How to write an application to the tax office for the return of erroneously transferred money

The content of the article

However, given that the Tax Code of the Russian Federation does not oblige inspectors to confirm with a receipt the fact of acceptance of documents received through the organization’s personal account, for this category of taxpayers it may be advisable to use other methods of filing applications for the return of overpayments. Let us remind you that the deadline for submitting an application for the return of an overpayment to the tax authority is three years from the date of payment of taxes, penalties, and fines in excess (clauses 7, 14 of Article 78 of the Tax Code of the Russian Federation). Note You can find out more about the calculation of the specified period in section. 2.1 “When can you apply to the tax authority for a credit or refund of overpaid taxes, penalties, and fines?” IN WHAT TIME CAN YOU CONTACT THE TAX AUTHORITY FOR A CREDIT OR REFUND OF OVERPAYED TAXES, PENALTIES, FINES The tax authorities carry out a credit or refund of overpayments at the request of the taxpayer (clause 4, paragraph 2, 3, clause 5, clause 6 of Art.

The tax was paid to the wrong tax office.

You need to write an application for a tax refund, since you transferred it by mistake. Indicate to which account you should receive the refund. At the same time, pay the tax and penalties at the proper place of payment of transport tax. It is your fault, not the tax authority's, that paying tax to another region is an improper fulfillment of tax obligations.

Payment of transport tax is carried out on the basis of the issued notice. The details must be there.

.If you were sent an incorrect notification, then it is the fault of the tax authority.

“Tax Code of the Russian Federation (Part One)” dated July 31, 1998 N 146-FZ (as amended on February 19, 2018)

""Article 78. Set-off or refund of amounts of overpaid taxes, fees, insurance premiums, penalties, fines

(see text in the previous “edition”)

Tax Guide. Questions of application of Art. 78 Tax Code of the Russian Federation

""1. The amount of overpaid tax is subject to offset against the taxpayer's upcoming payments for this or other taxes, repayment of arrears for other taxes, arrears of penalties and fines for tax offenses, or refund to the taxpayer in the manner prescribed by this article.

“The offset of the amounts of overpaid federal taxes and fees, regional and local taxes is carried out for the corresponding types of taxes and fees, as well as for penalties accrued on the corresponding taxes and fees.

1.1. The amount of overpaid insurance premiums is subject to offset against the relevant budget of the state extra-budgetary fund of the Russian Federation, to which this amount was credited, against the payer's upcoming payments for this contribution, debt on relevant penalties and fines for tax offenses, or the return of insurance premiums to the payer in the manner prescribed this article.

(clause 1.1 introduced by Federal Law dated July 3, 2016 N 243-FZ)

""2. A credit or refund of the amount of overpaid tax is carried out by the tax authority at the place of registration of the taxpayer, unless otherwise provided by this Code, without charging interest on this amount, unless otherwise established by this article.

""3. The tax authority is obliged to inform the taxpayer about each fact of excessive payment of tax that has become known to the tax authority and the amount of overpaid tax within 10 days from the date of discovery of such a fact.

“If facts are discovered indicating a possible excessive payment of tax, at the proposal of the tax authority or taxpayer, a joint reconciliation of calculations for taxes, fees, insurance premiums, penalties and fines may be carried out.

(as amended by Federal Laws dated July 27, 2010 N 229-FZ, dated July 3, 2016 N 243-FZ)

(see text in the previous “edition”)

The paragraph is no longer valid. — Federal Law of July 27, 2010 N 229-FZ.

(see text in the previous “edition”)

""4. The offset of the amount of overpaid tax against the taxpayer's upcoming payments for this or other taxes is carried out on the basis of a written “application” (application submitted in electronic form with an enhanced qualified electronic signature via telecommunication channels or submitted through the taxpayer’s personal account) of the taxpayer by decision of the tax authority .

(as amended by Federal Laws dated June 29, 2012 N 97-FZ, dated November 4, 2014 N 347-FZ)

(see text in the previous “edition”)

“The decision to offset the amount of overpaid tax against the taxpayer’s upcoming payments is made by the tax authority within 10 days from the date of receipt of the taxpayer’s application or from the date of signing by the tax authority and this taxpayer of a joint reconciliation report of the taxes paid by him, if such a joint reconciliation was carried out.

""5. The offset of the amount of overpaid tax to pay off arrears on other taxes, arrears on penalties and (or) fines subject to payment or collection in cases provided for by this Code is carried out by the tax authorities independently.

""In the case provided for by this paragraph, the decision to offset the amount of overpaid tax is made by the tax authority within 10 days from the date it discovers the fact of excessive payment of tax or from the date the tax authority and the taxpayer sign the act of joint reconciliation of taxes paid by him, if such a joint reconciliation was carried out, or from the date of entry into force of the court decision.

“The provision provided for in this paragraph does not prevent the taxpayer from submitting to the tax authority a written application (an application submitted in electronic form with an enhanced qualified electronic signature via telecommunication channels or submitted through the taxpayer’s personal account) to offset the amount of overpaid tax against the arrears. (debts on penalties, fines). In this case, the decision of the tax authority to set off the amount of overpaid tax to pay off the arrears and arrears of penalties and fines is made within 10 days from the date of receipt of the specified application of the taxpayer or from the date of signing by the tax authority and this taxpayer of the act of joint reconciliation of the taxes paid by him, if such a joint reconciliation was carried out.

(as amended by Federal Laws dated June 29, 2012 N 97-FZ, dated November 4, 2014 N 347-FZ)

(see text in the previous “edition”)

""6. The amount of overpaid tax is subject to refund upon a written “application” (an application submitted in electronic form with an enhanced qualified electronic signature via telecommunication channels or submitted through the taxpayer’s personal account) of the taxpayer within one month from the date the tax authority received such an application.

(as amended by Federal Laws dated June 29, 2012 N 97-FZ, dated November 4, 2014 N 347-FZ)

(see text in the previous “edition”)

“”Refund to the taxpayer of the amount of overpaid tax if he has arrears on other taxes of the corresponding type or debt on the corresponding penalties, as well as fines subject to collection in cases provided for by this Code, is made only after offsetting the amount of overpaid tax to repay the arrears ( debt).

6.1. A refund of the amount of overpaid insurance contributions for compulsory pension insurance is not made if, according to the territorial management body of the Pension Fund of the Russian Federation, information on the amount of overpaid insurance contributions for compulsory pension insurance is presented by the payer of insurance contributions as part of individual (personalized) accounting information and taken into account on individual personal accounts of insured persons in accordance with the legislation of the Russian Federation on individual (personalized) accounting in the compulsory pension insurance system.

(clause 6.1 introduced by Federal Law dated July 3, 2016 N 243-FZ; as amended by Federal Law dated November 30, 2016 N 401-FZ)

(see text in the previous “edition”)

""7. An “application” for offset or refund of the amount of overpaid tax may be submitted within three years from the date of payment of the specified amount, unless otherwise provided by the legislation of the Russian Federation on taxes and fees.

(as amended by Federal Laws dated July 27, 2010 N 229-FZ, dated June 23, 2014 N 166-FZ)

(see text in the previous “edition”)

""8. The decision to refund the amount of overpaid tax is made by the tax authority within 10 days from the date of receipt of the taxpayer’s application for the refund of the amount of overpaid tax or from the date of signing by the tax authority and this taxpayer of a joint reconciliation report of the taxes paid by him, if such a joint reconciliation was carried out.

“Before the expiration of the period established by the first paragraph of this paragraph, an order for the return of the amount of overpaid tax, issued on the basis of a decision of the tax authority to return this amount of tax, is subject to sending by the tax authority to the territorial body of the Federal Treasury to effect a refund to the taxpayer in accordance with budget legislation Russian Federation.

