The cancellation of insurance premiums for the 2nd quarter of 2021 means a reduction in the amount of insurance premiums that must be paid for 2021. The State Duma adopted the Law on insurance premiums for 2020 for individual entrepreneurs affected by the spread of coronavirus infection.

There was a lot of talk in the media that the government would cancel taxes for the 2nd quarter of 2021 for individual entrepreneurs. Let's figure out who needs to pay insurance premiums and who doesn't have to pay.

So, the amount of insurance contributions for compulsory pension insurance in a fixed amount for 2021 for such individual entrepreneurs will be 20,318 rubles instead of 32,448 rubles.

Note!

Only contributions to compulsory pension insurance will be reduced for 2021. Contributions for compulsory medical insurance (medical insurance) for affected individual entrepreneurs for 2021 remain at the same level - 8,426 rubles.

Who is entitled to a reduction in the amount of insurance premiums “for themselves” in 2020:

- Individual entrepreneurs whose main OKVED code is as of 03/01/2020. is on the list of those most affected by coronavirus, approved by the Government of the Russian Federation

- The individual entrepreneur is included in the SMSP register as of March 1, 2021.

How individual entrepreneurs can reduce insurance premiums “for themselves” in 2021.

Individual entrepreneurs from affected areas of activity do not need to submit special applications.

Since the deadline for paying insurance premiums in a fixed amount in 2020 is set at December 31, 2020, the entire amount of contributions for compulsory health insurance—20,318 rubles—must be paid no later than this deadline. Payment of contributions during the year is made in any amount.

For example, individual entrepreneurs who pay contributions quarterly, insurance premiums for compulsory pension insurance “for themselves” in the second quarter of 2021. may not pay.

Our recommendations.

Since the same Law provides for the exemption of individual entrepreneurs affected by coronavirus from paying UTII for the second quarter of 2021, it is not advisable to pay insurance premiums in a fixed amount for compulsory health insurance and compulsory medical insurance in the second quarter of 2021. UTII payable for the 2nd quarter of 2021 will be 0 rubles, and they will not be able to reduce the amount of tax by the amount of contributions “for themselves” in the second quarter of 2021, and they will also not be able to transfer the deduction to the 3rd quarter of 2021, since dues were paid in the second quarter.

To a lesser extent, this recommendation applies to simplified taxation system payers, since the tax under the simplified taxation system for 2021 is considered an accrual total from the beginning of the year, and the deduction will not be lost.

How to pay insurance premiums correctly for 2021

All individual entrepreneurs must, by December 31, 2020, correctly calculate and pay insurance premiums for compulsory health insurance and compulsory medical insurance to the budget in a fixed amount. If you do not pay insurance premiums by December 31, 2020, you may lose the right to reduce the single tax under the simplified tax system and UTII by the amount of contributions paid “for yourself.” And if you overpay contributions in 2021, you will not be able to reduce the tax for 2021 by the amount of the overpayment, since you can only reduce the tax on contributions within the calculated amounts. You will also lose the right to a tax reduction in 2021 by the amount of contributions paid in 2021 - the tax was actually paid in a different tax period, not in 2021.

Thus, before the end of 2021, you need to check your insurance premiums. And if necessary, pay additional fees, or write an application for a refund of the overpaid amount of fixed fees. This is especially true for entrepreneurs who are eligible for tax benefits due to COVID. We talk in detail about insurance premiums in this article.

Should an individual entrepreneur pay insurance premiums?

The question of whether a pensioner of an individual entrepreneur should pay insurance premiums interests many. Previously, legislation did not exempt entrepreneurs from paying insurance premiums for themselves, even upon reaching retirement age. But the situation changed in 2019, with the adoption of a new bill proposed by the President.

What happened in 2021

The government has decided that individual entrepreneurs will no longer pay insurance premiums from January 1, 2021. Citizens who have reached retirement age and are registered as individual entrepreneurs are exempt from paying contributions for mandatory pension and health insurance. This innovation is all the more fair since these individuals have already fulfilled their duty to the state for mandatory insurance transfers to the Pension Fund.

