Last modified: January 2021

Unreasonable assessment of tax payments, unlawful imposition of financial sanctions and delays in the return of erroneously established taxes are the most frequently recorded violations by the tax inspectorate. Both individuals and entrepreneurs are faced with actions that contradict legal norms.

According to Article 137 of the Tax Code of the Russian Federation, every taxpayer can officially file a complaint against representatives of the inspectorate. With its help, the inaction or action of employees is challenged, as well as documents and decisions made are appealed. In this article we will look at who and how to file a complaint against the tax office, what pitfalls and deadlines the procedure has.

Grounds for filing a complaint

It is advisable to file a complaint against the tax authority when you do not agree with its decisions or actions, but the inspectorate itself refuses to eliminate its violations. The most common reasons for such situations are:

- refusal to provide a tax deduction;

- personal data obtained during the processing of personal information was disclosed;

- taxes have been calculated incorrectly;

- denial of admission or service during reception hours;

- accrual of penalties for tax already paid;

- assessment of property taxes that are no longer owned.

At the same time, a violation on the part of the tax authorities can manifest itself not only in an illegal refusal or other action, but also in inaction or ignoring received applications.

Important! The peculiarity of appealing the actions of the Federal Tax Service is that its procedure is regulated by the Tax Code of the Russian Federation, and not by the Law on Citizens' Appeals. Therefore, when filing a complaint, you should take into account the provisions of Chapter 19 of the Tax Code of the Russian Federation.

Where to go if you are not satisfied with the solution

If the applicant is not satisfied with the resolution, there are other ways to appeal the violation. One of them is filing an appeal to a higher authority. It is drawn up by analogy with an ordinary deed.

If the tax service department abuses its powers, it is allowed to appeal to the supervisory authorities - the prosecutor's office and the court. Often individuals try to contact Rospotrebnadzor, but this structure is only concerned with protecting the rights of consumers, not applicants. A trial will help achieve justice, but the person will have to prepare a whole package of documents, including filling out an application.

Dear readers! To solve your problem right now, get a free consultation

— contact the lawyer on duty in the online chat on the right or call: +7 (499) 938 6124 — Moscow and region.

+7 (812) 425 6761 — St. Petersburg and region. 8 (800) 350 8362 - Other regions of the Russian Federation You will not need to waste your time and nerves - an experienced lawyer will solve all your problems! Or describe the situation in the form below:

Where can I complain to the tax office?

Before filing a complaint with the Federal Tax Service of Russia or other government agencies, you should try to figure it out with your regional Federal Tax Service Inspectorate. It may be enough to point out the error to the employee over the phone or in person, and it will be corrected, and you won’t have to file a tax complaint. If the problem is not solved in this way, you need to connect the appeal mechanism provided for by law.

Article 138 of the Tax Code of the Russian Federation establishes the following procedure for appealing actions and decisions of the tax authority:

- To a higher tax authority

- To court

This means that the first instance for filing a complaint against the tax inspectorate is always a higher tax authority. Next, the taxpayer has a choice: either continue appeals within the tax service, or file a lawsuit.

Within the tax service itself

If you choose the first option, a complaint about the actions or inaction of the tax authority can be submitted sequentially to the following authorities:

- District Federal Tax Service Inspectorate at your place of residence

- Department of the Federal Tax Service for the region

- Central office of the Federal Tax Service of Russia

There are several ways to file a complaint with the tax office at your place of residence:

- Come in person. To do this, you need to use the online booking service, where you can pre-book an appointment in the next 2 weeks. There you will need to fill in your personal and contact information, select an inspection for an appointment, as well as a suitable date and time. At a personal appointment, you can try to discuss the situation orally or submit an appeal in writing. We recommend that you always draw up a written document, because if during a conversation with the tax inspector it becomes clear that the problem cannot be solved on the spot, you can immediately submit a written appeal to the office addressed to the head of the inspectorate.

All written complaints to the tax service should be drawn up in two copies, so that on the second the Federal Tax Service employees sign a receipt for acceptance of the documents.Important! Even for an oral conversation with an inspector, you need to properly prepare and document your claims. For example, if a tax was assessed on a car that has long been sold, then you need to provide documents confirming the sale of this car.

- Make a phone call. You can find out the contacts of your Federal Tax Service on the official website of the government agency.

- Send a letter to the address of the tax office.