""9. The tax authority is obliged to inform the taxpayer about the decision taken to offset (refund) the amounts of overpaid tax or the decision to refuse to carry out the offset (refund) within five days from the date of adoption of the corresponding decision.

(as amended by Federal Law dated November 4, 2014 N 347-FZ)

(see text in the previous “edition”)

“” The specified message is transmitted to the head of the organization, an individual, or their representatives personally against a receipt or in another way confirming the fact and date of its receipt.

“Amounts of overpaid corporate income tax for a consolidated group of taxpayers are subject to offset (refund) to the responsible participant of this group in the manner established by this article.

(paragraph introduced by Federal Law dated November 16, 2011 N 321-FZ)

In the event of termination of the agreement on the creation of a consolidated group of taxpayers, the amounts of overpaid corporate income tax for the consolidated group of taxpayers that are not subject to offset (not offset) against the arrears available for this group are subject to offset (return) to the organization that was the responsible participant in the consolidated group of taxpayers, according to her statement.

(paragraph introduced by Federal Law dated November 16, 2011 N 321-FZ)

A refund to the responsible participant of a consolidated group of taxpayers of the amount of overpaid income tax for the consolidated group of taxpayers is not made if he has arrears for other taxes of the corresponding type or debts for the corresponding penalties, as well as for fines subject to collection in cases provided for by this Code.

(paragraph introduced by Federal Law dated November 16, 2011 N 321-FZ)

""10. If the refund of the amount of overpaid tax is carried out in violation of the deadline established by paragraph 6 of this article, the tax authority shall accrue interest payable to the taxpayer for each calendar day of violation of the refund deadline for the amount of overpaid tax that is not returned within the established period.

""The interest rate is taken equal to the refinancing rate of the Central Bank of the Russian Federation, which was in effect on the days when the repayment deadline was violated.

""eleven. The territorial body of the Federal Treasury, which has refunded the amount of overpaid tax, notifies the tax authority of the date of refund and the amount of money returned to the taxpayer.

""12. If the interest provided for in paragraph 10 of this article is not paid to the taxpayer in full, the tax authority makes a decision to return the remaining amount of interest, calculated based on the date of actual refund to the taxpayer of the amounts of overpaid tax, within three days from the date of receipt of the notification from the territorial body of the Federal Treasury on the date of return and the amount of funds returned to the taxpayer.

Before the expiration of the period established by the first paragraph of this paragraph, an order for the return of the remaining amount of interest, issued on the basis of a decision of the tax authority to return this amount, must be sent by the tax authority to the territorial body of the Federal Treasury for the refund.

13. Credit or refund of the amount of overpaid tax and payment of accrued interest are made in the currency of the Russian Federation.

13.1. Amounts of money paid to compensate for damage caused to the budget system of the Russian Federation as a result of crimes provided for in Articles 198 - 199.2 of the Criminal Code of the Russian Federation are not recognized as amounts of overpaid tax and are not subject to offset or refund in the manner prescribed by this article.

(clause 13.1 introduced by Federal Law dated November 30, 2016 N 401-FZ)

""14. The rules established by this article also apply to the offset or return of amounts of overpaid advance payments, fees, insurance premiums, penalties and fines and apply to tax agents, payers of fees, payers of insurance premiums and the responsible participant in a consolidated group of taxpayers.

(as amended by Federal Laws dated November 16, 2011 N 321-FZ, dated July 3, 2016 N 243-FZ)

(see text in the previous “edition”)

“The provisions of this article regarding the return or offset of overpaid amounts of state duty are applied taking into account the specifics established by “Chapter 25.3” of this Code.

“The rules established by this article also apply in relation to the offset or refund of the amount of value added tax subject to reimbursement by decision of the tax authority, in the case provided for in paragraph 11.1 of Article 176 of this Code.

(paragraph introduced by Federal Law dated July 23, 2013 N 248-FZ)

The rules established by this article also apply to the offset or return of interest paid in accordance with “clause 17 of Article 176.1” of this Code.

(paragraph introduced by Federal Law of November 30, 2016 N 401-FZ)

15. The fact of indicating a person as a nominal owner of property in a special declaration submitted in accordance with the Federal Law “On the voluntary declaration by individuals of assets and accounts (deposits) in banks and on amendments to certain legislative acts of the Russian Federation”, and the transfer of such property to its actual owner do not in themselves constitute grounds for recognizing as overpaid the amounts of taxes, fees, penalties and fines paid by the nominal owner in relation to such property.

(Clause 15 introduced by Federal Law dated 06/08/2015 N 150-FZ)

16. The rules established by this article also apply to amounts of overpaid value added tax that are subject to refund or credit to foreign organizations - taxpayers (tax agents) specified in “clause 3 of Article 174.2” of this Code. Refunds of the amount of overpaid value added tax to such organizations are made to an account opened with a bank.

(Clause 16 introduced by Federal Law dated 07/03/2016 N 244-FZ)

""17. The rules for the return of amounts of overpaid taxes established by this article also apply to the return of amounts of previously withheld corporate income tax that are subject to return to a foreign organization in the cases provided for by “clause 2 of Article 312” of this Code, taking into account the specifics established by this paragraph.

The decision to return the amount of previously withheld corporate income tax is made by the tax authority at the place of registration of the tax agent within six months from the date of receipt from a foreign organization of an application for the return of previously withheld tax and other documents specified in “clause 2 of Article 312” of this Code.

The amount of previously withheld corporate income tax is subject to refund within one month from the date the tax authority makes a decision to return the amount of previously withheld tax.

“Tax Code of the Russian Federation (Part Two)” dated 08/05/2000 N 117-FZ (as amended on 04/23/2018)

""Article 363. Procedure and terms for payment of tax and advance payments of tax

(as amended by Federal Law dated October 20, 2005 N 131-FZ)

(see text in the previous “edition”)

""1. Payment of tax and advance payments of tax is made by taxpayers to the budget at the location of the vehicles.

(as amended by Federal Law dated April 2, 2014 N 52-FZ)

(see text in the previous “edition”)

“The procedure and terms for payment of tax and advance payments of tax for taxpayer organizations are established by the laws of the constituent entities of the Russian Federation. In this case, the deadline for paying the tax cannot be set earlier than the deadline provided for in paragraph 3 of Article 363.1 of this Code.

(as amended by Federal Law dated April 2, 2014 N 52-FZ)

(see text in the previous “edition”)

“The tax is payable by individual taxpayers no later than December 1 of the year following the expired tax period.

(as amended by Federal Laws dated December 2, 2013 N 334-FZ, dated November 23, 2015 N 320-FZ)

(see text in the previous “edition”)

""2. During the tax period, taxpayers-organizations pay advance tax payments, unless otherwise provided by the laws of the constituent entities of the Russian Federation. At the end of the tax period, taxpayers-organizations pay the amount of tax calculated in the manner prescribed by paragraph 2 of Article 362 of this Code.

(as amended by Federal Laws dated October 20, 2005 N 131-FZ, dated November 4, 2014 N 347-FZ)

(see text in the previous “edition”)

ConsultantPlus: note.

From January 1, 2021, Federal Law dated July 3, 2016 N 249-FZ, paragraph two of paragraph 2 of Article 363 is declared invalid.

“Taxpayers-organizations do not pay calculated advance tax payments in relation to a vehicle with a permissible maximum weight of over 12 tons, registered in the register.

