Deadline for submitting the declaration

The UTII declaration, as a general rule, must be submitted to the Federal Tax Service no later than the 20th day of the first month following the tax period (quarter). That is, no later than April 20, July 20, October 20 and January 20 (clause 3 of Article 346.32 of the Tax Code of the Russian Federation). Therefore, the UTII declaration for the first quarter of 2021 must be submitted to the Federal Tax Service no later than April 20, 2021.

Who should report

All single tax payers must submit a UTII declaration for the first quarter of 2021 (clause 3 of Article 346.32 of the Tax Code of the Russian Federation). That is, all organizations and individual entrepreneurs that are members of the tax office as an “imputer”. The UTII declaration for the first quarter of 2021 must be submitted to inform the tax authorities about the amount of “imputed” tax, the types of activities and the place of business. There will be no need to report income and expenses in the first quarter, since UTII is calculated based on the basic profitability, and not the actual one.

Nuances of determining the value of a physical indicator

Separately, when filling out the declaration, it is worth focusing on determining the value of the physical indicator used to calculate the tax base on a monthly basis.

The indicator depends on the type of activity and “ties” the size of the tax base to the characteristics of the activity being carried out.

For example, in the example given, our individual entrepreneur independently carries out transportation using one truck. Accordingly, its physical indicator by type of activity is 1 (one truck).

For comparison: if an individual entrepreneur began to transport passengers, the physical indicator would no longer be the car, but the number of seats in this car. For example, 15. And then we would get a completely different calculation and a different value of the tax base for UTII.

For more information on how to determine a physical indicator, read: “Calculation of physical indicators for UTII 2015-2016” .

Declaration form for 1st quarter

The declaration form was approved by Order of the Federal Tax Service of Russia dated July 4, 2014 No. ММВ-7-3/353. This is the form that needs to be submitted for the first quarter of 2017. However, we note that by Order of the Federal Tax Service of Russia dated October 19, 2016 No. ММВ-7-3/574, changes were made to the imputed tax declaration (form KND 1152016). The declaration has been amended due to the fact that from 2021, individual entrepreneurs on UTII with employees can reduce the “imputed” tax on fixed contributions “for themselves.” These amendments were taken into account in the declaration and a new form of declaration for UTII was obtained. However, the composition of the form has not changed and includes:

- title page;

- Section 1 “Amount of single tax on imputed income subject to payment to the budget”;

- Section 2 “Calculation of the amount of single tax on imputed income for certain types of activities”;

- Section 3 “Calculation of the amount of single tax on imputed income for the tax period.”

Now we will give an example of filling out a UTII declaration for the 1st quarter of 2021, which may be useful for organizations and individual entrepreneurs. Also see “UTII declaration form from the first quarter of 2021: what has changed.”

Results

The UTII declaration in 2017 can be generated and submitted both on paper and online.

Despite the fact that the declaration form has been changed (taking into account changes in legislation), the procedure for filling it out remains approximately the same. Both in paper form and in electronic form, you should carefully approach such points as determining the code at the place of registration (the place of delivery and payment of tax will depend on it). You should also correctly determine the physical indicator of UTII when calculating the tax base. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Filling out the title page

On the title page of the declaration for the 1st quarter of 2021, show basic information about the company or individual entrepreneur. Let us explain some features of filling out the title page.

Taxpayer Identification Number and Checkpoint

On the title page (and each sheet of the declaration) show the TIN and KPP of the company. Moreover, enter the checkpoint regarding the organization at the place of registration as a UTII payer (the fifth and sixth positions of the checkpoint should contain the numbers 35). Let’s assume that with the Federal Tax Service, where the UTII declaration for the 1st quarter of 2021 is submitted, the organization is registered on two grounds: by the location of a separate division and by the place of conducting activities subject to UTII. Then in the declaration, show not the checkpoint that is assigned to the organization at the location of the separate division, but the one that is assigned to the company as a UTII payer (subclause 1, clause 3.2 of the Procedure, approved by Order of the Federal Tax Service of Russia dated July 4, 2014 No. ММВ-7-3/ 353).

Correction number

In the “Adjustment number” line, enter one of the numbers:

- “0” – for the primary declaration;

- “1” – for the first updated declaration;

- “2” – for the second clarification, etc.

Therefore, if you are submitting a declaration for the first time, you need to enter the code “0”.

Taxable period

In the “Tax period (code)” column, enter code “21”. It is this that will mean that you are submitting a declaration specifically for the 1st quarter of 2021 (and not for some other period).

Reporting year

In the “Reporting year” line, enter “2017”. This will mean that the declaration is submitted in 2021.