As in the case of a personal appeal, you will need to attach copies of all documents confirming your arguments to the letter. The shipment should be sent by registered mail with acknowledgment of receipt and a list of attachments to ensure that the application will be received and considered. Note! You should not send original documents in your complaint letter: they may get lost. Photocopies will be enough for the tax authority to make a decision. - Submit a complaint to the Federal Tax Service online. To do this, it is better to use the Taxpayer’s Personal Account, if you are registered in it. You can also use the publicly available electronic appeal form and submit a complaint to the Federal Tax Service through the website.

There are also several options for filing a complaint with the regional department of the Federal Tax Service and the Central Office. Contacts of these structures can be found on the Federal Tax Service website.

You can also contact the Central Office of the Federal Tax Service by way of pre-trial appeal through the State Services service.

To court

Complaints from individuals are mainly resolved within the tax service itself and rarely go to court. However, if the dispute cannot be resolved, and even more so if there is a financial dispute, for example, regarding a deduction, you can go to court through litigation.

To file a claim in court, you must:

- Pay the state fee. For statements of claim challenging the actions and decisions of an authority, the state duty is 300 rubles. If claims are made for the collection of funds, the state duty is calculated based on the amount of claims according to the rules of Article 333.19 of the Tax Code of the Russian Federation. Pensioners and disabled people of groups I and II are exempt from paying state duty. A receipt for payment is attached to the statement of claim.

- If the application is submitted in paper form, you need to print out the applications with copies of the attachments according to the number of persons participating in the case: for yourself, the tax office and the court.

- Take to the post office a copy of the claim for the defendant along with the attachments and send it to the Federal Tax Service by registered mail with acknowledgment of receipt. Receipts of delivery will also need to be attached to the claim in court.

- Apply to the court. This can be done in three ways:

- come to the court office and hand in the documents in person. Then the secretary will mark your copy as having been received and take away the claim along with all the attachments;

- send the claim by registered mail;

- use the electronic system of GAS Justice and send documents electronically in PDF format. This will require authorization through the ESIA.

The period for consideration of the case in the first instance takes about two months. When filing an appeal or cassation complaint, the dispute can drag on for up to a year.

To the prosecutor's office

Illegal actions or decisions of any government agency can be appealed to the Prosecutor's Office of the Russian Federation. The tax office is no exception. However, a complaint to the prosecutor's office against the tax inspectorate cannot replace an appeal to the tax service itself, so it makes sense to draw up an application to this supervisory authority if other ways to solve the problem with the tax inspectorate have been exhausted. Read our article about ways to contact the prosecutor's office.

To the prosecutor

The incredible variety of methods of address is amazing. In addition to traditional methods (written, oral, electronic, via the Internet), even telegraph and fax can be used.

For formal details, it makes sense to study the Federal Law of 01/17/1992 N 2202-1 “On the Prosecutor's Office of the Russian Federation”, as well as the Instructions on the procedure for considering applications and receiving citizens in the prosecutor's office of the Russian Federation (approved by Order of the Prosecutor General of 01/30/2013 N 45) , they are posted in the public domain on the official website of the Prosecutor General’s Office (genproc.gov.ru). By the way, there is also an Internet reception there. To avoid disappointment, you must understand that the subject of prosecutorial supervision, among other things, is compliance with the Constitution of the Russian Federation and laws, compliance with the rights and freedoms of man and citizen. In other words, the basis for taking prosecutorial response measures is a report of violations of the law, rights, freedoms and interests (of both individuals and citizens, as well as legal entities and entrepreneurs). In practice, this means that there is no point in requiring the prosecutor, for example, to recalculate the calculation made by the tax authorities, but you can apply if the procedure for a tax audit, tax collection, etc. is violated.

An appeal to the prosecutor's office can be formalized as a statement or complaint, but in any case must contain:

- name of the prosecutor's office (full name, position of the addressee);

- FULL NAME. applicant, address for response (postal or electronic);

- essence of the question;

- signature and date.

The appeal can be sent both to the prosecutor's office at the location of the applicant, and to the prosecutor's office at the location of the tax inspectorate about which the complaint is made.

Having established the fact of a violation, the prosecutor must submit a proposal to eliminate violations of the law to the tax inspectorate (official), whose competence is to eliminate the violations. The submission is subject to immediate consideration.

Within a month, specific measures must be taken to eliminate violations of the law, their causes and conditions conducive to them, and the results must be reported to the prosecutor in writing.