(paragraph introduced by Federal Law dated July 3, 2016 N 249-FZ)

""3. Taxpayers - individuals pay transport tax on the basis of a tax “notification” sent by the tax authority.

(as amended by Federal Law dated November 4, 2014 N 347-FZ)

(see text in the previous “edition”)

""Sending a tax notice is allowed no more than three tax periods preceding the calendar year of its sending.

(paragraph introduced by Federal Law dated November 28, 2009 N 283-FZ)

Taxpayers specified in paragraph one of this paragraph pay tax for no more than three tax periods preceding the calendar year of sending the tax notice specified in paragraph two of this paragraph.

(paragraph introduced by Federal Law dated November 28, 2009 N 283-FZ)

Refund (credit) of the amount of overpaid (collected) tax in connection with the recalculation of the tax amount is carried out for the period of such recalculation in the manner established by Articles 78 and 79 of this Code.

Sample letter for return of erroneously transferred funds

Refusal to return it on the grounds that the account is not entered into the tax authorities’ database is unlawful (Resolution of the Federal Antimonopoly Service of the Ural District dated May 25, 2009 N F09-3320/09-C3). If you did not provide bank details in the application, the tax authority can return the funds to any bank account known to it. Information about open accounts is received by tax authorities from banks (paragraph 2 - 4 clause 1 of article 86

Tax Code of the Russian Federation). Note! Previously, the obligation to notify the tax authorities about the opening of bank accounts also existed for taxpayers and participants in investment partnership agreements, who act as managing partners responsible for maintaining tax records. Such an obligation was established by paragraphs. 1 item 2 art. 23, pp. 4 p. 4 art. 24.1 Tax Code of the Russian Federation. According to paragraphs. “b clause 1, clause 2 art. 1 of Federal Law dated April 2, 2014 N 52-FZ, these norms have been cancelled.

Application to the tax office for the return of erroneously transferred funds

Tax Code of the Russian Federation, clause 1, paragraphs. “in paragraph 12 of Art. 1, part 4 art. 5 of the Federal Law of November 4, 2014 N 347-FZ.

- Personally in hands.

- Using courier services.

- By mail notification.

Whatever method of transmission of the letter is chosen, the recipient’s signature is required that he has been notified of the erroneous transfer of funds. Further, regardless of whether it is a legal entity or an individual, the defendant needs to check all monetary transactions that were made on his account. Organizations also need to reconcile all documents on the receipt and expenditure of money and the final balance.

After all internal checks, the defendant must send a response notice within the established calendar period, indicating whether a refund will be issued or not. If the answer is negative, the reason for non-return is indicated. The demand is signed and sent to the “affected party”.

What can you do about overpayment of personal income tax?

It is, of course, possible to refund the amount of overpaid personal income tax in 2021. However, you need to pay attention to why an organization or individual entrepreneur has overpaid income tax and what you want to do with this overpayment. Let's explain with examples:

- an organization or individual entrepreneur mistakenly paid an excess amount of personal income tax to the budget and wants to offset it against arrears of personal income tax or future tax payments;

- An organization or individual entrepreneur mistakenly contributed an extra amount of personal income tax to the budget. Now there is a desire to return it to the bank account;

- The Federal Tax Service has collected an excess amount of personal income tax from an organization or individual entrepreneur, and the taxpayer wants to return it.

Let us say right away that if you transferred personal income tax before the established deadline, then it can be returned, offset against arrears for this tax, as well as against arrears and future payments for other federal taxes. But offsetting the overpayment against future personal income tax payments is undesirable. Let us explain why.

To return the overpayment for personal income tax, no later than three years from the date of payment of the tax, submit to the Federal Tax Service an application, an extract from the personal income tax register and a payment order for tax payment (Letter of the Federal Tax Service dated 02/06/2017 N GD-4-8/).

Why offset against future personal income tax payments is undesirable

Personal income tax is an income tax that employers pay for their employees as a tax agent. Therefore, this tax must be preliminarily (before payment) withheld from income. This can only be done on the day when the organization issued money from the cash register or transferred it to employees’ bank accounts. Tax agents cannot pay tax at their own expense due to paragraph 9 of Article 226 of the Tax Code of the Russian Federation. This is confirmed by Letter of the Federal Tax Service dated February 6, 2017 No. GD-4-8/2085. Therefore, some Federal Tax Service Inspectors regard personal income tax received ahead of schedule as an “erroneous payment.” And they don’t even consider it a tax. And therefore it cannot be counted against future personal income tax accruals.

Overpayment can be applied to future payments for other taxes

An extra (erroneous) personal income tax payment can be offset against future payments for other taxes. For example, for VAT or income tax. This is due to the fact that such taxes are paid from one’s own funds. And they can be paid ahead of schedule (Letter of the Federal Tax Service of Russia dated February 6, 2021 No. GD-4-8/2085).

You can also simply return the overpayment of personal income tax. How to do this in 2019? We'll talk about this later.

Recalculation of personal income tax

There are quite a lot of cases of recalculation of personal income tax: a calculation error, recall of an employee from vacation, excessive withholding of personal income tax from an employee as a non-resident, if he is actually a resident, payment of interim dividends to foreigners, submission by an employee of documents confirming the deduction for a child... Each of the cases of recalculation has its own characteristics.

Before recalculating personal income tax, you need to understand whether your case falls under the recalculation of personal income tax. Let's consider the main cases.

An individual changed status from non-resident to resident

If an individual acquires the tax status of a resident of the Russian Federation, which will no longer change in the tax period, the tax agent must recalculate the amounts of personal income tax withheld from the individual’s income from sources in the Russian Federation, based on the tax rate of 13% (letter from the Ministry of Finance Russia dated 04/04/2014 No. 03-04-05/15215).

In some cases, there is no need to recalculate the tax.

Example 1.

If in 2015 a Russian organization withheld from the salary of an employee - a citizen of the Republic of Belarus, who is not a tax resident of the Russian Federation, personal income tax at a rate of 13% and the employee quit before the expiration of 183 days of stay in the Russian Federation, the organization does not recalculate personal income tax at a rate of 30% and pay additional tax must.

The employee is recalled from vacation

When an employee is recalled from vacation, the organization (tax agent) recalculates the amount of vacation pay and, accordingly, the previously withheld amount of personal income tax. Previously accrued amounts of vacation pay and the corresponding amounts of tax are reversed, and for the days actually worked, wages are accrued and tax is calculated (letter of the Federal Tax Service of Russia dated October 24, 2013 No. BS-4-11/190790).

Payment of dividends to foreign citizens

In Art. 232 of the Tax Code of the Russian Federation in relation to personal income tax, a special procedure is established for the implementation of the provisions of international treaties (agreements) on the avoidance of double taxation, establishing, in particular, that the maximum period for the taxpayer to submit the corresponding confirmation cannot exceed one year after the end of the tax period in which the taxpayer has grounds for their application (letter of the Ministry of Finance of the Russian Federation dated August 31, 2010 No. 03-04-08/4-189).

ORIGINAL SOURCE

Before the return of the excessively withheld and transferred amount of tax from the budget system of the Russian Federation, the tax agent has the right to refund such amount of tax at his own expense.

— Paragraph nine of paragraph 1 of Art. 231 Tax Code of the Russian Federation.

A counting error has occurred

In accordance with paragraphs. 3 and 4 tbsp. 226 of the Tax Code of the Russian Federation, tax amounts are calculated by tax agents on an accrual basis from the beginning of the tax period based on the results of each month in relation to all income in respect of which the tax rate established by clause 1 of Art. 224 of the Tax Code of the Russian Federation, accrued to the taxpayer for a given period, with the offset of the amount of tax withheld in previous months of the current tax period.