Submission code

In the “place of registration” field, show the code of the place of submission of the declaration for the 1st quarter. If, for example, a company submits a declaration at its location and submits one declaration, enter code 214. If the declaration is submitted at the place of business under UTII, enter 310 (letter of the Federal Tax Service of Russia dated February 5, 2014 No. GD-4-3/1895). Below in the table we present all the codes that can be indicated in the UTII declaration for the 1st quarter of 2021:

| Code | Name |

| 120 | At the place of residence of the individual entrepreneur |

| 214 | At the location of the Russian organization that is not the largest taxpayer |

| 215 | At the location of the legal successor who is not the largest taxpayer |

| 245 | At the place of activity of the foreign organization through a permanent representative office |

| 310 | At the place of activity of the Russian organization |

| 320 | At the place of activity of the individual entrepreneur |

| 331 | At the place of activity of the foreign organization through a branch of the foreign organization |

What is the second section of the form about?

This is a sheet reflecting the procedure for calculating imputed tax. It must be filled out separately:

- for each OKVED within one city (district);

- for each operating address of a commercial structure with its own OKTMO.

At the top of the page the standard “header” is indicated: TIN and KPP, sheet number in order. Below is a code corresponding to the area of activity of the company or individual entrepreneur, for example, “01” - household - car maintenance, etc.

Next, enter the full address of business with postal code. The corresponding OKTMO must be indicated.

Below, the declaration preparer fills in the lines:

- 040 – basic profitability for a specific OKVED, specified in the Tax Code of the Russian Federation.

- 050 - K1 - the value established by the federal authorities for the entire territory of the country for one year. It can be found out from the press and clarified on the websites of information and legal systems.

- 060 – local coefficient determined by the city (district) authorities. You can check it with “your” Federal Tax Service or look it up on the website of the local administration.

Lines 070 to 090 are values for three months of the quarter. The taxpayer specifies:

- the value of the physical indicator (for example, the number of employees, the footage of stores, the number of cars used, etc.);

- number of days of operation (filled in with dashes if the month has been fully worked out; values are entered for companies and individual entrepreneurs that were deregistered as “imputed” in a particular month);

- the size of the tax base calculated using the standard UTII formula.

Next, line No. 100 summarizes the fiscal base for three months, which gives the total for the quarter. It is multiplied by the rate (p. 105) and the total is displayed in field 110 - the amount of fiscal liability for a specific OKTMO and line of commercial activity.

OKVED codes

The declaration must explain what the main activities of the organization or individual entrepreneur are. For these purposes, you need to indicate the OKVED code. At the same time, in all declarations submitted from January 1, 2021, it is necessary to indicate codes according to the new OKVED2 classifier. However, if “clarifications” are submitted for periods expiring before 2021, then indicate in them the same codes that were entered in the initial declarations (Letter of the Federal Tax Service of Russia dated November 9, 2016 No. SD-4-3/21206).

How to find out the new OKVED

If you do not know your new OKVED code, use transition keys. You will find them on the website of the Russian Ministry of Economic Development at the link economy.gov.ru. Download the key “OKVED 2001 - OKVED2”. On the contrary, you can see the new code.

Let's give an example of a completed title page of the UTII declaration for the 1st quarter of 2021.

Declaration form 2017

The new UTII declaration form for 2021 came into force on January 1 of this year.

When filling out the report, you should adhere to certain rules:

- All data must be recorded starting from the leftmost cell. If there are empty cells left, you need to put dashes in them.

- When filling out text fields, you can only use block letters and capital letters.

- When completing the report manually, you can use purple, black, and blue ink.

- There is no need to include the imposed penalties in the 2017 UTII tax return.

- When filling out a report on a computer, you are allowed to use only Courier New font size 16-18.

- Physical data is recorded in whole units.

- There is no need to stitch report sheets.

- All pages must be numbered.

- Correcting errors is strictly prohibited.

Filling out section 2

Section 2 of the declaration for the 1st quarter of 2021 is called “Calculation of the amounts of the single tax on imputed income for certain types of activities.” Fill it out separately:

- for each type of activity;

- for each municipal entity in which “imputed” activities are carried out.

Example.

On the territory of one municipality, Lobby LLC is engaged in one type of “imputed” activity. On the territory of another municipality - three types of “imputed” activities. In such a situation, section 2 needs to be formed 4 times (1 + 3).

If you conduct the same “imputed” activity in different locations of the same municipality, then section 2 of the declaration for the 1st quarter of 2021 must be filled out once (letter of the Ministry of Finance of Russia dated July 22, 2013 No. 03-11-11/28613).