The conditions for providing benefits imply a transition to the tax regime of a self-employed person, with a limit on total income during the year to no more than 2.4 million rubles.

This exemption applies exclusively to payments that entrepreneurs make for themselves. The need to pay contributions for recruited personnel remains in full.

Will they pay in 2021?

In 2021, the introduced cancellation of payment of insurance premiums was retained. Therefore, entrepreneurs who have reached retirement age do not need to make payments to compulsory pension insurance and compulsory medical insurance. This continues to apply to payments for yourself, and not for employed employees.

Article on the topic: Peculiarities of taxation of sick leave with insurance premiums

Payments for injuries remained the same, without benefits or discounts.

The following categories of business entities can benefit from this exemption:

- Individual entrepreneurs working under a patent, since the cost of a patent does not depend on insurance premiums;

- entrepreneurs of the simplified system for the object “income minus expenses”; which is typical, the greatest benefit will be received by those individual entrepreneurs who have not made a profit from the business;

- businessmen on the simplified tax system and the single tax, for whom tax deductions do not exceed the amount of personal insurance contributions.

The differences in the profitability of the changes made are explained by the peculiarities of the Russian taxation system for different categories of entrepreneurs.

How can I be exempt from paying insurance premiums?

If you switch to the Professional Income Tax (PIT) regime (also called the “tax for the self-employed”), then you won’t have to pay insurance premiums at all. If you produce any products or carry out the work yourself, have an income of up to 200 thousand rubles per month and do not hire employees, then you can pay the NAP tax according to a simplified scheme. We'll look at how it works in this article.

What taxes do retired entrepreneurs need to pay?

With the exception of the cancellation of compulsory medical insurance and compulsory medical insurance premiums for certain categories of individual entrepreneurs (in relation to small and medium-sized businesses), these payers are required to pay:

- mandatory pension payments for recruited personnel;

- similar deductions for compulsory health insurance for employed employees;

- social insurance contributions against possible accidents at work (to the Social Insurance Fund) for yourself and employees on staff.

In addition to insurance premiums, individual entrepreneurs are required to pay taxes:

- the main ones provided for by the chosen taxation system;

- additional, depending on the type of activity performed.

The full composition of the assigned mandatory contributions is determined by the specified features of the work of an individual entrepreneur.

Does this category have any benefits?

Self-employment - pros and cons of this status

There are no special benefits for pensioners for individual entrepreneurs. Older people pay taxes and contributions at regular rates. They should be paid even if the individual entrepreneur does not work and does not generate income. No benefits are provided for persons of retirement age in this matter.

True, an older entrepreneur, just like his young colleagues, has the right to apply preferential taxation systems provided for by the Tax Code of the Russian Federation. You can also take advantage of regional benefits and other legally established preferences.

A pensioner can apply for registration of an individual entrepreneur in several ways:

- In electronic form using the State Services website.

- At the nearest MFC.

- In the territorial department of the Federal Tax Service of Russia at the place of residence.

The procedure in all cases of submitting documents is no different; in order to register an individual entrepreneur, you should:

- Fill out the application in the established form 21001. Its form can be printed from the Federal Tax Service website, and can also be obtained directly from the tax office or the MFC.

- Pay the fee. The payment receipt is included in the list of required documents.

- Present a passport of a citizen of the Russian Federation, a copy of it and a TIN certificate. If the last document is not available, then you can find out the TIN from the Federal Tax Service, as well as obtain a new or duplicate certificate in case of loss of the original.

- The application processing period takes no more than five working days.

- Open a bank account and prepare a seal.

To register as an individual entrepreneur, you will need two documents: a passport and an INN

OKVED codes cause particular difficulty for older people. These are digital designations of the types of activities that future businessmen plan to engage in. You can find OKVED in a special directory. There are usually several of them indicated in the application, but one must be the main one. The MFC helps to sort out this issue, so in order not to make mistakes and not rewrite the application several times, the board will contact this government agency.

After the allotted time for consideration of the application, the tax service is obliged to provide a package of documents on registration of individual entrepreneurs, or a document with a reasoned refusal.

Important! Individual entrepreneur registration certificates are no longer issued. Now a newly minted entrepreneur can only receive an extract from the unified state register of individual entrepreneurs.