Other measures of prosecutorial response are also very effective:

- resolution to initiate proceedings for an administrative offense;

- sending a warning to an official by the prosecutor about the inadmissibility of violating the law.

It happens, although not often, that prosecutors stumble. Then the only thing left to do is go to court. Thus, the taxpayer sent an application to the Federal Tax Service containing information about tax evasion by a group of entrepreneurs, and supporting documents on 48 sheets. The materials were transferred to the relevant tax office, but on 9 sheets. The loss of 39 sheets gave rise to gloomy thoughts, and the taxpayer asked the prosecutor's office to conduct a thorough check of the above facts and consider bringing the official to the appropriate type of responsibility (administrative or criminal). The court declared illegal the inaction of the prosecutor's office, expressed in the failure to make a decision on the administrative responsibility of the official of the Federal Tax Service, failure to provide a response to the application to initiate a criminal case, the head of the specified interested party was entrusted with the obligation to eliminate the violations of the applicant's rights (appeal ruling of the Sverdlovsk Regional Court dated January 15, 2014 in the case N 33-532/2014).

How to file a complaint?

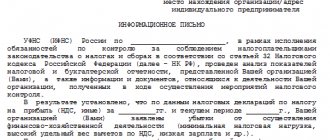

The complaint is made in writing in accordance with the requirements approved by the Federal Tax Service. Thus, according to Article 139.2 of the Tax Code of the Russian Federation, the complaint must contain:

- personal data of the applicant: full name and address;

- the essence of the appeal: what actions or decisions of the tax authority are being appealed, full name of the official, details of regulations, etc.;

- justification for his claims: for what reasons does the applicant consider these actions and or decisions to be inconsistent with the law, supporting documents;

- method of receiving a decision on a complaint: on paper by mail, electronically by e-mail or through the taxpayer’s personal account;

- applicant's signature.

All documents referred to by the applicant are attached to the complaint. Also, the application should not contain insults or profanity, otherwise it may be left without consideration.

Recommendations:

- The claims in the complaint must be justified, i.e. supported by relevant documents and references to the provisions of the law. Here everything largely depends on the circumstances in each specific situation, so it is better to seek advice from a lawyer.

- When writing, you must adhere to a business style of presentation, succinctly and concisely describe the circumstances of the complaint against the tax authority, and maintain chronological order.

- It is better not to deviate from the topic of the address, not to make lyrical digressions and exclude the emotional component.

Considering the above, when compiling, you should adhere to the order indicated below:

- The document header is in the upper right corner of the sheet (if the document is paper). Information about the recipient government agency and the applicant is indicated. It will not be possible to submit a complaint to the tax office anonymously if you want to get an answer to it, since it will not be accepted for consideration.

- The essence of the complaint against the tax inspectorate: what actions and decisions are being appealed, on what grounds.

- The final part lists specific requests to the government agency: cancel the decision of the tax authority, return the tax deduction, etc.

- List of application documents.

- Date and signature.

You can see what a complaint should look like using our example.

Sample complaint

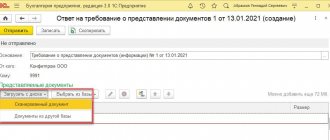

What is a complaint and how is it filed?

A complaint is a document drawn up in writing for the purpose of protesting actions/inactions or papers issued by tax authorities. This is how paragraph 1 of Article 138 of the Tax Code of the Russian Federation interprets this concept. There are several ways to file a complaint :

- to the window for receiving documents from the tax authority;

- to the tax office.

The first two methods involve filing a complaint in person. Contact the department that conducted the inspection. :

- by mail;

- online on the Federal Tax Service website;

- using telecommunication channels.

The complaint procedure is valid for 90 days from the moment the violation was discovered. But if the taxpayer does not meet the deadline, he has the right to request an extension for compelling reasons (evidence required). The procedure for submitting and reviewing a document generally takes up to 33 days. The first three days are spent on acceptance and registration of the document, the remaining 30 days are spent on consideration. The deadline for making a decision on a complaint may be extended by another 30 days, of which the taxpayer must be notified in advance.

Important! If the taxpayer considers the decision made following the appeal to be incorrect, in accordance with legislative norms, he can challenge it in court within the next 10 days.

Time limits and procedure for filing and consideration of a complaint by the tax authority

According to Article 139 of the Tax Code of the Russian Federation, the taxpayer has 1 year to appeal the actions and decisions of the Federal Tax Service to the regional department of the Federal Tax Service.

