Today, Russian citizens who have the right to receive subsidies by paying property taxes can fill out a corresponding application. It is necessary to enter information into the form according to KND 1150063, an example of which can be filled out in this article, without a single mistake. This should be done, for example, if you receive a disability status that gives you the right to benefits, or if you own several taxable objects.

The KND form consists of several sheets, each of which is dedicated to a specific piece of property owned by an individual and subject to taxes. When submitting an application to the Federal Tax Service, filling out all pages of the form is not required. The taxpayer should enter data only on the sheets he needs.

Submitting a form that confirms the right to receive tax benefits is a right, not an obligation, of an individual.

A citizen is not required to provide supporting documents to the tax service, since, if necessary, INFS inspectors will independently request information about them from the relevant authorities, and then inform the taxpayer about the decision made.

An individual can submit the KND form through the personal account of the Federal Tax Service or in person.

forms according to KND 1150063

What has changed regarding personal income tax in 2021

By Order of the Federal Tax Service dated December 6, 2019 No. ММВ-7-11/622, the notification form for choosing a tax authority for personal income tax was approved, which came into force on January 1, 2020. Now an enterprise that has separate units located on the territory of one municipality (or an enterprise located together with separate units on the same territory) can submit information and pay personal income tax in one of two ways:

- at the registration address of the main organization;

- at the registration address of one of the separate divisions.

Before the introduction of the new law, it was necessary to submit reports and pay personal income tax separately for each division. Now the tax agent has the right to independently choose the Federal Tax Service inspection through which information will be submitted (clause 2 of Article 230 of the Tax Code of the Russian Federation).

How to correctly enter information into the sheets with an application for a tax benefit?

Sheets with data on tax benefits must be filled out according to information about the property and the type of tax that implies preferential tax conditions.

If you, as a taxpayer, are entitled to receive several types of benefits, then a separate form must be drawn up for each property.

At the top of the application, the surname and initials of the payer, as well as his TIN, are entered. The next paragraph indicates information about the property using a code and full name. Then the validity period of the benefit and the details of the document that is the basis for receiving it are specified. At the end of the page there is a date and signature.

Contents of the personal income tax notification form 2021

The new form consists of two pages, but their number can be increased if the organization has more divisions than the approved form provides.

Let's consider what information is indicated in the notification.

First page

On the first page of the personal income tax notice, indicate:

- Full name of the enterprise.

- Code of the Federal Tax Service inspection through which personal income tax data will be submitted (at the place of registration of the main company or any of its divisions).

- Tax period for reporting and paying personal income tax.

- Checkpoint of the enterprise or selected division through which reporting will be provided.

- OKTMO code of the municipality on whose territory the enterprise with separate divisions is located.

- Reason for submitting the notice. There are 4 options, all of them are listed on the form. You should select one of them and indicate its code. If you chose point 4, in a special field you should list the changes that affect the procedure for reporting personal income tax.

General procedure for filling out the form according to KND 1150063

Currently, there are certain features of drawing up an application, on the basis of which citizens receive the right to apply for benefits on property, transport and land taxes.

The procedure for filling out the form according to KND 1150063 is regulated by current tax legislation. However, in order to learn how to fill out the form correctly, you should familiarize yourself with its ready-made example.

An example of filling out a form to receive benefits

The first page indicates the data of the tax authority (code), TIN and full name of the taxpayer, his date and place of birth, passport and contact information, as well as the method of informing about the results of the review, date and signature. In the lower left corner of the form, the information of the authorized person is written down if his representative submits the document for the taxpayer.

On the second page of the form, fill in the abbreviated full name of the person on whose behalf the application is being submitted. A code is selected in the tax benefit column. The details of the make and license plate number of the vehicle, as well as the period for granting the benefit, are detailed below. The following indicates the basis for obtaining the right to a subsidy. In the example above, this document is a certificate of disability. But in your case another document may be involved. In the next column, information is entered about the authority that issued the document, its date of receipt and validity period, as well as the series and number.

On the third page of the application, the abbreviated full name of the taxpayer is again entered. The next column indicates the cadastral number of the land plot, the validity period of the benefit, as well as the details of the document on the basis of which it is issued. The information is filled in similarly to the information on the second sheet.

On the fourth page, the abbreviated full name of the person receiving the property tax benefit is written down. Just below, select the type and indicate the number of the property. The deadline for granting the benefit must be entered, and the details of the document on the basis of which the taxpayer receives it are entered.

Rules for filling out personal income tax notifications in 2020

The requirements for filling out the notification are standard:

- The form should be filled out by hand in block capitals only, using blue, purple or black ink. Or use Courier New font and set the size to 16 or 18 points.

- You should start entering data from the first acquaintance.

- If there is no information, dashes are placed in the empty field.

- Corrections with a barcode corrector are not allowed.

- Double-sided printing is prohibited.