In the first part of section 2, indicate the address of business and the corresponding codes. In the second part of section 2 of the UTII declaration for the 1st quarter, you need to describe the basic profitability, coefficients and physical indicators. Let's explain in the table.

| Section 2 lines | |

| Line | Filling |

| 040 | Monthly base yield per unit of physical indicator |

| 050 | The value of the deflator coefficient K1. |

| 060 | The value of the correction factor K2. |

| 070,080,090 | In column 2 you need to indicate the value of the physical indicator for each month of the quarter; |

| If the “imputed person” was registered (deregistered) during the 1st quarter of 2021, in column 3 you need to show the number of calendar days of activity in the month of registration or deregistration. If the UTII payer did not register or cease activities, indicate dashes in column 3; | |

| In column 4, enter the value of the tax base, taking into account the actual duration of activity on UTII in a separate month. | |

| Indicate the total tax base for the quarter (add lines 050, 060 and 070 in column 4). | |

| 105 | Tax rate |

| 110 | Tax amount |

Determine OKTMO codes using the All-Russian Classifier, approved by order of Rosstandart dated June 14, 2013 No. 159-st. Enter information about the OKTMO code on line 030 starting from the first cell. Place dashes in empty cells.

Let's give an example of filling out section 2 of the UTII declaration for the 1st quarter of 2021 in a situation where, after redevelopment, the “responsor”’s sales area changed. Then the single tax should be calculated based on the changed value of the area from the month when it changed (clause 9 of Article 346.29 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated April 11, 2014 No. 03-11-11/16532). Let's assume that the sales floor area before March 15, 2021 was 35 square meters. m, and from the 16th it was reduced to 30 sq. m. Then the physical indicator for the first quarter of 2021 is equal to:

- 35 sq. m - for January;

- 35 sq. m - for February;

- 30 sq. m. - for March.

Example.

Lobby LLC retails food products in the city of Mytishchi. The sales area is 17 square meters. m, K1 - 1.798, K2 - 0.9, rate - 15% (decision of the Council of Deputies of the Mytishchi municipal district of the Moscow region dated November 22, 2012 No. 61/7). On March 12, the company rented additional space in the same premises. The physical indicator increased to 36 square meters. m. Here's how to fill out the UTII declaration for the first quarter of 2021.

The accountant took into account the new value of the area from March 2021. The tax base in January and February is the same - 49,517 rubles. (RUB 1,800 × 1,798 × 0.9 × 17 sq. m). Base for December - 104,859 rubles. (RUB 1,800 × 1,798 × 0.9 × 36 sq. m). The total tax base for the fourth quarter is RUB 203,893. (49,517 × 2 months + 104,859 rubles). UTII for the fourth quarter - 30,584 rubles. (RUB 203,893 × 15%).

In case of a zero declaration

The position of the law regarding the provision of zero declarations under “imputation” is clear - submitting zero declarations is not allowed!

The tax levy on imputed income is calculated not from the profit actually received, but from the income imputed by the state. Therefore, regardless of whether economic activity is actually carried out or not, it is necessary to pay taxes and file a declaration in any case.

What to do if there were no financial indicators during the reporting quarter? For example, the organization could be damaged by a fire or a responsible employee could become ill.

Even if you manage to file a zero declaration, according to the law, this will be a violation. Errors will have to be corrected by submitting an updated document with an additional tax charge.

It turns out that the position of the tax authorities regarding zero declarations is simple - if the activity is not carried out, you need to write an application for deregistration, and if it is carried out, then you need to make tax payments and submit “normal” declarations.

Filling out section 3

In section 3, calculate the total amount of tax payable for all places and types of activities on UTII (line 040). This section is formed based on the data from all sections 2. The order of filling out the lines is as follows:

| Line | Index |

| 005 | On line 005, indicate the taxpayer's characteristics: • 1 – for organizations and individual entrepreneurs paying income to individuals; • 2 – for individual entrepreneurs without employees. |

| 010 | The sum of the values of lines 110 of all sections 2 of the declaration. |

| 020 | Amounts of paid insurance premiums and paid disability benefits (only for taxpayer indicator – 1). |

| 030 | Filled out as an individual entrepreneur without employees. You need to enter the amount of insurance premiums “for yourself”. |

| 040 | You need the difference between lines 010 and 030. The resulting tax amount must be greater than or equal to zero. |

Here is a possible sample of section 3 of the declaration for the 1st quarter of 2017.

Filling example

Let us show with an example how to fill out a UTII declaration for an individual entrepreneur. If an entrepreneur works alone, then he has the right to reduce the tax calculated for the fourth quarter by the entire amount of contributions paid for himself during the same period.

Individual entrepreneur Sergey Ivanovich Kotov provides cargo transportation services in the city of Mytishchi, Moscow region. The main OKVED code is 49.41 (Activities of road freight transport). There are no hired workers.

Initial data:

- FP - number of vehicles used in the activity - 1;

- BD - basic profitability for this type of activity - 6,000;

- K1 for 2021 – 1.798;

- K2 (in Mytishchi for this type of activity) – 1;

- tax rate – 15%;

- the amount of fixed insurance premiums paid in the 4th quarter of 2016 is RUB 5,788.