The decision made by the regional department can be appealed to the Central Office of the Federal Tax Service within 3 months. Important! A complaint to a higher tax authority is submitted through the district Federal Tax Service, whose actions are being appealed.

Based on the results of consideration of the complaint, the tax authority makes one of the following decisions:

- refuses to satisfy the complaint;

- cancels the decision of the Federal Tax Service in whole or in part;

- makes a new decision in the case to replace the canceled one;

- recognizes the actions of the tax inspector as illegal.

Depending on the subject of the complaint filed, its consideration takes from 15 to 30 days. You can find out the status of the complaint on the official website of the Federal Tax Service.

Responsibilities of the tax inspectorate.

The duties of the tax service are established in Art. 32 of the Tax Code of the Russian Federation.

A citizen can contact a government agency on the following issues:

- obtaining information on taxation;

- monitoring compliance with tax legislation;

- receiving or providing a declaration of income, accrued fees to the treasury, etc.;

- requesting information about paying taxes, etc.

The regulatory legal act lists the main functions of the Federal Tax Service.

Tax service employees also perform other duties provided for by federal laws.

What should be in the document

The complaint can be drawn up in free form, but all the requirements and nuances listed in Federal Law No. 59-FZ of May 2, 2006 must be taken into account. There are quite a lot of them. If the document is drawn up independently, then there is a possibility of missing one or more mandatory nuances.

Thus, in order to ensure that no data is missed and the complaint is accepted, it is better to use a ready-made application form. This is what the lion's share of those who address this issue do.

Going to court

Where can I complain about the actions of the tax inspectorate if my appeal to the higher authorities of the Federal Tax Service did not bring the expected result? This question interests everyone who has had to challenge the decisions of the fiscal service at least once in their life.

If the taxpayer is confident that he is right, then he can complain to the court. But to do this, you need to know not only where exactly to send the application, but also how to fill it out correctly. The drafting of the document can be entrusted to a lawyer specializing in resolving tax disputes.

The court has the right to consider tax disputes for quite a long time.

According to the law, no more than 3 months are allotted for this purpose. If we are talking about studying a more complex case, the judge, at his discretion, can extend this period to 6 months. We also recommend articles:

- Application for transition to the simplified tax system;

- How to challenge transport tax;

- How to fill out and submit tax return 3-NDFL;

When a complaint is not accepted

The complaint is not considered accepted if:

- submission to the tax authority that did not issue the contested acts in relation to the person whose rights violation is being appealed;

- if the complaint does not comply with the approved format;

- the absence in the complaint of an enhanced qualified signature of the person filing the complaint or a discrepancy between the electronic signature of the enhanced qualified signature of the person filing the complaint;

- filing a complaint by a representative without attaching an information message about representation in tax relations.

About consideration of AJ

Clause 1 of Art. 140 of the Tax Code allows you to provide additional documents before the claim is resolved (during its consideration). Moreover, it will be necessary to explain why these additions were not provided earlier (clause 4 of Article 140 of the Tax Code). The EIT considers the application without the participation of the person submitting it. Exceptions will be cases where contradictions are identified between information from the audit materials and information received from the taxpayer. In such a development, the petitioner is notified of where and when it will be considered.

The AJ can be withdrawn in whole or in part until it is resolved. Also, the VNO may leave the claim without consideration in whole or in part, there are three reasons for this:

- The order from clause 1 of Art. has been violated. 139.2 of the Tax Code (not in writing, there is no signature of the complainant or his representative, it is not indicated what exactly violated the rights of the complainant).

- The person who filed the claim declared its full or partial withdrawal before its consideration.

- An AJ has already been filed on the same grounds.

AJ is permitted by UNO within a month after receiving it. This period can be extended by a maximum of a month.

There are also three possible outcomes of the appeal:

- The requirements from the complaint are not satisfied.

- The disputed decision of the tax authorities is canceled in whole or in part.

- The cancellation is accompanied by the adoption of a new decision on the case.

The decision on the AJ within three days after its adoption is handed over (sent) to the applicant.

When can a higher authority leave an application without consideration?

An appeal to a superior person or body may be left without consideration in the following cases:

- The deadline for filing an appeal has been missed, and there is no petition for its extension;

- Lack of a clearly formulated request and justification;

- Submission of an application by a person who does not have the right to represent the interests of the taxpayer;

- Availability of confirmation that the appeal was also submitted to a higher authority or person and is under consideration;

- Entry into force of a court decision on this issue.

