VAT on the invoice at rates of 10% and 18%.

- Line 220 shows the value of tax-exempt sales.

- Lines 230 – 250 reflect the amount of revenue excluding VAT for the sales book as a whole, broken down by rates.

- Lines 260 – 270 show the amount of VAT on the sales book separately at rates of 10% and 18%.

- Line 280 reflects the value of tax-exempt revenue in the sales book.

Section 9 (end)

If changes were made to the sales book related to the compilation of additional sheets, then you need to fill out Appendix 1 to Section 9. Its structure is similar to the main section.

Other changes

A couple more changes concern a narrow circle of people.

The first of them relates to special economic zones (SEZ). The gratuitous transfer to regional and municipal authorities of property created for the implementation of the agreement on the creation of a SEZ is not subject to VAT. Transferring organizations are not required to restore the amounts of VAT previously accepted for deduction on this property upon its transfer.

Another specific change is that the release of material assets from the state reserve by the responsible custodian and the borrower due to their renewal, replacement or borrowing is exempt from VAT.

Confirmation of zero rate when exporting by mail

Starting this year, the rules for confirming the zero VAT rate for the export of goods by mail . To do this you need to submit:

- original or copy of the payment order;

- optional: a customs declaration with marks from Russian customs authorities along with the accompanying CN 23 declaration (or a copy thereof);

- declaration CN 23 with marks from the Russian customs authorities.

Before these amendments came into force, it was not clearly defined what documents could be used to confirm 0% VAT for export sales by mail. Now the taxpayer has a choice. In addition, it follows from the provisions of the Code that a foreign trade contract does not need to be provided to confirm the rate.