The amount of tax in relation to income for which other tax rates are applied is calculated by the tax agent separately for each amount of the specified income accrued to the taxpayer.

If an error is detected in the calculation of personal income tax, it is necessary to recalculate the amounts.

POSITION OF THE COURT

A taxpayer can return personal income tax from the budget through the tax authority only in the absence of a tax agent. If a tax agent exists, then you should first contact him with an application for a refund of overly withheld tax.

— Determination of the Constitutional Court of the Russian Federation dated February 17, 2015 No. 262-O.

When the right to a deduction for a child arises

If an employee lately submitted documents confirming the right to deduct personal income tax for a child, then personal income tax must be recalculated (letter of the Ministry of Finance dated April 18, 2012 No. 03-04-06/8-118):

- if the right to deduction arose in the current year - from the moment of its occurrence. For example, if a child was born in March, and the employee brought the birth certificate in July, personal income tax must be recalculated for the period from March to June;

- if the right to deduction arose in past years - from January of the current year. For example, if a child was born in November last year, and the employee brought the birth certificate in February of the current year, the personal income tax must be recalculated only for January of the current year.

An employee's business trip lasting more than 183 days

If the duration of the business trip is more than six months, the employee will become a non-resident. After all, he will be outside the Russian Federation for more than 183 days (clause 2 of Article 207 of the Tax Code of the Russian Federation).

But the average earnings and daily allowance will still be his income from a source in the Russian Federation (letters from the Ministry of Finance of Russia dated August 22, 2013 No. 03-04-05/34436, dated March 19, 2013 No. 03-04-06/8402 and dated November 22, 2012 No. 03 -04-06/6-332).

IMPORTANT IN WORK

If the amount of tax to be transferred by the tax agent to the budget system of the Russian Federation is not enough to return the excessively withheld and transferred amount of personal income tax to the taxpayer within three months, the tax agent, within 10 days from the date the taxpayer submits an application to him, sends an application to the tax authority at the place of his registration. refund to the tax agent of the amount of tax withheld in excess.

Overpayment of personal income tax

If the company overpaid, then two situations are possible:

1. The company adjusts personal income tax amounts in its accounting and reverses them.

Example 2.

Bereg LLC provides leave to chief engineer A.K. Savelyev.

Vacation from March 29, 2021.

For a period of 14 calendar days.

However, due to the need to hand over the facility to the working commission, on April 6, 2021, the chief engineer was recalled from vacation.

The accountant, accordingly, recalculated.

| Debit | Credit | Sum | Operation |

| 96 | 70 | RUB 23,820.30 (RUB 1,701.45 x 14 calendar days) | Vacation pay accrued |

| 70 | 68 | 3097 | Personal income tax accrued |

| 68 | 51 | 3097 | Personal income tax from vacation pay transferred to the budget |

| 70 | 51 | 20 723,30 | Vacation pay is transferred to the employee’s bank card |

| 96 | 70 | 11 910,15 | Vacation pay reversed 7 calendar days |

| 44 | 70 | RUB 43,478.26 (RUB 50,000: 23 working days x 20 working days) | Wages accrued for April |

| 70 | 68 | 4104 rub. [(RUB 43,478.26 – RUB 11,910.15) x 13%] | Personal income tax accrued on income for July, taking into account the reversal of part of the amount of vacation pay for unused vacation days |

| 68 | 51 | 4104 rub. | Personal income tax transferred to the budget, taking into account reversed amounts |

2. The company recalculates personal income tax from the month when the employee received resident status, and the employee himself applies to the tax authority to return the overpayment.

Example 3.

A foreign worker, a qualified worker A.K. Belov, got a job at Bereg LLC.

The accountant withheld 30% of his income from November 1, 2015 to May 1, 2021. During this period, the employee was accrued 303,500 rubles. At this time he was not a tax resident of the Russian Federation. The amount of personal income tax withheld was RUB 91,050. (RUB 303,500 x 30%).

When calculating personal income tax on wages for May 2021, the accountant took into account the overpayment of tax. The amount of personal income tax accrued from wages for May amounted to 3,770 rubles. (RUB 29,000 x 13%). But there is no need to withhold it, since it is less than the overpayment of tax (RUB 51,595).

Consequently, from May the accountant calculates personal income tax at a rate of 13%.

In relation to the resulting overpayment for personal income tax in the amount of 51,595 rubles. the employee must contact the tax authority independently.

IMPORTANT IN WORK

The refund of the tax amount to the taxpayer in connection with the recalculation at the end of the tax period in accordance with his acquired status of tax resident of the Russian Federation is made by the tax authority in which he was registered at the place of residence (place of stay), when the taxpayer submits a tax return at the end of the specified tax period. period, as well as documents confirming the status of a tax resident of the Russian Federation in this tax period.

If a company refuses to recalculate personal income tax for an employee

As an example, consider a situation where an employee first brought documents confirming the right to a deduction, and then writes a statement that he does not want to receive a deduction.

In this case, the company may not recalculate.

Example 4.

During the tax period (calendar year), the taxpayer received income from two employers at once.

At the same time, he submitted an application to his first employer for a standard child tax deduction and the corresponding documents. Considering that the employee’s income for the period from January to April exceeded 280,000 rubles since the beginning of the year, the employer provided the employee with a deduction only for the period from January to March inclusive. Since April, the child deduction has not been provided.

This person also received income taxed at a rate of 13% from another employer in a given calendar year. But for the whole year they did not exceed 280,000 rubles.

And this taxpayer wanted to receive a deduction for a child for the entire tax period according to the declaration, replacing the first employer who provided a deduction for a child with another tax agent from whom he received income that did not exceed 280,000 rubles for the entire year.

Therefore, it was explained to him that recalculating the deduction for a child on the basis of the 3-NDFL declaration was impossible in his case (letter of the Ministry of Finance of Russia dated February 19, 2015 No. 03-04-05/7763).

IMPORTANT IN WORK

The return to the taxpayer of the excessively withheld amount of personal income tax is made by the tax agent at the expense of the amounts of this tax subject to transfer to the budget system of the Russian Federation on account of upcoming payments both for the specified taxpayer and for other individuals from whose income the tax agent withholds this tax, within three months from the date the agent receives the taxpayer’s application.

Refund of over-accrued amounts by the tax agent

If a company has overpaid personal income tax, it is possible to return the overcharged amounts. Companies often agree to refund overpayments when large amounts are involved.

A tax agent can submit an application for a refund (offset) of personal income tax within three years from the date of payment of the tax (Clause 7, Article 78 of the Tax Code of the Russian Federation).

It is advisable to attach documents confirming the fact of overpayment to the application, for example, this could be a reconciliation report.

Together with the application for the return of the amount of tax that was excessively withheld and transferred to the budgetary system of the Russian Federation, the tax agent submits to the tax authority an extract from the tax accounting register for the corresponding tax period and documents confirming the excessive withholding and transfer of the amount of tax to the budgetary system of the Russian Federation.

When making a refund of personal income tax, the type of income paid to other persons, as well as the applicable tax rate, does not matter (letter of the Federal Tax Service of Russia dated September 20, 2013 No. BS-4-11/17025).

The decision to return (offset) the “surplus” or to refuse to return it must be made by tax authorities within 10 days from the date of receipt of the application and attached documents or from the date of signing the act of joint reconciliation of the amounts paid by the tax agent, if one was carried out. The inspectors are required to inform him about the decision made within 5 days from the date of the verdict. If the decision is positive, the refund will be made within a month from the date the controllers receive the application.