- There is no need to staple the pages together.

As we can see, the same requirements apply to all major regulated reporting forms.

Deadlines for submitting the KND form

Individuals and individual entrepreneurs who are legally entitled to receive tax benefits must submit an application under KND 1150063. The form and deadlines for its submission are approved by the Government of the Russian Federation and regulated by current tax legislation.

According to the orders of the Federal Tax Service of the Russian Federation, the time frame for drawing up and submitting an application for benefits is not limited. In this regard, the tax authorities do not have the right to refuse to accept it.

The timing of the provision of benefits, on the contrary, is limited. Having received your documents, inspectors of the Federal Tax Service are required to review them and approve them within 24 hours.

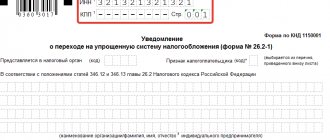

Sample notification of the choice of the Federal Tax Service for personal income tax payment

Now let's fill out the notification using an example.

Example

LLC "Confectioner" has two separate divisions located on the territory of one municipal formation of the city of Moscow. The main enterprise is registered with the Federal Tax Service Inspectorate No. 20, one division is registered with the Federal Tax Service Inspectorate No. 19, and the other is registered with the Federal Tax Service Inspectorate No. 18.

The company, taking into account the latest changes in legislation (clause 7 of article 226, clause 2 of article 230 of the Tax Code of the Russian Federation), from 01/01/2020 decided to submit reports and pay personal income tax through tax inspectorate No. 19. The Federal Tax Service Inspectorate No. 19 must be notified about this with a notice of choice tax authority for personal income tax.

Filling out the first page of the personal income tax notice

Fill out the second page of the personal income tax notice

Sample notification of choosing a tax authority for personal income tax

Rules for preparing the form for KND

The application for a tax benefit must be filled out by hand or on a computer. If data is entered manually, then it must be entered into the document with a black helium pen.

The form is drawn up in 1 copy without any blots. It is strictly prohibited to use proofreaders and other means to correct errors. If incorrect information is entered, the application must be rewritten.

For each type of data, the form has special fields with cells in which the corresponding numbers, letters and symbols must be entered.

Filling out the title page

The title page contains information in all fields, except for those about. The data is entered by the taxpayer personally or by his authorized representative.

The TIN column indicates the code assigned by the tax authority to a citizen who is registered as an individual entrepreneur. If a person is an ordinary individual, then in the TIN line he must indicate the number of his personal document.

Point No. 1 specifies the Federal Tax Service code, which was selected by the taxpayer when filling out the form. The tax office is assigned based on the registration or location of the property.

Point No. 2 indicates the taxpayer’s personal data without abbreviations, his information from his passport and information about the authority that issued the document.

Next, contact information is filled in on the title page. When specifying a phone number, spaces cannot be inserted, and all remaining cells must contain even dashes.

In paragraph No. 3, in the column with the phrase “The application was drawn up on...” you should indicate the number of completed pages of the document. In the next line you need to enter the total number of pages to be copied. These sheets prove the right of an individual to receive tax benefits legally due to him.

Point No. 4 clarifies the accuracy of all information filled out above. To do this, the person filling out the document must put the current date and signature. Below in the column with details, you should write down the data from your passport if the application is drawn up by a representative of the payer.

There is no signature or date on the title page if the document is filled out electronically and sent through the taxpayer’s personal account.

Let's sum it up

- In 2021, the Federal Tax Service approved a new form for notification of the selection of a tax authority for personal income tax. If you have detached houses located on the territory of one municipality (or if your parent organization is located together with the detached houses on the same territory), you can report on personal income tax and pay it to one Federal Tax Service of your choice.

- The personal income tax notice consists of two pages.

- The filling rules are standard for most tax reporting forms.

If you find an error, please select a piece of text and press Ctrl+Enter.

Who should fill out the KND form?

The form for granting tax benefits must, according to tax legislation, be filled out by the person who personally owns the property. Data in the application form can also be entered by his representative, if he has a power of attorney. However, in this case, the authorized person will have to fill out the application on his own behalf.

Composition of the form according to KND

The application for tax benefits includes:

- title page;

- tax benefit reminder;

- benefit form.

Each page of the form must be numbered on both sides at the top in a special field.

Responsibility for failure to provide documents

The taxpayer needs to apply for tax benefits personally, so filling out and submitting the form under KND 1150063 is his direct interest. The legislation does not provide for the imposition of penalties for the late transfer of documents to the Federal Tax Service, and therefore documents can be submitted at any time.

Thus, an individual and an individual entrepreneur have the right to apply with a completed form to receive a tax benefit for transport, land or real estate to the Federal Tax Service or through the taxpayer’s personal account. He can obtain information about benefits on the website of the Russian Tax Service or through a service containing reference information on rates and benefits for property taxes.