For the state, it makes no difference at what age an adult entrepreneur registers. Even if a pensioner opens an individual entrepreneur, the pros and cons will be about the same as those of young competitors.

Are there any benefits for retired entrepreneurs?

In addition to the specified exemption for fixed insurance contributions for themselves, individual entrepreneurs of retirement age do not have other benefits regarding social insurance payments.

Support measures provided for by law include:

- abolition of the tax on real estate owned personally and not involved in business activities;

- additional preferences established by resolutions of local authorities.

For example, the Moscow government, by regional resolutions, provides for the provision to pensioners of:

- the right to free travel by public city transport (excluding taxis and minibuses);

- preferential (free of charge or with significant discounts) purchases of medicines according to prescriptions prescribed by doctors;

- discounts on travel on commuter trains.

Related article: Contributions to OSS in case of disability or in connection with maternity

Certain subsidies are assigned to pensioners for paying for the services of utility organizations.

But otherwise, the legislation does not provide benefits for individual entrepreneurs of retirement age. On the contrary, while engaging in entrepreneurship, an individual entrepreneur retains the status of a working pensioner, which cancels the annual indexation of pensions as compensation for the adverse impact of inflationary processes.

It is also important to take into account that tax and insurance benefits are not provided for individual entrepreneurs who are pensioners in the event of being assigned a disability group.

Can a pensioner open an individual entrepreneur?

Is it possible for a pensioner to independently register and open an individual entrepreneur? Any adult citizen of the Russian Federation has the right to register an individual business, regardless of his gender, age, nationality and other similar characteristics. That is, opening an individual entrepreneur is not a particular problem for a pensioner. In addition, the process of registering a business for an elderly person does not have any distinctive features. Pensioners go through exactly the same procedures and pay the same state registration fee for everyone. That is, the state does not restrict the right of older people to do business, but it does not facilitate this process either.

According to the law, pensioners have every right to register as an individual entrepreneur

How many fees do you have to pay?

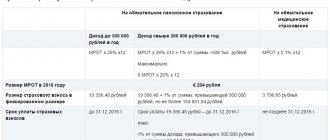

The amounts of mandatory fixed payments for themselves, which are made by those entrepreneurs who were not included in the number of those exempt from these insurance contributions in 2021, are (in thousands of rubles):

- according to OPS - 32,448, with an additional payment of one percent of the excess of the limit of 300,000 rubles. from the profit received per year;

- for compulsory health insurance – 8,426 (without setting limits).

For recruited employees employed by a pensioner individual entrepreneur on a permanent basis, the amount of insurance premiums is (indicated as a percentage):

- for compulsory pension insurance - 22, or 10 if the payment base exceeds 1,465 thousand rubles;

- for compulsory medical insurance – 5.1, with a maximum payment amount of 966,000 rubles;

- for social insurance – 2.9;

- for injuries - from 0.2 to 8.5 percent, taking into account the classification of the profession by degree of harm (taking into account the OKVED code).

Exemption from mandatory payments to the Pension Fund and the Compulsory Medical Insurance Fund for entrepreneurs who are pensioners is a reasonable measure that reduces the tax burden for certain categories of payers. But the degree to which such a benefit is beneficial for pensioners largely depends on the tax system chosen by the entrepreneur.

State Duma opinion

The State Duma considered the exemption of working pensioners from insurance contributions in a special manner.

And a positive preliminary decision was made on this issue. All that remains is to develop an appropriate legislative project that concerns employed pensioners, and at the legislative level to cancel payments to the Pension Fund of the Russian Federation.

In other words, there is a positive preliminary decision. Now we need to develop a legislative framework to exempt employers who hire pensioners from insurance contributions.

“Surprises” of pension reform for working pensioners. What to prepare for?

How to become bankrupt

The innovation will not lead to abuse, the parliamentarian noted. In order to prevent situations where businesses begin to be transferred to pensioners for the sake of benefits, the procedure for pensioners to suspend business activities will be determined by the Government, and the exemption from payment will be temporary, the deputy explains.