After this, the employer, in accordance with Art. 231 of the Tax Code of the Russian Federation returns personal income tax to the employee.

POSITION OF THE FTS

When filling out 2-NDFL certificates, the amounts of accrued income in the form of wages are reflected in the month of the tax period for which such income was accrued. The amounts of accrued personal income tax are also reflected in the tax period for which they were calculated. The amounts of withheld tax should be reflected in the certificate in the tax period for which the tax was calculated. If the amount of personal income tax is withheld after the end of the tax period and the submission of certificate 2-NDFL to the tax authority, then the certificates previously submitted to the tax authority are subject to adjustment by submitting a new certificate.

— Letter dated 03/02/2015 No. BS-4-11/3283.

What if the year is over?

As a general rule, recalculation is carried out:

- at the moment when the accountant discovered that it was necessary to make it (for example, an employee brought documents);

- at the end of the year (for example, if the employee changed his tax resident status).

Recalculation is carried out at the end of the year by the tax authority on the basis of a declaration and documents confirming the status of a resident of the Russian Federation, and not by a tax agent (clause 1.1 of Article 231 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated May 16, 2011 No. 03-04-05/6-353) .

However, if an error is discovered or recalculation needs to be done for the previous year, then in this case it is necessary to submit updated reporting for the previous year. In accordance with paragraph 2 of Art. 230 of the Tax Code of the Russian Federation, tax agents submit to the tax authority at the place of their registration information on the income of individuals for the expired tax period and the amounts accrued, withheld and transferred to the budget system of the Russian Federation for this tax period of taxes annually no later than April 1 of the year following the expired tax period . It follows from the above that when filling out certificates of income for individuals in Form 2-NDFL (hereinafter referred to as the Certificate), in the relevant sections of the Certificate, the amounts of accrued income in the form of wages are reflected in the month of the tax period for which such income was accrued. In this case, the amounts of accrued tax are reflected in the tax period for which they were calculated. The amounts of withheld tax should be reflected in the Certificate in the tax period for which the tax was calculated (letter of the Federal Tax Service of Russia dated March 2, 2015 No. BS-4-11/3283).

GOOD TO KNOW

Certificate 2-NDFL is filled out by the tax agent based on the data contained in the tax registers.

What if an employee quits?

If an employee quits, then it is still necessary to recalculate personal income tax. You need to understand whether the company should budget or not.

If the employment relationship with the employee is terminated and you do not pay him income, then, accordingly, you have nothing to withhold the missing tax amounts from. In this case, you need to inform the taxpayer and the tax authority at your place of registration in writing about the impossibility of withholding tax (letter of the Ministry of Finance of Russia dated March 19, 2007 No. 03-04-06-01/74).

If personal income tax was withheld excessively, it must be returned to the employee. According to paragraph 1 of Art. 231 of the Tax Code of the Russian Federation, within 10 days from the day you discovered excessive withholding of personal income tax, you are obliged to inform the former employee about it. In a letter dated December 24, 2012 No. 03-04-05/6-1430, the Ministry of Finance specifically noted that the termination of the employment relationship between the taxpayer and the organization that is the source of payment of income from which the tax was excessively withheld, as well as the period in which the excessively withheld tax is refunded , do not affect the procedure for applying the provisions of Art. 231 Tax Code of the Russian Federation. Therefore, if a former employee is found to have over-withheld personal income tax, he must be notified (for example, by sending a registered letter with return receipt requested to the address specified during employment).

This can be done by sending a registered letter with notification to the registration address. In this case, the refund of overpaid amounts will be made based on the employee’s application. You will have to return the tax within 3 months from the date of receipt of the application. If an employee received a notice of personal income tax refund, but did not show up for some reason (moved, was absent from his place of registration), then in this case the employer will not be held responsible for non-refund of the amounts to the taxpayer.

GOOD TO KNOW

The return to the taxpayer of excessively withheld tax amounts is made by the tax agent in non-cash form by transferring funds to his account in the bank specified in the application.

What if the recalculation was caused by incorrect or illegal actions of the accounting department?

If the recalculation was caused by incorrect or illegal actions of the accountant, the employer can do the following:

1. Do not take any action, because the work of an accountant is already difficult.

2. Impose disciplinary action on the employee.

For committing a disciplinary offense, i.e. for culpable failure or improper performance by an employee of his labor duties, three types of penalties can be applied to him (Part 1 of Article 192 of the Labor Code of the Russian Federation):

- remark (less strict measure of liability);

- reprimand (a more severe measure of responsibility);

- dismissal.

But, for example, it is impossible to collect a fine from an accountant’s salary.

In addition, when imposing a disciplinary sanction, it is important to remember that the disciplinary sanction must correspond to the degree of guilt of the employee, for example, if the overpayment of personal income tax due to the employee’s actions amounted to 1000 rubles, which can later be returned from the budget or offset, then the dismissal of the accountant will be at least at least illogical.

But, for example, if a mistake is made, a penalty can be imposed in the form of a reprimand, and if the accountant’s actions led to serious additional tax charges and penalties, then in this case one can reprimand and even fire the employee.

The procedure for imposing a disciplinary sanction is enshrined in Art. 193 Labor Code of the Russian Federation. In particular, before applying a disciplinary sanction, the employer must request a written explanation from the employee. If after two working days the employee does not provide the specified explanation, then a corresponding act is drawn up.

In this case, disciplinary sanction is applied no later than a month from the date of discovery of the misconduct, not counting the time of illness of the employee, his stay on vacation, as well as the time required to take into account the opinion of the representative body of employees.

In addition, a disciplinary sanction cannot be applied later than six months from the date of commission of the offense, and based on the results of an audit, inspection of financial and economic activities or an audit - later than two years from the date of its commission.

The employer's order to apply a disciplinary sanction is announced to the employee against signature within three working days from the date of its issuance, not counting the time the employee is absent from work. If the employee refuses to familiarize himself with the specified order against signature, then a report about this is drawn up.

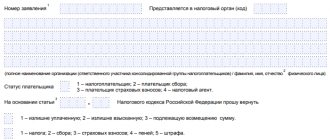

Application for personal income tax refund: application form in 2021

To return the overpayment of personal income tax to the organization’s current (personal) account, you need to submit an application to the tax office (clause 6 of article 78 of the Tax Code of the Russian Federation). Its new form was approved by order of the Federal Tax Service of Russia dated February 14, 2017 No. ММВ-7-8/182. This form is applicable as of March 31, 2017. You can download the new application form in Excel format. The new form can also be found on the Federal Tax Service website “Tax. RU"

The new personal income tax refund application form consists of three sheets. The first one indicates the TIN and name of the company (IP), the BCC of the tax with overpayment and the period of its occurrence, the amount and number of sheets of application documents. On the second sheet - enter account details - name, number and bank. If personal income tax is returned by an individual, then you need to fill out the third sheet.

Below is a sample application for a refund of overpaid personal income tax, which was submitted to the tax office in 2021.

Social benefits for treatment and training

To reduce tax on this basis, you must submit an application and supporting documentation, then receive a notification from the Federal Tax Service. Let us remind you that in accordance with Article 219 of the Tax Code of the Russian Federation, personal income tax benefits are issued for:

- education;

- treatment;

- payment of additional contributions to a funded pension;

- expenses for voluntary insurance: pension and life.

If you spent money on charity or an independent assessment of an employee’s qualifications, a refund of the tax paid will be provided only after filing a 3-NDFL declaration at the end of the reporting year.