If the circumstances that caused the refusal can be eliminated, the applicant will be asked to make corrections and file a complaint again.

Objections to claims set out in the tax audit report

After conducting any tax audit, as well as when facts are discovered indicating a violation of the legislation on taxes and fees, the inspectors draw up a report. If the taxpayer does not agree with the comments and claims stated in the document, he can draw up objections and send them to the Federal Tax Service. This must be done within 1 month from the date of receipt of the act (Article 100, paragraph 6 and Article 101.4, paragraph 5 of the Tax Code of the Russian Federation).

For reference: Upon receipt of the report, the taxpayer must sign and indicate the date of receipt. It is from this handwritten date that the deadline for filing objections begins. Therefore, you need to be careful and avoid mistakes. If you indicate not a real, but an already past date, then the time allowed for filing objections and complaints will be reduced. If the report is sent to the taxpayer by registered mail, then the starting date is considered to be the 6th day from the date of sending.

Objections can be made both for the entire act and for its individual parts. In this document it is necessary to indicate the number of the inspection report and the date of its preparation. Then you should set out in detail your objections with individual provisions or with the act as a whole. It is advisable to support your statements with documents, copies of which should be attached to your objections.

It is imperative to draw up a list of attached documents, which includes all attachments to the complaint. This will eliminate the possibility of accidentally or intentionally losing part of the attached documentation.

After receiving objections, the tax authority is obliged to inform the taxpayer of the time and place of their consideration. The author of the objections has the right to be present at this discussion and give oral explanations on any issues. However, the failure of the person brought to justice, provided that he was notified of the place and time of the hearing, is not a reason for refusing to consider the case (Article 101, paragraph 2, Article 101.4, paragraph 7 of the Tax Code of the Russian Federation).

During the consideration of objections of the person held accountable, the commission establishes:

- whether there were violations of the legislation on taxes and fees;

- whether the identified cases of non-compliance with legislation constitute a tax offense;

- are there any grounds for bringing the person in respect of whom the act was drawn up to administrative liability;

- circumstances that exclude or mitigate a person’s guilt in committing an offense.

Based on the results of the study, a decision is made. The decision can be either to hold the person accountable or to refuse to hold the person accountable. A decision may also be made to assign additional tax control measures.

If a decision is made to hold the taxpayer accountable, it must indicate the period within which it can be appealed. The complaint should be submitted to a higher authority, and the decision should indicate its name and address. If a refusal is issued at the second stage, the taxpayer can go to court.

Review of the arbitration court decision

While the decision made at the arbitration court meeting has not entered into force, it can be appealed. To do this, one of the parties to the process has the right to file a claim in the appellate court. The deadline for filing a complaint is 1 month from the date of receipt of the decision of the arbitration court of first instance.

A court decision on a previously filed appeal may be appealed in cassation proceedings in whole or in part, according to Art. 273 Arbitration Procedure Code of the Russian Federation.

Cassation appeals are filed within 2 months from the date of entry into force of the judicial act that is planned to be appealed. If the time for filing a complaint is missed for reasons beyond the control of the person who caused the delay, the deadline may be restored. To do this, it is necessary to submit a petition to the arbitration court of the cassation instance, but no later than six months after the entry into force of the decision that will be appealed (Article 276 of the Arbitration Procedure Code of the Russian Federation).

The request to restore the deadlines is considered within 5 days. In case of a positive decision, a judicial act is drawn up; in case of refusal, a ruling is issued. A copy of the act or ruling is sent to the person who filed the petition no later than 1 day after its issuance.

The court considers cassation appeals exclusively within the limits of the requirements of the originally filed complaint. Additional evidence is not included in the case, is not considered and is not taken into account when making a decision.

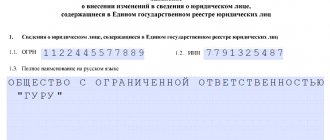

What to follow

Order of the Federal Tax Service of Russia dated December 20, 2021 No. ММВ-7-9/645 approved:

- complaint (appeal) form;

- the procedure for filling it out;

- electronic format;

- rules for filing a complaint (appeal);

- the procedure for sending decisions (notifications) on them in electronic form.

This document establishes the rules for filing complaints (appeals) by legal entities and individual entrepreneurs in electronic form specifically according to the TKS. It is valid from April 30, 2021.