We calculate the amount of UTII for the 4th quarter of 2021 using the formula: DB * FP * K1 * K2 * 15% * 3 months. Let's substitute our values, we get ((6,000 * 1 * 1.798 * 1 * 15%) * 3) = 4854.6 rubles, rounded to 4855 rubles. This is the amount of calculated tax that we can reduce by the contributions paid. We get that 4855 - 5,788 <0.

Until January 25, 2021, IP Kotov S.I. would have to pay tax to the budget, but in our case it is equal to 0 rubles. The lack of tax due is due to the fact that insurance premiums paid for the 4th quarter exceed the amount of calculated tax.

Filling out section 1

Lastly, based on the data in sections 2 and 3, you need to fill out section 1 of the UTII declaration for the 1st quarter of 2021. In section 1 please indicate:

- on line 010 – code of the municipality on whose territory the “imputed” activity is carried out;

- on line 020 - the amount of UTII payable for each municipal entity (each OKTMO).

In section 1, line 010 can be generated several times if a company or individual entrepreneur is engaged in “imputation” in several municipalities that are subordinate to one Federal Tax Service.

If an organization operates in the territory of several municipalities under the jurisdiction of one Federal Tax Service, then calculate the single tax payable for each OKTMO as follows:

- add up the amounts of UTII for the 1st quarter of 2021 for all types of activities carried out on the territory of each municipality (indicators of lines 110 for all sections 2 of the declaration for the 1st quarter, which indicate the same OKTMO);

- divide the total amount by the tax amounts for all municipalities (indicator for line 010 of section 3 of the declaration for the 1st quarter);

- multiply the total by the amount of UTII accrued for payment for the first quarter (line 040 of section 3 of the declaration).

The final indicators in section 1 of the declaration for the 1st quarter of 2017 may look like this example:

completed UTII declaration for the first quarter of 2021 in Excel format.

Declaration on UTII from January 1, 2020

Back in 2021, section No. 3 appeared in the declaration with the calculation of insurance premiums that reduce tax. Remember that companies cannot reduce the amount by more than half, however, individual entrepreneurs without employees can even reset the tax to zero and not pay it at all.

To allow individual entrepreneurs to include a tax deduction for the purchase of an online cash register in their declaration, tax authorities have developed a new reporting form. It was approved by order of the Federal Tax Service dated June 26, 2021 N ММВ-7-3/ [email protected]

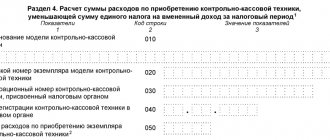

You won't have to spend a lot of time learning a new form. The form remained the same, but was supplemented with an additional section. Section 4 was introduced to reflect the costs of purchasing, installing and configuring online cash register systems by entrepreneurs. Let us remind you that the transition to online cash registers ended on July 1, 2021, so there is a need to update the form. When purchasing cash register equipment in this section you need to reflect:

- name of the purchased cash register model;

- serial number of the cash register;

- registration number received from the tax office;

- date of registration of the cash register with the inspection;

- expenses for purchase, installation and configuration - expenses in the amount of no more than 18,000 rubles per cash register can be deducted.

Responsibility

If the UTII declaration for the 1st quarter of 2021 is submitted later than April 20, 2021, then the organization or individual entrepreneur may be fined (Article 119 of the Tax Code of the Russian Federation). Fine – 5% of the UTII amount not paid on time based on the declaration for each full or partial month from the day established for its submission. That is, if the declaration for the first quarter of 2021 is submitted, say, one day later and the amount payable under this declaration is 125,600 rubles, then the fine is 6,280 rubles. However, the fine cannot be less than 1000 rubles and should not exceed 30% of the tax amount (Article 119 of the Tax Code of the Russian Federation).

For violation of the deadlines for submitting an “imputed” declaration, administrative liability is also provided for officials (individual entrepreneurs or directors): a warning or a fine of 300 to 500 rubles (Article 15.5 of the Code of Administrative Offenses of the Russian Federation).

Read also

15.03.2017

Is a declaration submitted if there was no activity?

Some taxpayers may mistakenly think that if activities are not carried out under UTII, then there is no need to submit reports. But that's not true. Imputed tax has no such thing as absence of activity and tax is always charged.

In this case, to begin conducting business, the payer must provide an application:

- Individual entrepreneurs provide an application in the UTII-2 form.

- LLCs submit an application in the form of UTII-1.

Attention! It is possible not to pay tax and not to provide reports in only one case - if the taxpayer has submitted to the tax office an application for termination of activities.

In order to suspend or close a single tax activity, an application is submitted:

- Organizations must submit an application in the UTII-3 form.

- Individual entrepreneurs submit an application using the UTII-4 form.

In all other cases, it will be necessary to calculate the tax according to the calculated indicators, pay and submit reports.