Document submission method

In 2021, you can submit an application for a personal income tax refund in one of the following ways:

- directly to the Federal Tax Service. We recommend that you have a second copy of the application with you. On it, the tax official receiving the correspondence must make a note about the date of receipt of the application, indicate his position, full name and signature. This mark will confirm which documents you submitted and when;

- by mail. It is better to use a valuable letter with a list of attachments, which also records the list of documents sent and the date the correspondence was sent;

- via telecommunication channels in electronic form with an enhanced qualified electronic signature. This follows from paragraph 6 of Art. 78 Tax Code of the Russian Federation;

- through the taxpayer’s personal account. This conclusion follows from clause 6 of Art. 78 Tax Code of the Russian Federation.

If you find an error, please select a piece of text and press Ctrl+Enter.

Sample letter for refund of money from one tax office to another

Application for refund of erroneously transferred tax sample

In many cases, you have the right to return the amount of tax from the budget. Get real money. There are many options. For example, you received a property deduction when purchasing a home. Then you can return the amount of income tax that was withheld from you at work.

Another variant. You paid transport tax. Although they had benefits according to it. You have the right to return the amount of tax that you paid for the last three years. Either way, you will need to apply for a tax refund.

It indicates the reason for the return, as well as your bank details to which the tax authorities will transfer the money.

- If we are talking about an individual entrepreneur or any other citizen of the Russian Federation, then it is enough to indicate his personal data:

- surname-first name-patronymic,

- TIN,

- residence address (according to passport)

- and a contact phone number (in case the tax officer needs any clarification).

- If the application is made on behalf of an organization, then you need to write:

- its full name,

- TIN,

- Checkpoint (in accordance with the constituent documents),

- legal address

- and also a telephone number for communication.

Each business entity - organization or entrepreneur - is required to make periodic payments to the budget. In this case, a situation may arise when a payment is made in a larger amount than necessary, and because of this an overpayment occurs. Also, the tax authority may mistakenly write off by mistake. The law gives the right to return overpaid amounts, but for this it will be necessary to submit to the Federal Tax Service an application for the return of the amount of overpaid tax.

According to the logic of the Federal Tax Service, if a company mistakenly transferred more personal income tax than it withheld from employees, then the erroneous amount is not considered tax at all (letters dated 10.19.11 No. ED-3-3/ [email protected] and dated 07.04.11 No. ED-4- 3/10764). The inspectors justified their conclusion by the fact that it is not allowed to transfer personal income tax at the expense of the tax agent (clause 9 of Art.

226 of the Tax Code of the Russian Federation). In practice, this means that offset of erroneous personal income tax is impossible. As confirmed by the tax service, you need to apply for a refund.

If you enter the bank details of another person (for example, a wife or husband) into the application, then the money will not be transferred to you under such an application. Also, you will not be able to receive money if you make a mistake in the details (it is enough to miss or write one number incorrectly). Of course, in all these situations there is nothing terrible.

The money will be returned to you in any case. But this will require a new application with the correct data. As a result, the return process will be delayed. In practice, it turns out differently, and the time frame for tax refunds can take months.

This is due to the fact that the tax authorities carry out a desk audit in relation to the application, which by law can last up to 3 months - this is prescribed in paragraph 2 of Article 88 of the Tax Code of the Russian Federation. Hence the discrepancy and contradiction in the law, and in reality you can’t count on a refund within a month.

Sample application

When applying to the Federal Tax Service, in addition to the application, you will need a 3-NDFL income declaration. Also attached are documents indicating the right to deduction.

The form of the document was approved by order of the Federal Tax Service No. ММВ-7-11/ [email protected] with the amendments reflected in order No. ММВ-7-11/ [email protected] dated 10/07/2019. Considering the fact that amendments are made almost annually, you can assume that next year the form will also be modified.

The form consists of 3 sections:

- Title page – reflects general information about the taxpayer and the grounds for applying to the Federal Tax Service.

- Account information – the bank details of the entity for payment of funds are reflected.

- Data about physical a person who does not have the status of an individual entrepreneur - filled out if the TIN is not reflected in other sections. In such situations, identification is carried out using passport data.

There are no general instructions for filling out the document, but the procedure for filling it out is simple and can be seen in the following example:

Citizen Ivanov I.I. declares a personal income tax refund in the amount of 8,000 rubles. He became entitled to compensation as a result of using a social deduction for treatment. The application was submitted by the applicant along with the income statement for 2021. The applicant independently prepared and submitted papers to the Federal Tax Service of Rostov-on-Don. The money must be transferred to his account at Sberbank.

The first sheet displays the TIN, document serial number, tax authority code, and full name of the applicant. The “Payer status” field is set to “1”. The grounds for compensation must be indicated. For example, to return overpaid tax, you need to refer to Art. 78 Tax Code of the Russian Federation. Next, the amount of compensation is stated - 8,000 rubles, the reporting period for which the money is returned (the combination GD.00.2020 means that the refund is due at the end of 2021). Additionally, the KBK code for personal income tax and OKTMO is displayed.

The second sheet contains payment details - bank name, account type and BIC. If the current account is set to 01, the current account is 02, the deposit account is 07, etc. You need to correctly display the account number and recipient's full name. Entering data without errors is a guarantee of timely transfer of funds. If there are errors or inaccuracies, the money will not be made available to the applicant within the period prescribed by law.

The third sheet is filled out if the applicant does not have a TIN number.

In many cases, you only need to fill out one form to receive the deduction. But in some situations, several applications will be required.

For example:

- a deduction is issued for several years at once;

- money is returned from payment of various taxes (for example, transport and profit) - a separate document is required for each tax;

- a tax deduction is being prepared that is withheld at different addresses and OKTMO codes - for example, when receiving income from several employers registered with different Federal Tax Service Inspectors;

- when errors are identified during the first application and resubmission.

You can also apply for a personal income tax refund in 2021 or fill out a document in electronic form on the Federal Tax Service website: www.nalog.ru. Here, representatives of organizations can use the “Legal Taxpayer” program to process deductions automatically.

Sample filling:

Instructions for refunding tax overpayments

Overpayment of tax payments occurs in almost all organizations and entrepreneurs. Someone, for example, simply made a mistake in the payment order. Someone filed an amended return with a reduced amount of tax payable. And for some, advance payments paid during the year exceeded the amount of tax at the end of the year.

The overpayment in all these cases can be returned or offset against other tax payments. How to do this will be discussed. But we will tell you about the offset and refund of tax payments excessively collected from you by the tax authority, and taxes paid as a tax agent, in upcoming issues. In a situation where an application for a refund (offset) of overpaid tax is submitted on the basis of a tax return, the deadline for the tax authority to make a decision on a refund (offset) of tax is 10 working days from the date of completion of the desk audit of this declaration or from the date of expiration of the monthly period allotted to conduct such an audit, depending on the deadline. Some fines also relate to types of taxes.

Thus, the fine for non-payment of taxes provided for in Art. 122 of the Tax Code of the Russian Federation, refers to the federal, regional or local type, depending on what type of tax is imposed for non-payment. This is determined by budget legislation. The general rule applies here: federal taxes are offset against federal ones, etc. At the same time, there are fines (the majority of them) that are not related to a specific type of tax (for example, all the fines provided for in Chapter 18 of the Tax Code of the Russian Federation, Art.

126 of the Tax Code of the Russian Federation, etc.). In my opinion, it is impossible to offset these fines in correspondence with types of tax payments related to the federal, regional or local type.