According to Natalya Kostenko, the bill will also help encourage pensioners to engage in entrepreneurship. On December 14, the deputy sent her amendments to the Tax Code and the Law “On Insurance Pensions” for approval to the United Russia faction, and after receiving the conclusion she plans to submit the document to the State Duma.

Individual entrepreneur - pensioner: rights and responsibilities

The algorithm for tax registration of individuals is the same for all applicants; the set of documents for registration and the timing of all procedures do not change depending on the age of the future entrepreneur. At the stage of registration of individual entrepreneurs, it is necessary to be guided by the norms of the law on state registration dated 08.08.2001 No. 129-FZ. In order for a pensioner to register an individual entrepreneur, he will need to submit the following documents to the tax office:

The fiscal burden on businessmen who have reached retirement age does not differ from that inherent in other categories of entrepreneurs. The list of taxes paid is compiled in relation to the applicable taxation system, but does not depend on the age of the entrepreneur himself. If an individual entrepreneur is opened by a pensioner, he must pay:

How to get

The head of the Federal Tax Service, Daniil Egorov, has already explained that entrepreneurs do not need to submit applications to receive the above-mentioned benefits. The tax will be written off automatically thanks to the organized information system. The business will continue to submit declarations on time, and the system itself will remind you of the right to write-off or notify that payment is not necessary.

Almost 2 million entrepreneurs across the country will receive government support.

© Author: Ksenia Paltseva Renovar.ru

List of OKVED to which taxes and contributions will be written off

| Kind of activity | OKVED code |

| Land passenger; automobile cargo (+ transportation); passenger air and cargo transport; bus terminals and bus stations; support activities related to air transport | 49.3, 49.4, 51.1, 51.21, 52.21.21, 52.23.1 |

| Creative activities, activities in the field of art and entertainment, cinemas, museums and zoos | 90, 59.14, 91.02, 91.04.1 |

| Physical education and health activities and sports | 93, 96.04, 86.90.4 |

| Travel agencies and other organizations involved in tourism | 79 |

| Hotels and organizations providing temporary accommodation | 55 |

| Catering | 56 |

| Additional education for adults and children, day care services for children | 85.41, 88.91 |

| Organization of conferences, exhibitions | 82.3 |

| Repair (computers, personal and household items), laundry, dry cleaning, hairdressing and beauty salon services | 95, 96.01, 96.02 |

| Dentistry | 86.23 |

| Retail trade of non-food products | 45.11.2, 45.11.3, 45.19.2, 45.19.3, 45.32, 45.40.2, 45.40.3, 47.19.1, 47.19.2, 47.4, 47.5, 47.6, 47.7, 47.82, 47.89 |

Individual entrepreneur taxes

Cases of non-payment are not common, but among defaulters, most people simply forget to do it on time. If the payment procedure is violated, the federal tax service, based on the delay, will impose a fine on the individual entrepreneur. The amount of the fine depends on the amount of unpaid funds. The amount of deductions will be 20 percent of the unpaid money.

Generally speaking, in Russia, insurance of individuals is the responsibility of their employers. Contribution rates for employees are quite high. If the type of activity does not qualify as preferential, then contributions for hired personnel are at least 30.2% of the amounts paid to them.

Insurance premiums from payments to individuals

Law No. 172-FZ also reset salary contributions for organizations and individual entrepreneurs accrued for April, May and June 2021.

That is, for the 2nd quarter. Within the established maximum value of the base for calculation for the corresponding type of insurance and above it for 2 sq. 2020 the following reduced insurance premium rates apply:

- for compulsory pension insurance (OPI) - in the amount of 0.0%;

- for mandatory social insurance in case of temporary disability and in connection with maternity (VNIM) – 0.0%;

- for compulsory health insurance (CHI) – 0.0 percent.

Insurance premium rates for payments to individuals for the 2nd quarter of 2020 have been reduced to 0% for all organizations and individual entrepreneurs who fall under the criteria for victims of coronavirus specified above. In addition, this includes:

- organizations from the register of socially oriented non-profit organizations, which, in particular, from 2021 receive certain grants and subsidies;

- some NGOs and religious organizations.