- the advance payments you made during the year exceeded the amount of tax calculated at the end of the year (for example, for income tax, for tax under the simplified tax system);

- you found an error in the last period (for example, you forgot to apply a benefit) and submitted an updated declaration for this period

- you have submitted a VAT return to the Federal Tax Service with the amount of tax to be refunded stated in it. If, at the same time, you delayed submitting an application for a refund or offset (that is, you submitted it when the Federal Tax Service has already made a decision on a tax refund), then the VAT refund and offset are made in the order described below

On what basis you must be registered with the Federal Tax Service is not specified in the Tax Code of the Russian Federation. Therefore, we can conclude that you can apply for a credit (refund) of the overpayment to any Federal Tax Service Inspectorate with which you are registered, regardless of the location of which Federal Tax Service Inspectorate the overpayment occurred. And for example, in the event of an overpayment of tax at the location of a separate division, you can, of your choice, contact either the Federal Tax Service Inspectorate at the location of the parent organization, or the Federal Tax Service Inspectorate at the location of a separate division. If you want the overpayment of tax to be offset against upcoming payments for the same tax (that is, within the same KBK, and then you do not need to contact the Federal Tax Service for an offset. Such an offset will be made in your personal account card automatically as soon as the next charges or receipts for this tax are reflected in it.

You are simply once again transferring to the budget less than necessary by the amount of the overpayment.

Refund of overpaid taxes

Often a situation arises when an overpayment appears on the personal account of an organization, individual entrepreneur or individual. There are different reasons for this:

- Incorrect tax calculation.

This can happen if the tax is calculated at a different rate, without taking into account expenses, insurance premiums, benefits, etc.

- Excessive amount of tax collected.

Overpayment for this reason may occur when a citizen applies for a personal income tax refund when claiming tax deductions. This also happens if the Federal Tax Service unlawfully collects tax in a larger amount than required.

- Paying tax in excess.

Most often, such an overpayment occurs when individual entrepreneurs or citizens pay tax in a much larger amount than necessary.

A taxpayer can find out about an existing overpayment:

- in your personal account on the Federal Tax Service website;

- directly from the Federal Tax Service.

The Federal Tax Service is entrusted with the obligation to notify organizations, individual entrepreneurs and individuals about detected facts of overpayment within 10 days from the date of its detection (clause 3 of Article 78 of the Tax Code of the Russian Federation).

The overpayment can be offset against future payments or returned to your bank account (Article 78 of the Tax Code of the Russian Federation). In both cases, you must contact the Federal Tax Service at the place of registration with a written application. You can submit it to the tax authority:

- personally or through a representative;

- through Russian Post (by sending an application by registered mail with a list of attachments);

- via TKS or through your Personal Account on the Federal Tax Service website.

The procedure for returning an overpayment is as follows:

- Submitting an application to the Federal Tax Service.

- Making a decision on the refund (refusal to refund) of the overpayment within 10 days from the date of receipt of the application from the taxpayer.

- Notification of the taxpayer about the decision made within 5 days from the date of its adoption.

- Refund of funds to a bank account within a month from the date of receipt of the application from the taxpayer.

If there is a tax debt of the same type, the refund will be made only after the overpayment is offset against the arrears (Clause 6, Article 78 of the Tax Code of the Russian Federation).

Application for a refund from the tax office

The application is filled out on an A4 sheet, which is supplemented by a unified form “Appendix No. 8” approved by the tax service. Documents are drawn up in 2 copies, with a signature and seal on both copies. If a person doubts that he will be able to fill out the form on his own, you can turn to the services of special companies or consultants.

- You must use block letters to complete the application.

- There should be no errors or inaccurate information on the form. If a mistake is still made, it is better to rewrite the form.

- The request is filled out in 2 copies - one for the tax office, the second for the payer of contributions.

- The form consists of 3 sheets:

- On the first sheet, general information about the payer of contributions and the tax is filled out.

- The second contains the bank details to which the excess amount will be returned.

- On the third - information about the payer.

- When drawing up a document, it is required to display what type of tax will be used to refund the funds.

- The signature on the application must be made only in the presence of a tax inspector.

- Errors in payment order . When filling out a payment order, due to the accountant’s carelessness, amounts are transferred that do not correspond to what is necessary.

- Errors in calculations . Here, shortcomings may arise due to ignorance of the legislation, as a result of which the tax base is used incorrectly, in which outdated rates are applied. If such errors are identified, additional updated declarations are sent to the inspection.

- Reducing the amount of duty . Sometimes, when filing an income tax return, enterprise employees forget about crediting advance payments.

- Full information about the applicant. The upper right section of the form displays:

- for individuals - full name, tax identification number, place of registration

- for legal entities persons - name of the company, tax identification number, checkpoint, legal place of registration.

- In the text section fill in:

- A request for the return of overpaid funds, with reference to the provisions in the Tax Code. You can ask to carry over the excess amount to offset taxes in the coming period.

- Tax period when the overpayment occurred.

- Details of the completed payment, codes KBK and OKTMO.

- Amount of funds to be returned. Displayed in numbers and words.

- Bank details where the money should be returned.

- Signature of the applicant and date of preparation.

Letter of transfer from one tax office to another with overpayment of personal income tax

An unpleasant situation can arise when moving to an address that was provided as a “legal” but not “actual” one. In other words, the address is only in the documents. Many law firms provide such a service as selection and provision of legal addresses. In this case, you need to be sure that sooner or later such an address will not become a mass registration address with the ensuing consequences.

The judges decided that the taxpayer did not miss the deadline for filing a claim for the return of budget debts incurred in 2005-2006, since he discovered the exact full amount of the overpayment only in 2010, having received an extract from his personal account. Before the taxpayer receives this document, the tax inspectorate itself, in violation of the requirements of paragraph 3 of Art. 78 of the Tax Code of the Russian Federation did not notify the company about the presence and amount of overpayment of VAT, and therefore the applicant did not have timely information about the presence of a disputed amount of overpayment of tax to the budget. The court critically assessed the acts of reconciliation of calculations drawn up by the inspectorate at the place of the taxpayer’s previous registration after the taxpayer’s transfer to another tax authority (they did not contain the names of the officials of the tax authority who carried out such reconciliation). Although it is not guaranteed and largely depends on the workload of the inspectorate and the official income of the taxpayer - the larger it is, the higher the likelihood of additional charges and audits. The change of legal address itself is not grounds for a tax audit.

There may or may not be a check. Everything will depend on how conscientious the taxpayer is. The new Federal Tax Service Inspectorate will come on a field trip to collect an old debt. The goal of the tax authorities is to check the correctness of calculation and timely payment of taxes. When changing legal entities addresses “the old Federal Tax Service Inspectorate transfers the act of settlement of taxes and fees to the new Federal Tax Service Inspectorate. Thus, all information about debts and overpayments of taxes and fees is transferred to the inspectorate to which the organization belongs. 78 the procedure for crediting or refunding tax established by Art. 79 Tax Code of the Russian Federation. It is obliged to inform the taxpayer about each fact of excessive payment of tax and the amount of overpaid tax that becomes known to the tax inspectorate within 10 days from the date of discovery of such a fact.

If facts are discovered indicating a possible overpayment of tax, at the suggestion of the tax inspectorate or the taxpayer, a joint reconciliation of calculations for taxes, fees, penalties and fines can be carried out (clause 3 of Article 78 of the Tax Code of the Russian Federation).

Within the same time frame, the tax inspectorate is obliged to notify the taxpayer of the establishment of the fact of excessive tax collection (clause. We can only guess from practice what these measures are: this is a visit to a new legal address, a survey of persons related to this address, and so on further. Do you want the transition process to be less painful? Notify the management of the previous tax office about the transition in advance by providing the details of your new “place of residence” in a letter addressed to them. Sample letter for refund of money from one tax office to another

How to offset tax when changing the Federal Tax Service

Answer:

If the legal address is changed, the organization's accounting file is transferred from the old Federal Tax Service to the new one, and the transferred documents also include the CRSB (data in the cards must be checked).

When moving from one Federal Tax Service Inspectorate to another, all data on taxes, as well as on arrears and overpayments, is transferred by the Federal Tax Service Inspectorate at the old place of registration (Vidnoye) to the Federal Tax Service Inspectorate at the new place of registration (Domodedovo), in which the KRSB and OKTMO at the old place are opened simultaneously place of registration and with OKTMO at the new place of registration. Thus, the organization that has changed its address will have two open registration and registration offices at its new place of registration. At the same time, such KRSB are closed after the procedure of deregistration with one tax authority and registration with another.

All procedures are carried out without a taxpayer’s application. Accordingly, if this is not done, then you need to file a complaint against the actions (inaction) of tax officials. After changing your address, you must contact the new Federal Tax Service (Domodedovo) for all tax issues. The organization has no grounds for applying to the Federal Tax Service for the city of Vidnoye, since it has already been deregistered, and such an application will be refused.

Organizations for tax control purposes must register with the tax authorities (hereinafter referred to as the Federal Tax Service) (clause 1 of Article 83 of the Tax Code of the Russian Federation):

- at the location of the organization;

- at the location of its separate divisions;

- at the location of real estate and vehicles owned by the organization;

- on other grounds provided for by the Tax Code of the Russian Federation.

As a general rule, the location of a legal entity (LE) is determined as the place of its state registration on the territory of the Russian Federation by indicating the name of the locality (municipal entity) (Article 54 of the Civil Code of the Russian Federation). The location of a legal entity is indicated in its constituent document and in the Unified State Register of Legal Entities, and if the legal entity operates on the basis of a standard charter approved by an authorized state body, only in the register. In addition, the Unified State Register of Legal Entities must reflect the address of the legal entity within its location.

When an organization changes its permanent location and at the new address already belongs to another Federal Tax Service, it needs to take into account the following.

When changing the official address, the organization must report this to the inspectorate that is responsible for registering taxpayers (Article 18 of the Federal Law of 08.08.2001 No. 129-FZ). Information in the Unified State Register of Legal Entities will be changed within 5 days from the date of submission of all necessary documents (clause 1, article 8, clause 3, article 18 of Law No. 129-FZ).

A change in the location of an organization is grounds for deregistering it with the Federal Tax Service with which the organization was registered (Vidnoye). To do this, tax authorities are given 5 working days from the date of entering the relevant information into the Unified State Register of Legal Entities (clause 4 of Article 84 of the Tax Code of the Russian Federation).

Within one day after making an entry in the Unified State Register of Legal Entities, the taxpayer must be deregistered with the old Federal Tax Service (Vidnoye). Then, within one day, the information must be sent to the new inspection (Domodedovo). And within one day from the moment of their receipt, the taxpayer organization must be registered there.

The accounting file is sent to the new tax authority (Domodedovo) within 3 working days from the date of deregistration with the old inspectorate (Vidnoe). However, the date of registration with the new Federal Tax Service is the date of entry into the Unified State Register of Legal Entities about a change in location (clauses 3.6-3.6.3 of the Procedure and conditions for assignment, application, as well as changes in the taxpayer identification number and forms of documents used for registration, deletion from the register of legal entities and individuals (approved by Order of the Federal Tax Service of the Russian Federation dated March 3, 2004 No. BG-3-09/178).

The budget settlement card (CRSB) is an information resource maintained by the Federal Tax Service and which reflects the status of settlements for taxes, fees, insurance premiums, as well as penalties and fines for them:

- accrued amounts of taxes, fees, insurance premiums, penalties and fines. They are entered into the CRSB on the basis of declarations, decisions based on the results of tax audits, decisions of a higher tax authority, judicial acts, etc.;

- the amount of taxes, fees, insurance premiums, penalties and fines paid to the budget;

- the difference between received and accrued payments. A negative balance in it shows the taxpayer’s debt to the budget, a positive balance indicates an overpayment of taxes, fees, insurance premiums, penalties or fines (clause 1 of section I, clauses 1, 3, 4 of section IV, section VI, clause 1 of section IX of the Unified requirements for the procedure for creating the information resource “Settlements with the Budget” at the local level, approved by Order of the Federal Tax Service of the Russian Federation dated January 18, 2012 No. YAK-7-1 / [email protected] (hereinafter referred to as the Unified Requirements), Appendix No. 1 to the Unified Requirements).

According to clause 3 of Section I of Order No. YAK-7-1/ [email protected], the Federal Tax Service is required to maintain a KRSB for each payer of the tax and fee established by the legislation on taxes and fees. By virtue of clause 2 of Section II “Opening of RSB cards”, KRSB are opened after completion of the registration procedure with the tax authority:

- from the moment the circumstances established by the legislation on taxes and fees arise that provide for the payment of this tax, fee, that is, from the moment the payer submits tax returns (calculations) or receives documents from the registration authorities that serve as the basis for registration with the Federal Tax Service, as well as for the calculation and paying taxes;

- from the moment of payment of taxes and fees in the manner established by the legislation on taxes and fees.

KRSB are opened for each BCC related to a specific tax, fee and the corresponding 8-digit OKTMO code of the municipality on the territory of which funds from paying the tax and fee are mobilized.

Important information in this situation is presented in section XI “Procedure for closing local level SSR cards.”

Thus, in the event of a change in legal address, the organization’s accounting file is transferred from the old Federal Tax Service to the new one, and the transferred documents also include the CRSB (data in the cards must be checked).

Accordingly, when moving from one Federal Tax Service Inspectorate to another, all data on taxes, as well as on arrears and overpayments, is transferred by the Federal Tax Service Inspectorate at the old place of registration (Vidnoe) to the Federal Tax Service Inspectorate at the new place of registration (Domodedovo), in which the KRSB and OKTMO are opened simultaneously at the old place of registration and with OKTMO at the new place of registration. Thus, an organization that has changed its address will have two KRSB opened at its new place of registration - clause 3 of Section XI of the Uniform Requirements, according to which, when organizations transfer to another Federal Tax Service Inspectorate, the KRSB is also transferred as part of the package of documents. At the same time, such KRSB are closed after the procedure of deregistration with one tax authority and registration with another.

Moreover, all procedures are carried out without a taxpayer’s application. Accordingly, if this is not done, then you need to file a complaint against the actions (inaction) of tax officials.

After changing your address, you must contact the new Federal Tax Service (Domodedovo) for all tax issues. The organization has no grounds for applying to the Federal Tax Service for the city of Vidnoe, since it has actually already been deregistered, and such an application from the organization will be refused.

A taxpayer organization has the right to appeal any acts of tax authorities, actions (inactions) of their officials, if, in its opinion, such acts or actions violate its rights (clause 12, clause 1, article 21, article 137 of the Tax Code of the Russian Federation).

The general appeal procedure is reflected in Art. Art. 137-142 Tax Code of the Russian Federation.

At the same time, almost all acts of tax authorities of a non-regulatory nature and the actions of their officials are appealed first to a higher tax authority, and then in court (clauses 1, 2 of Article 138 of the Tax Code of the Russian Federation). The exception is acts issued based on the results of consideration of complaints, as well as acts of the Federal Tax Service of the Russian Federation of a non-normative nature and actions (inaction) of its officials (clause 2 of Article 138 of the Tax Code of the Russian Federation). The latter are appealed directly in court.

The answer was prepared by the legal consulting service of the company RUNA